Key Insights

The global Data Center Logical Security Market is poised for significant expansion, projected to reach an estimated $4.43 billion in 2023, driven by a robust Compound Annual Growth Rate (CAGR) of 8.46%. This substantial growth is fueled by the escalating sophistication of cyber threats targeting critical data infrastructure. Organizations across all sectors are increasingly recognizing the paramount importance of protecting sensitive information and ensuring the continuous availability of their digital assets. The rising adoption of cloud computing, the proliferation of IoT devices, and the ever-increasing volume of data generated are creating new attack vectors, necessitating advanced logical security solutions. Key drivers include the growing need for compliance with stringent data privacy regulations such as GDPR and CCPA, the demand for advanced threat detection and prevention capabilities to combat ransomware and zero-day exploits, and the critical requirement for secure access control and identification mechanisms to safeguard against unauthorized entry into data centers. The burgeoning digital transformation initiatives across industries are further accelerating the market's upward trajectory.

Data Center Logical Security Market Market Size (In Billion)

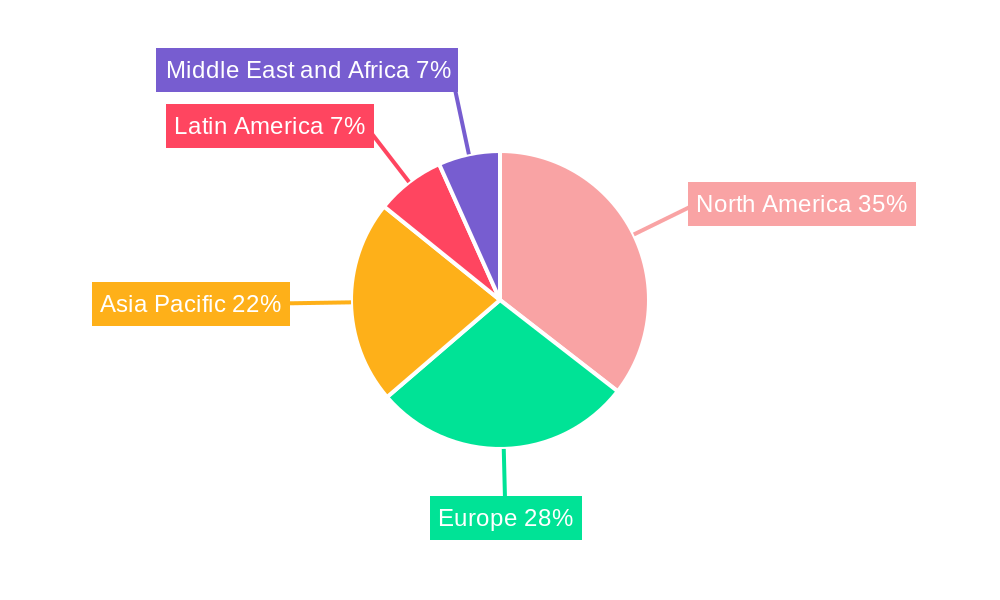

The market is segmented into several key solutions, with Access Control and Identification Solutions and Threat Protection Solutions emerging as dominant categories, reflecting the immediate need for both preventative and reactive security measures. Support and Maintenance services are also experiencing strong demand, underscoring the ongoing commitment required to maintain optimal security postures. Geographically, North America is expected to lead the market, followed closely by Europe and the rapidly growing Asia Pacific region, driven by significant investments in digital infrastructure and cybersecurity by both governments and private enterprises. Emerging economies within Latin America and the Middle East & Africa are also presenting considerable growth opportunities as they expand their data center capabilities and bolster their defenses against cyber threats. Restraints such as the high cost of advanced security solutions and the shortage of skilled cybersecurity professionals are present but are being addressed through increased investment in training and the development of more accessible, automated security platforms.

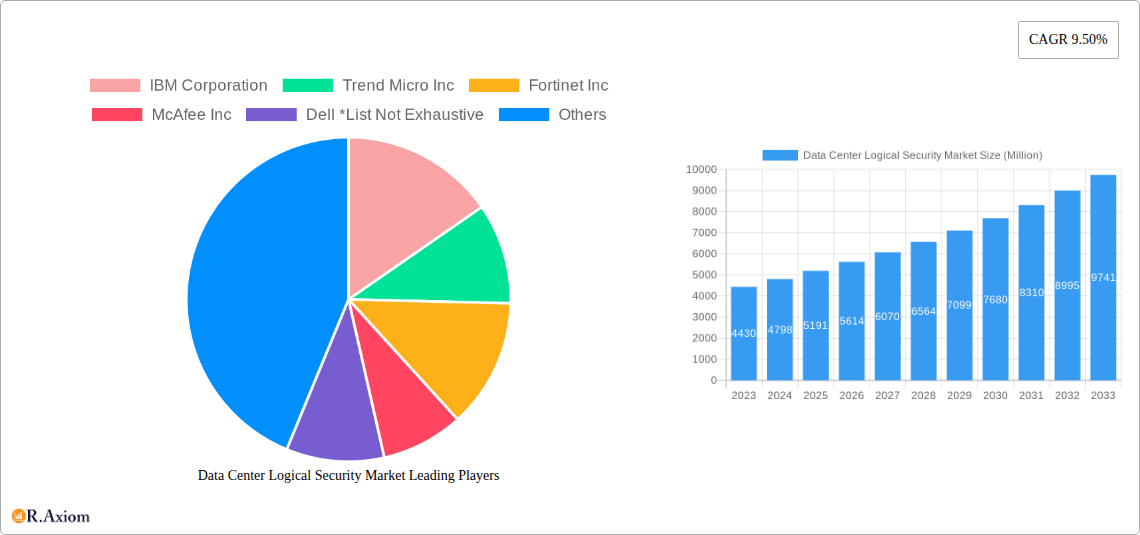

Data Center Logical Security Market Company Market Share

This in-depth report provides an exhaustive analysis of the global Data Center Logical Security Market, offering critical insights into its current landscape, future trajectory, and strategic opportunities. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is essential for industry stakeholders seeking to understand market dynamics, competitive strategies, and growth catalysts. The market is projected to reach $55.78 billion by 2025, with a projected CAGR of 12.5% during the forecast period, reaching an estimated $140.33 billion by 2033.

Data Center Logical Security Market Market Concentration & Innovation

The Data Center Logical Security Market exhibits a moderate to high market concentration, characterized by the presence of established technology giants and specialized security firms. Innovation is a key differentiator, driven by the relentless evolution of cyber threats and the increasing complexity of data center infrastructure. Regulatory frameworks, such as GDPR, CCPA, and industry-specific mandates, act as significant innovation drivers, compelling vendors to develop advanced solutions for data privacy and compliance. Product substitutes, while present in the form of integrated cloud security services or basic firewall solutions, are increasingly being outpaced by sophisticated, multi-layered logical security offerings. End-user trends reflect a growing demand for Zero Trust architectures, AI-powered threat detection, and automated security operations. Mergers and acquisitions (M&A) are a prevalent strategy for market consolidation and talent acquisition, with recent deal values reaching into the billions. For instance, acquisitions aimed at bolstering AI capabilities in threat intelligence and expanding cloud security portfolios are common. Key M&A activities contribute to a market share shift among leading players, with top companies holding approximately 35% of the market share by value in 2025.

Data Center Logical Security Market Industry Trends & Insights

The Data Center Logical Security Market is experiencing robust growth, propelled by an escalating volume of digital data, the widespread adoption of cloud computing, and the increasing sophistication of cyberattacks. The shift towards hybrid and multi-cloud environments necessitates integrated and granular logical security controls, creating a significant demand for advanced solutions. The increasing pervasiveness of ransomware, data breaches, and insider threats compels organizations across all sectors to invest heavily in comprehensive logical security measures. The market penetration of advanced threat protection solutions is expected to reach 78% by 2025. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for real-time threat detection and response, are transforming the market. AI-powered anomaly detection and predictive analytics are becoming critical components of effective logical security strategies. Furthermore, the growing emphasis on data privacy regulations globally is a major market driver, pushing organizations to adopt robust data loss prevention (DLP) and access control mechanisms. Consumer preferences are shifting towards intelligent, automated, and scalable security solutions that can adapt to dynamic data center environments. The competitive dynamics are characterized by intense innovation, strategic partnerships, and aggressive market expansion by leading players. The estimated CAGR for the forecast period is 12.5%, with the market size projected to grow from $55.78 billion in 2025 to $140.33 billion by 2033.

Dominant Markets & Segments in Data Center Logical Security Market

The Data Center Logical Security Market is dominated by North America, driven by its established technological infrastructure, high concentration of enterprises, and stringent regulatory environment, with the United States accounting for a significant portion of regional market share. Among the end-users, the Banking and Financial Services sector leads in adoption due to the highly sensitive nature of financial data and strict regulatory compliance requirements. This segment's market share is estimated at 22% in 2025.

Solutions:

- Threat Protection Solution: This segment is expected to witness the highest growth, driven by the increasing sophistication and frequency of cyber threats. Its market share is projected to reach 35% by 2025, with advanced endpoint detection and response (EDR) and security information and event management (SIEM) solutions being key contributors.

- Access Control and Identification Solution: Essential for preventing unauthorized access, this segment remains a cornerstone of data center security, holding a market share of approximately 25% in 2025. Multi-factor authentication (MFA) and identity and access management (IAM) are key growth drivers.

- Data Loss Prevention Solution: Crucial for regulatory compliance and protecting intellectual property, DLP solutions are experiencing steady growth, projected to capture 20% of the market share by 2025.

- Other Solutions: This encompasses encryption, network segmentation, and security analytics, collectively holding the remaining market share.

Services:

- Security Consulting Service: Organizations increasingly rely on expert guidance to design and implement effective logical security strategies. This service segment holds a significant market share of 30% in 2025, facilitating optimal solution deployment.

- Security Solution Deployment Service: The complexity of modern security solutions necessitates professional deployment services, which are projected to capture 30% of the market share by 2025.

- Support and Maintenance: Ongoing technical support and maintenance are critical for ensuring the continuous efficacy of logical security solutions, representing approximately 40% of the services market.

End-Users:

- Banking and Financial Services: Dominates due to stringent regulatory demands and the critical need for data protection.

- Technology: A major adopter of advanced security solutions to protect intellectual property and critical infrastructure.

- Healthcare: Driven by the increasing digitization of patient records and strict HIPAA regulations, demanding robust data security.

- Central/Local Government: Investing in secure data centers to protect sensitive citizen data and critical national infrastructure.

- Manufacturing, Energy, Entertainment and Media, and Other end-users represent growing adoption rates as they increasingly digitize operations and manage large datasets.

Data Center Logical Security Market Product Developments

Product development in the Data Center Logical Security Market is characterized by a strong emphasis on AI and ML integration for predictive threat analysis and automated response. Innovations include advanced behavioral analytics that can detect anomalous activities indicative of breaches, and intelligent access control systems that adapt to user behavior. Cloud-native security solutions designed for microservices architectures and containerized environments are gaining prominence. Furthermore, advancements in data encryption techniques and key management systems are enhancing data confidentiality. The competitive advantage lies in offering solutions that provide unified visibility, seamless integration with existing IT infrastructure, and demonstrable ROI through reduced breach impact and improved operational efficiency.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the Data Center Logical Security Market across various segments.

- Solutions: The market is segmented into Access Control and Identification Solution, Threat Protection Solution, Data Loss Prevention Solution, and Other Solutions. Threat Protection is anticipated to lead growth due to evolving cyber threats, while Access Control remains fundamental.

- Services: The key service segments include Security Consulting Service, Security Solution Deployment Service, and Support and Maintenance. Consulting and deployment services are projected for substantial growth as organizations seek expert guidance and implementation support.

- End-Users: The report analyzes adoption across Banking and Financial Services, Manufacturing, Technology, Energy, Healthcare, Central/Local Government, Entertainment and Media, and Other end-users. Banking and Financial Services are expected to maintain their leading position, with significant growth also anticipated in Healthcare and Government sectors due to increasing data sensitivity and regulatory pressures.

Key Drivers of Data Center Logical Security Market Growth

The growth of the Data Center Logical Security Market is propelled by several key factors. The exponential increase in data generation and storage requirements, coupled with the widespread adoption of cloud and hybrid cloud infrastructures, necessitates robust logical security measures. The escalating sophistication and frequency of cyber threats, including ransomware attacks and advanced persistent threats (APTs), are driving demand for advanced threat detection and prevention solutions. Stringent data privacy regulations globally, such as GDPR and CCPA, mandate organizations to implement comprehensive data protection strategies. Furthermore, the growing reliance on digital services across all industries, from critical infrastructure to consumer-facing applications, underscores the importance of maintaining secure and resilient data center operations.

Challenges in the Data Center Logical Security Market Sector

Despite robust growth, the Data Center Logical Security Market faces several challenges. The increasing complexity of data center environments, including the integration of diverse technologies like IoT and edge computing, creates new attack vectors and security vulnerabilities. The shortage of skilled cybersecurity professionals poses a significant barrier to implementing and managing advanced logical security solutions effectively. Evolving regulatory landscapes can also present compliance challenges, requiring continuous adaptation of security strategies. The high cost of advanced security solutions can be a deterrent for small and medium-sized enterprises (SMEs). Moreover, the constant need for updates and patches to address zero-day exploits requires significant ongoing investment and resource allocation.

Emerging Opportunities in Data Center Logical Security Market

Emerging opportunities in the Data Center Logical Security Market are abundant, driven by technological advancements and evolving security needs. The rapid growth of AI and ML presents significant opportunities for developing more intelligent and proactive security solutions, such as AI-powered threat hunting and automated incident response. The increasing adoption of edge computing and the Internet of Things (IoT) creates new markets for securing distributed data processing environments. The demand for specialized cloud security solutions tailored for specific cloud platforms and architectures is also a growing area. Furthermore, the ongoing digital transformation across industries, including the metaverse and blockchain technologies, will require novel approaches to logical security. The focus on data sovereignty and localized data processing will also create opportunities for regional security providers.

Leading Players in the Data Center Logical Security Market Market

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- McAfee Inc

- Dell

- Cisco Systems Inc

- Checkpoint Software Technologies Ltd

- Hewlett-Packard Enterprise Co

- Juniper Networks Inc

- VMware Inc

Key Developments in Data Center Logical Security Market Industry

- November 2022: Iron Mountain announced the expansion of its North American data center presence with the acquisition of a 10-acre land parcel for a 36-megawatt, 230K sq ft data center in Phoenix, Arizona. The new facility, AZP3, scheduled for completion in 2024, will adhere to BREEAM sustainability criteria and feature government-compliant physical and logical security.

- March 2022: Microsoft expanded its global footprint in India by establishing a new data center in Hyderabad, focusing on providing superior data security and cloud solutions to corporations, developers, education, start-ups, and government agencies.

- March 2022: Alibaba expanded its global footprint in Frankfurt, Germany, offering cloud computing solutions and ensuring compliance with the highest security requirements and Germany's Cloud Computing Compliance Controls Catalog (C5).

Strategic Outlook for Data Center Logical Security Market Market

The strategic outlook for the Data Center Logical Security Market is exceptionally positive, driven by an unwavering demand for robust data protection in an increasingly digital world. Key growth catalysts include the continued expansion of cloud computing, the pervasive adoption of hybrid and multi-cloud strategies, and the relentless evolution of cyber threats. Organizations will increasingly invest in proactive security measures, including AI-driven threat intelligence, automated security operations, and Zero Trust frameworks. The growing emphasis on data privacy and regulatory compliance will continue to shape product development and service offerings. Strategic partnerships and acquisitions will remain crucial for players seeking to enhance their technological capabilities and expand their market reach. The market's future potential lies in its ability to provide integrated, intelligent, and scalable security solutions that can adapt to the dynamic and complex nature of modern data center environments.

Data Center Logical Security Market Segmentation

-

1. Solution

- 1.1. Access Control and Identification Solution

- 1.2. Threat Protection Solution

- 1.3. Data Loss Prevention Solution

- 1.4. Other Solutions

-

2. Service

- 2.1. Security Consulting Service

- 2.2. Security Solution Deployment Service

- 2.3. Support and Maintenance

-

3. End-user

- 3.1. Banking and Financial Services

- 3.2. Manufacturing

- 3.3. Technology

- 3.4. Energy

- 3.5. Healthcare

- 3.6. Central/Local Government

- 3.7. Entertainment and Media

- 3.8. Other end-users

Data Center Logical Security Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Data Center Logical Security Market Regional Market Share

Geographic Coverage of Data Center Logical Security Market

Data Center Logical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Safety Concern for Business and Personal Data; Increasing Need for Cloud computing and Data Virtualization

- 3.3. Market Restrains

- 3.3.1. Availability of Low Priced Security Software

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Access Control and Identification Solution

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Access Control and Identification Solution

- 5.1.2. Threat Protection Solution

- 5.1.3. Data Loss Prevention Solution

- 5.1.4. Other Solutions

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Security Consulting Service

- 5.2.2. Security Solution Deployment Service

- 5.2.3. Support and Maintenance

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Banking and Financial Services

- 5.3.2. Manufacturing

- 5.3.3. Technology

- 5.3.4. Energy

- 5.3.5. Healthcare

- 5.3.6. Central/Local Government

- 5.3.7. Entertainment and Media

- 5.3.8. Other end-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Access Control and Identification Solution

- 6.1.2. Threat Protection Solution

- 6.1.3. Data Loss Prevention Solution

- 6.1.4. Other Solutions

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Security Consulting Service

- 6.2.2. Security Solution Deployment Service

- 6.2.3. Support and Maintenance

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Banking and Financial Services

- 6.3.2. Manufacturing

- 6.3.3. Technology

- 6.3.4. Energy

- 6.3.5. Healthcare

- 6.3.6. Central/Local Government

- 6.3.7. Entertainment and Media

- 6.3.8. Other end-users

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Access Control and Identification Solution

- 7.1.2. Threat Protection Solution

- 7.1.3. Data Loss Prevention Solution

- 7.1.4. Other Solutions

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Security Consulting Service

- 7.2.2. Security Solution Deployment Service

- 7.2.3. Support and Maintenance

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Banking and Financial Services

- 7.3.2. Manufacturing

- 7.3.3. Technology

- 7.3.4. Energy

- 7.3.5. Healthcare

- 7.3.6. Central/Local Government

- 7.3.7. Entertainment and Media

- 7.3.8. Other end-users

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Access Control and Identification Solution

- 8.1.2. Threat Protection Solution

- 8.1.3. Data Loss Prevention Solution

- 8.1.4. Other Solutions

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Security Consulting Service

- 8.2.2. Security Solution Deployment Service

- 8.2.3. Support and Maintenance

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Banking and Financial Services

- 8.3.2. Manufacturing

- 8.3.3. Technology

- 8.3.4. Energy

- 8.3.5. Healthcare

- 8.3.6. Central/Local Government

- 8.3.7. Entertainment and Media

- 8.3.8. Other end-users

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Access Control and Identification Solution

- 9.1.2. Threat Protection Solution

- 9.1.3. Data Loss Prevention Solution

- 9.1.4. Other Solutions

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Security Consulting Service

- 9.2.2. Security Solution Deployment Service

- 9.2.3. Support and Maintenance

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Banking and Financial Services

- 9.3.2. Manufacturing

- 9.3.3. Technology

- 9.3.4. Energy

- 9.3.5. Healthcare

- 9.3.6. Central/Local Government

- 9.3.7. Entertainment and Media

- 9.3.8. Other end-users

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Data Center Logical Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Access Control and Identification Solution

- 10.1.2. Threat Protection Solution

- 10.1.3. Data Loss Prevention Solution

- 10.1.4. Other Solutions

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Security Consulting Service

- 10.2.2. Security Solution Deployment Service

- 10.2.3. Support and Maintenance

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Banking and Financial Services

- 10.3.2. Manufacturing

- 10.3.3. Technology

- 10.3.4. Energy

- 10.3.5. Healthcare

- 10.3.6. Central/Local Government

- 10.3.7. Entertainment and Media

- 10.3.8. Other end-users

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trend Micro Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortinet Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 McAfee Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dell *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Checkpoint Software Technologies Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hewlett-Packard Enterprise Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Juniper Networks Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VMware Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global Data Center Logical Security Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Data Center Logical Security Market Revenue (undefined), by Solution 2025 & 2033

- Figure 3: North America Data Center Logical Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Data Center Logical Security Market Revenue (undefined), by Service 2025 & 2033

- Figure 5: North America Data Center Logical Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Data Center Logical Security Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: North America Data Center Logical Security Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: North America Data Center Logical Security Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Data Center Logical Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Data Center Logical Security Market Revenue (undefined), by Solution 2025 & 2033

- Figure 11: Europe Data Center Logical Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Data Center Logical Security Market Revenue (undefined), by Service 2025 & 2033

- Figure 13: Europe Data Center Logical Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 14: Europe Data Center Logical Security Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: Europe Data Center Logical Security Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Europe Data Center Logical Security Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Data Center Logical Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Data Center Logical Security Market Revenue (undefined), by Solution 2025 & 2033

- Figure 19: Asia Pacific Data Center Logical Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Data Center Logical Security Market Revenue (undefined), by Service 2025 & 2033

- Figure 21: Asia Pacific Data Center Logical Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Asia Pacific Data Center Logical Security Market Revenue (undefined), by End-user 2025 & 2033

- Figure 23: Asia Pacific Data Center Logical Security Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Asia Pacific Data Center Logical Security Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Data Center Logical Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Data Center Logical Security Market Revenue (undefined), by Solution 2025 & 2033

- Figure 27: Latin America Data Center Logical Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Latin America Data Center Logical Security Market Revenue (undefined), by Service 2025 & 2033

- Figure 29: Latin America Data Center Logical Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Latin America Data Center Logical Security Market Revenue (undefined), by End-user 2025 & 2033

- Figure 31: Latin America Data Center Logical Security Market Revenue Share (%), by End-user 2025 & 2033

- Figure 32: Latin America Data Center Logical Security Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Data Center Logical Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Data Center Logical Security Market Revenue (undefined), by Solution 2025 & 2033

- Figure 35: Middle East and Africa Data Center Logical Security Market Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Middle East and Africa Data Center Logical Security Market Revenue (undefined), by Service 2025 & 2033

- Figure 37: Middle East and Africa Data Center Logical Security Market Revenue Share (%), by Service 2025 & 2033

- Figure 38: Middle East and Africa Data Center Logical Security Market Revenue (undefined), by End-user 2025 & 2033

- Figure 39: Middle East and Africa Data Center Logical Security Market Revenue Share (%), by End-user 2025 & 2033

- Figure 40: Middle East and Africa Data Center Logical Security Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Data Center Logical Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 2: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global Data Center Logical Security Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 6: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 7: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 8: Global Data Center Logical Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 12: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 13: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 14: Global Data Center Logical Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 21: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 22: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 23: Global Data Center Logical Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: India Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 29: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 30: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 31: Global Data Center Logical Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Mexico Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Data Center Logical Security Market Revenue undefined Forecast, by Solution 2020 & 2033

- Table 37: Global Data Center Logical Security Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 38: Global Data Center Logical Security Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 39: Global Data Center Logical Security Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: United Arab Emirates Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Saudi Arabia Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Africa Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Data Center Logical Security Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Logical Security Market?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Data Center Logical Security Market?

Key companies in the market include IBM Corporation, Trend Micro Inc, Fortinet Inc, McAfee Inc, Dell *List Not Exhaustive, Cisco Systems Inc, Checkpoint Software Technologies Ltd, Hewlett-Packard Enterprise Co, Juniper Networks Inc, VMware Inc.

3. What are the main segments of the Data Center Logical Security Market?

The market segments include Solution, Service, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Safety Concern for Business and Personal Data; Increasing Need for Cloud computing and Data Virtualization.

6. What are the notable trends driving market growth?

Increasing Demand for Access Control and Identification Solution.

7. Are there any restraints impacting market growth?

Availability of Low Priced Security Software.

8. Can you provide examples of recent developments in the market?

November 2022: Iron Mountain, a global leader in innovative storage, asset lifecycle management, data center infrastructure, and information management services, expanded its North American data center presence with the acquisition of a 10-acre land parcel and a 50+ MVA substation in Phoenix, Arizona, for the development of a 36-megawatt, 230K sq ft data center. Iron Mountain's current 39-acre facility, which houses its AZP2 (48 megawatts) and AZP1 (41 megawatts) data centers, is close to the site. The first phase of the AZP3 expansion is scheduled to be completed in 2024. AZP3 will be built to BREEAM sustainability criteria and have government-compliant physical and logical security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Logical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Logical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Logical Security Market?

To stay informed about further developments, trends, and reports in the Data Center Logical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence