Key Insights

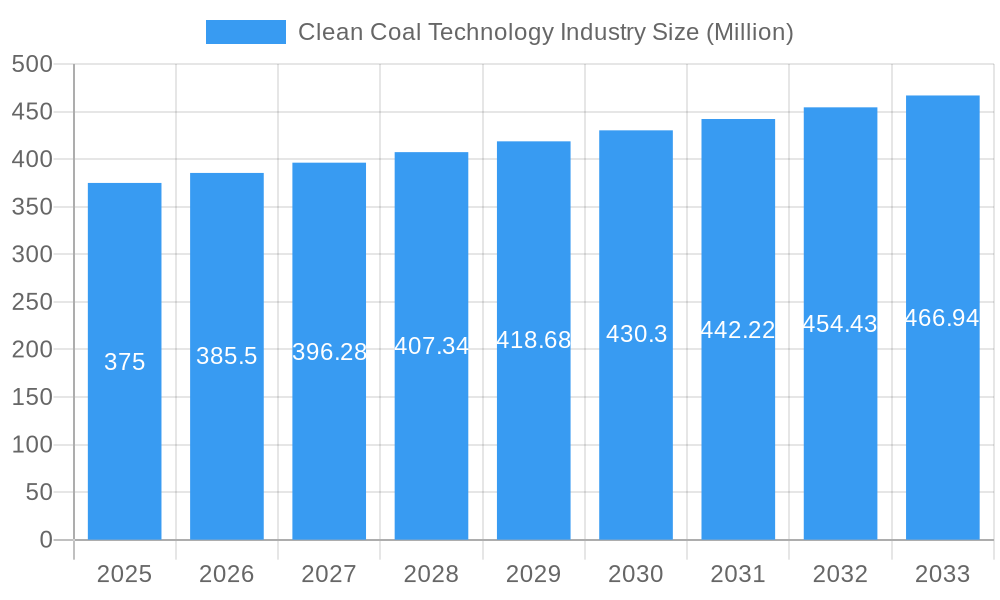

The Clean Coal Technology (CCT) market is projected for substantial growth, anticipated to reach $4.57 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.39% from a base year of 2025. This expansion is driven by increasing global energy demands and the critical need to reduce the environmental impact of conventional coal power. Key growth catalysts include advancements in Carbon Capture, Utilization, and Storage (CCUS), alongside more efficient combustion methods like Integrated Gasification Combined Cycle (IGCC). Supportive government regulations and incentives for cleaner energy adoption are further accelerating market penetration. The industry is shifting towards commercial-scale deployment of CCT, moving beyond pilot phases to widespread industrial application. Innovations in oxy-fuel combustion and advanced scrubbers are effectively lowering emissions of SO2, NOx, and particulate matter, positioning coal as a more sustainable energy source during the ongoing energy transition.

Clean Coal Technology Industry Market Size (In Billion)

Despite this positive outlook, the market confronts several challenges. The high upfront investment required for CCT deployment and the growing competitiveness of renewable energy sources such as solar and wind power present significant hurdles. Public perception and concerns regarding the long-term environmental implications of coal, even with cleaner technologies, also pose a considerable obstacle. The market is segmented by various applications including production, consumption, imports, exports, and price trends. Leading companies such as Shell PLC, KBR Inc., Siemens Energy AG, General Electric Company, and Alstom SA are actively investing in research and development to improve efficiency and cost-effectiveness, reinforcing their market positions and fostering innovation across key regions including North America, Europe, and Asia Pacific, which are at the forefront of CCT adoption due to their existing reliance on coal and strong industrial bases.

Clean Coal Technology Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Clean Coal Technology industry, providing essential insights for stakeholders in this evolving sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study examines market dynamics, technological progress, regulatory frameworks, and competitive strategies.

Clean Coal Technology Industry Market Concentration & Innovation

The Clean Coal Technology (CCT) industry exhibits a moderate to high market concentration, with key players investing significantly in research and development to gain a competitive edge. Innovation is primarily driven by stringent environmental regulations, the increasing global demand for energy, and the imperative to reduce greenhouse gas emissions from coal-fired power plants. Key innovation drivers include advancements in Carbon Capture, Utilization, and Storage (CCUS) technologies, improved efficiency in coal combustion processes, and the development of novel materials for emission control. Regulatory frameworks worldwide, particularly those aimed at climate change mitigation, are compelling companies to adopt and innovate CCT solutions. While product substitutes like renewable energy sources are gaining traction, CCT remains crucial for baseload power generation in many economies. End-user trends are leaning towards cleaner energy production and a reduced environmental footprint. Mergers and Acquisitions (M&A) activities, though not extensively documented publicly due to the niche nature of some segments, are likely to consolidate the market and foster technological integration. Estimated M&A deal values are anticipated to increase as larger energy corporations seek to bolster their CCT portfolios.

- Key Innovation Areas:

- Advanced Gasification Technologies

- Supercritical and Ultra-Supercritical Power Plants

- Flue Gas Desulfurization (FGD) and Selective Catalytic Reduction (SCR)

- Carbon Capture, Utilization, and Storage (CCUS)

Clean Coal Technology Industry Industry Trends & Insights

The Clean Coal Technology (CCT) industry is poised for significant growth, driven by a confluence of factors that underscore the ongoing relevance of coal as a primary energy source while demanding a substantial reduction in its environmental impact. The CAGR for the CCT market is projected to be a robust XX%, reflecting the increasing adoption of cleaner combustion and emission control technologies. Despite the rise of renewable energy, coal continues to be a cost-effective and readily available energy source for many nations, especially those with substantial domestic reserves. This ensures a sustained demand for CCT solutions that enable coal-fired power plants to operate more efficiently and with lower emissions. Technological disruptions are at the forefront, with ongoing advancements in Carbon Capture, Utilization, and Storage (CCUS) technologies attracting substantial investment. These technologies are critical for meeting ambitious climate targets by mitigating CO2 emissions. Furthermore, innovations in integrated gasification combined cycle (IGCC) and advanced combustion techniques are enhancing the efficiency of existing and new coal power infrastructure, making them more competitive and environmentally compliant. Consumer preferences, globally, are increasingly aligned with sustainability and reduced environmental impact. While direct consumer preference may not directly influence CCT, it translates into strong public and governmental pressure for cleaner industrial operations, thereby pushing utilities to adopt CCT. Competitive dynamics within the CCT market are characterized by a mix of established engineering firms, specialized technology providers, and national energy companies. Competition is fierce, driving innovation and cost-effectiveness. Market penetration of advanced CCT solutions is expected to rise significantly across developing economies seeking to balance energy security with environmental responsibility.

Dominant Markets & Segments in Clean Coal Technology Industry

The Clean Coal Technology (CCT) industry demonstrates distinct regional and segmental dominance, shaped by economic policies, infrastructure development, and regulatory pressures.

Production Analysis: The production of CCT solutions is heavily concentrated in regions with significant coal-fired power generation capacity and strong industrial manufacturing bases.

- Key Drivers: Presence of established power equipment manufacturers, availability of skilled labor, and government incentives for domestic production.

- Dominance: North America and Europe currently lead in the production of advanced CCT components and systems due to historical technological leadership and stringent environmental mandates. Asia, particularly China and India, is rapidly emerging as a key production hub, driven by massive investments in new coal power plants requiring CCT integration.

Consumption Analysis: Consumption of CCT is directly proportional to existing and planned coal-fired power generation infrastructure.

- Key Drivers: Energy demand, coal resource availability, environmental regulations, and the pace of renewable energy deployment.

- Dominance: Asia-Pacific, led by China and India, is the largest consumer of CCT. These nations are actively investing in new, more efficient coal power plants equipped with advanced CCT to meet their growing energy needs while attempting to curb emissions. Developed nations in North America and Europe also contribute to consumption through retrofitting existing plants and investing in next-generation CCT.

Import Market Analysis (Value & Volume): The import market for CCT is driven by the need for specialized technologies and components not readily available domestically or for projects requiring rapid deployment.

- Key Drivers: Technological gaps, cost-competitiveness of foreign suppliers, and specific project requirements.

- Dominance: Countries with high energy demand and limited indigenous CCT manufacturing capabilities are significant importers. For instance, emerging economies in Southeast Asia and Africa are key markets for imported CCT equipment and expertise. The value of imports is often higher due to the high-tech nature of components like advanced turbines, emission control systems, and CCUS equipment.

Export Market Analysis (Value & Volume): Nations with strong technological capabilities and established manufacturing in the CCT sector are leading exporters.

- Key Drivers: Technological prowess, economies of scale in manufacturing, and competitive pricing.

- Dominance: Countries like the United States, Germany, Japan, and China are major exporters of CCT technologies and services. Their exports range from large-scale power plant equipment to specialized components and engineering solutions, catering to global demand for cleaner coal power.

Price Trend Analysis: Price trends in the CCT market are influenced by raw material costs, technological complexity, and the scale of deployment.

- Key Drivers: Cost of metals and rare earth elements for components, R&D investment amortization, and economies of scale.

- Trends: Prices for advanced CCT solutions have been on a general downward trend due to technological maturation and increased competition. However, niche and highly customized technologies, especially in CCUS, can command premium pricing. The demand for retrofitting existing plants versus new builds also influences price dynamics.

Clean Coal Technology Industry Product Developments

Recent product developments in the Clean Coal Technology (CCT) industry are focused on enhancing efficiency and drastically reducing emissions. Innovations in advanced combustion techniques like ultra-supercritical boilers are improving thermal efficiency, thereby reducing fuel consumption and CO2 output per megawatt-hour. Carbon Capture, Utilization, and Storage (CCUS) technologies are seeing significant advancements, with pilot projects demonstrating improved capture rates and lower energy penalties. Flue gas desulfurization (FGD) and selective catalytic reduction (SCR) systems are becoming more compact, efficient, and cost-effective, enabling better removal of sulfur dioxide and nitrogen oxides. These advancements provide competitive advantages by allowing coal power plants to meet increasingly stringent environmental regulations and maintain their role in the energy mix.

Report Scope & Segmentation Analysis

This report comprehensively segments the Clean Coal Technology (CCT) industry to provide a detailed market overview. The segmentation encompasses:

- Production Analysis: Examining the manufacturing capabilities and output of CCT equipment and components across different regions and companies. Growth projections are tied to industrial expansion and technological adoption.

- Consumption Analysis: Analyzing the demand for CCT solutions based on existing and planned coal-fired power infrastructure and energy policies. Market sizes are driven by the installed capacity of coal power plants requiring CCT.

- Import Market Analysis (Value & Volume): Assessing the global trade of CCT technologies and components, highlighting key importing nations and the value proposition of imported solutions.

- Export Market Analysis (Value & Volume): Identifying leading exporting countries and their contribution to the global supply of CCT technologies, emphasizing competitive dynamics in international markets.

- Price Trend Analysis: Tracking historical and forecasted price movements of various CCT technologies, influenced by raw material costs, R&D, and market competition.

Key Drivers of Clean Coal Technology Industry Growth

The Clean Coal Technology (CCT) industry is propelled by several critical growth drivers:

- Energy Security and Baseload Power: Coal remains a significant source of reliable baseload power in many economies, and CCT enables its continued use while mitigating environmental concerns.

- Stringent Environmental Regulations: Global and national mandates for reducing air pollution and greenhouse gas emissions necessitate the adoption of CCT.

- Technological Advancements: Ongoing innovation in areas like CCUS, advanced combustion, and emission control systems makes coal power more efficient and cleaner.

- Economic Competitiveness: In regions with abundant coal reserves, CCT offers a cost-effective path to meeting energy demands compared to some alternative energy sources, especially for baseload power.

- Government Support and Incentives: Policies that promote the development and deployment of cleaner coal technologies, including R&D funding and tax credits, are crucial drivers.

Challenges in the Clean Coal Technology Industry Sector

Despite its growth drivers, the Clean Coal Technology (CCT) industry faces significant challenges:

- High Capital Investment: Implementing advanced CCT, particularly CCUS, requires substantial upfront capital investment, which can be a barrier for some utilities.

- Public Perception and ESG Concerns: Negative public perception surrounding coal power and increasing pressure from Environmental, Social, and Governance (ESG) investors can hinder investment and adoption.

- Competition from Renewables: Rapid cost declines and policy support for renewable energy sources like solar and wind present a significant competitive challenge.

- Technological Maturity and Scalability: While promising, some CCT, especially large-scale CCUS, are still undergoing development and scaling up, facing technical hurdles and economic viability concerns.

- Regulatory Uncertainty: Evolving and sometimes unpredictable regulatory landscapes regarding carbon pricing and emissions standards can create investment uncertainty.

Emerging Opportunities in Clean Coal Technology Industry

The Clean Coal Technology (CCT) industry is presented with several emerging opportunities:

- Carbon Capture, Utilization, and Storage (CCUS) Expansion: The growing focus on net-zero emissions targets creates a significant opportunity for the deployment and advancement of CCUS technologies, including the utilization of captured CO2 for industrial processes and enhanced oil recovery.

- Retrofitting Existing Power Plants: Many existing coal-fired power plants worldwide can be upgraded with CCT solutions, offering a less capital-intensive path to emission reduction compared to building new plants.

- Hydrogen Production from Coal: CCT can be integrated with coal gasification to produce low-carbon hydrogen, a key fuel for the future energy transition.

- Developing Economies' Energy Needs: Rapidly growing economies continue to rely on coal for baseload power, presenting a substantial market for cost-effective and cleaner coal technologies.

- Circular Economy Integration: Opportunities exist in developing CCT solutions that integrate with waste-to-energy processes or utilize byproducts from coal combustion.

Leading Players in the Clean Coal Technology Industry Market

- Shell PLC

- KBR Inc

- Siemens Energy AG

- General Electric Company

- Alstom SA

Key Developments in Clean Coal Technology Industry Industry

- February 2022: The Indian Institute of Chemical Technology (IICT) announced a collaborative project of approximately INR 7.31 core with Northern Coalfields Limits (NCL), Madhya Pradesh (MP), to undertake research and development in sustainable mining and clean coal technologies (CCT). This initiative aims to enhance the environmental performance of coal extraction and utilization in India.

- October 2021: Adani Power Limited announced its plan to commission the Godda Ultra Super Critical coal thermal Power Project by March 2022. The plant, located in Jharkhand, India, boasts an installed capacity of 1,600 MW. The commissioning of such large-scale, advanced coal power plants equipped with CCT is anticipated to drive the adoption and use of clean coal technologies during the forecast period.

Strategic Outlook for Clean Coal Technology Industry Market

The strategic outlook for the Clean Coal Technology (CCT) industry is one of continued relevance and innovation, albeit within an evolving energy landscape. The industry's future hinges on its ability to demonstrate cost-effectiveness, technological maturity, and a significant reduction in environmental impact, particularly greenhouse gas emissions. Continued investment in Carbon Capture, Utilization, and Storage (CCUS) is paramount, as this technology offers the most direct pathway for coal to remain a viable component of the energy mix while meeting climate goals. Strategic collaborations between technology providers, energy companies, and governments will be crucial for scaling up these advanced solutions. Furthermore, the development of hybrid energy systems that integrate CCT with renewable sources and energy storage will present significant growth opportunities, ensuring grid stability and reliability. As developing economies continue to prioritize energy security and affordability, the demand for cleaner coal solutions will persist, offering a substantial market for advanced CCT technologies.

Clean Coal Technology Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Clean Coal Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Clean Coal Technology Industry Regional Market Share

Geographic Coverage of Clean Coal Technology Industry

Clean Coal Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets

- 3.3. Market Restrains

- 3.3.1. 4.; Shift Toward Unmanned Aircraft

- 3.4. Market Trends

- 3.4.1. Growth in Power Consumption is Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East and Africa

- 5.6.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East and Africa Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. South America Clean Coal Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shell PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KBR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Energy AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Electric Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alstom SA*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Shell PLC

List of Figures

- Figure 1: Global Clean Coal Technology Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: Europe Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East and Africa Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Clean Coal Technology Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: South America Clean Coal Technology Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: South America Clean Coal Technology Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: South America Clean Coal Technology Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: South America Clean Coal Technology Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: South America Clean Coal Technology Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: South America Clean Coal Technology Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: South America Clean Coal Technology Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: South America Clean Coal Technology Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: South America Clean Coal Technology Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: South America Clean Coal Technology Industry Revenue (billion), by Country 2025 & 2033

- Figure 61: South America Clean Coal Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Clean Coal Technology Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Clean Coal Technology Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 32: Global Clean Coal Technology Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Global Clean Coal Technology Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Global Clean Coal Technology Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Global Clean Coal Technology Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Global Clean Coal Technology Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clean Coal Technology Industry?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Clean Coal Technology Industry?

Key companies in the market include Shell PLC, KBR Inc, Siemens Energy AG, General Electric Company, Alstom SA*List Not Exhaustive.

3. What are the main segments of the Clean Coal Technology Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Modernization and Upgrades of Existing Military Aircraft Fleets4.; Increasing Defense Budgets.

6. What are the notable trends driving market growth?

Growth in Power Consumption is Likely to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Unmanned Aircraft.

8. Can you provide examples of recent developments in the market?

In February 2022, the Indian Institute of Chemical Technology (IICT) announced a collaborative project of approximately INR 7.31 core with Northern Coalfields Limits (NCL), Madhya Pradesh (MP), to take up research and development in the field of sustainable mining and clean coal technologies (CCT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clean Coal Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clean Coal Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clean Coal Technology Industry?

To stay informed about further developments, trends, and reports in the Clean Coal Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence