Key Insights

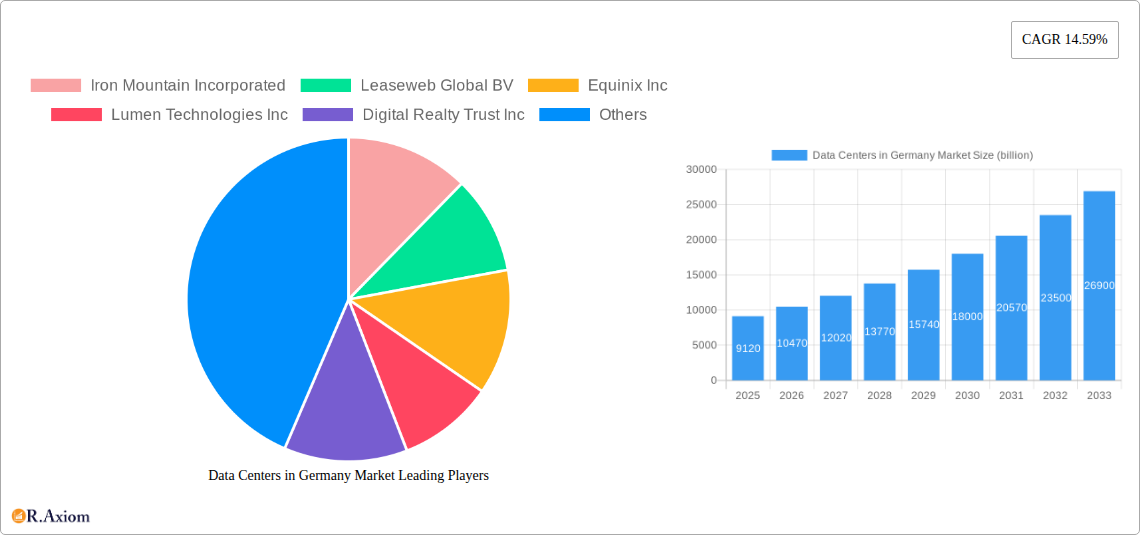

The German data center market is poised for significant expansion, with a projected market size of USD 9.12 billion in 2025, and anticipated to grow at a robust compound annual growth rate (CAGR) of 14.59% from 2025 to 2033. This dynamic growth is fueled by a confluence of factors, including the escalating demand for cloud computing services, the proliferation of digital transformation initiatives across industries, and the increasing need for high-density computing power driven by AI and big data analytics. Germany's strategic location in Europe, coupled with its strong industrial base and government support for digitalization, further solidifies its position as a key hub for data center development and operations. The market is witnessing substantial investment in the expansion of existing facilities and the construction of new hyperscale and massive data centers, particularly in key colocation hubs like Frankfurt.

Data Centers in Germany Market Market Size (In Billion)

The market segmentation reveals a strong emphasis on large and massive data center sizes, catering to the needs of hyperscalers and enterprises requiring significant capacity. Tier 3 and Tier 4 facilities are dominating the landscape, reflecting the critical need for high availability, reliability, and advanced infrastructure for mission-critical applications. The end-user segments are heavily influenced by the BFSI, Cloud, and Telecom sectors, which are primary drivers of data center demand due to their extensive data processing and storage requirements. Emerging trends include a growing focus on sustainability and energy efficiency within data center operations, as well as advancements in cooling technologies and power management. While the market exhibits immense growth potential, potential restraints might include the rising costs of energy, the availability of skilled labor, and evolving regulatory landscapes concerning data privacy and environmental impact, which will require strategic management and innovation.

Data Centers in Germany Market Company Market Share

Data Centers in Germany Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the Data Centers in Germany Market, covering the historical period from 2019 to 2024, a base and estimated year of 2025, and a robust forecast period extending to 2033. We delve into market dynamics, segmentation, key players, and future growth opportunities within this rapidly evolving sector. Keywords such as "Germany data center market," "colocation Germany," "hyperscale data centers Germany," "Frankfurt data center hub," and "digital infrastructure Germany" are integrated throughout to ensure maximum search visibility for industry stakeholders, including data center operators, investors, cloud providers, and enterprise IT decision-makers.

Data Centers in Germany Market Market Concentration & Innovation

The Data Centers in Germany Market is characterized by a moderate to high concentration, with a few dominant global players and several regional specialists vying for market share. Innovation is a critical differentiator, driven by the relentless demand for higher density, increased power efficiency, and advanced cooling solutions to support the ever-growing digital workload. Regulatory frameworks, particularly concerning data privacy (GDPR) and energy consumption, play a significant role in shaping operational strategies and investment decisions. While direct product substitutes for physical data center space are limited, the increasing adoption of edge computing and distributed IT infrastructure presents a dynamic competitive landscape. End-user trends heavily favor hyperscale and cloud deployments, fueled by the exponential growth of cloud computing, AI, and IoT. Mergers and acquisitions (M&A) are strategic tools for market consolidation and expansion. For instance, the acquisition of an office complex in Frankfurt by CyrusOne for EUR 95 million (USD 102.3 million) underscores the M&A activity focused on expanding critical capacity. The estimated M&A deal value in the sector is projected to reach several billion USD over the forecast period.

Data Centers in Germany Market Industry Trends & Insights

The Data Centers in Germany Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8-10% between 2025 and 2033. This expansion is primarily driven by the burgeoning demand for cloud services, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML), the proliferation of the Internet of Things (IoT), and the ongoing digital transformation initiatives across all industries. Technological disruptions, such as advancements in liquid cooling, AI-powered data center management, and the integration of renewable energy sources, are reshaping the industry's operational efficiency and sustainability. Consumer preferences are shifting towards more flexible and scalable colocation solutions, with a strong emphasis on performance, security, and low latency. Competitive dynamics are intensifying, characterized by significant capital investments, strategic partnerships, and the continuous pursuit of optimizing power utilization effectiveness (PUE). The market penetration of hyperscale facilities, in particular, is on an upward trajectory, reflecting the growing needs of major cloud providers. The overall market size is estimated to reach tens of billions of dollars by 2033, with continuous investment flowing into new builds and expansions.

Dominant Markets & Segments in Data Centers in Germany Market

The Frankfurt hotspot continues to dominate the Data Centers in Germany Market, leveraging its strategic location as a major internet exchange point and its well-established digital infrastructure. This region is a prime destination for hyperscale operators and global cloud providers, driving demand for Large and Massive data center sizes. The prevalence of Tier 3 and Tier 4 facilities is a testament to the high availability and reliability requirements of businesses operating within this critical hub. Hyperscale colocation dominates, catering to the immense capacity needs of cloud giants.

The Rest of Germany segment is witnessing significant growth, driven by an expanding digital economy and the need to bring computing closer to end-users for reduced latency. Emerging hubs in Berlin and other major cities are attracting substantial investment. While Medium and Large data centers are prevalent, there is a growing demand for Mega facilities to support regional cloud deployments. Tier 3 facilities are standard, with an increasing focus on energy-efficient designs. Wholesale colocation is gaining traction alongside hyperscale, as businesses seek dedicated capacity without the full operational burden.

In terms of Data Center Size, Large (e.g., 5,000-10,000 sqm) and Massive (e.g., 10,000-20,000 sqm) facilities are leading the market, particularly in Frankfurt, due to the intense demand from hyperscalers. Mega (over 20,000 sqm) facilities are becoming increasingly important in areas outside of the primary hotspot.

Regarding Tier Type, Tier 3 facilities are the most prevalent, offering a balance of redundancy and uptime crucial for most enterprise workloads. However, the demand for Tier 4 facilities, offering the highest level of fault tolerance, is growing for mission-critical applications.

Absorption of capacity is a key metric, with Non-Utilized space shrinking rapidly in prime locations due to high demand. The market is experiencing a tight supply-demand balance in key areas.

By Colocation Type, Hyperscale leads significantly due to major cloud providers' expansion. Wholesale colocation is the second-largest segment, providing dedicated infrastructure for large enterprises. Retail colocation caters to smaller businesses and specific niche requirements.

The End-User segment is dominated by Cloud providers, followed by BFSI (Banking, Financial Services, and Insurance) and Telecom, all of whom are major consumers of data center capacity. E-Commerce and Media & Entertainment also represent significant growth areas, driven by increasing online activity and content streaming. The Government sector is investing in secure, sovereign cloud solutions, while Manufacturing and Other End Users are increasingly leveraging digital technologies.

Data Centers in Germany Market Product Developments

Product developments in the Data Centers in Germany Market are focused on enhancing efficiency, sustainability, and scalability. Innovations in cooling technologies, such as advanced liquid cooling solutions and free cooling systems, are crucial for managing heat loads in high-density deployments. AI-driven software for data center infrastructure management (DCIM) is improving operational efficiency and predictive maintenance. The integration of renewable energy sources and sophisticated power management systems are key competitive advantages, addressing both environmental concerns and operational costs. These advancements are vital for meeting the evolving demands of hyperscalers and enterprises seeking cost-effective and environmentally responsible data center solutions.

Report Scope & Segmentation Analysis

This report segments the Data Centers in Germany Market based on several key factors. The geographical segmentation includes the Hotspot: Frankfurt and the Rest of Germany. Facility size is analyzed across Small, Medium, Large, Massive, and Mega data centers. Tier classifications include Tier 1 and 2, Tier 3, and Tier 4. Absorption is assessed by Non-Utilized capacity. Colocation types explored are Hyperscale, Retail, and Wholesale. Finally, end-user segments include BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End User. Each segment's projected growth, market size, and competitive dynamics are thoroughly examined throughout the study period.

Key Drivers of Data Centers in Germany Market Growth

Several key drivers are propelling the growth of the Data Centers in Germany Market. The accelerating adoption of cloud computing services by businesses of all sizes is a primary catalyst, creating immense demand for scalable infrastructure. The ongoing digital transformation initiatives across industries, including the implementation of AI, IoT, and big data analytics, necessitate significant computing power and storage. Furthermore, Germany's strong regulatory environment, emphasizing data sovereignty and privacy, encourages domestic data center development and investment. The presence of major internet exchange points, particularly in Frankfurt, further solidifies its position as a crucial digital hub. Finally, government initiatives supporting digitalization and technological advancement contribute to a favorable investment climate.

Challenges in the Data Centers in Germany Market Sector

Despite robust growth, the Data Centers in Germany Market faces several challenges. Securing adequate power supply and managing rising energy costs are significant concerns, especially with increasing demand for high-density computing. Stringent environmental regulations and the push for sustainability can lead to higher operational costs and complex compliance requirements. Land acquisition and permitting processes for new data center construction can be lengthy and complex, leading to project delays. The competitive landscape is intense, with global players investing heavily, putting pressure on smaller operators. Additionally, the ongoing global supply chain issues for critical hardware components can impact expansion timelines and project feasibility.

Emerging Opportunities in Data Centers in Germany Market

Emerging opportunities in the Data Centers in Germany Market are abundant, driven by evolving technological trends and market demands. The increasing demand for edge computing solutions presents a significant growth area, as businesses require localized processing power to reduce latency. The development of specialized data centers for AI and high-performance computing (HPC) workloads is another key opportunity. Furthermore, the growing focus on sustainability is driving innovation in green data center technologies and renewable energy integration, creating a market for eco-friendly solutions. The expansion of 5G networks will also fuel demand for distributed data center infrastructure. Finally, the continuous growth of the cloud sector and the increasing need for data localization present ongoing opportunities for capacity expansion.

Leading Players in the Data Centers in Germany Market Market

- Iron Mountain Incorporated

- Leaseweb Global BV

- Equinix Inc

- Lumen Technologies Inc

- Digital Realty Trust Inc

- Vantage Data Centers LLC

- CyrusOne Inc

- Telehouse (KDDI Corporation)

- Noris Network AG

- Global Switch Holdings Limited

- NTT Ltd

- GlobalConnect AB

Key Developments in Data Centers in Germany Market Industry

- January 2023: CyrusOne acquired an office complex in Frankfurt, Germany, for EUR 95 million (USD 102.3 million), with plans to develop it into a significant data center campus. This move highlights the strategic expansion of hyperscale players in key German markets.

- November 2022: Lumen announced plans to sell its EMEA operations, including its German presence, to Colt Technology Services for USD 1.8 billion. This potential deal signals significant consolidation and strategic realignments within the European telecommunications and data center infrastructure landscape, with a projected closing as early as late 2023.

- November 2022: Vantage Data Centers announced the delivery of three new facilities in Berlin and Frankfurt, alongside the opening of a new German office in Raunheim. Their Berlin I campus expansion includes a new 16MW facility, with plans for a total of four data centers and 56MW of IT capacity upon full development, underscoring significant investment in new capacity by key operators.

Strategic Outlook for Data Centers in Germany Market Market

The strategic outlook for the Data Centers in Germany Market remains exceptionally strong, driven by a confluence of factors. The sustained demand from hyperscale cloud providers, coupled with the increasing adoption of AI and IoT across all sectors, ensures a continuous need for scalable and high-performance data center capacity. Investments in green energy solutions and sustainable operational practices will be crucial for long-term growth and compliance. The development of edge data centers to support 5G and latency-sensitive applications presents a substantial new avenue for expansion. Furthermore, Germany's strategic importance as a European digital hub, coupled with its robust regulatory framework, will continue to attract significant international investment. The market is poised for continued growth and innovation, offering lucrative opportunities for stakeholders.

Data Centers in Germany Market Segmentation

-

1. Hotspot

- 1.1. Frankfurt

- 1.2. Rest of Germany

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

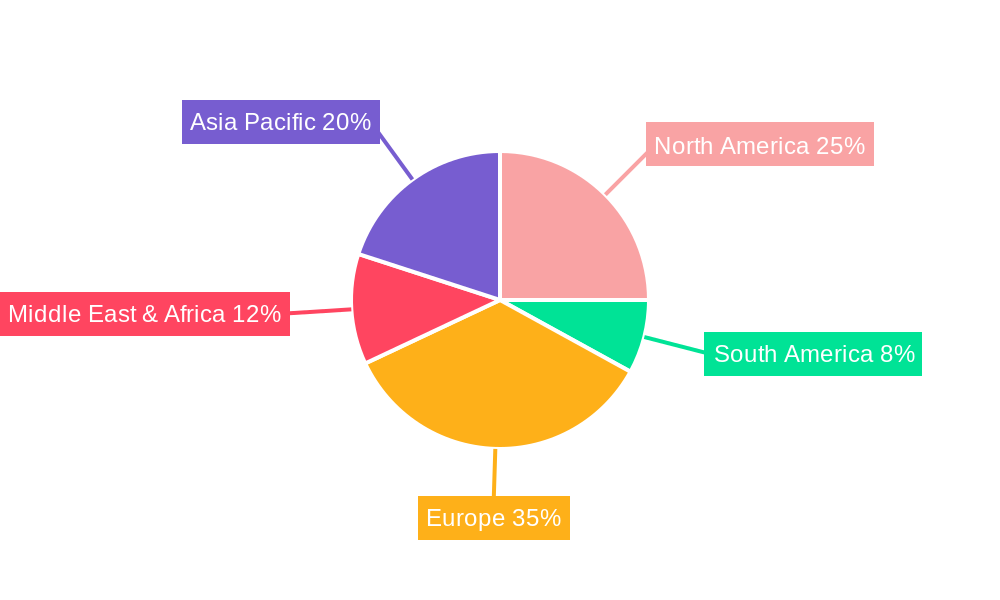

Data Centers in Germany Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Centers in Germany Market Regional Market Share

Geographic Coverage of Data Centers in Germany Market

Data Centers in Germany Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Frankfurt

- 5.1.2. Rest of Germany

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. Frankfurt

- 6.1.2. Rest of Germany

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.4.2. By Colocation Type

- 6.4.2.1. Hyperscale

- 6.4.2.2. Retail

- 6.4.2.3. Wholesale

- 6.4.3. By End User

- 6.4.3.1. BFSI

- 6.4.3.2. Cloud

- 6.4.3.3. E-Commerce

- 6.4.3.4. Government

- 6.4.3.5. Manufacturing

- 6.4.3.6. Media & Entertainment

- 6.4.3.7. Telecom

- 6.4.3.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. Frankfurt

- 7.1.2. Rest of Germany

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.4.2. By Colocation Type

- 7.4.2.1. Hyperscale

- 7.4.2.2. Retail

- 7.4.2.3. Wholesale

- 7.4.3. By End User

- 7.4.3.1. BFSI

- 7.4.3.2. Cloud

- 7.4.3.3. E-Commerce

- 7.4.3.4. Government

- 7.4.3.5. Manufacturing

- 7.4.3.6. Media & Entertainment

- 7.4.3.7. Telecom

- 7.4.3.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. Frankfurt

- 8.1.2. Rest of Germany

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.4.2. By Colocation Type

- 8.4.2.1. Hyperscale

- 8.4.2.2. Retail

- 8.4.2.3. Wholesale

- 8.4.3. By End User

- 8.4.3.1. BFSI

- 8.4.3.2. Cloud

- 8.4.3.3. E-Commerce

- 8.4.3.4. Government

- 8.4.3.5. Manufacturing

- 8.4.3.6. Media & Entertainment

- 8.4.3.7. Telecom

- 8.4.3.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. Frankfurt

- 9.1.2. Rest of Germany

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.4.2. By Colocation Type

- 9.4.2.1. Hyperscale

- 9.4.2.2. Retail

- 9.4.2.3. Wholesale

- 9.4.3. By End User

- 9.4.3.1. BFSI

- 9.4.3.2. Cloud

- 9.4.3.3. E-Commerce

- 9.4.3.4. Government

- 9.4.3.5. Manufacturing

- 9.4.3.6. Media & Entertainment

- 9.4.3.7. Telecom

- 9.4.3.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Centers in Germany Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. Frankfurt

- 10.1.2. Rest of Germany

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.4.2. By Colocation Type

- 10.4.2.1. Hyperscale

- 10.4.2.2. Retail

- 10.4.2.3. Wholesale

- 10.4.3. By End User

- 10.4.3.1. BFSI

- 10.4.3.2. Cloud

- 10.4.3.3. E-Commerce

- 10.4.3.4. Government

- 10.4.3.5. Manufacturing

- 10.4.3.6. Media & Entertainment

- 10.4.3.7. Telecom

- 10.4.3.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Iron Mountain Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leaseweb Global BV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Equinix Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lumen Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Digital Realty Trust Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CyrusOne Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telehouse (KDDI Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Noris Network AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Global Switch Holdings Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NTT Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GlobalConnect AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Iron Mountain Incorporated

List of Figures

- Figure 1: Global Data Centers in Germany Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Data Centers in Germany Market Revenue (billion), by Hotspot 2025 & 2033

- Figure 3: North America Data Centers in Germany Market Revenue Share (%), by Hotspot 2025 & 2033

- Figure 4: North America Data Centers in Germany Market Revenue (billion), by Data Center Size 2025 & 2033

- Figure 5: North America Data Centers in Germany Market Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 6: North America Data Centers in Germany Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 7: North America Data Centers in Germany Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 8: North America Data Centers in Germany Market Revenue (billion), by Absorption 2025 & 2033

- Figure 9: North America Data Centers in Germany Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 10: North America Data Centers in Germany Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Data Centers in Germany Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Data Centers in Germany Market Revenue (billion), by Hotspot 2025 & 2033

- Figure 13: South America Data Centers in Germany Market Revenue Share (%), by Hotspot 2025 & 2033

- Figure 14: South America Data Centers in Germany Market Revenue (billion), by Data Center Size 2025 & 2033

- Figure 15: South America Data Centers in Germany Market Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 16: South America Data Centers in Germany Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 17: South America Data Centers in Germany Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 18: South America Data Centers in Germany Market Revenue (billion), by Absorption 2025 & 2033

- Figure 19: South America Data Centers in Germany Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 20: South America Data Centers in Germany Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Data Centers in Germany Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Data Centers in Germany Market Revenue (billion), by Hotspot 2025 & 2033

- Figure 23: Europe Data Centers in Germany Market Revenue Share (%), by Hotspot 2025 & 2033

- Figure 24: Europe Data Centers in Germany Market Revenue (billion), by Data Center Size 2025 & 2033

- Figure 25: Europe Data Centers in Germany Market Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 26: Europe Data Centers in Germany Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 27: Europe Data Centers in Germany Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 28: Europe Data Centers in Germany Market Revenue (billion), by Absorption 2025 & 2033

- Figure 29: Europe Data Centers in Germany Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 30: Europe Data Centers in Germany Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Data Centers in Germany Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Data Centers in Germany Market Revenue (billion), by Hotspot 2025 & 2033

- Figure 33: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Hotspot 2025 & 2033

- Figure 34: Middle East & Africa Data Centers in Germany Market Revenue (billion), by Data Center Size 2025 & 2033

- Figure 35: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 36: Middle East & Africa Data Centers in Germany Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 37: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Middle East & Africa Data Centers in Germany Market Revenue (billion), by Absorption 2025 & 2033

- Figure 39: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Middle East & Africa Data Centers in Germany Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Data Centers in Germany Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Data Centers in Germany Market Revenue (billion), by Hotspot 2025 & 2033

- Figure 43: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Hotspot 2025 & 2033

- Figure 44: Asia Pacific Data Centers in Germany Market Revenue (billion), by Data Center Size 2025 & 2033

- Figure 45: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Data Center Size 2025 & 2033

- Figure 46: Asia Pacific Data Centers in Germany Market Revenue (billion), by Tier Type 2025 & 2033

- Figure 47: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 48: Asia Pacific Data Centers in Germany Market Revenue (billion), by Absorption 2025 & 2033

- Figure 49: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 50: Asia Pacific Data Centers in Germany Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Data Centers in Germany Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 2: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 3: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 4: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 5: Global Data Centers in Germany Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 7: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 8: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 9: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 10: Global Data Centers in Germany Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 15: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 16: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 17: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 18: Global Data Centers in Germany Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 23: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 24: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 25: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 26: Global Data Centers in Germany Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 37: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 38: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 39: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 40: Global Data Centers in Germany Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Data Centers in Germany Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 48: Global Data Centers in Germany Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 49: Global Data Centers in Germany Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 50: Global Data Centers in Germany Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 51: Global Data Centers in Germany Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Data Centers in Germany Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Centers in Germany Market?

The projected CAGR is approximately 14.59%.

2. Which companies are prominent players in the Data Centers in Germany Market?

Key companies in the market include Iron Mountain Incorporated, Leaseweb Global BV, Equinix Inc, Lumen Technologies Inc, Digital Realty Trust Inc, Vantage Data Centers LLC5 4 LIST OF COMPANIES STUDIE, CyrusOne Inc, Telehouse (KDDI Corporation), Noris Network AG, Global Switch Holdings Limited, NTT Ltd, GlobalConnect AB.

3. What are the main segments of the Data Centers in Germany Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2023: CyrusOne acquired an office complex in Frankfurt, Germany, planning to turn it into a data center campus. The investment group Corum had sold the Europark office complex in Frankfurt for EUR 95 million (USD 102.3 million), before confirming that CyrusOne was the buyer.November 2022: Lumen announced plans to sell its EMEA operations to Colt Technology Services. The communications company announced entering into an exclusive arrangement for the proposed sale of Lumen's Europe, Middle East, and Africa (EMEA) business to Colt for USD 1.8 billion. The deal was set to close as early as late 2023.November 2022: Vantage Data Centers announced delivering three new facilities in Berlin and Frankfurt and opening a new German office in Raunheim. Vantage welcomed a second data center on its 25-acre (10-hectare) Berlin I campus. The two-story, 130,000 square foot (12,000 square meters) facility offered 16MW of IT capacity to hyperscalers and large cloud providers. Once fully developed, the expanding campus would include 4 data centers totaling 56MW and 474,000 square feet (44,000 square meters).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Centers in Germany Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Centers in Germany Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Centers in Germany Market?

To stay informed about further developments, trends, and reports in the Data Centers in Germany Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence