Key Insights

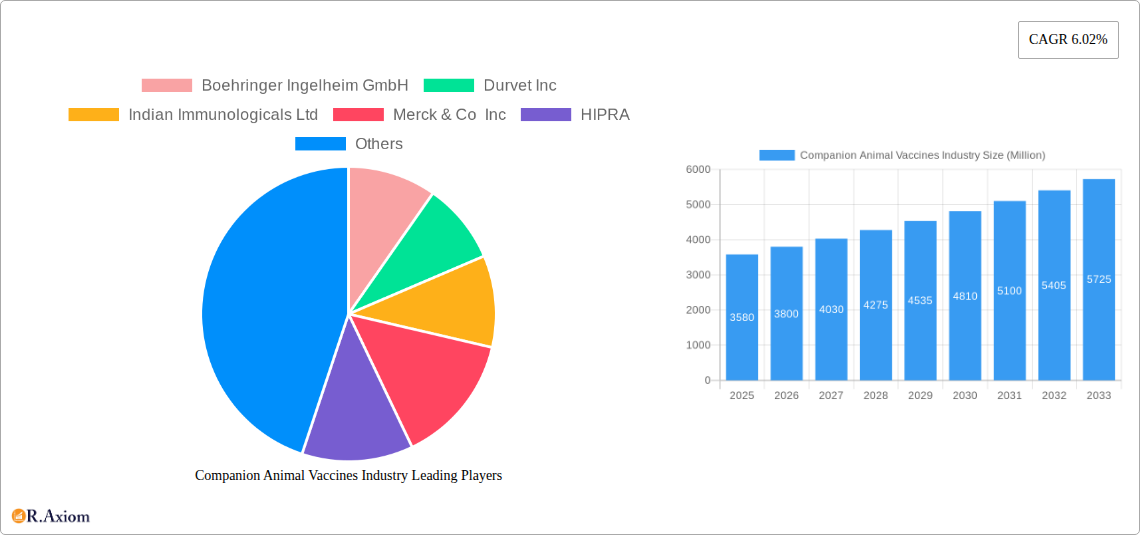

The global Companion Animal Vaccines market is projected for robust growth, currently valued at an estimated \$3.58 billion in 2025 and expected to expand at a Compound Annual Growth Rate (CAGR) of 6.02% through 2033. This expansion is fueled by a confluence of factors, primarily the increasing humanization of pets, leading owners to invest more in preventative healthcare and prioritize their animal companions' well-being. Growing awareness among pet owners about the importance of regular vaccinations for disease prevention and control, coupled with advancements in vaccine technology, including the development of more effective and convenient recombinant and live attenuated vaccines, are significant drivers. Furthermore, the rising prevalence of zoonotic diseases, which can be transmitted from animals to humans, is also a critical factor prompting increased vaccination rates to safeguard both animal and public health. The market's trajectory is further supported by a growing veterinary infrastructure and increasing disposable incomes in emerging economies, enabling wider access to advanced pet healthcare solutions.

Companion Animal Vaccines Industry Market Size (In Billion)

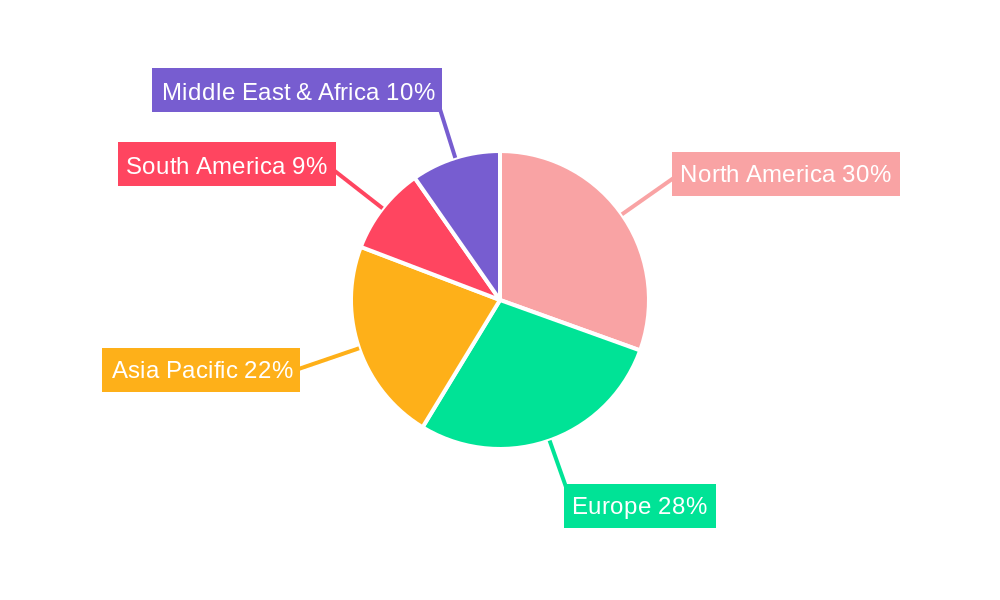

The market segmentation highlights key areas of focus and opportunity. In terms of technology, Live Attenuated Vaccines and Inactivated Vaccines are expected to dominate, owing to their established efficacy and widespread use. However, Recombinant Vaccines are poised for significant growth due to their enhanced safety profiles and targeted disease prevention capabilities. For animal types, the segments of Dogs and Cats will continue to represent the largest share, driven by their popularity as pets globally. The competitive landscape is characterized by the presence of major pharmaceutical companies such as Zoetis Inc., Merck & Co. Inc., and Boehringer Ingelheim GmbH, alongside several emerging players. These companies are actively engaged in research and development of novel vaccines and strategic collaborations to expand their product portfolios and market reach. Regional analysis indicates North America and Europe as leading markets, owing to well-established veterinary healthcare systems and high pet ownership rates, while the Asia Pacific region presents substantial growth potential due to its expanding pet population and increasing pet care expenditure.

Companion Animal Vaccines Industry Company Market Share

This in-depth market research report provides a detailed analysis of the global Companion Animal Vaccines Industry. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, the report offers critical insights into market dynamics, growth drivers, competitive landscape, and future projections. The report is essential for stakeholders seeking to understand the evolving landscape of veterinary pharmaceuticals, including manufacturers, distributors, researchers, investors, and policymakers.

Companion Animal Vaccines Industry Market Concentration & Innovation

The Companion Animal Vaccines Industry exhibits a moderate to high market concentration, driven by the dominance of a few key global players and strategic consolidation. Innovation is a primary catalyst, fueled by advancements in biotechnology and a persistent need for effective disease prevention in companion animals. Key innovation drivers include the development of novel vaccine platforms, such as recombinant vaccines, offering enhanced specificity and reduced side effects. Regulatory frameworks, while essential for ensuring product safety and efficacy, can also present barriers to entry for smaller players. The increasing prevalence of zoonotic diseases also elevates the importance of robust companion animal vaccination programs. Product substitutes, while limited in the core vaccination market, can emerge in the form of advanced diagnostics and therapeutic treatments for certain diseases. End-user trends highlight a growing pet humanization movement, leading to increased spending on premium healthcare services, including advanced vaccination protocols. Mergers and acquisitions (M&A) activities are strategically shaping the competitive landscape, with deal values in the hundreds of millions of dollars observed as companies aim to expand their product portfolios, geographical reach, and technological capabilities. For instance, acquisitions of smaller biotechnology firms with promising vaccine technologies are common.

Companion Animal Vaccines Industry Industry Trends & Insights

The Companion Animal Vaccines Industry is experiencing robust growth, driven by an escalating global demand for pet healthcare services, propelled by the “pet humanization” trend. Owners are increasingly viewing their pets as integral family members, leading to a willingness to invest significantly in preventive healthcare, including comprehensive vaccination schedules. This trend is expected to fuel a projected Compound Annual Growth Rate (CAGR) of approximately 7-9% over the forecast period. Technological disruptions are playing a pivotal role, with advancements in recombinant vaccines, subunit vaccines, and mRNA vaccine technologies offering improved efficacy, safety profiles, and ease of administration. These innovations are crucial in addressing emerging infectious diseases and providing protection against a broader spectrum of pathogens. Consumer preferences are shifting towards more convenient and less invasive vaccination methods, pushing research and development towards novel delivery systems, such as intranasal or oral vaccines. The competitive landscape is characterized by intense innovation and strategic partnerships, with major pharmaceutical companies investing heavily in R&D to maintain market leadership. The increasing market penetration of advanced veterinary diagnostic tools further supports the proactive approach to animal health, encouraging routine vaccinations and early detection of potential health issues. Market penetration in developed economies is already high, with significant growth opportunities emerging in developing regions as disposable incomes rise and awareness of animal welfare increases. The rising incidence of chronic and zoonotic diseases in companion animals is another significant market growth driver, emphasizing the critical role of vaccines in public health and animal well-being.

Dominant Markets & Segments in Companion Animal Vaccines Industry

The Companion Animal Vaccines Industry is characterized by distinct regional dominance and segment leadership, driven by varying economic conditions, pet ownership demographics, and regulatory environments.

North America currently holds a dominant position within the global market, largely attributed to:

- High Pet Ownership Rates: A deeply ingrained culture of pet ownership, with a significant percentage of households including at least one pet.

- Strong Economic Affluence: Higher disposable incomes enable owners to invest more in premium veterinary care, including advanced and routine vaccinations.

- Advanced Veterinary Infrastructure: Well-developed veterinary clinics and hospitals, equipped with the latest diagnostic and treatment technologies.

- Robust Regulatory Framework: A well-established system for approving and monitoring veterinary biologics, ensuring high standards of safety and efficacy.

- Prevalence of Zoonotic Diseases: The presence of diseases like rabies and Lyme disease, necessitating comprehensive vaccination programs.

Within the Technology segmentation, Live Attenuated Vaccines and Inactivated Vaccines continue to hold significant market share due to their long-standing efficacy and established manufacturing processes. However, Recombinant Vaccines are witnessing rapid growth, driven by their enhanced specificity, safety profile, and ability to elicit robust immune responses with fewer side effects. Their application in preventing complex diseases and developing multi-valent vaccines is a key driver.

In terms of Animal Type, the Dogs segment commands the largest market share. This dominance is due to:

- Highest Pet Population: Dogs are the most common companion animals globally.

- Extensive Vaccination Needs: Dogs require a comprehensive vaccination protocol covering a wide range of infectious diseases, including distemper, parvovirus, adenovirus, and rabies.

- Owner Compliance: Dog owners generally exhibit high compliance with recommended vaccination schedules.

- Development of Multi-valent Vaccines: Numerous combination vaccines are available for dogs, simplifying administration and increasing protection.

The Cats segment is the second-largest and is experiencing substantial growth, fueled by:

- Increasing Cat Ownership: A rising trend in cat adoption and ownership across various demographics.

- Specific Feline Pathogens: The need to protect cats against diseases like feline herpesvirus, feline calicivirus, feline panleukopenia, and rabies.

- Advancements in Feline Vaccines: Development of more effective and safer vaccines tailored for feline physiology.

The Other Animal Types segment, while smaller, is a rapidly growing area. This includes vaccines for small mammals like rabbits, ferrets, and exotic pets. Growth is driven by:

- Emerging Pet Trends: Increasing popularity of unconventional pets.

- Specialized Veterinary Care: Growing availability of veterinary expertise for these animals.

- Need for Disease Prevention: Recognition of disease risks in these populations.

The Market Share of these dominant segments underscores the focus of R&D and marketing efforts by leading companies. Economic policies promoting animal welfare and public health initiatives aimed at disease control significantly influence the growth trajectory of these dominant markets and segments.

Companion Animal Vaccines Industry Product Developments

Product development in the Companion Animal Vaccines Industry is characterized by a focus on enhanced efficacy, safety, and convenience. Innovations are centered around recombinant DNA technology, subunit vaccines, and advanced adjuvant formulations to elicit stronger and more durable immune responses. For example, the development of novel vaccines targeting emerging infectious diseases and providing broader protection against multiple strains of a virus is a key trend. These advancements aim to reduce the frequency of vaccinations, minimize potential side effects, and improve overall animal health and well-being, thereby offering significant competitive advantages to companies leading in these innovative product categories.

Report Scope & Segmentation Analysis

This report meticulously segments the Companion Animal Vaccines Industry across key parameters. The Technology segmentation includes Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines, Recombinant Vaccines, and Other Technologies, each analyzed for market size, growth projections, and competitive dynamics. The Animal Type segmentation covers Dogs, Cats, and Other Animal Types (e.g., rabbits, ferrets, birds), detailing their respective market shares, growth rates, and influencing factors. Market sizes for each segment are projected to reach billions of dollars.

Key Drivers of Companion Animal Vaccines Industry Growth

The growth of the Companion Animal Vaccines Industry is propelled by several interconnected factors.

- Pet Humanization: The increasing trend of viewing pets as family members drives higher spending on veterinary care and preventive health measures, including vaccines.

- Technological Advancements: Innovations in vaccine technologies, such as recombinant and mRNA vaccines, offer improved efficacy, safety, and novel applications.

- Rising Incidence of Zoonotic Diseases: The growing awareness of diseases transmissible from animals to humans necessitates comprehensive vaccination programs for companion animals, contributing to public health.

- Increasing Disposable Income: In both developed and emerging economies, rising disposable incomes enable pet owners to afford premium veterinary services and advanced vaccines.

- Government Initiatives and Regulations: Supportive policies and regulations promoting animal health and disease control programs encourage widespread vaccination adoption.

Challenges in the Companion Animal Vaccines Industry Sector

Despite robust growth, the Companion Animal Vaccines Industry faces several challenges.

- Stringent Regulatory Approval Processes: Navigating complex and time-consuming regulatory pathways for new vaccine approvals can be a significant hurdle.

- High Research and Development Costs: Developing and testing novel vaccine platforms requires substantial financial investment.

- Cold Chain Logistics: Maintaining the integrity of temperature-sensitive vaccines throughout the supply chain, especially in remote or underdeveloped regions, poses logistical challenges.

- Vaccine Hesitancy and Misinformation: Addressing owner concerns and misinformation regarding vaccine safety and necessity can impact market penetration.

- Emergence of New Pathogens: The constant evolution of pathogens and the emergence of novel diseases require continuous adaptation and development of new vaccines.

Emerging Opportunities in Companion Animal Vaccines Industry

The Companion Animal Vaccines Industry presents significant emerging opportunities.

- Development of Novel Vaccine Platforms: Continued research into mRNA, viral vector, and nanovaccine technologies promises more effective and adaptable preventative solutions.

- Expansion into Emerging Markets: The growing pet population and increasing disposable incomes in developing regions offer substantial untapped market potential.

- Personalized and Precision Vaccination: Tailoring vaccination protocols based on individual pet lifestyle, risk factors, and genetic predispositions.

- Preventative Care Solutions: Integrating vaccines with advanced diagnostics and preventative health management services to offer comprehensive pet wellness programs.

- Addressing Antimicrobial Resistance: Developing vaccines that reduce the reliance on antibiotic treatments for bacterial infections.

Leading Players in the Companion Animal Vaccines Industry Market

- Boehringer Ingelheim GmbH

- Durvet Inc

- Indian Immunologicals Ltd

- Merck & Co Inc

- HIPRA

- Brilliant Bio Pharma

- Hester Biosciences Limited

- Phibro Animal Health Corporation

- Virbac

- Bioveta AS

- Elanco Animal Health Incorporated

- Zoetis Inc

Key Developments in Companion Animal Vaccines Industry Industry

- September 2022: Merck Animal Health donated more than five million doses of its NOBIVAC rabies vaccine to key partners Mission Rabies and Rabies Free Africa through the Afya Program, bolstering efforts to eliminate canine-mediated rabies.

- May 2022: Ceva Santé Animale (Ceva) acquired the Canadian oral rabies vaccine manufacturer Artemis Technologies Inc., significantly expanding Ceva's presence and capabilities in the North American oral rabies vaccine segment.

Strategic Outlook for Companion Animal Vaccines Industry Market

The strategic outlook for the Companion Animal Vaccines Industry remains exceptionally positive, driven by the enduring trend of pet humanization and continuous technological innovation. Future growth will be fueled by the development of next-generation vaccines, including those utilizing advanced platforms like mRNA and gene editing, capable of addressing a broader spectrum of diseases with enhanced efficacy and safety. The expansion of veterinary services in emerging economies presents a significant opportunity for market penetration. Furthermore, a growing emphasis on preventive healthcare and the integration of vaccination with comprehensive wellness plans will solidify the industry's role in ensuring the longevity and well-being of companion animals worldwide. Strategic collaborations and acquisitions are expected to continue shaping the competitive landscape, as companies seek to expand their portfolios and technological prowess.

Companion Animal Vaccines Industry Segmentation

-

1. Technology

- 1.1. Live Attenuated Vaccines

- 1.2. Inactivated Vaccines

- 1.3. Toxoid Vaccines

- 1.4. Recombinant Vaccines

- 1.5. Other Technologies

-

2. Animal Type

- 2.1. Dogs

- 2.2. Cats

- 2.3. Other Animal Types

Companion Animal Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Companion Animal Vaccines Industry Regional Market Share

Geographic Coverage of Companion Animal Vaccines Industry

Companion Animal Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Adoption of Companion Animals

- 3.2.2 such as Dogs and Cats; Increasing Cases of Zoonotic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Vaccine Development and Regulatory Concern

- 3.4. Market Trends

- 3.4.1. Dogs Segment is Expected to Hold a Major Share in the Companion Animal Vaccine Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Live Attenuated Vaccines

- 5.1.2. Inactivated Vaccines

- 5.1.3. Toxoid Vaccines

- 5.1.4. Recombinant Vaccines

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs

- 5.2.2. Cats

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Live Attenuated Vaccines

- 6.1.2. Inactivated Vaccines

- 6.1.3. Toxoid Vaccines

- 6.1.4. Recombinant Vaccines

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs

- 6.2.2. Cats

- 6.2.3. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Live Attenuated Vaccines

- 7.1.2. Inactivated Vaccines

- 7.1.3. Toxoid Vaccines

- 7.1.4. Recombinant Vaccines

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs

- 7.2.2. Cats

- 7.2.3. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Live Attenuated Vaccines

- 8.1.2. Inactivated Vaccines

- 8.1.3. Toxoid Vaccines

- 8.1.4. Recombinant Vaccines

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs

- 8.2.2. Cats

- 8.2.3. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Live Attenuated Vaccines

- 9.1.2. Inactivated Vaccines

- 9.1.3. Toxoid Vaccines

- 9.1.4. Recombinant Vaccines

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs

- 9.2.2. Cats

- 9.2.3. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. GCC Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Live Attenuated Vaccines

- 10.1.2. Inactivated Vaccines

- 10.1.3. Toxoid Vaccines

- 10.1.4. Recombinant Vaccines

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs

- 10.2.2. Cats

- 10.2.3. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. South America Companion Animal Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Live Attenuated Vaccines

- 11.1.2. Inactivated Vaccines

- 11.1.3. Toxoid Vaccines

- 11.1.4. Recombinant Vaccines

- 11.1.5. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Dogs

- 11.2.2. Cats

- 11.2.3. Other Animal Types

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Boehringer Ingelheim GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Durvet Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Indian Immunologicals Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Merck & Co Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HIPRA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Brilliant Bio Pharma

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hester Biosciences Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Phibro Animal Health Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Virbac

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bioveta AS

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Elanco Animal Health Incorporated

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Zoetis Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Companion Animal Vaccines Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: Europe Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Asia Pacific Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Middle East Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: GCC Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: GCC Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: GCC Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: GCC Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: GCC Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: GCC Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Companion Animal Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 33: South America Companion Animal Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: South America Companion Animal Vaccines Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 35: South America Companion Animal Vaccines Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: South America Companion Animal Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: South America Companion Animal Vaccines Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 21: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 29: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 33: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South Africa Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 37: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 38: Global Companion Animal Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Brazil Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Companion Animal Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Companion Animal Vaccines Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Companion Animal Vaccines Industry?

Key companies in the market include Boehringer Ingelheim GmbH, Durvet Inc, Indian Immunologicals Ltd, Merck & Co Inc, HIPRA, 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES, Brilliant Bio Pharma, Hester Biosciences Limited, Phibro Animal Health Corporation, Virbac, Bioveta AS, Elanco Animal Health Incorporated, Zoetis Inc.

3. What are the main segments of the Companion Animal Vaccines Industry?

The market segments include Technology, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Companion Animals. such as Dogs and Cats; Increasing Cases of Zoonotic Diseases.

6. What are the notable trends driving market growth?

Dogs Segment is Expected to Hold a Major Share in the Companion Animal Vaccine Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Vaccine Development and Regulatory Concern.

8. Can you provide examples of recent developments in the market?

In September 2022, Merck Animal Health donated more than five million doses of its NOBIVAC rabies vaccine to help eliminate canine-mediated rabies to their key partners Mission Rabies and Rabies Free Africa through Afya Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Companion Animal Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Companion Animal Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Companion Animal Vaccines Industry?

To stay informed about further developments, trends, and reports in the Companion Animal Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence