Key Insights

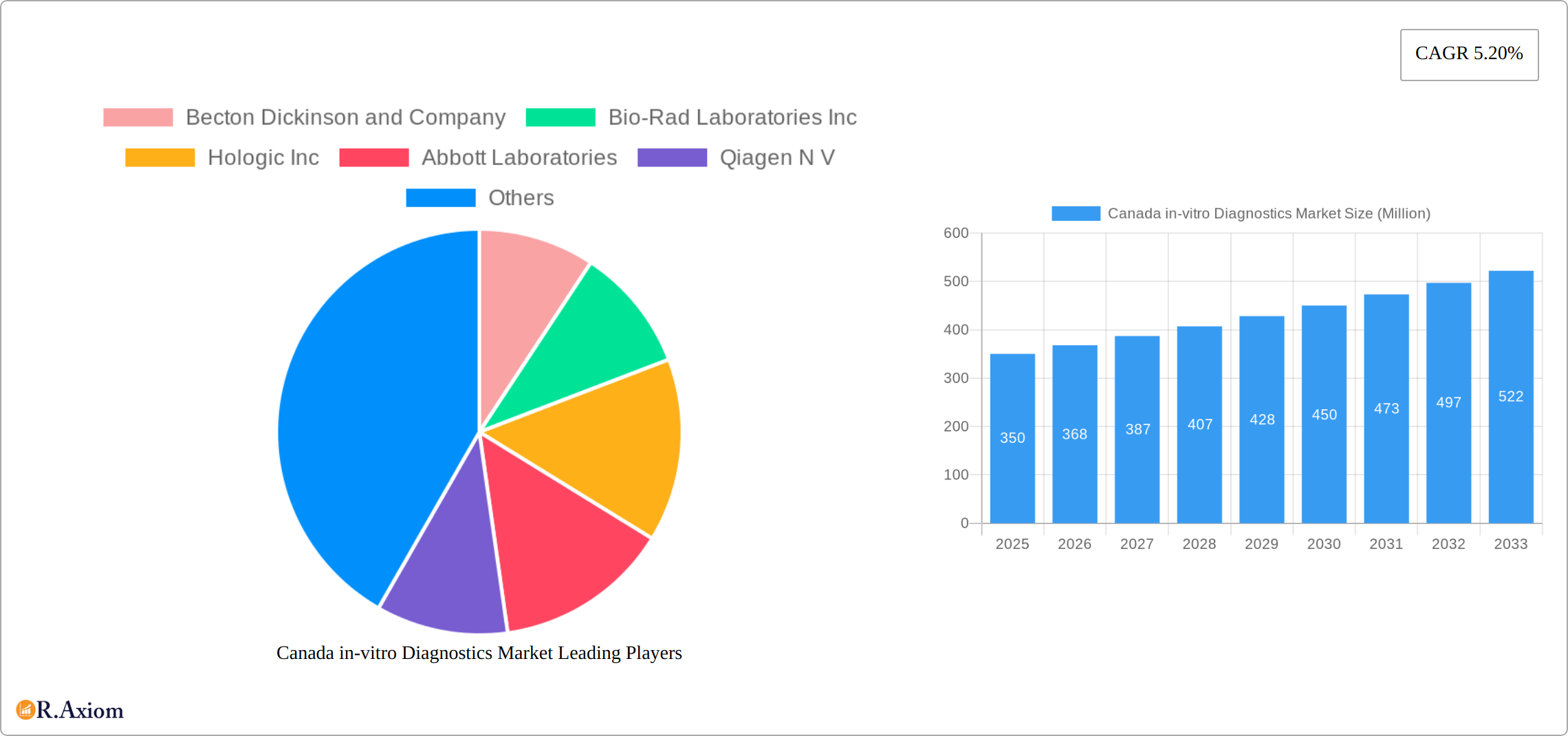

The Canadian in-vitro diagnostics (IVD) market presents a robust growth opportunity, driven by factors such as an aging population, rising prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), and increasing government initiatives to improve healthcare infrastructure. The market, segmented by test type (clinical chemistry, molecular diagnostics, hematology, immunodiagnostics, and others), product (instruments, reagents, and other products), usability (disposable and reusable devices), application (infectious diseases, diabetes, cancer, cardiology, autoimmune diseases, nephrology, and others), and end-users (diagnostic laboratories, hospitals and clinics, and others), is experiencing a Compound Annual Growth Rate (CAGR) of 5.20%. This growth is fueled by technological advancements leading to the development of faster, more accurate, and automated diagnostic tests. The increasing demand for point-of-care diagnostics and personalized medicine further contributes to market expansion. While data for the precise market size in 2025 is unavailable, extrapolating from the provided CAGR and assuming a 2024 market size in the hundreds of millions (a reasonable estimate given the size and healthcare spending of Canada), the 2025 market size would likely fall within the range of $300 million to $400 million.

Significant growth is anticipated across all segments, with molecular diagnostics and immunodiagnostics expected to experience particularly rapid expansion due to their crucial role in infectious disease management and the growing prevalence of autoimmune disorders. The reusable IVD devices segment is likely to experience slower growth compared to disposable devices due to factors such as cost and maintenance considerations. However, the hospital and clinic segment within the end-user category will be a significant driver of growth. The presence of established multinational companies such as Becton Dickinson, Bio-Rad, Abbott, and Roche underscores the market's maturity and attractiveness to investors. Challenges remain, including regulatory hurdles and the need for continuous investment in research and development to ensure the market keeps pace with advancements in diagnostic technology. The Canadian IVD market's future trajectory is positive, promising substantial growth and innovation throughout the forecast period.

Canada In-Vitro Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Canada in-vitro diagnostics (IVD) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes extensive data and analysis to present a robust understanding of market dynamics, trends, and future projections, expressed in Millions (M).

Canada in-vitro Diagnostics Market Market Concentration & Innovation

The Canadian IVD market exhibits a moderately concentrated landscape, dominated by multinational corporations like Abbott Laboratories, Roche, and Siemens, holding a combined market share of approximately xx%. Smaller, specialized companies, however, are also significant players, particularly in niche areas like molecular diagnostics. Innovation is a key driver, fueled by advancements in molecular diagnostics, point-of-care testing, and automation. Stringent Health Canada regulatory frameworks ensure product safety and efficacy, influencing market access and shaping innovation strategies. Substitutes, such as traditional diagnostic methods, exert limited competitive pressure, as IVD technologies increasingly offer superior speed, accuracy, and efficiency. End-user trends demonstrate a growing preference for rapid, accurate diagnostic solutions, pushing the demand for advanced technologies. Recent mergers and acquisitions (M&A) activity, with deal values exceeding xx Million in the past five years, indicate a focus on expanding market reach and technology portfolios.

- Market Concentration: High (xx% by top 3 players).

- Innovation Drivers: Molecular diagnostics, automation, point-of-care testing.

- M&A Activity: Deal values exceeding xx Million in the last 5 years.

- Regulatory Landscape: Stringent, impacting market access.

Canada in-vitro Diagnostics Market Industry Trends & Insights

The Canadian IVD market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing prevalence of chronic diseases (diabetes, cancer), an aging population, rising healthcare expenditure, and technological advancements that enhance diagnostic capabilities. Technological disruptions, such as the integration of AI and machine learning, are transforming diagnostic workflows, increasing efficiency and accuracy. Consumer preferences are increasingly shifting toward faster, more convenient, and personalized diagnostic services. Competitive dynamics are characterized by intense rivalry amongst established players and emerging companies, driving innovation and market expansion. Market penetration of advanced technologies is increasing, with adoption rates particularly high in larger hospitals and diagnostic laboratories.

Dominant Markets & Segments in Canada in-vitro Diagnostics Market

The Canadian IVD market demonstrates strong growth across various segments.

- Leading Segment: Molecular diagnostics is expected to witness the fastest growth, driven by advancements in next-generation sequencing and PCR technologies. Clinical chemistry remains the largest segment by market value.

Key Drivers by Segment:

- Test Type: Increased prevalence of infectious diseases and chronic illnesses fuels demand for clinical chemistry, molecular diagnostics, and immunoassays.

- Product: Reagent demand is high due to the consumable nature of these products. Instrument sales are driven by technology upgrades and increased testing volumes.

- Usability: Disposable IVD devices are more popular due to convenience and reduced risk of contamination.

- Application: Infectious disease diagnostics see strong growth due to public health concerns. Cancer/Oncology is also a major driver due to increasing cancer rates.

- End Users: Hospitals and clinics constitute the largest segment, owing to the high volume of tests conducted in these settings.

Dominance Analysis: Ontario and Quebec, given their larger populations and concentrated healthcare infrastructure, are expected to be the leading markets. This dominance stems from factors like increased healthcare spending, higher density of diagnostic laboratories and hospitals, and robust governmental support for healthcare advancements.

Canada in-vitro Diagnostics Market Product Developments

Recent product innovations focus on improving diagnostic speed, accuracy, and efficiency. Point-of-care testing devices are gaining popularity due to their convenience and rapid turnaround times. Miniaturized diagnostic systems, coupled with advances in molecular diagnostics, offer improved sensitivity and specificity. These advancements are significantly enhancing patient care and streamlining diagnostic workflows. Companies are focusing on developing integrated systems that automate various steps in the diagnostic process. The market fit of these new products is strong, driven by the ongoing need for faster, more accurate diagnoses.

Report Scope & Segmentation Analysis

This report segments the Canadian IVD market based on test type (clinical chemistry, molecular diagnostics, hematology, immuno diagnostics, other tests), product (instrument, reagent, other products), usability (disposable, reusable), application (infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, other applications), and end-user (diagnostic laboratories, hospitals & clinics, other end-users). Each segment provides detailed market size estimations, growth projections, and competitive landscape analysis for the study period. For instance, the molecular diagnostics segment is projected to exhibit a CAGR of xx%, while the reagent market will grow at xx% due to increased testing volumes. The competitive intensity varies across segments, with some exhibiting higher levels of concentration than others.

Key Drivers of Canada in-vitro Diagnostics Market Growth

The Canadian IVD market growth is fueled by several factors:

- Technological Advancements: Point-of-care testing, rapid diagnostics, and molecular diagnostic technologies.

- Rising Prevalence of Chronic Diseases: Diabetes, cancer, and cardiovascular diseases drive demand for diagnostic tests.

- Government Initiatives: Increased healthcare spending and investment in healthcare infrastructure.

- Aging Population: The growing elderly population leads to increased demand for diagnostic services.

Challenges in the Canada in-vitro Diagnostics Market Sector

The Canadian IVD market faces several challenges:

- Regulatory Hurdles: Navigating Health Canada's stringent approval processes can delay product launches.

- High Costs: Advanced diagnostic technologies can be expensive, impacting affordability and access.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of essential components and reagents.

- Intense Competition: The market faces strong competition from both established and emerging players.

Emerging Opportunities in Canada in-vitro Diagnostics Market

Emerging opportunities include:

- Personalized Medicine: Tailored diagnostic solutions based on individual genetic profiles.

- Telehealth Integration: Remote diagnostics and monitoring solutions.

- Artificial Intelligence (AI) in Diagnostics: AI-powered diagnostic tools for improved accuracy and efficiency.

- Expansion into Rural and Underserved Areas: Addressing diagnostic access gaps in remote regions.

Leading Players in the Canada in-vitro Diagnostics Market Market

- Becton Dickinson and Company (BD)

- Bio-Rad Laboratories Inc (Bio-Rad)

- Hologic Inc (Hologic)

- Abbott Laboratories (Abbott)

- Qiagen N V (Qiagen)

- Siemens AG (Siemens Healthineers)

- Danaher Corporation (Danaher)

- F Hoffmann-La Roche AG (Roche)

- Thermo Fischer Scientific Inc (Thermo Fisher Scientific)

- Arkray Inc

Key Developments in Canada in-vitro Diagnostics Market Industry

- May 2022: BioMérieux received Health Canada approval for the BioFire BCID2 panel, expanding rapid bloodstream infection identification capabilities.

- January 2022: Yourgene launched its expanded facility, "Yourgene Health Canada Inc.", strengthening its presence in the Canadian molecular diagnostics market.

Strategic Outlook for Canada in-vitro Diagnostics Market Market

The Canadian IVD market is poised for continued growth, driven by technological advancements, rising healthcare spending, and the increasing prevalence of chronic diseases. Opportunities exist for companies to leverage new technologies, expand into underserved markets, and develop innovative solutions to address unmet clinical needs. Strategic partnerships and collaborations will play a vital role in shaping the future of the Canadian IVD market. The focus on personalized medicine and AI-driven diagnostics will further enhance market growth and improve patient outcomes.

Canada in-vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Immuno Diagnostics

- 1.5. Other Tests

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End Users

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

Canada in-vitro Diagnostics Market Segmentation By Geography

- 1. Canada

Canada in-vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Point-of-Care (POC) Diagnostics and Advancements in Technology; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations and Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. Reagent Segment is Expected to hold the Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Immuno Diagnostics

- 5.1.5. Other Tests

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End Users

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Eastern Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada in-vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Becton Dickinson and Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bio-Rad Laboratories Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hologic Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Laboratories

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Qiagen N V

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Siemens AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Danaher Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 F Hoffmann-La Roche AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Thermo Fischer Scientific Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Arkray Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Canada in-vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada in-vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Canada in-vitro Diagnostics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 7: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Central Canada Canada in-vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 13: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 15: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Canada in-vitro Diagnostics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: Canada in-vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada in-vitro Diagnostics Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Canada in-vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, Hologic Inc, Abbott Laboratories, Qiagen N V, Siemens AG, Danaher Corporation, F Hoffmann-La Roche AG, Thermo Fischer Scientific Inc, Arkray Inc.

3. What are the main segments of the Canada in-vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Point-of-Care (POC) Diagnostics and Advancements in Technology; Increasing Awareness and Acceptance of Personalized Medicine and Companion Diagnostics.

6. What are the notable trends driving market growth?

Reagent Segment is Expected to hold the Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations and Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In May 2022, BioMérieux received Health Canada approval for the BioFire Blood Culture Identification 2 (BCID2) panel for rapid identification of bloodstream infections. The BCID2 panel includes additional pathogens, an expanded list of antimicrobial resistance genes, and revised targets compared to the original BCID panel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada in-vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada in-vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada in-vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the Canada in-vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence