Key Insights

The United Arab Emirates (UAE) baby diaper market is witnessing a significant surge in demand for cloth diapers, driven by growing environmental consciousness and the long-term cost-efficiency of reusable options. Parents are actively seeking sustainable alternatives to disposable diapers, addressing concerns surrounding plastic waste and the ecological footprint of production and disposal. This trend is particularly evident among affluent and environmentally aware demographics in the UAE, who are investing in premium, durable cloth diapers and accessories. While the overall UAE baby diaper market is substantial, estimated at $3.59 billion by 2025, the cloth diaper segment, though smaller, boasts a higher CAGR of 11.13% compared to the broader market. This rapid expansion signals a key opportunity for brands specializing in eco-friendly diaper solutions. The market's growth is further amplified by the increasing availability of aesthetically pleasing and user-friendly cloth diaper designs, coupled with enhanced online retail platforms that improve product accessibility and information dissemination for parents. Increased competition is anticipated, with both established diaper manufacturers expanding their offerings and new companies focusing solely on sustainable baby products entering the market.

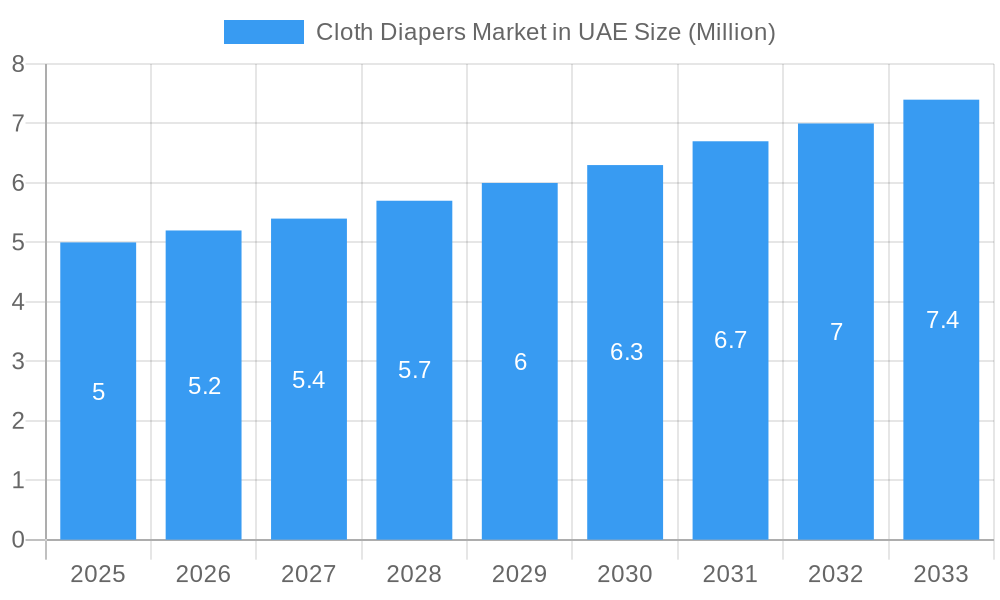

Cloth Diapers Market in UAE Market Size (In Billion)

The expansion of the UAE cloth diaper market faces certain obstacles. The upfront expenditure for cloth diapers and essential accessories (liners, covers, cleaning supplies) presents a potential deterrent for some consumers. Furthermore, cultural norms and practical considerations, such as water availability and laundry infrastructure, may impact adoption rates. Nevertheless, the strong consumer preference for eco-friendly goods and the expanding online retail landscape indicate sustained growth for the UAE cloth diaper market over the coming decade. Strategic collaborations between diaper brands and laundry services could also expedite market penetration by mitigating the perceived inconvenience of cloth diaper maintenance. Emphasizing the long-term economic and health benefits of cloth diapers will be crucial for continued market expansion.

Cloth Diapers Market in UAE Company Market Share

Cloth Diapers Market in UAE: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Cloth Diapers Market in the UAE, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The market is segmented by distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailing, Drug Stores/Pharmacies, Other Distribution Channels) and product type (Baby Diapers, Baby Wipes). Key players analyzed include Domtar Corporation, Procter & Gamble, Unicharm Corporation, Essity Aktiebolag, Unilever PLC, Daio Paper Corporation, Kimberly-Clark Corporation, Kao Corporation, and Johnson & Johnson Middle East FZ - LLC.

Cloth Diapers Market in UAE Market Concentration & Innovation

The UAE's cloth diaper market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players is estimated to be xx% in 2025. Innovation is driven by the increasing demand for eco-friendly and sustainable products, along with advancements in material technology leading to more absorbent and comfortable cloth diapers. Regulatory frameworks concerning product safety and environmental standards play a crucial role. The market faces competition from disposable diapers, but the growing awareness of environmental concerns and health benefits associated with cloth diapers is fueling market growth. M&A activities in the sector have been relatively limited in recent years, with a total deal value estimated at xx Million in the period 2019-2024. Future M&A activity is expected to be driven by strategic expansion and consolidation within the market.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Drivers: Sustainability concerns, material technology advancements, and consumer preference for eco-friendly products.

- Regulatory Framework: UAE standards for product safety and environmental compliance.

- Product Substitutes: Disposable diapers are the primary substitute.

- End-User Trends: Increasing adoption of eco-conscious lifestyle choices and growing awareness of the environmental impact of disposable diapers.

- M&A Activity: Estimated deal value of xx Million during 2019-2024.

Cloth Diapers Market in UAE Industry Trends & Insights

The cloth diaper market in the UAE is experiencing a significant upswing, fueled by a powerful combination of growing environmental consciousness and an increasing appreciation for the health advantages of reusable options. This burgeoning market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR here, e.g., 8.5%]** during the forecast period of 2025-2033. Technological advancements are playing a pivotal role, with innovations in advanced fabric technologies and user-friendly fastening systems dramatically enhancing the convenience and efficacy of cloth diapers, thereby accelerating their adoption. The current market penetration of cloth diapers in the UAE is estimated to be around **[Insert specific percentage here, e.g., 15%]**, a figure projected to climb steadily. Consumer preferences are leaning towards premium, high-performance cloth diapers that offer superior absorbency, exceptional comfort, and modern designs. The competitive landscape is characterized by robust competition among well-established brands and the strategic emergence of niche players offering specialized and artisanal products. The market's growth trajectory is further bolstered by rising birth rates and a consistent increase in disposable incomes across the Emirates.

Dominant Markets & Segments in Cloth Diapers Market in UAE

The online retailing channel is expected to dominate the UAE cloth diaper market in 2025, capturing xx% of the total market share. This dominance is primarily attributed to the increasing penetration of e-commerce and the convenience offered to consumers. Baby diapers constitute the largest product segment, accounting for xx% of the market share, driven by high demand from parents seeking eco-friendly alternatives to disposable options. The growth of the online segment is further propelled by the robust digital infrastructure, ease of access to online marketplaces, and targeted digital marketing campaigns.

Key Drivers for Online Retailing Dominance:

- Wide product selection and competitive pricing.

- Convenience of home delivery.

- Increased smartphone and internet penetration.

- Targeted digital marketing campaigns.

Key Drivers for Baby Diapers Segment Dominance:

- Higher demand compared to baby wipes.

- Growing awareness of environmental benefits.

- Health and safety concerns surrounding disposable diapers.

Cloth Diapers Market in UAE Product Developments

Recent product evolution in the UAE cloth diaper sector has centered on enhancing functionality and user experience. Innovations include the development of highly absorbent and leak-proof designs, often employing advanced sustainable materials such as breathable bamboo and GOTS-certified organic cotton. These advancements significantly improve comfort and practicality, effectively addressing historical concerns about bulkiness and potential leaks. The integration of intuitive fastening systems, including durable snaps and adjustable hook-and-loop closures, has streamlined the diaper changing process for parents. These developments are meticulously designed to cater to the dynamic needs of contemporary parents while aligning with the growing global demand for eco-friendly and sustainable baby care solutions. While still in its nascent stages, the market is also beginning to witness the integration of nascent smart technologies, with an eye towards optimizing usage efficiency and potentially tracking diaper changes.

Report Scope & Segmentation Analysis

This report segments the UAE cloth diaper market by distribution channel and product type.

By Distribution Channel:

- Supermarkets/Hypermarkets: This channel is expected to witness moderate growth driven by the accessibility and established presence of these retailers. Market size is projected to reach xx Million by 2033.

- Convenience Stores: This segment is expected to experience slower growth due to limited space and stock-keeping capabilities.

- Online Retailing: This channel is projected to be the fastest-growing segment with xx% CAGR, driven by the convenience of online shopping.

- Drug Stores/Pharmacies: This segment offers moderate growth potential due to the association with health and baby products.

- Other Distribution Channels: This includes specialized baby stores and direct-to-consumer sales which offer niche market growth opportunities.

By Product Type:

- Baby Diapers: This segment is the largest, with an expected market size of xx Million in 2033, driven by high demand for eco-friendly alternatives.

- Baby Wipes: This segment is smaller but experiencing growth driven by demand for reusable and eco-friendly options.

Key Drivers of Cloth Diapers Market in UAE Growth

Several compelling factors are propelling the expansion of the cloth diaper market in the UAE. A primary driver is the escalating awareness among consumers regarding environmental sustainability and a strong desire to minimize household waste, making cloth diapers a more responsible choice. Concurrently, growing parental concern over the potential health implications of certain chemicals found in disposable diapers is encouraging a shift towards natural and reusable alternatives. Furthermore, favorable economic conditions, including rising disposable incomes and the increasing affordability of durable, high-quality cloth diapering systems, are contributing significantly to market accessibility and growth. The supportive stance of government initiatives promoting eco-conscious living and sustainable practices within the UAE also plays an instrumental role in fostering market expansion.

Challenges in the Cloth Diapers Market in UAE Sector

Despite its promising growth, the UAE cloth diaper market encounters certain challenges. The initial investment cost for purchasing a comprehensive set of cloth diapers and accompanying accessories can be a considerable barrier for some households. The perceived inconvenience associated with the washing and maintenance routine of cloth diapers, especially when contrasted with the immediate disposability of traditional options, remains a significant deterrent for a segment of the consumer base. The entrenched market presence and widespread availability of established disposable diaper brands create substantial competitive pressure, impacting market share acquisition. Additionally, inconsistent product quality observed among certain cloth diaper brands currently available in the market can lead to consumer apprehension and hesitation, potentially hindering broader adoption rates.

Emerging Opportunities in Cloth Diapers Market in UAE

The market presents exciting opportunities. The rising popularity of sustainable lifestyles is creating increasing demand for eco-friendly products. The potential for premiumization, offering higher-quality, specialized cloth diapers, presents a lucrative opportunity. Furthermore, technological advancements, such as the development of more efficient and convenient washing solutions for cloth diapers, could address consumer concerns and boost adoption. Finally, direct-to-consumer marketing strategies have the potential to increase market reach effectively.

Leading Players in the Cloth Diapers Market in UAE Market

- Domtar Corporation

- Procter & Gamble

- Unicharm Corporation

- Essity Aktiebolag

- Unilever PLC

- Daio Paper Corporation

- Kimberly-Clark Corporation

- Kao Corporation

- Johnson & Johnson Middle East FZ - LLC

Key Developments in Cloth Diapers Market in UAE Industry

- 2022 Q3: A leading sustainable baby product brand introduced an innovative new line of ultra-soft, GOTS-certified organic cotton cloth diapers, emphasizing superior comfort and eco-friendliness.

- 2023 Q1: A pioneering eco-conscious rental service for cloth diapers was launched, offering flexible and cost-effective solutions for parents seeking to try cloth diapering without a large upfront investment.

- 2024 Q2: A surge in targeted digital marketing campaigns across the UAE highlighted the compelling environmental benefits, long-term cost savings, and potential health advantages of adopting cloth diapers, reaching a wider audience of eco-aware parents.

Strategic Outlook for Cloth Diapers Market in UAE Market

The UAE cloth diaper market holds significant potential for growth, driven by increasing consumer awareness, technological advancements, and favorable government policies promoting sustainability. Further market expansion is expected through increased product innovation, focused marketing strategies, and the expansion of online retail channels. Addressing consumer concerns regarding convenience and cost-effectiveness through innovative solutions will be critical to unlocking the market's full potential. The market is projected to continue its robust growth trajectory, supported by a growing population, changing consumer preferences, and expanding e-commerce penetration in the region.

Cloth Diapers Market in UAE Segmentation

-

1. Product

- 1.1. Baby Diapers

- 1.2. Baby Wipes

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retailing

- 2.4. Drug Stores/Pharmacies

- 2.5. Other Distribution Channels

Cloth Diapers Market in UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloth Diapers Market in UAE Regional Market Share

Geographic Coverage of Cloth Diapers Market in UAE

Cloth Diapers Market in UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion

- 3.3. Market Restrains

- 3.3.1. Limited Sensory Experience

- 3.4. Market Trends

- 3.4.1. Organic Diapers are Gaining a Considerable Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Baby Diapers

- 5.1.2. Baby Wipes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retailing

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Baby Diapers

- 6.1.2. Baby Wipes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retailing

- 6.2.4. Drug Stores/Pharmacies

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Baby Diapers

- 7.1.2. Baby Wipes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retailing

- 7.2.4. Drug Stores/Pharmacies

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Baby Diapers

- 8.1.2. Baby Wipes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retailing

- 8.2.4. Drug Stores/Pharmacies

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Baby Diapers

- 9.1.2. Baby Wipes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retailing

- 9.2.4. Drug Stores/Pharmacies

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Cloth Diapers Market in UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Baby Diapers

- 10.1.2. Baby Wipes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retailing

- 10.2.4. Drug Stores/Pharmacies

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Domtar Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Procter & Gamble

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unicharm Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Essity Aktiebolag

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daio Paper Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kimberly-Clark Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kao Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson Middle East FZ - LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Domtar Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Cloth Diapers Market in UAE Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cloth Diapers Market in UAE Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Cloth Diapers Market in UAE Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Cloth Diapers Market in UAE Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Cloth Diapers Market in UAE Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cloth Diapers Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cloth Diapers Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cloth Diapers Market in UAE Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Cloth Diapers Market in UAE Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Cloth Diapers Market in UAE Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Cloth Diapers Market in UAE Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Cloth Diapers Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Cloth Diapers Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cloth Diapers Market in UAE Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Cloth Diapers Market in UAE Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Cloth Diapers Market in UAE Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Cloth Diapers Market in UAE Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Cloth Diapers Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Cloth Diapers Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cloth Diapers Market in UAE Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Cloth Diapers Market in UAE Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Cloth Diapers Market in UAE Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Cloth Diapers Market in UAE Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Cloth Diapers Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cloth Diapers Market in UAE Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cloth Diapers Market in UAE Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Cloth Diapers Market in UAE Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Cloth Diapers Market in UAE Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Cloth Diapers Market in UAE Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Cloth Diapers Market in UAE Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Cloth Diapers Market in UAE Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Cloth Diapers Market in UAE Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cloth Diapers Market in UAE Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloth Diapers Market in UAE?

The projected CAGR is approximately 11.13%.

2. Which companies are prominent players in the Cloth Diapers Market in UAE?

Key companies in the market include Domtar Corporation*List Not Exhaustive, Procter & Gamble, Unicharm Corporation, Essity Aktiebolag, Unilever PLC, Daio Paper Corporation, Kimberly-Clark Corporation, Kao Corporation, Johnson & Johnson Middle East FZ - LLC.

3. What are the main segments of the Cloth Diapers Market in UAE?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion.

6. What are the notable trends driving market growth?

Organic Diapers are Gaining a Considerable Market Share.

7. Are there any restraints impacting market growth?

Limited Sensory Experience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloth Diapers Market in UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloth Diapers Market in UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloth Diapers Market in UAE?

To stay informed about further developments, trends, and reports in the Cloth Diapers Market in UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence