Key Insights

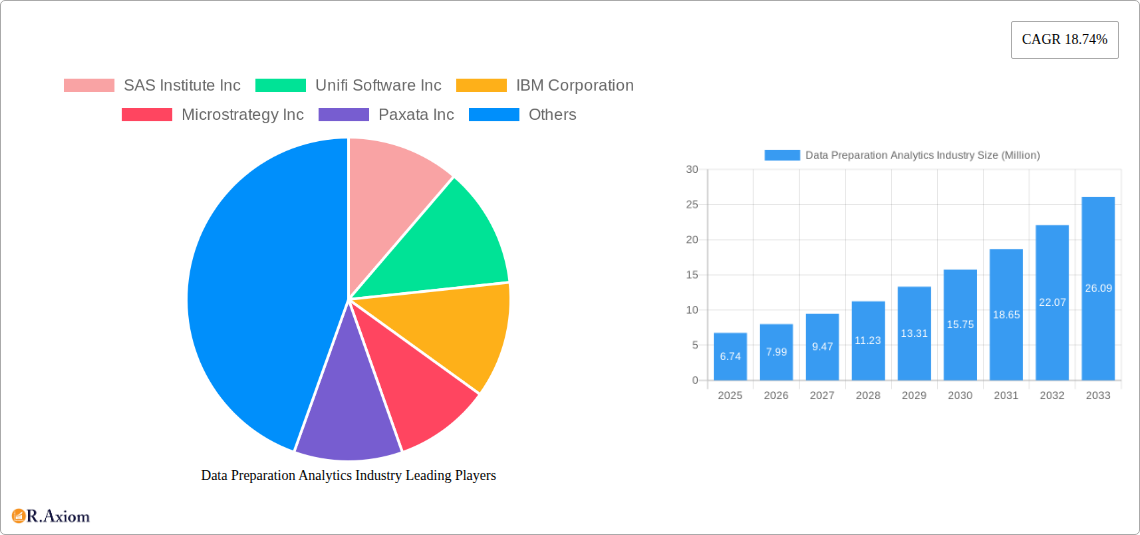

The Data Preparation Analytics Industry is poised for remarkable expansion, projected to reach a substantial $6.74 billion by 2025, driven by a compelling 18.74% Compound Annual Growth Rate (CAGR) through 2033. This robust growth is fueled by an increasing demand for efficient data cleansing, transformation, and enrichment processes across diverse business verticals. Organizations are recognizing the critical importance of accurate and well-prepared data for effective decision-making, advanced analytics, and the successful implementation of AI and machine learning initiatives. The widespread adoption of cloud-based solutions is a significant accelerator, offering scalability, flexibility, and cost-effectiveness, particularly for Small and Medium Enterprises (SMEs) who are increasingly leveraging these platforms to democratize data access and analytics capabilities. The BFSI, Healthcare, and Retail sectors are leading the charge, investing heavily in data preparation tools to gain competitive advantages through enhanced customer insights, risk management, and operational efficiencies.

Data Preparation Analytics Industry Market Size (In Million)

The market dynamics are further shaped by the ongoing digital transformation initiatives across industries, leading to an exponential increase in data volume and complexity. While the significant market potential is evident, certain restraints may emerge, such as the scarcity of skilled data professionals and the initial costs associated with integrating advanced data preparation solutions. However, the overwhelming benefits of accurate data, improved analytical outcomes, and streamlined workflows are expected to outweigh these challenges. Key players like SAS Institute Inc, IBM Corporation, Oracle Corporation, and Tableau Software LLC are actively innovating, introducing more intuitive and automated data preparation functionalities. The competitive landscape is characterized by strategic partnerships and mergers & acquisitions, aimed at expanding product portfolios and market reach. Asia is emerging as a high-growth region, with increasing digital adoption and a burgeoning startup ecosystem contributing to the demand for sophisticated data preparation tools.

Data Preparation Analytics Industry Company Market Share

Data Preparation Analytics Industry Market Analysis Report: Navigating the Future of Data Intelligence (2019-2033)

This comprehensive report offers an in-depth analysis of the global Data Preparation Analytics Industry, providing critical insights into market dynamics, growth drivers, and future trajectories. Spanning the historical period of 2019-2024, with a base year of 2025 and a detailed forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to capitalize on the rapidly evolving landscape of data analytics and business intelligence. The report delves into market segmentation by deployment models, enterprise sizes, and key end-user verticals, alongside a thorough examination of emerging trends, competitive strategies, and product innovations.

Data Preparation Analytics Industry Market Concentration & Innovation

The Data Preparation Analytics Industry exhibits a moderate to high degree of market concentration, with several key players dominating significant market shares. The market is driven by continuous innovation in areas like AI-powered data cleansing, automated data transformation, and self-service data preparation tools. Regulatory frameworks, particularly data privacy regulations such as GDPR and CCPA, are increasingly shaping data handling practices and driving demand for compliant data preparation solutions. Product substitutes are emerging from broader business intelligence platforms and specialized data governance tools, yet dedicated data preparation analytics solutions offer a distinct advantage in efficiency and user-friendliness. End-user trends show a growing preference for cloud-based solutions and a demand for intuitive, low-code/no-code interfaces that empower business users. Mergers and acquisitions (M&A) activities are prominent, with significant deal values indicating consolidation and strategic expansion within the industry. For instance, the strategic investment in MANTA by Alteryx, Inc. signifies a move towards enhanced data lineage capabilities, a critical aspect of data preparation. The total M&A deal value in the historical period is estimated at over XX Million. Key companies like SAS Institute Inc, Unifi Software Inc, IBM Corporation, and Alteryx Inc are at the forefront of this innovation. The market share of leading players is estimated to be over XX% combined.

Data Preparation Analytics Industry Industry Trends & Insights

The Data Preparation Analytics Industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This growth is underpinned by several pivotal trends and insights that are reshaping how businesses leverage their data. The increasing volume, velocity, and variety of data generated across all sectors necessitate sophisticated data preparation tools to ensure data quality, consistency, and accessibility for effective analysis. Technological disruptions, including advancements in artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), are automating complex data preparation tasks, reducing manual effort, and improving accuracy. The proliferation of cloud computing has democratized access to powerful analytics tools, fostering the adoption of cloud-based data preparation solutions. Consumer preferences are shifting towards self-service analytics, empowering business users to prepare and analyze data without extensive IT support. This demand has spurred the development of user-friendly interfaces and drag-and-drop functionalities. Competitive dynamics are intense, with vendors differentiating themselves through specialized features, integration capabilities, and pricing models. Market penetration is expanding rapidly, driven by digital transformation initiatives across industries. For example, the November 2022 update to Amazon QuickSight, introducing new data preparation features, highlights the industry's focus on enhancing these capabilities within broader analytics platforms. The estimated market size for data preparation analytics in the base year 2025 is XXX Million.

Dominant Markets & Segments in Data Preparation Analytics Industry

The Data Preparation Analytics Industry is witnessing significant dominance across various segments, driven by distinct market forces and evolving industry needs.

Deployment:

- Cloud-based solutions are emerging as the dominant deployment model, projected to capture over XX% of the market share by 2033. This dominance is fueled by the scalability, flexibility, and cost-effectiveness of cloud infrastructure, enabling organizations of all sizes to access advanced data preparation capabilities without significant upfront investment. Key drivers include reduced IT overhead, faster deployment times, and seamless integration with other cloud-based services. The estimated market size for cloud-based deployment in 2025 is XXX Million.

- On-premise solutions maintain a strong presence, particularly in sectors with stringent data residency and security requirements. While its market share is expected to gradually decline relative to cloud solutions, it will continue to be a significant segment, driven by legacy systems and specific industry regulations.

Enterprise Size:

- Large Enterprises represent the largest segment by market value, accounting for an estimated XX% of the total market revenue in 2025, valued at XXX Million. These organizations generate vast amounts of data and have the resources to invest in comprehensive data preparation suites to manage complex analytical workflows. The demand for advanced features, scalability, and robust security is paramount for this segment.

- Small and Medium Enterprises (SMEs) are exhibiting the fastest growth rate, driven by the increasing affordability and accessibility of cloud-based data preparation tools. As SMEs recognize the competitive advantage of data-driven decision-making, adoption rates are soaring, projected to increase by XX% annually.

End-user Vertical:

- The BFSI (Banking, Financial Services, and Insurance) sector leads in terms of market adoption and investment, with an estimated market share of XX% in 2025, valued at XXX Million. This is attributed to the high volume of sensitive financial data, stringent regulatory compliance needs, and the critical role of data analytics in fraud detection, risk management, and customer personalization.

- The Healthcare sector is a rapidly growing vertical, driven by the increasing use of electronic health records (EHRs), genomic data, and the pursuit of personalized medicine. The need for accurate and clean data for clinical research, patient care improvement, and operational efficiency is paramount.

- Retail and IT and Telecommunication sectors are also significant contributors, leveraging data preparation for customer analytics, supply chain optimization, and network performance monitoring.

Data Preparation Analytics Industry Product Developments

Product developments in the Data Preparation Analytics Industry are heavily focused on enhancing automation, intelligence, and user experience. Companies are integrating advanced AI and ML algorithms to automate data cleansing, anomaly detection, and transformation processes, significantly reducing manual effort. Innovations include self-service data preparation tools with intuitive graphical interfaces, enabling citizen data scientists to prepare data without extensive technical expertise. Furthermore, there's a growing emphasis on data lineage tracking and governance capabilities, ensuring transparency and compliance. Competitive advantages are being built around seamless integration with existing data ecosystems, real-time data processing, and specialized connectors for diverse data sources. The trend towards embedding data preparation directly within broader analytics platforms, as seen with Amazon QuickSight, underscores the drive for a unified data intelligence experience.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the Data Preparation Analytics Industry segmented across key dimensions to provide granular market insights.

Deployment: The market is segmented into On-premise and Cloud-based deployments. Cloud-based solutions are anticipated to dominate the market due to their scalability and flexibility, with an estimated market size of XXX Million in 2025. On-premise solutions will continue to cater to organizations with specific security and regulatory needs.

Enterprise Size: The segmentation includes Small and Medium Enterprises (SMEs) and Large Enterprises. Large enterprises currently hold the largest market share, valued at XXX Million in 2025, due to their extensive data needs. However, SMEs are projected to exhibit the highest growth rate as they increasingly adopt data-driven strategies.

End-user Vertical: Key end-user verticals analyzed include BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunication, and Other End-user Verticals. The BFSI sector is expected to lead in market value in 2025, estimated at XXX Million, driven by regulatory compliance and risk management demands. The Healthcare sector is a rapidly expanding segment due to the growing use of health data for research and patient care.

Key Drivers of Data Preparation Analytics Industry Growth

The Data Preparation Analytics Industry is propelled by several key drivers:

- Explosion of Big Data: The exponential growth in data volume, velocity, and variety across all industries necessitates robust data preparation tools to derive meaningful insights.

- Demand for Data-Driven Decision-Making: Businesses are increasingly reliant on accurate and timely data for strategic planning, operational efficiency, and competitive advantage.

- Advancements in AI and ML: The integration of artificial intelligence and machine learning is automating complex data preparation tasks, enhancing accuracy and speed.

- Cloud Computing Adoption: The widespread adoption of cloud infrastructure provides scalable and cost-effective solutions for data preparation, democratizing access.

- Stringent Regulatory Compliance: Evolving data privacy regulations (e.g., GDPR, CCPA) mandate better data governance and preparation to ensure compliance.

Challenges in the Data Preparation Analytics Industry Sector

Despite its robust growth, the Data Preparation Analytics Industry faces several challenges:

- Data Silos and Integration Complexity: Integrating data from disparate sources and overcoming data silos remains a significant hurdle for many organizations.

- Skills Gap: A shortage of skilled data professionals capable of effectively utilizing advanced data preparation tools can hinder adoption and optimal utilization.

- Data Quality Issues: Inconsistent or inaccurate source data can still lead to flawed analysis, even with sophisticated preparation tools.

- Cost of Implementation: While cloud solutions are becoming more accessible, initial setup costs and ongoing subscription fees can be a barrier for some SMEs.

- Resistance to Change: Overcoming organizational inertia and fostering a culture that embraces data-driven practices can be challenging.

Emerging Opportunities in Data Preparation Analytics Industry

The Data Preparation Analytics Industry presents significant emerging opportunities:

- AI-Powered Augmented Data Preparation: Further development and integration of AI for automated data profiling, cleansing, and enrichment will streamline workflows.

- Real-time Data Preparation: The growing need for immediate insights is driving demand for solutions capable of real-time data preparation and analysis.

- Democratization of Data Preparation: Continued innovation in user-friendly interfaces and low-code/no-code platforms will empower a wider range of users.

- Enhanced Data Governance and Compliance Tools: As regulations evolve, there is a growing market for data preparation solutions that offer superior data lineage, security, and compliance features.

- Industry-Specific Solutions: Tailored data preparation solutions designed for the unique needs of specific verticals like healthcare, manufacturing, and finance will see increased demand.

Leading Players in the Data Preparation Analytics Industry Market

- SAS Institute Inc

- Unifi Software Inc

- IBM Corporation

- Microstrategy Inc

- Paxata Inc

- ClearStory Data Inc

- Alteryx Inc

- Oracle Corporation

- Rapid Insight Inc

- Informatica LLC

- Tableau Software LLC (Salesforce com Inc)

- SAP SE

- Qlik Technologies Inc QlikTech International AB

Key Developments in Data Preparation Analytics Industry Industry

- December 2022: Alteryx, Inc., the Analytics Automation company, announced a strategic investment in MANTA, the data lineage company. MANTA enables businesses to achieve complete visibility into the most complex data environments. With this investment from Alteryx Ventures, the company can bolster product innovation, expand its partner ecosystem, and grow in key markets.

- November 2022: Amazon Web Services (AWS) announced a series of new features for Amazon QuickSight, the cloud computing giant's analytics platform. The update includes new query, forecasting, and data preparation features, adding functionality to QuickSight Q, a natural language query (NLQ) tool.

Strategic Outlook for Data Preparation Analytics Industry Market

The strategic outlook for the Data Preparation Analytics Industry is exceptionally positive, driven by the imperative for organizations to harness the full potential of their data. Future growth will be catalyzed by continued advancements in AI and ML for automated data quality management and intelligent data transformation. The increasing adoption of cloud-native analytics platforms and the growing demand for self-service business intelligence will further fuel market expansion. Emphasis will increasingly be placed on robust data governance, lineage tracking, and compliance features to meet evolving regulatory requirements. Strategic partnerships and acquisitions will remain a key trend as companies aim to consolidate their market positions and expand their offerings. The integration of data preparation capabilities directly into broader data science and analytics workflows will be crucial for providing end-to-end solutions that empower businesses to make faster, more informed decisions. The estimated market size for the Data Preparation Analytics Industry in 2033 is projected to reach XXX Million.

Data Preparation Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud-based

-

2. Enterprise Size

- 2.1. Small and Medium Enterprises (SMEs)

- 2.2. Large Enterprises

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Manufacturing

- 3.5. IT and Telecommunication

- 3.6. Other End-user Verticals

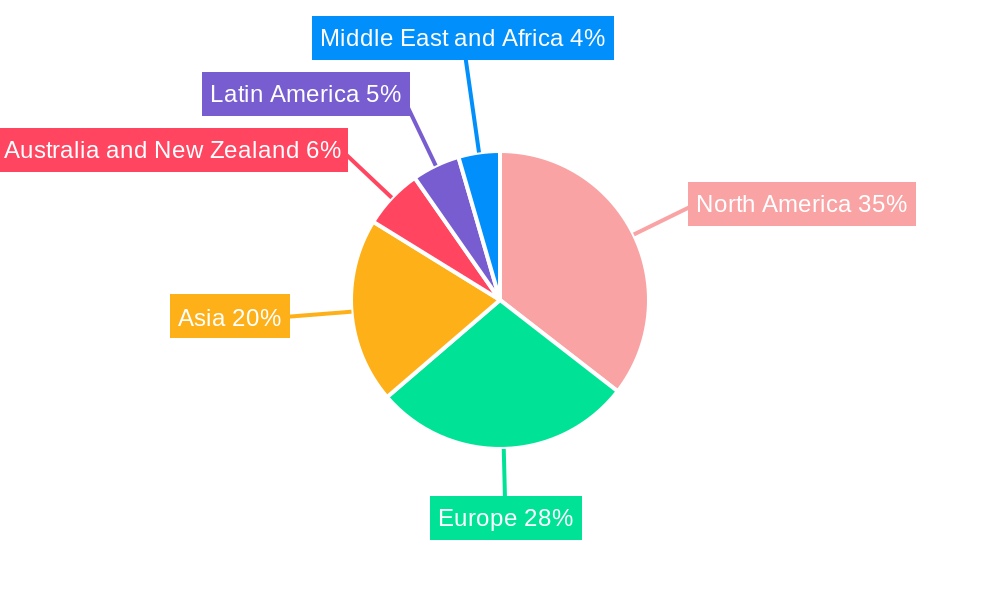

Data Preparation Analytics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Data Preparation Analytics Industry Regional Market Share

Geographic Coverage of Data Preparation Analytics Industry

Data Preparation Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Self-service Data Preparation Tools; Increasing Demand for Data Analytics

- 3.3. Market Restrains

- 3.3.1. Limited Budgets and Low Investments owing to Complexities and Associated Risks.

- 3.4. Market Trends

- 3.4.1. IT and Telecom Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.2.1. Small and Medium Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Manufacturing

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud-based

- 6.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.2.1. Small and Medium Enterprises (SMEs)

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. Manufacturing

- 6.3.5. IT and Telecommunication

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud-based

- 7.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.2.1. Small and Medium Enterprises (SMEs)

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. Manufacturing

- 7.3.5. IT and Telecommunication

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud-based

- 8.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.2.1. Small and Medium Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. Manufacturing

- 8.3.5. IT and Telecommunication

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud-based

- 9.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.2.1. Small and Medium Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. Manufacturing

- 9.3.5. IT and Telecommunication

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud-based

- 10.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.2.1. Small and Medium Enterprises (SMEs)

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. Retail

- 10.3.4. Manufacturing

- 10.3.5. IT and Telecommunication

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Data Preparation Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. On-premise

- 11.1.2. Cloud-based

- 11.2. Market Analysis, Insights and Forecast - by Enterprise Size

- 11.2.1. Small and Medium Enterprises (SMEs)

- 11.2.2. Large Enterprises

- 11.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.3.1. BFSI

- 11.3.2. Healthcare

- 11.3.3. Retail

- 11.3.4. Manufacturing

- 11.3.5. IT and Telecommunication

- 11.3.6. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SAS Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Unifi Software Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microstrategy Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Paxata Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ClearStory Data Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Alteryx Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oracle Corporation*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Rapid Insight Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Informatica LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Tableau Software LLC (Salesforce com Inc )

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SAP SE

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Qlik Technologies Inc QlikTech International AB

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Data Preparation Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 5: North America Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 6: North America Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 13: Europe Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 14: Europe Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 21: Asia Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 22: Asia Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Australia and New Zealand Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Australia and New Zealand Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 29: Australia and New Zealand Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 30: Australia and New Zealand Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Australia and New Zealand Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Australia and New Zealand Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Latin America Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 37: Latin America Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 38: Latin America Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Latin America Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Latin America Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Data Preparation Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 43: Middle East and Africa Data Preparation Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Middle East and Africa Data Preparation Analytics Industry Revenue (Million), by Enterprise Size 2025 & 2033

- Figure 45: Middle East and Africa Data Preparation Analytics Industry Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 46: Middle East and Africa Data Preparation Analytics Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 47: Middle East and Africa Data Preparation Analytics Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 48: Middle East and Africa Data Preparation Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Data Preparation Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 3: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Data Preparation Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 7: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 11: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 15: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 19: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 23: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Data Preparation Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 26: Global Data Preparation Analytics Industry Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 27: Global Data Preparation Analytics Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Data Preparation Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Preparation Analytics Industry?

The projected CAGR is approximately 18.74%.

2. Which companies are prominent players in the Data Preparation Analytics Industry?

Key companies in the market include SAS Institute Inc, Unifi Software Inc, IBM Corporation, Microstrategy Inc, Paxata Inc, ClearStory Data Inc, Alteryx Inc, Oracle Corporation*List Not Exhaustive, Rapid Insight Inc, Informatica LLC, Tableau Software LLC (Salesforce com Inc ), SAP SE, Qlik Technologies Inc QlikTech International AB.

3. What are the main segments of the Data Preparation Analytics Industry?

The market segments include Deployment, Enterprise Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Self-service Data Preparation Tools; Increasing Demand for Data Analytics.

6. What are the notable trends driving market growth?

IT and Telecom Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Limited Budgets and Low Investments owing to Complexities and Associated Risks..

8. Can you provide examples of recent developments in the market?

December 2022: Alteryx, Inc., the Analytics Automation company, announced a strategic investment in MANTA, the data lineage company. MANTA enables businesses to achieve complete visibility into the most complex data environments. With this investment from Alteryx Ventures, the company can bolster product innovation, expand its partner ecosystem, and grow in key markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Preparation Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Preparation Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Preparation Analytics Industry?

To stay informed about further developments, trends, and reports in the Data Preparation Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence