Key Insights

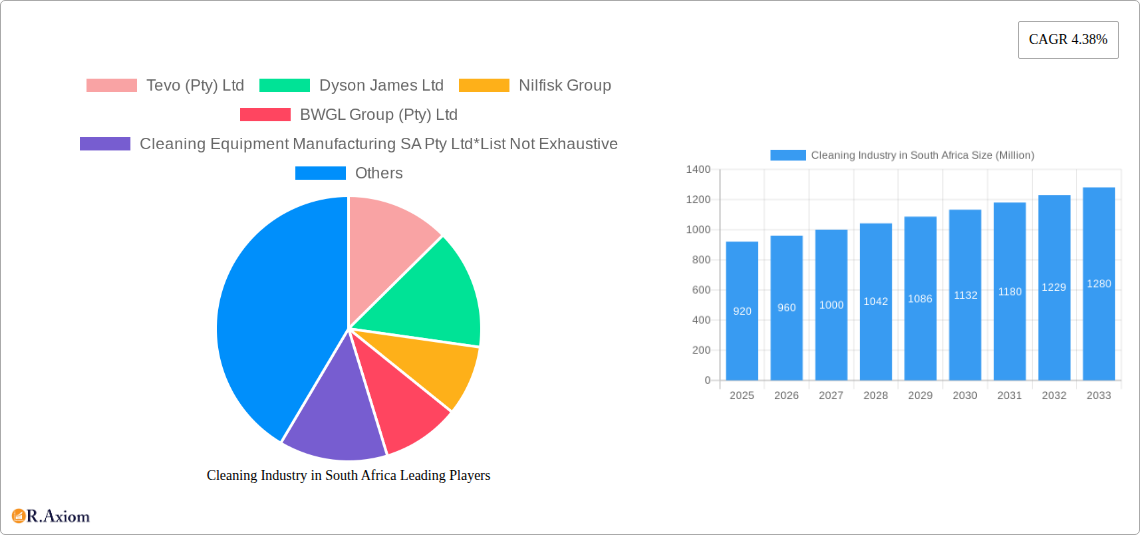

The South African cleaning industry is poised for steady growth, with an estimated market size of ZAR 920 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.38% through 2033. This expansion is primarily driven by increasing urbanization, a growing awareness of hygiene and sanitation standards across both residential and commercial sectors, and the rising demand for advanced cleaning technologies. The commercial and industrial segment, encompassing hospitality, healthcare, and manufacturing, is expected to remain the dominant force due to higher spending on professional cleaning solutions. Furthermore, the escalating need for specialized cleaning equipment and eco-friendly cleaning chemicals, driven by both regulatory pressures and consumer preferences for sustainability, will act as significant growth catalysts. The shift towards more efficient and automated cleaning solutions, such as advanced vacuum cleaners and high-pressure washers, will also contribute to market dynamism.

Cleaning Industry in South Africa Market Size (In Million)

Key trends shaping the South African cleaning market include the increasing adoption of smart and connected cleaning equipment, offering enhanced efficiency and data-driven insights for facility management. The surge in online sales channels is democratizing access to a wider range of cleaning products and equipment, challenging traditional offline distribution networks. However, the market faces restraints such as fluctuating raw material costs for chemicals and consumables, and the initial high investment required for sophisticated cleaning machinery, which can be a barrier for smaller businesses. Despite these challenges, the inherent demand for cleanliness and a rising disposable income in certain segments of the population, coupled with a strong presence of established international and local players like Karcher and Dyson, are expected to fuel continued market penetration and innovation.

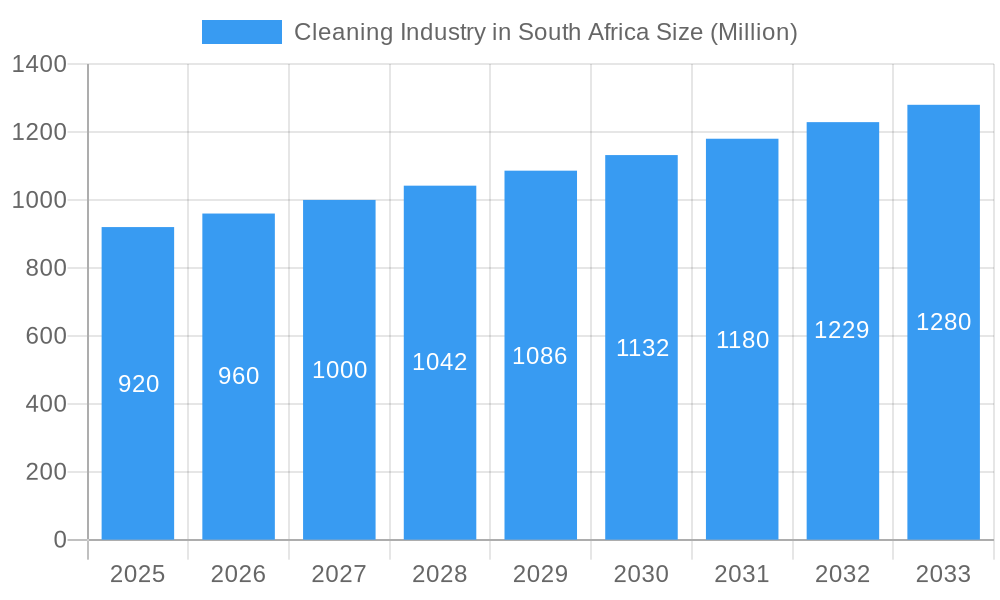

Cleaning Industry in South Africa Company Market Share

Here is an SEO-optimized, detailed report description for the Cleaning Industry in South Africa, incorporating high-traffic keywords and adhering to all your specifications.

This comprehensive report provides an in-depth analysis of the South African cleaning industry, covering market dynamics, growth drivers, challenges, and future opportunities. Examining the period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand the current landscape and forecast future trends. We meticulously analyze market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and M&A activities, alongside detailed industry trends, insights, dominant markets, and product developments. This report is essential for businesses looking to strategize, invest, and thrive in the dynamic South African cleaning sector.

Cleaning Industry in South Africa Market Concentration & Innovation

The South African cleaning industry exhibits a moderate to high market concentration, with key players like Tevo (Pty) Ltd, Dyson James Ltd, Nilfisk Group, BWGL Group (Pty) Ltd, and Cleaning Equipment Manufacturing SA Pty Ltd holding significant market shares. While specific market share percentages are proprietary, the collective dominance of these entities indicates a competitive yet consolidated environment. Innovation is a critical driver, fueled by increasing consumer demand for eco-friendly and technologically advanced cleaning solutions. Regulatory frameworks, particularly concerning chemical safety and environmental impact, are shaping product development and market entry strategies. Product substitutes, such as DIY cleaning solutions and the increasing adoption of reusable cleaning tools, present a growing challenge. End-user trends are shifting towards hygiene, convenience, and sustainability, influencing product design and marketing. Mergers and acquisitions (M&A) activity, while not extensively documented publicly in terms of deal value, are present as larger companies seek to expand their portfolios and market reach. For instance, the strategic integration of new technologies or product lines by BWGL Group (Pty) Ltd and Chemstrat signifies a consolidation of expertise and market presence. The overall M&A landscape is projected to evolve as market players adapt to changing consumer demands and competitive pressures, aiming to secure a stronger foothold.

Cleaning Industry in South Africa Industry Trends & Insights

The South African cleaning industry is poised for robust growth, driven by several interconnected trends. A significant catalyst is the rising awareness of hygiene and sanitation, particularly amplified by global health events, leading to increased demand across all end-user segments, from residential households to large-scale commercial and industrial facilities. The CAGR (Compound Annual Growth Rate) for the cleaning chemicals market is projected to be around 5.5% over the forecast period. Market penetration for specialized cleaning equipment, such as advanced vacuum cleaners and steam cleaners, is steadily increasing as consumers and businesses invest in efficiency and deep cleaning capabilities. Technological disruptions are a defining feature, with the integration of smart technologies, automation, and AI in cleaning equipment offering enhanced performance and user experience. For example, the introduction of advanced filtration systems in vacuum cleaners and the development of automated cleaning robots for industrial settings are transforming operational efficiencies. Consumer preferences are increasingly leaning towards sustainable and eco-friendly cleaning products and practices. This demand for green cleaning solutions is propelling innovation in biodegradable chemicals, plant-based formulations, and energy-efficient equipment. The competitive dynamics are intensifying, with both established international brands and emerging local players vying for market share. The rise of e-commerce and online distribution channels is also reshaping the competitive landscape, offering new avenues for market access and customer engagement. The Commercial/Industrial segment, in particular, is experiencing substantial growth due to increased outsourcing of cleaning services by businesses and the demand for specialized cleaning in sectors like healthcare, hospitality, and manufacturing. The Residential segment, while mature, is witnessing a surge in demand for premium and specialized cleaning products, driven by disposable income and a growing interest in home maintenance and well-being. The increasing disposable income and urbanization trends are further bolstering demand for cleaning products and services across the nation.

Dominant Markets & Segments in Cleaning Industry in South Africa

The South African cleaning industry's dominance is clearly delineated across several key segments. Within Product Type, Cleaning Equipment commands a significant market share, driven by the demand for durable and efficient tools.

- Vacuum Cleaners: This sub-segment is particularly strong, fueled by both residential and commercial demand for effective dust and allergen removal. The introduction of cordless and advanced filtration models by companies like Dyson James Ltd and Samsung has significantly boosted this category.

- High-Pressure Cleaners: Essential for industrial cleaning, automotive care, and large-scale property maintenance, this segment demonstrates steady growth. Alfred Karcher SE & Co KG is a prominent player in this domain.

- Scrubbers/Polishers: Critical for maintaining large floor surfaces in commercial and industrial settings, this segment is supported by the growth of facility management services. Nilfisk Group and Robert Bosch GmbH offer competitive solutions.

- Steam Cleaners: Gaining traction in both residential and commercial markets due to their eco-friendly and deep-cleaning capabilities, especially in sanitization.

- Other Cleaning Equipment: Encompasses a broad range of items like floor sweepers, carpet cleaners, and specialized industrial machinery, catering to niche demands.

In terms of End User, the Commercial/Industrial segment represents the largest share of the market. This is attributed to the extensive cleaning needs of businesses, manufacturing plants, healthcare facilities, hospitality venues, and public spaces. The increasing trend of outsourcing cleaning services further bolsters this segment. However, the Residential segment is also a crucial contributor, driven by rising disposable incomes, urbanization, and a growing emphasis on domestic hygiene.

The Distribution Channel landscape is bifurcated, with both Offline Channel and Online Channel playing pivotal roles. The Offline Channel, encompassing supermarkets, specialized cleaning supply stores, and direct sales, retains a strong presence, especially for bulk purchases and professional services. However, the Online Channel is experiencing exponential growth, facilitated by e-commerce platforms, direct-to-consumer websites, and online marketplaces. This channel offers convenience, wider product selection, and competitive pricing, appealing to a growing segment of consumers.

Cleaning Industry in South Africa Product Developments

Product developments in the South African cleaning industry are heavily focused on enhancing efficiency, sustainability, and user experience. Innovations in cordless vacuum cleaners, such as those by Samsung, offer greater convenience and portability. The development of eco-friendly cleaning chemicals, exemplified by BWGL Group (Pty) Ltd's new range, addresses growing consumer demand for sustainable solutions. Furthermore, advancements in concentrated formulas for cleaning chemicals reduce packaging waste and transportation costs. The integration of smart technology, like self-cleaning features and app connectivity, is also emerging, promising greater control and performance for consumers and businesses alike. These developments are driven by a competitive landscape that rewards innovation and a market increasingly conscious of environmental impact and operational cost-effectiveness.

Report Scope & Segmentation Analysis

This report offers a granular segmentation analysis of the South African cleaning industry. The Product Type segmentation includes Cleaning Equipment (further broken down into Vacuum Cleaners, Steam Cleaners, High-Pressure Cleaners, Scrubbers/Polishers, and Other Cleaning Equipment), Consumables, Chemicals, and Powders and Gels. The End User segmentation categorizes the market into Residential and Commercial/Industrial. Finally, the Distribution Channel is analyzed through Offline Channel and Online Channel. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a comprehensive understanding of the industry's structure and future trajectory.

Key Drivers of Cleaning Industry in South Africa Growth

Several key factors are propelling the growth of the South African cleaning industry. Rising disposable incomes and a growing middle class are increasing consumer spending on cleaning products and services for both homes and businesses. The escalating awareness of hygiene and sanitation standards, particularly post-pandemic, is a significant driver, boosting demand for effective cleaning solutions across all sectors. Technological advancements in cleaning equipment, offering enhanced efficiency and convenience, are also stimulating market growth. Furthermore, government initiatives promoting cleaner environments and improved public health contribute to sustained demand. The burgeoning commercial and industrial sectors, including healthcare and hospitality, require specialized and consistent cleaning services, further fueling industry expansion.

Challenges in the Cleaning Industry in South Africa Sector

Despite its growth potential, the South African cleaning industry faces several challenges. Economic volatility and currency fluctuations can impact the affordability of imported raw materials and finished goods, affecting pricing and profitability. Intense competition from both local and international players can lead to price wars and squeezed profit margins. Regulatory hurdles and compliance costs associated with chemical safety, waste disposal, and environmental standards can be substantial. Supply chain disruptions, including logistics issues and raw material availability, can impact production and delivery timelines. Furthermore, the informal sector, while providing a competitive price point, often operates without adhering to quality or safety standards, posing a challenge for formal businesses.

Emerging Opportunities in Cleaning Industry in South Africa

The South African cleaning industry is ripe with emerging opportunities. The growing demand for green and sustainable cleaning products presents a significant avenue for market expansion, with companies focusing on biodegradable formulations and eco-friendly packaging. The increasing adoption of advanced cleaning technologies, such as smart cleaning equipment and automation, offers opportunities for innovation and value-added services. The expansion of the e-commerce channel provides a direct route to consumers, enabling niche players to reach wider audiences. Furthermore, the growing demand for specialized cleaning services in sectors like healthcare, education, and the food industry creates opportunities for targeted service offerings. The development of concentrated cleaning solutions also offers a sustainable and cost-effective product line.

Leading Players in the Cleaning Industry in South Africa Market

The leading players in the South African cleaning industry include:

- Tevo (Pty) Ltd

- Dyson James Ltd

- Nilfisk Group

- BWGL Group (Pty) Ltd

- Cleaning Equipment Manufacturing SA Pty Ltd

- Chemstrat

- Robert Bosch GmbH

- Alfred Karcher SE & Co KG

- Miele & Cie KG

- Nu-World Holdings Ltd

Key Developments in Cleaning Industry in South Africa Industry

- November 2021: South Africa's BWGL Group (Pty) Ltd, under its Lioness brand, launched a new range of natural and environmentally friendly cleaning products, aligning with the growing demand for sustainable solutions.

- October 2021: Unilever SA launched Sunlight, the world's first dishwashing liquid to utilize captured carbon emissions, marking a significant innovation in eco-conscious product development within the consumer goods sector.

- July 2021: Samsung introduced an industry-first all-new clean station named Samsung Jet cordless stick vacuum cleaners. This product delivers a high-performance, hygienic, and user-friendly solution, enhancing the convenience and effectiveness of home cleaning.

Strategic Outlook for Cleaning Industry in South Africa Market

The strategic outlook for the South African cleaning industry is characterized by sustained growth and evolving consumer preferences. The industry is expected to witness continued expansion driven by the persistent focus on hygiene, increasing disposable incomes, and technological advancements. Opportunities lie in catering to the burgeoning demand for eco-friendly and sustainable cleaning solutions, as well as embracing digital transformation through enhanced online distribution channels and smart cleaning technologies. Companies that can effectively navigate regulatory landscapes, innovate with product offerings, and adapt to changing consumer needs will be well-positioned for success. Strategic partnerships and potential M&A activities will likely shape the competitive landscape further, consolidating market presence and fostering innovation. The emphasis on health and well-being will continue to be a strong market catalyst.

Cleaning Industry in South Africa Segmentation

-

1. Product Type

-

1.1. Cleaning Equipment

- 1.1.1. Vaccum Cleaners

- 1.1.2. Steam Cleaners

- 1.1.3. High-Pressure Cleaners

- 1.1.4. Scrubbers/Polishers

- 1.1.5. Other Cleaning Equipement

- 1.2. Consumables

- 1.3. Chemicals, Powders and Gels

-

1.1. Cleaning Equipment

-

2. End User

- 2.1. Residential

- 2.2. Commercial/Industrial

-

3. Distribution Channel

- 3.1. Offline Channel

- 3.2. Online Channel

Cleaning Industry in South Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cleaning Industry in South Africa Regional Market Share

Geographic Coverage of Cleaning Industry in South Africa

Cleaning Industry in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Diabetic Population Across the Globe; Innovative and Fashionable Footwear

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit and Poor-Quality Products

- 3.4. Market Trends

- 3.4.1. Growing Penetration of Cleaning Products in Households

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cleaning Equipment

- 5.1.1.1. Vaccum Cleaners

- 5.1.1.2. Steam Cleaners

- 5.1.1.3. High-Pressure Cleaners

- 5.1.1.4. Scrubbers/Polishers

- 5.1.1.5. Other Cleaning Equipement

- 5.1.2. Consumables

- 5.1.3. Chemicals, Powders and Gels

- 5.1.1. Cleaning Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial/Industrial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Channel

- 5.3.2. Online Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cleaning Equipment

- 6.1.1.1. Vaccum Cleaners

- 6.1.1.2. Steam Cleaners

- 6.1.1.3. High-Pressure Cleaners

- 6.1.1.4. Scrubbers/Polishers

- 6.1.1.5. Other Cleaning Equipement

- 6.1.2. Consumables

- 6.1.3. Chemicals, Powders and Gels

- 6.1.1. Cleaning Equipment

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial/Industrial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Channel

- 6.3.2. Online Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cleaning Equipment

- 7.1.1.1. Vaccum Cleaners

- 7.1.1.2. Steam Cleaners

- 7.1.1.3. High-Pressure Cleaners

- 7.1.1.4. Scrubbers/Polishers

- 7.1.1.5. Other Cleaning Equipement

- 7.1.2. Consumables

- 7.1.3. Chemicals, Powders and Gels

- 7.1.1. Cleaning Equipment

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial/Industrial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Channel

- 7.3.2. Online Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cleaning Equipment

- 8.1.1.1. Vaccum Cleaners

- 8.1.1.2. Steam Cleaners

- 8.1.1.3. High-Pressure Cleaners

- 8.1.1.4. Scrubbers/Polishers

- 8.1.1.5. Other Cleaning Equipement

- 8.1.2. Consumables

- 8.1.3. Chemicals, Powders and Gels

- 8.1.1. Cleaning Equipment

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial/Industrial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Channel

- 8.3.2. Online Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cleaning Equipment

- 9.1.1.1. Vaccum Cleaners

- 9.1.1.2. Steam Cleaners

- 9.1.1.3. High-Pressure Cleaners

- 9.1.1.4. Scrubbers/Polishers

- 9.1.1.5. Other Cleaning Equipement

- 9.1.2. Consumables

- 9.1.3. Chemicals, Powders and Gels

- 9.1.1. Cleaning Equipment

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial/Industrial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Channel

- 9.3.2. Online Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cleaning Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cleaning Equipment

- 10.1.1.1. Vaccum Cleaners

- 10.1.1.2. Steam Cleaners

- 10.1.1.3. High-Pressure Cleaners

- 10.1.1.4. Scrubbers/Polishers

- 10.1.1.5. Other Cleaning Equipement

- 10.1.2. Consumables

- 10.1.3. Chemicals, Powders and Gels

- 10.1.1. Cleaning Equipment

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial/Industrial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Channel

- 10.3.2. Online Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tevo (Pty) Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dyson James Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nilfisk Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BWGL Group (Pty) Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cleaning Equipment Manufacturing SA Pty Ltd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chemstrat

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alfred Karcher SE & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Miele & Cie KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nu-World Holdings Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tevo (Pty) Ltd

List of Figures

- Figure 1: Global Cleaning Industry in South Africa Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cleaning Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cleaning Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cleaning Industry in South Africa Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Cleaning Industry in South Africa Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Cleaning Industry in South Africa Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Cleaning Industry in South Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Cleaning Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cleaning Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cleaning Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America Cleaning Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Cleaning Industry in South Africa Revenue (Million), by End User 2025 & 2033

- Figure 13: South America Cleaning Industry in South Africa Revenue Share (%), by End User 2025 & 2033

- Figure 14: South America Cleaning Industry in South Africa Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Cleaning Industry in South Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Cleaning Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cleaning Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cleaning Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Cleaning Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Cleaning Industry in South Africa Revenue (Million), by End User 2025 & 2033

- Figure 21: Europe Cleaning Industry in South Africa Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Cleaning Industry in South Africa Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Cleaning Industry in South Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Cleaning Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cleaning Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cleaning Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Cleaning Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Cleaning Industry in South Africa Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East & Africa Cleaning Industry in South Africa Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East & Africa Cleaning Industry in South Africa Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Cleaning Industry in South Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Cleaning Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cleaning Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cleaning Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Cleaning Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Cleaning Industry in South Africa Revenue (Million), by End User 2025 & 2033

- Figure 37: Asia Pacific Cleaning Industry in South Africa Revenue Share (%), by End User 2025 & 2033

- Figure 38: Asia Pacific Cleaning Industry in South Africa Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Cleaning Industry in South Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Cleaning Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cleaning Industry in South Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cleaning Industry in South Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Cleaning Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Cleaning Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Cleaning Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 34: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Cleaning Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cleaning Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global Cleaning Industry in South Africa Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Cleaning Industry in South Africa Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Cleaning Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cleaning Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleaning Industry in South Africa?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the Cleaning Industry in South Africa?

Key companies in the market include Tevo (Pty) Ltd, Dyson James Ltd, Nilfisk Group, BWGL Group (Pty) Ltd, Cleaning Equipment Manufacturing SA Pty Ltd*List Not Exhaustive, Chemstrat, Robert Bosch GmbH, Alfred Karcher SE & Co KG, Miele & Cie KG, Nu-World Holdings Ltd.

3. What are the main segments of the Cleaning Industry in South Africa?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Diabetic Population Across the Globe; Innovative and Fashionable Footwear.

6. What are the notable trends driving market growth?

Growing Penetration of Cleaning Products in Households.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit and Poor-Quality Products.

8. Can you provide examples of recent developments in the market?

November 2021: South Africa's BWGL Group (Pty) Ltd, Lioness, launched a new range of natural and environmentally friendly cleaning products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cleaning Industry in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cleaning Industry in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cleaning Industry in South Africa?

To stay informed about further developments, trends, and reports in the Cleaning Industry in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence