Key Insights

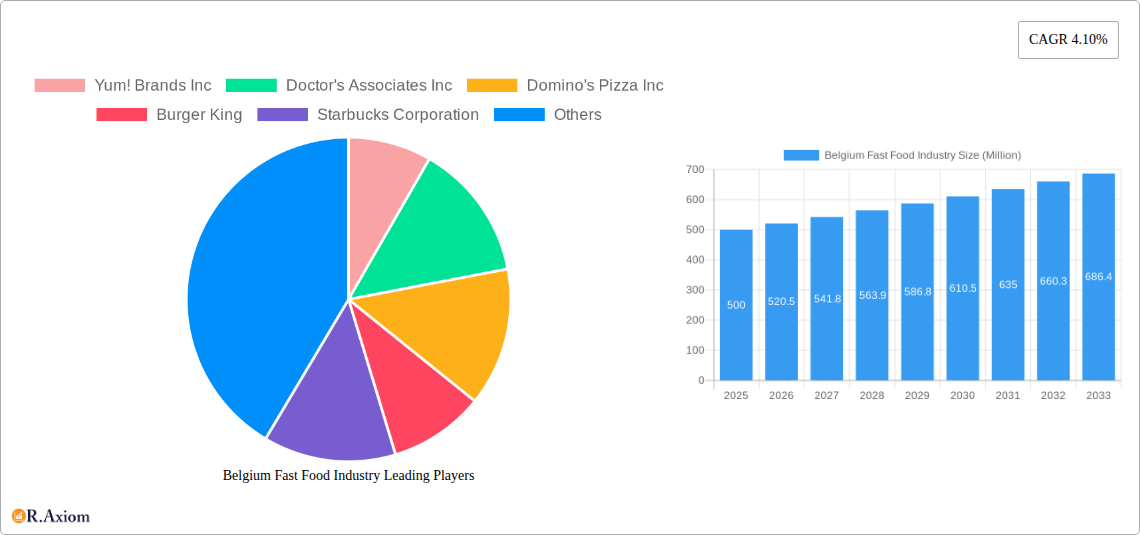

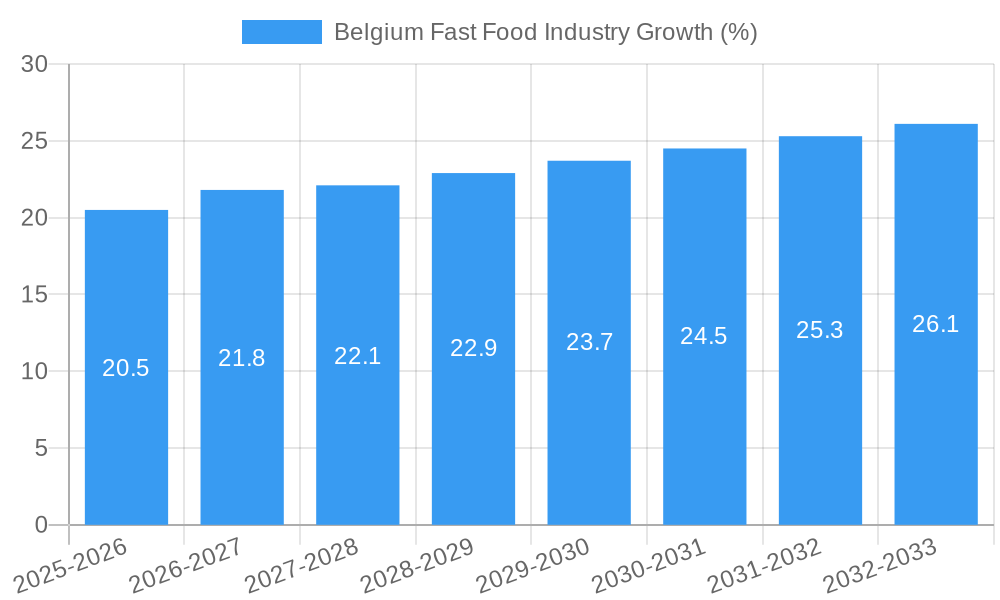

The Belgian fast-food market, valued at approximately €500 million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization and changing lifestyles are leading to higher demand for convenient and readily available food options. The rising disposable incomes of Belgian consumers, coupled with the popularity of international fast-food chains and the continued evolution of local culinary offerings within the fast-food sector, contribute to this market expansion. The segment encompassing independent outlets currently holds a significant market share, though chained outlets are steadily gaining ground, driven by aggressive expansion strategies and brand recognition. While the consumer foodservice sector (restaurants, cafes) remains dominant, the street stall/kiosk segment is showing promising growth, particularly in urban areas. However, challenges remain. Health concerns related to high-fat and processed food items, coupled with increasing awareness of sustainable and ethical food sourcing practices, pose potential restraints to market growth. The industry will need to adapt by incorporating healthier options and promoting transparency in their sourcing to mitigate these concerns and maintain sustainable growth trajectories. Furthermore, economic fluctuations and competition from other food service segments will continue to shape the market landscape.

The Belgian fast-food market's future is characterized by a dynamic interplay between consumer preferences and industry innovation. The successful players will be those that effectively balance convenience and affordability with health and sustainability concerns. International chains like McDonald's, Burger King, and Domino's will likely continue to dominate the chained outlet segment, while independent businesses will thrive by offering unique and localized experiences catering to specific tastes. The emergence of innovative delivery platforms and technology-driven customer engagement strategies will also play a significant role in shaping the competitive landscape over the forecast period. The increasing popularity of healthier fast-food alternatives, such as vegetarian and vegan options, presents an important area for growth. Strategic partnerships with local food suppliers will also allow operators to respond effectively to growing consumer demand for ethically sourced and sustainable products. This will be vital for ensuring the long-term success and sustainability of the fast-food industry in Belgium.

Belgium Fast Food Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Belgium fast food industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Key market segments, leading players, and future growth prospects are thoroughly examined. The report utilizes robust data analysis and incorporates high-impact keywords to ensure optimal search engine visibility.

Belgium Fast Food Industry Market Concentration & Innovation

The Belgian fast food market exhibits a moderately concentrated structure, dominated by established international players like McDonald's Corporation, Burger King, and Domino's Pizza Inc. However, the presence of local chains like Chez Léon and the recent entry of BigChefs indicate ongoing competition and potential for market share shifts. Innovation in the sector is driven by evolving consumer preferences towards healthier options, personalized experiences, and technological advancements in ordering and delivery systems. Regulatory frameworks concerning food safety, hygiene, and marketing practices significantly influence industry operations. Substitute products, including healthier alternatives and home-cooked meals, represent a considerable competitive threat, especially among health-conscious consumers.

Market Share (Estimated 2025):

- McDonald's Corporation: xx%

- Burger King: xx%

- Domino's Pizza Inc: xx%

- Other International Chains: xx%

- Local Chains (Chez Léon, BigChefs etc.): xx%

- Independent Outlets: xx%

M&A Activities (2019-2024): The Belgian fast-food sector saw a total of xx M&A deals valued at approximately €xx Million during the historical period. These transactions primarily involved smaller chains being acquired by larger players or private equity firms aiming to consolidate market share.

Belgium Fast Food Industry Industry Trends & Insights

The Belgium fast-food market has witnessed consistent growth over the historical period (2019-2024), with a CAGR of xx%. This growth is fueled by several key factors: rising disposable incomes, increasing urbanization, changing lifestyles favoring convenience, and the burgeoning popularity of online food delivery platforms. Technological disruptions, particularly in digital ordering, mobile payment systems, and data analytics, are transforming the customer experience and operational efficiency. Consumer preferences are shifting towards healthier options, plant-based alternatives, and personalized meal customization. The competitive landscape remains dynamic, with both established players and new entrants vying for market share through innovative product offerings, aggressive marketing strategies, and strategic partnerships. Market penetration of online ordering and delivery services is expected to reach xx% by 2033.

Dominant Markets & Segments in Belgium Fast Food Industry

The Belgium fast-food market is largely driven by urban areas, with Antwerp, Brussels, and Ghent exhibiting the highest concentration of outlets.

Key Drivers of Dominance:

- High Population Density: Urban centers boast a larger consumer base compared to rural areas.

- Tourist Foot Traffic: Major cities attract significant tourist traffic, boosting demand for convenient food options.

- Strong Infrastructure: Efficient transportation networks and well-developed delivery infrastructure facilitate widespread accessibility.

- Higher Disposable Incomes: Urban areas generally have higher average disposable incomes, driving consumer spending on fast food.

Segment Analysis:

- Type: Consumer Foodservice remains the dominant segment, accounting for the majority of market revenue.

- Street Stalls/Kiosks: This segment shows modest growth, particularly in high-traffic areas.

- Hotels: Fast food options within hotels cater to a specific segment of travelers and guests.

- Institutional (Catering): This segment is expected to grow steadily as demand for catering services in offices and educational institutions increases.

- Structure: Chained outlets hold a significant majority of the market share compared to independent outlets. This is largely driven by the economies of scale and brand recognition offered by national and international chains.

Belgium Fast Food Industry Product Developments

Recent product innovations in the Belgian fast-food sector include the rise of customizable meals, plant-based alternatives, and healthier options incorporating fresh ingredients. Technological advancements are evident in the adoption of automated kiosks, online ordering platforms, and personalized marketing campaigns. These developments are aimed at meeting evolving consumer preferences while enhancing operational efficiency and profitability. The market fit for these innovations is largely driven by consumer demand for convenience, personalization, and healthier choices.

Report Scope & Segmentation Analysis

This report segments the Belgian fast-food market across several key dimensions:

Type: Consumer Foodservice, Street Stalls/Kiosks, Hotels, Institutional (Catering). Consumer foodservice is projected to maintain its dominant position, experiencing steady growth over the forecast period.

Structure: Independent Outlet, Chained Outlet. Chained outlets are expected to continue their market dominance, while independent outlets may face challenges in competing with established brands.

Growth projections vary significantly across segments. Consumer foodservice and chained outlets are poised for consistent growth, while other segments exhibit more moderate expansion rates. Competitive dynamics are influenced by the degree of market concentration in each segment, with chained outlets exhibiting stronger competitive advantages.

Key Drivers of Belgium Fast Food Industry Growth

Several factors contribute to the growth of the Belgian fast-food industry. Firstly, rising disposable incomes and changing lifestyles fuel demand for convenient and affordable meals. Secondly, the increasing popularity of online food delivery platforms expands market access and convenience. Finally, technological advancements streamline operations and personalize customer experiences.

Challenges in the Belgium Fast Food Industry Sector

The Belgium fast-food sector faces challenges like rising input costs, impacting profitability, and intense competition for market share from both established and emerging players. Stricter health and hygiene regulations also increase operational costs and complexity.

Emerging Opportunities in Belgium Fast Food Industry

Opportunities abound for expansion into underserved rural areas, the development of sustainable and ethical sourcing practices, and the creation of personalized dining experiences through data analytics and targeted marketing. Further, the growing demand for healthier and plant-based alternatives presents significant growth opportunities for innovative food companies.

Leading Players in the Belgium Fast Food Industry Market

- Yum! Brands Inc

- Doctor's Associates Inc

- Domino's Pizza Inc

- Burger King

- Starbucks Corporation

- Restaurant Brands International Inc

- McDonald's Corporation

- BigChefs

- Chez Léon

Key Developments in Belgium Fast Food Industry Industry

- May 2021: Burger King announced its plans to launch operations in Belgium, focusing on fresh ingredients and a new ad campaign.

- March 2023: BigChefs launched its first branch in Antwerp, marking its entry into the Belgian market.

Strategic Outlook for Belgium Fast Food Industry Market

The Belgian fast-food market is poised for continued growth, driven by rising disposable incomes, evolving consumer preferences, and technological advancements. Strategic players will need to adapt to changing consumer demands for healthier and more sustainable options, embracing technological innovations and prioritizing efficient delivery and customer service to capture growing market share.

Belgium Fast Food Industry Segmentation

-

1. Type

-

1.1. Consumer Foodservice

- 1.1.1. Cafes and Bars

- 1.1.2. Full-Service Restaurants

- 1.1.3. Fast Food

- 1.1.4. Pizza Consumer Foodservice

- 1.1.5. Self-Service Cafeterias

- 1.1.6. 100% Home Delivery/Takeaway

- 1.1.7. Street Stalls/Kiosks

- 1.2. Hotels

- 1.3. Institutional (Catering)

-

1.1. Consumer Foodservice

-

2. Structure

- 2.1. Independent Outlet

- 2.2. Chained Outlet

Belgium Fast Food Industry Segmentation By Geography

- 1. Belgium

Belgium Fast Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Ready Meals

- 3.4. Market Trends

- 3.4.1. Institutional (Catering) is Projected to Record a Significant Growth due to increasing per capita income.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Fast Food Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Consumer Foodservice

- 5.1.1.1. Cafes and Bars

- 5.1.1.2. Full-Service Restaurants

- 5.1.1.3. Fast Food

- 5.1.1.4. Pizza Consumer Foodservice

- 5.1.1.5. Self-Service Cafeterias

- 5.1.1.6. 100% Home Delivery/Takeaway

- 5.1.1.7. Street Stalls/Kiosks

- 5.1.2. Hotels

- 5.1.3. Institutional (Catering)

- 5.1.1. Consumer Foodservice

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Independent Outlet

- 5.2.2. Chained Outlet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Yum! Brands Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Doctor's Associates Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Domino's Pizza Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Burger King

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Starbucks Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Restaurant Brands International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McDonald's Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BigChefs

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chez Léon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Yum! Brands Inc

List of Figures

- Figure 1: Belgium Fast Food Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Fast Food Industry Share (%) by Company 2024

List of Tables

- Table 1: Belgium Fast Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Fast Food Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Belgium Fast Food Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Belgium Fast Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Belgium Fast Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Belgium Fast Food Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Belgium Fast Food Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: Belgium Fast Food Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Fast Food Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Belgium Fast Food Industry?

Key companies in the market include Yum! Brands Inc, Doctor's Associates Inc, Domino's Pizza Inc, Burger King, Starbucks Corporation, Restaurant Brands International Inc, McDonald's Corporation, BigChefs, Chez Léon.

3. What are the main segments of the Belgium Fast Food Industry?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption.

6. What are the notable trends driving market growth?

Institutional (Catering) is Projected to Record a Significant Growth due to increasing per capita income..

7. Are there any restraints impacting market growth?

Increasing Demand for Ready Meals.

8. Can you provide examples of recent developments in the market?

In March 2023, BigChefs launched its first branch in Belgium in Antwerp.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Fast Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Fast Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Fast Food Industry?

To stay informed about further developments, trends, and reports in the Belgium Fast Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence