Key Insights

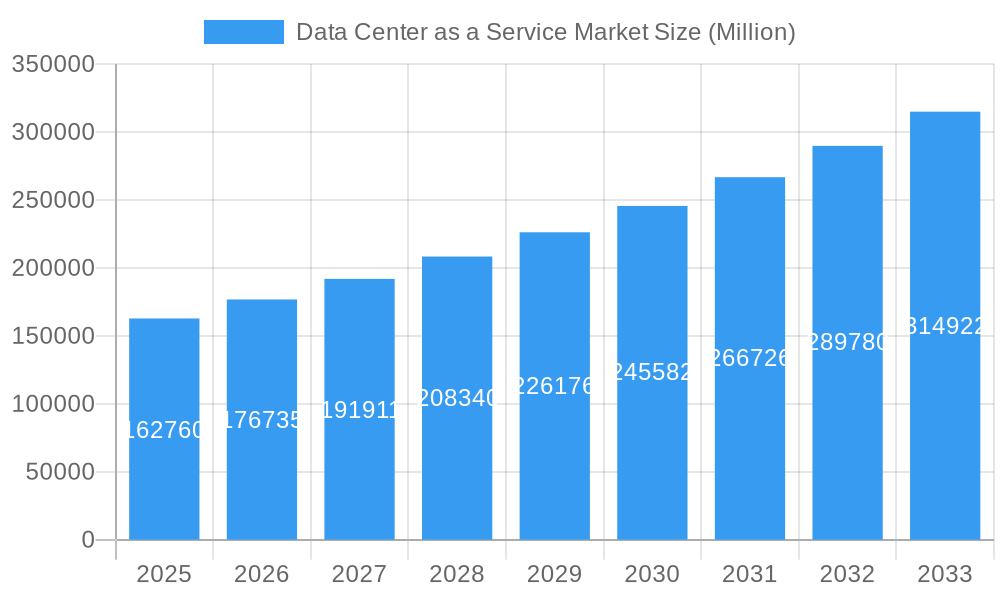

The global Data Center as a Service (DaaS) market is poised for significant expansion, with an estimated market size of $162.76 billion in 2025. Driven by the escalating demand for scalable, flexible, and cost-effective IT infrastructure, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.82% over the forecast period of 2025-2033. This growth is primarily fueled by the increasing adoption of cloud computing, the proliferation of big data analytics, and the burgeoning Internet of Things (IoT) ecosystem, all of which necessitate advanced data management and processing capabilities. Enterprises across various sectors are increasingly leveraging DaaS solutions to offload the complexities and capital expenditures associated with building and maintaining their own data centers, thereby allowing them to focus on core business competencies. Managed hosting services and colocation services are expected to remain dominant segments within the DaaS market, catering to diverse business needs for outsourced infrastructure management and physical space for IT equipment.

Data Center as a Service Market Market Size (In Billion)

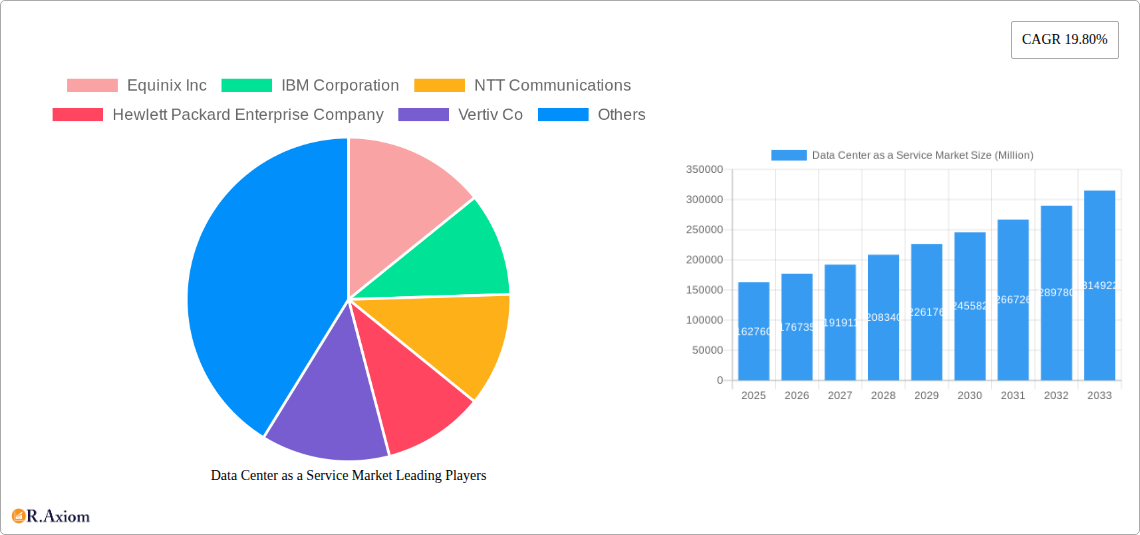

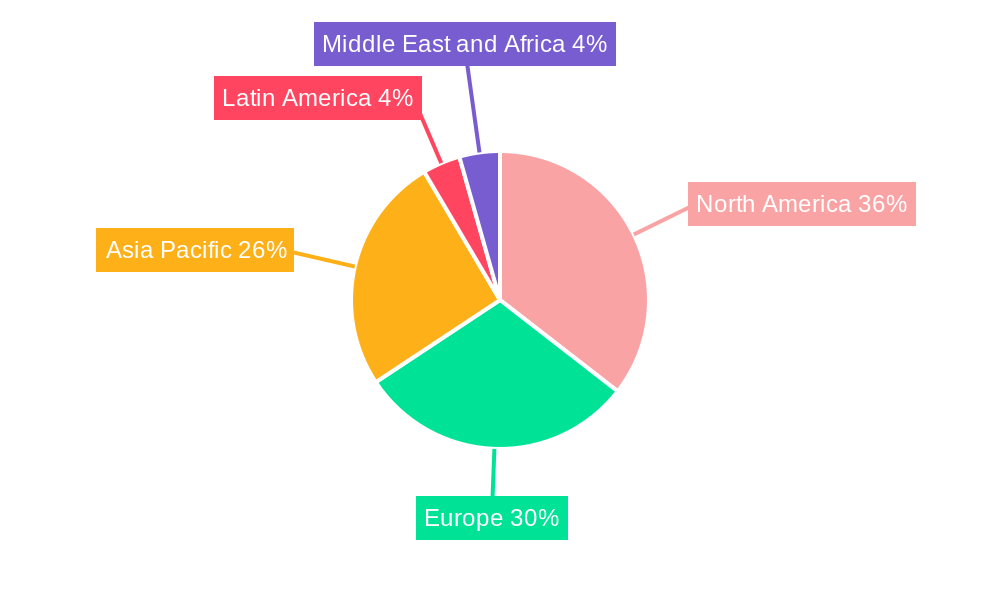

Further analysis of the DaaS market reveals a strong trend towards sophisticated data center types, with Tier-III and Tier-IV facilities gaining traction due to their higher levels of redundancy, reliability, and uptime guarantees. This demand is particularly pronounced in critical end-user industries such as BFSI, Healthcare, and IT and Telecom, where business continuity and data security are paramount. While the market benefits from strong drivers, certain restraints, such as data security concerns and the need for specialized expertise, need to be addressed by service providers. Geographically, North America and Europe are anticipated to lead the market share, owing to the presence of established IT infrastructure and a high concentration of technologically advanced enterprises. However, the Asia Pacific region is expected to witness the fastest growth, propelled by rapid digitalization and increasing investments in data center facilities. Key players like Equinix Inc., IBM Corporation, and NTT Communications are at the forefront of innovation, offering comprehensive DaaS solutions to meet the evolving demands of a dynamic market.

Data Center as a Service Market Company Market Share

Data Center as a Service Market Market Concentration & Innovation

The Data Center as a Service (DCaaS) market exhibits a moderate level of concentration, with several global giants like Equinix Inc., IBM Corporation, and NTT Communications holding significant market share. Innovation is a key differentiator, driven by advancements in cloud computing, edge computing, and AI. Regulatory frameworks, while generally supportive of digital infrastructure development, can vary by region, influencing deployment strategies and compliance costs. Product substitutes, such as on-premises data centers and private cloud solutions, continue to exist, but the agility, scalability, and cost-efficiency of DCaaS are increasingly favored. End-user trends show a strong demand for hybrid and multi-cloud environments, robust security, and high availability, particularly from the BFSI and IT & Telecom sectors. Mergers and Acquisitions (M&A) activity is prevalent, with strategic consolidations aimed at expanding geographic reach and service portfolios. For instance, recent M&A deals have valued in the hundreds of millions to billions of dollars, consolidating market power and enhancing capabilities. The market is projected to reach an estimated value of over $150 billion by 2025, with a compound annual growth rate (CAGR) of approximately 15% during the forecast period.

- Key Players Driving Innovation: Equinix Inc., IBM Corporation, NTT Communications, Hewlett Packard Enterprise Company, Vertiv Co.

- Dominant Segments: Colocation Services and Tier-III Data Centers represent significant portions of the market share.

- M&A Deal Values: Ranging from hundreds of millions to over $10 billion for major acquisitions.

- End-User Drivers: Growing adoption of cloud services, digital transformation initiatives, and the need for scalable infrastructure.

Data Center as a Service Market Industry Trends & Insights

The Data Center as a Service (DCaaS) market is experiencing robust growth, propelled by an escalating demand for scalable, flexible, and cost-effective IT infrastructure solutions. The ongoing digital transformation across all industries, coupled with the proliferation of data generated by emerging technologies like 5G, IoT, and AI, is creating an unprecedented need for sophisticated data management and processing capabilities. Cloud adoption continues to be a primary growth driver, with organizations increasingly migrating their workloads to external data centers to reduce operational overhead and enhance agility. The rise of hybrid and multi-cloud strategies further fuels the DCaaS market, as businesses seek to leverage the benefits of different cloud environments while maintaining control and security.

Technological disruptions are also playing a pivotal role. The advancements in AI and machine learning are not only increasing the computational demands on data centers but also enabling new service offerings within DCaaS, such as intelligent automation and predictive maintenance. The burgeoning edge computing trend, driven by the need for low latency processing for real-time applications, is creating new opportunities for distributed data center deployments, a segment where DCaaS providers are well-positioned to excel. Consumer preferences are shifting towards more resilient, secure, and sustainable data center solutions. Energy efficiency and the use of renewable energy sources are becoming critical considerations for businesses making DCaaS choices, reflecting growing environmental consciousness.

The competitive dynamics within the DCaaS market are intensifying. Established players are expanding their global footprints and diversifying their service portfolios through organic growth and strategic acquisitions. New entrants, often specializing in niche areas like edge data centers or specific industry verticals, are also emerging. The market is characterized by a strong focus on service level agreements (SLAs), offering guaranteed uptime, performance, and security. The projected market size for DCaaS is expected to reach over $150 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 15% anticipated during the forecast period of 2025-2033. This growth trajectory underscores the indispensable role of DCaaS in supporting the digital economy.

- Market Growth Drivers: Digital transformation, 5G rollout, IoT adoption, AI and ML growth, hybrid/multi-cloud strategies.

- Technological Disruptions: Edge computing, advancements in AI/ML, virtualization technologies.

- Consumer Preferences: High availability, robust security, energy efficiency, sustainability, compliance adherence.

- Competitive Dynamics: Global expansion, service portfolio diversification, strategic partnerships, focus on SLAs.

- Market Penetration: Increasing adoption across SMBs and enterprises, especially in data-intensive sectors.

Dominant Markets & Segments in Data Center as a Service Market

The Data Center as a Service (DCaaS) market is segmented across various service types, data center classifications, and end-user industries, with distinct segments demonstrating dominant growth and adoption patterns.

Type of Service Dominance:

- Colocation Service: This segment consistently holds a significant market share. Businesses opt for colocation to house their own IT infrastructure within a secure, purpose-built facility. The increasing need for reliable power, cooling, and physical security, coupled with the cost savings compared to building and maintaining their own data centers, makes colocation a preferred choice. The demand is particularly strong from enterprises looking for dedicated space and control over their hardware.

- Managed Hosting Service: This segment is also experiencing substantial growth. It caters to organizations that require a fully managed environment, including hardware, software, and network infrastructure. The appeal lies in outsourcing the complexities of IT management, allowing businesses to focus on their core competencies. The rising adoption of cloud-native applications and the need for specialized expertise drive the demand for managed hosting.

Data Center Type Dominance:

- Tier-III Data Centers: These facilities represent a significant portion of the market and are highly sought after. Tier-III data centers offer redundant power and cooling systems, ensuring a high level of availability (99.982% uptime). This makes them ideal for mission-critical applications and businesses that cannot afford significant downtime. The growing emphasis on business continuity and disaster recovery fuels the demand for Tier-III infrastructure.

- Tier-IV Data Centers: While representing a smaller, premium segment, Tier-IV data centers are gaining traction for highly sensitive and critical operations requiring the highest levels of fault tolerance and availability (99.995% uptime). Industries such as BFSI and government entities often mandate Tier-IV compliance for their most critical data.

End-user Industry Dominance:

- IT and Telecom: This sector is a foundational driver of the DCaaS market. The ever-increasing data traffic, the development of new telecommunication services, and the continuous need for robust IT infrastructure make this industry the largest consumer of DCaaS solutions. Cloud providers, software companies, and telecommunications giants rely heavily on DCaaS for their scalable computing needs.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector is a major contributor to the DCaaS market. The stringent regulatory requirements, the need for high security, extreme data privacy, and continuous availability for financial transactions make DCaaS indispensable. Cloud adoption in BFSI is accelerating, driven by the need for advanced analytics, fraud detection, and improved customer experiences.

- Healthcare: With the increasing digitization of patient records, the growth of telehealth, and the need for advanced medical imaging and data analytics, the healthcare industry is a rapidly expanding segment. DCaaS providers offer the necessary infrastructure to securely store, process, and analyze sensitive patient data while ensuring compliance with regulations like HIPAA.

The market is projected to reach over $150 billion by 2025, with a CAGR of approximately 15% from 2025 to 2033. North America currently dominates the market due to its mature digital infrastructure and high concentration of technology and financial services companies. However, the Asia-Pacific region is expected to witness the fastest growth, driven by rapid digitalization, increasing internet penetration, and government initiatives to promote data infrastructure development.

Data Center as a Service Market Product Developments

The Data Center as a Service (DCaaS) market is characterized by continuous innovation aimed at enhancing performance, scalability, security, and cost-efficiency. Key product developments revolve around advanced automation, AI-driven management, and specialized solutions for emerging trends like edge computing. These innovations are crucial for meeting the evolving demands of industries for agile, secure, and high-performance digital infrastructure. Product advancements focus on providing seamless integration, hybrid cloud capabilities, and optimized resource utilization, giving service providers a competitive edge in delivering tailored solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Data Center as a Service (DCaaS) market, segmented by Type of Service, Data Center Type, and End-user Industry. The Type of Service includes Managed Hosting Service and Colocation Service, each catering to distinct outsourcing needs. The Data Center Type covers Tier-I and -II, Tier-III, and Tier-IV facilities, reflecting varying levels of redundancy and availability. The End-user Industry segmentation analyzes adoption across BFSI, Healthcare, Retail, Manufacturing, IT and Telecom, and Other End-user Industries. Growth projections and market sizes are estimated for each segment, with a focus on competitive dynamics and adoption drivers within these categories. The forecast period for this analysis is 2025–2033, with a base year of 2025, offering insights into future market trends and opportunities.

Key Drivers of Data Center as a Service Market Growth

The Data Center as a Service (DCaaS) market is propelled by a confluence of powerful drivers. The exponential growth of data generation from IoT devices, social media, and digital services necessitates scalable and robust infrastructure. Digital transformation initiatives across all sectors are compelling organizations to leverage cloud-based solutions for agility and cost-efficiency. The increasing adoption of AI, machine learning, and big data analytics requires significant computing power and storage, readily available through DCaaS. Furthermore, the global shift towards hybrid and multi-cloud strategies, driven by the need for flexibility and risk mitigation, positions DCaaS as a critical enabler. Favorable government policies promoting digital infrastructure and cybersecurity enhancements further bolster market expansion.

Challenges in the Data Center as a Service Market Sector

Despite its robust growth, the Data Center as a Service (DCaaS) market faces several challenges. Stringent data privacy regulations and compliance requirements across different geographies can complicate global deployment and increase operational costs. The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures, which can be a significant expense. Interoperability issues between different cloud platforms and legacy systems can hinder seamless integration and migration for some organizations. Additionally, the high upfront capital investment required for building and maintaining state-of-the-art data centers, coupled with potential supply chain disruptions for hardware components, can pose challenges for service providers. Fierce competition can also lead to price pressures, impacting profitability.

Emerging Opportunities in Data Center as a Service Market

The Data Center as a Service (DCaaS) market is ripe with emerging opportunities. The rapid expansion of edge computing, driven by the need for low-latency processing for applications like autonomous vehicles and real-time analytics, presents a significant growth avenue for distributed DCaaS solutions. The increasing demand for sustainable and green data center operations opens up opportunities for providers who can offer energy-efficient solutions and utilize renewable energy sources. The growing adoption of specialized workloads, such as high-performance computing (HPC) for scientific research and AI model training, creates niche markets for tailored DCaaS offerings. Furthermore, the digital transformation in emerging economies, coupled with the increasing digital literacy and smartphone penetration, promises substantial market expansion in these regions.

Leading Players in the Data Center as a Service Market Market

- Equinix Inc.

- IBM Corporation

- NTT Communications

- Hewlett Packard Enterprise Company

- Vertiv Co.

- Cisco Systems Inc.

- Fujitsu Limited

- Dell Inc.

- Capgemini SE

- Digital Realty Trust Inc.

- Singapore Telecommunications Limited(Singtel)

Key Developments in Data Center as a Service Market Industry

- November 2022: Equinix, Inc., a global provider of digital infrastructure, and VMware, Inc. announced an extended global partnership to provide innovative digital infrastructure and multi-cloud services. The companies collaborated to launch VMware Cloud on Equinix Metal, a new distributed cloud service providing a more performant, secure, and cost-effective cloud solution for enterprise applications.

- September 2022: Arm Ltd, a British chip technology company owned by SoftBank Group Corp, announced Neoverse V2, its next generation of data center chip technology, to address the increasing data surge from 5G and Internet-connected devices.

- March 2022: Elea Digital and Vertiv joined together to provide edge data center services in Brazil. Vertiv will operate and maintain Elea Digital data centers in many Brazilian cities, that include Curitiba, Porto Alegre, and Brasilia. Collaborating with Vertiv provides crucial accountability, automation, and real-time administration of critical infrastructure. It will also use software solutions to ensure Elea Digital's six data centers' energy efficiency and cost control. Through this collaboration, Vertiv will get access to a wider and broader market to help the Brazilian data center sector.

Strategic Outlook for Data Center as a Service Market Market

The strategic outlook for the Data Center as a Service (DCaaS) market is exceptionally positive, driven by the unceasing digital evolution. Continued investment in advanced technologies like AI, edge computing, and sustainable energy solutions will be paramount for providers to maintain a competitive edge. Strategic partnerships and collaborations will be key to expanding service offerings and geographic reach, catering to the increasing demand for hybrid and multi-cloud environments. The focus on robust security and compliance will remain a critical differentiator, especially for industries with stringent regulatory mandates. As the global economy continues its digital transformation, the demand for scalable, flexible, and reliable data center infrastructure will only intensify, positioning DCaaS as an indispensable component of the modern IT landscape and promising sustained, high-growth opportunities.

Data Center as a Service Market Segmentation

-

1. Type of Service

- 1.1. Managed Hosting Service

- 1.2. Colocation Service

-

2. Data Center Type

- 2.1. Tier-I and -II

- 2.2. Tier-III

- 2.3. Tier-IV

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Manufacturing

- 3.5. IT and Telecom

- 3.6. Other End-user Industries

Data Center as a Service Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Data Center as a Service Market Regional Market Share

Geographic Coverage of Data Center as a Service Market

Data Center as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Expenditure on Data Center Technology; Rising Data Center Complexities Due to Scalability

- 3.3. Market Restrains

- 3.3.1. Security risks associated with application data

- 3.4. Market Trends

- 3.4.1. Cloud and Hosting is Expected to Capture a Major Share in the Data Center Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 5.1.1. Managed Hosting Service

- 5.1.2. Colocation Service

- 5.2. Market Analysis, Insights and Forecast - by Data Center Type

- 5.2.1. Tier-I and -II

- 5.2.2. Tier-III

- 5.2.3. Tier-IV

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Manufacturing

- 5.3.5. IT and Telecom

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 6. North America Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Service

- 6.1.1. Managed Hosting Service

- 6.1.2. Colocation Service

- 6.2. Market Analysis, Insights and Forecast - by Data Center Type

- 6.2.1. Tier-I and -II

- 6.2.2. Tier-III

- 6.2.3. Tier-IV

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. Manufacturing

- 6.3.5. IT and Telecom

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type of Service

- 7. Europe Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Service

- 7.1.1. Managed Hosting Service

- 7.1.2. Colocation Service

- 7.2. Market Analysis, Insights and Forecast - by Data Center Type

- 7.2.1. Tier-I and -II

- 7.2.2. Tier-III

- 7.2.3. Tier-IV

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. Manufacturing

- 7.3.5. IT and Telecom

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type of Service

- 8. Asia Pacific Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Service

- 8.1.1. Managed Hosting Service

- 8.1.2. Colocation Service

- 8.2. Market Analysis, Insights and Forecast - by Data Center Type

- 8.2.1. Tier-I and -II

- 8.2.2. Tier-III

- 8.2.3. Tier-IV

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. Manufacturing

- 8.3.5. IT and Telecom

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type of Service

- 9. Latin America Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Service

- 9.1.1. Managed Hosting Service

- 9.1.2. Colocation Service

- 9.2. Market Analysis, Insights and Forecast - by Data Center Type

- 9.2.1. Tier-I and -II

- 9.2.2. Tier-III

- 9.2.3. Tier-IV

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. Manufacturing

- 9.3.5. IT and Telecom

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type of Service

- 10. Middle East and Africa Data Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Service

- 10.1.1. Managed Hosting Service

- 10.1.2. Colocation Service

- 10.2. Market Analysis, Insights and Forecast - by Data Center Type

- 10.2.1. Tier-I and -II

- 10.2.2. Tier-III

- 10.2.3. Tier-IV

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Retail

- 10.3.4. Manufacturing

- 10.3.5. IT and Telecom

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type of Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Equinix Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NTT Communications

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hewlett Packard Enterprise Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vertiv Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fujitsu Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dell Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Capgemini SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Digital Realty Trust Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Singapore Telecommunications Limited(Singtel)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Equinix Inc

List of Figures

- Figure 1: Global Data Center as a Service Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Data Center as a Service Market Revenue (undefined), by Type of Service 2025 & 2033

- Figure 3: North America Data Center as a Service Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 4: North America Data Center as a Service Market Revenue (undefined), by Data Center Type 2025 & 2033

- Figure 5: North America Data Center as a Service Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 6: North America Data Center as a Service Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Data Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Data Center as a Service Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Data Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Data Center as a Service Market Revenue (undefined), by Type of Service 2025 & 2033

- Figure 11: Europe Data Center as a Service Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 12: Europe Data Center as a Service Market Revenue (undefined), by Data Center Type 2025 & 2033

- Figure 13: Europe Data Center as a Service Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 14: Europe Data Center as a Service Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe Data Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Data Center as a Service Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Data Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Data Center as a Service Market Revenue (undefined), by Type of Service 2025 & 2033

- Figure 19: Asia Pacific Data Center as a Service Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 20: Asia Pacific Data Center as a Service Market Revenue (undefined), by Data Center Type 2025 & 2033

- Figure 21: Asia Pacific Data Center as a Service Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 22: Asia Pacific Data Center as a Service Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Data Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Data Center as a Service Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Data Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Data Center as a Service Market Revenue (undefined), by Type of Service 2025 & 2033

- Figure 27: Latin America Data Center as a Service Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 28: Latin America Data Center as a Service Market Revenue (undefined), by Data Center Type 2025 & 2033

- Figure 29: Latin America Data Center as a Service Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 30: Latin America Data Center as a Service Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Latin America Data Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Data Center as a Service Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Data Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Data Center as a Service Market Revenue (undefined), by Type of Service 2025 & 2033

- Figure 35: Middle East and Africa Data Center as a Service Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 36: Middle East and Africa Data Center as a Service Market Revenue (undefined), by Data Center Type 2025 & 2033

- Figure 37: Middle East and Africa Data Center as a Service Market Revenue Share (%), by Data Center Type 2025 & 2033

- Figure 38: Middle East and Africa Data Center as a Service Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Data Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Data Center as a Service Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Data Center as a Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 2: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 3: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Data Center as a Service Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 6: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 7: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Data Center as a Service Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 10: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 11: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Data Center as a Service Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 14: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 15: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Data Center as a Service Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 18: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 19: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Data Center as a Service Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Data Center as a Service Market Revenue undefined Forecast, by Type of Service 2020 & 2033

- Table 22: Global Data Center as a Service Market Revenue undefined Forecast, by Data Center Type 2020 & 2033

- Table 23: Global Data Center as a Service Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Data Center as a Service Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center as a Service Market?

The projected CAGR is approximately 8.82%.

2. Which companies are prominent players in the Data Center as a Service Market?

Key companies in the market include Equinix Inc, IBM Corporation, NTT Communications, Hewlett Packard Enterprise Company, Vertiv Co, Cisco Systems Inc, Fujitsu Limited, Dell Inc, Capgemini SE, Digital Realty Trust Inc, Singapore Telecommunications Limited(Singtel).

3. What are the main segments of the Data Center as a Service Market?

The market segments include Type of Service, Data Center Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Expenditure on Data Center Technology; Rising Data Center Complexities Due to Scalability.

6. What are the notable trends driving market growth?

Cloud and Hosting is Expected to Capture a Major Share in the Data Center Services Market.

7. Are there any restraints impacting market growth?

Security risks associated with application data.

8. Can you provide examples of recent developments in the market?

November 2022: Equinix, Inc., a global provider of digital infrastructure, and VMware, Inc. announced an extended global partnership to provide innovative digital infrastructure and multi-cloud services. The companies collaborated to launch VMware Cloud on Equinix Metal, a new distributed cloud service providing a more performant, secure, and cost-effective cloud solution for enterprise applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center as a Service Market?

To stay informed about further developments, trends, and reports in the Data Center as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence