Key Insights

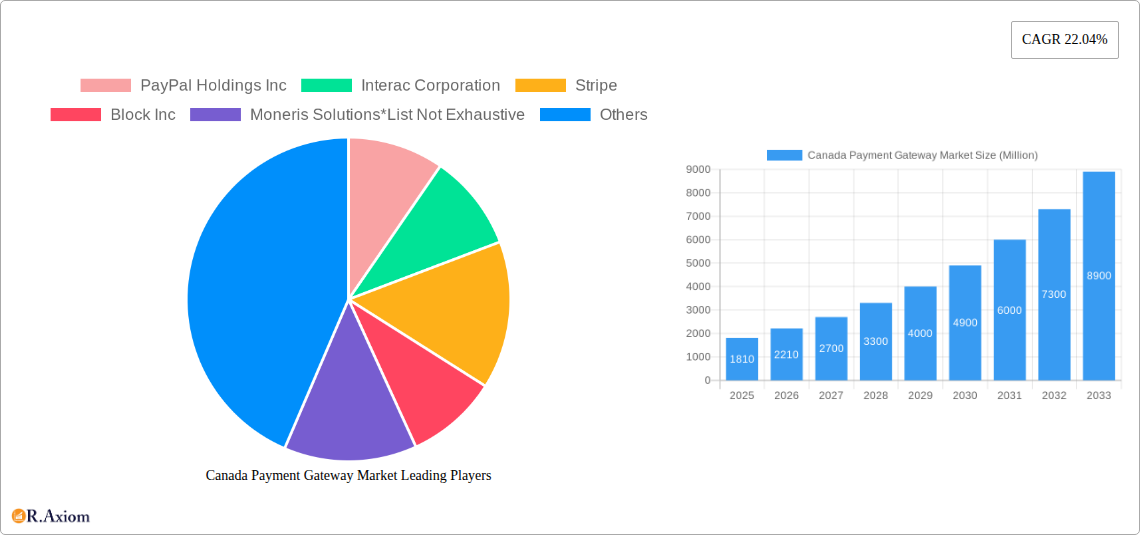

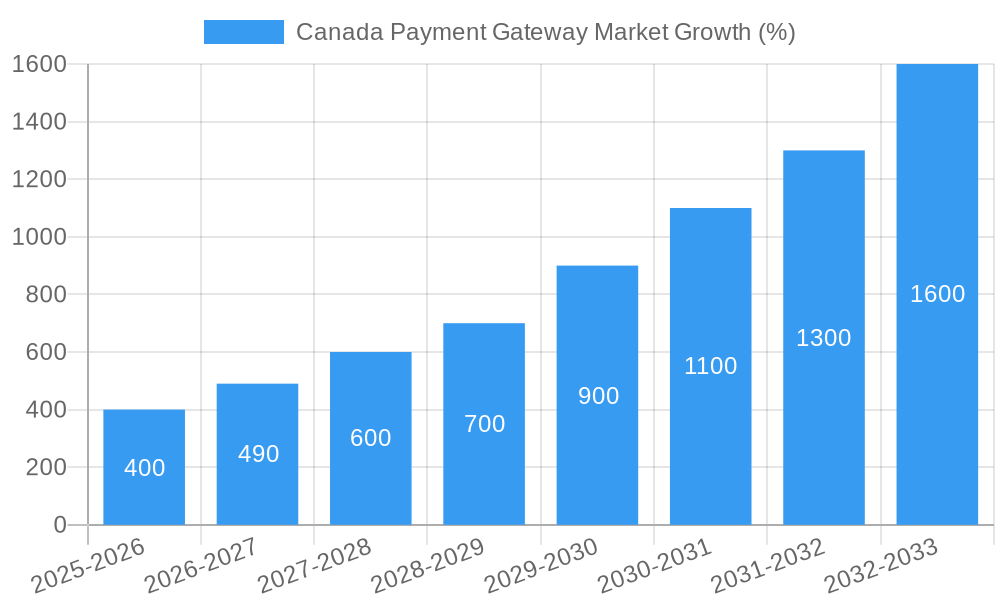

The Canadian payment gateway market is experiencing robust growth, projected to reach $1.81 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 22.04% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of e-commerce and digital transactions across various sectors, from retail and hospitality to healthcare and government services, is a primary driver. Furthermore, the growing preference for contactless payments, spurred by the COVID-19 pandemic and evolving consumer preferences, significantly contributes to market growth. Technological advancements, including the integration of advanced security features and the rise of mobile payment solutions like Apple Pay and Google Pay, further enhance the appeal and security of payment gateways, encouraging wider adoption. Competition in the market is fierce, with established players like PayPal Holdings Inc., Interac Corporation, Stripe, Block Inc., and Moneris Solutions vying for market share alongside emerging fintech companies. Regulatory changes aimed at improving data security and consumer protection are also shaping the market landscape, influencing both technological development and business strategies within the industry.

The sustained growth trajectory of the Canadian payment gateway market is expected to continue throughout the forecast period (2025-2033). This positive outlook is underpinned by the ongoing digital transformation across all sectors of the Canadian economy, increasing investments in technological infrastructure, and the ongoing development of innovative payment solutions catering to evolving consumer needs. However, challenges remain, including the need for robust cybersecurity measures to mitigate the risks of fraud and data breaches. Furthermore, maintaining compliance with evolving regulations and addressing the potential for fragmentation within the market due to the presence of numerous players are ongoing concerns. Despite these challenges, the long-term outlook remains optimistic, with the market poised for substantial growth driven by the persistent expansion of digital commerce in Canada.

Canada Payment Gateway Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Payment Gateway Market, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for businesses, investors, and stakeholders seeking a clear understanding of this dynamic market.

The report meticulously analyzes market concentration, innovation, industry trends, dominant segments, product developments, and challenges, ultimately offering a strategic outlook for the forecast period (2025-2033).

Key aspects covered include:

- Market size and growth projections (in Millions)

- Competitive landscape and market share analysis

- Detailed segmentation analysis

- Impact of technological advancements and regulatory changes

- Emerging opportunities and key challenges

Detailed Report Structure:

Canada Payment Gateway Market Market Concentration & Innovation

This section analyzes the level of market concentration in the Canadian payment gateway market, identifying major players and their respective market share. We examine innovation drivers, including technological advancements and regulatory changes, exploring the influence of these factors on market dynamics. The role of mergers and acquisitions (M&A) activities is assessed, including deal values and their impact on market consolidation. Product substitutes and their potential impact are also discussed, along with emerging end-user trends shaping the demand for payment gateway solutions in Canada.

- Market Concentration: The market is moderately concentrated, with a few major players holding significant market share. [Insert predicted market share data for top 3 players here, e.g., PayPal: 25%, Interac: 20%, Stripe: 15%]. However, numerous smaller players also contribute significantly to the overall market.

- Innovation Drivers: Technological advancements, such as the increasing adoption of mobile payments and the development of new payment methods, are key innovation drivers. Regulatory changes, such as the introduction of PSD2 (if applicable to Canada) and Open Banking initiatives, also play a crucial role.

- Regulatory Framework: The Canadian regulatory landscape is relatively stable, though ongoing changes in data privacy and security regulations are impacting market players.

- M&A Activity: [Insert predicted number of M&A deals and total value in Millions during the historical period (2019-2024), e.g., There were approximately xx M&A deals totaling xx Million during the historical period]. Future M&A activity is expected to consolidate the market further.

- Product Substitutes: Alternative payment methods, such as peer-to-peer (P2P) transfers and mobile wallets, pose a competitive threat to traditional payment gateways.

Canada Payment Gateway Market Industry Trends & Insights

This section delves into the key trends and insights shaping the Canada Payment Gateway Market. It examines market growth drivers, including the increasing adoption of e-commerce, the rising popularity of mobile payments, and the growing demand for secure and reliable payment solutions. The report further analyzes technological disruptions, such as the emergence of new payment technologies (e.g., blockchain and cryptocurrencies) and their potential impact on the market. Consumer preferences are also analyzed, focusing on the changing demands and expectations of Canadian consumers regarding online payment experiences. The competitive dynamics of the market, including pricing strategies, market share, and innovation are also explored.

- CAGR: [Insert predicted CAGR for the forecast period (2025-2033), e.g., The market is expected to grow at a CAGR of xx% during the forecast period].

- Market Penetration: [Insert predicted market penetration data for key segments, e.g., The market penetration of online payment gateways is estimated at xx% in 2025 and expected to reach xx% by 2033].

Dominant Markets & Segments in Canada Payment Gateway Market

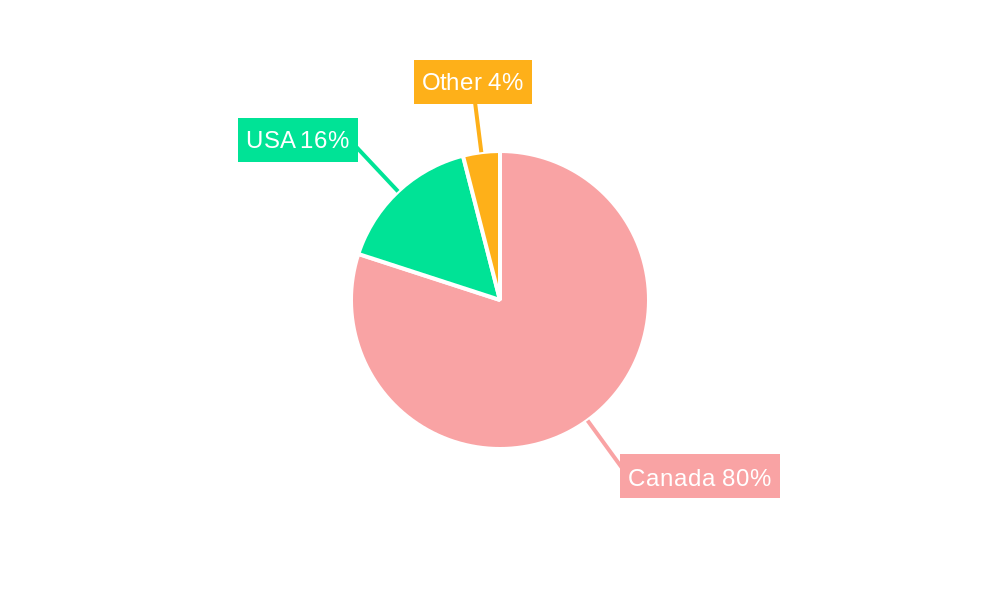

This section identifies the leading regions, countries, or segments within the Canadian payment gateway market. The analysis delves into the key drivers behind the dominance of these segments, considering factors such as economic policies, infrastructure development, consumer behavior, and regulatory frameworks. A detailed examination of the competitive landscape within these dominant segments is also included.

- Dominant Segment: [Insert predicted dominant segment, e.g., The e-commerce segment is expected to remain the dominant segment throughout the forecast period]

- Key Drivers of Dominance:

- High internet penetration and e-commerce adoption: The high rate of internet and smartphone usage in Canada drives e-commerce growth, consequently increasing the demand for payment gateway solutions.

- Favorable government policies: Government initiatives promoting digitalization and e-commerce further fuel market growth.

- Robust infrastructure: Well-developed telecommunications infrastructure enables seamless online transactions and payment processing.

Canada Payment Gateway Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages of payment gateway solutions in the Canadian market. Technological trends driving product development, such as AI, machine learning, and enhanced security features, are discussed. The analysis emphasizes the market fit and potential of these new products and services. The section also explores the competitive advantages offered by various payment gateway providers, considering aspects like transaction fees, security features, and customer support.

[Insert paragraph summarizing product innovations, focusing on technological trends and market fit. Mention examples of specific features like fraud detection, mobile optimization, and international payment capabilities]

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report. It provides an overview of each segment, including growth projections, market sizes (in Millions), and competitive dynamics.

- By Payment Type: Credit cards, debit cards, mobile wallets, online banking, etc. [Insert predicted market size and growth projections for each sub-segment]

- By Industry Vertical: E-commerce, retail, travel, healthcare, etc. [Insert predicted market size and growth projections for each sub-segment]

- By Enterprise Size: Small and medium-sized enterprises (SMEs), large enterprises [Insert predicted market size and growth projections for each sub-segment]

[Insert predicted market size and growth projections for each segment]

Key Drivers of Canada Payment Gateway Market Growth

This section outlines the key factors driving growth in the Canada Payment Gateway Market. These factors include technological advancements, economic factors, and regulatory developments.

- Technological Advancements: The rise of mobile commerce, contactless payments, and improved security features are driving market growth.

- Economic Factors: The increasing adoption of e-commerce and the growth of the digital economy are boosting demand for payment gateways.

- Regulatory Developments: Government initiatives supporting digital payments and financial technology innovation are contributing to market growth.

Challenges in the Canada Payment Gateway Market Sector

This section discusses the barriers and restraints that may hinder the growth of the Canada Payment Gateway Market.

- Regulatory Hurdles: Compliance with stringent data privacy and security regulations can be costly and complex.

- Supply Chain Issues: Disruptions in the supply chain can affect the availability of payment processing equipment and services.

- Competitive Pressures: The market is highly competitive, with numerous players vying for market share. [Insert predicted impact of these challenges on market growth, quantified if possible, e.g., Regulatory hurdles are estimated to reduce market growth by approximately x% in 2026].

Emerging Opportunities in Canada Payment Gateway Market

This section highlights emerging trends and opportunities in the Canada Payment Gateway Market.

- Open Banking: The increasing adoption of open banking APIs offers opportunities for the development of innovative payment solutions.

- Blockchain Technology: Blockchain technology could revolutionize payment processing by improving security and efficiency.

- New Payment Methods: The emergence of new payment methods, such as Buy Now, Pay Later (BNPL), is creating new opportunities for growth.

Leading Players in the Canada Payment Gateway Market Market

- PayPal Holdings Inc

- Interac Corporation

- Stripe

- Block Inc

- Moneris Solutions

Key Developments in Canada Payment Gateway Market Industry

- April 2024: Payments Canada, in partnership with IBM and CGI, announces the launch of its Real-Time Rail (RTR) system by 2026, promising faster and more secure digital payments. This development is expected to significantly impact the market by enhancing transaction speed and security.

- May 2024: Intellect Design Arena Ltd launches Canada eMACH.ai Cloud, a comprehensive AI-powered suite for banks and credit unions, improving digital engagement and streamlining payment services. This is expected to lead to greater efficiency and customization for financial institutions, ultimately benefiting consumers.

Strategic Outlook for Canada Payment Gateway Market Market

The Canada Payment Gateway Market is poised for significant growth over the next decade. The ongoing adoption of e-commerce, the increasing use of mobile devices, and the development of innovative payment technologies will all contribute to market expansion. The anticipated launch of Real-Time Rail and the wider availability of AI-powered solutions will further accelerate growth and drive innovation. Opportunities exist for players to capitalize on emerging trends such as open banking and BNPL, while navigating regulatory changes and competitive pressures. The market will likely see increased consolidation through M&A activity as companies seek to expand their market share and service offerings.

Canada Payment Gateway Market Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End User

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End-users

Canada Payment Gateway Market Segmentation By Geography

- 1. Canada

Canada Payment Gateway Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.3. Market Restrains

- 3.3.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.4. Market Trends

- 3.4.1. Increased Demand for Mobile-based Payments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Payment Gateway Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PayPal Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Interac Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Block Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moneris Solutions*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 PayPal Holdings Inc

List of Figures

- Figure 1: Canada Payment Gateway Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Payment Gateway Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Canada Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Canada Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 6: Canada Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 7: Canada Payment Gateway Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Canada Payment Gateway Market Volume Billion Forecast, by End User 2019 & 2032

- Table 9: Canada Payment Gateway Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Payment Gateway Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Canada Payment Gateway Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Canada Payment Gateway Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Canada Payment Gateway Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 14: Canada Payment Gateway Market Volume Billion Forecast, by Enterprise 2019 & 2032

- Table 15: Canada Payment Gateway Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Canada Payment Gateway Market Volume Billion Forecast, by End User 2019 & 2032

- Table 17: Canada Payment Gateway Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Canada Payment Gateway Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Payment Gateway Market?

The projected CAGR is approximately 22.04%.

2. Which companies are prominent players in the Canada Payment Gateway Market?

Key companies in the market include PayPal Holdings Inc, Interac Corporation, Stripe, Block Inc, Moneris Solutions*List Not Exhaustive.

3. What are the main segments of the Canada Payment Gateway Market?

The market segments include Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

6. What are the notable trends driving market growth?

Increased Demand for Mobile-based Payments.

7. Are there any restraints impacting market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

8. Can you provide examples of recent developments in the market?

April 2024: Payments Canada, in partnership with tech giants IBM and CGI, is set to unveil its Real-Time Rail (RTR) system for swift digital payments by 2026. This announcement comes after a decade-long journey marked by several delays since the initiative's inception. The RTR system is designed to enhance transaction oversight and security for Canadians, enabling real-time payments around the clock every day of the year, with swift clearance and settlement in mere seconds.May 2024: Intellect Design Arena Ltd, a versatile financial technology company catering to banks, credit unions, and insurance clients, has unveiled the Canada eMACH.ai Cloud tailored for banks and credit unions. This all-encompassing product suite covers areas such as digital engagement, liquidity, virtual accounts, and core banking (encompassing Payments and Deposits). With integrated AI, these offerings empower financial institutions to customize their digital services, meeting but surpassing customer expectations and driving growth. Furthermore, all products are fully operational or specifically designed for the Canadian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Payment Gateway Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Payment Gateway Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Payment Gateway Market?

To stay informed about further developments, trends, and reports in the Canada Payment Gateway Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence