Key Insights

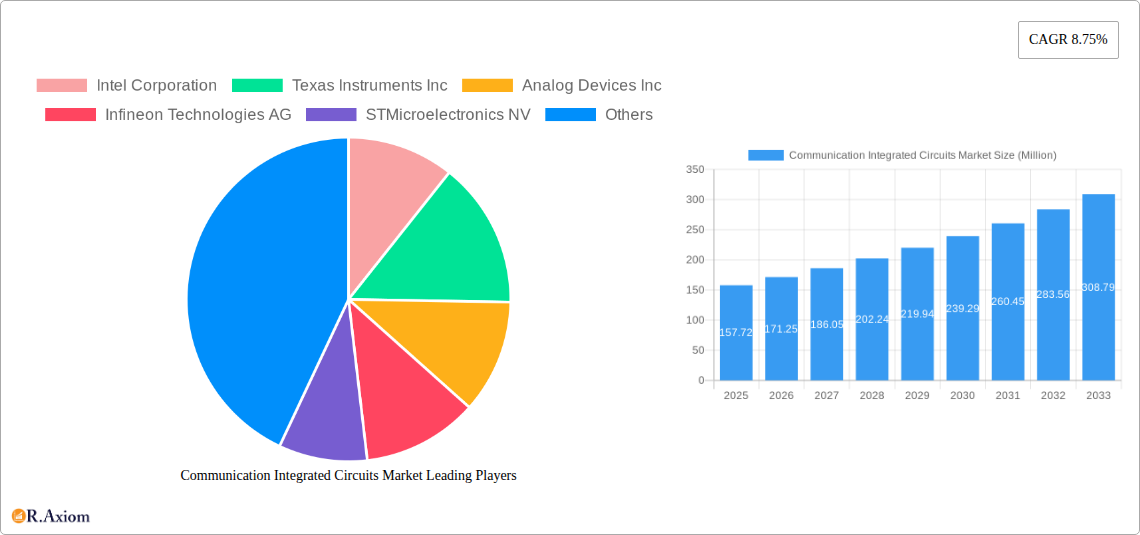

The global Communication Integrated Circuits (ICs) market is poised for significant expansion, with a market size estimated at USD 157.72 million in 2025 and projected to grow at a robust CAGR of 8.75% through 2033. This growth is underpinned by escalating demand for faster, more efficient, and interconnected communication systems across various sectors. Key drivers include the relentless advancement of 5G and the burgeoning deployment of IoT devices, which necessitate sophisticated ICs for data processing, transmission, and management. The increasing adoption of cloud computing, artificial intelligence, and machine learning further fuels this demand, as these technologies rely heavily on high-performance communication infrastructure. Furthermore, the continuous innovation in consumer electronics, automotive electronics, and industrial automation, all heavily dependent on seamless communication, are contributing factors to the market's upward trajectory.

Communication Integrated Circuits Market Market Size (In Million)

The market is characterized by dynamic trends, including the shift towards higher bandwidth and lower latency solutions, the miniaturization of components for portable devices, and the increasing integration of advanced functionalities into single ICs. The rise of specialized ICs for specific communication protocols and applications, such as Wi-Fi 6/6E, Bluetooth, and satellite communication, is also a prominent trend. While growth prospects are strong, the market faces certain restraints, including the high cost of research and development for cutting-edge technologies and the complex global supply chain challenges that can impact production and availability. However, strategic investments in R&D, coupled with collaborations and partnerships among key players, are expected to mitigate these challenges and ensure sustained market growth. The market is segmented into Analog ICs, Logic ICs, Memory, and Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors, each contributing to the overall market evolution.

Communication Integrated Circuits Market Company Market Share

This in-depth report provides an exhaustive analysis of the global Communication Integrated Circuits (ICs) market, offering critical insights into its current state, future trajectory, and key growth drivers. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and an extensive forecast period extending to 2033, this report is an indispensable resource for industry stakeholders, investors, and strategists seeking to navigate the dynamic landscape of communication ICs. We meticulously examine market concentration, innovation trends, regulatory environments, product substitutes, evolving end-user demands, and strategic merger and acquisition (M&A) activities. The report delves into the intricate web of industry trends, technological disruptions, evolving consumer preferences, and intense competitive dynamics shaping the market. Furthermore, it identifies dominant regions, countries, and key market segments within Analog ICs, Logic ICs, Memory, and Micro ICs (including Microprocessors, Microcontrollers, and Digital Signal Processors), providing granular detail on growth projections, market sizes, and competitive landscapes. Strategic outlooks, growth catalysts, emerging opportunities, and critical challenges are thoroughly dissected, equipping stakeholders with actionable intelligence for informed decision-making.

Communication Integrated Circuits Market Market Concentration & Innovation

The Communication Integrated Circuits (ICs) market exhibits a moderate to high level of concentration, characterized by the significant presence of established semiconductor giants and a growing number of specialized players. Innovation serves as a primary catalyst for market expansion, driven by the relentless demand for higher speeds, increased bandwidth, reduced power consumption, and enhanced functionality across diverse communication applications. Key innovation drivers include the miniaturization of components, advancements in semiconductor manufacturing processes, the integration of artificial intelligence (AI) and machine learning (ML) capabilities, and the development of specialized architectures for emerging technologies like 5G, IoT, and advanced wireless communication systems.

- Market Concentration Metrics: While specific market share figures vary across sub-segments, leading companies such as Intel Corporation, Texas Instruments Inc., Analog Devices Inc., Infineon Technologies AG, and STMicroelectronics NV collectively hold substantial portions of the global market. The top 10 companies are estimated to command a market share exceeding 70%.

- M&A Activities: Merger and acquisition activities are a significant aspect of market concentration and strategic positioning. Recent years have seen strategic acquisitions aimed at broadening product portfolios, acquiring niche technologies, and expanding market reach. Deal values in the semiconductor industry, including those impacting communication ICs, have ranged from tens of millions to several billion dollars, signifying the strategic importance and high valuations within the sector.

- Innovation Drivers:

- Advancements in semiconductor materials and fabrication (e.g., GaN, advanced FinFETs).

- Development of integrated solutions for multi-protocol support and software-defined radio.

- Focus on low-power consumption for battery-operated devices in IoT.

- Integration of signal processing capabilities for advanced data analytics and real-time communication.

- Regulatory Frameworks: The market is influenced by various regulatory bodies setting standards for interoperability, safety, and electromagnetic compatibility (EMC). These frameworks, while ensuring market integrity, can also influence product development timelines and costs.

- Product Substitutes: While direct substitutes for highly integrated communication ICs are limited, advancements in system-level integration and the increasing adoption of software-defined solutions can, in some instances, reduce the reliance on specific hardware components. However, the fundamental need for robust and efficient communication ICs remains paramount.

- End-User Trends: The proliferation of connected devices, the demand for seamless high-speed data transfer, and the increasing adoption of cloud computing and edge computing are key end-user trends propelling the communication ICs market forward.

Communication Integrated Circuits Market Industry Trends & Insights

The global Communication Integrated Circuits (ICs) market is experiencing robust growth, driven by a confluence of accelerating technological advancements, evolving consumer demands, and expanding application areas. The fundamental undercurrent of this expansion is the ever-increasing need for faster, more reliable, and more efficient data transmission and processing across a myriad of devices and networks. This sustained growth is projected to continue at a significant Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033), pushing the market valuation from an estimated $XX Billion in 2025 to well over $XXX Billion by 2033.

Technological disruptions are a constant feature of this dynamic market. The ongoing rollout and evolution of 5G networks worldwide are a paramount growth driver, necessitating the development and deployment of advanced communication ICs for base stations, user equipment, and network infrastructure. These ICs are critical for enabling higher data speeds, lower latency, and greater connection density, thus powering a new generation of applications such as enhanced mobile broadband, massive machine-type communications (mMTC), and ultra-reliable low-latency communications (URLLC). Beyond 5G, the burgeoning Internet of Things (IoT) ecosystem is another colossal demand generator. Billions of connected devices, ranging from smart home appliances and wearable technology to industrial sensors and smart city infrastructure, all rely on specialized communication ICs for connectivity, data acquisition, and processing. The demand for low-power, compact, and cost-effective ICs is particularly acute in this segment.

Consumer preferences are increasingly shifting towards seamless, high-performance digital experiences. This translates into a demand for faster and more stable internet connections, immersive entertainment, and sophisticated smart devices. Consequently, manufacturers of consumer electronics, including smartphones, tablets, smart TVs, and gaming consoles, are continually integrating more advanced communication ICs to meet these expectations. The automotive industry is also emerging as a significant growth area, with the increasing prevalence of connected vehicles, advanced driver-assistance systems (ADAS), and autonomous driving technologies requiring sophisticated communication ICs for vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communication.

The competitive landscape is characterized by intense rivalry among established semiconductor players and emerging innovators. Companies are heavily investing in research and development (R&D) to gain a competitive edge through product differentiation, technological leadership, and cost optimization. Strategic partnerships, collaborations, and mergers and acquisitions are common strategies employed to consolidate market share, acquire complementary technologies, and expand geographical reach. The industry is also witnessing a trend towards greater integration, with companies aiming to offer more comprehensive solutions that combine multiple functionalities on a single chip, thereby reducing system complexity and cost for their customers. The push for greater energy efficiency in semiconductor design is also a significant trend, driven by both environmental concerns and the need to extend battery life in portable and IoT devices. This involves the development of advanced power management techniques and low-power architectures within the communication ICs themselves. The increasing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) in telecommunications infrastructure is also influencing the types of communication ICs required, favoring more flexible and programmable solutions.

Dominant Markets & Segments in Communication Integrated Circuits Market

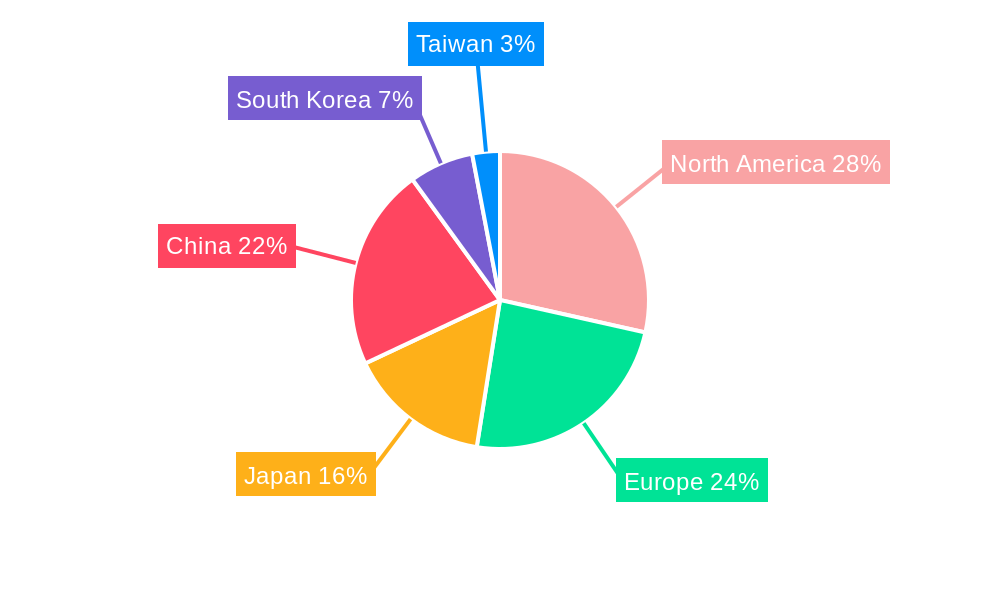

The global Communication Integrated Circuits (ICs) market is characterized by significant regional dominance and distinct segment leadership, driven by a complex interplay of economic policies, infrastructure development, technological adoption rates, and consumer demand. Asia Pacific, led by China, Japan, and South Korea, stands out as the dominant region. This dominance is fueled by its expansive manufacturing capabilities, robust adoption of advanced communication technologies like 5G, and a massive consumer base for electronic devices. China, in particular, acts as both a major consumer and producer of communication ICs, benefiting from government initiatives supporting domestic semiconductor production and innovation. The region’s dense population and rapid urbanization contribute to a high demand for consumer electronics, telecommunications infrastructure, and smart city solutions, all of which are significant end-users of communication ICs.

Within this dominant region, key drivers of growth include:

- Extensive 5G Network Deployment: Asia Pacific is at the forefront of 5G network implementation, creating substantial demand for 5G-enabled communication ICs for base stations, mobile devices, and network equipment.

- Manufacturing Hub: The region's status as a global manufacturing hub for electronic goods ensures a consistent demand for various types of communication ICs across a broad spectrum of products.

- Government Support and Investment: Several countries in Asia Pacific have implemented strong policies and significant investments to foster their domestic semiconductor industries, aiming for greater self-sufficiency and technological advancement.

- Growing Middle Class and Disposable Income: A burgeoning middle class with increasing disposable income drives the demand for premium consumer electronics and connected devices, further boosting the market.

In terms of segmentation, the Micro ICs segment, encompassing Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors (DSP), is projected to hold the largest market share and exhibit the highest growth rate. This dominance is largely attributable to the ubiquitous nature of these components across virtually all electronic devices.

- Microcontrollers (MCU): These are particularly dominant due to their widespread application in embedded systems, IoT devices, automotive electronics, industrial automation, and consumer appliances. Their cost-effectiveness, low power consumption, and ability to perform a wide range of control functions make them indispensable. The growing adoption of smart devices and automation in industries is a key driver for MCUs.

- Microprocessors (MPU): While often associated with higher-performance computing, MPUs are crucial for complex communication tasks in servers, high-end networking equipment, and advanced consumer electronics. The increasing demand for sophisticated data processing in communication systems fuels the demand for powerful MPUs.

- Digital Signal Processors (DSP): DSPs are vital for signal processing applications in telecommunications, audio/video processing, and advanced sensor systems. Their ability to perform complex mathematical operations at high speeds makes them essential for technologies like advanced wireless communication, noise cancellation, and image processing.

The Analog IC segment also represents a substantial and growing portion of the market. Analog ICs are fundamental for interfacing the digital world with the physical environment, converting signals and performing essential functions like amplification, filtering, and data conversion in all communication systems. The increasing complexity of communication signals and the demand for higher precision and efficiency are driving innovation and growth in this segment.

- Analog ICs: Critical for signal conditioning, power management, and RF front-ends in wireless communication modules, these ICs are indispensable for signal integrity and performance. Their role in enabling higher frequencies and wider bandwidths for 5G and future wireless technologies is paramount.

The Logic IC segment, while important, may experience moderate growth compared to Micro ICs, as many logic functions are increasingly being integrated into microcontrollers and other complex SoCs. However, specialized logic ICs continue to be vital in specific applications requiring high-speed switching and complex combinatorial functions.

- Logic ICs: These perform logical operations and are integral to the control and data manipulation within communication systems. Their demand is steady across various applications requiring precise digital control.

The Memory segment, encompassing volatile and non-volatile memory solutions, is also critical, with demand being driven by the increasing data storage and processing requirements of modern communication systems and the proliferation of data-intensive applications.

- Memory: Essential for storing firmware, data, and operational information in all communication devices, the demand for memory is directly correlated with the increasing sophistication and data handling capabilities of communication systems.

Communication Integrated Circuits Market Product Developments

The Communication Integrated Circuits (ICs) market is a hotbed of innovation, with companies continuously launching advanced products to meet the evolving demands of the digital age. Recent product developments highlight a strong focus on enhancing performance, reducing power consumption, and enabling new functionalities. For instance, the introduction of new microcontroller families, such as NXP Semiconductors' MCX A14x and MCX A15x, showcases a drive towards cost-effective, user-friendly solutions with compact footprints, ideal for a wide array of embedded applications. Simultaneously, advancements in memory technology, exemplified by Toshiba’s addition of higher flash memory capacities (512 KB/1 MB) to their microcontroller offerings, signify a push towards supporting more complex applications and larger data sets within integrated solutions. These product developments are crucial for enabling next-generation wireless technologies, sophisticated IoT networks, and advanced automotive systems, providing manufacturers with competitive advantages through superior performance, efficiency, and integration capabilities.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Communication Integrated Circuits (ICs) market, segmenting it across key product categories. The primary segmentation includes:

- Analog IC: This segment encompasses devices such as amplifiers, data converters, power management ICs, and RF components, crucial for signal processing and interfacing with the real world. Growth in this segment is driven by the increasing complexity of wireless communication and the need for high-fidelity signal manipulation.

- Logic IC: This category includes digital logic gates, multiplexers, decoders, and other combinatorial and sequential logic circuits essential for controlling and processing digital information within communication systems. Demand here is driven by the need for high-speed and efficient digital operations.

- Memory: This segment covers volatile memory (like DRAM) and non-volatile memory (like Flash, EEPROM) used for storing data, firmware, and operating parameters in communication devices. The ever-increasing data generated by connected devices fuels continuous growth in this segment.

- Micro ICs: This broad category includes Microprocessors (MPU) for high-performance computing, Microcontrollers (MCU) for embedded control applications, and Digital Signal Processors (DSP) for specialized signal processing tasks. The proliferation of smart devices and advanced communication protocols makes this the most dynamic and rapidly growing segment.

Key Drivers of Communication Integrated Circuits Market Growth

The Communication Integrated Circuits (ICs) market is propelled by several potent growth drivers. The relentless expansion of the 5G network infrastructure and the subsequent increase in 5G-enabled devices represent a significant catalyst. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart homes, industrial automation, wearables, and smart cities, is creating an insatiable demand for low-power, connected ICs. Furthermore, the increasing sophistication of automotive electronics, driven by the adoption of connected car technologies, ADAS, and autonomous driving, necessitates advanced communication and processing ICs. The ongoing digital transformation across industries, leading to greater automation and data-driven decision-making, also fuels the demand for robust communication ICs. Government initiatives promoting domestic semiconductor manufacturing and the development of digital infrastructure further bolster market growth.

Challenges in the Communication Integrated Circuits Market Sector

Despite its robust growth prospects, the Communication Integrated Circuits (ICs) market faces several challenges. Intense global competition, particularly from Asian manufacturers, exerts significant pricing pressure and necessitates continuous innovation to maintain market share. Supply chain disruptions, exacerbated by geopolitical factors and manufacturing complexities, can lead to production delays and increased costs. The escalating complexity of semiconductor design and manufacturing requires substantial R&D investments, posing a barrier for smaller players. Stringent regulatory requirements and evolving standards across different regions can also impact product development timelines and market entry strategies. Furthermore, the skilled labor shortage in semiconductor design and engineering presents an ongoing challenge for the industry.

Emerging Opportunities in Communication Integrated Circuits Market

The Communication Integrated Circuits (ICs) market is rife with emerging opportunities. The expansion of edge computing, which involves processing data closer to the source, is creating a demand for specialized, low-latency ICs. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in communication systems, for applications like intelligent network management and predictive maintenance, opens avenues for AI-accelerating ICs. The development of next-generation wireless technologies beyond 5G, such as 6G, presents a long-term opportunity for groundbreaking innovation in communication ICs. The growing demand for connectivity in remote and underserved areas, coupled with advancements in satellite communication, also offers new market frontiers. Furthermore, the increasing focus on energy efficiency and sustainability in electronics is driving innovation in low-power communication ICs.

Leading Players in the Communication Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc.

- Analog Devices Inc.

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc.

- Renesas Electronics Corporation

- MediaTek Inc.

Key Developments in Communication Integrated Circuits Market Industry

- March 2024: Toshiba added eight new products with 512 KB/1 MB flash memory capacity and four types of packages to the M4K Group of the TXZ+ Family Advanced Class 32-bit microcontrollers equipped with Cortex-M4 core with FPU. The new products expand code flash memory capacity from the 256 kb maximum of Toshiba’s current product to 512 KB/1 MB, depending on the product, and RAM capacity from 24 KB to 64 KB. This development enhances the capabilities of embedded systems requiring larger memory footprints.

- January 2024: NXP Semiconductors introduced the MCX A14x and MCX A15x, marking the inaugural families in the versatile A Series of the MCX portfolio, which are now available for purchase. These new MCX A series microcontrollers are designed to empower engineers by providing a cost-effective, user-friendly solution with a compact footprint. This launch targets the growing demand for accessible and efficient embedded processing solutions.

Strategic Outlook for Communication Integrated Circuits Market Market

The strategic outlook for the Communication Integrated Circuits (ICs) market is exceptionally bright, driven by the persistent global demand for enhanced connectivity, data processing, and intelligent functionalities. Key growth catalysts include the continued build-out and evolution of 5G and the nascent development of 6G technologies, which will necessitate a new generation of high-performance ICs. The explosive growth of the Internet of Things (IoT) across consumer, industrial, and automotive sectors will continue to fuel demand for a wide array of specialized and low-power communication ICs. Furthermore, the increasing integration of AI and machine learning into devices and networks will drive the need for ICs capable of efficient edge AI processing. Strategic investments in R&D for advanced materials, innovative architectures, and enhanced integration capabilities will be crucial for companies to maintain a competitive edge. The market's future success hinges on addressing supply chain resilience, navigating complex regulatory landscapes, and fostering a skilled workforce to drive innovation and manufacturing excellence in this vital technology sector.

Communication Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

Communication Integrated Circuits Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Communication Integrated Circuits Market Regional Market Share

Geographic Coverage of Communication Integrated Circuits Market

Communication Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World

- 3.3. Market Restrains

- 3.3.1. The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World

- 3.4. Market Trends

- 3.4.1. Logic IC Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog IC

- 6.1.2. Logic IC

- 6.1.3. Memory

- 6.1.4. Micro

- 6.1.4.1. Microprocessors (MPU)

- 6.1.4.2. Microcontrollers (MCU)

- 6.1.4.3. Digital Signal Processors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog IC

- 7.1.2. Logic IC

- 7.1.3. Memory

- 7.1.4. Micro

- 7.1.4.1. Microprocessors (MPU)

- 7.1.4.2. Microcontrollers (MCU)

- 7.1.4.3. Digital Signal Processors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog IC

- 8.1.2. Logic IC

- 8.1.3. Memory

- 8.1.4. Micro

- 8.1.4.1. Microprocessors (MPU)

- 8.1.4.2. Microcontrollers (MCU)

- 8.1.4.3. Digital Signal Processors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. China Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog IC

- 9.1.2. Logic IC

- 9.1.3. Memory

- 9.1.4. Micro

- 9.1.4.1. Microprocessors (MPU)

- 9.1.4.2. Microcontrollers (MCU)

- 9.1.4.3. Digital Signal Processors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analog IC

- 10.1.2. Logic IC

- 10.1.3. Memory

- 10.1.4. Micro

- 10.1.4.1. Microprocessors (MPU)

- 10.1.4.2. Microcontrollers (MCU)

- 10.1.4.3. Digital Signal Processors

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Taiwan Communication Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Analog IC

- 11.1.2. Logic IC

- 11.1.3. Memory

- 11.1.4. Micro

- 11.1.4.1. Microprocessors (MPU)

- 11.1.4.2. Microcontrollers (MCU)

- 11.1.4.3. Digital Signal Processors

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intel Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Texas Instruments Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Analog Devices Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Infineon Technologies AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 STMicroelectronics NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NXP Semiconductors NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 On Semiconductor Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Microchip Technology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Renesas Electronics Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 MediaTek Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Intel Corporation

List of Figures

- Figure 1: Global Communication Integrated Circuits Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Communication Integrated Circuits Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United States Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United States Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United States Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 12: Europe Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 13: Europe Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Japan Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Japan Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Japan Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Japan Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 28: China Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 29: China Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: China Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 31: China Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 36: South Korea Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 37: South Korea Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: South Korea Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 39: South Korea Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Communication Integrated Circuits Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Taiwan Communication Integrated Circuits Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Taiwan Communication Integrated Circuits Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Taiwan Communication Integrated Circuits Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Taiwan Communication Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Communication Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Communication Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Communication Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Communication Integrated Circuits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Communication Integrated Circuits Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 7: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 23: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Communication Integrated Circuits Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Communication Integrated Circuits Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Communication Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Communication Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Communication Integrated Circuits Market?

The projected CAGR is approximately 8.75%.

2. Which companies are prominent players in the Communication Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the Communication Integrated Circuits Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 157.72 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World.

6. What are the notable trends driving market growth?

Logic IC Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

The Rising Need for High-Band Connectivity Services will Support the Market Growth; Increasing Deployment of 5G Across the World.

8. Can you provide examples of recent developments in the market?

March 2024: Toshiba added eight new products with 512 KB/1 MB flash memory capacity and four types of packages to the M4K Group of the TXZ+ Family Advanced Class 32-bit microcontrollers equipped with Cortex-M4 core with FPU. The new products expand code flash memory capacity from the 256 kb maximum of Toshiba’s current product to 512 KB/1 MB, depending on the product, and RAM capacity from 24 KB to 64 KB.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Communication Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Communication Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Communication Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Communication Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence