Key Insights

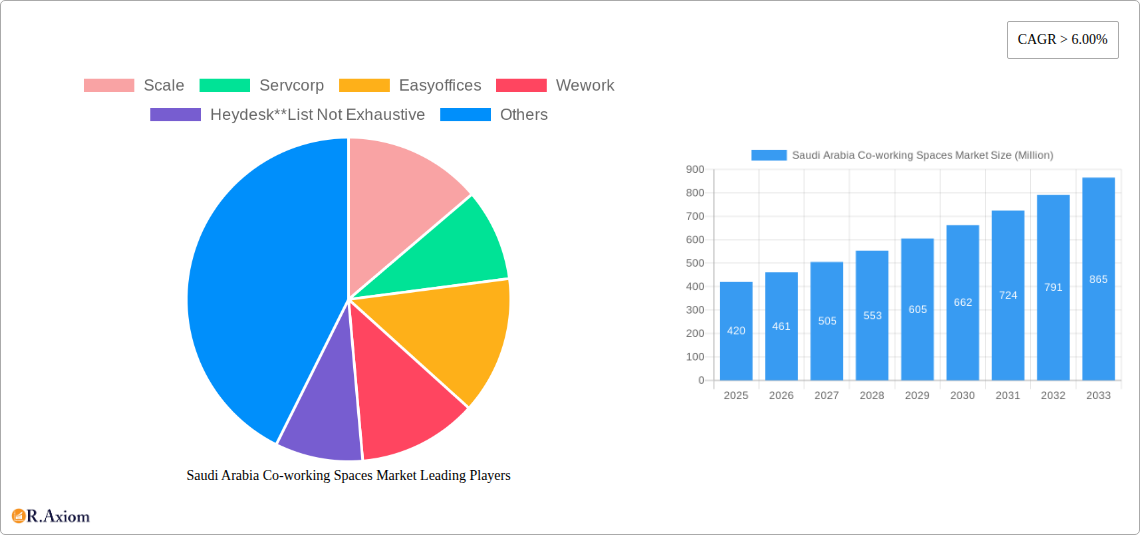

The Saudi Arabian co-working spaces market is poised for significant expansion, projected to reach an estimated $420 million in 2025, with a robust compound annual growth rate (CAGR) of 9.72% anticipated throughout the forecast period (2025-2033). This impressive growth is primarily fueled by the Kingdom's ambitious Vision 2030, which actively encourages entrepreneurship, innovation, and foreign investment, creating a fertile ground for flexible workspace solutions. The burgeoning startup ecosystem, coupled with the increasing adoption of hybrid work models by both small and large enterprises, are key drivers. Companies are actively seeking cost-effective, agile, and amenity-rich office environments that foster collaboration and productivity. The demand is particularly strong within the Information Technology (IT and ITES), Legal Services, and BFSI sectors, where flexibility and access to a skilled talent pool are paramount.

Saudi Arabia Co-working Spaces Market Market Size (In Million)

Further propelling this market momentum are evolving workplace trends, including a greater emphasis on community building within co-working spaces, the integration of smart technologies for enhanced user experience, and the growing preference for serviced offices that offer comprehensive facilities and management. While the market benefits from these positive trends, it also faces certain restraints, such as the initial capital investment required for establishing premium co-working facilities and the potential for increased competition as more players enter the market. However, the strategic initiatives by the Saudi government to diversify its economy and attract global businesses are expected to significantly outweigh these challenges, solidifying the co-working spaces market as a vital component of the Kingdom's evolving commercial landscape.

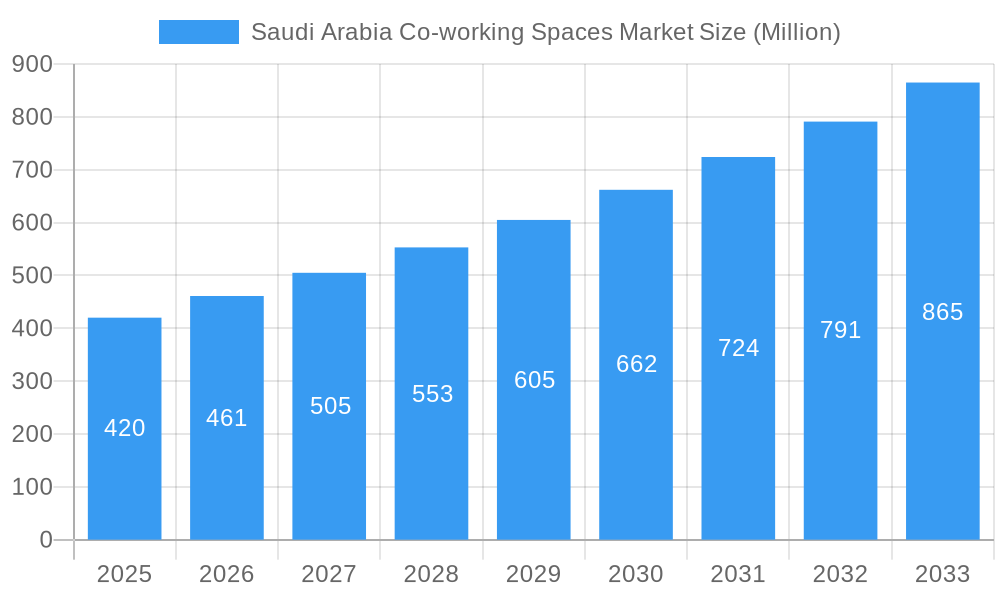

Saudi Arabia Co-working Spaces Market Company Market Share

Saudi Arabia Co-working Spaces Market Market Concentration & Innovation

The Saudi Arabia co-working spaces market exhibits a moderate level of concentration, with established global players like WeWork and Regus coexisting alongside burgeoning local enterprises such as Gravita and The Space. Innovation is primarily driven by the increasing demand for flexible work solutions and the integration of smart technology to enhance user experience. Regulatory frameworks are evolving to support the growth of the gig economy and remote work, fostering a more conducive environment for co-working. While direct product substitutes are limited, traditional office rentals represent an alternative for larger corporations. End-user trends are shifting towards personalized, community-driven workspaces that offer networking opportunities and specialized amenities. Mergers and acquisitions (M&A) activity is anticipated to increase as larger players seek to expand their footprint and smaller entities aim for consolidation. For instance, a hypothetical M&A deal value in the range of USD 5 million to USD 20 million could be observed in the coming years for strategically acquired regional co-working providers. The market share of leading co-working providers is estimated to be around 15-25% each, with the remaining fragmented among smaller operators.

Saudi Arabia Co-working Spaces Market Industry Trends & Insights

The Saudi Arabia co-working spaces market is poised for substantial growth, driven by a confluence of economic diversification initiatives, a young and digitally-savvy population, and a progressive shift towards flexible work models. The Kingdom's Vision 2030 blueprint, with its emphasis on creating a vibrant society and a thriving economy, is a significant catalyst, encouraging entrepreneurship and attracting foreign investment, both of which necessitate adaptable office solutions. The burgeoning Information Technology (IT and ITES) sector, along with the growing Legal Services and BFSI sectors, are prime adopters of co-working spaces due to their inherent need for agility and collaboration. The ongoing digital transformation across all industries further fuels the demand for agile workspaces that can accommodate fluctuating team sizes and project-based work.

Technological advancements are playing a pivotal role in shaping the co-working landscape. The integration of IoT devices for smart building management, AI-powered booking systems, and seamless connectivity solutions are becoming standard expectations for users. This technological infusion not only enhances operational efficiency but also elevates the user experience, fostering loyalty and attracting new clientele. Consumer preferences are increasingly leaning towards aesthetically pleasing, community-focused environments that offer more than just a desk. Networking events, workshops, and professional development programs hosted within co-working hubs are becoming key value propositions. This shift from a purely functional space to a holistic ecosystem is crucial for market penetration.

The competitive dynamics are intensifying, with both global giants and local startups vying for market share. Companies are differentiating themselves through unique service offerings, specialized community building, and strategic partnerships. For instance, partnerships with technology providers or local business associations can create exclusive value for members. The average revenue per user (ARPU) in co-working spaces is projected to see a steady increase, driven by the demand for premium services and longer-term commitments from established businesses. The market penetration rate, currently estimated at around 10-15% of the potential addressable market, is expected to surge in the coming years as more businesses recognize the cost-effectiveness and flexibility of co-working models. The compound annual growth rate (CAGR) for the Saudi Arabia co-working spaces market is projected to be in the range of 18-25% during the forecast period, reflecting its robust expansion trajectory.

Dominant Markets & Segments in Saudi Arabia Co-working Spaces Market

The Saudi Arabia co-working spaces market is experiencing a dynamic expansion across its various segments, with a pronounced dominance observed in key geographical areas and user demographics. Riyadh, as the capital and economic heart of the Kingdom, stands out as the leading region, attracting the largest share of co-working investments and user adoption. Its robust infrastructure, concentration of corporate headquarters, and a thriving startup ecosystem create an ideal environment for flexible workspace solutions. Jeddah and Dammam also represent significant growth markets, driven by their industrial and commercial importance respectively.

Within the End User segmentation, Small Scale Companies are currently the largest adopters of co-working spaces. These businesses, often early-stage startups or growing SMEs, benefit immensely from the cost-effectiveness, flexibility, and networking opportunities that co-working offers, allowing them to scale their operations without significant upfront capital expenditure on traditional office leases. However, Large Scale Companies are increasingly exploring co-working solutions for specific project teams, remote workers, or to pilot new market entries, indicating a significant growth potential in this segment. Personal Users, comprising freelancers and remote professionals, continue to be a stable and growing segment, appreciating the professional environment and community aspect.

In terms of Type, Flexible Managed Offices are the most sought-after. This model provides a balance of privacy and communal resources, catering to businesses that require dedicated office spaces but still value the flexibility and services offered by co-working providers. Serviced Offices, which offer a higher degree of customization and private facilities, are also gaining traction, particularly among larger enterprises seeking branded and fully-equipped office solutions.

The Application segmentation reveals Information Technology (IT and ITES) as the dominant sector. The fast-paced nature of the IT industry, with its emphasis on innovation, collaboration, and a dynamic workforce, aligns perfectly with the agility and infrastructure provided by co-working spaces. Legal Services and BFSI (Banking, Financial Services, and Insurance) sectors are also significant contributors, utilizing co-working spaces for project-specific needs, satellite offices, and to access specialized amenities. Consulting firms also represent a growing segment, valuing the flexibility and professional environment for client meetings and team collaboration.

Key drivers for this dominance include:

- Government Initiatives: Vision 2030 policies fostering entrepreneurship and economic diversification.

- Infrastructure Development: Significant investments in modern infrastructure across major cities, supporting business growth.

- Technological Adoption: High internet penetration and a digitally-native population embracing flexible work.

- Talent Pool: Availability of a young and skilled workforce increasingly seeking flexible employment.

- Cost-Effectiveness: Co-working spaces offer a more economical alternative to traditional office leases for many businesses.

Saudi Arabia Co-working Spaces Market Product Developments

Product developments in the Saudi Arabia co-working spaces market are focused on enhancing user experience through technology and community building. Innovations include AI-powered space management systems for seamless booking and access, integrated smart office amenities for enhanced productivity, and curated networking events designed to foster collaboration. Companies are also developing hybrid workspace models that cater to both remote and in-office employees, offering flexible membership tiers. The competitive advantage lies in creating value-added services such as business support, mentorship programs, and access to exclusive industry networks, thereby transforming co-working spaces into vibrant entrepreneurial ecosystems.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Saudi Arabia co-working spaces market, segmenting it to provide granular insights. The End User segmentation includes Personal Users, Small Scale Companies, Large Scale Companies, and Other End Users. Personal Users, comprising freelancers and independent professionals, are projected to see a steady growth rate of approximately 15% annually. Small Scale Companies, currently dominating the market, are expected to maintain a strong growth trajectory of around 20% driven by their increasing reliance on flexible solutions. Large Scale Companies are projected to experience the highest growth rate, estimated at 25% annually, as they increasingly adopt co-working for distributed workforce strategies.

The Type segmentation covers Flexible Managed Offices and Serviced Offices. Flexible Managed Offices are anticipated to hold the largest market share, with a projected growth of 22% annually, due to their broad appeal. Serviced Offices are expected to grow at a slightly lower rate of 18% annually, catering to a more specialized, premium segment.

The Application segmentation includes Information Technology (IT and ITES), Legal Services, BFSI (Banking, Financial Services, and Insurance), Consulting, and Other Services. The IT and ITES sector is projected to lead in market size and growth, with an estimated annual growth of 28%, reflecting the digital transformation agenda. BFSI and Consulting sectors are also expected to exhibit robust growth, around 20% and 19% respectively, as they embrace modern workspace solutions.

Key Drivers of Saudi Arabia Co-working Spaces Market Growth

The Saudi Arabia co-working spaces market is propelled by several key drivers. Economic Diversification: Vision 2030 initiatives are fostering entrepreneurship and attracting foreign investment, creating a demand for flexible office solutions. Technological Advancement: High internet penetration and the adoption of digital tools enable remote work and the efficient operation of co-working spaces. Young Demographics: A large, tech-savvy youth population is more inclined towards flexible work arrangements and startup culture. Regulatory Support: Evolving government policies are increasingly supportive of flexible work and the gig economy. Cost-Effectiveness: Co-working offers a significant cost advantage over traditional office leases, especially for SMEs and startups.

Challenges in the Saudi Arabia Co-working Spaces Market Sector

Despite its growth, the Saudi Arabia co-working spaces market faces certain challenges. Regulatory Ambiguity: While evolving, some regulations related to business setup and licensing in co-working environments can still pose complexities for new entrants. Market Saturation in Prime Locations: In highly sought-after areas, increased competition can lead to price wars and pressure on profit margins. Perception of Insecurity: Some traditional businesses may still harbor concerns about data security and privacy in shared workspace environments. Skilled Workforce Shortage: A lack of readily available talent with specialized co-working management skills can hinder operational efficiency. Infrastructure Gaps in Emerging Areas: While major cities are well-developed, co-working accessibility in less developed regions might be constrained by infrastructure limitations.

Emerging Opportunities in Saudi Arabia Co-working Spaces Market

The Saudi Arabia co-working spaces market presents numerous emerging opportunities. The expansion into Tier 2 and Tier 3 cities presents a significant untapped market, catering to the growing demand for flexible workspaces outside major urban centers. The specialization of co-working spaces for specific industries, such as fintech hubs or creative studios, offers niche market potential. Integration of advanced technologies like VR/AR for virtual meetings and immersive experiences can create unique value propositions. The increasing focus on sustainability and green building practices within co-working spaces aligns with global trends and can attract environmentally conscious businesses. Furthermore, partnerships with corporate real estate firms can facilitate the transition of larger enterprises towards hybrid work models, opening up a substantial new client base.

Leading Players in the Saudi Arabia Co-working Spaces Market Market

- Scale

- Servcorp

- Easyoffices

- WeWork

- Heydesk

- Regus

- White Space

- Gravita

- The Space

- Vibes offices

Key Developments in Saudi Arabia Co-working Spaces Market Industry

- December 2022: Letswork, the Dubai-based subscription service and marketplace for on-demand workspaces, announced that it has raised a USD 2.1 million seed round. It is also soft launching in Riyadh, bringing its total markets to five, along with Portugal, Spain, and Bahrain. Participants in the round included 500 Global, The Space, DTEC Ventures, and other notable angel investors.

- January 2022: For a better customer experience, White Space (a Saudi Coworking Space-based hospitality company) entered into a partnership with Yourspace. (Yourspace is an app for those who are looking for a space to work, meeting rooms, or has that extra space in the office no one is using).

Strategic Outlook for Saudi Arabia Co-working Spaces Market Market

The strategic outlook for the Saudi Arabia co-working spaces market is exceptionally positive, fueled by a strong combination of government support, a growing entrepreneurial spirit, and a societal shift towards flexible work. The continued implementation of Vision 2030 will undoubtedly foster further economic diversification, creating sustained demand for agile and cost-effective office solutions. Expansion into underserved regions and the development of niche co-working concepts tailored to specific industries represent significant growth avenues. Embracing cutting-edge technology and prioritizing community building will be paramount for providers aiming to differentiate themselves and capture market share. Strategic partnerships with corporations and real estate developers will also be crucial for scaling operations and tapping into larger enterprise needs. The market is ripe for innovation and consolidation, promising a dynamic and expanding future for co-working in the Kingdom.

Saudi Arabia Co-working Spaces Market Segmentation

-

1. End User

- 1.1. Personal User

- 1.2. Small Scale Company

- 1.3. Large Scale Company

- 1.4. Other End Users

-

2. Type

- 2.1. Flexible Managed Office

- 2.2. Serviced Office

-

3. Application

- 3.1. Information Technology (IT and ITES)

- 3.2. Legal Services

- 3.3. BFSI (Banking, Financial Services, and Insurance)

- 3.4. Consulting

- 3.5. Other Services

Saudi Arabia Co-working Spaces Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Co-working Spaces Market Regional Market Share

Geographic Coverage of Saudi Arabia Co-working Spaces Market

Saudi Arabia Co-working Spaces Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Remote and Hybrid Work Model

- 3.3. Market Restrains

- 3.3.1. Lack of Privacy

- 3.4. Market Trends

- 3.4.1. Saudi Arabia’s Office Spaces Market is on the Rise

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Co-working Spaces Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Personal User

- 5.1.2. Small Scale Company

- 5.1.3. Large Scale Company

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Flexible Managed Office

- 5.2.2. Serviced Office

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Information Technology (IT and ITES)

- 5.3.2. Legal Services

- 5.3.3. BFSI (Banking, Financial Services, and Insurance)

- 5.3.4. Consulting

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Scale

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Servcorp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Easyoffices

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wework

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Heydesk**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Regus

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 White Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gravita

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Space

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vibes offices

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Scale

List of Figures

- Figure 1: Saudi Arabia Co-working Spaces Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Co-working Spaces Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Saudi Arabia Co-working Spaces Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Co-working Spaces Market?

The projected CAGR is approximately 9.72%.

2. Which companies are prominent players in the Saudi Arabia Co-working Spaces Market?

Key companies in the market include Scale, Servcorp, Easyoffices, Wework, Heydesk**List Not Exhaustive, Regus, White Space, Gravita, The Space, Vibes offices.

3. What are the main segments of the Saudi Arabia Co-working Spaces Market?

The market segments include End User, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Remote and Hybrid Work Model.

6. What are the notable trends driving market growth?

Saudi Arabia’s Office Spaces Market is on the Rise.

7. Are there any restraints impacting market growth?

Lack of Privacy.

8. Can you provide examples of recent developments in the market?

December 2022: Letswork, the Dubai-based subscription service and marketplace for on-demand workspaces, announced that it has raised a USD 2.1 million seed round. It is also soft launching in Riyadh, bringing its total markets to five, along with Portugal, Spain, and Bahrain. Participants in the round included 500 Global, The Space, DTEC Ventures, and other notable angel investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Co-working Spaces Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Co-working Spaces Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Co-working Spaces Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Co-working Spaces Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence