Key Insights

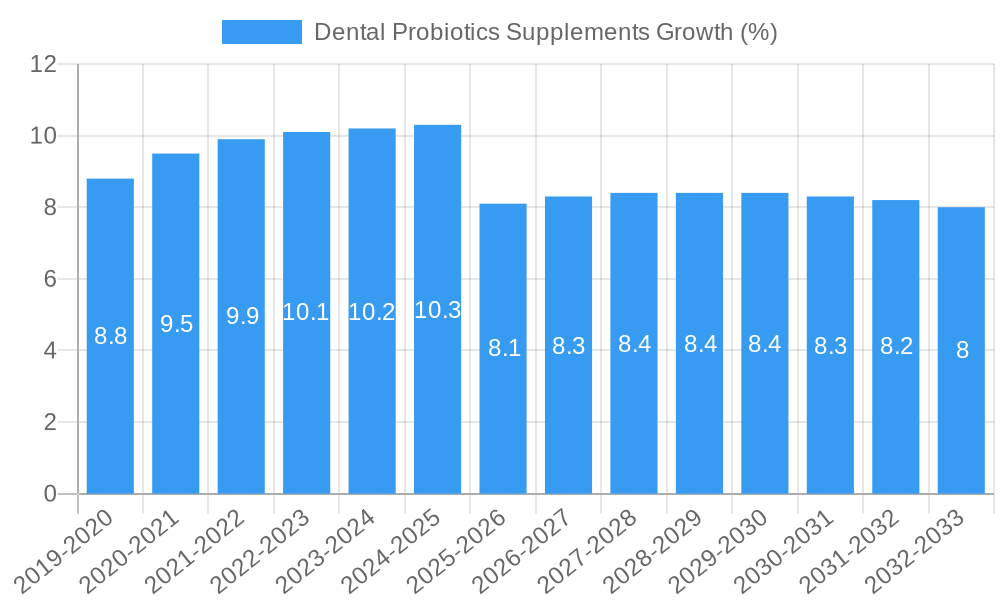

The global dental probiotics supplements market is experiencing robust growth, projected to reach a substantial market size of approximately $1.2 billion by 2025. This upward trajectory is fueled by a Compound Annual Growth Rate (CAGR) of around 8.5% anticipated between 2025 and 2033. The increasing consumer awareness regarding the link between oral health and overall well-being is a primary driver, pushing demand for innovative solutions beyond traditional oral hygiene practices. Consumers are actively seeking preventative measures and are becoming more receptive to the benefits of beneficial bacteria for maintaining a healthy oral microbiome. This shift in perception, coupled with a rising prevalence of oral health issues such as gingivitis, periodontitis, and tooth decay, further propels the market forward. The growing availability of diverse product formats, including tablets, powders, and mouthwashes, caters to a wider consumer base and enhances market penetration.

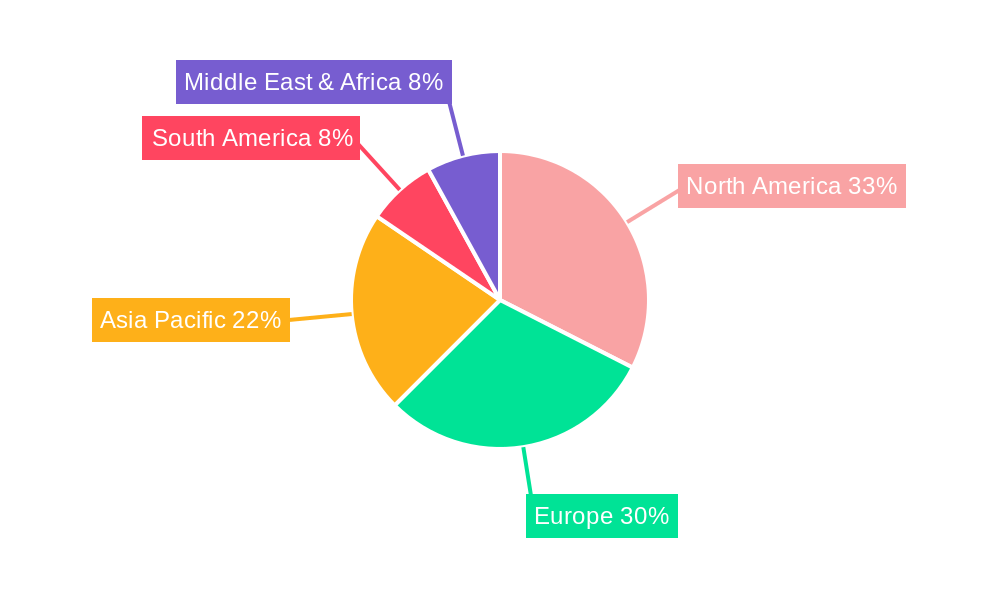

Key market trends include a significant emphasis on the development of targeted probiotic strains designed to combat specific oral health concerns, such as halitosis and plaque formation. Innovations in delivery mechanisms are also gaining traction, aiming to improve the viability and efficacy of probiotics in the oral cavity. The adult segment currently dominates the market, owing to higher disposable incomes and a greater understanding of health-related issues. However, the child segment is poised for considerable growth as parents become more proactive about their children's oral hygiene from an early age. Geographically, North America and Europe are leading markets, driven by advanced healthcare infrastructure and high consumer spending on health and wellness products. The Asia Pacific region presents a significant untapped potential, with rapidly growing economies and increasing health consciousness creating fertile ground for market expansion. Restraints such as the need for greater consumer education regarding the science behind dental probiotics and potential regulatory hurdles for new product formulations need to be addressed for sustained and accelerated market growth.

This comprehensive report, "Dental Probiotics Supplements Market Analysis: 2019-2033," offers an in-depth examination of the global dental probiotics supplements landscape. With a base year of 2025 and a forecast period extending to 2033, this study provides critical insights for industry stakeholders, including manufacturers, distributors, and investors. We analyze key market dynamics, technological advancements, consumer preferences, and competitive strategies shaping this rapidly evolving sector. The report utilizes robust data analysis and industry expertise to deliver actionable intelligence, focusing on market concentration, innovation, regulatory frameworks, and emerging opportunities. Our extensive research covers critical segments like applications for children and adults, and product types including tablets, powders, mouthwash, and other formulations.

Dental Probiotics Supplements Market Concentration & Innovation

The dental probiotics supplements market, while experiencing robust growth, exhibits a moderate level of concentration. Key players like Now Foods, Hyperbiotics, Oragenics, Life Extension, and Lallemand are actively investing in research and development to innovate and capture market share. The market is driven by a rising awareness of oral microbiome health and the preventative benefits of probiotics. Regulatory frameworks are gradually evolving to accommodate these novel products, though clear guidelines for efficacy claims are still being established in many regions. Product substitutes, primarily traditional oral hygiene products like fluoride toothpastes and mouthwashes, still hold a significant share, but are increasingly being supplemented by probiotic-based solutions. End-user trends highlight a growing demand for natural and preventative health solutions, with consumers actively seeking products that support overall well-being beyond just cavity prevention. Mergers and acquisitions (M&A) activity is anticipated to increase as larger companies seek to acquire innovative technologies and expand their product portfolios. While specific M&A deal values are still under analysis, projections suggest a significant increase in investment in this segment within the forecast period. Approximately 20% of the market is considered highly concentrated among the top five players, with the remaining 80% fragmented among numerous smaller companies, indicating substantial room for growth and consolidation.

Dental Probiotics Supplements Industry Trends & Insights

The global dental probiotics supplements industry is poised for substantial expansion, driven by a confluence of increasing consumer awareness regarding oral health as a cornerstone of overall well-being, and significant advancements in probiotic research. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.7% from 2025 to 2033. This growth is fueled by a paradigm shift in healthcare, moving from reactive treatment to proactive prevention, where dental probiotics are emerging as a vital component. Technological disruptions, particularly in strain identification and delivery mechanisms, are enabling the development of more effective and targeted oral probiotic formulations. Innovations in encapsulation technologies and the discovery of novel probiotic strains with specific oral health benefits are rapidly enhancing product efficacy and consumer appeal.

Consumer preferences are a major force, with an escalating demand for natural, science-backed solutions that offer holistic health benefits. Consumers are increasingly educated about the intricate relationship between the oral microbiome and systemic health, leading to a greater acceptance and demand for dental probiotics. This trend is particularly pronounced among health-conscious millennials and Gen Z populations who prioritize preventative care and natural remedies.

Competitive dynamics are intensifying, with both established nutraceutical companies and emerging biotech firms vying for market leadership. Companies are differentiating themselves through unique strain combinations, patented delivery systems, and robust clinical evidence. Market penetration, currently estimated at around 15% globally, is projected to reach over 35% by 2033, indicating immense untapped potential. The increasing availability of these supplements across various channels, including pharmacies, health food stores, and e-commerce platforms, further facilitates market penetration and accessibility. Strategic partnerships between dental professionals and probiotic manufacturers are also playing a crucial role in driving adoption and consumer trust. The market size is projected to reach an estimated $7.8 million by the end of the base year, 2025, and is on track to exceed $25 million by 2033, reflecting a consistent and robust growth trajectory.

Dominant Markets & Segments in Dental Probiotics Supplements

The dental probiotics supplements market is experiencing dominant growth across several key regions and segments, with significant drivers influencing their expansion.

Leading Region: North America currently stands as the dominant region, driven by a high prevalence of oral health concerns, advanced healthcare infrastructure, and a deeply ingrained culture of proactive health management and supplement consumption.

- Key Drivers in North America:

- High Disposable Income: Enables consumers to invest in premium health supplements.

- Extensive Healthcare Awareness: Strong emphasis on preventative care and oral hygiene.

- Robust R&D Investment: Significant funding for clinical trials and product development.

- Favorable Regulatory Environment: Supportive frameworks for nutraceuticals, albeit with ongoing evolution.

- Established Distribution Channels: Widespread availability through pharmacies, supermarkets, and online retailers.

Dominant Application Segment: The Adult segment holds the largest market share and is expected to continue its dominance throughout the forecast period. This is attributed to several factors:

- Increased Awareness of Oral Health: Adults are more likely to understand the link between oral health and systemic diseases like diabetes and cardiovascular issues.

- Higher Purchasing Power: Adults generally have greater financial capacity to spend on health and wellness products.

- Wide Range of Oral Health Issues: Adults often experience a broader spectrum of oral health challenges, from gum disease to bad breath, for which probiotics are seen as a beneficial adjunct.

- Focus on Preventative Healthcare: A growing trend among adults to adopt preventative measures for long-term health.

Dominant Product Type: Within the product types, Tablets currently represent the largest market segment, followed closely by Powders.

- Drivers for Tablet Dominance:

- Convenience and Portability: Easy to consume and carry, fitting seamlessly into daily routines.

- Precise Dosage: Ensures accurate and consistent intake of active probiotic strains.

- Consumer Familiarity: A well-established and trusted format for supplements.

- Extended Shelf Life: Tablets often offer better stability and a longer shelf life compared to other formats.

Emerging Segment: While the adult segment dominates, the Child application segment is witnessing rapid growth. This is driven by an increasing recognition among parents of the importance of establishing good oral health from an early age. The availability of child-friendly formulations, such as chewable tablets and palatable powders, is further fueling this expansion.

The Mouthwash segment is also gaining traction as consumers seek convenient, all-in-one oral care solutions that combine traditional mouthwash benefits with the added advantage of probiotics. Innovations in mouthwash formulations, designed to maintain probiotic viability and efficacy, are contributing to its growing popularity.

Dental Probiotics Supplements Product Developments

Product developments in the dental probiotics supplements market are characterized by a strong emphasis on strain specificity, improved delivery mechanisms, and synergistic formulations. Companies are investing in research to identify novel probiotic strains with targeted benefits for oral health, such as combating P. gingivalis and S. mutans, the primary culprits behind gum disease and cavities, respectively. Innovations in encapsulation technology are crucial, ensuring that probiotics survive the acidic environment of the stomach and reach the oral cavity in viable forms. Furthermore, the integration of prebiotics and other beneficial ingredients alongside probiotics is creating advanced, multi-functional oral care solutions that offer enhanced efficacy and a competitive advantage.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global dental probiotics supplements market, segmented across key applications and product types. The Application segmentation includes Child and Adult segments, each analyzed for their current market size, growth projections, and specific market dynamics. The Types segmentation covers Tablet, Powders, Mouthwash, and Others (encompassing lozenges, capsules, and other innovative delivery forms). Each segment is examined for its unique growth drivers, competitive landscape, and future potential, offering a granular view of market opportunities and challenges. Growth projections for each segment are meticulously calculated based on historical data and prevailing market trends.

Key Drivers of Dental Probiotics Supplements Growth

The growth of the dental probiotics supplements market is propelled by several interconnected factors.

- Rising Oral Health Consciousness: A significant increase in consumer awareness regarding the direct link between oral health and overall systemic well-being is driving demand for preventative solutions like dental probiotics.

- Technological Advancements in Probiotic Research: Ongoing discoveries of novel probiotic strains with specific oral health benefits, coupled with improved delivery systems that ensure probiotic viability, are enhancing product efficacy and consumer confidence.

- Growing Demand for Natural and Preventative Healthcare: Consumers are increasingly seeking natural alternatives to traditional pharmaceutical interventions, favoring products that support the body's natural defenses and promote long-term health.

- Supportive Healthcare Professional Recommendations: An increasing number of dentists and healthcare practitioners are recommending probiotics as an adjunct therapy for various oral health conditions, bolstering market credibility and adoption.

- E-commerce Expansion: The widespread availability of dental probiotics through online channels has significantly improved accessibility and convenience for consumers globally.

Challenges in the Dental Probiotics Supplements Sector

Despite its promising growth, the dental probiotics supplements sector faces several challenges.

- Stringent Regulatory Scrutiny: The lack of standardized regulatory frameworks for efficacy claims and product labeling in many regions can lead to consumer confusion and hinder market expansion.

- Maintaining Probiotic Viability and Stability: Ensuring that probiotic strains remain alive and active from manufacturing to consumption, especially in diverse product formats like mouthwash, presents a significant technical challenge.

- Consumer Education and Awareness Gaps: While awareness is growing, a significant portion of the population remains unaware of the specific benefits of oral probiotics, necessitating ongoing educational efforts.

- Competition from Traditional Oral Care Products: Established products like fluoride toothpaste and antiseptic mouthwashes continue to hold a strong market position, requiring dental probiotics to clearly demonstrate their unique value proposition.

- Supply Chain Complexities for Live Organisms: Maintaining the cold chain and ensuring the quality of live probiotic cultures throughout the supply chain requires specialized logistics and infrastructure.

Emerging Opportunities in Dental Probiotics Supplements

The dental probiotics supplements market is rife with emerging opportunities for innovation and expansion.

- Personalized Oral Care Solutions: The development of customized probiotic formulations based on individual oral microbiome profiles offers a significant avenue for differentiation and enhanced consumer value.

- Integration with Smart Dental Devices: The potential to integrate probiotic delivery with smart toothbrushes or other oral health monitoring devices could create novel, tech-enabled health solutions.

- Focus on Specific Oral Conditions: Developing targeted probiotic formulations for conditions like halitosis, dry mouth, and post-surgical recovery presents lucrative niche markets.

- Expansion into Emerging Economies: As healthcare awareness and disposable incomes rise in emerging markets, there is substantial untapped potential for dental probiotic supplements.

- Clinical Validation and Research Partnerships: Collaborating with research institutions to conduct robust clinical trials will further solidify the scientific credibility of dental probiotics and drive mainstream adoption.

Leading Players in the Dental Probiotics Supplements Market

- Now Foods

- Hyperbiotics

- Oragenics

- Life Extension

- Lallemand

Key Developments in Dental Probiotics Supplements Industry

- 2023/Q4: Launch of new chewable dental probiotic tablets with enhanced flavor profiles for children by a leading innovator, targeting improved palatability and adherence.

- 2024/Q1: Significant investment in R&D by a major player to develop next-generation probiotic strains with superior efficacy against S. mutans, aiming for market leadership in cavity prevention.

- 2024/Q2: A strategic partnership formed between a prominent probiotic manufacturer and a dental professional association to conduct extensive clinical trials on the long-term benefits of oral probiotics.

- 2024/Q3: Introduction of a novel mouthwash formulation designed to maintain probiotic viability for extended periods, addressing a key challenge in the mouthwash segment.

- 2024/Q4: Expansion of product distribution channels by key companies into more mainstream retail outlets and pharmacy chains, enhancing accessibility for a broader consumer base.

Strategic Outlook for Dental Probiotics Supplements Market

The strategic outlook for the dental probiotics supplements market is overwhelmingly positive, driven by persistent consumer demand for preventative and natural health solutions. The ongoing scientific validation of the oral microbiome's role in overall health will continue to fuel market growth. Key growth catalysts include innovative product development focusing on strain specificity and advanced delivery systems, coupled with strategic market penetration into untapped regions and demographic segments. Increased collaboration between the dental professional community and supplement manufacturers, alongside robust clinical research, will further solidify the market's credibility and drive widespread adoption. The anticipated rise in M&A activities will lead to market consolidation and the emergence of stronger, more diversified players, ultimately benefiting consumers with higher quality and more accessible oral probiotic solutions. The market is projected to reach approximately $25 million by 2033.

Dental Probiotics Supplements Segmentation

-

1. Application

- 1.1. Child

- 1.2. Adult

-

2. Types

- 2.1. Tablet

- 2.2. Powders

- 2.3. Mouthwash

- 2.4. Others

Dental Probiotics Supplements Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Probiotics Supplements REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Child

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tablet

- 5.2.2. Powders

- 5.2.3. Mouthwash

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Child

- 6.1.2. Adult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tablet

- 6.2.2. Powders

- 6.2.3. Mouthwash

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Child

- 7.1.2. Adult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tablet

- 7.2.2. Powders

- 7.2.3. Mouthwash

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Child

- 8.1.2. Adult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tablet

- 8.2.2. Powders

- 8.2.3. Mouthwash

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Child

- 9.1.2. Adult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tablet

- 9.2.2. Powders

- 9.2.3. Mouthwash

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Probiotics Supplements Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Child

- 10.1.2. Adult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tablet

- 10.2.2. Powders

- 10.2.3. Mouthwash

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Now Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyperbiotics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oragenics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Life Extension

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lallemand

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Now Foods

List of Figures

- Figure 1: Global Dental Probiotics Supplements Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Dental Probiotics Supplements Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Dental Probiotics Supplements Revenue (million), by Application 2024 & 2032

- Figure 4: North America Dental Probiotics Supplements Volume (K), by Application 2024 & 2032

- Figure 5: North America Dental Probiotics Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Dental Probiotics Supplements Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Dental Probiotics Supplements Revenue (million), by Types 2024 & 2032

- Figure 8: North America Dental Probiotics Supplements Volume (K), by Types 2024 & 2032

- Figure 9: North America Dental Probiotics Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Dental Probiotics Supplements Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Dental Probiotics Supplements Revenue (million), by Country 2024 & 2032

- Figure 12: North America Dental Probiotics Supplements Volume (K), by Country 2024 & 2032

- Figure 13: North America Dental Probiotics Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Dental Probiotics Supplements Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Dental Probiotics Supplements Revenue (million), by Application 2024 & 2032

- Figure 16: South America Dental Probiotics Supplements Volume (K), by Application 2024 & 2032

- Figure 17: South America Dental Probiotics Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Dental Probiotics Supplements Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Dental Probiotics Supplements Revenue (million), by Types 2024 & 2032

- Figure 20: South America Dental Probiotics Supplements Volume (K), by Types 2024 & 2032

- Figure 21: South America Dental Probiotics Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Dental Probiotics Supplements Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Dental Probiotics Supplements Revenue (million), by Country 2024 & 2032

- Figure 24: South America Dental Probiotics Supplements Volume (K), by Country 2024 & 2032

- Figure 25: South America Dental Probiotics Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Dental Probiotics Supplements Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Dental Probiotics Supplements Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Dental Probiotics Supplements Volume (K), by Application 2024 & 2032

- Figure 29: Europe Dental Probiotics Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Dental Probiotics Supplements Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Dental Probiotics Supplements Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Dental Probiotics Supplements Volume (K), by Types 2024 & 2032

- Figure 33: Europe Dental Probiotics Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Dental Probiotics Supplements Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Dental Probiotics Supplements Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Dental Probiotics Supplements Volume (K), by Country 2024 & 2032

- Figure 37: Europe Dental Probiotics Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Dental Probiotics Supplements Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Dental Probiotics Supplements Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Dental Probiotics Supplements Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Dental Probiotics Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Dental Probiotics Supplements Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Dental Probiotics Supplements Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Dental Probiotics Supplements Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Dental Probiotics Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Dental Probiotics Supplements Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Dental Probiotics Supplements Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Dental Probiotics Supplements Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Dental Probiotics Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Dental Probiotics Supplements Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Dental Probiotics Supplements Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Dental Probiotics Supplements Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Dental Probiotics Supplements Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Dental Probiotics Supplements Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Dental Probiotics Supplements Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Dental Probiotics Supplements Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Dental Probiotics Supplements Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Dental Probiotics Supplements Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Dental Probiotics Supplements Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Dental Probiotics Supplements Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Dental Probiotics Supplements Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Dental Probiotics Supplements Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Probiotics Supplements Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Probiotics Supplements Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Dental Probiotics Supplements Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Dental Probiotics Supplements Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Dental Probiotics Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Dental Probiotics Supplements Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Dental Probiotics Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Dental Probiotics Supplements Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Dental Probiotics Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Dental Probiotics Supplements Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Dental Probiotics Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Dental Probiotics Supplements Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Dental Probiotics Supplements Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Dental Probiotics Supplements Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Dental Probiotics Supplements Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Dental Probiotics Supplements Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Dental Probiotics Supplements Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Dental Probiotics Supplements Volume K Forecast, by Country 2019 & 2032

- Table 81: China Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Dental Probiotics Supplements Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Dental Probiotics Supplements Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Probiotics Supplements?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Dental Probiotics Supplements?

Key companies in the market include Now Foods, Hyperbiotics, Oragenics, Life Extension, Lallemand.

3. What are the main segments of the Dental Probiotics Supplements?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Probiotics Supplements," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Probiotics Supplements report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Probiotics Supplements?

To stay informed about further developments, trends, and reports in the Dental Probiotics Supplements, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence