Key Insights

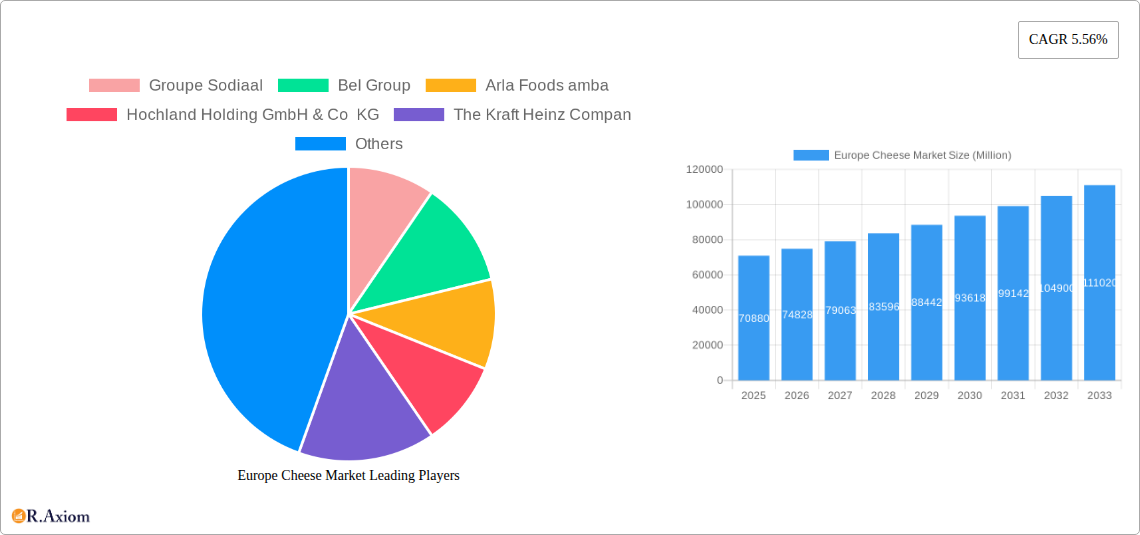

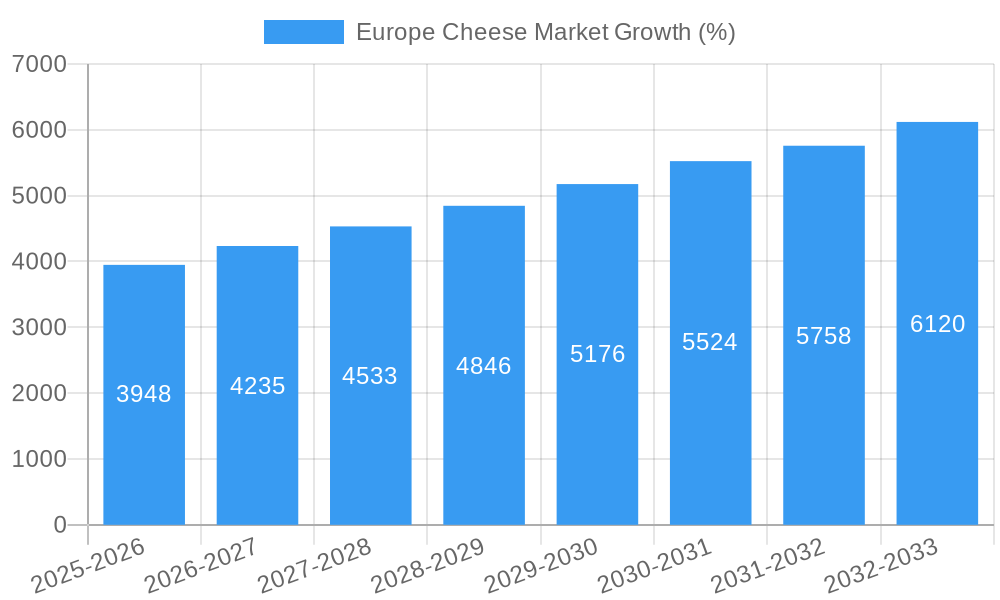

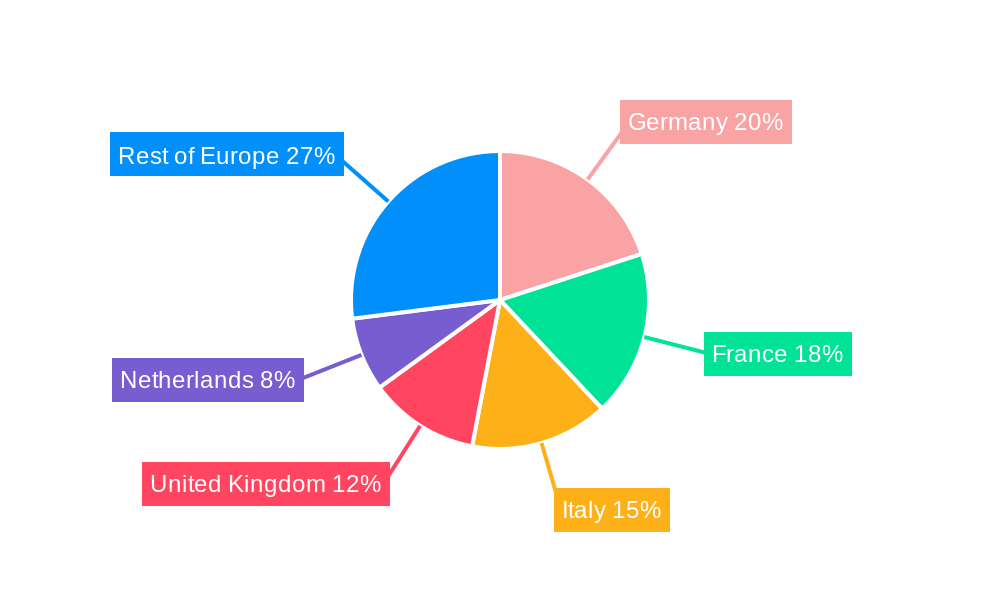

The European cheese market, valued at €70.88 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes across major European nations, coupled with increasing consumer preference for premium and specialty cheeses, are fueling market expansion. The growing popularity of cheese in various culinary applications, beyond traditional uses, further contributes to this positive trend. Processed cheese segments benefit from convenience and affordability, while the natural cheese segment appeals to health-conscious consumers seeking high-quality, artisanal products. Market segmentation reveals strong performance across various distribution channels, including the robust off-trade sector (supermarkets, grocery stores) and a steadily growing on-trade segment (restaurants, cafes). Germany, France, Italy, and the UK represent significant market shares, reflecting established cheese consumption habits and strong domestic production capabilities. However, potential restraints include fluctuating milk prices, impacting production costs, and increasing regulatory scrutiny regarding food safety and labeling. Furthermore, the market faces challenges from substitute products and evolving consumer preferences toward plant-based alternatives. Despite these challenges, the market's steady CAGR of 5.56% indicates a promising future, particularly with the expansion of e-commerce platforms and innovative product offerings catering to evolving consumer demands. The continued diversification of product offerings, including organic and lactose-free options, is likely to further fuel market growth throughout the forecast period.

The competitive landscape is characterized by both large multinational companies and smaller regional producers. Key players like Groupe Sodiaal, Bel Group, and Arla Foods amba leverage their established brand recognition and extensive distribution networks to maintain market dominance. However, smaller, specialized producers are capitalizing on growing consumer interest in artisanal and regional cheeses, fostering innovation and niche product development. The market’s future growth is heavily reliant on sustained consumer demand, effective supply chain management to mitigate price volatility, and successful adaptation to evolving consumer preferences concerning health, sustainability, and ethical sourcing. This includes increasing focus on traceability and transparency throughout the supply chain, enhancing consumer trust and brand loyalty.

Europe Cheese Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe cheese market, covering the period 2019-2033. With a focus on key segments, leading players, and emerging trends, this report offers invaluable insights for industry stakeholders seeking to navigate this dynamic market. The report uses 2025 as its base year and offers detailed forecasts until 2033.

Europe Cheese Market Market Concentration & Innovation

The European cheese market exhibits a moderately concentrated landscape, dominated by several large multinational players and a significant number of regional and local producers. Key players such as Groupe Sodiaal, Bel Group, Arla Foods amba, and others hold substantial market share, although the exact figures vary across different segments and countries. The market concentration is further analyzed by examining the Herfindahl-Hirschman Index (HHI) and market share distribution across major players. This report also assesses the innovation drivers within the industry. These include:

- Technological advancements: Automation in production, improved packaging technologies, and novel cheese-making techniques continuously contribute to efficiency and product diversification.

- Consumer demand for diverse flavors and healthier options: This drives innovation in product development, with a rise in organic, lactose-free, and specialty cheeses.

- Stringent regulatory frameworks: Food safety regulations across Europe influence production practices and ingredient choices, encouraging innovation in compliance and traceability.

- Product substitutes: The presence of plant-based cheese alternatives and other dairy products creates competitive pressure, prompting innovation in taste, texture, and nutritional value of traditional cheese products.

- End-user trends: Growing health consciousness and evolving dietary preferences (e.g., flexitarianism) are changing consumer demands, triggering innovation in low-fat, high-protein cheese varieties.

- Mergers & Acquisitions (M&A) activities: Significant M&A activity, such as Granarolo S.p.A.'s acquisition of Mario Costa S.p.A. (November 2021) and Sodiaal's planned EUR 170 Million investment (October 2021), shapes market dynamics and influences market concentration. The report details deal values and analyses the impact of these activities on market competition and innovation.

Europe Cheese Market Industry Trends & Insights

The European cheese market is experiencing robust growth, driven by several factors. Consumer preference for cheese as a staple food and versatile ingredient contributes significantly to market expansion. Furthermore, rising disposable incomes, particularly in emerging European economies, fuel demand for premium cheese varieties. Technological advancements in production and distribution optimize efficiency and enhance product quality. This also leads to increased product availability and wider market penetration.

The market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, while the forecast period (2025-2033) projects a CAGR of xx%. Market penetration for various cheese types differs substantially across countries, with mature markets showing steadier growth and emerging markets displaying more significant expansion. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of niche brands focusing on specific consumer segments. Changing consumer preferences towards healthier options and sustainability are shaping product innovation and marketing strategies.

Dominant Markets & Segments in Europe Cheese Market

Dominant Regions/Countries: The report identifies France, Germany, Italy, and the United Kingdom as the dominant markets within Europe, accounting for a significant share of the overall cheese consumption. These markets showcase mature consumer preferences, well-established distribution networks, and robust economic conditions that facilitate high consumption rates.

- Key Drivers in Dominant Markets:

- France: Strong cheese-making tradition, high per capita consumption, and diverse product offerings.

- Germany: Large population, robust economy, and well-developed retail infrastructure.

- Italy: Rich culinary heritage emphasizing cheese in diverse dishes, strong production base of PDO cheeses.

- United Kingdom: High consumer demand, well-established import and distribution channels.

Dominant Segments:

- Product Type: Natural cheese currently holds the largest market share, driven by its traditional appeal and wide variety of flavors and textures. Processed cheese, while smaller in size, displays steady growth potential owing to its convenience and longer shelf life.

- Distribution Channel: The off-trade channel (supermarkets, hypermarkets, specialty stores) dominates, reflecting the high penetration of organized retail across Europe. The on-trade segment (restaurants, hotels) contributes significantly, particularly in regions with strong food service industries. Other distribution channels, such as warehouse clubs and gas stations, are showing gradual growth, indicating rising convenience purchases.

Detailed analysis of market size, growth projections, and competitive dynamics are provided for each segment in the full report.

Europe Cheese Market Product Developments

Recent product innovations focus on convenience, health, and sustainability. This includes the rise of ready-to-eat cheese snacks, single-serve portions, and organic/plant-based options. Technological advancements such as modified atmosphere packaging (MAP) extend shelf life and maintain product quality. The market emphasizes clean-label products, appealing to health-conscious consumers. Competitive advantages are increasingly derived from unique flavor profiles, ethical sourcing, and sustainable packaging solutions.

Report Scope & Segmentation Analysis

This report segments the Europe cheese market based on product type (natural cheese and processed cheese), distribution channel (off-trade, on-trade, others), and country (Belgium, France, Germany, Italy, Netherlands, Russia, Spain, Turkey, United Kingdom, Rest of Europe). Each segment's market size, growth projections, and competitive landscape are thoroughly analyzed. The report provides a detailed overview of market dynamics within each segment, highlighting key growth drivers, challenges, and opportunities.

Key Drivers of Europe Cheese Market Growth

The European cheese market's growth is propelled by several factors: a rising demand for convenient and ready-to-eat foods, increasing consumer disposable incomes leading to premium product consumption, and favorable government policies supporting the dairy industry. Technological advancements in production, including automation and improved packaging, also contribute to growth. The growing popularity of cheese in various cuisines further fuels market expansion.

Challenges in the Europe Cheese Market Sector

The European cheese market faces challenges like increasing raw material costs (milk), fluctuating energy prices impacting production costs, and stringent food safety regulations. Supply chain disruptions and labor shortages also create production bottlenecks, impacting output. Competition from plant-based alternatives and evolving consumer preferences put pressure on traditional cheese manufacturers. Quantifiable impacts of these challenges are included in the report.

Emerging Opportunities in Europe Cheese Market

The European cheese market presents opportunities in the growth of specialized cheese varieties (e.g., artisanal, organic), rising demand for convenient formats and ready-to-eat snacks, and the development of healthier and functional cheese products. Expansion into emerging markets within Europe offers untapped potential. The adoption of sustainable practices and packaging innovations presents a significant opportunity for differentiation.

Leading Players in the Europe Cheese Market Market

- Groupe Sodiaal https://www.sodiaal.com/en/

- Bel Group https://www.belgroup.com/en/

- Arla Foods amba https://www.arlafoods.com/

- Hochland Holding GmbH & Co KG

- The Kraft Heinz Company https://www.kraftheinzcompany.com/

- Savencia Fromage & Dairy https://www.savenciagro.com/

- Granarolo SpA https://www.granarolo.it/en/

- Egidio Galbani SRL

- Koninklijke ERU Kaasfabriek BV

- Kingcott Dairy

- Saputo Inc https://www.saputo.com/

- Groupe Lactalis https://www.lactalis.com/en/

Key Developments in Europe Cheese Market Industry

- September 2021: Bel UK, a subsidiary of Bel Group, expanded its Boursin cheese brand by launching a range of flavored hot cheese bites. This indicates a focus on innovation and diversification within established brands.

- October 2021: Sodiaal announced a EUR 170 Million investment over five years to support its cheese branch's development. This signifies a commitment to growth and expansion within the sector.

- November 2021: Granarolo S.p.A. announced the acquisition of Mario Costa S.p.A., a significant producer of PDO Gorgonzola cheese. This M&A activity consolidates market share and expands product portfolios.

Strategic Outlook for Europe Cheese Market Market

The Europe cheese market presents a promising outlook, driven by sustained consumer demand and ongoing innovation. Future growth will be shaped by evolving consumer preferences, including increasing demand for healthier, sustainable, and convenient options. Companies with a focus on product diversification, technological advancements, and strong distribution networks are well-positioned to capture market share. The market’s future potential hinges on adapting to changing consumer preferences and leveraging technological advancements to enhance efficiency and product quality.

Europe Cheese Market Segmentation

-

1. Product Type

- 1.1. Natural Cheese

- 1.2. Processed Cheese

-

2. Distribution Channel

-

2.1. Off-Trade

-

2.1.1. By Sub Distribution Channels

- 2.1.1.1. Convenience Stores

- 2.1.1.2. Online Retail

- 2.1.1.3. Specialist Retailers

- 2.1.1.4. Supermarkets and Hypermarkets

- 2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

2.1.1. By Sub Distribution Channels

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Cheese Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cheese Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Costs and Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Cheese

- 5.1.2. Processed Cheese

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. By Sub Distribution Channels

- 5.2.1.1.1. Convenience Stores

- 5.2.1.1.2. Online Retail

- 5.2.1.1.3. Specialist Retailers

- 5.2.1.1.4. Supermarkets and Hypermarkets

- 5.2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.1.1. By Sub Distribution Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Cheese Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Groupe Sodiaal

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bel Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Arla Foods amba

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hochland Holding GmbH & Co KG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 The Kraft Heinz Compan

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Savencia Fromage & Dairy

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Granarolo SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Egidio Galbani SRL

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Koninklijke ERU Kaasfabriek BV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Kingcott Dairy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Saputo Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Groupe Lactalis

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Groupe Sodiaal

List of Figures

- Figure 1: Europe Cheese Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cheese Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Cheese Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cheese Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Cheese Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Europe Cheese Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Europe Cheese Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Cheese Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Cheese Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Cheese Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Cheese Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Cheese Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Cheese Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Cheese Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 27: Europe Cheese Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Cheese Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Cheese Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Cheese Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Cheese Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Cheese Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cheese Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Europe Cheese Market?

Key companies in the market include Groupe Sodiaal, Bel Group, Arla Foods amba, Hochland Holding GmbH & Co KG, The Kraft Heinz Compan, Savencia Fromage & Dairy, Granarolo SpA, Egidio Galbani SRL, Koninklijke ERU Kaasfabriek BV, Kingcott Dairy, Saputo Inc, Groupe Lactalis.

3. What are the main segments of the Europe Cheese Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 70880 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Manufacturing Costs and Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2021: Granarolo S.p.A. announced the acquisition of Mario Costa S.p.A., a landmark producer of PDO Gorgonzola cheese.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cheese Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cheese Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cheese Market?

To stay informed about further developments, trends, and reports in the Europe Cheese Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence