Key Insights

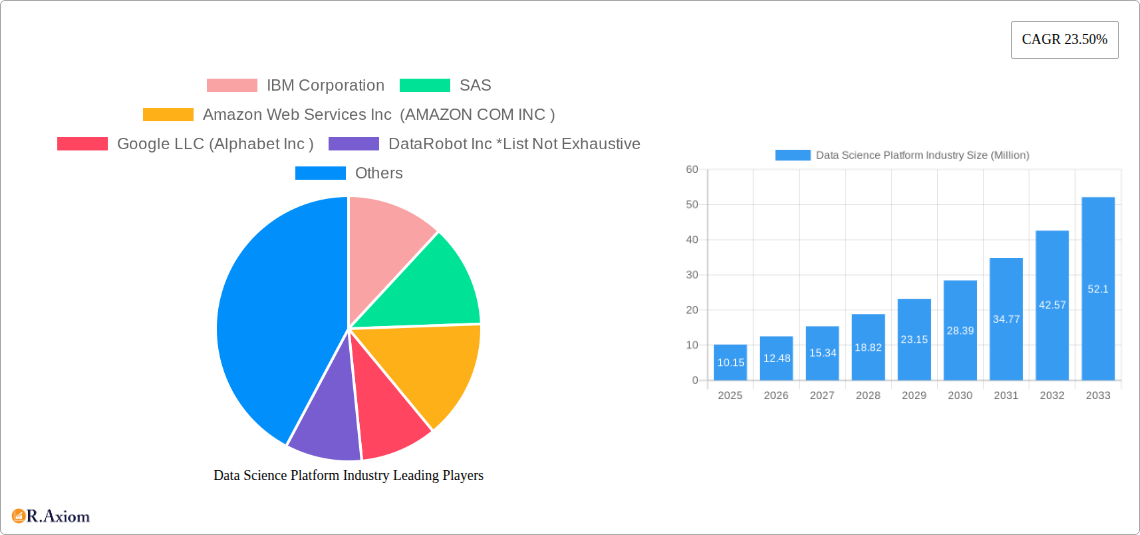

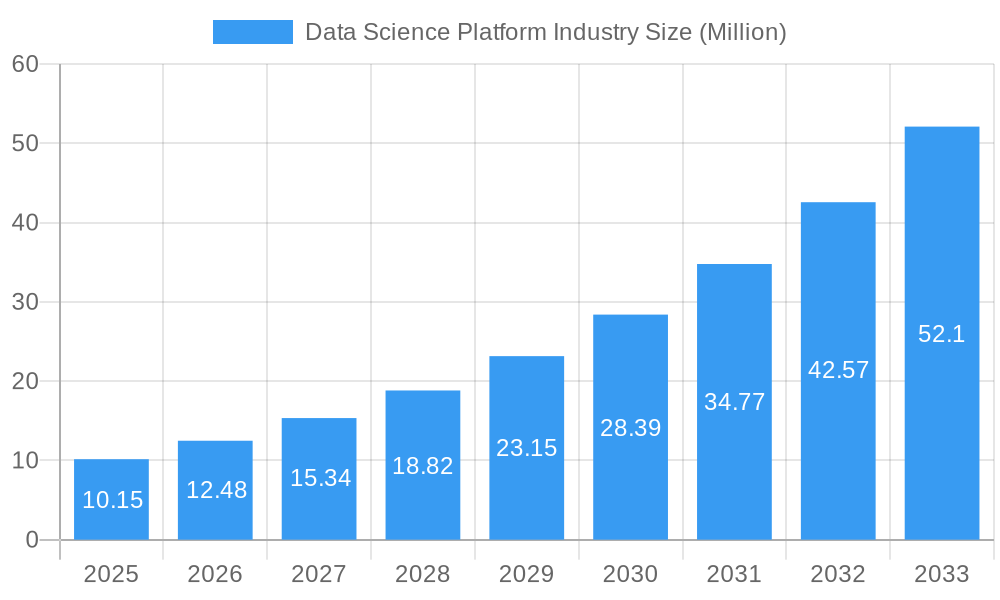

The global Data Science Platform market is poised for remarkable expansion, with an estimated market size of $10.15 million in the base year of 2025 and a projected Compound Annual Growth Rate (CAGR) of an impressive 23.50% through to 2033. This rapid ascent is primarily fueled by the escalating need for businesses across all sectors to derive actionable insights from vast and ever-growing datasets. Key drivers include the increasing adoption of AI and machine learning technologies, the growing demand for predictive analytics in decision-making, and the imperative for organizations to enhance operational efficiency and gain a competitive edge. The platform segment is expected to lead growth, offering integrated solutions for data preparation, model building, deployment, and management, thereby democratizing data science capabilities. Furthermore, the shift towards cloud-based deployments will significantly contribute to market expansion, offering scalability, cost-effectiveness, and enhanced accessibility for enterprises of all sizes.

Data Science Platform Industry Market Size (In Million)

The market's growth trajectory will also be shaped by a strong emphasis on advanced analytics and the democratization of data science tools. Small and medium-sized enterprises (SMEs) are increasingly embracing these platforms to level the playing field with larger corporations, leveraging them for everything from customer behavior analysis to risk management. Vertically, IT and Telecom, BFSI, and Retail and E-commerce are anticipated to be major adoption hubs due to their data-intensive nature and reliance on sophisticated analytics for personalized services and fraud detection. While the market demonstrates robust growth, potential restraints may include the complexity of integration with existing legacy systems and the ongoing need for skilled data science professionals. However, the continuous innovation by key players like IBM Corporation, Amazon Web Services, Google LLC, and Microsoft Corporation in developing user-friendly and comprehensive platforms is expected to mitigate these challenges and further accelerate market penetration.

Data Science Platform Industry Company Market Share

This in-depth report provides a comprehensive analysis of the global Data Science Platform Industry, offering critical insights into market dynamics, growth drivers, emerging trends, and competitive landscapes. Leveraging historical data from 2019-2024 and projecting forward to 2033, with a base year of 2025 and an estimated year also of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving data science ecosystem. We delve into market concentration, technological innovations, segment-specific performance, and strategic initiatives from leading players. The study period covers 2019 through 2033, with a forecast period of 2025–2033.

Data Science Platform Industry Market Concentration & Innovation

The Data Science Platform Industry exhibits a dynamic market concentration, characterized by the presence of both established giants and agile innovators. Key innovation drivers include the rapid advancement of artificial intelligence (AI) and machine learning (ML) algorithms, the increasing demand for predictive analytics, and the proliferation of big data. Regulatory frameworks, particularly around data privacy and security, are shaping platform development and deployment strategies. Product substitutes, such as specialized analytical tools and cloud-based ML services, are constantly emerging, pushing platform providers to offer integrated, end-to-end solutions. End-user trends are heavily influenced by the need for actionable insights from vast datasets, leading to a growing preference for user-friendly, low-code/no-code platforms. Mergers and acquisitions (M&A) activity remains a significant factor, with an estimated XX billion USD in deal values during the historical period, driven by the desire for market consolidation and the acquisition of specialized technologies. Key players are focusing on enhancing their platform capabilities to address the growing demand for AI-powered decision-making across various industry verticals.

- Market Share: Leading companies hold significant but diverse market shares, reflecting the competitive intensity.

- M&A Deal Values: Strategic acquisitions are bolstering market consolidation and technological integration, with estimated deal values reaching XX billion USD.

- Innovation Drivers: AI/ML advancements, big data analytics, and demand for predictive insights.

- Regulatory Impact: Data privacy (e.g., GDPR, CCPA) and security standards influence platform design.

- End-User Preferences: Shift towards intuitive interfaces and integrated analytics workflows.

Data Science Platform Industry Industry Trends & Insights

The Data Science Platform Industry is experiencing robust growth, driven by an escalating need for data-driven decision-making across virtually every sector. The Compound Annual Growth Rate (CAGR) is projected to be XX% during the forecast period (2025-2033). This surge is propelled by the democratization of data science, enabling a wider array of users to leverage sophisticated analytical tools without deep technical expertise. Technological disruptions, particularly in the realm of generative AI (GenAI) and large language models (LLMs), are revolutionizing how data is analyzed and how insights are generated. These advancements are enabling the creation of more sophisticated predictive models, advanced natural language processing capabilities, and automated content generation, all within data science platforms. Consumer preferences are increasingly leaning towards platforms that offer seamless integration, scalability, and ease of use, allowing for faster deployment of AI/ML models from experimentation to production. The competitive dynamics are intense, with established technology giants and specialized startups vying for market share by continuously innovating their offerings and expanding their service portfolios. Market penetration is deepening as more small and medium-sized enterprises (SMEs) adopt data science solutions to gain a competitive edge. The growing volume and complexity of data generated by businesses worldwide necessitate powerful and efficient data science platforms to extract meaningful value. This includes enhanced capabilities for data preparation, model building, deployment, and monitoring, all crucial for deriving actionable intelligence and driving business outcomes.

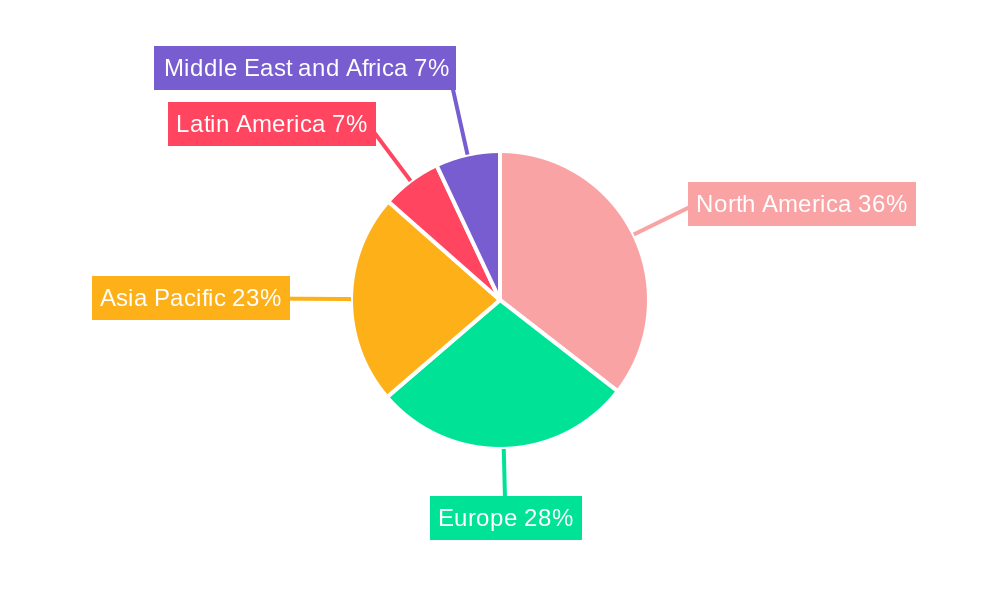

Dominant Markets & Segments in Data Science Platform Industry

The Data Science Platform Industry is characterized by significant regional dominance and segment-specific growth. North America, driven by its strong technological infrastructure, a high concentration of AI/ML research and development, and a mature business ecosystem, currently holds the leading market share. Within North America, the United States remains the most significant country due to its large enterprise adoption and innovation hubs.

- Offering: The Platform segment is anticipated to dominate, accounting for an estimated XX% of the market revenue in 2025, due to its comprehensive suite of tools for the entire data science lifecycle. The Services segment, including consulting and implementation, will also witness substantial growth, driven by the need for specialized expertise.

- Deployment: Cloud deployment is expected to lead, capturing approximately XX% of the market, owing to its scalability, flexibility, and cost-effectiveness. On-premise solutions will continue to cater to industries with stringent data sovereignty requirements.

- Size of Enterprises: Large Enterprises currently represent the largest market share, driven by their substantial data volumes and sophisticated analytics needs. However, Small and Medium Enterprises (SMEs) are rapidly increasing their adoption, projected to contribute XX% to market growth due to the availability of more accessible and affordable solutions.

- Industry Vertical:

- IT and Telecom will continue to be a dominant vertical, leveraging data science for network optimization, customer churn prediction, and personalized services, projected to account for XX% of the market.

- BFSI is another major segment, utilizing data science for fraud detection, risk management, algorithmic trading, and customer segmentation, with an estimated XX% market share.

- Retail and E-commerce will see significant expansion, driven by demand for personalized recommendations, inventory management, and supply chain optimization, contributing XX% to the market.

- Manufacturing will increasingly adopt data science for predictive maintenance, quality control, and process optimization.

- Oil, Gas and Energy will utilize data science for exploration, production optimization, and resource management.

- Government and Defense will leverage data science for intelligence, security, and public service delivery.

- Other Industry Verticals are also showing strong adoption trends, indicating the pervasive applicability of data science platforms.

Key drivers for dominance in these segments include government initiatives supporting digital transformation, robust IT infrastructure, availability of skilled talent, and a strong research and development ecosystem.

Data Science Platform Industry Product Developments

Recent product developments in the Data Science Platform Industry are heavily focused on integrating advanced AI capabilities, enhancing user experience, and improving model operationalization. Platforms are increasingly incorporating generative AI features for automated code generation, data augmentation, and report summarization. Emphasis is being placed on democratizing AI through low-code/no-code interfaces, enabling citizen data scientists to build and deploy models. Furthermore, advancements in MLOps (Machine Learning Operations) are enabling more robust model monitoring, management, and retraining pipelines, ensuring that deployed models remain accurate and relevant. Competitive advantages are being built around comprehensive end-to-end solutions that cover the entire data science lifecycle, from data ingestion and preparation to model deployment and governance.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Data Science Platform Industry across several key segments to provide a granular understanding of market dynamics. The segmentation includes:

- Offering: The market is divided into Platform solutions, encompassing integrated environments for data science tasks, and Services, which include consulting, implementation, and managed services. The Platform segment is expected to grow at a CAGR of XX% from 2025-2033, while Services will grow at XX%.

- Deployment: We analyze both On-premise deployments, catering to organizations with strict data control needs, and Cloud deployments, which dominate due to flexibility and scalability. Cloud deployment is projected to achieve a market size of XX Million USD by 2033.

- Size of Enterprises: The report differentiates between Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are showing a higher growth rate of XX% due to increasing adoption of scalable and cost-effective solutions.

- Industry Vertical: A detailed breakdown of key verticals including IT and Telecom, BFSI, Retail and E-commerce, Oil Gas and Energy, Manufacturing, Government and Defense, and Other Industry Verticals is provided. The IT and Telecom sector is expected to maintain its leading position with a market share of XX% by 2033.

Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined to provide actionable insights for strategic planning.

Key Drivers of Data Science Platform Industry Growth

The Data Science Platform Industry is fueled by a confluence of powerful growth drivers. The exponential increase in data generation across all sectors is a primary catalyst, necessitating advanced tools for analysis and insight extraction. The rapid advancements in Artificial Intelligence and Machine Learning technologies are enabling more sophisticated analytics and predictive capabilities, directly boosting demand for platforms that can harness these innovations. Economic factors, such as the pursuit of operational efficiency and competitive advantage through data-driven strategies, are significant. Furthermore, supportive government initiatives promoting digital transformation and innovation in AI research are creating a fertile ground for market expansion. The increasing availability of cloud computing resources also lowers the barrier to entry for data science solutions, making them accessible to a broader range of businesses.

Challenges in the Data Science Platform Industry Sector

Despite its robust growth, the Data Science Platform Industry faces several challenges. A significant hurdle is the shortage of skilled data scientists and AI/ML engineers, which can impede the adoption and effective utilization of complex platforms. Regulatory hurdles, particularly concerning data privacy and security compliance (e.g., GDPR, CCPA), require constant adaptation and can add complexity to platform development and deployment. Supply chain issues, though less pronounced for software, can impact the hardware components supporting large-scale AI deployments. Competitive pressures are intense, with a crowded market leading to price wars and the need for continuous innovation to maintain differentiation. Ensuring data quality and governance across disparate data sources remains a persistent challenge for many organizations, impacting the reliability of their data science initiatives.

Emerging Opportunities in Data Science Platform Industry

The Data Science Platform Industry is ripe with emerging opportunities. The burgeoning field of Generative AI (GenAI) presents a transformative opportunity, with platforms integrating GenAI capabilities for automated content creation, code generation, and enhanced natural language understanding. The increasing demand for Explainable AI (XAI) and Ethical AI solutions is creating a market for platforms that prioritize transparency and fairness in algorithmic decision-making. The growing adoption of edge AI, where data is processed closer to the source, opens new avenues for specialized data science platforms. Furthermore, the expanding market for AI-as-a-Service (AIaaS) provides opportunities for cloud providers and specialized vendors to offer pre-trained models and AI functionalities, further democratizing access to advanced analytics. The need for robust MLOps solutions to streamline the deployment and management of AI models in production environments also represents a significant growth area.

Leading Players in the Data Science Platform Industry Market

- IBM Corporation

- SAS

- Amazon Web Services Inc

- Google LLC

- DataRobot Inc

- Microsoft Corporation

- Alteryx

- The MathWorks Inc

- Databricks

- RapidMiner

Key Developments in Data Science Platform Industry Industry

- November 2023: Stagwell announced a partnership with Google Cloud and SADA, a Google Cloud premier partner, to develop generative AI (gen AI) marketing solutions that support Stagwell agencies, client partners, and product development within the Stagwell Marketing Cloud (SMC). The partnership will help in harnessing data analytics and insights by developing and training a proprietary Stagwell large language model (LLM) purpose-built for Stagwell clients, productizing data assets via APIs to create new digital experiences for brands, and multiplying the value of their first-party data ecosystems to drive new revenue streams using Vertex AI and open source-based models.

- May 2023: IBM launched a new AI and data platform, watsonx, it is aimed at allowing businesses to accelerate advanced AI usage with trusted data, speed and governance. IBM also introduced GPU-as-a-service, which is designed to support AI intensive workloads, with an AI dashboard to measure, track and help report on cloud carbon emissions. With watsonx, IBM offers an AI development studio with access to IBM curated and trained foundation models and open-source models, access to a data store to gather and clean up training and tune data.

These developments highlight a strong industry trend towards integrating generative AI, enhancing cloud-based AI services, and offering comprehensive platforms for accelerated AI adoption with governance and ethical considerations.

Strategic Outlook for Data Science Platform Industry Market

The strategic outlook for the Data Science Platform Industry remains highly optimistic, with continued robust growth projected. The increasing integration of AI and ML across all business functions will drive sustained demand for sophisticated data science platforms. Key growth catalysts include the expanding adoption of cloud-native solutions, the rise of citizen data scientists empowered by user-friendly interfaces, and the continuous evolution of AI technologies like generative AI and explainable AI. Strategic partnerships and mergers & acquisitions will continue to shape the market landscape, fostering innovation and consolidation. Companies that can offer end-to-end solutions, prioritize data governance and ethical AI practices, and adapt quickly to emerging technological trends are well-positioned for success. The industry's ability to translate complex data into actionable business intelligence will be paramount for unlocking future market potential.

Data Science Platform Industry Segmentation

-

1. Offering

- 1.1. Platform

- 1.2. Services

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. Size of Enterprises

- 3.1. Small and Medium Enterprises

- 3.2. Large Enterprises

-

4. Industry Vertical

- 4.1. IT and Telecom

- 4.2. BFSI

- 4.3. Retail and E-commerce

- 4.4. Oil Gas and Energy

- 4.5. Manufacturing

- 4.6. Government and Defense

- 4.7. Other Industry Verticals

Data Science Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Greece

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Southeast Asia

- 4. Indonesia

- 5. Philippines

- 6. Malaysia

- 7. Singapore

-

8. Rest of Southeast Asia

- 8.1. Rest of Asia Pacific

-

9. Latin America

- 9.1. Brazil

- 9.2. Argentina

- 9.3. Mexico

- 9.4. Rest of Latin America

-

10. Middle East and Africa

- 10.1. Saudi Arabia

- 10.2. GCC

- 11. United Arab Emirates

-

12. Rest of GCC

- 12.1. South Africa

- 12.2. Rest of Middle East and Africa

Data Science Platform Industry Regional Market Share

Geographic Coverage of Data Science Platform Industry

Data Science Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Big Data; Emerging Promising Use Cases of Data Science and Machine Learning; Shift of Organizations Toward Data-intensive Approach and Decisions

- 3.3. Market Restrains

- 3.3.1. Lack of Skillset in Workforce; Data Security and Reliability Concerns

- 3.4. Market Trends

- 3.4.1. Small and Medium Enterprises to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Platform

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.4.1. IT and Telecom

- 5.4.2. BFSI

- 5.4.3. Retail and E-commerce

- 5.4.4. Oil Gas and Energy

- 5.4.5. Manufacturing

- 5.4.6. Government and Defense

- 5.4.7. Other Industry Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Indonesia

- 5.5.5. Philippines

- 5.5.6. Malaysia

- 5.5.7. Singapore

- 5.5.8. Rest of Southeast Asia

- 5.5.9. Latin America

- 5.5.10. Middle East and Africa

- 5.5.11. United Arab Emirates

- 5.5.12. Rest of GCC

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Platform

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.4.1. IT and Telecom

- 6.4.2. BFSI

- 6.4.3. Retail and E-commerce

- 6.4.4. Oil Gas and Energy

- 6.4.5. Manufacturing

- 6.4.6. Government and Defense

- 6.4.7. Other Industry Verticals

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Platform

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.4.1. IT and Telecom

- 7.4.2. BFSI

- 7.4.3. Retail and E-commerce

- 7.4.4. Oil Gas and Energy

- 7.4.5. Manufacturing

- 7.4.6. Government and Defense

- 7.4.7. Other Industry Verticals

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Platform

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.4.1. IT and Telecom

- 8.4.2. BFSI

- 8.4.3. Retail and E-commerce

- 8.4.4. Oil Gas and Energy

- 8.4.5. Manufacturing

- 8.4.6. Government and Defense

- 8.4.7. Other Industry Verticals

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Indonesia Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Platform

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.4.1. IT and Telecom

- 9.4.2. BFSI

- 9.4.3. Retail and E-commerce

- 9.4.4. Oil Gas and Energy

- 9.4.5. Manufacturing

- 9.4.6. Government and Defense

- 9.4.7. Other Industry Verticals

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Philippines Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Platform

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.4.1. IT and Telecom

- 10.4.2. BFSI

- 10.4.3. Retail and E-commerce

- 10.4.4. Oil Gas and Energy

- 10.4.5. Manufacturing

- 10.4.6. Government and Defense

- 10.4.7. Other Industry Verticals

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Malaysia Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 11.1.1. Platform

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 11.3.1. Small and Medium Enterprises

- 11.3.2. Large Enterprises

- 11.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 11.4.1. IT and Telecom

- 11.4.2. BFSI

- 11.4.3. Retail and E-commerce

- 11.4.4. Oil Gas and Energy

- 11.4.5. Manufacturing

- 11.4.6. Government and Defense

- 11.4.7. Other Industry Verticals

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 12. Singapore Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 12.1.1. Platform

- 12.1.2. Services

- 12.2. Market Analysis, Insights and Forecast - by Deployment

- 12.2.1. On-premise

- 12.2.2. Cloud

- 12.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 12.3.1. Small and Medium Enterprises

- 12.3.2. Large Enterprises

- 12.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 12.4.1. IT and Telecom

- 12.4.2. BFSI

- 12.4.3. Retail and E-commerce

- 12.4.4. Oil Gas and Energy

- 12.4.5. Manufacturing

- 12.4.6. Government and Defense

- 12.4.7. Other Industry Verticals

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 13. Rest of Southeast Asia Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Offering

- 13.1.1. Platform

- 13.1.2. Services

- 13.2. Market Analysis, Insights and Forecast - by Deployment

- 13.2.1. On-premise

- 13.2.2. Cloud

- 13.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 13.3.1. Small and Medium Enterprises

- 13.3.2. Large Enterprises

- 13.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 13.4.1. IT and Telecom

- 13.4.2. BFSI

- 13.4.3. Retail and E-commerce

- 13.4.4. Oil Gas and Energy

- 13.4.5. Manufacturing

- 13.4.6. Government and Defense

- 13.4.7. Other Industry Verticals

- 13.1. Market Analysis, Insights and Forecast - by Offering

- 14. Latin America Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Offering

- 14.1.1. Platform

- 14.1.2. Services

- 14.2. Market Analysis, Insights and Forecast - by Deployment

- 14.2.1. On-premise

- 14.2.2. Cloud

- 14.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 14.3.1. Small and Medium Enterprises

- 14.3.2. Large Enterprises

- 14.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 14.4.1. IT and Telecom

- 14.4.2. BFSI

- 14.4.3. Retail and E-commerce

- 14.4.4. Oil Gas and Energy

- 14.4.5. Manufacturing

- 14.4.6. Government and Defense

- 14.4.7. Other Industry Verticals

- 14.1. Market Analysis, Insights and Forecast - by Offering

- 15. Middle East and Africa Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Offering

- 15.1.1. Platform

- 15.1.2. Services

- 15.2. Market Analysis, Insights and Forecast - by Deployment

- 15.2.1. On-premise

- 15.2.2. Cloud

- 15.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 15.3.1. Small and Medium Enterprises

- 15.3.2. Large Enterprises

- 15.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 15.4.1. IT and Telecom

- 15.4.2. BFSI

- 15.4.3. Retail and E-commerce

- 15.4.4. Oil Gas and Energy

- 15.4.5. Manufacturing

- 15.4.6. Government and Defense

- 15.4.7. Other Industry Verticals

- 15.1. Market Analysis, Insights and Forecast - by Offering

- 16. United Arab Emirates Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Offering

- 16.1.1. Platform

- 16.1.2. Services

- 16.2. Market Analysis, Insights and Forecast - by Deployment

- 16.2.1. On-premise

- 16.2.2. Cloud

- 16.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 16.3.1. Small and Medium Enterprises

- 16.3.2. Large Enterprises

- 16.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 16.4.1. IT and Telecom

- 16.4.2. BFSI

- 16.4.3. Retail and E-commerce

- 16.4.4. Oil Gas and Energy

- 16.4.5. Manufacturing

- 16.4.6. Government and Defense

- 16.4.7. Other Industry Verticals

- 16.1. Market Analysis, Insights and Forecast - by Offering

- 17. Rest of GCC Data Science Platform Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - by Offering

- 17.1.1. Platform

- 17.1.2. Services

- 17.2. Market Analysis, Insights and Forecast - by Deployment

- 17.2.1. On-premise

- 17.2.2. Cloud

- 17.3. Market Analysis, Insights and Forecast - by Size of Enterprises

- 17.3.1. Small and Medium Enterprises

- 17.3.2. Large Enterprises

- 17.4. Market Analysis, Insights and Forecast - by Industry Vertical

- 17.4.1. IT and Telecom

- 17.4.2. BFSI

- 17.4.3. Retail and E-commerce

- 17.4.4. Oil Gas and Energy

- 17.4.5. Manufacturing

- 17.4.6. Government and Defense

- 17.4.7. Other Industry Verticals

- 17.1. Market Analysis, Insights and Forecast - by Offering

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 IBM Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 SAS

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Amazon Web Services Inc (AMAZON COM INC )

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Google LLC (Alphabet Inc )

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 DataRobot Inc *List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Microsoft Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Alteryx

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 The MathWorks Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Databricks

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 RapidMiner

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 IBM Corporation

List of Figures

- Figure 1: Global Data Science Platform Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 7: North America Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 8: North America Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 9: North America Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 10: North America Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 13: Europe Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 14: Europe Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 17: Europe Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 18: Europe Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 19: Europe Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 20: Europe Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 23: Asia Pacific Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 24: Asia Pacific Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 27: Asia Pacific Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 28: Asia Pacific Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 29: Asia Pacific Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 30: Asia Pacific Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Indonesia Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 33: Indonesia Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 34: Indonesia Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Indonesia Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Indonesia Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 37: Indonesia Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 38: Indonesia Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 39: Indonesia Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 40: Indonesia Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Indonesia Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 43: Philippines Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 44: Philippines Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 45: Philippines Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Philippines Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 47: Philippines Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 48: Philippines Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 49: Philippines Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 50: Philippines Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Philippines Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Malaysia Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 53: Malaysia Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 54: Malaysia Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 55: Malaysia Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 56: Malaysia Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 57: Malaysia Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 58: Malaysia Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 59: Malaysia Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 60: Malaysia Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Malaysia Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Singapore Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 63: Singapore Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 64: Singapore Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 65: Singapore Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 66: Singapore Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 67: Singapore Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 68: Singapore Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 69: Singapore Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 70: Singapore Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 71: Singapore Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 72: Rest of Southeast Asia Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 73: Rest of Southeast Asia Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 74: Rest of Southeast Asia Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 75: Rest of Southeast Asia Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 76: Rest of Southeast Asia Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 77: Rest of Southeast Asia Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 78: Rest of Southeast Asia Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 79: Rest of Southeast Asia Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 80: Rest of Southeast Asia Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 81: Rest of Southeast Asia Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 83: Latin America Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 84: Latin America Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 85: Latin America Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 86: Latin America Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 87: Latin America Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 88: Latin America Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 89: Latin America Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 90: Latin America Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 91: Latin America Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 92: Middle East and Africa Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 93: Middle East and Africa Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 94: Middle East and Africa Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 95: Middle East and Africa Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 96: Middle East and Africa Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 97: Middle East and Africa Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 98: Middle East and Africa Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 99: Middle East and Africa Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 100: Middle East and Africa Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 101: Middle East and Africa Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: United Arab Emirates Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 103: United Arab Emirates Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 104: United Arab Emirates Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 105: United Arab Emirates Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 106: United Arab Emirates Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 107: United Arab Emirates Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 108: United Arab Emirates Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 109: United Arab Emirates Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 110: United Arab Emirates Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 111: United Arab Emirates Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 112: Rest of GCC Data Science Platform Industry Revenue (Million), by Offering 2025 & 2033

- Figure 113: Rest of GCC Data Science Platform Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 114: Rest of GCC Data Science Platform Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 115: Rest of GCC Data Science Platform Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 116: Rest of GCC Data Science Platform Industry Revenue (Million), by Size of Enterprises 2025 & 2033

- Figure 117: Rest of GCC Data Science Platform Industry Revenue Share (%), by Size of Enterprises 2025 & 2033

- Figure 118: Rest of GCC Data Science Platform Industry Revenue (Million), by Industry Vertical 2025 & 2033

- Figure 119: Rest of GCC Data Science Platform Industry Revenue Share (%), by Industry Vertical 2025 & 2033

- Figure 120: Rest of GCC Data Science Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 121: Rest of GCC Data Science Platform Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 4: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 5: Global Data Science Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 9: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 10: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 14: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 16: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 17: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Greece Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 26: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 27: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 28: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 29: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: China Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Southeast Asia Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 36: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 37: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 38: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 39: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 41: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 42: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 43: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 44: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 45: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 46: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 47: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 48: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 49: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 51: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 52: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 53: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 54: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 55: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 56: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 57: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 58: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 59: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Rest of Asia Pacific Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 62: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 63: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 64: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 65: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Brazil Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: Argentina Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Mexico Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 69: Rest of Latin America Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 71: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 72: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 73: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 74: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 75: Saudi Arabia Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 77: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 78: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 79: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 80: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 81: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 82: Global Data Science Platform Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 83: Global Data Science Platform Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 84: Global Data Science Platform Industry Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 85: Global Data Science Platform Industry Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 86: Global Data Science Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 87: South Africa Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Rest of Middle East and Africa Data Science Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Science Platform Industry?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the Data Science Platform Industry?

Key companies in the market include IBM Corporation, SAS, Amazon Web Services Inc (AMAZON COM INC ), Google LLC (Alphabet Inc ), DataRobot Inc *List Not Exhaustive, Microsoft Corporation, Alteryx, The MathWorks Inc, Databricks, RapidMiner.

3. What are the main segments of the Data Science Platform Industry?

The market segments include Offering, Deployment, Size of Enterprises, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Big Data; Emerging Promising Use Cases of Data Science and Machine Learning; Shift of Organizations Toward Data-intensive Approach and Decisions.

6. What are the notable trends driving market growth?

Small and Medium Enterprises to Witness Major Growth.

7. Are there any restraints impacting market growth?

Lack of Skillset in Workforce; Data Security and Reliability Concerns.

8. Can you provide examples of recent developments in the market?

November 2023 - Stagwell announced a partnership with Google Cloud and SADA, a Google Cloud premier partner, to develop generative AI (gen AI) marketing solutions that support Stagwell agencies, client partners, and product development within the Stagwell Marketing Cloud (SMC). The partnership will help in harnessing data analytics and insights by developing and training a proprietary Stagwell large language model (LLM) purpose-built for Stagwell clients, productizing data assets via APIs to create new digital experiences for brands, and multiplying the value of their first-party data ecosystems to drive new revenue streams using Vertex AI and open source-based models.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Science Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Science Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Science Platform Industry?

To stay informed about further developments, trends, and reports in the Data Science Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence