Key Insights

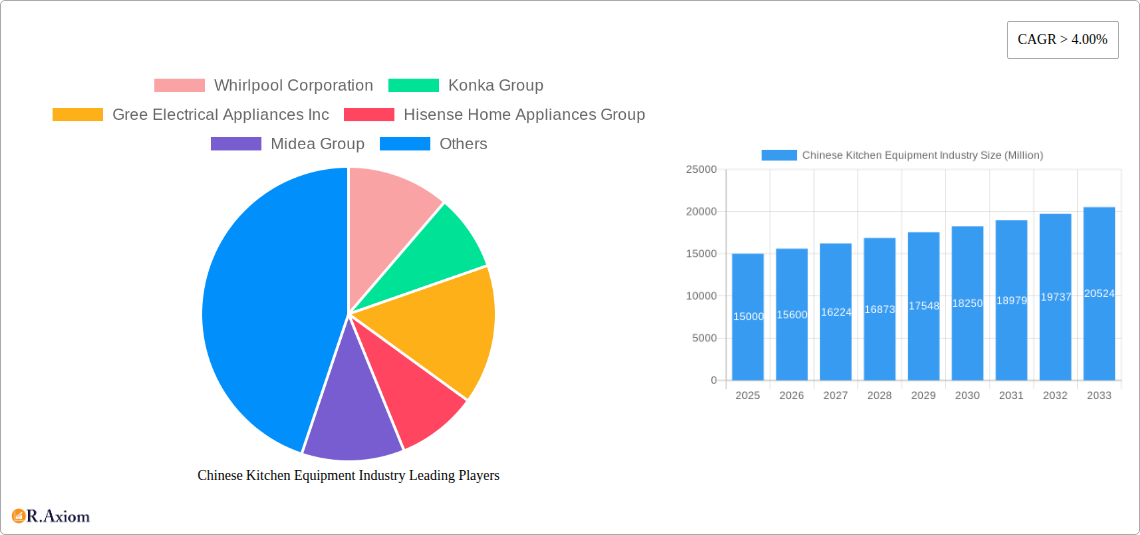

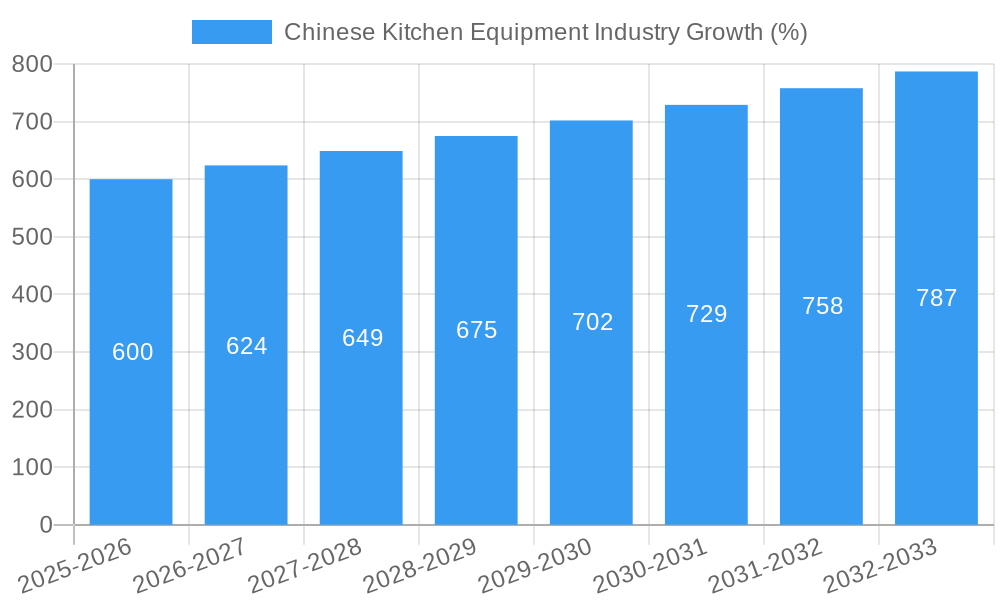

The Chinese kitchen equipment market, currently experiencing robust growth with a CAGR exceeding 4%, presents a significant opportunity for investors and businesses. Driven by rising disposable incomes, urbanization, and a growing preference for modern, convenient kitchens, the market is witnessing a surge in demand for a diverse range of appliances. Refrigerators and freezers remain the largest segment, followed by dishwashers and microwave ovens. The increasing adoption of smart home technology is fueling the demand for technologically advanced appliances with features like Wi-Fi connectivity and intelligent controls. The residential sector dominates the market, but the commercial segment is exhibiting promising growth, particularly in the food service and hospitality industries. Major players like Haier, Midea, and Whirlpool are fiercely competing for market share, leveraging their brand recognition and extensive distribution networks. While the market faces challenges like fluctuating raw material prices and potential economic slowdowns, the long-term outlook remains positive, fueled by sustained consumer spending and ongoing technological advancements.

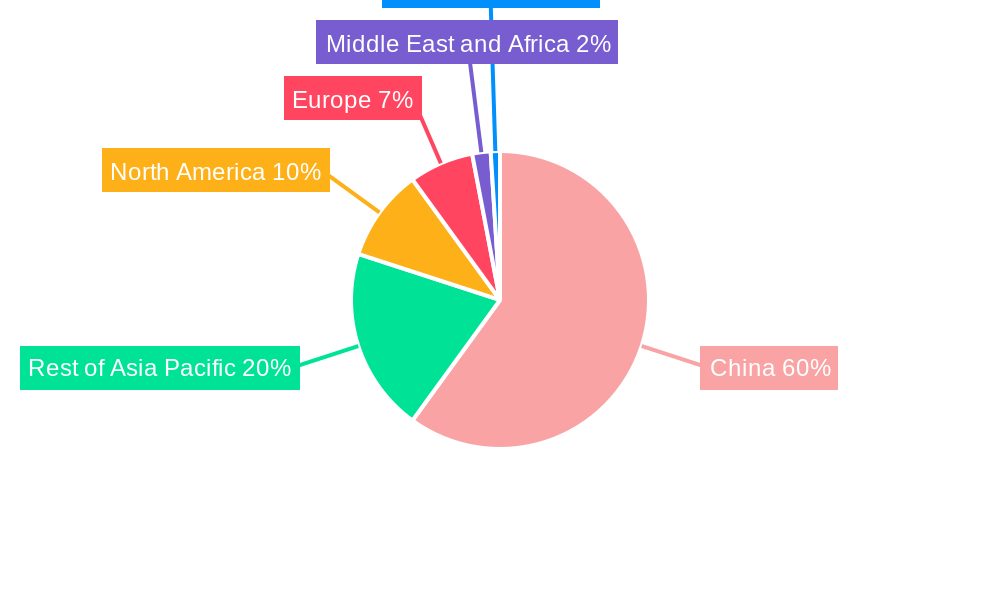

The geographical distribution of the market shows strong growth in tier-1 and tier-2 cities, driven by increasing consumer awareness and access to e-commerce platforms. Online sales are rapidly gaining traction, complementing traditional retail channels like multi-brand stores and exclusive brand outlets. Future market expansion will likely be driven by the rising middle class, the increasing adoption of smart kitchen technologies, and government initiatives promoting energy-efficient appliances. Furthermore, manufacturers are increasingly focusing on product innovation and customization to meet the evolving needs of consumers, leading to the introduction of energy-efficient, space-saving, and aesthetically pleasing kitchen appliances. This focus on innovation and market segmentation will likely be key drivers of continued market growth in the coming years.

Chinese Kitchen Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Chinese kitchen equipment industry, covering market size, segmentation, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors. The report's focus is on providing data-driven analysis to support strategic decision-making.

Chinese Kitchen Equipment Industry Market Concentration & Innovation

The Chinese kitchen equipment market is characterized by a moderate level of concentration, with several major players holding significant market share. While precise market share figures for each company fluctuate, Midea Group, Haier Smart Home, and Hisense Home Appliances Group consistently rank among the top contenders, collectively controlling an estimated xx% of the market in 2025. The market witnesses continuous innovation driven by increasing consumer demand for smart, energy-efficient, and multifunctional appliances. Government regulations focused on energy efficiency and safety standards further shape product development. The presence of established international players like Whirlpool Corporation and LG Electronics introduces competitive pressure and advanced technologies. Product substitutes, such as traditional cooking methods or alternative food preparation technologies, present a minor threat to market growth. However, the ongoing trend towards convenience and improved lifestyles fuels the demand for modern kitchen equipment. Mergers and acquisitions (M&A) are relatively frequent, with deal values ranging from tens to hundreds of Millions of USD annually, consolidating market share and accelerating innovation. Recent M&A activities have primarily focused on expanding product portfolios and enhancing distribution networks. For instance, a recent merger between two smaller players resulted in a xx Million USD deal, significantly increasing their market presence in the affordable segment.

Chinese Kitchen Equipment Industry Industry Trends & Insights

The Chinese kitchen equipment market is experiencing robust growth, driven by a combination of factors. Rising disposable incomes, rapid urbanization, and changing consumer lifestyles are significantly boosting demand for modern kitchen appliances. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fuelled by increasing penetration of smart home technologies, a preference for convenient and time-saving cooking solutions, and the growing adoption of online shopping channels. Technological advancements, including the integration of IoT (Internet of Things) features, smart controls, and enhanced energy efficiency, are transforming the industry. Consumer preferences are shifting toward aesthetically pleasing, space-saving, and multifunctional appliances. The competitive landscape is highly dynamic, with both domestic and international brands vying for market share. This competition fosters innovation and drives down prices, benefiting consumers. Market penetration for specific product categories like smart refrigerators and dishwashers is steadily increasing, with penetration rates reaching xx% and xx% respectively, in 2025.

Dominant Markets & Segments in Chinese Kitchen Equipment Industry

By Product: Refrigerators and freezers constitute the largest segment, driven by their essential role in food preservation. Microwave ovens and other small kitchen appliances also show strong growth due to increasing urbanization and smaller living spaces. The market for water purifiers is expanding rapidly due to growing concerns about water quality.

By End User: The residential segment dominates the market, reflecting the growing number of households purchasing modern kitchen equipment. However, the commercial segment is also exhibiting healthy growth, spurred by the expansion of the hospitality and food service industries.

By Distribution Channel: Online channels are experiencing rapid growth, driven by the increasing adoption of e-commerce, while multi-brand stores remain a significant distribution channel, maintaining a considerable market share.

Key drivers for the dominant segments include rising disposable incomes, increased awareness of healthy eating habits (particularly fueling demand for water purifiers), and the government's push towards infrastructure development (beneficial for both residential and commercial segments). The significant growth in the online distribution channel is facilitated by robust e-commerce infrastructure and increasing internet penetration.

Chinese Kitchen Equipment Industry Product Developments

The Chinese kitchen equipment industry is witnessing a wave of product innovations focusing on smart features, energy efficiency, and multifunctional designs. The integration of IoT capabilities allows for remote control, smart cooking features, and data-driven insights. Energy-efficient designs, compliant with stringent government regulations, are becoming increasingly common. Products are designed to save space and integrate seamlessly into modern kitchens. Competition forces manufacturers to continuously improve product features and functionalities to meet evolving consumer preferences. This focus on innovation ensures a sustained competitive edge in the rapidly evolving market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Chinese kitchen equipment market, segmented by product type (Refrigerators and Freezers, Dishwashers, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, Other Kitchen Appliances), end-user (Residential, Commercial), and distribution channel (Multi-Brand Stores, Exclusive Stores, Online, Other Distribution Channel). Each segment's growth projections, market size estimates, and competitive dynamics are thoroughly examined. The report projects substantial growth across all segments, with variations depending on factors like economic conditions and consumer preferences. The online distribution channel is expected to witness the highest growth rate. The residential segment will continue to dominate in terms of market size.

Key Drivers of Chinese Kitchen Equipment Industry Growth

Several factors drive growth in the Chinese kitchen equipment industry. Technological advancements, including the integration of smart features and energy-efficient designs, are a significant catalyst. Rising disposable incomes and changing lifestyles lead to increased consumer spending on home appliances. Government policies promoting energy efficiency and sustainable consumption further stimulate market expansion. The development of robust e-commerce infrastructure facilitates the growth of online sales channels. Finally, expanding urbanization and a growing middle class contribute to the overall growth of the market.

Challenges in the Chinese Kitchen Equipment Industry Sector

The industry faces certain challenges. Intense competition from both domestic and international brands creates pressure on pricing and profit margins. Fluctuations in raw material costs and supply chain disruptions can impact production and profitability. Stringent government regulations on energy efficiency and safety require continuous investment in research and development. Additionally, the increasing prevalence of counterfeit products poses a threat to legitimate businesses. These challenges, while significant, are being actively addressed by industry players through innovation, strategic partnerships, and supply chain diversification.

Emerging Opportunities in Chinese Kitchen Equipment Industry

The industry presents various promising opportunities. The growing popularity of smart home technologies opens avenues for innovation in connected kitchen appliances. Expanding into rural markets and targeting lower-income segments offers significant growth potential. There is increasing demand for customized and personalized kitchen appliances. Finally, the development of sustainable and environmentally friendly kitchen equipment aligns with consumer preferences and government initiatives.

Leading Players in the Chinese Kitchen Equipment Industry Market

- Whirlpool Corporation

- Konka Group

- Gree Electrical Appliances Inc

- Hisense Home Appliances Group

- Midea Group

- TCL Corporation

- Haier Smart Home

- Xiaomi Smart Home

- Hangzhou Miyoung Smart Home Co Ltd

- LG Electronics

Key Developments in Chinese Kitchen Equipment Industry Industry

- September 2022: Xiaomi launched the MIJIA Cooking Robot, offering 35 cooking options and a 2.2-liter capacity, significantly expanding the smart cooking appliance market.

- August 2023: Xiaomi launched the Mijia 5.5L Visual Air Fryer with a 6.8-inch viewing window, emphasizing convenience and healthier cooking methods. This launch showcased innovation in the air fryer segment, highlighting features desirable to health-conscious consumers.

Strategic Outlook for Chinese Kitchen Equipment Industry Market

The Chinese kitchen equipment market is poised for sustained growth, driven by technological innovation, evolving consumer preferences, and favorable economic conditions. Continued investment in smart home technologies, energy-efficient designs, and multifunctional appliances will be crucial for maintaining a competitive edge. Expanding into untapped markets and catering to diverse consumer segments will unlock further growth potential. Strategic partnerships and collaborations will play a significant role in shaping the industry's future. The market's long-term prospects remain positive, with significant opportunities for both established players and new entrants.

Chinese Kitchen Equipment Industry Segmentation

-

1. Product

- 1.1. Refrigerators and Freezers

- 1.2. Dishwashers

- 1.3. Mixers and Grinders

- 1.4. Microwave Ovens

- 1.5. Grills and Roasters

- 1.6. Water Purifiers

- 1.7. Other Kitchen Appliances

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi- Brand Stores

- 3.2. Exclusive Stores

- 3.3. Online

- 3.4. Other Distribution Channel

Chinese Kitchen Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Kitchen Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances

- 3.3. Market Restrains

- 3.3.1. High power consumption from smart home appliances; Limited spaces in households for appliances

- 3.4. Market Trends

- 3.4.1. Smart Kitchen Appliances are driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators and Freezers

- 5.1.2. Dishwashers

- 5.1.3. Mixers and Grinders

- 5.1.4. Microwave Ovens

- 5.1.5. Grills and Roasters

- 5.1.6. Water Purifiers

- 5.1.7. Other Kitchen Appliances

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi- Brand Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators and Freezers

- 6.1.2. Dishwashers

- 6.1.3. Mixers and Grinders

- 6.1.4. Microwave Ovens

- 6.1.5. Grills and Roasters

- 6.1.6. Water Purifiers

- 6.1.7. Other Kitchen Appliances

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Multi- Brand Stores

- 6.3.2. Exclusive Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators and Freezers

- 7.1.2. Dishwashers

- 7.1.3. Mixers and Grinders

- 7.1.4. Microwave Ovens

- 7.1.5. Grills and Roasters

- 7.1.6. Water Purifiers

- 7.1.7. Other Kitchen Appliances

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Multi- Brand Stores

- 7.3.2. Exclusive Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators and Freezers

- 8.1.2. Dishwashers

- 8.1.3. Mixers and Grinders

- 8.1.4. Microwave Ovens

- 8.1.5. Grills and Roasters

- 8.1.6. Water Purifiers

- 8.1.7. Other Kitchen Appliances

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Multi- Brand Stores

- 8.3.2. Exclusive Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Refrigerators and Freezers

- 9.1.2. Dishwashers

- 9.1.3. Mixers and Grinders

- 9.1.4. Microwave Ovens

- 9.1.5. Grills and Roasters

- 9.1.6. Water Purifiers

- 9.1.7. Other Kitchen Appliances

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Multi- Brand Stores

- 9.3.2. Exclusive Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Refrigerators and Freezers

- 10.1.2. Dishwashers

- 10.1.3. Mixers and Grinders

- 10.1.4. Microwave Ovens

- 10.1.5. Grills and Roasters

- 10.1.6. Water Purifiers

- 10.1.7. Other Kitchen Appliances

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Multi- Brand Stores

- 10.3.2. Exclusive Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 USA

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia

- 13.1.4 India

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 Egypt

- 14.1.3 UAE

- 14.1.4 Rest of Middle East and Africa

- 15. South America Chinese Kitchen Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Argentina

- 15.1.2 Colombia

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Whirlpool Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Konka Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Gree Electrical Appliances Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Hisense Home Appliances Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Midea Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 TCL Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Haier Smart Home

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Xiaomi Smart Home

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 LG Electronics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global Chinese Kitchen Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: South America Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 23: South America Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 24: South America Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: South America Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Europe Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Europe Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Product 2024 & 2032

- Figure 45: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Product 2024 & 2032

- Figure 46: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by End User 2024 & 2032

- Figure 47: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by End User 2024 & 2032

- Figure 48: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Chinese Kitchen Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: USA Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Egypt Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: UAE Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Argentina Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of South America Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: United Kingdom Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Germany Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Russia Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Benelux Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Nordics Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 61: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Turkey Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: GCC Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: North Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East & Africa Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 70: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 71: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 72: Global Chinese Kitchen Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 73: China Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: India Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Japan Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Korea Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: ASEAN Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Oceania Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Rest of Asia Pacific Chinese Kitchen Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Kitchen Equipment Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Chinese Kitchen Equipment Industry?

Key companies in the market include Whirlpool Corporation, Konka Group, Gree Electrical Appliances Inc, Hisense Home Appliances Group, Midea Group, TCL Corporation, Haier Smart Home, Xiaomi Smart Home, Hangzhou Miyoung Smart Home Co Ltd*List Not Exhaustive, LG Electronics.

3. What are the main segments of the Chinese Kitchen Equipment Industry?

The market segments include Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances.

6. What are the notable trends driving market growth?

Smart Kitchen Appliances are driving the growth of the market.

7. Are there any restraints impacting market growth?

High power consumption from smart home appliances; Limited spaces in households for appliances.

8. Can you provide examples of recent developments in the market?

August 2023: Xiamoi launched The Mijia 5.5L Visual Air Fryer, which comes with a host of features designed to elevate the cooking experience. Its standout feature is the 6.8-inch ingredient viewing window, allowing users to monitor their dishes without interrupting the cooking process. The appliance supports efficient oil removal and no-flip cooking techniques, ensuring convenient and healthier meals. The device also features a circular OLED display, which shows the temperature, timer, and different modes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Kitchen Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Kitchen Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Kitchen Equipment Industry?

To stay informed about further developments, trends, and reports in the Chinese Kitchen Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence