Key Insights

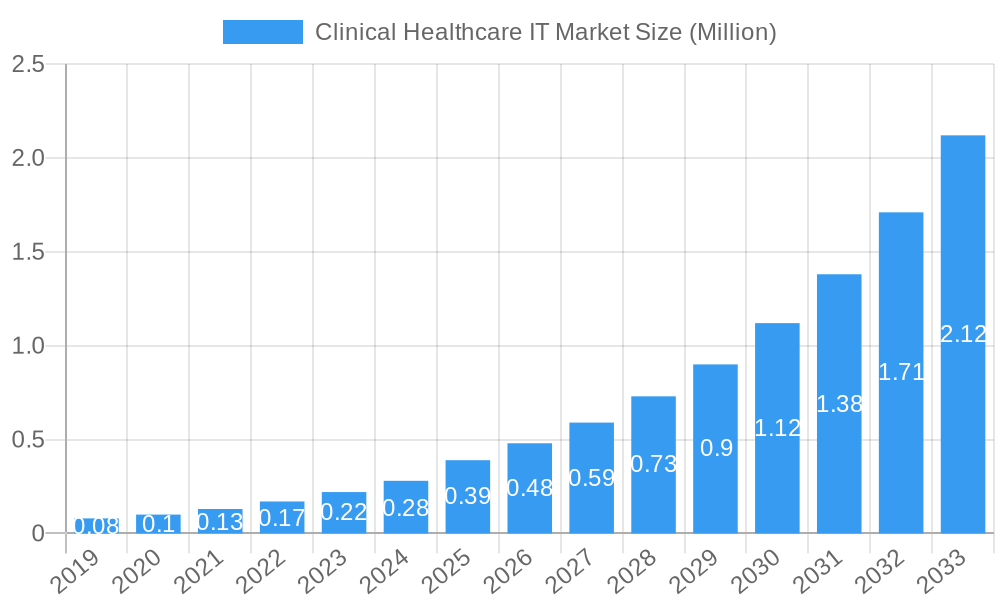

The Clinical Healthcare IT Market is poised for significant expansion, projected to reach a substantial market size of approximately $0.39 billion by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 24.22%. This robust growth trajectory, extending through to 2033, indicates a dynamic and rapidly evolving sector. Key market drivers include the escalating demand for enhanced patient care, the increasing adoption of digital health solutions to improve operational efficiency in healthcare facilities, and the critical need for data security and interoperability across diverse healthcare systems. The push towards value-based care models, where patient outcomes and cost-effectiveness are paramount, further fuels the investment in advanced clinical IT solutions. Furthermore, the growing prevalence of chronic diseases necessitates sophisticated patient management systems and remote monitoring capabilities, creating fertile ground for market expansion.

Clinical Healthcare IT Market Market Size (In Million)

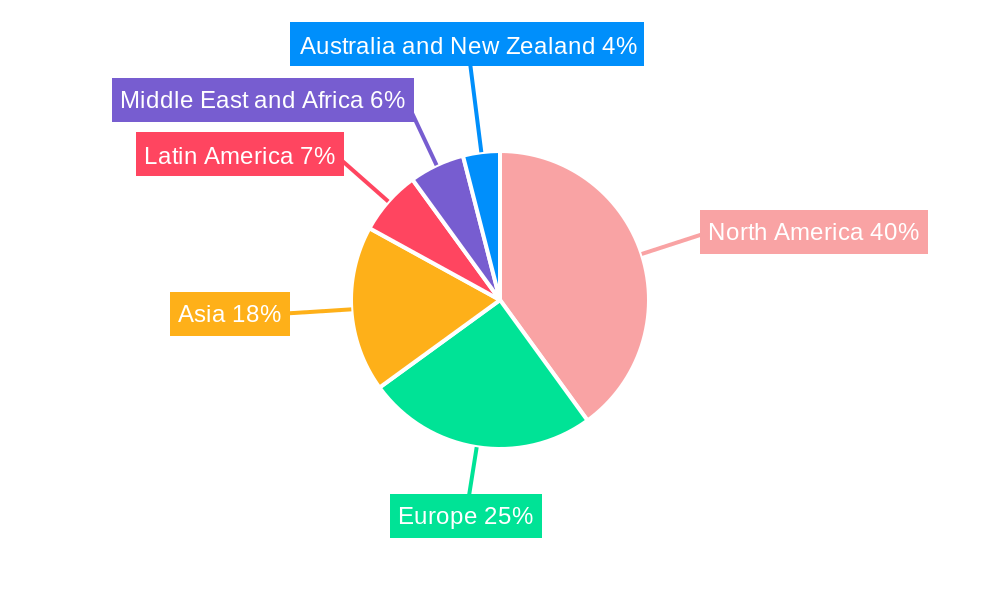

The market is segmented across various critical areas, with Electronic Health Records (EHR) and Telemedicine & Telehealth emerging as prominent segments due to their direct impact on patient care delivery and accessibility. The "Others" category likely encompasses emerging technologies and niche solutions that contribute to the overall market dynamism. End-users are primarily concentrated within Government and Public Health organizations, as well as Private Hospitals and Diagnostic Centers, reflecting the widespread integration of clinical IT across the healthcare spectrum. Geographically, North America is expected to lead the market, followed by Europe and Asia, with developing regions like Latin America, the Middle East, and Africa demonstrating significant growth potential as they modernize their healthcare infrastructure.

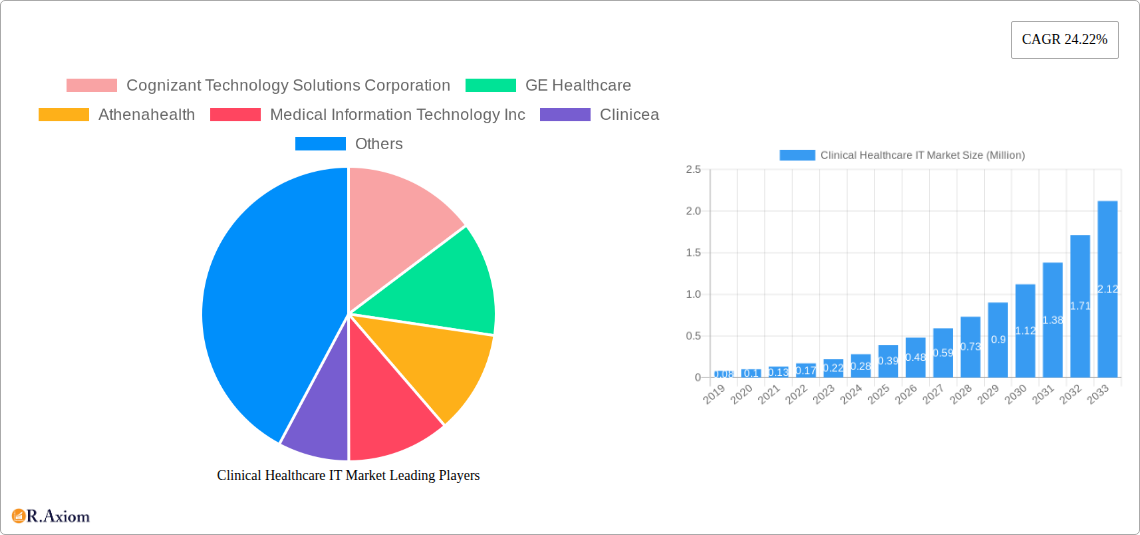

Clinical Healthcare IT Market Company Market Share

This detailed report provides an in-depth analysis of the global Clinical Healthcare IT Market, offering critical insights into market dynamics, growth drivers, key players, and future trends. Covering the period from 2019 to 2033, with a base year of 2025, this study is an essential resource for stakeholders seeking to understand the evolving landscape of healthcare technology. The report meticulously examines market concentration, innovation, industry trends, dominant segments, product developments, and strategic outlooks, all while incorporating high-traffic keywords such as Electronic Health Records (EHR), Telemedicine, Healthcare IT Solutions, Digital Health, and mHealth to enhance search visibility.

Clinical Healthcare IT Market Market Concentration & Innovation

The Clinical Healthcare IT Market exhibits a moderate level of market concentration, with a mix of large, established players and emerging innovators. Key companies like Epic Systems Corporation, Oracle Corporation, and GE Healthcare hold significant market shares, driven by their comprehensive suite of solutions and extensive customer bases. Innovation is a primary driver, fueled by advancements in artificial intelligence (AI), machine learning (ML), cloud computing, and the increasing demand for interoperability between disparate healthcare systems. Regulatory frameworks, such as HIPAA in the United States and GDPR in Europe, play a crucial role in shaping product development and data security protocols, influencing market entry and competition. Product substitutes are emerging, particularly in the realm of patient engagement platforms and point-of-care diagnostics, although core EHR and LIMS solutions remain dominant. End-user trends are leaning towards cloud-based solutions and mobile accessibility, pushing providers to adopt more flexible and user-friendly technologies. Mergers and Acquisitions (M&A) activities are prevalent, with deal values in the range of XX Million to XX Million, as larger companies seek to acquire innovative startups and expand their service portfolios. For instance, strategic acquisitions are often focused on bolstering AI capabilities for predictive analytics or enhancing telemedicine offerings to meet growing demand. The market's innovation ecosystem thrives on partnerships between technology providers and healthcare institutions, leading to the development of bespoke solutions for specific clinical needs.

Clinical Healthcare IT Market Industry Trends & Insights

The Clinical Healthcare IT Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is propelled by several key factors, including the escalating adoption of digital health technologies, the imperative for improved patient outcomes, and the increasing need for operational efficiency within healthcare organizations. The shift towards value-based care models necessitates sophisticated IT infrastructure to track patient data, manage chronic diseases, and streamline care coordination, thereby driving demand for integrated clinical solutions. Technological disruptions, such as the widespread implementation of AI for diagnostic assistance, robotic process automation for administrative tasks, and the expansion of the Internet of Medical Things (IoMT) for remote patient monitoring, are fundamentally reshaping the healthcare delivery landscape. Consumer preferences are increasingly aligned with convenient and accessible healthcare services, leading to a surge in demand for telemedicine and telehealth platforms, which enable remote consultations, diagnoses, and treatment monitoring. This growing patient expectation for digital-first healthcare experiences is forcing providers to invest heavily in user-friendly interfaces and mobile applications. The competitive dynamics within the market are intensifying, with established vendors enhancing their existing portfolios and new entrants focusing on niche solutions and disruptive technologies. Market penetration for core EHR systems is already high in developed regions, with future growth expected from emerging economies and specialized clinical applications. The continuous evolution of data analytics capabilities allows healthcare providers to glean actionable insights from vast patient datasets, leading to more personalized treatment plans and proactive disease management. The increasing digitization of healthcare records also facilitates research and development, accelerating the discovery of new treatments and therapies. Furthermore, government initiatives and funding aimed at modernizing healthcare infrastructure globally are significant catalysts for market expansion.

Dominant Markets & Segments in Clinical Healthcare IT Market

The Clinical Healthcare IT Market is characterized by the dominance of certain regions and specific software and end-user segments.

Software Segment Dominance:

Electronic Health Records (EHR): This segment is the largest and most mature, projected to account for over XX% of the total market value by 2033.

- Key Drivers: Mandated government incentives for EHR adoption, the need for comprehensive patient data management, improved care coordination, and enhanced clinical decision support systems are the primary growth catalysts. The increasing focus on interoperability between different healthcare providers and systems further strengthens the EHR market.

- Dominance Analysis: North America and Europe lead in EHR adoption due to strong regulatory mandates and advanced healthcare infrastructure. However, the Asia-Pacific region is showing rapid growth due to increasing investments in healthcare digitalization and a rising patient population. The transition towards cloud-based EHR solutions is a significant trend, offering scalability and accessibility.

Telemedicine and Telehealth: This segment is experiencing the most rapid growth, with a projected CAGR of XX%.

- Key Drivers: The COVID-19 pandemic accelerated its adoption, and continued patient preference for remote access, coupled with technological advancements in broadband and video conferencing, fuels its expansion. It is crucial for improving access to care in rural areas and managing chronic conditions remotely.

- Dominance Analysis: North America and Western Europe are currently leading in telemedicine adoption due to established reimbursement policies and patient readiness. The demand for remote patient monitoring (RPM) solutions is also a significant contributor to this segment's growth.

Lab Information Management System (LIMS): While a more specialized segment, LIMS remains critical for diagnostic centers and research facilities.

- Key Drivers: The need for stringent quality control, efficient sample tracking, and compliance with laboratory regulations are key drivers. Advancements in automation and integration with other clinical systems are enhancing its value.

- Dominance Analysis: Developed economies with advanced research infrastructure and high diagnostic volumes dominate this segment.

Computerized Provider Order Entry (CPOE): Integral to EHR systems, CPOE reduces medication errors and improves order accuracy.

- Key Drivers: Its role in enhancing patient safety and streamlining clinical workflows makes it indispensable. Integration with pharmacy and laboratory systems is crucial.

- Dominance Analysis: Its adoption is directly tied to EHR implementation rates.

End-User Segment Dominance:

Private Hospitals and Diagnostic Centers: These entities represent the largest end-user segment, driven by their significant IT budgets and the imperative to remain competitive.

- Key Drivers: The demand for advanced patient care, operational efficiency, and data-driven decision-making are paramount. These organizations are early adopters of new technologies to improve patient experience and clinical outcomes.

- Dominance Analysis: Private healthcare providers, especially large hospital networks, are investing heavily in comprehensive IT solutions, including integrated EHRs, advanced imaging systems, and patient portals.

Government and Public Health: This segment is characterized by large-scale implementation projects and a focus on population health management.

- Key Drivers: Public health initiatives, disease surveillance, and the need to provide accessible healthcare to a broad population drive investment. Government mandates often dictate the adoption of specific IT solutions.

- Dominance Analysis: While adoption rates can be slower due to bureaucratic processes, government initiatives like the myCGHS app demonstrate a commitment to leveraging technology for public health benefits.

Clinical Healthcare IT Market Product Developments

The Clinical Healthcare IT Market is characterized by continuous product innovation aimed at enhancing efficiency, accuracy, and patient engagement. Recent developments focus on integrating AI and ML into existing platforms to enable predictive analytics for disease risk assessment and personalized treatment plans. Cloud-based solutions are gaining prominence, offering scalability, improved accessibility, and cost-effectiveness. The development of interoperable systems that seamlessly share data between different providers and applications is a key competitive advantage. Furthermore, advancements in mobile health (mHealth) applications are empowering patients to actively participate in their care, track their health metrics, and communicate with providers remotely, thereby improving adherence and outcomes.

Report Scope & Segmentation Analysis

This report meticulously segments the Clinical Healthcare IT Market into key categories for a comprehensive analysis.

Software Segmentation:

- Electronic Health Records (EHR): This segment is projected to reach $XX Million by 2033, driven by ongoing digitization efforts and the need for unified patient data.

- Lab Information Management System (LIMS): Valued at approximately $XX Million, LIMS will continue to be vital for diagnostic accuracy and research.

- Telemedicine and Telehealth: This rapidly expanding segment is expected to grow significantly, reaching $XX Million, fueled by demand for remote care solutions.

- Picture Archiving and Communication System (PACS): With an estimated market size of $XX Million, PACS remains crucial for medical imaging management.

- Computerized Provider Order Entry (CPOE): Expected to reach $XX Million, CPOE is integral to reducing medical errors.

- Others: This category, encompassing various specialized healthcare IT solutions, is projected to be worth $XX Million.

End-User Segmentation:

- Government and Public Health: This segment is expected to reach $XX Million, driven by national health initiatives and digital transformation programs.

- Private Hospitals and Diagnostic Centers: These entities represent the largest share, projected to reach $XX Million, due to substantial IT investments for enhanced patient care and operational efficiency.

Key Drivers of Clinical Healthcare IT Market Growth

The Clinical Healthcare IT Market is propelled by several key drivers:

- Technological Advancements: The integration of AI, ML, cloud computing, and IoT in healthcare applications significantly enhances diagnostic accuracy, treatment personalization, and operational efficiency.

- Government Initiatives and Regulations: Mandates for EHR adoption, data security regulations (e.g., HIPAA, GDPR), and government funding for healthcare digitalization projects encourage market growth.

- Increasing Patient Demand for Digital Health: The growing preference for convenient, accessible, and personalized healthcare experiences drives the adoption of telemedicine, mHealth, and patient portals.

- Focus on Value-Based Care and Cost Reduction: Healthcare providers are investing in IT solutions to improve patient outcomes, reduce readmission rates, and optimize resource allocation, thereby lowering overall healthcare costs.

- Growing Prevalence of Chronic Diseases: The rise in chronic conditions necessitates continuous patient monitoring and effective care coordination, making advanced clinical IT solutions indispensable.

Challenges in the Clinical Healthcare IT Market Sector

Despite its robust growth, the Clinical Healthcare IT Market faces several challenges:

- High Implementation Costs: The initial investment required for acquiring, implementing, and maintaining sophisticated healthcare IT systems can be substantial, posing a barrier for smaller institutions.

- Interoperability Issues: The lack of seamless data exchange between different healthcare IT systems and providers remains a significant hurdle, impacting care coordination and data utilization.

- Data Security and Privacy Concerns: Protecting sensitive patient health information from cyber threats and ensuring compliance with stringent data privacy regulations are critical challenges.

- Resistance to Change and Lack of Skilled Workforce: Healthcare professionals may exhibit resistance to adopting new technologies, and a shortage of skilled IT professionals in the healthcare sector can hinder implementation and adoption.

- Complex Regulatory Landscape: Navigating the intricate and evolving regulatory frameworks across different regions adds complexity and cost to product development and market entry.

Emerging Opportunities in Clinical Healthcare IT Market

The Clinical Healthcare IT Market is ripe with emerging opportunities:

- AI-Powered Diagnostics and Personalized Medicine: The application of AI in image analysis, drug discovery, and predictive diagnostics offers immense potential for improving treatment efficacy and patient outcomes.

- Expansion of Telehealth in Underserved Areas: Leveraging telemedicine and mHealth to bridge the gap in healthcare access for rural and remote populations presents a significant growth opportunity.

- Growth of Wearable Health Technology and IoMT: The increasing adoption of wearable devices and connected medical devices for continuous remote patient monitoring opens avenues for proactive health management and early intervention.

- Data Analytics for Population Health Management: Utilizing big data analytics to understand health trends, identify at-risk populations, and implement targeted public health interventions is a growing area of focus.

- Blockchain for Healthcare Data Security and Transparency: Exploring the use of blockchain technology to enhance the security, integrity, and traceability of healthcare data could revolutionize data management.

Leading Players in the Clinical Healthcare IT Market Market

- Cognizant Technology Solutions Corporation

- GE Healthcare

- Athenahealth

- Medical Information Technology Inc

- Clinicea

- NextGen Healthcare

- Veradigm LLC

- eClinicalWorks

- Epic Systems Corporation

- Oracle Corporation

Key Developments in Clinical Healthcare IT Market Industry

- April 2024: The Union Health Ministry launched the innovative myCGHS app for iOS devices, aiming to boost access to EHR, information, and resources for the beneficiaries of the Central Government Health Scheme (CGHS).

- March 2024: Emory Healthcare led the way in transforming how clinicians access patient health records with its deployment of the 15-inch MacBook Air and the launch of the new native Epic Hyperspace app. This marked the first time Epic was made available to clinicians on the Mac App Store.

Strategic Outlook for Clinical Healthcare IT Market Market

The strategic outlook for the Clinical Healthcare IT Market is exceptionally positive, driven by an unwavering commitment to enhancing healthcare delivery through technological innovation. The increasing adoption of AI and ML algorithms for advanced analytics and predictive care will be a major growth catalyst. Furthermore, the expansion of telehealth and remote patient monitoring solutions will continue to democratize access to healthcare, particularly in underserved regions. Investments in cloud-based infrastructure will enable greater scalability, interoperability, and data security. The focus on patient-centric care models and the demand for seamless data integration across the healthcare ecosystem will further fuel market expansion. Strategic partnerships and collaborations between technology providers, healthcare institutions, and regulatory bodies will be crucial in navigating the evolving landscape and unlocking new opportunities for growth.

Clinical Healthcare IT Market Segmentation

-

1. Software

- 1.1. Electronic Health Records

- 1.2. Lab Information Management System (LIMS)

- 1.3. Telemedicine and Telehealth

- 1.4. Picture

- 1.5. Computerized Provider Order Entry (CPOE)

- 1.6. Others (

-

2. End-user

- 2.1. Government and Public Health

- 2.2. Private Hospitals and Diagnostic Centers

Clinical Healthcare IT Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

Clinical Healthcare IT Market Regional Market Share

Geographic Coverage of Clinical Healthcare IT Market

Clinical Healthcare IT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment

- 3.3. Market Restrains

- 3.3.1. Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment

- 3.4. Market Trends

- 3.4.1. Electronic Health Record (EHR) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Software

- 5.1.1. Electronic Health Records

- 5.1.2. Lab Information Management System (LIMS)

- 5.1.3. Telemedicine and Telehealth

- 5.1.4. Picture

- 5.1.5. Computerized Provider Order Entry (CPOE)

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Government and Public Health

- 5.2.2. Private Hospitals and Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Software

- 6. North America Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Software

- 6.1.1. Electronic Health Records

- 6.1.2. Lab Information Management System (LIMS)

- 6.1.3. Telemedicine and Telehealth

- 6.1.4. Picture

- 6.1.5. Computerized Provider Order Entry (CPOE)

- 6.1.6. Others (

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Government and Public Health

- 6.2.2. Private Hospitals and Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Software

- 7. Europe Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Software

- 7.1.1. Electronic Health Records

- 7.1.2. Lab Information Management System (LIMS)

- 7.1.3. Telemedicine and Telehealth

- 7.1.4. Picture

- 7.1.5. Computerized Provider Order Entry (CPOE)

- 7.1.6. Others (

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Government and Public Health

- 7.2.2. Private Hospitals and Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Software

- 8. Asia Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Software

- 8.1.1. Electronic Health Records

- 8.1.2. Lab Information Management System (LIMS)

- 8.1.3. Telemedicine and Telehealth

- 8.1.4. Picture

- 8.1.5. Computerized Provider Order Entry (CPOE)

- 8.1.6. Others (

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Government and Public Health

- 8.2.2. Private Hospitals and Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Software

- 9. Australia and New Zealand Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Software

- 9.1.1. Electronic Health Records

- 9.1.2. Lab Information Management System (LIMS)

- 9.1.3. Telemedicine and Telehealth

- 9.1.4. Picture

- 9.1.5. Computerized Provider Order Entry (CPOE)

- 9.1.6. Others (

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Government and Public Health

- 9.2.2. Private Hospitals and Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Software

- 10. Latin America Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Software

- 10.1.1. Electronic Health Records

- 10.1.2. Lab Information Management System (LIMS)

- 10.1.3. Telemedicine and Telehealth

- 10.1.4. Picture

- 10.1.5. Computerized Provider Order Entry (CPOE)

- 10.1.6. Others (

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Government and Public Health

- 10.2.2. Private Hospitals and Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Software

- 11. Middle East and Africa Clinical Healthcare IT Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Software

- 11.1.1. Electronic Health Records

- 11.1.2. Lab Information Management System (LIMS)

- 11.1.3. Telemedicine and Telehealth

- 11.1.4. Picture

- 11.1.5. Computerized Provider Order Entry (CPOE)

- 11.1.6. Others (

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Government and Public Health

- 11.2.2. Private Hospitals and Diagnostic Centers

- 11.1. Market Analysis, Insights and Forecast - by Software

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cognizant Technology Solutions Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Healthcare

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Athenahealth

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Medical Information Technology Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Clinicea

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NextGen Healthcare

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Veradigm LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 eClinicalWorks

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Epic Systems Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Oracle Corporatio

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cognizant Technology Solutions Corporation

List of Figures

- Figure 1: Global Clinical Healthcare IT Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Clinical Healthcare IT Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 4: North America Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 5: North America Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 6: North America Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 7: North America Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 8: North America Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 9: North America Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 11: North America Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 16: Europe Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 17: Europe Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 18: Europe Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 19: Europe Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 20: Europe Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 21: Europe Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Europe Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 23: Europe Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 28: Asia Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 29: Asia Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 30: Asia Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 31: Asia Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 32: Asia Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 33: Asia Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Asia Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 35: Asia Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Asia Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 40: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 41: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 42: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 43: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 44: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 45: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 47: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 52: Latin America Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 53: Latin America Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 54: Latin America Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 55: Latin America Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 56: Latin America Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 57: Latin America Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 58: Latin America Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 59: Latin America Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Latin America Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by Software 2025 & 2033

- Figure 64: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by Software 2025 & 2033

- Figure 65: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by Software 2025 & 2033

- Figure 66: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by Software 2025 & 2033

- Figure 67: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by End-user 2025 & 2033

- Figure 68: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by End-user 2025 & 2033

- Figure 69: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by End-user 2025 & 2033

- Figure 70: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by End-user 2025 & 2033

- Figure 71: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 2: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 3: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 5: Global Clinical Healthcare IT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 8: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 9: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 11: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 18: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 19: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 21: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 23: Germany Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: France Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Italy Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 32: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 33: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 34: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 35: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: China Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: China Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Japan Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: India Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 46: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 47: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 48: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 49: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 51: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 52: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 53: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 54: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 55: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 57: Brazil Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Argentina Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Mexico Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Mexico Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2020 & 2033

- Table 64: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2020 & 2033

- Table 65: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 66: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2020 & 2033

- Table 67: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 69: United Arab Emirates Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: United Arab Emirates Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Saudi Arabia Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: South Africa Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clinical Healthcare IT Market?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Clinical Healthcare IT Market?

Key companies in the market include Cognizant Technology Solutions Corporation, GE Healthcare, Athenahealth, Medical Information Technology Inc, Clinicea, NextGen Healthcare, Veradigm LLC, eClinicalWorks, Epic Systems Corporation, Oracle Corporatio.

3. What are the main segments of the Clinical Healthcare IT Market?

The market segments include Software, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment.

6. What are the notable trends driving market growth?

Electronic Health Record (EHR) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment.

8. Can you provide examples of recent developments in the market?

April 2024: The Union Health Ministry launched the innovative myCGHS app for iOS devices, aiming to boost access to EHR, information, and resources for the beneficiaries of the Central Government Health Scheme (CGHS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clinical Healthcare IT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clinical Healthcare IT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clinical Healthcare IT Market?

To stay informed about further developments, trends, and reports in the Clinical Healthcare IT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence