Key Insights

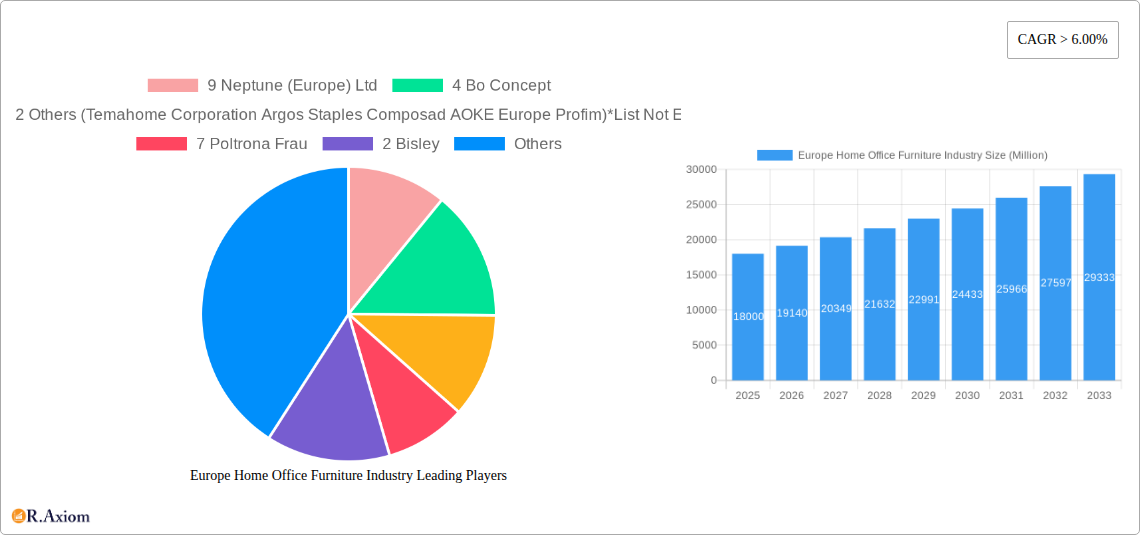

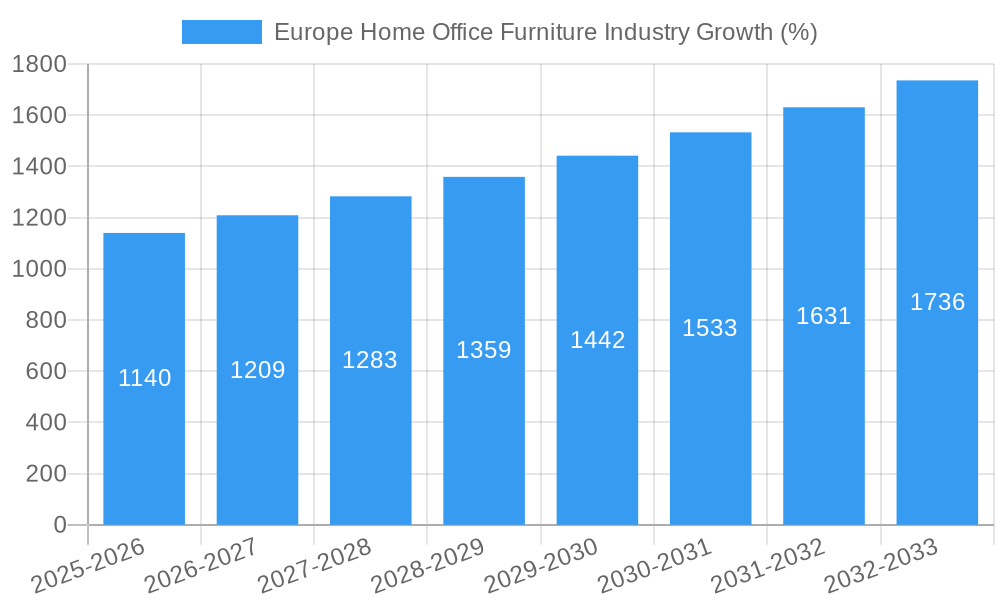

The European home office furniture market, valued at approximately €[Estimate based on available data – a reasonable estimate considering a "XX" market size and a CAGR of >6% might be between €15-20 Billion in 2025] in 2025, is projected to experience robust growth exceeding 6% CAGR through 2033. This expansion is fueled by several key factors. The enduring shift towards remote and hybrid work models, accelerated by the pandemic, continues to drive demand for ergonomic and functional home office solutions. Growing urbanization and smaller living spaces in major European cities are prompting consumers to seek space-saving, multi-functional furniture. Furthermore, increasing disposable incomes and a rising preference for aesthetically pleasing and high-quality home furnishings contribute to market growth. Leading players like IKEA, Vitra, and Knoll, alongside regional specialists, cater to diverse needs, from budget-conscious consumers to those seeking premium designs.

The market is segmented by product (seating, tables & desks, storage, and other furniture), distribution channel (flagship stores, specialty stores, online, and others), and geography (with significant contributors being the UK, Germany, France, Italy, and Spain). Online channels are experiencing rapid expansion, driven by e-commerce penetration and the convenience of home delivery. However, the market faces some restraints, including economic uncertainties, supply chain disruptions (which could impact pricing and availability), and fluctuations in raw material costs. Competition is intensifying, with established players and emerging brands vying for market share. Strategic partnerships, product innovation (e.g., incorporating smart technology), and effective marketing strategies are crucial for success within this dynamic market. The forecast suggests continued growth, driven by the sustained adoption of remote work practices and evolving consumer preferences.

Europe Home Office Furniture Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Home Office Furniture industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to project market trends during the forecast period (2025-2033). This in-depth analysis is crucial for businesses, investors, and stakeholders seeking a thorough understanding of this dynamic market.

Europe Home Office Furniture Industry Market Concentration & Innovation

The European home office furniture market exhibits a moderately concentrated structure. While IKEA and a few other large players hold significant market share, numerous smaller companies contribute significantly to the overall market volume. The top 12 companies (including IKEA, 9 Neptune (Europe) Ltd, 4 Bo Concept, 3 IKEA, 7 Poltrona Frau, 2 Bisley, 6 Vitra International Ag, 11 Nowy Styl, 8 Laporta, 10 Royal Ahrend, 5 Knoll, 1 Actona Company A/S and 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive) account for approximately xx% of the market in 2025, indicating considerable fragmentation.

Innovation is driven by factors like:

- Ergonomics and health: Growing awareness of workplace health leads to increased demand for ergonomically designed chairs and desks.

- Sustainability: Consumers increasingly prefer eco-friendly materials and sustainable manufacturing processes.

- Smart technology integration: Smart desks with adjustable heights and integrated power solutions are gaining popularity.

Regulatory frameworks concerning material safety and emissions play a significant role. Product substitutes, like repurposed furniture or DIY solutions, present a competitive challenge. M&A activity has been moderate in recent years, with deal values estimated at xx Million in 2024. The market share of individual players is dynamic, with shifts expected based on product innovation and marketing strategies.

Europe Home Office Furniture Industry Industry Trends & Insights

The European home office furniture market experienced robust growth during the historical period (2019-2024), fueled by the rise of remote work and the increasing preference for dedicated home workspaces. The COVID-19 pandemic significantly accelerated this trend. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033.

Several key factors are driving this growth:

- Remote and hybrid work models: The widespread adoption of remote and hybrid work continues to boost demand for home office furniture.

- E-commerce growth: Online retailers are expanding their home office furniture offerings, enhancing convenience and reach.

- Changing consumer preferences: Consumers are increasingly willing to invest in high-quality, functional, and aesthetically pleasing home office furniture.

- Technological advancements: Smart furniture and innovative designs are attracting consumers seeking enhanced functionality and comfort.

- Rising disposable incomes: In many European countries, increasing disposable incomes are enabling consumers to invest in better home office setups.

Market penetration of smart home office furniture remains relatively low but is anticipated to increase steadily as prices become more competitive. Competitive dynamics are intense, with established players focusing on innovation and brand building while new entrants leverage e-commerce to gain market share.

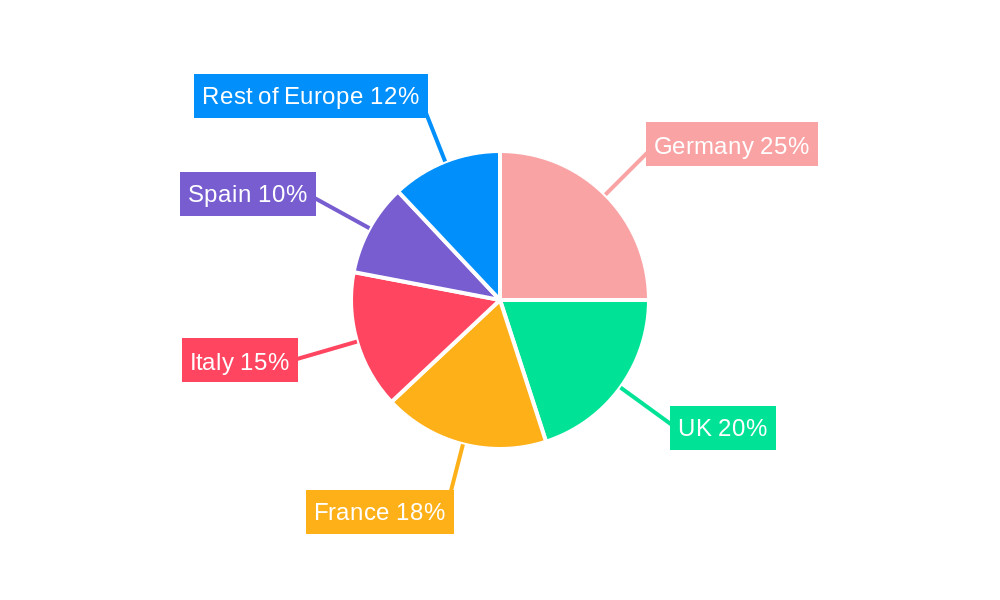

Dominant Markets & Segments in Europe Home Office Furniture Industry

The United Kingdom, Germany, and France represent the largest national markets within Europe. The United Kingdom's dominance is attributed to its robust economy, higher disposable incomes, and a significant proportion of its workforce embracing remote work. Germany benefits from a strong manufacturing base and high consumer spending power. France also exhibits a substantial market driven by similar factors.

- Key Drivers for UK Dominance: Strong economy, high disposable incomes, and high adoption of remote work.

- Key Drivers for German Dominance: Strong manufacturing base, high consumer spending, and a large population of skilled workers.

- Key Drivers for French Dominance: Similar to UK and Germany, with a considerable population and established market infrastructure.

By product segment, seating (chairs, ergonomic seating) constitutes the largest revenue share, driven by the essential nature of comfortable and supportive seating for extended periods of work from home. Tables and desks follow closely, with storage units representing a sizable yet less dominant segment. Online distribution channels are witnessing the highest growth rate, reflecting the increasing preference for online shopping and the convenience it offers.

Europe Home Office Furniture Industry Product Developments

Recent product innovations focus on ergonomics, sustainability, and smart technology integration. Adjustable height desks, ergonomic chairs with advanced lumbar support, and storage solutions with integrated power outlets are gaining traction. The market is witnessing a rise in eco-friendly materials and manufacturing processes, aligning with consumer demand for sustainable products. These advancements enhance both functionality and aesthetic appeal, improving market fit and competitive advantage.

Report Scope & Segmentation Analysis

The report comprehensively analyzes the European home office furniture market across various segments:

By Country: United Kingdom, Germany, France, Italy, Spain, and Rest of Europe. Each country's market size, growth projections, and competitive landscape are examined.

By Product: Seating, Tables and Desks, Storage Units, and Other Home Office Furniture. Each segment's growth trajectory, market share, and key drivers are analyzed.

By Distribution Channel: Flagship Stores, Specialty Stores, Online, and Other Distribution Channels. The analysis explores the evolution of each channel, the impact of e-commerce, and its influence on the overall market dynamics. The market sizes and growth projections are provided for each segment, along with a deep dive into competitive dynamics.

Key Drivers of Europe Home Office Furniture Industry Growth

Several factors drive the growth of the European home office furniture market:

- Increased adoption of remote work: The shift toward hybrid and remote work models continues to fuel demand for home office furniture.

- Rising disposable incomes: Greater spending power among consumers allows for investments in higher-quality home office setups.

- Technological advancements: Smart furniture and innovative designs enhance the functionality and appeal of home office furniture.

- Growing e-commerce penetration: Online retailers expand their product offerings and improve accessibility, driving sales.

Challenges in the Europe Home Office Furniture Industry Sector

The industry faces several challenges:

- Supply chain disruptions: Global supply chain issues can impact material availability and production costs, affecting profitability.

- Increased competition: The market's growing popularity attracts new entrants, intensifying competition and potentially decreasing profit margins.

- Fluctuating raw material costs: Changes in raw material prices impact manufacturing costs and ultimately affect product pricing and profitability. This challenge is estimated to impact the industry by xx Million annually.

Emerging Opportunities in Europe Home Office Furniture Industry

The industry presents several promising opportunities:

- Growth in the smart furniture segment: Integrating smart technology into furniture can offer enhanced functionality and appeal, opening new market avenues.

- Expansion into niche markets: Targeting specific consumer segments with specialized needs (e.g., ergonomic furniture for gamers) can create new revenue streams.

- Increased focus on sustainability: Offering eco-friendly products made from recycled and sustainable materials can attract environmentally conscious consumers.

Leading Players in the Europe Home Office Furniture Industry Market

- 9 Neptune (Europe) Ltd

- 4 Bo Concept

- 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive

- 7 Poltrona Frau

- 2 Bisley

- 6 Vitra International Ag

- 11 Nowy Styl

- 8 Laporta

- 10 Royal Ahrend

- 5 Knoll

- 1 Actona Company A/S

- 3 IKEA

Key Developments in Europe Home Office Furniture Industry Industry

- 2022 Q4: IKEA launched a new line of sustainable home office furniture.

- 2023 Q1: Vitra International AG partnered with a tech company to integrate smart features into its desks.

- 2024 Q2: A major merger occurred between two smaller furniture companies, increasing market consolidation. (Further details on specific mergers and acquisitions are included in the full report).

Strategic Outlook for Europe Home Office Furniture Industry Market

The European home office furniture market is poised for sustained growth, driven by ongoing trends in remote work, technological advancements, and evolving consumer preferences. Companies focused on innovation, sustainability, and efficient e-commerce strategies are well-positioned to capitalize on the market's future potential. The market is expected to experience a healthy expansion throughout the forecast period, presenting significant opportunities for both established players and emerging businesses.

Europe Home Office Furniture Industry Segmentation

-

1. Product

- 1.1. Seating

- 1.2. Tables and Desks

- 1.3. Storage Units

- 1.4. Other Home Office Furniture

-

2. Distribution Channel

- 2.1. Flagship Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Europe Home Office Furniture Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Office Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The integration of technology into home office furniture is a significant driver. Desks and chairs with built-in technology

- 3.2.2 such as integrated power outlets

- 3.2.3 cable management systems

- 3.2.4 and connectivity features

- 3.2.5 are becoming more popular as they enhance the functionality of home office setups

- 3.3. Market Restrains

- 3.3.1 The home office furniture market is highly competitive

- 3.3.2 with numerous local and international brands vying for market share. Price sensitivity among consumers can put pressure on manufacturers and retailers to offer competitive pricing

- 3.3.3 potentially impacting profit margins.

- 3.4. Market Trends

- 3.4.1. The demand for flexible and adaptable furniture solutions is growing. Consumers are looking for home office furniture that can be easily adjusted or reconfigured to suit different work needs and spaces. Multi-functional furniture that serves various purposes is particularly popular

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating

- 5.1.2. Tables and Desks

- 5.1.3. Storage Units

- 5.1.4. Other Home Office Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flagship Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 9 Neptune (Europe) Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 4 Bo Concept

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 7 Poltrona Frau

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 2 Bisley

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 6 Vitra International Ag

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 11 Nowy Styl

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 8 Laporta

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 10 Royal Ahrend

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 5 Knoll

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 1 Actona Company A/S

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 3 IKEA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 9 Neptune (Europe) Ltd

List of Figures

- Figure 1: Europe Home Office Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Home Office Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Home Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Home Office Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Home Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Home Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Home Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Home Office Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Europe Home Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Home Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Office Furniture Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Europe Home Office Furniture Industry?

Key companies in the market include 9 Neptune (Europe) Ltd, 4 Bo Concept, 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive, 7 Poltrona Frau, 2 Bisley, 6 Vitra International Ag, 11 Nowy Styl, 8 Laporta, 10 Royal Ahrend, 5 Knoll, 1 Actona Company A/S, 3 IKEA.

3. What are the main segments of the Europe Home Office Furniture Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The integration of technology into home office furniture is a significant driver. Desks and chairs with built-in technology. such as integrated power outlets. cable management systems. and connectivity features. are becoming more popular as they enhance the functionality of home office setups.

6. What are the notable trends driving market growth?

The demand for flexible and adaptable furniture solutions is growing. Consumers are looking for home office furniture that can be easily adjusted or reconfigured to suit different work needs and spaces. Multi-functional furniture that serves various purposes is particularly popular.

7. Are there any restraints impacting market growth?

The home office furniture market is highly competitive. with numerous local and international brands vying for market share. Price sensitivity among consumers can put pressure on manufacturers and retailers to offer competitive pricing. potentially impacting profit margins..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Office Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Office Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Office Furniture Industry?

To stay informed about further developments, trends, and reports in the Europe Home Office Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence