Key Insights

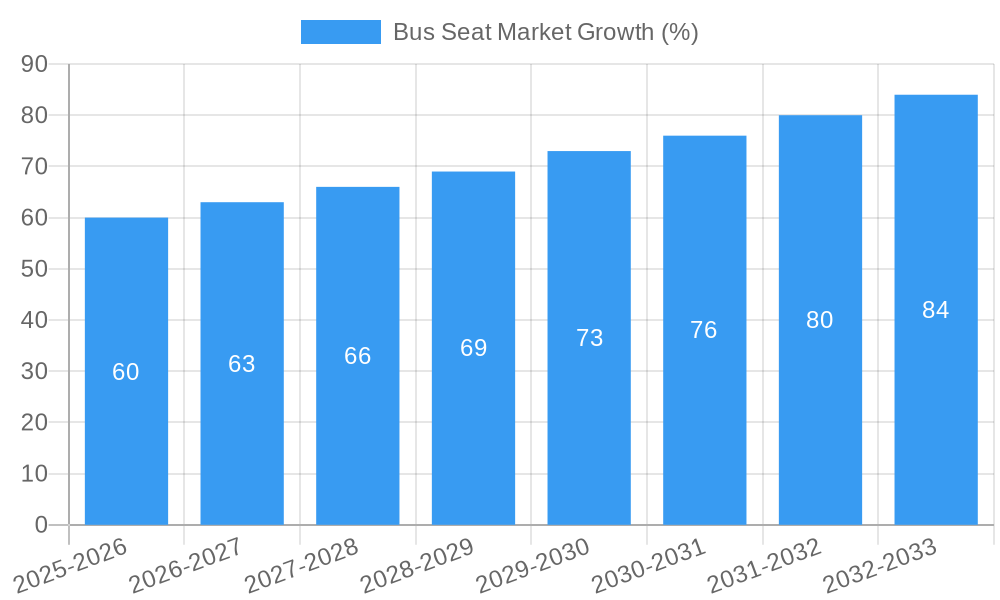

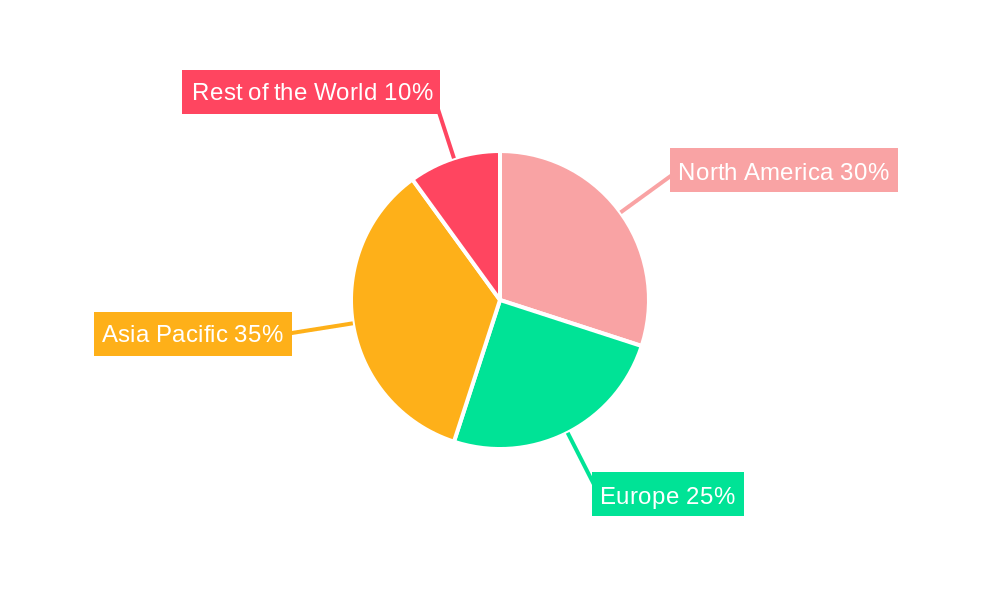

The global bus seat market is experiencing robust growth, driven by increasing passenger transportation demand, particularly in emerging economies with expanding urban populations and infrastructure development. The market's Compound Annual Growth Rate (CAGR) exceeding 5% indicates a significant upward trajectory projected through 2033. Several factors contribute to this expansion. Rising disposable incomes in developing nations lead to increased public and private bus travel. Government initiatives promoting public transportation to reduce carbon emissions and traffic congestion further stimulate market growth. Technological advancements in seat design, incorporating ergonomic features, enhanced safety mechanisms, and improved durability, are also key drivers. The market is segmented by seat type (standard, recliner), component type (frame, upholstery), and bus type (transit, school, others). The recliner segment is expected to witness faster growth due to increasing preference for comfort, especially in long-distance travel. Similarly, the transit bus segment dominates the market share, driven by large-scale public transport systems. Key players like Toyota Boshoku, Magna International, and TACHI-S are leveraging technological innovations and strategic partnerships to strengthen their market positions. However, fluctuations in raw material prices and stringent regulatory requirements concerning safety and emissions standards pose challenges to market growth. Regional analysis shows strong growth in the Asia-Pacific region, propelled by rapid urbanization and infrastructure investment in countries like India and China. North America and Europe also exhibit significant market share, driven by existing robust public transport networks and ongoing fleet upgrades. The competitive landscape is marked by both established global players and regional manufacturers, leading to increased product diversification and price competition.

The forecast period of 2025-2033 presents considerable opportunities for growth, especially within the segments focusing on enhanced comfort, safety, and sustainable materials. Manufacturers are increasingly focusing on lightweight yet durable seat designs, incorporating advanced materials and manufacturing techniques to improve fuel efficiency and reduce operational costs for bus operators. The integration of intelligent features, such as integrated charging ports and improved accessibility features, are becoming significant factors influencing purchasing decisions. Furthermore, the increasing focus on sustainable practices within the automotive industry will likely influence the adoption of eco-friendly materials and manufacturing processes within the bus seat market, paving the way for a more environmentally conscious transportation sector. Continuous innovation in seat design and manufacturing technologies will be crucial for maintaining the market’s positive growth trajectory.

Bus Seat Market: A Comprehensive Market Analysis (2019-2033)

This detailed report provides a comprehensive analysis of the global Bus Seat Market, offering valuable insights into market dynamics, key players, and future growth opportunities. Covering the period 2019-2033, with 2025 as the base year, this report is an indispensable resource for industry stakeholders, investors, and market researchers. The report utilizes a robust methodology to analyze historical data (2019-2024), current estimations (2025), and projections (2025-2033).

Bus Seat Market Market Concentration & Innovation

This section analyzes the competitive landscape of the bus seat market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities.

The market is moderately concentrated, with several key players holding significant market share. While precise market share figures for each company are proprietary data within the full report, Toyota Boshoku Corporation, Magna International Inc., and Grammer AG are among the prominent players, commanding a collectively significant portion of the overall market. However, smaller regional players and specialized manufacturers also contribute substantially, fostering healthy competition.

Innovation is driven by the increasing demand for enhanced comfort, safety, and technological integration in bus seats. Regulatory frameworks concerning safety and emissions standards influence product design and manufacturing. The emergence of lightweight materials and advanced ergonomic designs is reshaping the market. Product substitutes, such as alternative seating arrangements and improved standing areas, exert pressure on the market, while end-user trends, including increasing demand for eco-friendly materials and customizable seating options, are shaping product development strategies.

M&A activities have played a significant role in shaping the market landscape. Recent deals, while not disclosing exact values, indicate considerable investment in expanding product portfolios and market reach. For instance, Lear Corporation's acquisition of Kongsberg Automotive's ICS business unit strengthens their presence in the comfort seating segment, significantly impacting market competition. These activities reflect the industry’s focus on expansion, technological integration, and securing a competitive edge.

Bus Seat Market Industry Trends & Insights

The global bus seat market is witnessing robust growth, driven by several factors. The expanding global public transportation infrastructure, particularly in developing economies, fuels demand for new buses and subsequently, bus seats. Governments worldwide are investing significantly in upgrading their public transportation systems, stimulating market growth. The increasing urbanization and growing commuter populations are other major drivers. This expansion is expected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Technological advancements have significantly influenced the market. The integration of advanced materials, such as lightweight composites and high-performance fabrics, enhances seat durability, comfort, and fuel efficiency. The adoption of innovative designs, focusing on ergonomics and passenger comfort, improves the overall travel experience. Consumer preferences are shifting towards increased customization options, including adjustable headrests, integrated multimedia systems, and advanced features such as heating, cooling, and massage functions. These technological disruptions and evolving preferences are significantly influencing the competitive landscape, prompting manufacturers to innovate rapidly and stay ahead of the curve. Market penetration of advanced features is growing steadily, reflecting an increase in consumer demand for premium experiences.

Dominant Markets & Segments in Bus Seat Market

The report identifies xx as the dominant region in the global bus seat market, driven by a combination of factors including strong economic growth, extensive public transportation infrastructure, and favorable government policies. Other key markets include xx and xx.

By Seat Type: The recliner segment is experiencing faster growth compared to standard seats, driven by the increasing preference for enhanced comfort among passengers.

By Component Type: The upholstery segment holds a larger market share, primarily due to its significant contribution to seat comfort and aesthetics.

By Bus Type: The transit bus segment dominates the market, owing to the high volume of transit buses in operation globally. However, the school bus segment is also expected to showcase significant growth during the forecast period, driven by increasing school enrollment and safety regulations.

Bus Seat Market Product Developments

Recent years have witnessed significant product innovations in the bus seat market. Manufacturers are focusing on developing lightweight and durable seats, often incorporating advanced materials like carbon fiber and high-performance polymers. Smart features, such as integrated USB charging ports and infotainment systems, enhance passenger experience. Improved safety features, including enhanced seatbelts and crash-resistant structures, are also gaining prominence. These developments aim to improve passenger comfort, safety, and convenience, aligning with market demands and fostering competitive advantages among manufacturers.

Report Scope & Segmentation Analysis

This report segments the bus seat market based on seat type (standard, recliner), component type (frame, upholstery), and bus type (transit bus, school bus, others).

By Seat Type: The market is segmented into standard and recliner seats, with projected growth rates showing faster expansion for the recliner segment.

By Component Type: This analysis includes frames and upholstery, providing insights into material trends and cost structures. The growth of this segment is closely linked to developments in material science and design.

By Bus Type: The segmentation by bus type provides a nuanced view of the market, highlighting the demand for seats in transit buses, school buses, and other specialized bus applications. Growth rates vary according to factors like government regulations and public transport initiatives.

Key Drivers of Bus Seat Market Growth

Several factors are driving the growth of the bus seat market. Firstly, substantial investments in public transportation infrastructure across several regions are creating opportunities for seat manufacturers. Secondly, the increasing demand for comfortable and safe travel is boosting the adoption of premium features like ergonomic designs, advanced cushioning, and improved safety mechanisms. Finally, stringent safety regulations are pushing manufacturers to integrate advanced safety technologies into their products.

Challenges in the Bus Seat Market Sector

The bus seat market faces several challenges. Fluctuations in raw material prices significantly impact production costs and profitability. Stringent safety and environmental regulations increase manufacturing complexity and add to overall expenses. Intense competition among established and emerging players puts pressure on margins. Disruptions in the global supply chain can lead to production delays and affect the availability of essential components.

Emerging Opportunities in Bus Seat Market

Several emerging opportunities exist within the bus seat market. The rising demand for customized and personalized seating solutions presents opportunities for manufacturers to tailor products to specific customer needs. Integration of advanced technologies, such as smart seating and connected systems, offers substantial potential. Expansion into emerging markets with growing public transportation needs offers significant growth potential. Sustainable and eco-friendly materials offer an emerging opportunity to align with environmental regulations and rising consumer expectations for responsible manufacturing.

Leading Players in the Bus Seat Market Market

- Toyota Boshoku Corporation

- Magna International Inc

- TACHI-S Co Ltd

- Freedman seating company

- Franz Kiel GmbH

- Commercial Vehicle Group Inc

- Harita Seating Company

- Prakash Seating Private Ltd

- Lazzerini SRL

- Grammer AG

Key Developments in Bus Seat Market Industry

August 2022: Volvo Buses India launched the next-gen Volvo 9600 platform, introducing new sleeper and seater coaches with enhanced passenger capacity. This significantly impacts the demand for bus seats in the high-end segment.

October 2021: Lear Corporation's acquisition of Kongsberg Automotive's ICS business unit expands their market share and capabilities in comfort seating solutions. This consolidation strengthens their market position and potentially alters pricing and innovation strategies.

April 2021: Freedman Seating Company launched SeatLink™, a seat information tracking system, improving fleet management and enhancing operational efficiency. This innovative technology improves fleet management and data collection for bus operators.

Strategic Outlook for Bus Seat Market Market

The bus seat market is poised for continued growth, driven by factors such as increasing urbanization, investments in public transport infrastructure, and the growing preference for comfortable and technologically advanced seating solutions. Opportunities abound for manufacturers to capitalize on this growth by focusing on innovation, sustainability, and customized solutions that meet the evolving needs of passengers and bus operators. The market’s future is bright, provided manufacturers adapt to changing regulations and consumer preferences.

Bus Seat Market Segmentation

-

1. Seat Type

- 1.1. Standard

- 1.2. Recliner

-

2. Component Type

- 2.1. Frame

- 2.2. Upholstery

-

3. Bus Type

- 3.1. Transit Bus

- 3.2. School Bus

- 3.3. Others

Bus Seat Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Bus Seat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Recliner Seats Segment of Market to Play key role in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Seat Type

- 5.1.1. Standard

- 5.1.2. Recliner

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Frame

- 5.2.2. Upholstery

- 5.3. Market Analysis, Insights and Forecast - by Bus Type

- 5.3.1. Transit Bus

- 5.3.2. School Bus

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Seat Type

- 6. North America Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Seat Type

- 6.1.1. Standard

- 6.1.2. Recliner

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Frame

- 6.2.2. Upholstery

- 6.3. Market Analysis, Insights and Forecast - by Bus Type

- 6.3.1. Transit Bus

- 6.3.2. School Bus

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Seat Type

- 7. Europe Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Seat Type

- 7.1.1. Standard

- 7.1.2. Recliner

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Frame

- 7.2.2. Upholstery

- 7.3. Market Analysis, Insights and Forecast - by Bus Type

- 7.3.1. Transit Bus

- 7.3.2. School Bus

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Seat Type

- 8. Asia Pacific Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Seat Type

- 8.1.1. Standard

- 8.1.2. Recliner

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Frame

- 8.2.2. Upholstery

- 8.3. Market Analysis, Insights and Forecast - by Bus Type

- 8.3.1. Transit Bus

- 8.3.2. School Bus

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Seat Type

- 9. Rest of the World Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Seat Type

- 9.1.1. Standard

- 9.1.2. Recliner

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Frame

- 9.2.2. Upholstery

- 9.3. Market Analysis, Insights and Forecast - by Bus Type

- 9.3.1. Transit Bus

- 9.3.2. School Bus

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Seat Type

- 10. North America Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Bus Seat Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Toyota Boshoku Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Magna International Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 TACHI-S Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Freedman seating company

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Franz Kiel GmbH

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Commercial Vehicle Group Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Harita Seating Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Prakash Seating Private Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Lazzerini SRL*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Grammer AG

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Toyota Boshoku Corporation

List of Figures

- Figure 1: Global Bus Seat Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Bus Seat Market Revenue (Million), by Seat Type 2024 & 2032

- Figure 11: North America Bus Seat Market Revenue Share (%), by Seat Type 2024 & 2032

- Figure 12: North America Bus Seat Market Revenue (Million), by Component Type 2024 & 2032

- Figure 13: North America Bus Seat Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 14: North America Bus Seat Market Revenue (Million), by Bus Type 2024 & 2032

- Figure 15: North America Bus Seat Market Revenue Share (%), by Bus Type 2024 & 2032

- Figure 16: North America Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Bus Seat Market Revenue (Million), by Seat Type 2024 & 2032

- Figure 19: Europe Bus Seat Market Revenue Share (%), by Seat Type 2024 & 2032

- Figure 20: Europe Bus Seat Market Revenue (Million), by Component Type 2024 & 2032

- Figure 21: Europe Bus Seat Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 22: Europe Bus Seat Market Revenue (Million), by Bus Type 2024 & 2032

- Figure 23: Europe Bus Seat Market Revenue Share (%), by Bus Type 2024 & 2032

- Figure 24: Europe Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bus Seat Market Revenue (Million), by Seat Type 2024 & 2032

- Figure 27: Asia Pacific Bus Seat Market Revenue Share (%), by Seat Type 2024 & 2032

- Figure 28: Asia Pacific Bus Seat Market Revenue (Million), by Component Type 2024 & 2032

- Figure 29: Asia Pacific Bus Seat Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 30: Asia Pacific Bus Seat Market Revenue (Million), by Bus Type 2024 & 2032

- Figure 31: Asia Pacific Bus Seat Market Revenue Share (%), by Bus Type 2024 & 2032

- Figure 32: Asia Pacific Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Bus Seat Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Bus Seat Market Revenue (Million), by Seat Type 2024 & 2032

- Figure 35: Rest of the World Bus Seat Market Revenue Share (%), by Seat Type 2024 & 2032

- Figure 36: Rest of the World Bus Seat Market Revenue (Million), by Component Type 2024 & 2032

- Figure 37: Rest of the World Bus Seat Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 38: Rest of the World Bus Seat Market Revenue (Million), by Bus Type 2024 & 2032

- Figure 39: Rest of the World Bus Seat Market Revenue Share (%), by Bus Type 2024 & 2032

- Figure 40: Rest of the World Bus Seat Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Bus Seat Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bus Seat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bus Seat Market Revenue Million Forecast, by Seat Type 2019 & 2032

- Table 3: Global Bus Seat Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Global Bus Seat Market Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 5: Global Bus Seat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: India Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: China Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Bus Seat Market Revenue Million Forecast, by Seat Type 2019 & 2032

- Table 25: Global Bus Seat Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 26: Global Bus Seat Market Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 27: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of North America Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Bus Seat Market Revenue Million Forecast, by Seat Type 2019 & 2032

- Table 32: Global Bus Seat Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 33: Global Bus Seat Market Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 34: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Bus Seat Market Revenue Million Forecast, by Seat Type 2019 & 2032

- Table 40: Global Bus Seat Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 41: Global Bus Seat Market Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 42: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: India Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Bus Seat Market Revenue Million Forecast, by Seat Type 2019 & 2032

- Table 49: Global Bus Seat Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 50: Global Bus Seat Market Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 51: Global Bus Seat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: South America Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Middle East and Africa Bus Seat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bus Seat Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Bus Seat Market?

Key companies in the market include Toyota Boshoku Corporation, Magna International Inc, TACHI-S Co Ltd, Freedman seating company, Franz Kiel GmbH, Commercial Vehicle Group Inc, Harita Seating Company, Prakash Seating Private Ltd, Lazzerini SRL*List Not Exhaustive, Grammer AG.

3. What are the main segments of the Bus Seat Market?

The market segments include Seat Type, Component Type, Bus Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Recliner Seats Segment of Market to Play key role in the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In August 2022, Volvo Buses India, a division of VE Commercial Vehicles Limited, launched the next-gen Volvo 9600 platform. The first offerings on this platform are factory-built sleeper and seater coaches in 15m 6x2; and 13.5m 4x2 configurations. The 15m seater coach has a passenger capacity of 55, whereas the sleeper coach has 40 berths. The 13.5m coach seats up to 47 passengers, while the sleeper variant hosts 36 berths.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bus Seat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bus Seat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bus Seat Market?

To stay informed about further developments, trends, and reports in the Bus Seat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence