Key Insights

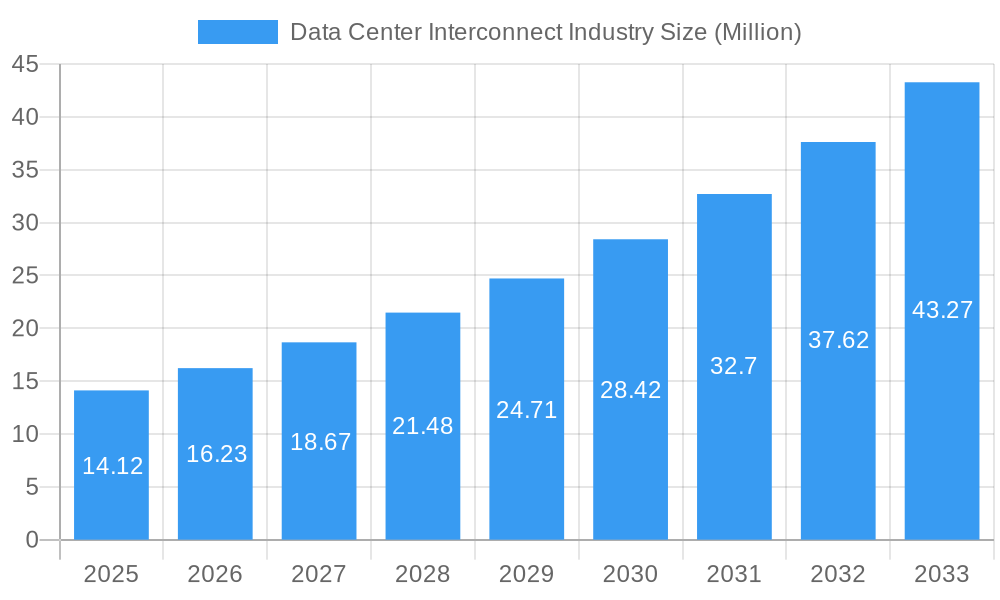

The Data Center Interconnect (DCI) market is experiencing robust growth, projected to reach a significant $14.12 million in value by 2025. This expansion is fueled by a compelling compound annual growth rate (CAGR) of 14.98% during the forecast period of 2025-2033. A primary driver for this surge is the escalating demand for disaster recovery and business continuity solutions, as organizations increasingly recognize the critical need to safeguard their data and maintain operational resilience in the face of unforeseen events. Furthermore, the imperative for efficient shared data and resource utilization across distributed data centers is a key growth enabler. As cloud adoption accelerates and hybrid cloud strategies become mainstream, the need for seamless and high-speed connectivity between data centers is paramount. This trend is particularly pronounced in the Communications Service Providers (CSPs) and Internet industries, where real-time data processing and low-latency communication are non-negotiable.

Data Center Interconnect Industry Market Size (In Million)

Emerging trends such as the increasing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are revolutionizing DCI architectures, offering greater flexibility, automation, and cost-efficiency. These advancements are enabling service providers to dynamically allocate bandwidth and resources, thereby optimizing network performance and agility. However, the market also faces certain restraints, including the substantial initial investment required for deploying advanced DCI infrastructure and the ongoing operational costs associated with maintaining these complex networks. Cybersecurity concerns and the need for robust data protection also present challenges, requiring continuous innovation in secure interconnectivity solutions. Despite these hurdles, the persistent demand for enhanced data mobility, driven by Big Data analytics, AI/ML workloads, and edge computing initiatives, is expected to propel the DCI market forward, with Asia Pacific anticipated to be a significant contributor to this growth due to rapid digitalization and increasing data center investments in the region.

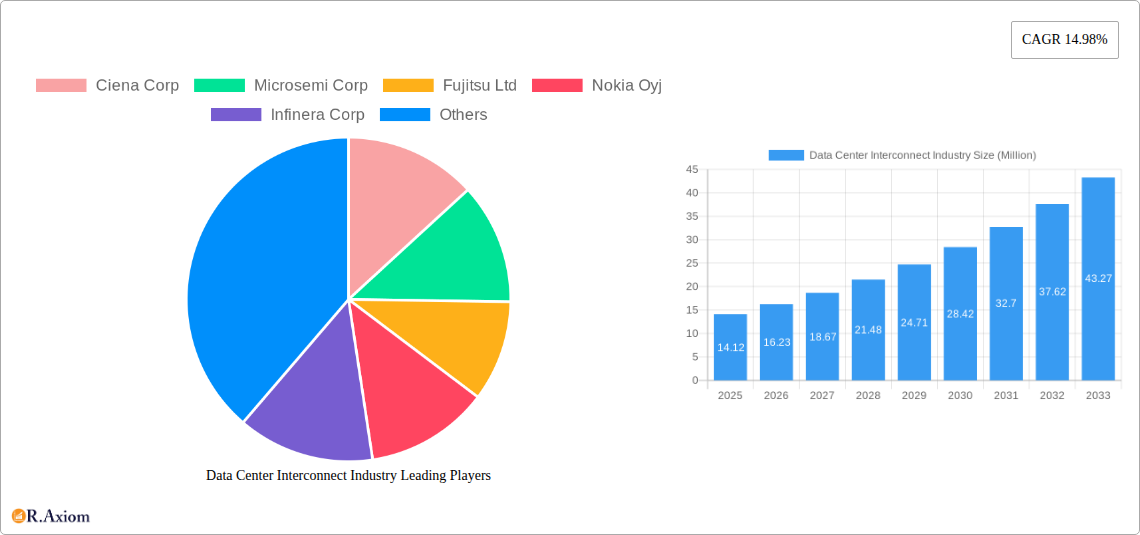

Data Center Interconnect Industry Company Market Share

Data Center Interconnect Industry: Market Analysis and Growth Projections (2019–2033)

This comprehensive report delves into the dynamic Data Center Interconnect (DCI) industry, providing in-depth analysis, market segmentation, and future growth projections. Covering the historical period of 2019–2024, the base year of 2025, and a forecast period extending to 2033, this study offers critical insights for industry stakeholders. We examine key market drivers, emerging trends, dominant segments, and the competitive landscape, with a focus on essential applications such as Disaster Recovery and Business Continuity, Shared Data and Resources, and Data (Storage) Mobility, and end-user industries including Communications Service Providers (CSPs), Internet, Government/Research and Education (Government/R&E), and Other End-user Verticals. With the global DCI market projected to reach [Insert Market Size in Million] Million by 2033, driven by an estimated CAGR of [Insert CAGR Value]%, this report is an indispensable resource for strategic decision-making.

Data Center Interconnect Industry Market Concentration & Innovation

The Data Center Interconnect (DCI) industry is characterized by a moderate level of market concentration, with a few key players holding significant market share. Innovation is a primary driver, fueled by the relentless demand for higher bandwidth, lower latency, and increased network flexibility. Companies are heavily investing in advancements in optical networking technologies, software-defined networking (SDN), and artificial intelligence (AI) for network management and optimization. The market share of leading companies is continuously evolving, with Ciena Corp and Nokia Oyj currently holding substantial portions of the DCI market, estimated at approximately [Insert Ciena Market Share in Million]% and [Insert Nokia Market Share in Million]% respectively. M&A activities, while not overwhelmingly dominant, play a role in consolidating the market and acquiring innovative technologies. For instance, a notable M&A deal in the historical period involved [Insert M&A Deal Value in Million] Million. Regulatory frameworks are generally supportive of DCI expansion, focusing on ensuring fair competition and promoting digital infrastructure development. However, evolving data privacy regulations and cross-border data flow policies can influence interconnectivity strategies. Product substitutes, such as direct cloud connections or dedicated private lines, exist but often lack the scalability and flexibility offered by dedicated DCI solutions. End-user trends indicate a growing preference for hybrid and multi-cloud environments, necessitating robust DCI solutions for seamless data exchange.

Data Center Interconnect Industry Industry Trends & Insights

The Data Center Interconnect (DCI) industry is experiencing robust growth, propelled by an escalating demand for seamless, high-speed data transfer between distributed data centers. The projected Compound Annual Growth Rate (CAGR) for the DCI market is an impressive [Insert CAGR Value]% during the forecast period of 2025–2033, indicating a significant expansion from its historical trajectory. This growth is fundamentally driven by the exponential increase in data generation and consumption, coupled with the proliferation of cloud computing, big data analytics, and the Internet of Things (IoT). Technological disruptions are at the forefront of DCI evolution. Innovations such as coherent optical technology, wavelength division multiplexing (WDM) advancements, and the increasing adoption of software-defined networking (SDN) are enabling higher bandwidth densities and more agile network configurations. These advancements are crucial for supporting bandwidth-intensive applications like artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). Consumer preferences are increasingly leaning towards hybrid and multi-cloud strategies, where businesses leverage a combination of on-premises data centers and public/private cloud services. This necessitates robust and flexible DCI solutions to ensure uninterrupted data flow, seamless application performance, and effective disaster recovery. The competitive dynamics within the DCI market are intense, with established players continuously innovating and emerging companies focusing on niche solutions. The market penetration of advanced DCI solutions is rapidly increasing across various end-user industries, from telecommunications to finance and healthcare. The estimated market size for DCI solutions is projected to reach [Insert Market Size in Million] Million by 2033, reflecting the substantial market opportunity. The increasing adoption of edge computing further accentuates the need for efficient DCI, enabling localized processing and reducing latency for real-time applications. The cybersecurity landscape also plays a pivotal role, driving demand for secure and resilient DCI solutions that protect sensitive data during transit.

Dominant Markets & Segments in Data Center Interconnect Industry

The Data Center Interconnect (DCI) industry is witnessing significant traction across various segments, with certain regions and end-user verticals emerging as dominant players.

Dominant Application Segments:

- Disaster Recovery and Business Continuity: This segment is a primary growth driver for DCI solutions. Organizations across all sectors recognize the critical need for robust disaster recovery plans to ensure minimal downtime and data loss. The ability of DCI to replicate data and provide failover capabilities between geographically dispersed data centers makes it indispensable for business continuity. The market for DR/BC related DCI solutions is estimated to reach [Insert DR/BC Market Size in Million] Million by 2033.

- Shared Data and Resources: As enterprises adopt collaborative work environments and leverage centralized data repositories, the demand for efficient DCI to share data and resources across multiple locations intensifies. This includes sharing applications, databases, and storage resources, leading to improved operational efficiency and cost savings. The market for DCI solutions supporting shared data is projected to grow to [Insert Shared Data Market Size in Million] Million by 2033.

- Data (Storage) Mobility: With the increasing adoption of cloud storage and the need for flexible data management, DCI plays a crucial role in enabling seamless data mobility between on-premises and cloud environments, as well as between different cloud providers. This facilitates data migration, archiving, and access from anywhere, anytime. The market for DCI supporting data mobility is expected to reach [Insert Data Mobility Market Size in Million] Million by 2033.

- Other Applications: This encompasses a broad range of use cases including high-performance computing (HPC) clusters, big data analytics, content delivery networks (CDNs), and gaming, all of which require high-bandwidth, low-latency interconnectivity.

Dominant End-user Industry Segments:

- Communications Service Providers (CSPs): CSPs are major consumers and providers of DCI solutions. They require extensive DCI networks to support their vast infrastructure, including mobile backhaul, broadband services, and cloud connectivity for their customers. The growth of 5G and increasing data traffic are significant catalysts for DCI adoption within CSPs. The DCI market within CSPs is projected to be [Insert CSP Market Size in Million] Million by 2033.

- Internet: Companies operating large-scale internet infrastructure, including cloud providers and content delivery networks, are significant users of DCI. They rely on DCI to connect their geographically distributed data centers to ensure high availability, low latency, and efficient content distribution to a global user base. The DCI market serving the Internet sector is expected to reach [Insert Internet Market Size in Million] Million by 2033.

- Government/Research and Education (Government/R&E): Government agencies and research institutions are increasingly leveraging DCI for scientific research, national security initiatives, and educational purposes. High-performance computing, large-scale data analysis for scientific discovery, and secure communication networks are key drivers of DCI adoption in this sector. The DCI market within Government/R&E is estimated to grow to [Insert Gov/R&E Market Size in Million] Million by 2033.

- Other End-user Verticals: This includes industries such as finance, healthcare, manufacturing, and retail, all of which are increasingly adopting digital transformation strategies that rely on robust DCI for cloud migration, data analytics, and operational efficiency.

The dominance of these segments is driven by factors such as increasing digitalization, the need for business resilience, evolving regulatory landscapes, and advancements in networking technologies. Economic policies promoting digital infrastructure development and the continuous expansion of cloud services further bolster the growth of these dominant markets and segments.

Data Center Interconnect Industry Product Developments

Product innovation in the Data Center Interconnect (DCI) industry is primarily focused on enhancing speed, efficiency, and programmability. Companies are developing next-generation optical transport solutions that support higher data rates, such as 400Gbps, 800Gbps, and beyond, utilizing advanced modulation techniques and coherent optics. The integration of software-defined networking (SDN) and network function virtualization (NFV) is enabling more agile and automated DCI networks, allowing for dynamic bandwidth allocation and on-demand service provisioning. Key product developments include modular and disaggregated DCI platforms, simplifying deployment and reducing operational costs. Competitive advantages are being gained through solutions offering lower power consumption, smaller form factors, and enhanced security features for data in transit.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Data Center Interconnect (DCI) industry, segmented by application and end-user vertical.

Application Segmentation: The market is analyzed across Disaster Recovery and Business Continuity, Shared Data and Resources, Data (Storage) Mobility, and Other Applications. Growth projections for each application segment are detailed, with estimated market sizes for the base year and forecast period. Competitive dynamics within each application are also assessed, considering the unique demands and solutions tailored for each use case.

End-user Industry Segmentation: The report further segments the market by Communications Service Providers (CSPs), Internet, Government/Research and Education (Government/R&E), and Other End-user Verticals. Market sizes, growth rates, and competitive landscapes are explored for each end-user industry, highlighting their specific DCI requirements and adoption trends. This segmentation provides a granular understanding of the diverse markets influenced by DCI technologies.

Key Drivers of Data Center Interconnect Industry Growth

The Data Center Interconnect (DCI) industry is experiencing significant growth driven by several key factors. The exponential increase in data volumes, fueled by cloud computing, big data analytics, and the proliferation of connected devices, necessitates higher bandwidth and more efficient interconnectivity. The growing adoption of hybrid and multi-cloud strategies by enterprises requires robust DCI solutions for seamless data flow and application performance across diverse environments. Advancements in optical networking technologies, such as coherent optics and denser WDM, are enabling higher speeds and lower costs for DCI. Furthermore, the increasing demand for low-latency applications, including real-time analytics, gaming, and edge computing, is a critical growth catalyst. Regulatory initiatives promoting digital infrastructure development and the need for enhanced cybersecurity and data resiliency also contribute significantly to market expansion.

Challenges in the Data Center Interconnect Industry Sector

Despite robust growth, the Data Center Interconnect (DCI) industry faces several challenges. The high cost of deploying and upgrading advanced DCI infrastructure can be a significant barrier for some organizations, particularly smaller enterprises. Evolving cybersecurity threats necessitate continuous investment in secure DCI solutions, adding to operational complexity and cost. Supply chain disruptions, as observed in recent global events, can impact the availability of critical components and lead to project delays. Competition from alternative connectivity solutions, while often not as comprehensive, requires DCI providers to constantly demonstrate their value proposition. Furthermore, the rapid pace of technological change demands continuous innovation, requiring substantial R&D investment to stay competitive. The limited availability of skilled professionals to design, deploy, and manage complex DCI networks also presents a challenge.

Emerging Opportunities in Data Center Interconnect Industry

The Data Center Interconnect (DCI) industry is ripe with emerging opportunities. The rapid expansion of edge computing presents a significant opportunity for DCI solutions that can connect distributed edge data centers to core networks, enabling low-latency processing and localized data analytics. The increasing demand for high-performance computing (HPC) for scientific research, AI model training, and complex simulations requires ultra-high bandwidth and low-latency DCI. The growth of the metaverse and immersive experiences will also drive demand for DCI to support real-time content delivery and interaction. Furthermore, the development of AI-powered network automation and management tools for DCI offers opportunities for enhanced operational efficiency and reduced costs. The increasing focus on sustainability is also creating opportunities for DCI solutions that offer lower power consumption and improved energy efficiency.

Leading Players in the Data Center Interconnect Industry Market

- Ciena Corp

- Microsemi Corp

- Fujitsu Ltd

- Nokia Oyj

- Infinera Corp

- Pluribus Networks Inc

- Cisco Systems Inc

- Juniper Networks Inc

- Huawei Technologies Co Ltd

- ADVA Optical Networking SE

Key Developments in Data Center Interconnect Industry Industry

- June 2022: Cologix extended its strategic partnership with Console Connect by PCCW Global by deploying the Console Connect Software-Defined Interconnection platform at its TOR1 data center in Toronto, enhancing digital edge linkages for Canadian customers globally. This move strengthens interconnection ecosystems with over 600 networks and 300 cloud providers.

- November 2022: Equinix, Inc. and VMware, Inc. announced an extended partnership to launch VMware Cloud on Equinix Metal, a new distributed cloud service offering enhanced performance, security, and cost-effectiveness for enterprise applications by integrating VMware's cloud infrastructure with Equinix's Bare Metal as a Service.

Strategic Outlook for Data Center Interconnect Industry Market

The strategic outlook for the Data Center Interconnect (DCI) market remains exceptionally positive. The sustained growth in data creation, the widespread adoption of cloud computing, and the burgeoning demand for low-latency applications are fundamental growth catalysts. The ongoing evolution of optical networking technologies, enabling higher capacities and greater efficiency, will continue to fuel market expansion. Strategic investments in 5G infrastructure, edge computing deployments, and the development of AI/ML capabilities will further drive the need for robust and agile DCI solutions. Companies that can offer scalable, secure, and cost-effective DCI platforms that integrate seamlessly with hybrid and multi-cloud environments are well-positioned for success. The increasing emphasis on sustainability also presents an opportunity for providers to differentiate through energy-efficient DCI solutions.

Data Center Interconnect Industry Segmentation

-

1. Application

- 1.1. Disaster Recovery and Business Continuity

- 1.2. Shared Data and Resources

- 1.3. Data (Storage) Mobility

- 1.4. Other Applications

-

2. End-user Industry

- 2.1. Communications Service Providers (CSPs)

- 2.2. Internet

- 2.3. Government/Research and Education (Government/R&E)

- 2.4. Other End-user Verticals

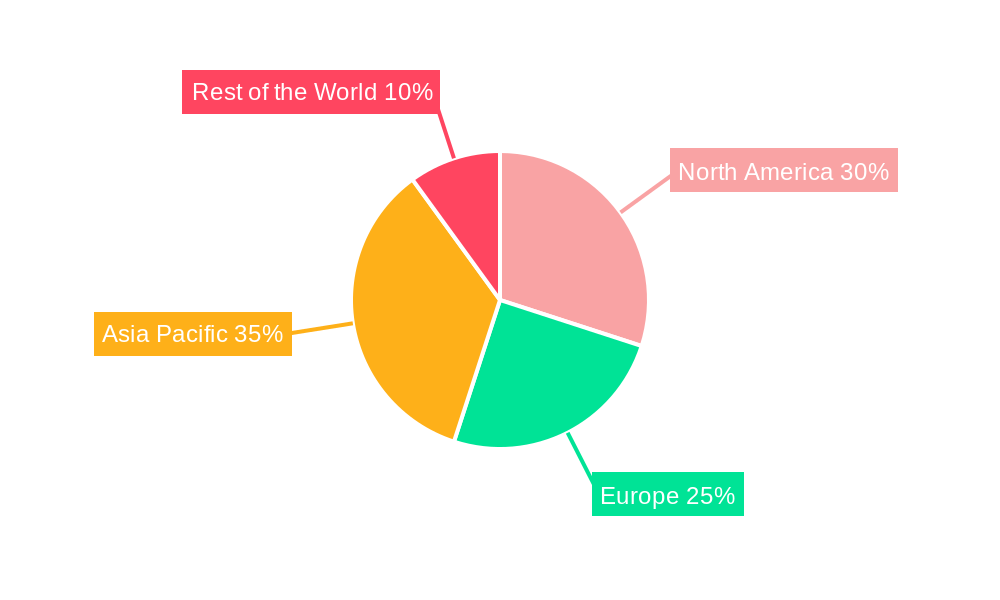

Data Center Interconnect Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Data Center Interconnect Industry Regional Market Share

Geographic Coverage of Data Center Interconnect Industry

Data Center Interconnect Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Number of Data Centers (Edge and Hyperscale); Increasing Need for Ultra- broadband

- 3.2.2 Simplified

- 3.2.3 and Intelligent DCI Networks due to Applications

- 3.2.4 like AI and HPC

- 3.3. Market Restrains

- 3.3.1. Complex Manufacturing Process

- 3.4. Market Trends

- 3.4.1. Increasing Number of Data Centers to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Interconnect Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Disaster Recovery and Business Continuity

- 5.1.2. Shared Data and Resources

- 5.1.3. Data (Storage) Mobility

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communications Service Providers (CSPs)

- 5.2.2. Internet

- 5.2.3. Government/Research and Education (Government/R&E)

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Data Center Interconnect Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Disaster Recovery and Business Continuity

- 6.1.2. Shared Data and Resources

- 6.1.3. Data (Storage) Mobility

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communications Service Providers (CSPs)

- 6.2.2. Internet

- 6.2.3. Government/Research and Education (Government/R&E)

- 6.2.4. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Disaster Recovery and Business Continuity

- 7.1.2. Shared Data and Resources

- 7.1.3. Data (Storage) Mobility

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communications Service Providers (CSPs)

- 7.2.2. Internet

- 7.2.3. Government/Research and Education (Government/R&E)

- 7.2.4. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Data Center Interconnect Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Disaster Recovery and Business Continuity

- 8.1.2. Shared Data and Resources

- 8.1.3. Data (Storage) Mobility

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communications Service Providers (CSPs)

- 8.2.2. Internet

- 8.2.3. Government/Research and Education (Government/R&E)

- 8.2.4. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Data Center Interconnect Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Disaster Recovery and Business Continuity

- 9.1.2. Shared Data and Resources

- 9.1.3. Data (Storage) Mobility

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communications Service Providers (CSPs)

- 9.2.2. Internet

- 9.2.3. Government/Research and Education (Government/R&E)

- 9.2.4. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ciena Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Microsemi Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fujitsu Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nokia Oyj

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Infinera Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pluribus Networks Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Juniper Networks Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ADVA Optical Networking SE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Ciena Corp

List of Figures

- Figure 1: Global Data Center Interconnect Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Center Interconnect Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Data Center Interconnect Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Data Center Interconnect Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Data Center Interconnect Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Data Center Interconnect Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Data Center Interconnect Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Data Center Interconnect Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Data Center Interconnect Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Data Center Interconnect Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Data Center Interconnect Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Data Center Interconnect Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Data Center Interconnect Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Data Center Interconnect Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Data Center Interconnect Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Data Center Interconnect Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Rest of the World Data Center Interconnect Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Data Center Interconnect Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Data Center Interconnect Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Data Center Interconnect Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Data Center Interconnect Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Data Center Interconnect Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Data Center Interconnect Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Data Center Interconnect Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Data Center Interconnect Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Interconnect Industry?

The projected CAGR is approximately 14.98%.

2. Which companies are prominent players in the Data Center Interconnect Industry?

Key companies in the market include Ciena Corp, Microsemi Corp, Fujitsu Ltd, Nokia Oyj, Infinera Corp, Pluribus Networks Inc, Cisco Systems Inc, Juniper Networks Inc, Huawei Technologies Co Ltd, ADVA Optical Networking SE.

3. What are the main segments of the Data Center Interconnect Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Data Centers (Edge and Hyperscale); Increasing Need for Ultra- broadband. Simplified. and Intelligent DCI Networks due to Applications. like AI and HPC.

6. What are the notable trends driving market growth?

Increasing Number of Data Centers to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Complex Manufacturing Process.

8. Can you provide examples of recent developments in the market?

June 2022: Cologix, one of North America's leading network-neutral interconnection and hyperscale edge data center providers, announced that it had extended its strategic partnership with Console Connect by PCCW Global by deploying the Console Connect Software-Defined Interconnection platform at its TOR1 data center in Toronto. Cologix, in conjunction with Console Connect, now provides Canadian customers with extra fast and reliable digital edge linkages to connect with their customers, partners, and workers globally. Furthermore, Cologix offers clients choice and flexibility through an interconnection ecosystem of 600+ networks, 300+ cloud providers, and 30+ onramps across the United States and Canada. Cologix is looking forward to future business opportunities with Console Connect.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Interconnect Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Interconnect Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Interconnect Industry?

To stay informed about further developments, trends, and reports in the Data Center Interconnect Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence