Key Insights

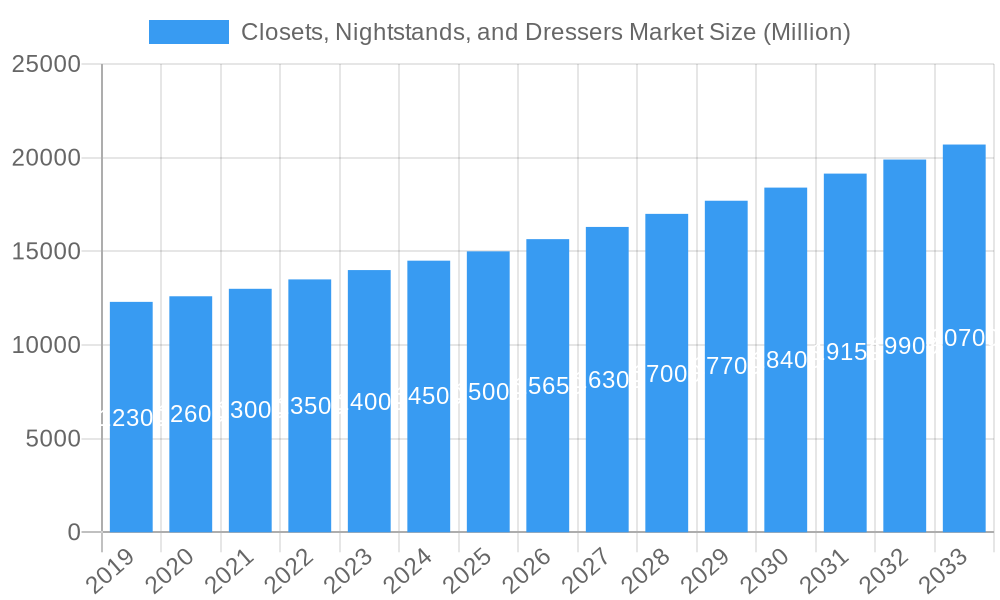

The global Closets, Nightstands, and Dressers market is poised for substantial growth, driven by shifting consumer priorities toward home organization and aesthetic enhancement, coupled with increasing disposable incomes in emerging economies. The market is projected to reach approximately USD 15 billion by 2025, with a Compound Annual Growth Rate (CAGR) of over 5% through 2033. This expansion is propelled by a growing appreciation for well-designed living spaces and demand for efficient, space-saving furniture. Key catalysts include urbanization, leading to smaller residences requiring optimized storage, and the pervasive influence of interior design trends promoted across digital platforms and publications. The burgeoning e-commerce sector, offering extensive selection and convenience, is also significantly contributing to market reach and accessibility. Furthermore, the trend towards personalized home furnishings is spurring manufacturers to develop modular and custom closet systems, nightstands, and dressers to meet diverse individual needs and design preferences.

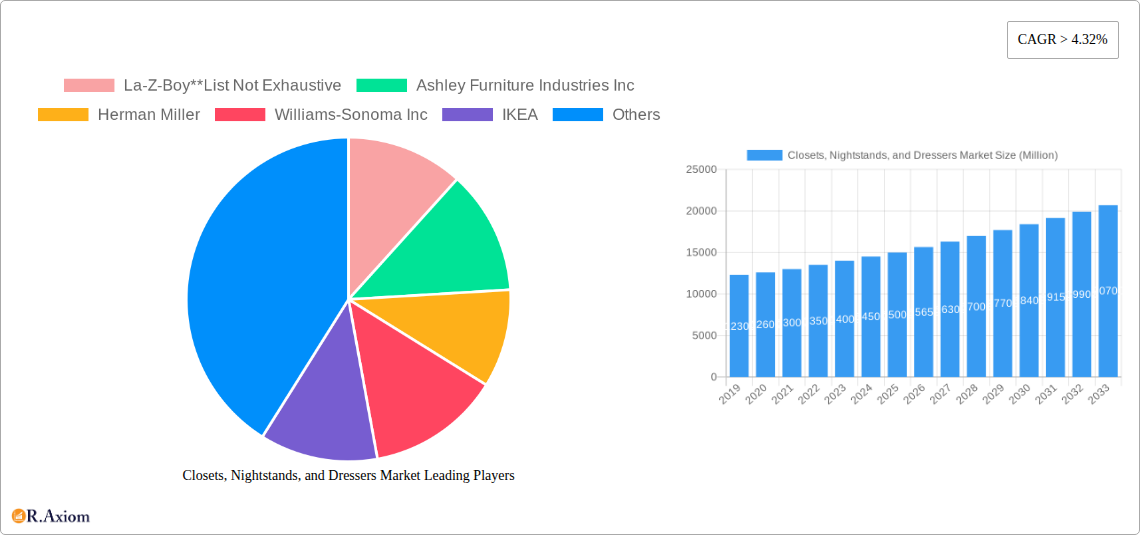

Closets, Nightstands, and Dressers Market Market Size (In Billion)

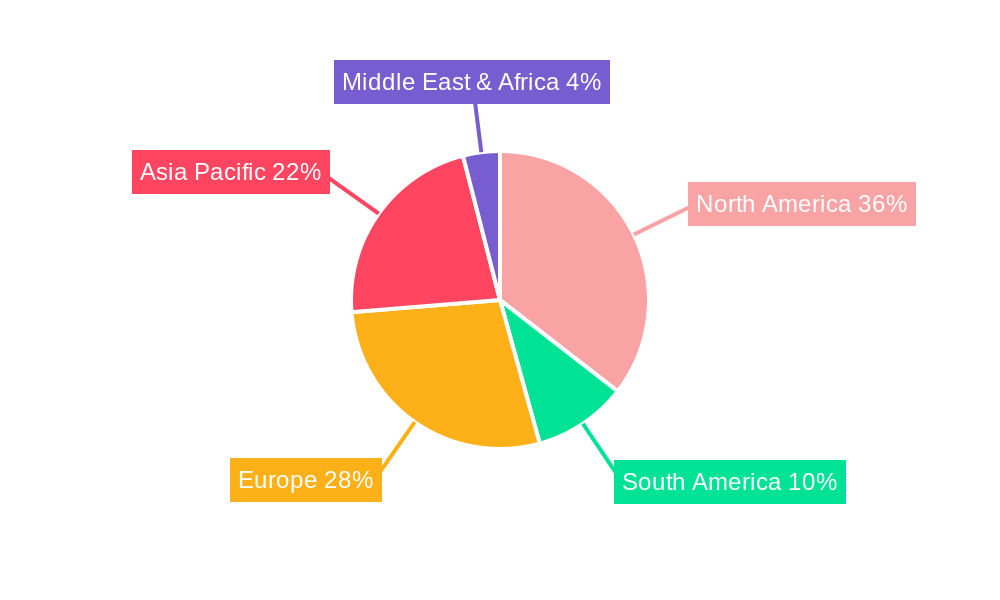

The market is marked by vigorous competition among established brands and new entrants, especially within online retail. Leading companies are investing in product innovation, sustainable materials, and integrated smart home functionalities to expand their market presence. The online distribution channel is expected to experience the most rapid growth, attributed to the ease of online shopping, broader product availability, and competitive pricing. While North America currently leads in market share due to its mature furniture industry and high consumer expenditure, the Asia Pacific region is anticipated to demonstrate the highest growth trajectory, fueled by robust economic development, an expanding middle class, and accelerating urbanization. Despite the optimistic outlook, the market faces challenges such as volatile raw material costs and potential supply chain disruptions, which could affect production expenses and delivery schedules. Nevertheless, the overarching consumer desire for more organized and aesthetically pleasing homes is expected to overcome these obstacles, ensuring sustained market expansion.

Closets, Nightstands, and Dressers Market Company Market Share

This comprehensive market analysis delves into the global Closets, Nightstands, and Dressers market, encompassing the historical period of 2019-2024 and a forecast extending from 2025 to 2033, with 2025 designated as the base year. The report delivers actionable intelligence for industry participants, including manufacturers, suppliers, retailers, and investors, through an examination of critical market drivers, emerging trends, competitive landscapes, and segmentation. We explore market dynamics, from evolving consumer preferences and technological advancements to dominant regions and distribution channels. This report is designed to equip businesses with the strategic insights necessary to navigate the complexities of the closets, nightstands, and dressers industry and capitalize on future growth opportunities.

Closets, Nightstands, and Dressers Market Market Concentration & Innovation

The global Closets, Nightstands, and Dressers market exhibits a moderate to high degree of concentration, with a few key players holding significant market share. Innovation is a critical differentiator, driven by the increasing demand for customizable solutions, space-saving designs, and smart furniture features. Regulatory frameworks, while generally supportive of industry growth, can impact product safety standards and material sourcing. Product substitutes, such as modular shelving systems and integrated closet solutions, pose a competitive threat but also encourage further innovation. End-user trends highlight a growing preference for minimalist aesthetics, sustainable materials, and multifunctional furniture. Mergers and acquisitions (M&A) are strategic tools for market consolidation and expansion, with deal values in recent years ranging from tens to hundreds of millions of US dollars, further shaping the competitive landscape. Key companies like IKEA and Williams-Sonoma Inc. are actively pursuing M&A to broaden their product portfolios and geographical reach.

Closets, Nightstands, and Dressers Market Industry Trends & Insights

The Closets, Nightstands, and Dressers market is experiencing robust growth, fueled by several interconnected trends. A primary growth driver is the continuous urbanization and shrinking living spaces, particularly in metropolitan areas, which necessitates the adoption of efficient and aesthetically pleasing storage solutions like compact nightstands and modular closets. Furthermore, rising disposable incomes across developing economies are translating into increased consumer spending on home furnishings, including high-quality dressers and bedroom furniture sets. The e-commerce revolution has fundamentally reshaped distribution channels, with online sales of furniture experiencing exponential growth. This trend is amplified by the convenience of online shopping, a wider selection, and competitive pricing. Technological disruptions are also playing a significant role, with the integration of smart features like wireless charging, integrated lighting, and app-controlled functionality becoming increasingly sought after. Companies are investing heavily in research and development to incorporate these advanced technologies, enhancing the utility and appeal of their products. Consumer preferences are evolving rapidly, leaning towards sustainable materials, eco-friendly manufacturing processes, and customizable designs that reflect individual style and space requirements. The demand for minimalist and Scandinavian-inspired designs remains strong, alongside a growing interest in personalized furniture solutions. Competitive dynamics are intense, with both large established players and agile direct-to-consumer (DTC) brands vying for market share. The average annual growth rate (CAGR) for this market is projected to be between 5% and 7% over the forecast period, indicating substantial market penetration and ongoing expansion. Key players are focusing on supply chain optimization and brand storytelling to differentiate themselves in this crowded marketplace. The estimated market size in 2025 is approximately USD 55,000 million, with projected growth to over USD 80,000 million by 2033.

Dominant Markets & Segments in Closets, Nightstands, and Dressers Market

The global Closets, Nightstands, and Dressers market is characterized by regional dominance and a dynamic distribution channel landscape. North America currently holds the largest market share due to its mature economy, high consumer spending power, and established home furnishing industry. Within North America, the United States leads significantly due to factors like a large housing market, increasing renovation activities, and a strong presence of major retailers. The economic policies that support homeownership and consumer credit availability are pivotal to this dominance. Infrastructure development, including efficient logistics and widespread internet penetration, further supports market growth across all segments.

Distribution Channel: Online: The online segment is the fastest-growing and is rapidly gaining dominance.

- Key Drivers: Convenience, vast product selection, competitive pricing, and the rise of e-commerce platforms like Wayfair Inc. and direct-to-consumer (DTC) brands. The proliferation of smartphones and reliable internet access globally makes online purchasing accessible to a wider audience.

- Dominance Analysis: Online sales are projected to surpass traditional retail channels within the forecast period. This segment benefits from lower overhead costs for sellers and a personalized shopping experience for buyers, facilitated by advanced algorithms and virtual try-on technologies. The ability to reach consumers directly, bypassing intermediaries, contributes to its significant market penetration.

Distribution Channel: Specialty Stores: Specialty furniture stores and home décor outlets continue to hold a substantial market share.

- Key Drivers: Expert advice, hands-on product experience, curated selections, and brand loyalty. These stores often cater to a discerning customer base looking for premium quality and unique designs.

- Dominance Analysis: While facing competition from online retailers, specialty stores thrive on providing a high-touch customer experience. Their dominance is sustained by offering personalized design consultations and services that online platforms often struggle to replicate. Brands like Ashley Furniture Industries Inc. and La-Z-Boy maintain a strong presence through their extensive network of physical stores.

Distribution Channel: Supermarkets & Hypermarkets: This channel plays a minor but evolving role.

- Key Drivers: Convenience for impulse purchases, bundled deals with other home goods, and catering to budget-conscious consumers.

- Dominance Analysis: Supermarkets and hypermarkets typically offer a limited range of basic and often lower-priced options. Their dominance is constrained by the specialized nature of bedroom furniture and the expectation of quality and design associated with closets, nightstands, and dressers. However, collaborations with furniture brands can expand their reach.

Distribution Channel: Other Distribution Channels: This category includes independent furniture makers, custom furniture designers, and direct sales from manufacturers.

- Key Drivers: Niche markets, bespoke designs, and direct customer relationships.

- Dominance Analysis: While not a dominant channel in terms of sheer volume, "other" channels cater to specific customer segments seeking uniqueness and craftsmanship, influencing design trends and pushing the boundaries of innovation.

Closets, Nightstands, and Dressers Market Product Developments

Product innovation in the closets, nightstands, and dressers market is centered on enhanced functionality, aesthetic appeal, and sustainability. Companies are developing modular closet systems that can be reconfigured to suit evolving storage needs and spatial constraints. Nightstands are increasingly incorporating smart features like built-in wireless charging pads, USB ports, and ambient lighting. Dressers are seeing a resurgence in demand for durable, eco-friendly materials such as recycled wood and bamboo. Competitive advantages are being gained through smart design, space optimization, and the integration of technology, making furniture more adaptable and user-friendly for modern living.

Report Scope & Segmentation Analysis

This report segments the Closets, Nightstands, and Dressers market by Distribution Channel: Supermarkets & Hypermarkets, Specialty Stores, Online, and Other Distribution Channels. The Online segment is projected to witness the highest growth, driven by convenience and competitive pricing, with an estimated market size of USD 25,000 million in 2025 and a projected CAGR of 8.5% through 2033. Specialty Stores represent a significant share, valued at approximately USD 20,000 million in 2025, and are expected to grow at a CAGR of 5.2%, driven by premium product offerings and personalized customer experiences. Supermarkets & Hypermarkets, estimated at USD 5,000 million in 2025, will experience a modest growth of 3.0% CAGR, catering to the budget-conscious segment. Other Distribution Channels, valued at USD 5,000 million in 2025, will grow at a CAGR of 6.0%, serving niche markets and custom furniture demands.

Key Drivers of Closets, Nightstands, and Dressers Market Growth

The Closets, Nightstands, and Dressers market growth is propelled by several key factors. Increasing urbanization and smaller living spaces worldwide drive demand for space-saving and multi-functional furniture. Rising disposable incomes, particularly in emerging economies, enable consumers to invest in higher-quality and more aesthetically pleasing bedroom furniture. The e-commerce revolution, with its convenience and accessibility, has opened new sales avenues and significantly expanded market reach. Technological advancements, including smart home integration and sustainable material innovations, are creating new product categories and appealing to a wider consumer base. Furthermore, the growing emphasis on home décor and interior design trends as a reflection of personal style fuels the demand for stylish and functional closets, nightstands, and dressers.

Challenges in the Closets, Nightstands, and Dressers Market Sector

Despite robust growth, the Closets, Nightstands, and Dressers market faces several challenges. Supply chain disruptions, including raw material price volatility and logistics bottlenecks, can impact production costs and delivery times. Intense competition from both established brands and emerging online retailers can lead to price wars and squeezed profit margins. Regulatory hurdles related to product safety, environmental standards, and sustainable sourcing can add to operational complexities and compliance costs. The high cost of furniture manufacturing and the logistics of shipping bulky items also present significant challenges for smaller players. Evolving consumer preferences, requiring continuous product innovation and adaptation, can strain R&D budgets.

Emerging Opportunities in Closets, Nightstands, and Dressers Market

The Closets, Nightstands, and Dressers market presents numerous emerging opportunities. The growing demand for sustainable and eco-friendly furniture creates a niche for manufacturers utilizing recycled materials and environmentally conscious production processes. The integration of smart home technology, such as voice-activated storage solutions and connected furniture, offers a significant avenue for innovation and premium product development. Expansion into emerging markets with growing middle classes and increasing urbanization provides substantial growth potential. The customization trend is another key opportunity, allowing consumers to design furniture tailored to their specific needs and aesthetic preferences, driving higher-value sales. Furthermore, the increasing popularity of small-space living solutions presents ongoing demand for cleverly designed and compact bedroom furniture.

Leading Players in the Closets, Nightstands, and Dressers Market Market

- La-Z-Boy

- Ashley Furniture Industries Inc.

- Herman Miller

- Williams-Sonoma Inc.

- IKEA

- Heritage Home Group

- Wayfair Inc.

- Home Depot Inc.

- Target Corporation

- Bed Bath & Beyond Inc.

Key Developments in Closets, Nightstands, and Dressers Market Industry

- September 2023: IKEA opened its biggest South American store in Colombia, as part of an international expansion plan which includes growth in Peru and Chile with an investment worth USD 600 million.

- November 2022: IKEA Canada announced plans to expand its successful small-store format with a new location in Scarborough, Ontario.

- July 2022: Bed Bath & Beyond Partners with The Novogratz was anticipated to launch curated furniture and décor. Bed Bath & Beyond was also teaming up with husband-and-wife design duo, The Novogratz, for back-to-college with colorful, modern furniture and décor.

Strategic Outlook for Closets, Nightstands, and Dressers Market Market

The strategic outlook for the Closets, Nightstands, and Dressers market is highly positive, driven by a confluence of sustained urbanization, rising disposable incomes, and evolving consumer preferences. The continued digital transformation of retail, with a strong emphasis on e-commerce and omnichannel strategies, will be crucial for market players. Companies focusing on innovation, particularly in areas of sustainable materials, smart furniture integration, and space-saving designs, will gain a significant competitive edge. Strategic partnerships and potential acquisitions will shape the market's consolidation and expansion. The increasing demand for personalized and customizable furniture solutions presents a lucrative opportunity for businesses that can offer tailored products and exceptional customer experiences, ensuring continued market growth and profitability.

Closets, Nightstands, and Dressers Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets & Hypermarkets

- 1.2. Specialty Stores

- 1.3. Online

- 1.4. Other Distribution Channels

Closets, Nightstands, and Dressers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Rest of Europe

-

4. Asia Pacific

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Rest of Asia Pacific

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Closets, Nightstands, and Dressers Market Regional Market Share

Geographic Coverage of Closets, Nightstands, and Dressers Market

Closets, Nightstands, and Dressers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment

- 3.3. Market Restrains

- 3.3.1. Changes in Consumer Preferences and Behavior

- 3.4. Market Trends

- 3.4.1 Rising Online Sales of Closets

- 3.4.2 Nightstand and Dresser

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets & Hypermarkets

- 5.1.2. Specialty Stores

- 5.1.3. Online

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Asia Pacific

- 5.2.5. Middle East

- 5.2.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets & Hypermarkets

- 6.1.2. Specialty Stores

- 6.1.3. Online

- 6.1.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets & Hypermarkets

- 7.1.2. Specialty Stores

- 7.1.3. Online

- 7.1.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets & Hypermarkets

- 8.1.2. Specialty Stores

- 8.1.3. Online

- 8.1.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Asia Pacific Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets & Hypermarkets

- 9.1.2. Specialty Stores

- 9.1.3. Online

- 9.1.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Middle East Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets & Hypermarkets

- 10.1.2. Specialty Stores

- 10.1.3. Online

- 10.1.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. United Arab Emirates Closets, Nightstands, and Dressers Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.1.1. Supermarkets & Hypermarkets

- 11.1.2. Specialty Stores

- 11.1.3. Online

- 11.1.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 La-Z-Boy**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ashley Furniture Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Herman Miller

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Williams-Sonoma Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IKEA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Heritage Home Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Wayfair Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Home Depot Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Target Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bed Bath & Beyond Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 La-Z-Boy**List Not Exhaustive

List of Figures

- Figure 1: Global Closets, Nightstands, and Dressers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 3: North America Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: South America Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Asia Pacific Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Asia Pacific Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Asia Pacific Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Middle East Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Middle East Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: United Arab Emirates Closets, Nightstands, and Dressers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: United Arab Emirates Closets, Nightstands, and Dressers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: United Arab Emirates Closets, Nightstands, and Dressers Market Revenue (billion), by Country 2025 & 2033

- Figure 25: United Arab Emirates Closets, Nightstands, and Dressers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Brazil Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Argentina Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of South America Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Closets, Nightstands, and Dressers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Saudi Arabia Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: South Africa Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East Closets, Nightstands, and Dressers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Closets, Nightstands, and Dressers Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Closets, Nightstands, and Dressers Market?

Key companies in the market include La-Z-Boy**List Not Exhaustive, Ashley Furniture Industries Inc, Herman Miller, Williams-Sonoma Inc, IKEA, Heritage Home Group, Wayfair Inc, Home Depot Inc, Target Corporation, Bed Bath & Beyond Inc.

3. What are the main segments of the Closets, Nightstands, and Dressers Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

Wooden Furniture Products are Preferred in Canadian Households; Rise in the Demand of Furniture Residential Segment.

6. What are the notable trends driving market growth?

Rising Online Sales of Closets. Nightstand and Dresser.

7. Are there any restraints impacting market growth?

Changes in Consumer Preferences and Behavior.

8. Can you provide examples of recent developments in the market?

In September 2023, IKEA opened its biggest South American store in Colombia, as part of an international expansion plan which includes growth in Peru and Chile with an investment worth USD 600 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Closets, Nightstands, and Dressers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Closets, Nightstands, and Dressers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Closets, Nightstands, and Dressers Market?

To stay informed about further developments, trends, and reports in the Closets, Nightstands, and Dressers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence