Key Insights

The Denmark Data Center Networking Market is poised for significant expansion, projected to reach USD 130 Million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 10.40% over the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for data processing and storage, driven by the burgeoning digital transformation across various sectors. Key sectors such as IT & Telecommunication, BFSI, and Government are leading this charge, investing heavily in advanced networking infrastructure to support cloud computing, big data analytics, and the Internet of Things (IoT). The increasing adoption of high-speed Ethernet switches and sophisticated routers is central to meeting these evolving demands, ensuring seamless data flow and enhanced network performance.

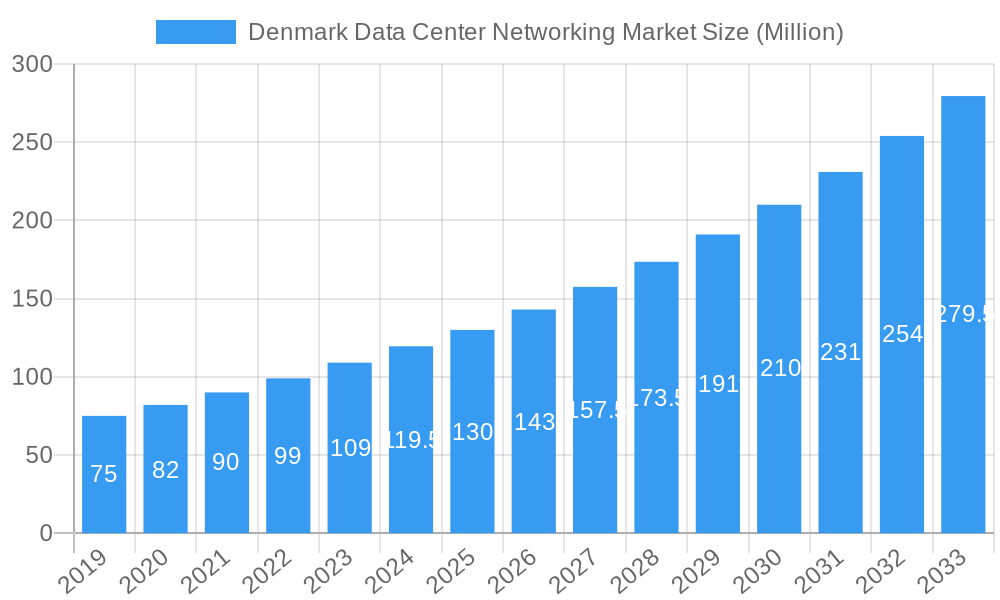

Denmark Data Center Networking Market Market Size (In Million)

Further impetus for market growth comes from the critical need for reliable and scalable data center operations. Trends such as the adoption of software-defined networking (SDN) and network function virtualization (NFV) are revolutionizing how data centers are managed, offering greater flexibility, automation, and cost efficiencies. The market also benefits from the continuous innovation in networking hardware, with companies like NVIDIA, Cisco Systems, and Arista Networks playing a pivotal role in introducing cutting-edge solutions. While the market experiences strong tailwinds, potential restraints such as the high initial investment costs for advanced networking equipment and the ongoing cybersecurity threats necessitate strategic planning and robust security measures to ensure sustained growth and user confidence in Denmark's data center ecosystem.

Denmark Data Center Networking Market Company Market Share

This detailed report provides an in-depth analysis of the Denmark Data Center Networking market, offering critical insights for stakeholders looking to capitalize on emerging opportunities within this dynamic sector. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period from 2025 to 2033, this study meticulously examines market size, segmentation, growth drivers, challenges, and competitive landscapes. With an estimated market value of [XX] Million in 2025, the Denmark Data Center Networking market is poised for significant expansion driven by increasing demand for robust and scalable data infrastructure.

Denmark Data Center Networking Market Market Concentration & Innovation

The Denmark Data Center Networking market exhibits a moderate level of concentration, with key players like Cisco Systems Inc., Arista Networks Inc., and IBM Corporation holding substantial market shares. Innovation is primarily driven by advancements in high-speed Ethernet switches, software-defined networking (SDN), and network function virtualization (NFV), crucial for supporting the growing data processing needs of businesses. Regulatory frameworks, particularly those concerning data privacy and security (e.g., GDPR), significantly influence networking strategies, encouraging investments in secure and compliant solutions. The availability of product substitutes, such as cloud-based networking solutions, presents a competitive challenge but also drives innovation towards more integrated and efficient on-premise and hybrid solutions. End-user trends highlight a growing preference for agile, scalable, and high-performance networks to support AI, big data analytics, and IoT deployments. Mergers and acquisition (M&A) activities, while not extensively documented in terms of specific deal values for Denmark, generally indicate a trend towards consolidation and strategic partnerships aimed at expanding technological capabilities and market reach. Key M&A deals in the global data center networking space often focus on acquiring advanced software platforms and specialized hardware for AI and cloud environments. The market share of leading players is estimated to be around [XX]% collectively.

Denmark Data Center Networking Market Industry Trends & Insights

The Denmark Data Center Networking market is experiencing robust growth, propelled by a confluence of technological advancements and evolving industry demands. The burgeoning adoption of cloud computing, the proliferation of big data analytics, and the increasing implementation of Artificial Intelligence (AI) and Machine Learning (ML) are fundamental drivers, necessitating sophisticated and high-capacity networking infrastructure. Data centers are constantly being upgraded to support these workloads, leading to higher demand for advanced Ethernet switches, routers, and specialized networking equipment. The compound annual growth rate (CAGR) for this market is projected to be approximately [XX]% over the forecast period. Furthermore, the growing emphasis on digital transformation across various sectors, including IT & Telecommunication, BFSI, and Government, is fueling the expansion of data center capabilities and, consequently, the demand for networking solutions. The rise of edge computing, driven by the need for low-latency processing of data generated by IoT devices and other real-time applications, also presents a significant growth opportunity, requiring decentralized yet interconnected networking architectures. Consumer preferences are shifting towards seamless connectivity, enhanced security, and greater network agility, pushing vendors to offer more intelligent and automated networking solutions. Competitive dynamics are characterized by intense innovation, with companies vying to offer superior performance, efficiency, and scalability in their networking products and services. Market penetration for advanced networking technologies is steadily increasing as organizations recognize the critical role of robust data center networking in maintaining a competitive edge. The increasing digitalization of services and the continuous generation of vast amounts of data are fundamentally reshaping the networking landscape, making it more complex and demanding.

Dominant Markets & Segments in Denmark Data Center Networking Market

The IT & Telecommunication sector currently dominates the Denmark Data Center Networking market. This segment's supremacy is attributed to the continuous demand for high-bandwidth, low-latency networking solutions to support cloud services, data transmission, and the ever-expanding digital infrastructure essential for telecommunication providers. The widespread adoption of 5G technology, alongside the ongoing expansion of fiber optic networks, necessitates advanced data center networking capabilities to manage and process the colossal volumes of data generated. Economic policies in Denmark, such as those fostering digital innovation and investment in infrastructure, further bolster this segment.

Within the Component: By Product segmentation, Ethernet Switches represent the most significant market share. The increasing density of servers, the growing need for inter-server communication in high-performance computing (HPC) and AI workloads, and the inherent scalability of Ethernet technology make these switches indispensable. The projected market size for Ethernet switches is estimated to reach [XX] Million by 2033. Key drivers for this dominance include:

- Demand for High Bandwidth: Enabling faster data transfer rates required for cloud, AI, and big data applications.

- Scalability: Allowing data centers to easily expand their networking capacity as demands grow.

- Cost-Effectiveness: Compared to some legacy networking technologies, Ethernet offers a favorable price-to-performance ratio.

In terms of Component: By Services, Support & Maintenance holds a substantial share. The complexity of modern data center networks, coupled with the critical nature of uptime and performance, necessitates ongoing professional support to ensure operational efficiency and minimize downtime. The projected market size for Support & Maintenance services is estimated to reach [XX] Million by 2033. Key drivers include:

- Minimizing Downtime: Ensuring continuous availability of critical services.

- Optimizing Performance: Proactive monitoring and issue resolution to maintain peak operational efficiency.

- Security Updates and Patching: Protecting networks from evolving cyber threats.

Among End-Users, the BFSI (Banking, Financial Services, and Insurance) sector also exhibits significant influence. This is driven by the stringent security requirements, the need for high transaction processing speeds, and the increasing adoption of digital financial services. The growing volume of financial data and the emphasis on regulatory compliance fuel the demand for robust and secure data center networking.

Denmark Data Center Networking Market Product Developments

Recent product developments in the Denmark Data Center Networking market highlight a strong focus on enhanced performance, AI integration, and cloud-native capabilities. NVIDIA's announcement of SpectrumXtreme, a platform that couples the NVIDIA Spectrum-4 Ethernet switch with the NVIDIA BlueField-3 DPU, aims to significantly boost AI performance and power efficiency in cloud environments by achieving 1.7x better overall AI performance. This innovation caters to the growing demand for accelerated networking solutions for AI training and inference. Similarly, Juniper Networks' introduction of the EX4100 series of enterprise-class wired access switches, powered by Mist AI and a microservices cloud, signifies a push towards more intelligent, user-friendly, and secure networking for campus fabric architectures. These advancements underscore the market's trajectory towards smarter, more automated, and highly efficient networking solutions that can adeptly handle the demands of modern data-intensive applications.

Report Scope & Segmentation Analysis

This report delves into the comprehensive segmentation of the Denmark Data Center Networking market. The Component: By Product segment includes Ethernet Switches, Routers, Storage Area Network (SAN), Application Delivery Controller (ADC), and Other Networking Equipment. The Component: By Services segment covers Installation & Integration, Training & Consulting, and Support & Maintenance. The End-User segmentation encompasses IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a granular view of market opportunities. The IT & Telecommunication segment is expected to lead growth due to its continuous need for advanced networking infrastructure, while Support & Maintenance services are projected for substantial revenue generation due to the complexity and criticality of data center operations.

Key Drivers of Denmark Data Center Networking Market Growth

Several key factors are propelling the growth of the Denmark Data Center Networking market. The escalating adoption of cloud computing services is a primary driver, requiring robust and scalable network infrastructure to support data storage, processing, and accessibility. The continuous advancements in Artificial Intelligence (AI) and Machine Learning (ML) are also creating a significant demand for high-performance networking solutions capable of handling massive datasets and complex computations. Furthermore, the increasing digitalization across various sectors, including government services, financial institutions, and media, necessitates enhanced data center capabilities and, consequently, advanced networking. Government initiatives promoting digital transformation and investment in digital infrastructure also play a crucial role in fostering market expansion.

Challenges in the Denmark Data Center Networking Market Sector

Despite its growth trajectory, the Denmark Data Center Networking market faces several challenges. High initial investment costs for advanced networking equipment and infrastructure can be a significant barrier for smaller organizations. Furthermore, the complexity of integrating new networking technologies with existing legacy systems can pose technical and operational hurdles. The evolving cybersecurity landscape presents a constant challenge, requiring continuous investment in secure networking solutions and vigilant threat mitigation strategies. Supply chain disruptions, as observed in recent global events, can also impact the availability and cost of essential networking components. Finally, the shortage of skilled networking professionals capable of deploying and managing complex data center networks can hinder market growth.

Emerging Opportunities in Denmark Data Center Networking Market

The Denmark Data Center Networking market presents several emerging opportunities for growth and innovation. The increasing adoption of edge computing solutions, driven by the need for low-latency data processing for IoT devices and real-time applications, opens avenues for decentralized networking architectures. The growing demand for green data center technologies and energy-efficient networking solutions presents an opportunity for vendors focused on sustainability. The expansion of the 5G network infrastructure will also necessitate significant upgrades and enhancements in data center networking to handle the surge in data traffic. Moreover, the increasing use of network automation and AI-driven network management tools offers opportunities for service providers to offer more intelligent and efficient operational solutions, optimizing performance and reducing operational expenditures.

Leading Players in the Denmark Data Center Networking Market Market

- NVIDIA

- IBM Corporation

- Arista Networks Inc.

- Cisco Systems Inc.

- HP Development Company L.P.

- Juniper Networks Inc.

- Dell Inc.

- Huawei Technologies Co. Ltd.

- VMware Inc.

- Schneider Electric

- Intel Corporation

Key Developments in Denmark Data Center Networking Market Industry

- July 2023: Juniper Networks announced the launch of an enterprise-class wired access switch, the EX4100 series, leveraging a modern microservices cloud and Mist AI for superior performance, ease of use, flexibility, and security. This development enhances their offering for campus fabric architectures.

- May 2023: NVIDIA announced SpectrumXtreme, an accelerated networking platform that couples the NVIDIA Spectrum-4 Ethernet switch with the NVIDIA BlueField-3 DPU. This platform aims to enhance AI performance and power efficiency, delivering 1.7x better overall AI performance and consistent, predictable performance in multi-tenant environments.

Strategic Outlook for Denmark Data Center Networking Market Market

The strategic outlook for the Denmark Data Center Networking market remains highly positive, driven by continuous technological advancements and the unwavering demand for robust digital infrastructure. The increasing integration of AI and machine learning in data center operations, coupled with the growth of edge computing, will necessitate more intelligent and agile networking solutions. Investments in high-speed Ethernet, SDN, and NFV technologies are projected to accelerate, supporting the expansion of cloud services and big data analytics. Furthermore, a growing emphasis on sustainability and energy efficiency in data center operations will create opportunities for vendors offering green networking solutions. Strategic partnerships and acquisitions aimed at expanding technological capabilities and market reach will continue to shape the competitive landscape. The Danish government's commitment to fostering digital innovation and digital transformation initiatives will further underpin market growth, ensuring sustained demand for advanced data center networking solutions.

Denmark Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Denmark Data Center Networking Market Segmentation By Geography

- 1. Denmark

Denmark Data Center Networking Market Regional Market Share

Geographic Coverage of Denmark Data Center Networking Market

Denmark Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory constraints

- 3.4. Market Trends

- 3.4.1. Ethernet Switches is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NVIDIA (Cumulus Networks Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HP Development Company L P

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VMware Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schneider Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intel Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: Denmark Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Denmark Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Denmark Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Denmark Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Denmark Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Denmark Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Denmark Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Data Center Networking Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Denmark Data Center Networking Market?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, Arista Networks Inc, Cisco Systems Inc, HP Development Company L P, Juniper Networks Inc, Dell Inc, Huawei Technologies Co Ltd, VMware Inc, Schneider Electric, Intel Corporation.

3. What are the main segments of the Denmark Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector.

6. What are the notable trends driving market growth?

Ethernet Switches is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

Regulatory constraints.

8. Can you provide examples of recent developments in the market?

July 2023: Juniper Networks, a leading provider of secure AI-driven networks, announced the launch of an enterprise-class wired access switch. Leveraging a modern microservices cloud and Mist AI, this switch promises superior performance, ease of use, flexibility, and security, introduced as the new EX4100 series. It offers access to all enterprise layer switching environments, including campus fabric architectures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Data Center Networking Market?

To stay informed about further developments, trends, and reports in the Denmark Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence