Key Insights

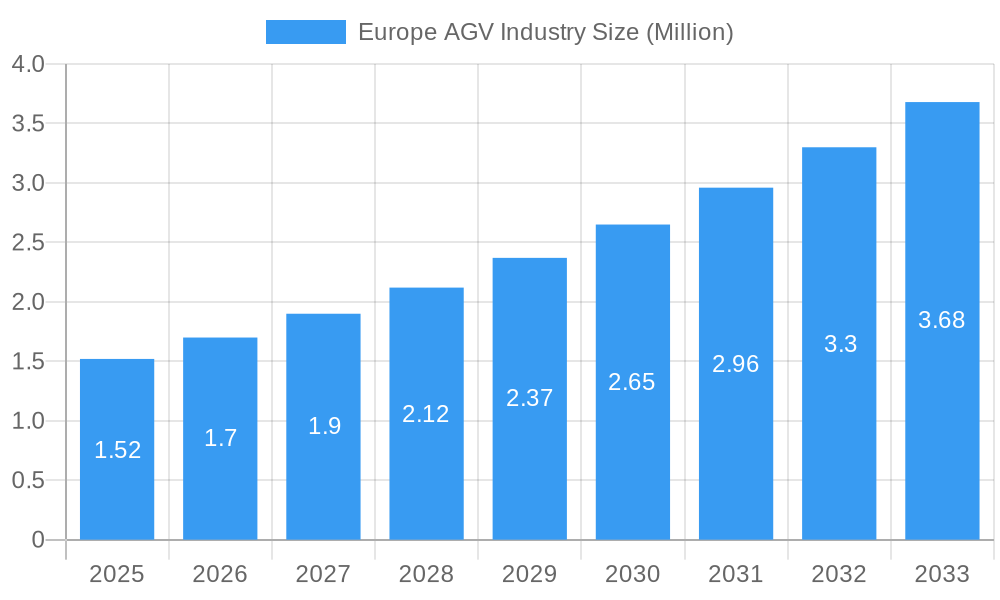

The European Automated Guided Vehicle (AGV) market is poised for substantial expansion, driven by increasing demand for automation across various industrial sectors. The market, valued at 1.52 Million in 2025, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 11.50% through 2033. This significant growth is fueled by the relentless pursuit of operational efficiency, enhanced safety, and reduced labor costs by businesses in sectors such as Food & Beverage, Automotive, Retail, and Electronics & Electrical. The inherent flexibility and scalability of AGVs make them an attractive solution for optimizing material handling processes, from intricate assembly lines to large-scale unit load movements. Furthermore, advancements in AGV technology, including improved navigation systems, enhanced payload capacities, and greater integration capabilities with existing warehouse management systems (WMS) and manufacturing execution systems (MES), are accelerating adoption. The push towards Industry 4.0 and smart manufacturing initiatives across Europe is a primary catalyst, encouraging businesses to invest in intelligent automation solutions that can streamline operations and boost productivity.

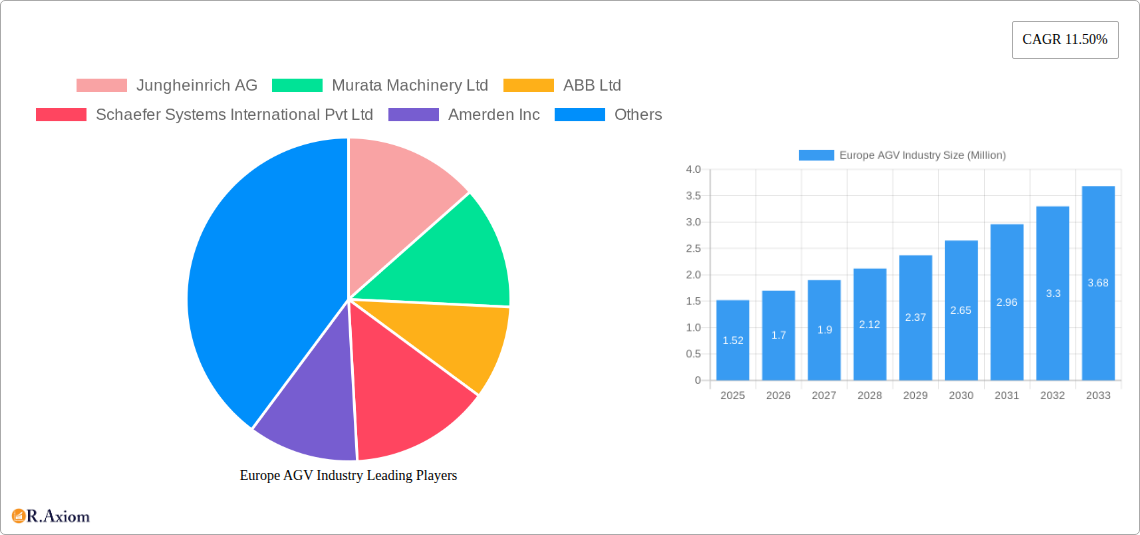

Europe AGV Industry Market Size (In Million)

Key growth drivers for the European AGV market include the imperative to improve supply chain agility and responsiveness in the face of evolving consumer demands and global disruptions. The increasing complexity of logistics, coupled with labor shortages in certain regions, further propels the adoption of automated solutions. While the market benefits from strong demand across product types like Automated Forklifts, Automated Tow/Tractors/Tugs, and Unit Load carriers, certain segments such as Assembly Line and Special Purpose AGVs are also witnessing steady growth due to tailored application needs. However, the market also faces certain restraints, including the significant initial capital investment required for AGV deployment and the need for specialized infrastructure modifications in some facilities. Despite these challenges, the long-term benefits of improved throughput, reduced error rates, and enhanced worker safety are expected to outweigh the upfront costs, ensuring sustained market expansion. Prominent players like Jungheinrich AG, Murata Machinery Ltd, ABB Ltd, and KUKA AG are at the forefront of innovation, offering sophisticated AGV solutions that cater to the diverse needs of the European industrial landscape.

Europe AGV Industry Company Market Share

Europe AGV Industry Market Concentration & Innovation

The European Automated Guided Vehicle (AGV) industry exhibits a moderate level of market concentration, with key players like Jungheinrich AG, Murata Machinery Ltd, and KUKA AG holding significant market shares, estimated to be over 30% collectively in 2025. Innovation remains a primary driver, fueled by advancements in AI, IoT, and robotics, leading to enhanced AGV capabilities and operational efficiencies across diverse end-user industries such as Automotive, Food & Beverage, and Retail. Regulatory frameworks, particularly concerning workplace safety and autonomous system integration, are evolving to support wider AGV adoption, albeit with regional variations. The threat of product substitutes, while present from traditional material handling equipment, is diminishing as AGVs offer superior flexibility and automation benefits. End-user demand for optimized logistics, reduced operational costs, and improved safety protocols continues to propel the market. Merger and Acquisition (M&A) activities are expected to remain robust, with projected deal values potentially reaching hundreds of millions of Euros in the coming years, as larger players seek to consolidate market presence and acquire innovative technologies. For instance, anticipated M&A activity could see companies acquiring specialized AGV developers or software providers to bolster their comprehensive solutions.

Europe AGV Industry Industry Trends & Insights

The European AGV industry is poised for substantial growth, driven by an accelerating adoption of automation across various sectors. The market is experiencing a robust Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period of 2025-2033, with the base year 2025 expected to see market penetration for AGVs reach over 40% in key industrial segments. Technological disruptions, including the integration of sophisticated Artificial Intelligence (AI) for predictive maintenance and real-time route optimization, alongside the proliferation of the Internet of Things (IoT) for seamless fleet management, are fundamentally reshaping the AGV landscape. Consumer preferences are increasingly leaning towards solutions that offer higher operational throughput, reduced human error, and enhanced worker safety, all of which AGVs are uniquely positioned to deliver. Competitive dynamics are intensifying, characterized by a strategic focus on developing highly customized AGV solutions tailored to specific industry needs and application requirements. Major players are investing heavily in research and development to create more agile, intelligent, and energy-efficient AGV systems. The increasing demand for sustainable logistics solutions is also driving innovation in AGV power sources, with a notable shift towards electric and, in some cases, hydrogen-powered models, further contributing to the market's upward trajectory. This trend is further amplified by stringent environmental regulations across European Union member states, compelling industries to seek cleaner and more efficient material handling alternatives.

Dominant Markets & Segments in Europe AGV Industry

The Automotive end-user industry is currently the dominant market segment within the European AGV industry, driven by its continuous pursuit of manufacturing efficiency, just-in-time production, and the optimization of complex assembly lines. Economic policies promoting advanced manufacturing and the significant investments made by automotive giants in Industry 4.0 initiatives have cemented this dominance.

Within Product Types, the Automated Fork Lift segment is expected to maintain a leading position due to its versatility in warehouse and factory floor operations, handling a wide range of palletized goods.

Key Drivers for Automotive Dominance:

- High volume production lines requiring precise and repetitive material movement.

- Strict safety regulations and the desire to minimize workplace accidents.

- Integration of AGVs into lean manufacturing processes and smart factory ecosystems.

- Significant R&D investments in advanced automation technologies by automotive manufacturers.

Key Drivers for Automated Fork Lift Dominance:

- Adaptability to various warehouse layouts and storage systems.

- Ability to handle diverse load capacities and types.

- Cost-effectiveness compared to fully automated conveyor systems for certain applications.

- Increasing demand for automated storage and retrieval systems (AS/RS).

The Food & Beverage sector is emerging as a significant growth area, driven by stringent hygiene requirements, the need for efficient cold chain logistics, and the increasing demand for automated solutions to ensure product traceability and reduce contamination risks. Regulatory compliance for food safety standards plays a crucial role in this segment's expansion.

The Retail sector is witnessing a surge in AGV adoption, particularly for in-warehouse order fulfillment and inventory management, fueled by the explosive growth of e-commerce and the demand for faster delivery times.

Key Drivers for Food & Beverage Growth:

- Need for sterile and controlled environments.

- Efficient handling of perishable goods and temperature-sensitive products.

- Compliance with strict food safety and traceability regulations.

- Reduction of manual labor in high-volume processing and packaging.

Key Drivers for Retail Growth:

- High demand for efficient and accurate e-commerce order picking.

- Optimization of warehouse space and inventory management.

- Labor shortages and the need for operational efficiency.

- Integration with omnichannel fulfillment strategies.

Europe AGV Industry Product Developments

Recent product developments in the Europe AGV industry showcase a strong emphasis on enhanced intelligence, flexibility, and sustainability. Innovations include AGVs equipped with advanced AI for superior navigation and obstacle avoidance, alongside IoT integration for seamless fleet management and real-time data analytics. The introduction of specialized AGVs, such as hydrogen-powered fuel cell AGVs for demanding port operations, highlights a commitment to zero-emission logistics and extended operating hours. Furthermore, custom-move AGV solutions, like those developed for automotive manufacturing, demonstrate an increasing ability to tailor AGV functionalities to precise operational needs, offering competitive advantages through optimized workflows and reduced operational downtime. These advancements are crucial for meeting evolving industry demands for efficiency, safety, and environmental responsibility.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe AGV Industry market, segmented by Product Type and End-User Industry.

Product Type Segmentation: The market is analyzed across Automated Fork Lifts, Automated Tow/Tractor/Tugs, Unit Load, Assembly Line, and Special Purpose AGVs. Each segment's market size, growth projections, and competitive dynamics are detailed, highlighting the unique drivers and challenges influencing their adoption rates. For instance, the Automated Fork Lift segment is projected to witness substantial market growth due to its widespread applicability in warehousing.

End-User Industry Segmentation: The report delves into the market performance within the Food & Beverage, Automotive, Retail, Electronics & Electrical, General Manufacturing, Pharmaceuticals, and Other End-user Industries. Detailed analysis includes market penetration, revenue forecasts, and the key factors driving AGV adoption within each sector, such as regulatory compliance in Pharmaceuticals or automation demands in Electronics & Electrical.

Key Drivers of Europe AGV Industry Growth

The European AGV industry is propelled by several key drivers. Technologically, advancements in AI, IoT, and robotics are enabling more intelligent, flexible, and efficient AGV systems. Economically, the pursuit of operational cost reduction, improved productivity, and the mitigation of labor shortages across industries are significant motivators for AGV investment. Regulatory factors, including increasing emphasis on workplace safety and sustainability mandates, are also pushing companies towards automated solutions. For example, the EU's Green Deal initiatives encourage the adoption of cleaner technologies, benefiting electric and hydrogen-powered AGVs. The consistent growth of e-commerce further fuels demand for automated warehouse solutions, a core application for AGVs.

Challenges in the Europe AGV Industry Sector

Despite robust growth, the Europe AGV industry faces several challenges. Significant initial investment costs can be a barrier for small and medium-sized enterprises (SMEs). The integration of AGVs into existing complex operational environments requires careful planning and execution, which can lead to implementation challenges. Evolving regulatory landscapes, particularly concerning autonomous vehicle safety standards and data security, necessitate continuous adaptation. Furthermore, the availability of skilled labor for AGV maintenance and operation, while improving, remains a concern in some regions. Competitive pressures from established material handling providers and the rapid pace of technological change also demand constant innovation and strategic adjustments from AGV manufacturers and solution providers.

Emerging Opportunities in Europe AGV Industry

Emerging opportunities within the Europe AGV industry are diverse and promising. The increasing demand for hyper-personalized logistics solutions presents a significant avenue for customized AGV deployments. The expansion of AGV applications beyond traditional manufacturing and warehousing into areas like healthcare logistics and agricultural operations offers new market frontiers. The development and integration of collaborative robots (cobots) with AGVs create synergistic automation solutions, enhancing flexibility and human-robot interaction. Furthermore, the growing focus on Industry 5.0, which emphasizes human-centric, sustainable, and resilient manufacturing, positions AGVs as crucial enablers for creating more adaptable and efficient workforces. The rise of the circular economy also presents opportunities for AGVs in optimized waste management and recycling processes within industrial settings.

Leading Players in the Europe AGV Industry Market

- Jungheinrich AG

- Murata Machinery Ltd

- ABB Ltd

- Schaefer Systems International Pvt Ltd

- Amerden Inc

- KUKA AG

- Dematic Corp

- Transbotics Corporation

- Toyota Material Handling International AB

- John Bean Technologies (JBT) Corporation

- Swisslog Holding AG

- Seegrid Corporation

Key Developments in Europe AGV Industry Industry

- June 2022: ek robotics entered into a strategic partnership with BMW to deliver a comprehensive, turnkey automated guided vehicle (AGV) solution. This collaboration aims to optimize BMW's manufacturing and warehouse operations through ek robotics' advanced Custom Move, Vario Move, and Very Narrow Aisle (VNA) AGVs, with the solution successfully implemented at BMW's PGA Press Plant in Swindon, England.

- March 2022: GAUSSIN launched the world's first hydrogen-powered fuel cell Automated Guided Vehicles (AGV H2) specifically designed for seaports. These innovative vehicles complement GAUSSIN's existing range of hydrogen-powered transportation solutions, offering autonomous navigation in mixed-traffic and infrastructure-free environments, thereby enabling ports to transition to zero-emission operations with benefits like shorter refueling times, longer operational hours, and quiet, efficient transport.

Strategic Outlook for Europe AGV Industry Market

The strategic outlook for the Europe AGV industry is highly optimistic, driven by an escalating demand for automation, operational efficiency, and sustainable logistics. The market is poised for continued expansion as companies across all sectors recognize the transformative potential of AGVs in optimizing supply chains, enhancing worker safety, and reducing operational costs. Key growth catalysts include the ongoing digitalization of manufacturing (Industry 4.0 and beyond), the exponential growth of e-commerce, and stricter environmental regulations encouraging cleaner technologies. Investments in research and development for more intelligent, flexible, and energy-efficient AGV solutions will be crucial. Furthermore, strategic partnerships and potential M&A activities will shape the competitive landscape, fostering innovation and market consolidation, ensuring the industry's robust trajectory through the forecast period.

Europe AGV Industry Segmentation

-

1. Product Type

- 1.1. Automated Fork Lift

- 1.2. Automated Tow/Tractor/Tugs

- 1.3. Unit Load

- 1.4. Assembly Line

- 1.5. Special Purpose

-

2. End-User Industry

- 2.1. Food & Beverage

- 2.2. Automotive

- 2.3. Retail

- 2.4. Electronics & Electrical

- 2.5. General Manufacturing

- 2.6. Pharmaceuticals

- 2.7. Other End-user Industries

Europe AGV Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

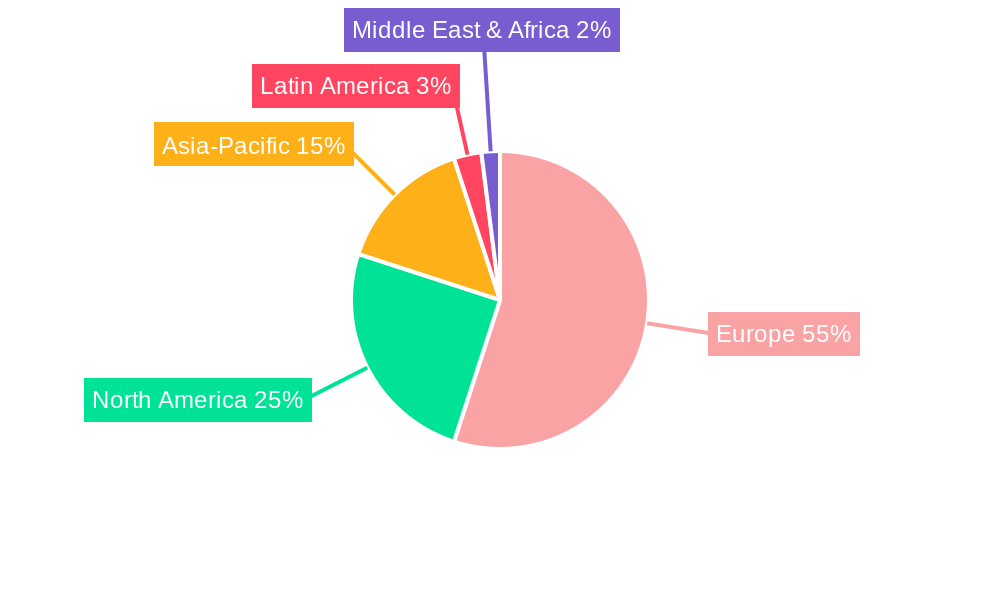

Europe AGV Industry Regional Market Share

Geographic Coverage of Europe AGV Industry

Europe AGV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth of the E-commerce Industry; Need for Automation in Maritime Applications for Improvement in Terminal Efficiency

- 3.3. Market Restrains

- 3.3.1. Limitation of Real-time Wireless Control Due to Communication Delays

- 3.4. Market Trends

- 3.4.1. Food and Beverages is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automated Fork Lift

- 5.1.2. Automated Tow/Tractor/Tugs

- 5.1.3. Unit Load

- 5.1.4. Assembly Line

- 5.1.5. Special Purpose

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food & Beverage

- 5.2.2. Automotive

- 5.2.3. Retail

- 5.2.4. Electronics & Electrical

- 5.2.5. General Manufacturing

- 5.2.6. Pharmaceuticals

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jungheinrich AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Murata Machinery Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schaefer Systems International Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amerden Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KUKA AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dematic Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Transbotics Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Material Handling International AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 John Bean Technologies (JBT) Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swisslog Holding AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seegrid Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Jungheinrich AG

List of Figures

- Figure 1: Europe AGV Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe AGV Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe AGV Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe AGV Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Europe AGV Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Europe AGV Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: Europe AGV Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe AGV Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe AGV Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe AGV Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Europe AGV Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Europe AGV Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Europe AGV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe AGV Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe AGV Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Europe AGV Industry?

Key companies in the market include Jungheinrich AG, Murata Machinery Ltd, ABB Ltd, Schaefer Systems International Pvt Ltd, Amerden Inc, KUKA AG, Dematic Corp, Transbotics Corporation, Toyota Material Handling International AB, John Bean Technologies (JBT) Corporation, Swisslog Holding AG, Seegrid Corporation.

3. What are the main segments of the Europe AGV Industry?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth of the E-commerce Industry; Need for Automation in Maritime Applications for Improvement in Terminal Efficiency.

6. What are the notable trends driving market growth?

Food and Beverages is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Limitation of Real-time Wireless Control Due to Communication Delays.

8. Can you provide examples of recent developments in the market?

June 2022 - ek robotics entered in a partnership with BMW to provide a complete turnkey automated guided vehicle (AGV) solution. The ek robotics' massive custom-move AVG solution would enable BMW to optimize its manufacturing and warehouse activities. The equipment includes the Custom Move, Vario Move, and Very Narrow Aisle (VNA) AGVs. The AGV solution was delivered and implemented at BMW's PGA Press Plant in Swindon, England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe AGV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe AGV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe AGV Industry?

To stay informed about further developments, trends, and reports in the Europe AGV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence