Key Insights

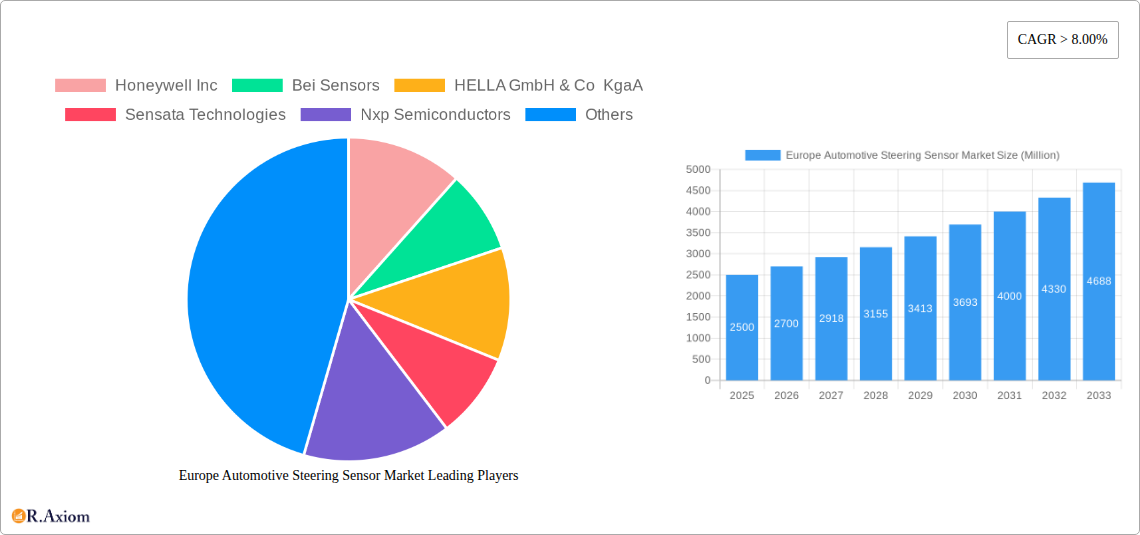

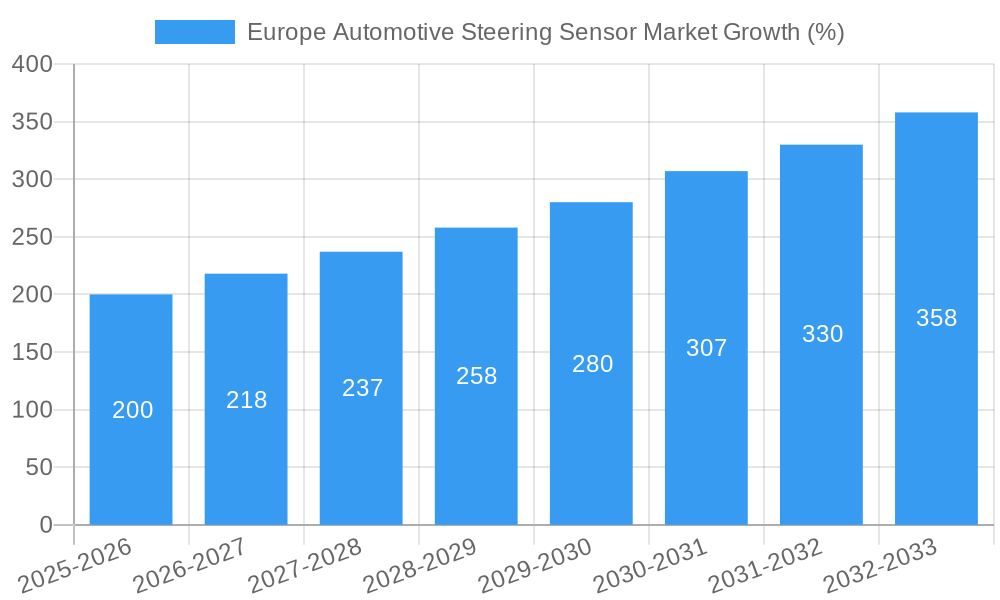

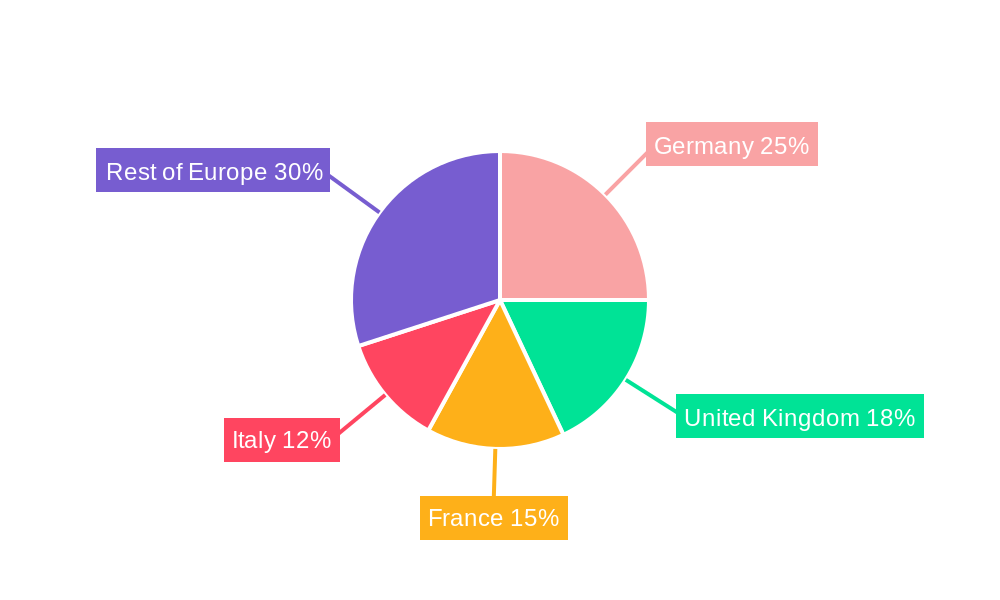

The European automotive steering sensor market is experiencing robust growth, driven by increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. The market's Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2024 indicates significant expansion. This growth is fueled by several key factors, including stringent safety regulations mandating the inclusion of steering sensors in new vehicles, a rising demand for enhanced vehicle safety features, and the increasing integration of electric and hybrid vehicles, which rely heavily on precise steering control. The market is segmented by vehicle type (passenger cars and commercial vehicles), sensor type (health monitoring systems, torque and angle sensors, position sensors, and others), and technology type (contacting and magnetic). Passenger cars currently dominate the market share, although the commercial vehicle segment is exhibiting faster growth due to the increasing demand for improved safety and efficiency in commercial fleets. The adoption of more sophisticated sensor technologies, such as magnetic sensors offering better durability and accuracy, is also contributing to market growth. Germany, the United Kingdom, and France represent the largest national markets, reflecting the established automotive manufacturing base and higher vehicle ownership rates in these countries.

While the market faces challenges such as high initial investment costs for advanced sensor technologies and potential supply chain disruptions, the long-term outlook remains positive. The continuous development of sophisticated ADAS features, the growing trend towards autonomous vehicles, and increasing investments in research and development within the automotive sector are expected to further propel market expansion. Major players like Honeywell, Bosch, and Continental are actively investing in innovation and strategic partnerships to consolidate their market positions. The market's continued growth trajectory is projected to remain strong throughout the forecast period (2025-2033), driven by the ongoing technological advancements and increasing demand for enhanced safety and driving experience in European vehicles. We anticipate a market size in the range of several billion Euros by 2033, reflecting the substantial potential within the European automotive landscape.

Europe Automotive Steering Sensor Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Automotive Steering Sensor Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. The market is segmented by vehicle type, sensor type, technology type, and country, offering a granular understanding of market dynamics. Key players such as Honeywell Inc, Bei Sensors, HELLA GmbH & Co KgaA, Sensata Technologies, NXP Semiconductors, Continental AG, Infineon Technologies, Asahi Kasei, Robert Bosch GmbH, Valeo SA, and DENSO Corporation are analyzed for their market share, strategies, and competitive positioning. The total market size in 2025 is estimated at xx Million.

Europe Automotive Steering Sensor Market Concentration & Innovation

The Europe Automotive Steering Sensor market exhibits a moderately concentrated landscape, with the top 5 players holding approximately xx% of the market share in 2025. Market concentration is influenced by factors such as economies of scale, technological expertise, and established distribution networks. Innovation within the sector is driven by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving technologies, and stricter safety regulations. Key innovation areas include the development of miniaturized sensors, improved sensor accuracy, enhanced durability, and the integration of sensor fusion technologies. Regulatory frameworks, such as those pertaining to vehicle safety and emissions, significantly impact market growth and technological advancements. The market witnesses continuous product substitution, with newer technologies like magnetic sensors gradually replacing contacting sensors due to their enhanced reliability and longevity. End-user trends towards enhanced vehicle safety and comfort fuel the demand for sophisticated steering sensors. M&A activity in the sector is moderate, with deal values totaling approximately xx Million in the last 5 years, primarily focused on strategic acquisitions to expand technological capabilities and market reach.

- Market Share (2025): Top 5 players: xx%

- M&A Deal Value (2020-2024): Approximately xx Million

- Key Innovation Drivers: ADAS, Autonomous Driving, Safety Regulations

Europe Automotive Steering Sensor Market Industry Trends & Insights

The Europe Automotive Steering Sensor market is projected to witness robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key factors: the rising adoption of ADAS and autonomous driving features in passenger and commercial vehicles, the increasing demand for improved vehicle safety and fuel efficiency, and continuous technological advancements in sensor technology. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in steering sensor systems, are enhancing sensor accuracy and reliability. Consumer preference for advanced safety features is driving the demand for higher-performing steering sensors. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative solutions. Market penetration of advanced steering sensor technologies is increasing steadily, driven by technological advancements and decreasing costs.

Dominant Markets & Segments in Europe Automotive Steering Sensor Market

Dominant Regions & Segments:

- By Vehicle Type: The passenger car segment dominates the market, driven by high vehicle production volumes and increasing integration of advanced safety features.

- By Sensor Type: Torque and angle sensors hold the largest market share, owing to their critical role in steering control and vehicle stability.

- By Technology Type: Magnetic sensors are gaining significant traction, surpassing contacting sensors due to their superior performance and reliability.

- By Country: Germany holds the leading position, attributed to its robust automotive industry, high vehicle production, and presence of major sensor manufacturers.

Key Drivers of Segment Dominance:

- Germany: Strong automotive manufacturing base, presence of major sensor manufacturers, favorable government policies supporting the automotive industry.

- Passenger Cars: High vehicle production, increasing adoption of ADAS and autonomous driving technologies, and consumer preference for advanced safety features.

- Torque and Angle Sensors: Critical role in steering control and vehicle stability, high demand from ADAS and autonomous driving applications.

- Magnetic Sensors: Superior performance and reliability, cost-effectiveness compared to contacting sensors, and increasing adoption in new vehicle models.

Europe Automotive Steering Sensor Market Product Developments

Recent product innovations focus on miniaturization, improved accuracy, and enhanced durability of steering sensors. Applications extend beyond traditional steering control to include advanced driver assistance systems (ADAS) and autonomous driving functionalities. Key competitive advantages are derived from superior sensor performance, cost-effectiveness, and integration capabilities. Technological trends indicate a shift towards sensor fusion, AI-powered algorithms, and advanced materials for improved reliability and performance. The market fit for these advanced sensors is strong, driven by the industry’s continuous demand for improved safety and driving experience.

Report Scope & Segmentation Analysis

This report comprehensively segments the Europe Automotive Steering Sensor market across several parameters:

By Vehicle Type: Passenger Cars and Commercial Vehicles, with passenger cars currently holding a larger market share but commercial vehicle segment exhibiting higher growth projection.

By Sensor Type: Health Monitoring Systems, Torque and Angle Sensors, Position Sensors, and Others, where Torque and Angle sensors dominate with strong growth outlook across all vehicle segments.

By Technology Type: Contacting and Magnetic, where Magnetic technology shows increasing adoption due to superior performance characteristics.

By Country: Germany, United Kingdom, Italy, France, Spain, Norway, The Netherlands, and Rest of Europe, with Germany holding a leading position driven by its strong automotive industry.

Each segment includes detailed analysis of market size, growth projections, and competitive dynamics.

Key Drivers of Europe Automotive Steering Sensor Market Growth

The Europe Automotive Steering Sensor market's growth is propelled by several key factors. Technological advancements, particularly in miniaturization and sensor fusion, are enabling the integration of more sophisticated sensors in vehicles. Stringent safety regulations across Europe mandate the inclusion of advanced safety features, driving the demand for high-performance steering sensors. The increasing popularity of ADAS and autonomous driving technologies significantly boosts market growth, as these features heavily rely on accurate and reliable steering sensor data. Furthermore, economic growth and increasing vehicle production volumes in the region contribute to the market's expansion.

Challenges in the Europe Automotive Steering Sensor Market Sector

The Europe Automotive Steering Sensor market faces several challenges. Stringent regulatory compliance requirements for sensor safety and performance can increase production costs and time-to-market. Supply chain disruptions and fluctuations in raw material prices pose significant risks to manufacturers. Intense competition from established and emerging players exerts pressure on pricing and margins. The market is also subject to the cyclical nature of the automotive industry, making it susceptible to economic downturns. These challenges can cumulatively impact market growth and profitability.

Emerging Opportunities in Europe Automotive Steering Sensor Market

Several promising opportunities exist in the Europe Automotive Steering Sensor market. The expansion of the electric vehicle (EV) market presents significant growth potential, as EVs require advanced sensor systems for enhanced safety and performance. The increasing demand for autonomous driving features opens avenues for innovation in sensor fusion and AI-based sensor technologies. Emerging markets within Europe, characterized by increasing vehicle ownership and rising disposable incomes, offer significant expansion potential. Finally, the development of new sensor materials and manufacturing processes can lead to cost reductions and improved sensor performance, further stimulating market growth.

Leading Players in the Europe Automotive Steering Sensor Market Market

- Honeywell Inc

- Bei Sensors

- HELLA GmbH & Co KgaA

- Sensata Technologies

- NXP Semiconductors

- Continental AG

- Infineon Technologies

- Asahi Kasei

- Robert Bosch GmbH

- Valeo SA

- DENSO Corporation

Key Developments in Europe Automotive Steering Sensor Market Industry

- Jan 2023: Honeywell Inc. launched a new generation of steering angle sensors with improved accuracy and durability.

- May 2022: Continental AG acquired a smaller sensor technology company, expanding its product portfolio.

- Oct 2021: Robert Bosch GmbH announced a strategic partnership to develop advanced sensor fusion technologies for autonomous driving. (Add further relevant developments with year/month and impact)

Strategic Outlook for Europe Automotive Steering Sensor Market Market

The Europe Automotive Steering Sensor market is poised for substantial growth, driven by the ongoing adoption of ADAS and autonomous driving features, stringent safety regulations, and technological innovations. The increasing demand for electric vehicles and the development of advanced sensor technologies present significant opportunities for market expansion. Companies with strong technological capabilities, robust supply chains, and a focus on innovation are well-positioned to capitalize on the market's growth potential. Further consolidation through mergers and acquisitions is anticipated, shaping the market landscape. The focus will remain on providing higher accuracy, enhanced reliability, reduced size and weight, and affordability.

Europe Automotive Steering Sensor Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Sensor Type

- 2.1. Health Monitoring Systems

- 2.2. Torque and Angle Sensors

- 2.3. Position Sensors

- 2.4. Others

-

3. Technology Type

- 3.1. Contacting

- 3.2. Magnetic

Europe Automotive Steering Sensor Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Steering Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electrification of Vehicles

- 3.3. Market Restrains

- 3.3.1. Precise Testing and Validation

- 3.4. Market Trends

- 3.4.1. Position Sensors is expected to hold the major share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Health Monitoring Systems

- 5.2.2. Torque and Angle Sensors

- 5.2.3. Position Sensors

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Technology Type

- 5.3.1. Contacting

- 5.3.2. Magnetic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bei Sensors

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HELLA GmbH & Co KgaA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sensata Technologies

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nxp Semiconductors

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Continental AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Infineon Technology

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Asahi Kase

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Robert Bosch GmbH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Valeo SA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 DENSO Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Honeywell Inc

List of Figures

- Figure 1: Europe Automotive Steering Sensor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Automotive Steering Sensor Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 4: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 5: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 16: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 17: Europe Automotive Steering Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Automotive Steering Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Steering Sensor Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe Automotive Steering Sensor Market?

Key companies in the market include Honeywell Inc, Bei Sensors, HELLA GmbH & Co KgaA, Sensata Technologies, Nxp Semiconductors, Continental AG, Infineon Technology, Asahi Kase, Robert Bosch GmbH, Valeo SA, DENSO Corporation.

3. What are the main segments of the Europe Automotive Steering Sensor Market?

The market segments include Vehicle Type, Sensor Type, Technology Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electrification of Vehicles.

6. What are the notable trends driving market growth?

Position Sensors is expected to hold the major share in the market.

7. Are there any restraints impacting market growth?

Precise Testing and Validation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Steering Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Steering Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Steering Sensor Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Steering Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence