Key Insights

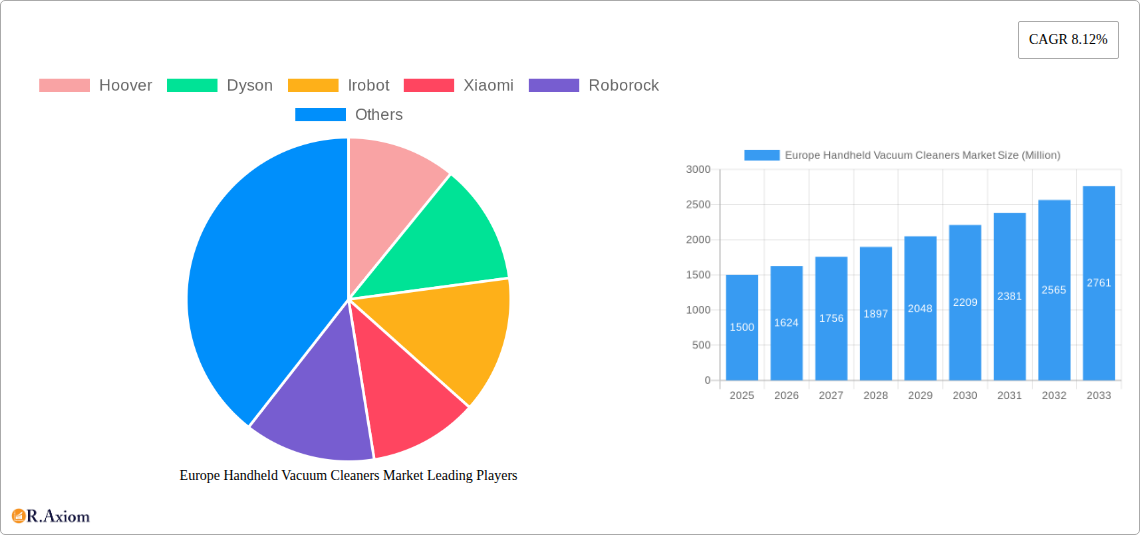

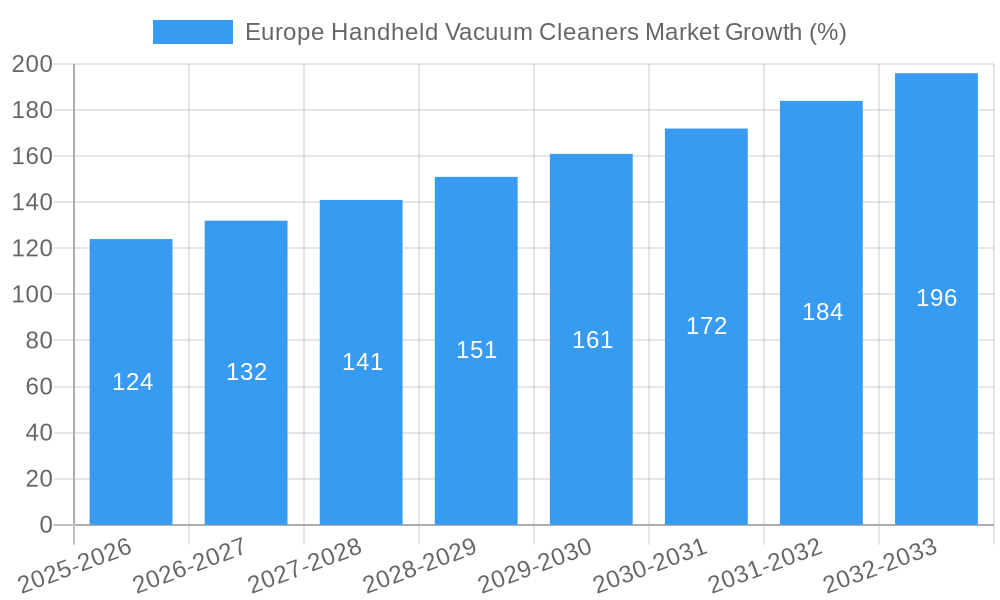

The European handheld vacuum cleaner market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of cordless models, fueled by advancements in battery technology offering longer runtimes and improved suction power, is a significant driver. Consumers are increasingly prioritizing convenience and ease of use, making cordless options particularly attractive for quick cleanups and spot cleaning. Furthermore, the rise in popularity of smaller, more maneuverable vacuum cleaners is catering to the needs of apartment dwellers and those with limited storage space. The growing demand for hygiene and cleanliness in both residential and commercial settings further bolsters market growth. While the corded segment continues to hold a market share due to its affordability and long operating time, the cordless segment is expected to dominate growth in the forecast period (2025-2033). Premium brands like Dyson and innovative entrants like Dreame and Roborock are competing fiercely, offering advanced features such as smart connectivity and self-emptying dustbins. This competitive landscape drives innovation and affordability, expanding the market's reach.

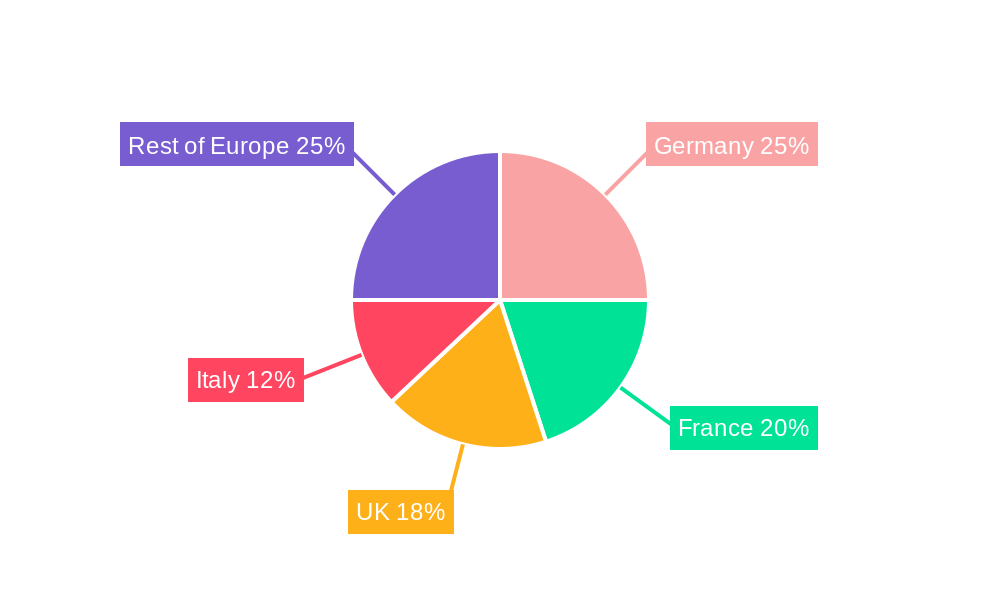

Despite positive growth projections, certain restraints exist. Pricing remains a barrier for some consumers, especially for high-end cordless models. Concerns regarding battery life and the environmental impact of disposable batteries also need addressing. The market’s growth will, therefore, depend on manufacturers’ ability to address these concerns through technological advancements and sustainable practices. The online distribution channel is experiencing substantial growth, benefiting from increased e-commerce penetration and convenient home delivery options. However, offline retailers remain important for demonstrating product features and addressing customer inquiries, suggesting a balanced distribution channel approach is optimal for market success. The segment breakdown shows a strong bias toward home applications, but growth is also expected in commercial and automotive cleaning segments, fuelled by increased demand for efficient and hygienic cleaning solutions in various settings. Germany, France, and the UK represent the largest markets within Europe, with further growth potential in other regions such as the Netherlands and Sweden. The CAGR of 8.12% suggests continued expansion across all segments throughout the forecast period.

Europe Handheld Vacuum Cleaners Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe handheld vacuum cleaner market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, including manufacturers, distributors, retailers, and investors, by examining market trends, competitive dynamics, and future growth opportunities. The report leverages extensive primary and secondary research to provide a robust understanding of this dynamic market segment. The base year for the analysis is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

Europe Handheld Vacuum Cleaners Market Market Concentration & Innovation

The European handheld vacuum cleaner market exhibits a moderately concentrated landscape, with key players like Dyson, Hoover, and Bosch commanding significant market share. However, the entry of innovative brands like Xiaomi, Roborock, and Dreame is increasing competition and driving innovation. The market is characterized by continuous product development, focusing on enhanced battery life, improved suction power, and smart features. Market concentration is estimated at xx%, with Dyson holding an estimated xx% market share in 2025. Regulatory frameworks, particularly those related to energy efficiency and waste disposal, are influencing product design and manufacturing processes. The increasing popularity of cordless models is impacting the market, leading to a decline in the sales of corded vacuum cleaners. The average M&A deal value in the sector over the past five years has been approximately $xx Million.

- Key Players: Dyson, Hoover, Bosch, Xiaomi, Roborock, Dreame, Bissell, Karcher, Shark, iRobot.

- Innovation Drivers: Technological advancements in battery technology, motor design, and filtration systems.

- Regulatory Factors: EU regulations on energy efficiency and waste management.

- Substitutes: Other cleaning tools like handheld mops and steam cleaners.

- End-user Trends: Growing preference for cordless, lightweight, and easy-to-use vacuum cleaners.

- M&A Activities: Consolidation among smaller players is expected to continue.

Europe Handheld Vacuum Cleaners Market Industry Trends & Insights

The European handheld vacuum cleaner market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is driven by increasing disposable incomes, changing lifestyles, and a rising preference for convenient and efficient cleaning solutions. The market penetration of cordless handheld vacuum cleaners is significantly higher than corded ones, further fueled by technological advancements leading to longer battery life and improved suction power. Consumer preferences are shifting towards smart features like app connectivity and voice control. Intense competition among established and emerging brands is leading to innovative product launches and aggressive pricing strategies. The market is further segmented by application, with the home segment dominating, followed by the commercial and automotive sectors.

Dominant Markets & Segments in Europe Handheld Vacuum Cleaners Market

The Germany market currently dominates the European handheld vacuum cleaner market due to high disposable incomes, a preference for technologically advanced cleaning appliances, and a well-developed distribution network. The UK and France follow closely as major markets.

- Type: Cordless vacuum cleaners are the dominant segment, owing to their convenience and portability. The cordless segment holds an estimated xx% market share in 2025 and is projected to maintain its dominance through 2033.

- Application: The home segment constitutes the largest application area, accounting for approximately xx% of the total market in 2025. This is driven by increasing urbanization and smaller living spaces.

- Distribution Channel: Online channels are rapidly gaining traction, driven by e-commerce growth and consumer preference for convenience. However, offline channels through brick-and-mortar retailers remain significant, particularly for demonstration and hands-on experience.

Key Drivers:

- Germany: Strong economy, high consumer spending, and established retail infrastructure.

- UK: High adoption of new technologies and a preference for convenient cleaning solutions.

- France: Growing middle class and a rising demand for premium household appliances.

Europe Handheld Vacuum Cleaners Market Product Developments

Recent product innovations focus on enhancing battery life, improving suction power, and integrating smart features like app connectivity, voice control, and self-emptying dustbins. Manufacturers are also focusing on lightweight designs, improved ergonomics, and enhanced maneuverability to cater to evolving consumer needs. These improvements cater to a wider range of users and cleaning tasks, creating competitive advantages in the market.

Report Scope & Segmentation Analysis

This report segments the European handheld vacuum cleaner market based on type (cordless and corded), application (home, commercial, automotive, other), and distribution channel (online and offline). Each segment's growth projections, market size estimations (in Million), and competitive dynamics are analyzed in detail. The cordless vacuum cleaner segment is expected to exhibit the highest growth rate throughout the forecast period. Similarly, the home application segment is expected to remain the most dominant sector, followed by the commercial segment.

- Cordless: The cordless segment holds a significant market share and exhibits robust growth potential driven by advancements in battery technology and consumer preference for wireless convenience. Projected growth is xx% CAGR from 2025-2033.

- Corded: The corded segment is anticipated to experience slower growth, owing to the increasing dominance of cordless models. However, it remains a relevant option for budget-conscious consumers.

- Home Application: This segment dominates the market, expected to reach xx Million by 2033.

- Commercial Application: This segment is expected to grow steadily, driven by the increasing need for efficient cleaning solutions in commercial spaces.

- Automotive Application: This niche segment is projected to grow at a moderate rate, as consumers increasingly seek convenience for car cleaning.

- Other Applications: This segment encompasses various niche applications and shows potential for future growth.

- Online Channel: This channel is growing rapidly, driven by increased online shopping and consumer convenience.

- Offline Channel: Offline channels retain their importance for providing consumers with hands-on product experience.

Key Drivers of Europe Handheld Vacuum Cleaners Market Growth

Several factors contribute to the growth of the European handheld vacuum cleaner market: rising disposable incomes across Europe, increasing urbanization and smaller living spaces, the growing popularity of convenient and efficient cleaning appliances, and advancements in battery technology that extend cordless vacuum cleaner runtime and suction power. Furthermore, the increasing adoption of smart home technologies and the integration of smart features in handheld vacuum cleaners are also crucial growth catalysts.

Challenges in the Europe Handheld Vacuum Cleaners Market Sector

The European handheld vacuum cleaner market faces challenges such as fluctuating raw material prices, increasing competition from both established and new entrants, concerns about the environmental impact of battery production and disposal, and the evolving regulatory landscape affecting energy efficiency and waste management. These factors can impact production costs, product design, and market access.

Emerging Opportunities in Europe Handheld Vacuum Cleaners Market

The market presents opportunities for manufacturers to develop sustainable products using recycled materials and environmentally friendly batteries. There's also room for advancements in smart features, such as enhanced object detection, improved mapping capabilities, and even greater autonomy in cleaning tasks. Moreover, expansion into niche segments such as pet care and specialized cleaning solutions offer further growth opportunities.

Leading Players in the Europe Handheld Vacuum Cleaners Market Market

Key Developments in Europe Handheld Vacuum Cleaners Market Industry

- September 2023: ISS Partners With ToolSense to digitize asset operations, improving management of assets like vacuum cleaners. This reflects a growing industry focus on asset tracking and maintenance.

- May 2023: Eros Group partners with Dreame, expanding Dreame's distribution network in the UAE and potentially indicating future expansion plans into Europe.

Strategic Outlook for Europe Handheld Vacuum Cleaners Market Market

The European handheld vacuum cleaner market holds significant growth potential, driven by continuous technological advancements, changing consumer preferences, and the increasing demand for convenient cleaning solutions. The focus on sustainability, smart features, and niche applications will shape future market dynamics. Companies that invest in research and development, build strong distribution networks, and adapt to evolving consumer needs are poised to capture significant market share in the years to come.

Europe Handheld Vacuum Cleaners Market Segmentation

-

1. Type

- 1.1. Cordless Vacuum Cleaner

- 1.2. Corded Vacuum Cleaner

-

2. Application

- 2.1. Home

- 2.2. Commercial

- 2.3. Automotive

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Europe Handheld Vacuum Cleaners Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. Spain

- 4. United Kingdom

- 5. Rest of the Europe

Europe Handheld Vacuum Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing Lifestyles and Housing Conditions is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Price Sensitivity of Consumers

- 3.4. Market Trends

- 3.4.1. Cordless Technology is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cordless Vacuum Cleaner

- 5.1.2. Corded Vacuum Cleaner

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home

- 5.2.2. Commercial

- 5.2.3. Automotive

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. Italy

- 5.4.3. Spain

- 5.4.4. United Kingdom

- 5.4.5. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cordless Vacuum Cleaner

- 6.1.2. Corded Vacuum Cleaner

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home

- 6.2.2. Commercial

- 6.2.3. Automotive

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Italy Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cordless Vacuum Cleaner

- 7.1.2. Corded Vacuum Cleaner

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home

- 7.2.2. Commercial

- 7.2.3. Automotive

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cordless Vacuum Cleaner

- 8.1.2. Corded Vacuum Cleaner

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home

- 8.2.2. Commercial

- 8.2.3. Automotive

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United Kingdom Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cordless Vacuum Cleaner

- 9.1.2. Corded Vacuum Cleaner

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home

- 9.2.2. Commercial

- 9.2.3. Automotive

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the Europe Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cordless Vacuum Cleaner

- 10.1.2. Corded Vacuum Cleaner

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home

- 10.2.2. Commercial

- 10.2.3. Automotive

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Germany Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Hoover

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Dyson

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Irobot

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Xiaomi

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Roborock

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Dreame

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Bissell

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Karcher

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Bosch

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Shark

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Hoover

List of Figures

- Figure 1: Europe Handheld Vacuum Cleaners Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Handheld Vacuum Cleaners Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Handheld Vacuum Cleaners Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Handheld Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 29: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 37: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 39: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 41: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 45: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 47: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 49: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 53: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 55: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 56: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 57: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 61: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 63: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 64: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 65: Europe Handheld Vacuum Cleaners Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Handheld Vacuum Cleaners Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the Europe Handheld Vacuum Cleaners Market?

Key companies in the market include Hoover, Dyson, Irobot, Xiaomi, Roborock, Dreame, Bissell, Karcher, Bosch, Shark.

3. What are the main segments of the Europe Handheld Vacuum Cleaners Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Changing Lifestyles and Housing Conditions is Driving the Market.

6. What are the notable trends driving market growth?

Cordless Technology is Driving the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity of Consumers.

8. Can you provide examples of recent developments in the market?

September 2023: ISS Partners With ToolSense to Digitise Asset Operations. ISS has established a new global strategic partnership with tech startup company ToolSense to help their employees manage moveable assets such as vacuum cleaners and healthcare equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Handheld Vacuum Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Handheld Vacuum Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Handheld Vacuum Cleaners Market?

To stay informed about further developments, trends, and reports in the Europe Handheld Vacuum Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence