Key Insights

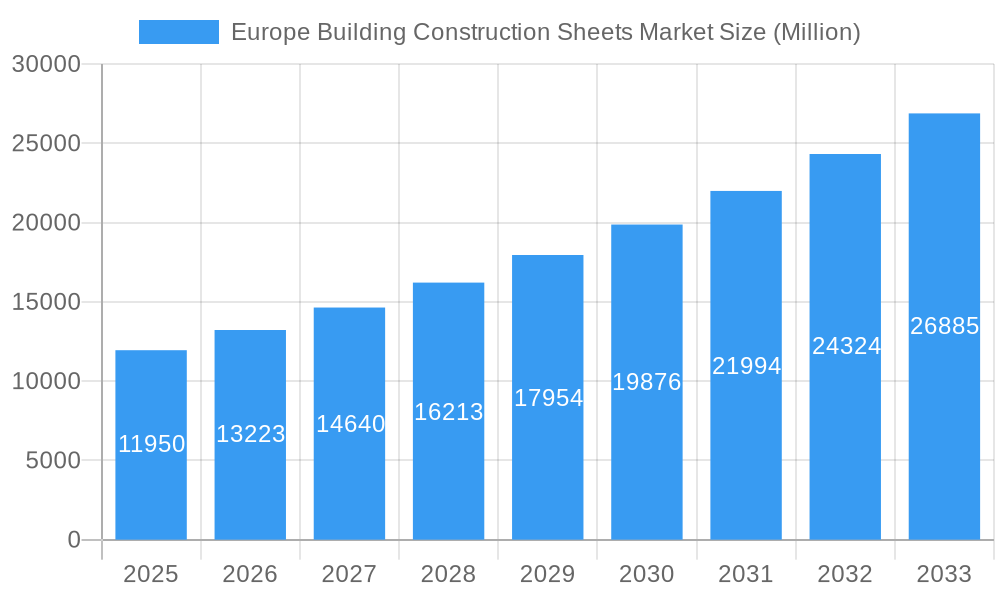

The Europe Building Construction Sheets Market is poised for substantial growth, projected to reach USD 11.95 billion in 2025, driven by a robust CAGR of 10.66% throughout the forecast period. This expansion is underpinned by increasing construction activities across residential, commercial, and industrial sectors, fueled by urbanization, infrastructure development, and a growing demand for energy-efficient and aesthetically pleasing building materials. Key drivers include government initiatives promoting sustainable construction, a rising disposable income leading to upgrades in existing structures, and advancements in material technology offering enhanced durability and performance. The market benefits from a diverse material landscape, with Bitumen, Rubber, Metal, and Polymer sheets all playing significant roles, catering to a wide array of structural and design requirements. Emerging trends like the adoption of lightweight and recyclable materials, coupled with smart building technologies, are further shaping the market's trajectory.

Europe Building Construction Sheets Market Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints. These include the fluctuating prices of raw materials, stringent environmental regulations that necessitate costly compliance measures, and the initial high investment required for certain advanced construction sheet technologies. The competitive landscape is characterized by the presence of major global players such as Saint Gobain, James Hardie Industries plc, and LyondellBasell, alongside specialized regional manufacturers. Intense competition and a focus on product innovation, particularly in areas of sustainability and improved insulation properties, are expected to define the market's dynamics. Europe, with countries like the United Kingdom, Germany, and France leading the charge, represents a critical and mature market, with a consistent demand for high-quality construction sheets that balance performance, cost-effectiveness, and environmental responsibility.

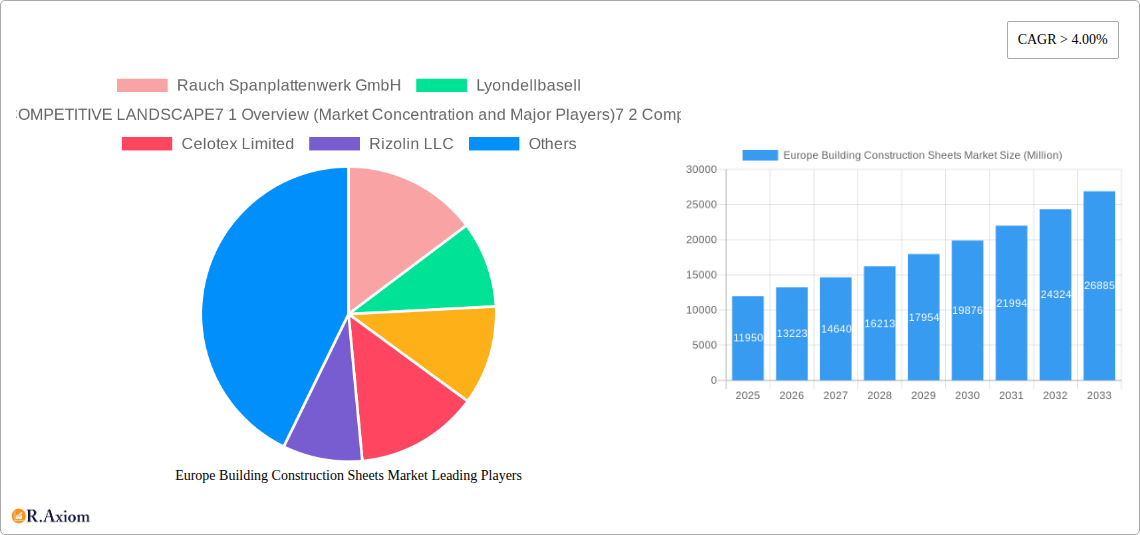

Europe Building Construction Sheets Market Company Market Share

This report offers an in-depth analysis of the Europe Building Construction Sheets Market, a critical sector driving infrastructure development and sustainable building practices across the continent. With a study period spanning from 2019 to 2033, including a base year of 2025 and a historical period from 2019-2024, this report provides robust market insights for industry stakeholders. The market is segmented by Material (Bitumen, Rubber, Metal, Polymer) and End User (Residential, Commercial, Industrial), offering granular analysis of growth trajectories and competitive landscapes.

Europe Building Construction Sheets Market Market Concentration & Innovation

The Europe Building Construction Sheets Market exhibits a moderate level of market concentration, characterized by the presence of both large, established players and a growing number of specialized manufacturers. Innovation is a key driver, fueled by increasing demand for energy-efficient, durable, and environmentally friendly building materials. Regulatory frameworks, such as stringent building codes and sustainability mandates, are pushing manufacturers to develop advanced sheet solutions. Product substitutes, including alternative roofing and facade materials, present a dynamic competitive element, necessitating continuous product development. Merger and acquisition (M&A) activities are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, significant M&A deals in the past have been valued in the hundreds of millions to billions of Euros, consolidating market share and driving innovation. The market share of leading players ranges from approximately 5% to 15%, with a focus on specialization within material segments.

Europe Building Construction Sheets Market Industry Trends & Insights

The Europe Building Construction Sheets Market is poised for significant growth, driven by a confluence of macro-economic factors and evolving construction practices. The increasing urbanization across Europe, coupled with substantial government investments in infrastructure development and renovation projects, acts as a primary growth catalyst. Furthermore, a heightened global awareness regarding climate change and the need for sustainable building solutions is propelling the demand for eco-friendly construction sheets. Innovations in material science are leading to the development of lighter, stronger, and more insulating sheet products, contributing to energy efficiency in buildings and reducing operational costs. The market penetration of advanced polymer-based sheets and metal composites is steadily increasing, reflecting a shift towards high-performance materials.

The forecast period (2025–2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 6.0%, underscoring the robust expansion potential of this sector. Consumer preferences are increasingly leaning towards materials that offer superior durability, aesthetic appeal, and lower lifecycle costs. The residential construction segment, in particular, is witnessing a surge in demand for aesthetically pleasing and weather-resistant sheets. In the commercial sector, the focus is on fire-resistant and high-performance materials for large-scale projects. Industrial applications are characterized by the need for robust, chemically resistant, and load-bearing sheet solutions. The competitive dynamics are shaped by product differentiation, price competitiveness, and the ability of manufacturers to meet evolving regulatory standards and customer demands. The integration of smart technologies, such as embedded sensors for monitoring structural integrity, represents a nascent but significant technological disruption.

Dominant Markets & Segments in Europe Building Construction Sheets Market

The European Building Construction Sheets Market demonstrates distinct regional dominance and segmentation trends. Germany, the UK, and France consistently lead the market in terms of overall value and volume, driven by robust construction activities, significant infrastructure investments, and stringent building codes that favor high-quality materials.

Material Segmentation Dominance:

- Polymer Sheets: Currently dominate the market due to their versatility, durability, lightweight nature, and excellent insulation properties. They are widely adopted across residential, commercial, and industrial applications, particularly in roofing, cladding, and interior finishing. The increasing focus on sustainable and recyclable polymers further bolsters their market share.

- Metal Sheets: Continue to hold a substantial market share, especially in industrial and commercial constructions, owing to their inherent strength, fire resistance, and longevity. Innovations in coatings and alloys are enhancing their corrosion resistance and aesthetic appeal, making them suitable for a wider range of applications.

- Bitumen Sheets: Remain a significant segment, particularly in roofing applications for their cost-effectiveness and waterproofing capabilities, especially in less demanding construction projects.

- Rubber Sheets: While a smaller segment, they are crucial for specialized applications requiring excellent waterproofing, vibration dampening, and flexibility, such as in specific roofing systems and industrial flooring.

End User Segmentation Dominance:

- Residential Construction: Represents the largest end-user segment, driven by ongoing new housing projects, extensive renovation and retrofitting activities, and the increasing demand for energy-efficient and aesthetically pleasing homes.

- Commercial Construction: Follows closely, with significant demand from offices, retail spaces, and hospitality sectors. Factors such as modernization of existing structures and new commercial developments contribute to this segment's growth.

- Industrial Construction: While smaller in volume compared to residential and commercial, this segment is characterized by a high demand for specialized, robust, and performance-driven sheet materials to withstand harsh environmental conditions and specific industrial processes.

Economic policies promoting sustainable construction, coupled with growing infrastructure development projects across Europe, are key drivers for the dominance of these segments. The adoption of advanced polymer and metal sheets in both new builds and renovations is a testament to their superior performance characteristics.

Europe Building Construction Sheets Market Product Developments

Product innovation in the Europe Building Construction Sheets Market is centered on enhancing sustainability, performance, and ease of installation. Manufacturers are actively developing lightweight, high-strength polymer sheets with advanced insulation properties to improve building energy efficiency. Metal sheets are seeing advancements in corrosion-resistant coatings and recyclable materials. The integration of fire-retardant additives and the development of bio-based or recycled content polymers are key trends. These developments cater to stringent building codes and growing consumer demand for eco-friendly and durable solutions, offering competitive advantages through superior performance and reduced lifecycle costs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe Building Construction Sheets Market segmented by Material and End User.

Material Segmentation: The analysis covers Bitumen sheets, Rubber sheets, Metal sheets, and Polymer sheets. Each segment's market size, growth projections, and competitive dynamics are detailed, with Polymer sheets projected to exhibit the highest growth rate due to their versatility and sustainability advantages.

End User Segmentation: The report details the market dynamics for Residential, Commercial, and Industrial end-use segments. The Residential sector is expected to maintain its dominance, driven by new construction and renovation trends, while Commercial and Industrial segments also show robust growth driven by specific industry needs and modernization efforts.

Key Drivers of Europe Building Construction Sheets Market Growth

The growth of the Europe Building Construction Sheets Market is primarily propelled by several interconnected factors. Foremost is the sustained investment in urban development and infrastructure projects across European nations, driving demand for construction materials. Increasingly stringent environmental regulations and building codes are pushing for the adoption of energy-efficient, sustainable, and durable sheet materials. Technological advancements in material science are enabling the development of higher-performance sheets, such as lightweight, insulating polymer composites and enhanced metal alloys. Furthermore, a growing consumer preference for aesthetically pleasing, low-maintenance, and long-lasting building envelopes contributes significantly to market expansion.

Challenges in the Europe Building Construction Sheets Market Sector

Despite its growth prospects, the Europe Building Construction Sheets Market faces several challenges. Volatility in raw material prices, particularly for polymers and metals, can impact profit margins and product pricing. Stringent regulatory compliance, while a driver for innovation, also adds to development costs and time-to-market. Supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of essential materials. Intense competition among numerous players, both established and emerging, can lead to price pressures and the need for continuous differentiation. The adoption of new technologies also requires significant investment in research and development, posing a hurdle for smaller market participants.

Emerging Opportunities in Europe Building Construction Sheets Market

Emerging opportunities within the Europe Building Construction Sheets Market are abundant and point towards future growth areas. The increasing focus on retrofitting and renovating existing buildings to meet modern energy efficiency standards presents a significant market for specialized sheets. The burgeoning demand for sustainable and green building materials offers a substantial avenue for manufacturers utilizing recycled content and bio-based polymers. Innovations in smart building technologies, such as integrating sensors into construction sheets for structural monitoring or energy management, represent a nascent but promising frontier. Furthermore, the expansion of modular construction techniques is creating new applications for prefabricated sheet components, streamlining construction processes and reducing waste.

Leading Players in the Europe Building Construction Sheets Market Market

- Rauch Spanplattenwerk GmbH

- Lyondellbasell

- Celotex Limited

- Rizolin LLC

- James Hardie Industries plc

- Paul Bauder GmbH

- Euramax International

- Saint Gobain

- Icopal ApS

- CBG Composites GmbH

Key Developments in Europe Building Construction Sheets Market Industry

- 2023: Launch of a new generation of high-performance, recyclable polymer roofing membranes by a leading European manufacturer, enhancing energy efficiency and sustainability.

- 2022: A major merger acquisition event in the metal construction sheets sector, consolidating market share and expanding product offerings.

- 2021: Introduction of advanced fire-resistant composite sheets for industrial applications, meeting stricter safety regulations.

- 2020: Increased investment in R&D for bio-based polymers in construction sheets, responding to growing demand for eco-friendly materials.

- 2019: Significant product innovation in lightweight metal cladding systems designed for faster installation and reduced structural load.

Strategic Outlook for Europe Building Construction Sheets Market Market

The strategic outlook for the Europe Building Construction Sheets Market is overwhelmingly positive, driven by a commitment to sustainability, technological advancement, and robust infrastructure development. Companies that focus on developing innovative, eco-friendly, and high-performance sheet solutions will be well-positioned for growth. Strategic partnerships and collaborations, particularly with technology providers and research institutions, will be crucial for staying ahead of the innovation curve. Expanding product portfolios to cater to niche applications and emerging construction trends like modular building will also be a key strategy. Continuous adaptation to evolving regulatory landscapes and proactive engagement with sustainability initiatives will solidify market leadership and ensure long-term success in this dynamic sector.

Europe Building Construction Sheets Market Segmentation

-

1. Material

- 1.1. Bitumen

- 1.2. Rubber

- 1.3. Metal

- 1.4. Polymer

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

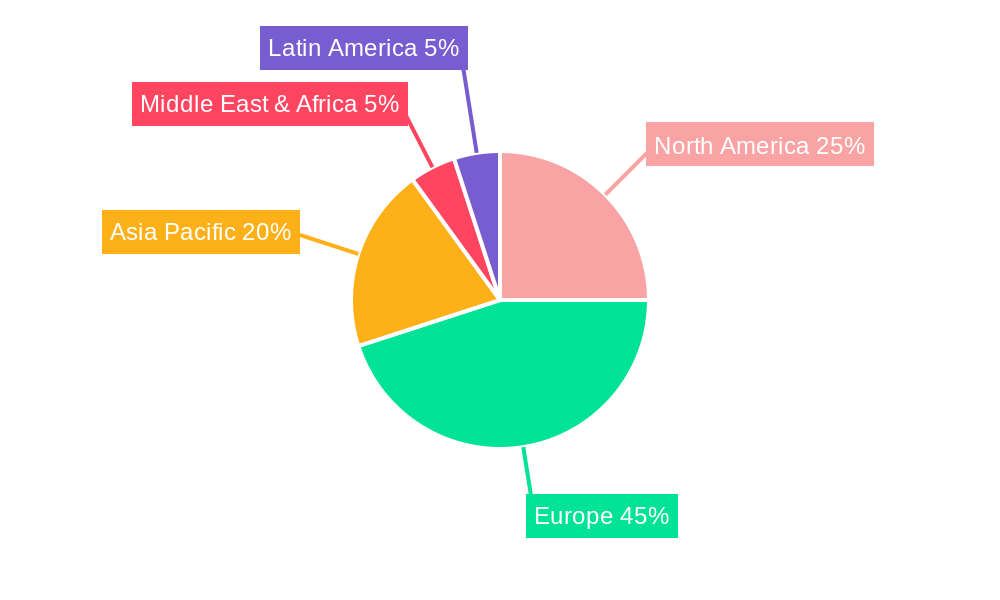

Europe Building Construction Sheets Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Building Construction Sheets Market Regional Market Share

Geographic Coverage of Europe Building Construction Sheets Market

Europe Building Construction Sheets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry; Need for Precast Concrete Technology Driving the Market

- 3.3. Market Restrains

- 3.3.1. Higher Transportation Cost

- 3.4. Market Trends

- 3.4.1. Rise in Construction Equipment Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Building Construction Sheets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Bitumen

- 5.1.2. Rubber

- 5.1.3. Metal

- 5.1.4. Polymer

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rauch Spanplattenwerk GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lyondellbasell

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 7 COMPETITIVE LANDSCAPE7 1 Overview (Market Concentration and Major Players)7 2 Company profiles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celotex Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rizolin LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 James Hardie Industries plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Paul Bauder GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Euramax International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saint Gobain

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Icopal ApS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CBG Composites GmbH**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Rauch Spanplattenwerk GmbH

List of Figures

- Figure 1: Europe Building Construction Sheets Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Building Construction Sheets Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Building Construction Sheets Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Europe Building Construction Sheets Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Europe Building Construction Sheets Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Building Construction Sheets Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Europe Building Construction Sheets Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Europe Building Construction Sheets Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Building Construction Sheets Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Building Construction Sheets Market?

The projected CAGR is approximately 10.66%.

2. Which companies are prominent players in the Europe Building Construction Sheets Market?

Key companies in the market include Rauch Spanplattenwerk GmbH, Lyondellbasell, 7 COMPETITIVE LANDSCAPE7 1 Overview (Market Concentration and Major Players)7 2 Company profiles, Celotex Limited, Rizolin LLC, James Hardie Industries plc, Paul Bauder GmbH, Euramax International, Saint Gobain, Icopal ApS, CBG Composites GmbH**List Not Exhaustive.

3. What are the main segments of the Europe Building Construction Sheets Market?

The market segments include Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry; Need for Precast Concrete Technology Driving the Market.

6. What are the notable trends driving market growth?

Rise in Construction Equipment Sales.

7. Are there any restraints impacting market growth?

Higher Transportation Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Building Construction Sheets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Building Construction Sheets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Building Construction Sheets Market?

To stay informed about further developments, trends, and reports in the Europe Building Construction Sheets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence