Key Insights

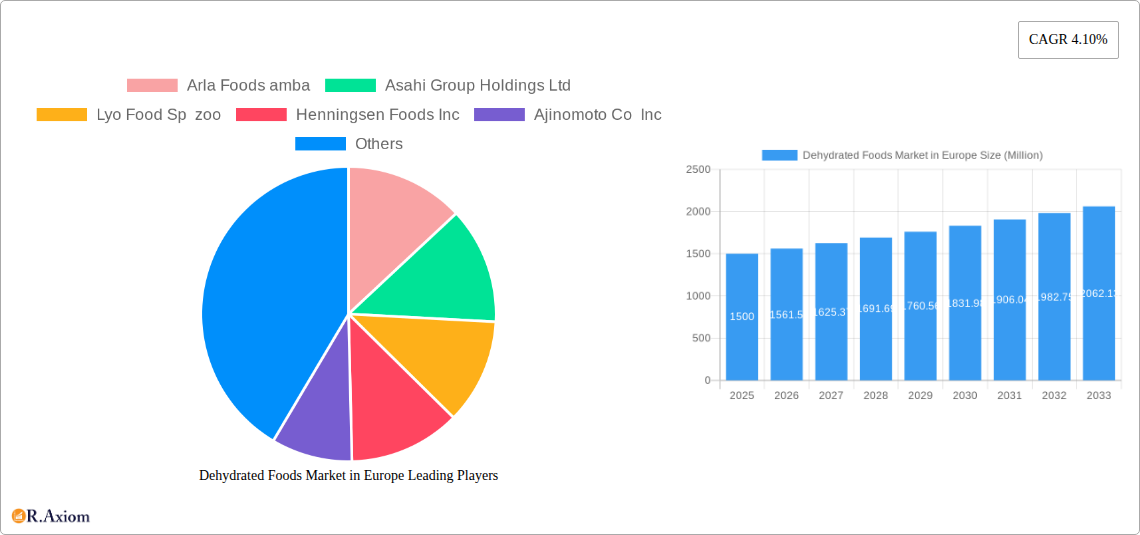

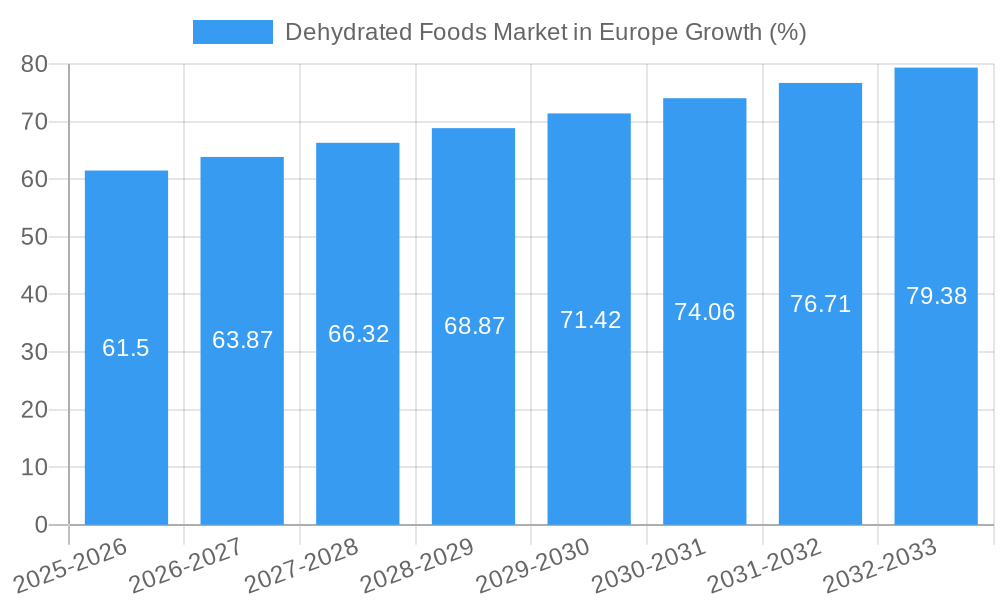

The European dehydrated foods market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for convenient and shelf-stable food products fuels the market's growth, particularly among busy consumers and single-person households. Health-conscious consumers are also driving demand for dehydrated fruits and vegetables as a healthy and nutritious snack option. Furthermore, the rise in the food processing industry and advancements in dehydration technologies are contributing to the market's expansion. The market is segmented by type (freeze-dried, spray-dried, vacuum-dried, sun-dried, and others), product (dairy products, vegetables & fruits, meat & seafood, and others), and distribution channel (supermarkets/hypermarkets, convenience stores, online retailing, and others). The dominance of specific segments varies based on consumer preferences and regional nuances. For instance, freeze-dried products often command a premium price point, reflecting their superior quality and longer shelf life. Meanwhile, online retailing is expected to witness significant growth, driven by the increasing adoption of e-commerce platforms and home delivery services.

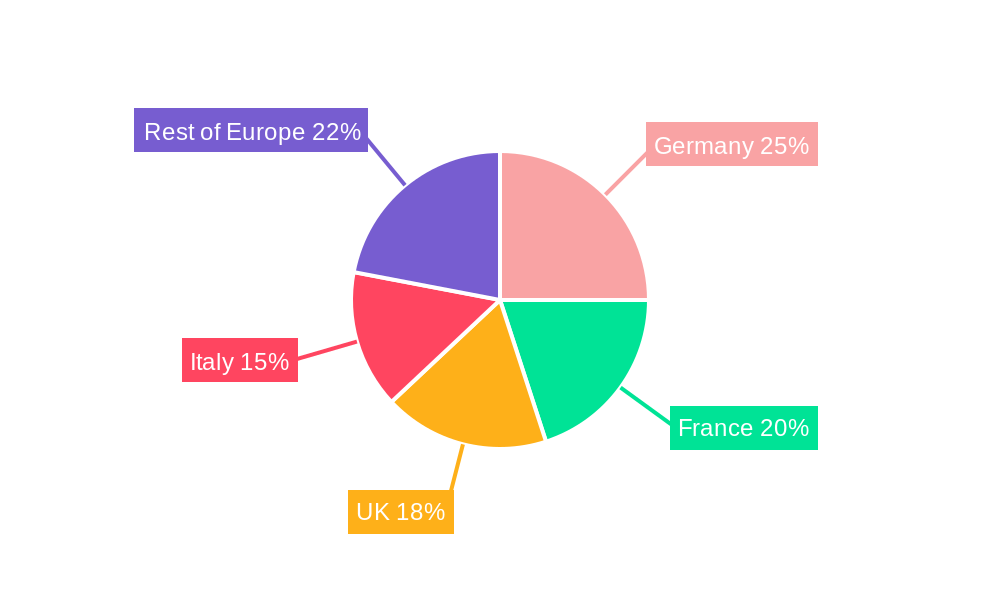

Geographical variations exist within the European market. Countries like Germany, France, the United Kingdom, and Italy are major contributors due to their large populations, developed food retail infrastructure, and considerable consumer spending power. However, growth potential is also evident in other European nations. While the report focuses on Europe, the market is subject to global factors such as fluctuating raw material prices and evolving consumer preferences for sustainable and ethically sourced products, which present both challenges and opportunities for market participants. Key players, including Arla Foods amba, Asahi Group Holdings Ltd, and Nestle S.A., are actively engaged in innovation, product diversification, and strategic partnerships to maintain their competitive edge and capitalize on the market's growth potential. The competitive landscape is dynamic, featuring both established multinational corporations and smaller, specialized companies.

Dehydrated Foods Market in Europe: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Dehydrated Foods Market in Europe, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, challenges, and opportunities, enabling stakeholders to make informed strategic decisions. The report utilizes data from 2019-2024 as its historical period, 2025 as the base and estimated year, and projects the market's trajectory from 2025 to 2033. The market size is expressed in Millions throughout the report.

Dehydrated Foods Market in Europe Market Concentration & Innovation

This section analyzes the competitive landscape of the European dehydrated foods market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with a few major players holding significant market share. However, the presence of numerous smaller companies and regional players indicates a dynamic competitive environment.

Market Concentration: The top five players account for approximately xx% of the market share in 2025, indicating a moderately consolidated market. This concentration is expected to remain relatively stable during the forecast period, albeit with minor shifts due to M&A activities and new product launches.

Innovation Drivers: Key innovation drivers include advancements in drying technologies (e.g., freeze-drying, spray-drying), the development of novel dehydrated food products catering to specific dietary needs (e.g., organic, vegan), and the growing demand for convenient and shelf-stable food options.

Regulatory Frameworks: European Union food safety regulations significantly influence the market, requiring strict adherence to quality and labeling standards. These regulations drive innovation in food processing and packaging to ensure product safety and extend shelf life.

Product Substitutes: Fresh and frozen foods represent the primary substitutes for dehydrated foods. However, the convenience and extended shelf life of dehydrated foods provide a strong competitive advantage, especially in the context of busy lifestyles and the growing demand for convenient meal solutions.

End-User Trends: The rising popularity of health-conscious diets, increasing demand for convenient snacks, and the growth of the food service industry are major end-user trends driving market growth.

M&A Activities: Recent M&A activity, such as the Roha Group's acquisition of Saraf Foods in 2022, highlights the strategic importance of expanding product portfolios and technological capabilities within the sector. The deal value for this transaction was approximately xx Million. Further M&A activities are expected in the coming years, driven by companies seeking to consolidate their market position and expand their product offerings.

Dehydrated Foods Market in Europe Industry Trends & Insights

The European dehydrated foods market is experiencing robust growth, driven by a confluence of factors. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, exceeding the global average. This growth is fueled by several key trends:

- Increased Demand for Convenience: The fast-paced lifestyles of European consumers are driving demand for convenient, ready-to-eat meals and snacks, boosting the popularity of dehydrated food products.

- Technological Advancements: Innovations in drying technologies are improving product quality, texture, and nutritional value, making dehydrated foods more appealing to consumers.

- Health and Wellness Trends: The growing awareness of health and wellness is fueling demand for healthy and nutritious snacks, leading to the development of dehydrated foods with added nutritional benefits. The market penetration of organic and functional dehydrated foods is increasing significantly, reaching xx% in 2025.

- E-commerce Growth: The expansion of online retail channels is offering new avenues for dehydrated food manufacturers to reach consumers directly, further propelling market growth.

- Sustainable Consumption: The rise of environmentally conscious consumers is driving demand for sustainably produced dehydrated foods, prompting manufacturers to adopt eco-friendly packaging and sourcing practices.

Dominant Markets & Segments in Dehydrated Foods Market in Europe

The European dehydrated foods market is geographically diverse, with several countries and regions showing strong growth potential. Germany and the UK represent the most dominant markets in terms of consumption, driven by factors like higher disposable incomes and well-established food retail infrastructure.

Leading Segments:

- Type: Freeze-dried products dominate the market due to their superior quality and nutritional retention, capturing approximately xx% of the market share in 2025.

- Product: Vegetables and fruits constitute the largest product segment, driven by the growing consumer preference for healthy and convenient snack options. Meat and seafood products are also gaining traction, driven by the demand for convenient and shelf-stable protein sources.

- Distribution Channel: Supermarkets/hypermarkets represent the primary distribution channel, however, online retailing is experiencing rapid growth, with a projected market penetration of xx% by 2033.

Key Drivers for Dominant Segments:

- Economic Factors: High disposable incomes in certain regions drive demand for premium and convenient food options.

- Infrastructure: Well-established food retail infrastructure facilitates the distribution and reach of dehydrated food products.

- Consumer Preferences: Health-conscious consumers drive demand for specific product types like freeze-dried items and specific product categories such as vegetables and fruits.

Dehydrated Foods Market in Europe Product Developments

Recent product innovations in the European dehydrated foods market emphasize convenience, extended shelf life, and improved nutritional value. Freeze-dried garnishes for drinks, like those launched by Mixologist's Garden, showcase the expanding applications of this technology. The introduction of freeze-dried jackfruit highlights the versatility and potential for substituting traditional ingredients in various culinary applications. These developments reflect the ongoing technological advances and the market's responsiveness to consumer demands for innovative and convenient food options. Technological trends, like advanced drying methods and optimized packaging solutions, are key factors differentiating products and driving market growth.

Report Scope & Segmentation Analysis

This report segments the European dehydrated foods market based on several key parameters:

Type: Freeze-dried, Spray-dried, Vacuum-dried, Sun-dried, and Other Types. Each type exhibits unique characteristics and growth trajectories based on their properties, cost, and applications. Freeze-dried dominates due to its superior quality and nutritional preservation.

Product: Dairy Products, Vegetables and Fruits, Meat and Seafood, and Other Products. Growth is driven by the growing demand for convenience and healthy options across various food categories.

Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retailing, and Other Distribution Channels. The online retail channel is experiencing significant growth, driven by changing consumer behavior and improved e-commerce infrastructure. Market size and competitive dynamics are analyzed for each channel, showcasing evolving distribution strategies.

Each segment's growth projection is detailed within the report, providing a clear picture of market size, competitive dynamics, and future growth potential.

Key Drivers of Dehydrated Foods Market in Europe Growth

The European dehydrated foods market is propelled by several key factors:

- Technological advancements: Improved drying techniques and innovative packaging solutions enhance product quality, shelf life, and consumer appeal.

- Health-conscious consumers: Growing awareness of health and nutrition drives demand for convenient yet healthy options.

- Changing consumer lifestyles: Busy lifestyles and increasing demand for convenience food boosts consumption of ready-to-eat and ready-to-prepare products.

- Favorable regulatory environment: Stringent quality and safety regulations ensure product safety and consumer trust.

Challenges in the Dehydrated Foods Market in Europe Sector

Despite the positive growth outlook, several challenges hinder market expansion:

- Price volatility of raw materials: Fluctuations in agricultural commodity prices affect production costs and profitability.

- Supply chain disruptions: Global events and logistical challenges can disrupt the supply of raw materials and finished products, impacting market stability.

- Intense competition: A relatively large number of players, particularly in certain product segments, creates competitive pressure on margins and market share.

- Maintaining product quality: Ensuring consistent quality and sensory attributes across production batches poses significant challenges.

Emerging Opportunities in Dehydrated Foods Market in Europe

Several emerging trends present significant opportunities for growth:

- Demand for organic and sustainably sourced products: Consumers increasingly seek environmentally friendly and ethically produced food, offering opportunities for manufacturers to tap into this market segment.

- Development of functional dehydrated foods: Adding nutritional benefits, such as prebiotics or probiotics, can create premium products with a higher price point.

- Expansion into niche markets: Catering to specific dietary needs (e.g., vegan, gluten-free) unlocks new market segments and customer bases.

- Innovation in packaging: Eco-friendly and convenient packaging solutions improve shelf life and product presentation.

Leading Players in the Dehydrated Foods Market in Europe Market

- Arla Foods amba

- Asahi Group Holdings Ltd

- Lyo Food Sp zoo

- Henningsen Foods Inc

- Ajinomoto Co Inc

- Harmony House Foods Inc

- Thrive Foods

- European Freeze Dry

- Nestle S A

- Kanegrade Ltd

Key Developments in Dehydrated Foods Market in Europe Industry

- November 2022: Roha Group acquired Saraf Foods, expanding its technology and product portfolio in dehydrated vegetables, fruits, and herbs.

- August 2022: Mixologist's Garden launched freeze-dried garnishes in the UK, highlighting the expansion of applications for dehydrated products.

- February 2021: European Freeze Dry launched freeze-dried jackfruit, demonstrating the versatility of dehydrated ingredients.

Strategic Outlook for Dehydrated Foods Market in Europe Market

The European dehydrated foods market exhibits strong growth potential, driven by sustained demand for convenience, health-conscious options, and technological innovations. Continued expansion of online channels, the development of value-added products, and strategic M&A activity will further shape market dynamics. Manufacturers focusing on sustainability, product diversification, and technological innovation are poised to capture significant market share in the coming years. The market is expected to witness consistent growth, exceeding xx Million by 2033.

Dehydrated Foods Market in Europe Segmentation

-

1. Type

- 1.1. Freeze-dried

- 1.2. Spray-dried

- 1.3. Vacuum-dried

- 1.4. Sun-dried

- 1.5. Other Types

-

2. Product

- 2.1. Dairy Products

- 2.2. Vegetables and Fruits

- 2.3. Meat and Seafood

- 2.4. Other Products

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retailing

- 3.4. Other Distribution Channels

Dehydrated Foods Market in Europe Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

Dehydrated Foods Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Rising Demand for Freeze-dried Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Freeze-dried

- 5.1.2. Spray-dried

- 5.1.3. Vacuum-dried

- 5.1.4. Sun-dried

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Dairy Products

- 5.2.2. Vegetables and Fruits

- 5.2.3. Meat and Seafood

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retailing

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Russia

- 5.4.5. Italy

- 5.4.6. Spain

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Freeze-dried

- 6.1.2. Spray-dried

- 6.1.3. Vacuum-dried

- 6.1.4. Sun-dried

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Dairy Products

- 6.2.2. Vegetables and Fruits

- 6.2.3. Meat and Seafood

- 6.2.4. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Online Retailing

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Freeze-dried

- 7.1.2. Spray-dried

- 7.1.3. Vacuum-dried

- 7.1.4. Sun-dried

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Dairy Products

- 7.2.2. Vegetables and Fruits

- 7.2.3. Meat and Seafood

- 7.2.4. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Online Retailing

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Freeze-dried

- 8.1.2. Spray-dried

- 8.1.3. Vacuum-dried

- 8.1.4. Sun-dried

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Dairy Products

- 8.2.2. Vegetables and Fruits

- 8.2.3. Meat and Seafood

- 8.2.4. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Online Retailing

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Freeze-dried

- 9.1.2. Spray-dried

- 9.1.3. Vacuum-dried

- 9.1.4. Sun-dried

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Dairy Products

- 9.2.2. Vegetables and Fruits

- 9.2.3. Meat and Seafood

- 9.2.4. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Online Retailing

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Freeze-dried

- 10.1.2. Spray-dried

- 10.1.3. Vacuum-dried

- 10.1.4. Sun-dried

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Dairy Products

- 10.2.2. Vegetables and Fruits

- 10.2.3. Meat and Seafood

- 10.2.4. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Online Retailing

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Spain Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Freeze-dried

- 11.1.2. Spray-dried

- 11.1.3. Vacuum-dried

- 11.1.4. Sun-dried

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Dairy Products

- 11.2.2. Vegetables and Fruits

- 11.2.3. Meat and Seafood

- 11.2.4. Other Products

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets/Hypermarkets

- 11.3.2. Convenience Stores

- 11.3.3. Online Retailing

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Freeze-dried

- 12.1.2. Spray-dried

- 12.1.3. Vacuum-dried

- 12.1.4. Sun-dried

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Product

- 12.2.1. Dairy Products

- 12.2.2. Vegetables and Fruits

- 12.2.3. Meat and Seafood

- 12.2.4. Other Products

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Supermarkets/Hypermarkets

- 12.3.2. Convenience Stores

- 12.3.3. Online Retailing

- 12.3.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 14. France Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Italy Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Dehydrated Foods Market in Europe Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Arla Foods amba

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Asahi Group Holdings Ltd

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Lyo Food Sp zoo

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Henningsen Foods Inc

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Ajinomoto Co Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Harmony House Foods Inc

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Thrive Foods

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 European Freeze Dry

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Nestle S A *List Not Exhaustive

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Kanegrade Ltd

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Arla Foods amba

List of Figures

- Figure 1: Dehydrated Foods Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Dehydrated Foods Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Dehydrated Foods Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Dehydrated Foods Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Dehydrated Foods Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 20: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 24: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Dehydrated Foods Market in Europe Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Dehydrated Foods Market in Europe Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Dehydrated Foods Market in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Dehydrated Foods Market in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dehydrated Foods Market in Europe?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Dehydrated Foods Market in Europe?

Key companies in the market include Arla Foods amba, Asahi Group Holdings Ltd, Lyo Food Sp zoo, Henningsen Foods Inc, Ajinomoto Co Inc, Harmony House Foods Inc, Thrive Foods, European Freeze Dry, Nestle S A *List Not Exhaustive, Kanegrade Ltd.

3. What are the main segments of the Dehydrated Foods Market in Europe?

The market segments include Type, Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Rising Demand for Freeze-dried Food.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

In November 2022, Roha Group acquired Saraf Foods, a freeze-drying leader. With this acquisition, Roha further expanded its technology and product portfolio of dehydrated vegetables, fruits, and herbs in addition to its existing Newfoods plants in Italy. It added advanced technology like freeze-drying, air drying, and Individual Quick Freezing (IQF) of fruits, vegetables, spices, and herbs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dehydrated Foods Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dehydrated Foods Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dehydrated Foods Market in Europe?

To stay informed about further developments, trends, and reports in the Dehydrated Foods Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence