Key Insights

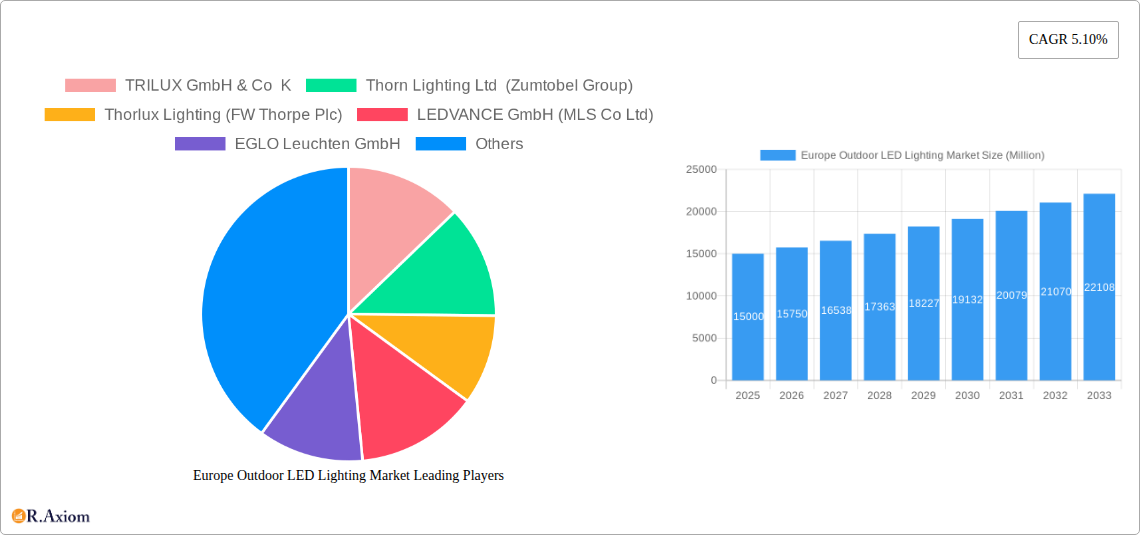

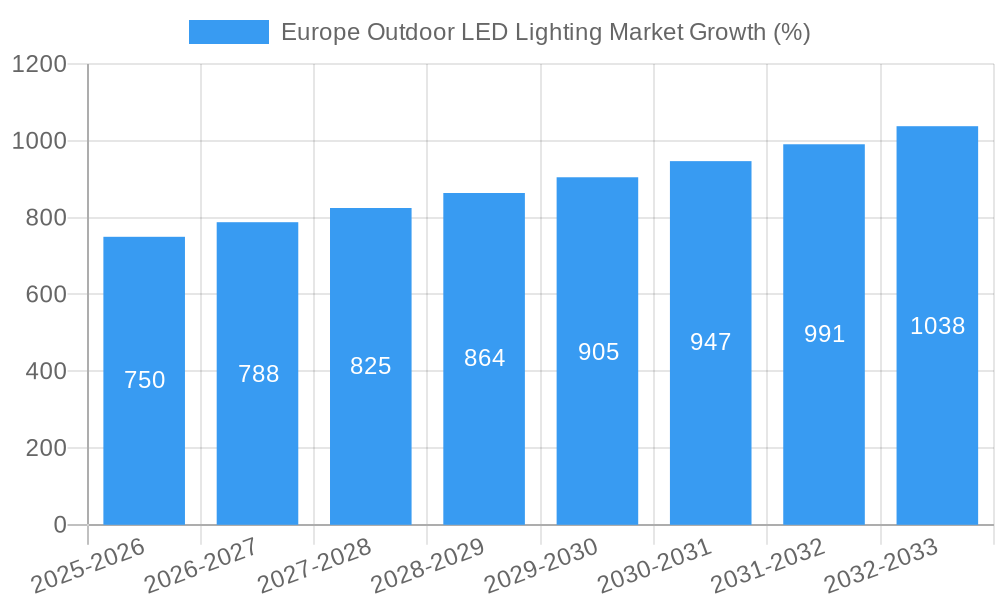

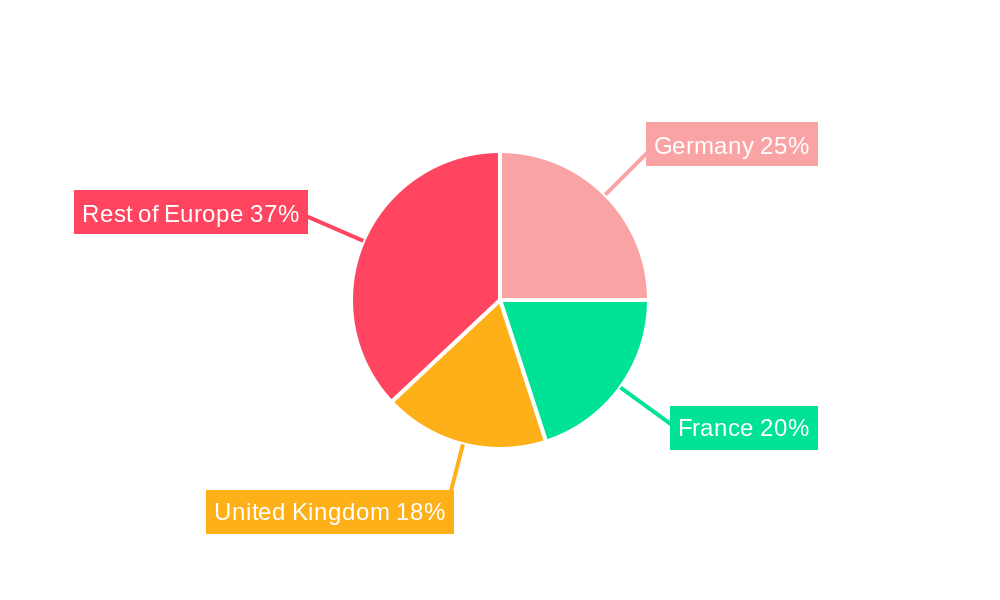

The European outdoor LED lighting market is experiencing robust growth, driven by increasing environmental concerns, stringent government regulations promoting energy efficiency, and the rising adoption of smart city initiatives. The market's Compound Annual Growth Rate (CAGR) of 5.10% from 2019 to 2024 indicates a consistent upward trajectory. This growth is further fueled by the long lifespan and energy efficiency of LED technology compared to traditional lighting solutions, leading to significant cost savings for municipalities and businesses alike. Key application segments include public places, streets and roadways, and other outdoor areas such as parks and private residential complexes. Germany, France, and the United Kingdom represent the largest national markets within Europe, driven by significant investments in infrastructure upgrades and smart city projects. The market is highly competitive, with major players such as Signify (Philips), Osram, and Acuity Brands vying for market share through innovation in product design, smart lighting solutions, and strategic partnerships. While challenges remain, such as the initial high capital investment associated with LED installations, the long-term benefits are compelling, ensuring sustained growth.

Looking forward, the forecast period of 2025-2033 is expected to witness continued expansion, potentially exceeding the previous CAGR due to increased government support for green technologies and the growing demand for energy-efficient and sustainable solutions. The integration of smart features into outdoor LED lighting systems, enabling remote monitoring, control, and data analytics, is a significant trend shaping the market. This capability optimizes energy consumption, enhances safety, and improves operational efficiency. Furthermore, the increasing focus on sustainable and environmentally friendly solutions will further propel market growth. Competitive dynamics will continue to influence market share, with players investing in research and development to improve product performance and offer innovative solutions tailored to specific market needs. The ongoing adoption of smart city initiatives across European nations will play a crucial role in driving demand and shaping the future of this dynamic market.

Europe Outdoor LED Lighting Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Outdoor LED Lighting Market, offering invaluable insights for industry stakeholders, investors, and market strategists. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. The market is segmented by country (France, Germany, United Kingdom, Rest of Europe) and application (Public Places, Streets and Roadways, Others). The report's value surpasses €xx Million in 2025 and is projected to reach €xx Million by 2033, exhibiting a CAGR of xx%.

Europe Outdoor LED Lighting Market Concentration & Innovation

This section analyzes the competitive landscape of the European outdoor LED lighting market, encompassing market concentration, innovation drivers, regulatory influences, and recent M&A activities. The market exhibits a moderately concentrated structure, with several key players holding significant market share. Signify Holding (Philips) and Osram are amongst the leading players, collectively commanding approximately xx% of the market in 2025. Other key players include TRILUX GmbH & Co K, Thorn Lighting Ltd (Zumtobel Group), Thorlux Lighting (FW Thorpe Plc), LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, ACUITY BRANDS INC, Dialight PLC, and Panasonic Holdings Corporation.

- Market Share: The top five players account for approximately xx% of the total market share in 2025.

- Innovation Drivers: Stringent energy efficiency regulations, coupled with the increasing adoption of smart city initiatives, are driving innovation in areas like smart lighting controls and energy-harvesting technologies.

- Regulatory Framework: EU directives related to energy efficiency and environmental sustainability are significantly influencing the market's trajectory.

- Product Substitutes: While LED technology currently dominates, alternative lighting solutions continue to face competition from conventional lighting systems.

- M&A Activity: The market has witnessed several mergers and acquisitions in recent years, driving consolidation and shaping the competitive landscape. The total value of M&A deals in the past five years is estimated at €xx Million. These activities are primarily driven by the pursuit of economies of scale and technological advancements.

- End-user trends: Increased demand for aesthetically pleasing, durable, and energy-efficient outdoor lighting solutions, particularly within smart city projects, influences market trends.

Europe Outdoor LED Lighting Market Industry Trends & Insights

This section explores the key trends shaping the European outdoor LED lighting market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is expected to witness robust growth driven by increasing government initiatives promoting energy efficiency and sustainable infrastructure. Furthermore, technological advancements, including the integration of smart features and IoT connectivity, are augmenting the functionality and appeal of outdoor LED lighting systems. The market's CAGR from 2025 to 2033 is estimated to be xx%, primarily fueled by rising demand for energy-efficient and aesthetically advanced lighting solutions across various applications. Market penetration of LED lighting in outdoor applications is consistently increasing, reaching approximately xx% in 2025.

Dominant Markets & Segments in Europe Outdoor LED Lighting Market

This section identifies the leading regions, countries, and segments within the European outdoor LED lighting market. Germany and the United Kingdom represent the largest national markets, driven by robust infrastructure development and government support for energy-efficient solutions.

Key Drivers:

- Germany: Strong government support for energy efficiency and smart city initiatives. Extensive urban infrastructure development.

- United Kingdom: Significant investments in public infrastructure projects and rising adoption of smart city technologies.

- France: Increasing focus on sustainable urban development and energy efficiency regulations.

- Rest of Europe: Diverse market dynamics, with varying levels of infrastructure development and government support.

Application Segment Dominance:

- Streets and Roadways: This segment dominates the market, owing to the extensive network of roads and streets requiring efficient and durable lighting solutions.

- Public Places: Rapid growth is expected in public places, driven by the growing adoption of smart city initiatives and the need for enhanced security and aesthetics.

- Others: This segment encompasses various applications, such as parks, gardens, and commercial areas.

Europe Outdoor LED Lighting Market Product Developments

Recent product innovations have focused on enhancing energy efficiency, improving light quality, and incorporating smart features. Manufacturers are integrating advanced technologies like smart controls, IoT connectivity, and energy-harvesting capabilities into their products. This focus on innovation allows manufacturers to provide tailored solutions to meet specific application needs, enhancing their competitive advantage. The market is witnessing a growing trend towards aesthetically pleasing designs that complement the surrounding environment.

Report Scope & Segmentation Analysis

This report segments the European outdoor LED lighting market by country (France, Germany, United Kingdom, and Rest of Europe) and application (Public Places, Streets and Roadways, and Others). Growth projections for each segment are provided, along with analysis of market size and competitive dynamics. The market size for each country and application segment is provided for the historical period (2019-2024), the base year (2025), and the forecast period (2026-2033).

Key Drivers of Europe Outdoor LED Lighting Market Growth

Several factors drive the growth of the European outdoor LED lighting market. These include stringent government regulations promoting energy efficiency, increasing adoption of smart city technologies, and the rising need for enhanced safety and security in public spaces. Furthermore, the continuous advancements in LED technology, leading to improved energy efficiency and longer lifespans, are key drivers of market growth. Government incentives and subsidies for energy-efficient lighting systems also contribute to market expansion.

Challenges in the Europe Outdoor LED Lighting Market Sector

The European outdoor LED lighting market faces challenges such as fluctuating raw material prices, which impact production costs. Furthermore, intense competition among numerous players can lead to price wars and reduced profit margins. Stringent regulations related to energy efficiency and environmental standards require continuous innovation and investment to maintain compliance. Finally, maintaining a secure and reliable supply chain is crucial to manage potential disruptions.

Emerging Opportunities in Europe Outdoor LED Lighting Market

The market presents significant opportunities for growth in several areas. The increasing adoption of smart city initiatives creates substantial demand for smart lighting solutions with integrated sensors and IoT capabilities. Furthermore, the growing focus on sustainable and environmentally friendly solutions opens doors for eco-friendly LED lighting products. Expansion into niche markets, such as specialized lighting for sports venues or architectural lighting, presents additional growth opportunities.

Leading Players in the Europe Outdoor LED Lighting Market Market

- TRILUX GmbH & Co K

- Thorn Lighting Ltd (Zumtobel Group)

- Thorlux Lighting (FW Thorpe Plc)

- LEDVANCE GmbH (MLS Co Ltd)

- EGLO Leuchten GmbH

- ams-OSRAM AG

- ACUITY BRANDS INC

- Dialight PLC

- Signify Holding (Philips)

- Panasonic Holdings Corporation

Key Developments in Europe Outdoor LED Lighting Market Industry

- November 2022: Panasonic lights up the state-of-the-art Rudraksh Convention Centre in India, showcasing the capabilities of LED lighting in large-scale projects.

- April 2023: Hydrel expands its M9000 ingrade luminaire family with the addition of the M9700 RGBW fixture, enhancing its product portfolio with advanced color-changing capabilities.

- May 2023: Cyclone Lighting launches the Elencia luminaire, a modern post-top light featuring high-performance optics and an upscale design, enhancing the aesthetic appeal of outdoor lighting.

Strategic Outlook for Europe Outdoor LED Lighting Market Market

The European outdoor LED lighting market is poised for continued growth, driven by factors such as increasing urbanization, rising demand for energy-efficient solutions, and the expanding adoption of smart city technologies. Future market potential lies in the development and deployment of advanced lighting solutions that enhance safety, security, and aesthetics in urban environments. Innovation in areas like smart controls, IoT connectivity, and energy harvesting will play a crucial role in shaping the market's future trajectory.

Europe Outdoor LED Lighting Market Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

Europe Outdoor LED Lighting Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Outdoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. Europe Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. Germany Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. France Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Italy Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. United Kingdom Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Netherlands Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Sweden Europe Outdoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 TRILUX GmbH & Co K

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Thorn Lighting Ltd (Zumtobel Group)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Thorlux Lighting (FW Thorpe Plc)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LEDVANCE GmbH (MLS Co Ltd)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 EGLO Leuchten GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ams-OSRAM AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ACUITY BRANDS INC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dialight PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Signify Holding (Philips)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 TRILUX GmbH & Co K

List of Figures

- Figure 1: Europe Outdoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Outdoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 5: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 22: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Outdoor Lighting 2019 & 2032

- Table 23: Europe Outdoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Outdoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Germany Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: France Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Italy Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Spain Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Netherlands Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Netherlands Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Belgium Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Belgium Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Sweden Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Sweden Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Norway Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Norway Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Poland Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Poland Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Denmark Europe Outdoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Denmark Europe Outdoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Outdoor LED Lighting Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Europe Outdoor LED Lighting Market?

Key companies in the market include TRILUX GmbH & Co K, Thorn Lighting Ltd (Zumtobel Group), Thorlux Lighting (FW Thorpe Plc), LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, ams-OSRAM AG, ACUITY BRANDS INC, Dialight PLC, Signify Holding (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Europe Outdoor LED Lighting Market?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires, has announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look thanks to high-performance optics and revised, modern lantern style.April 2023: Hydrel, an established innovator and producer of outdoor architectural and landscape lighting systems, announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family.November 2022: In 2022, Panasonic lights up state-of-the-art Rudraksh Convention Centre. This centre is constructed by Grand aid by Japan through Japan Internation Cooperation Agency (JICA)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Outdoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Outdoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Outdoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the Europe Outdoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence