Key Insights

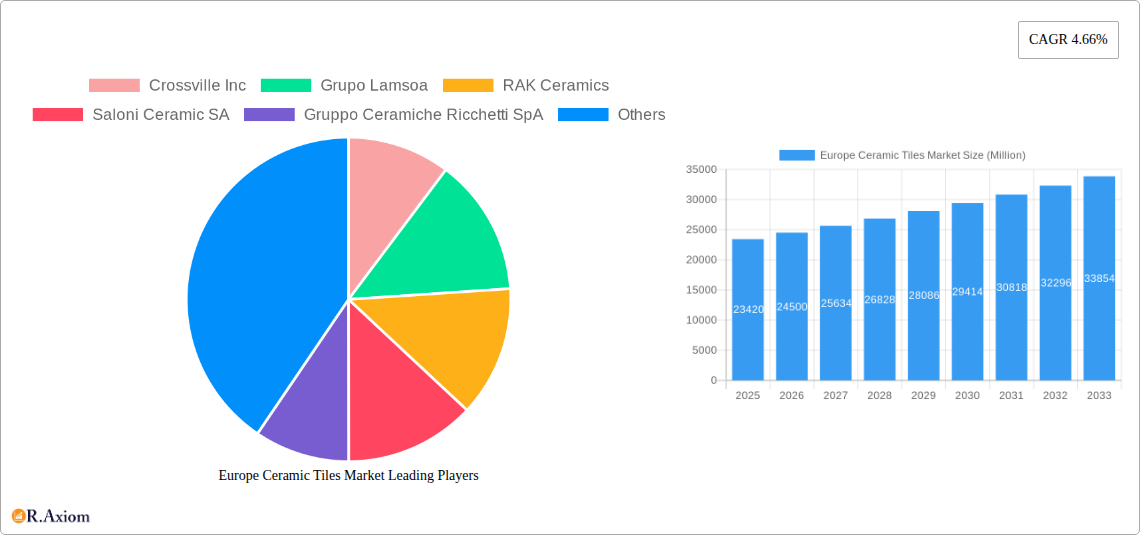

The European ceramic tile market, valued at €23.42 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, particularly in new residential and commercial projects across major European economies like Germany, France, and the UK, significantly boosts demand. Furthermore, the increasing preference for aesthetically pleasing and durable flooring and wall solutions in renovation and replacement projects contributes to market growth. The rising popularity of glazed and porcelain tiles, known for their resilience and ease of maintenance, is another significant driver. While the market faces challenges such as fluctuating raw material prices and economic uncertainties, the sustained demand for sustainable and eco-friendly tile options presents lucrative opportunities for manufacturers. The market segmentation reveals that residential applications currently hold a larger share, but the commercial segment is expected to witness faster growth due to increasing infrastructural developments and refurbishment activities. Key players like Crossville Inc, RAK Ceramics, and Porcelanosa Group are actively shaping the market landscape through innovation and strategic expansions.

Europe Ceramic Tiles Market Market Size (In Billion)

The competitive landscape is characterized by both established international players and regional manufacturers. The presence of strong domestic players in specific countries like Italy and Spain ensures a dynamic market. Ongoing technological advancements leading to improved tile manufacturing processes and the emergence of innovative product designs, such as scratch-free tiles, are expected to further enhance market appeal. Government initiatives promoting sustainable construction practices and energy efficiency also contribute to the market’s positive outlook. However, potential restraints include environmental regulations concerning tile manufacturing and the availability of skilled labor. The consistent market expansion is further bolstered by the rising disposable incomes in many European countries, enabling consumers to invest in high-quality home improvements. The forecast period indicates a steady upward trajectory for the European ceramic tile market, presenting attractive prospects for businesses involved in production, distribution, and installation.

Europe Ceramic Tiles Market Company Market Share

Europe Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Ceramic Tiles Market, offering actionable insights for industry stakeholders. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The report delves into market size, segmentation, growth drivers, challenges, and opportunities, providing a holistic view of this dynamic sector. The report is enriched with data, trends and projections from a variety of credible sources in the European ceramic tile market. The analysis includes a deep dive into market concentration, leading players, and significant industry developments, offering a 360° perspective on the current and future landscape.

Europe Ceramic Tiles Market Concentration & Innovation

This section analyzes the competitive landscape of the European ceramic tile market, exploring market concentration, innovation drivers, regulatory frameworks, and industry dynamics. We examine the market share held by key players such as Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc, Blackstone Industrial (Foshan) Ltd, and China Ceramics Co Ltd (list not exhaustive). The analysis includes an assessment of mergers and acquisitions (M&A) activity within the sector, evaluating deal values and their impact on market consolidation. Specific metrics like market share percentages for the top five players will be presented to showcase the concentration level. We also analyze innovation drivers such as technological advancements in tile manufacturing, design innovation, and sustainability initiatives and discuss the regulatory frameworks influencing market operations, encompassing environmental regulations and building codes impacting material standards. The report will also discuss factors such as the emergence of substitute products and their competitive impact, as well as evolving end-user trends and preferences. The impact of these factors on the market dynamics will be rigorously assessed to provide valuable insights for strategic decision-making. We estimate the total M&A value for the period 2019-2024 at approximately xx Million.

Europe Ceramic Tiles Market Industry Trends & Insights

This section provides a comprehensive overview of the European ceramic tiles market trends, including market growth drivers, technological advancements, shifting consumer preferences and competitive pressures. We examine the historical and projected Compound Annual Growth Rate (CAGR) for the market, supported by robust data analysis and market forecasts. Specific factors influencing market growth will be detailed, such as construction activity, infrastructural developments, and the growing demand for aesthetically pleasing and durable tiling solutions. Furthermore, this analysis will encompass technological disruptions such as advancements in manufacturing processes, the introduction of innovative materials, and the adoption of digital technologies for design and marketing, while analyzing the effects of changing consumer preferences – in terms of style, functionality, and sustainability— on the market demand. The competitive dynamics within the sector are examined, taking into account strategies of leading players, including market penetration strategies, pricing tactics, product diversification and brand building. The level of market penetration for sustainable ceramic tiles in 2024 is estimated at xx%.

Dominant Markets & Segments in Europe Ceramic Tiles Market

This section identifies the leading regions, countries, and market segments within the European ceramic tiles market based on construction type (new construction vs. replacement & renovation), end-user type (residential vs. commercial), product type (glazed, porcelain, scratch-free, other), and application (floor tiles, wall tiles, other).

- Key Drivers:

- Economic Policies: Government incentives for construction and renovation projects.

- Infrastructure Development: Investments in new residential and commercial developments.

- Tourism and Hospitality: Growth in the tourism and hospitality sectors driving demand for high-quality tiles.

- Consumer Preferences: Increasing demand for aesthetically pleasing, durable, and sustainable tiles.

We will present a detailed dominance analysis for each segment, incorporating statistical data and qualitative insights to substantiate the findings. For example, we will ascertain which specific region or country possesses the highest market share, and rationalize this dominance. This segment will explore, in detail, each of these dimensions to identify current and emerging leaders in the market.

Europe Ceramic Tiles Market Product Developments

Recent innovations in ceramic tile technology have led to the development of products with enhanced properties such as scratch resistance, improved durability and aesthetic appeal. The market is witnessing a growing trend towards large format tiles, offering a seamless look for both commercial and residential applications. Furthermore, the increased emphasis on sustainability has driven the production of eco-friendly tiles made from recycled materials, enhancing the market’s environmental profile. These innovations are altering competitive dynamics and changing the appeal to consumers seeking modern and sustainable solutions. Manufacturers are constantly striving to offer innovative products that provide superior performance and aesthetic appeal, leading to continuous advancement in the sector.

Report Scope & Segmentation Analysis

This report segments the Europe Ceramic Tiles Market based on several criteria.

- By Construction Type: New Construction and Replacement & Renovation. The new construction segment shows higher growth projections, driven by large-scale residential and commercial projects.

- By End-User Type: Residential and Commercial. The commercial segment demonstrates high demand for durable and high-traffic-resistant tiles.

- By Product Type: Glazed, Porcelain, Scratch-Free, and Other Product Types. Porcelain tiles dominate the market, given its superior properties.

- By Application: Floor Tiles, Wall Tiles, and Other Tiles. Floor tiles constitute the largest market segment owing to widespread usage in all construction projects.

Each segment's growth projections, market size estimations, and competitive dynamics will be thoroughly explored. This section will incorporate both quantitative data and qualitative assessments. The market size will be stated for each segment and its associated CAGR.

Key Drivers of Europe Ceramic Tiles Market Growth

The growth of the European ceramic tiles market is fueled by several key factors. Firstly, robust growth in the construction industry, particularly in new residential and commercial buildings, significantly boosts the demand for tiles. Secondly, renovation and refurbishment projects are also driving the market, as homeowners and businesses seek to upgrade their existing spaces with modern, stylish tiles. Thirdly, positive economic conditions in many European countries stimulate consumer spending, leading to an increase in tile demand. Finally, technological advancements, such as the production of more durable, aesthetically pleasing, and eco-friendly tiles, further propel market expansion.

Challenges in the Europe Ceramic Tiles Market Sector

The European ceramic tiles market faces several challenges. Fluctuations in raw material prices impact production costs, putting pressure on profit margins. The stringent environmental regulations in many European countries require manufacturers to comply with demanding sustainability standards, increasing operational costs. Furthermore, intense competition among numerous manufacturers necessitates continuous innovation and product diversification to maintain a competitive edge. Supply chain disruptions, particularly exacerbated by geopolitical instability, can significantly impact production and distribution, resulting in higher prices and delivery delays. These challenges are expected to impact the market's growth trajectory. The overall impact of these challenges is estimated to reduce market growth by approximately xx% over the forecast period.

Emerging Opportunities in Europe Ceramic Tiles Market

Despite challenges, several opportunities exist for growth. The increasing demand for sustainable and eco-friendly tiles presents a significant opportunity for manufacturers to cater to environmentally conscious consumers. Advancements in digital printing technology enable the creation of highly customized tiles, catering to individualized preferences. The expanding hospitality and tourism sectors create a large demand for high-quality, aesthetically pleasing tiles. Furthermore, the growing interest in smart home technology opens up avenues for integrating smart features into tiles, potentially leading to new product development opportunities.

Leading Players in the Europe Ceramic Tiles Market Market

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- NITCO

- Atlas Concorde S P A

- Johnson Tiles

- Mohawk Industries Inc

- Siam Cement Group

- Centura Tile Inc

- Blackstone Industrial (Foshan) Ltd

- China Ceramics Co Ltd

Key Developments in Europe Ceramic Tiles Market Industry

- February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, showcasing a wide range of products and design options. This significantly impacts the competitive landscape by offering a wider selection and improved coordinated environments for its customers.

- March 2022: Johnson Tile's collaboration with the material lab for the Tile Trace Trend & Format Forum provided valuable insights into current interior design trends, allowing them to adapt their product offerings to meet market demands. This directly affected their product development and market positioning.

Strategic Outlook for Europe Ceramic Tiles Market Market

The European ceramic tiles market is poised for continued growth, driven by robust construction activity, increasing consumer spending, and ongoing technological innovations. The focus on sustainability and the development of eco-friendly tiles will be a key factor influencing market dynamics. Furthermore, the adoption of digital technologies and customized designs will create new opportunities for manufacturers to cater to specific customer needs. The market's growth potential remains strong, offering ample opportunities for companies to expand their presence and market share, while adopting strategies that reflect consumer needs and market trends.

Europe Ceramic Tiles Market Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Product Types

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential

- 4.2. Commercial

Europe Ceramic Tiles Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

Europe Ceramic Tiles Market Regional Market Share

Geographic Coverage of Europe Ceramic Tiles Market

Europe Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Italy is the Major Exporter of Ceramic Tiles in Europe Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Germany

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Russia

- 5.5.6. Belgium

- 5.5.7. Poland

- 5.5.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Other Tiles

- 11.3. Market Analysis, Insights and Forecast - by Construction Type

- 11.3.1. New Construction

- 11.3.2. Replacement & Renovation

- 11.4. Market Analysis, Insights and Forecast - by End-User Type

- 11.4.1. Residential

- 11.4.2. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Glazed

- 12.1.2. Porcelain

- 12.1.3. Scratch Free

- 12.1.4. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Floor Tiles

- 12.2.2. Wall Tiles

- 12.2.3. Other Tiles

- 12.3. Market Analysis, Insights and Forecast - by Construction Type

- 12.3.1. New Construction

- 12.3.2. Replacement & Renovation

- 12.4. Market Analysis, Insights and Forecast - by End-User Type

- 12.4.1. Residential

- 12.4.2. Commercial

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Glazed

- 13.1.2. Porcelain

- 13.1.3. Scratch Free

- 13.1.4. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Floor Tiles

- 13.2.2. Wall Tiles

- 13.2.3. Other Tiles

- 13.3. Market Analysis, Insights and Forecast - by Construction Type

- 13.3.1. New Construction

- 13.3.2. Replacement & Renovation

- 13.4. Market Analysis, Insights and Forecast - by End-User Type

- 13.4.1. Residential

- 13.4.2. Commercial

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Crossville Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Grupo Lamsoa

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 RAK Ceramics

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Saloni Ceramic SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gruppo Ceramiche Ricchetti SpA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Porcelanosa Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NITCO

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Atlas Concorde S P A

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Johnson Tiles

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mohawk Industries Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Siam Cement Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Centura Tile Inc **List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Blackstone Industrial (Foshan) Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 China Ceramics Co Ltd

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Crossville Inc

List of Figures

- Figure 1: Europe Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 15: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 19: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 20: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 24: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 25: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 29: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 30: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 34: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 35: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 40: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 44: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 45: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ceramic Tiles Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Europe Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc **List Not Exhaustive, Blackstone Industrial (Foshan) Ltd, China Ceramics Co Ltd.

3. What are the main segments of the Europe Ceramic Tiles Market?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Italy is the Major Exporter of Ceramic Tiles in Europe Region.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, The Atlas Concorde product system and a stylish assortment of surfaces are both inside to help customers design finished coordinated environments. Large slabs, kitchen counters, tables, and accessories, as well as sinks and bathroom fixtures, are all design elements that can broaden the design options for any intended application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Europe Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence