Key Insights

The China Electrical Appliance Market is projected to experience significant expansion, reaching an estimated $747.64 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. This growth is primarily driven by a growing middle class, rising disposable incomes, and sustained demand for innovative, energy-efficient home appliances. Government policies encouraging domestic consumption and smart home integration are further accelerating market development. Key trends include the increasing adoption of smart appliances, the integration of AI and IoT technologies, and a consumer shift towards premium, feature-rich products. Additionally, a strong emphasis on environmental sustainability is boosting demand for energy-saving appliances, creating substantial opportunities for manufacturers.

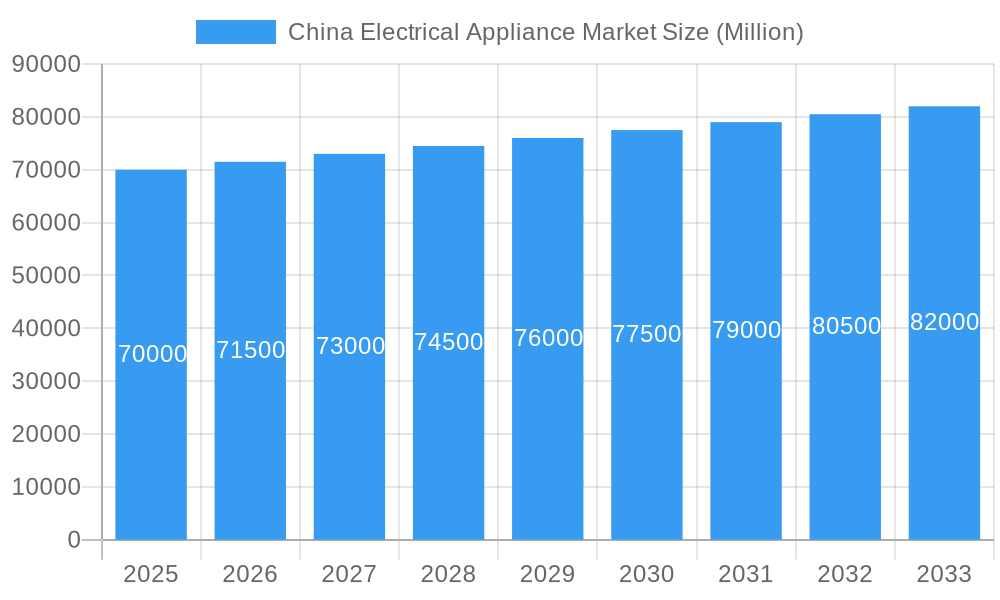

China Electrical Appliance Market Market Size (In Billion)

However, the market is subject to certain challenges, including intense competition from both domestic and international brands, which can lead to pricing pressures and the imperative for ongoing innovation. Volatility in raw material costs also poses a risk to profit margins. The aging demographic in certain areas may influence demand patterns. The market is analyzed across production, consumption, import, export, and price dynamics, offering a comprehensive view of this expansive sector. Leading companies such as Supor, Haier Electronics Group, Hisense, Gree Electric Appliances, and Midea Group are at the forefront, spearheading innovation and addressing varied consumer requirements throughout China. The Chinese electrical appliance market is a dynamic landscape characterized by technological progress, evolving consumer preferences, and a competitive yet expanding environment.

China Electrical Appliance Market Company Market Share

China Electrical Appliance Market Market Concentration & Innovation

The China Electrical Appliance Market exhibits a dynamic interplay between established giants and emerging innovators. Market concentration is notably high, with a few key players dominating significant shares. For instance, Midea Group holds an estimated 20% market share in the overall electrical appliance sector, followed closely by Haier Electronics Group Co Ltd with approximately 18%. Gree Electric Appliances Inc. is a dominant force in the air conditioning segment, commanding over 30% of that sub-market. Innovation is a critical differentiator, driven by the integration of smart technologies and the burgeoning Internet of Things (IoT). Leading companies are heavily investing in R&D for smart home solutions, aiming to enhance user experience and product stickiness. Regulatory frameworks, such as energy efficiency standards and product safety regulations, shape innovation pathways and market entry. Product substitutes, particularly from low-cost online brands, pose a continuous challenge, forcing incumbents to innovate not only on features but also on pricing and value propositions. End-user trends are rapidly shifting towards connected, energy-efficient, and aesthetically pleasing appliances. Mergers and acquisitions (M&A) activities, while present, are often strategic consolidations aimed at expanding product portfolios or technological capabilities. Recent M&A deals have seen values ranging from tens of millions to hundreds of millions, indicating a mature market with consolidation opportunities.

China Electrical Appliance Market Industry Trends & Insights

The China Electrical Appliance Market is poised for sustained growth, fueled by a confluence of robust economic development, evolving consumer preferences, and rapid technological advancements. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025–2033, driven by increasing disposable incomes and a growing middle class demanding higher-quality and more sophisticated home appliances. Technological disruptions are at the forefront of market evolution. The widespread adoption of smart home technologies, enabled by the Internet of Things (IoT), is transforming traditional appliances into interconnected devices that offer enhanced convenience, energy efficiency, and personalized user experiences. Leading brands are actively integrating AI and machine learning capabilities into their product offerings, leading to predictive maintenance, optimized performance, and seamless integration within smart ecosystems. Consumer preferences are shifting significantly towards sustainability and energy efficiency. With growing environmental awareness and government initiatives promoting green consumption, consumers are increasingly opting for appliances with higher energy ratings and eco-friendly features. This trend is not only influencing product design and manufacturing but also creating a niche for brands that prioritize environmental responsibility. The competitive landscape is characterized by intense rivalry among both domestic and international players. Chinese giants like Midea, Haier, and Gree are leveraging their strong manufacturing capabilities, extensive distribution networks, and aggressive pricing strategies to maintain their market dominance. Simultaneously, international brands are focusing on premium product segments and innovative features to capture market share. The rise of online retail channels has further intensified competition, providing a platform for both established and emerging brands to reach a wider consumer base. The penetration of smart appliances is rapidly increasing, with an estimated 40% of households expected to own at least one smart appliance by 2028, indicating a significant market opportunity for innovative and connected solutions. The demand for large appliances, particularly white goods like refrigerators, washing machines, and air conditioners, remains a significant market driver, largely propelled by a strong replacement cycle and urban housing development.

Dominant Markets & Segments in China Electrical Appliance Market

The Production Analysis within the China Electrical Appliance Market is heavily concentrated in key industrial hubs, particularly in eastern China. Provinces like Guangdong, Zhejiang, and Jiangsu are major manufacturing powerhouses, benefiting from well-developed industrial infrastructure, skilled labor, and supportive government policies aimed at fostering manufacturing excellence. These regions account for over 70% of the nation's electrical appliance production. Key drivers for this dominance include access to raw material suppliers, efficient logistics networks, and a high concentration of related industries, creating a robust supply chain ecosystem.

In terms of Consumption Analysis, the market is driven by a burgeoning urban population and a rapidly expanding middle class. Tier-1 and Tier-2 cities like Shanghai, Beijing, Guangzhou, and Shenzhen represent the largest consumption centers, characterized by higher disposable incomes and a greater demand for premium and smart home appliances. The sheer volume of household penetration, estimated at over 95% for basic appliances and rapidly increasing for advanced ones, underscores the significance of these urban markets. Economic policies promoting domestic consumption and urbanization directly fuel this segment's growth.

The Import Market Analysis (Value & Volume) reveals a specialized demand for high-end, niche, and technologically advanced appliances that domestic manufacturers may not yet fully produce. South Korea, Japan, and European countries are significant import sources for certain categories like high-end kitchen appliances and specialized consumer electronics. The value of imports is often higher than the volume due to the premium pricing of these specialized products. Factors influencing import dominance include brand reputation, unique technological features, and specific consumer preferences that lean towards international brands for certain product types.

Conversely, the Export Market Analysis (Value & Volume) showcases China's prowess as a global manufacturing hub. The country is a leading exporter of a wide range of electrical appliances, from basic consumer electronics to large home appliances. Southeast Asia, Africa, and emerging markets in Latin America are major destinations, attracted by the cost-effectiveness and diverse product offerings. The volume of exports is exceptionally high, reflecting China's extensive manufacturing capacity. Government initiatives supporting export-oriented industries and trade agreements play a crucial role in maintaining this dominance.

The Price Trend Analysis is characterized by a dualistic market. While a significant segment of the market competes on price, particularly for mass-market products and through online channels, there is also a growing segment for premium and smart appliances where price is less of a determinant and value-added features command higher prices. The overall trend indicates a gradual increase in average selling prices (ASPs) for smart and energy-efficient appliances, while prices for conventional, non-smart appliances remain relatively stable or see minor reductions due to intense competition and production efficiencies.

China Electrical Appliance Market Product Developments

Product developments in the China Electrical Appliance Market are increasingly focused on intelligent integration and enhanced user experience. Companies are heavily investing in smart home technologies, embedding IoT capabilities into appliances like refrigerators, washing machines, and air conditioners. This leads to features such as remote control via mobile apps, AI-powered optimization, and seamless connectivity with other smart devices. Innovations are also driven by energy efficiency and sustainability, with a focus on reducing power consumption and utilizing eco-friendly materials. Competitive advantages are being built on the back of these advanced features, appealing to a growing consumer base that values convenience, intelligence, and environmental responsibility.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the China Electrical Appliance Market, segmented across key areas including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The Production Analysis segment will detail the manufacturing landscape and key production hubs, with projected growth in specialized manufacturing capabilities. Consumption Analysis will focus on the demand-side dynamics, consumer demographics, and evolving preferences, with an anticipated increase in the adoption of smart appliances. The Import Market Analysis will examine the value and volume of imported electrical appliances, highlighting key product categories and import origins, and is expected to show steady growth in high-end segments. The Export Market Analysis will explore China's role as a global supplier, detailing export destinations and product types, with continued strong volume growth projected. Finally, Price Trend Analysis will dissect pricing strategies, the impact of technological advancements on pricing, and the growing premium segment, anticipating a gradual rise in average selling prices for innovative products.

Key Drivers of China Electrical Appliance Market Growth

The China Electrical Appliance Market is propelled by several key drivers. Technologically, the pervasive integration of the Internet of Things (IoT) and Artificial Intelligence (AI) is leading to the development of smarter, more connected appliances that enhance user convenience and efficiency. Economically, rising disposable incomes and a growing middle class are fueling demand for upgraded and feature-rich home appliances. Government initiatives promoting domestic consumption, energy efficiency standards, and smart city development further act as significant catalysts. The rapid urbanization trend also contributes to increased household formation and demand for essential and advanced electrical appliances.

Challenges in the China Electrical Appliance Market Sector

Despite robust growth, the China Electrical Appliance Market faces several challenges. The rise of online brands and IoT-enabled products, particularly from tech giants like Xiaomi, poses a threat to conventional home appliance companies through competitive pricing and enhanced user experience via mobile apps. The risk of inadequate product control for some IoT brands due to outsourced production in low-labor-cost countries can also impact quality perception. Intense competition, both domestic and international, leads to price wars in certain segments, squeezing profit margins. Moreover, evolving regulatory landscapes concerning data privacy and cybersecurity for smart appliances can create compliance hurdles. Supply chain disruptions, as witnessed during global events, can also impact production and distribution.

Emerging Opportunities in China Electrical Appliance Market

Emerging opportunities in the China Electrical Appliance Market are multifaceted. The continued expansion of the smart home ecosystem presents a significant avenue for growth, with increasing demand for seamlessly integrated devices and platforms. The growing consumer focus on health and wellness is driving demand for appliances that contribute to a healthier living environment, such as air purifiers and advanced water filters. Furthermore, the sustainability trend is creating opportunities for manufacturers of energy-efficient and eco-friendly appliances. The burgeoning rural market, with its increasing disposable incomes and desire for modern amenities, represents a vast untapped potential for market penetration. The development of innovative business models, such as appliance-as-a-service and subscription models for smart home features, also offers new avenues for revenue generation.

Leading Players in the China Electrical Appliance Market Market

- Supor

- Haier Electronics Group Co Ltd

- Hisense

- Gree Electric Appliances Inc

- Konka

- Fotile

- Midea Group

- Boss

- Aux Group

- Aucma Co Ltd

- Joyoung

- Changhong

- Vantage

Key Developments in China Electrical Appliance Market Industry

- 2020: Demand for large appliances, including washing machines, air conditioners, and refrigerators, surged due to lockdowns, leading to a rosy performance in market share and production capacity for Chinese giants.

- Ongoing: The rise of the Internet of Things (IoT) and online brands is posing a threat to conventional home appliance companies, especially TV makers, with smart home appliances from leading IoT brand Xiaomi being competitive on pricing and offering enhanced user experience through mobile apps.

- Ongoing: The rise of online shopping is facilitating the penetration of IoT brands, though many bear the risk of inadequate product control due to outsourcing production to countries with cheap labor.

Strategic Outlook for China Electrical Appliance Market Market

The strategic outlook for the China Electrical Appliance Market is one of continued innovation and expansion, driven by technological convergence and evolving consumer needs. The focus will increasingly shift towards developing sophisticated smart home ecosystems that offer integrated convenience and personalized experiences. Emphasis on sustainability and energy efficiency will remain paramount, aligning with national environmental goals and growing consumer consciousness. Companies that can effectively leverage AI, IoT, and big data to create intelligent, connected, and user-centric products will be best positioned for success. The market will witness further consolidation and strategic partnerships to enhance R&D capabilities and expand market reach. The growing demand in Tier-2 and Tier-3 cities, along with a focus on premium and value-added segments, will shape future growth catalysts.

China Electrical Appliance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Electrical Appliance Market Segmentation By Geography

- 1. China

China Electrical Appliance Market Regional Market Share

Geographic Coverage of China Electrical Appliance Market

China Electrical Appliance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Demand for Premium

- 3.2.2 Smart

- 3.2.3 and Innovative Appliances is Driven by Rising Incomes and Disposable Income; Major Appliances Segment is Dominating the Appliances Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Smart Appliances; Lack of Interoperability Between Devices and Platforms

- 3.4. Market Trends

- 3.4.1. Sales Through E-commerce Increased Manifold in the Chinese Home Appliances Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electrical Appliance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Supor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hisense

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gree Electric Appliances Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Konka

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fotile

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Midea Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boss

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aux Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aucma Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Joyoung

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Changhong

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Vantage

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Supor

List of Figures

- Figure 1: China Electrical Appliance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Electrical Appliance Market Share (%) by Company 2025

List of Tables

- Table 1: China Electrical Appliance Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Electrical Appliance Market Volume K Unit Forecast, by Production Analysis 2020 & 2033

- Table 3: China Electrical Appliance Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: China Electrical Appliance Market Volume K Unit Forecast, by Consumption Analysis 2020 & 2033

- Table 5: China Electrical Appliance Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: China Electrical Appliance Market Volume K Unit Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: China Electrical Appliance Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: China Electrical Appliance Market Volume K Unit Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: China Electrical Appliance Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: China Electrical Appliance Market Volume K Unit Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: China Electrical Appliance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: China Electrical Appliance Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: China Electrical Appliance Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: China Electrical Appliance Market Volume K Unit Forecast, by Production Analysis 2020 & 2033

- Table 15: China Electrical Appliance Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: China Electrical Appliance Market Volume K Unit Forecast, by Consumption Analysis 2020 & 2033

- Table 17: China Electrical Appliance Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: China Electrical Appliance Market Volume K Unit Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: China Electrical Appliance Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: China Electrical Appliance Market Volume K Unit Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: China Electrical Appliance Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: China Electrical Appliance Market Volume K Unit Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: China Electrical Appliance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Electrical Appliance Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electrical Appliance Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the China Electrical Appliance Market?

Key companies in the market include Supor, Haier Electronics Group Co Ltd, Hisense, Gree Electric Appliances Inc, Konka, Fotile, Midea Group, Boss, Aux Group, Aucma Co Ltd, Joyoung, Changhong, Vantage.

3. What are the main segments of the China Electrical Appliance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 747.64 billion as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Premium. Smart. and Innovative Appliances is Driven by Rising Incomes and Disposable Income; Major Appliances Segment is Dominating the Appliances Market.

6. What are the notable trends driving market growth?

Sales Through E-commerce Increased Manifold in the Chinese Home Appliances Market.

7. Are there any restraints impacting market growth?

High Cost of Installing Smart Appliances; Lack of Interoperability Between Devices and Platforms.

8. Can you provide examples of recent developments in the market?

The rise of the Internet of Things (IoT) and online brands may pose some threats to conventional home appliance companies, especially TV makers. Smart home appliances from leading loT brand Xiaomi are competitive on pricing and are internet-connected through mobile apps, which have greatly improved user experience and stickiness. The rise of online shopping should help IoT brands to increase their penetration, but most IoT brands bear the risk of inadequate product control as they outsource production to countries with cheap labor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electrical Appliance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electrical Appliance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electrical Appliance Market?

To stay informed about further developments, trends, and reports in the China Electrical Appliance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence