Key Insights

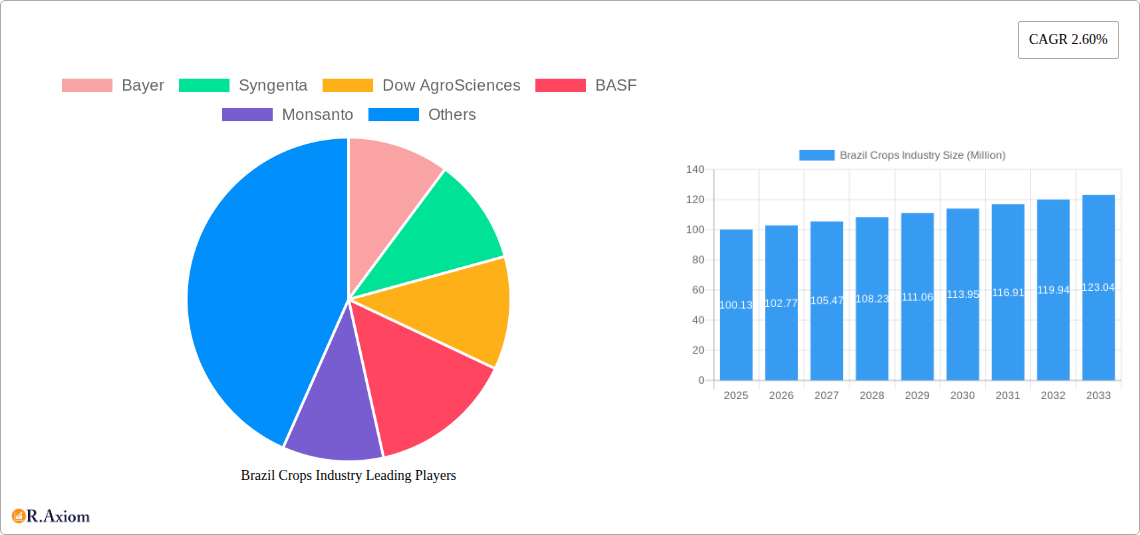

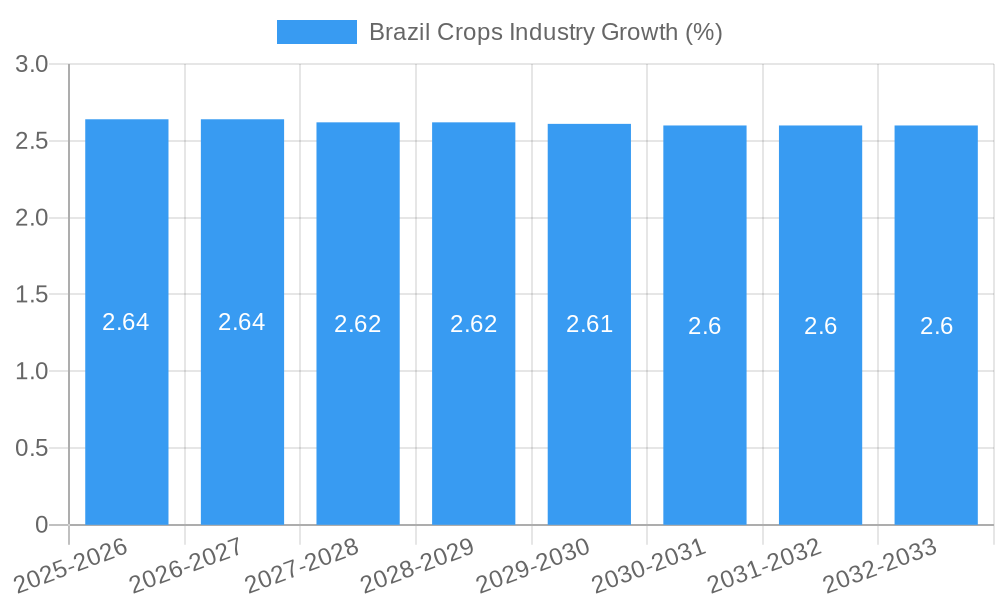

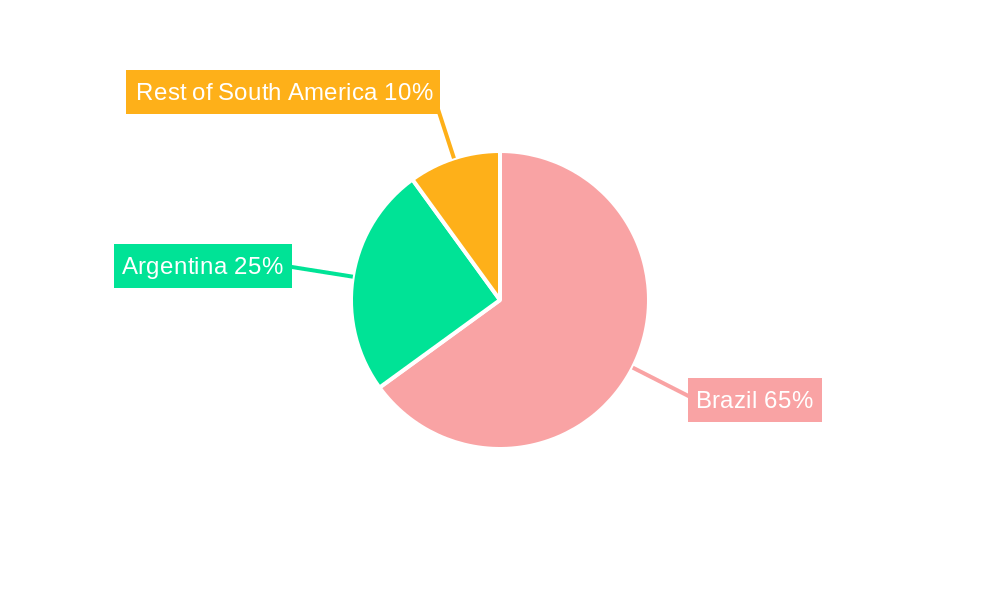

The Brazil crops industry, valued at $100.13 million in 2025, is projected to experience steady growth, driven primarily by increasing global demand for food and biofuels, coupled with Brazil's favorable agricultural conditions. Soybeans, corn, and cotton are major contributors, with the food and feed applications dominating the market. The industry benefits from substantial investments in agricultural technology and improved farming practices, leading to higher yields and efficiency. However, challenges remain, including climate change impacts (droughts, unpredictable rainfall) affecting crop yields and potentially leading to price volatility. Furthermore, global economic fluctuations can influence export demand and overall market stability. Competition among major players like Bayer, Syngenta, BASF, and Monsanto, along with increasing land acquisition costs, add further complexities to the market landscape. Despite these challenges, the long-term outlook remains positive, supported by continued technological advancements and a growing global population requiring food security. The projected Compound Annual Growth Rate (CAGR) of 2.60% over the forecast period (2025-2033) reflects a moderate yet sustainable growth trajectory. This growth will likely be unevenly distributed across the segments. For example, the biofuel segment may experience faster growth than the food segment depending on government policies and global energy demands. The South American region, particularly Brazil and Argentina, will continue to play a crucial role due to their significant agricultural output and production capabilities. Strategic partnerships and sustainable agricultural practices will be crucial for industry players to ensure long-term competitiveness and sustainability.

The forecast period (2025-2033) presents opportunities for expansion in value-added products and precision agriculture techniques. Focus on enhancing crop resilience to climate change and adopting sustainable farming methods will be key for long-term success. The market’s segmentation based on product type (Soybeans, Corn, Cotton, Wheat, Other Crops) and application (Food, Feed, Biofuel) allows for a targeted approach to understanding specific market dynamics and identifying profitable niches. Growth within the "Other Crops" segment will depend on the diversification of agricultural production and the emergence of new high-value crops within Brazil. The focus on regional analysis, concentrating on Brazil and Argentina, ensures a granular understanding of the specific challenges and opportunities within each market.

Brazil Crops Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil crops industry, covering market size, growth trends, key players, and future outlook. With a detailed study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report uses Million (M) for all values.

Brazil Crops Industry Market Concentration & Innovation

The Brazilian crops industry exhibits a moderately concentrated market structure, with a few multinational giants like Bayer, Syngenta, Dow AgroSciences, BASF, and Monsanto holding significant market share. However, a considerable number of smaller, regional players also contribute to the overall market dynamics. Market share data for 2025 estimates Bayer at 15%, Syngenta at 12%, BASF at 10%, Monsanto at 8% and Dow AgroSciences at 7%, with the remaining 48% distributed among various other companies. Innovation is driven by factors such as increasing demand for high-yielding and disease-resistant crops, growing biofuel production, and stringent regulatory frameworks related to pesticide usage and environmental sustainability. M&A activity has been relatively high in recent years, with deal values exceeding xx M in the period 2019-2024. Key drivers for these transactions include expansion into new markets, technological advancements, and access to advanced crop technologies.

- Market Concentration: Moderately concentrated with significant players.

- Innovation Drivers: High-yielding crops, biofuel demand, stringent regulations.

- Regulatory Frameworks: Increasing focus on sustainable agriculture practices.

- Product Substitutes: Limited due to specific climatic conditions and crop suitability.

- End-User Trends: Growing demand for sustainably produced food and feed.

- M&A Activity: Significant activity in recent years, with deal values exceeding xx M.

Brazil Crops Industry Industry Trends & Insights

The Brazilian crops industry is experiencing robust growth, driven by factors such as favorable climatic conditions, increasing global demand for agricultural commodities, and government initiatives promoting agricultural modernization. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated to be around 5%, and this is projected to continue at approximately 4% from 2025-2033. Technological advancements, particularly in precision agriculture, genetics, and biotechnologies, are playing a crucial role in enhancing productivity and efficiency. Consumer preferences are also shifting towards sustainably produced and higher-quality food products. Competitive dynamics are shaped by factors like pricing, innovation, and market access. Market penetration of genetically modified (GM) crops is high, exceeding 80% for soybeans, contributing significantly to the country’s agricultural output.

Dominant Markets & Segments in Brazil Crops Industry

Soybeans dominate the Brazilian crops industry, driven by favorable climatic conditions and high global demand. The Mato Grosso state stands out as the most significant producing region.

- Soybeans: Key drivers include high global demand, favorable climatic conditions, and government support. The market size in 2025 is estimated to be xx M.

- Corn: The production of corn is significant and driven by its use in both feed and biofuel industries. The market size in 2025 is estimated to be xx M.

- Cotton: The cotton industry is concentrated in certain regions. Market size in 2025 is estimated to be xx M.

- Wheat: The production is substantial in certain regions. Market size in 2025 is estimated to be xx M.

- Other Crops: This segment comprises various crops, with sugarcane being a major contributor, primarily used for biofuel production. The market size in 2025 is estimated to be xx M.

- Food Application: This remains the primary application for most crops, with continuous growth driven by rising population and increasing per capita income.

- Feed Application: Demand from livestock and poultry industries is a major driver for corn and soybean production.

- Biofuel Application: Sugarcane and corn are key components for bioethanol production, contributing to the biofuel segment's growth.

Key drivers include:

- Favorable climatic conditions: Brazil’s climate is ideal for growing various crops.

- Government support: Policies aimed at promoting agricultural modernization and exports.

- Export opportunities: High demand from global markets.

- Technological advancements: Improved farming techniques and genetically modified seeds.

- Land availability: Brazil possesses vast tracts of arable land suitable for agriculture.

Brazil Crops Industry Product Developments

Recent product innovations focus on developing high-yielding, disease-resistant, and drought-tolerant varieties of soybeans, corn, and other crops. These advancements leverage genetic engineering, biotechnology, and precision agriculture techniques to enhance crop productivity and sustainability. The competitive advantage lies in offering superior crop yields, reduced input costs, and improved resilience to environmental stresses, aligning with market demands for efficient and sustainable agricultural practices.

Report Scope & Segmentation Analysis

This report comprehensively segments the Brazilian crops industry by product (soybeans, corn, cotton, wheat, other crops) and application (food, feed, biofuel). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics, providing a granular understanding of the industry’s structure and potential. For example, the soybean segment is expected to witness significant growth driven by strong global demand, while the biofuel segment's growth is closely tied to government policies and technological advancements in biofuel production.

Key Drivers of Brazil Crops Industry Growth

The Brazilian crops industry’s growth is propelled by several key factors: favorable climate, increasing global demand for agricultural commodities, government support for agricultural modernization, technological advancements in crop breeding and farming techniques, and expanding biofuel production. These factors contribute to higher yields, improved efficiency, and increased export opportunities.

Challenges in the Brazil Crops Industry Sector

Challenges include: climate variability impacting crop yields, infrastructure limitations hindering efficient transportation and logistics, price volatility of agricultural commodities, and regulatory hurdles related to pesticide usage and environmental sustainability. These factors affect profitability and sustainability within the industry, demanding innovative solutions and strategic adaptations.

Emerging Opportunities in Brazil Crops Industry

Emerging opportunities include: growing demand for sustainably produced crops, expanding biofuel market, increasing adoption of precision agriculture technologies, and potential for developing new crop varieties adapted to climate change. Capitalizing on these opportunities requires investments in research and development, sustainable farming practices, and infrastructure upgrades.

Leading Players in the Brazil Crops Industry Market

Key Developments in Brazil Crops Industry Industry

- 2022 October: Bayer launches a new soybean variety with improved drought tolerance.

- 2023 March: Syngenta announces a partnership to expand its biofuel production facilities.

- 2024 June: BASF invests in a new research facility focused on sustainable agriculture practices.

- 2024 November: Monsanto and a local company merge to expand their market reach in Brazil. (xx M deal value)

Strategic Outlook for Brazil Crops Industry Market

The Brazilian crops industry presents significant growth potential. The combination of favorable climatic conditions, substantial land resources, and growing global demand for agricultural products positions Brazil as a key player in the global food and biofuel markets. Continued investment in agricultural technology, infrastructure development, and sustainable practices will be crucial to unlocking the industry's full potential and addressing the existing challenges.

Brazil Crops Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Crops Industry Segmentation By Geography

- 1. Brazil

Brazil Crops Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Increasing Food Crop Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Crops Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil Brazil Crops Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Brazil Crops Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Brazil Crops Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Bayer

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Syngenta

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Dow AgroSciences

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BASF

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Monsanto

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Bayer

List of Figures

- Figure 1: Brazil Crops Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Crops Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Crops Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Crops Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Brazil Crops Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Brazil Crops Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Brazil Crops Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Brazil Crops Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Brazil Crops Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Crops Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Brazil Crops Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Brazil Crops Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America Brazil Crops Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Crops Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 13: Brazil Crops Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 14: Brazil Crops Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 15: Brazil Crops Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Brazil Crops Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 17: Brazil Crops Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Crops Industry?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Brazil Crops Industry?

Key companies in the market include Bayer, Syngenta, Dow AgroSciences, BASF, Monsanto.

3. What are the main segments of the Brazil Crops Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.13 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Food Crop Production.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Crops Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Crops Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Crops Industry?

To stay informed about further developments, trends, and reports in the Brazil Crops Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence