Key Insights

The European Proximity Sensors market is projected for significant growth, expected to reach 5319.5 million by 2025. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 6% through 2033. This expansion is driven by the increasing automation in manufacturing, automotive, and aerospace sectors. The rise of smart factories, Industry 4.0, and advancements in robotics are fueling demand for sophisticated proximity sensing solutions. Technological innovations in inductive, capacitive, and photoelectric sensors are enhancing their accuracy, reliability, and cost-efficiency, making them crucial for modern industrial operations. The consumer electronics sector, with its focus on miniaturization and integrated sensing, also presents a substantial growth opportunity.

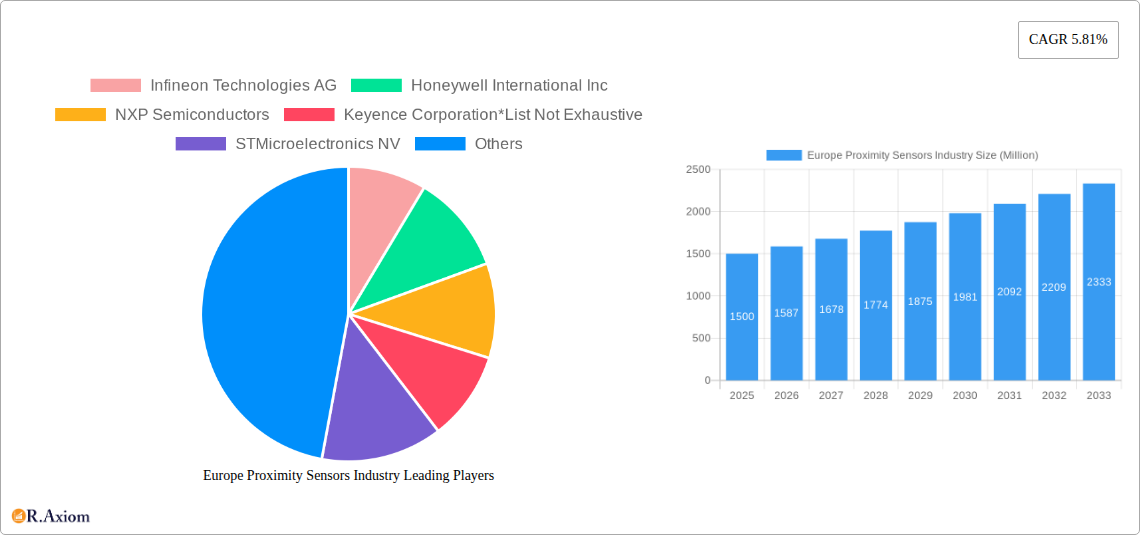

Europe Proximity Sensors Industry Market Size (In Billion)

Key European markets, including Germany, the United Kingdom, France, and Italy, are central to these growth trends. Stringent safety regulations and the pursuit of operational efficiency in European industries further stimulate demand for proximity sensors. Potential challenges include the initial investment costs for advanced sensor integration in legacy systems and the requirement for skilled personnel. However, continuous technological advancements and growing awareness of the long-term benefits are expected to overcome these hurdles. The market features established companies such as Infineon Technologies AG, Honeywell International Inc., and NXP Semiconductors, alongside specialized vendors, contributing to a dynamic competitive environment.

Europe Proximity Sensors Industry Company Market Share

Europe Proximity Sensors Industry Market Concentration & Innovation

The Europe Proximity Sensors Industry is characterized by a moderate to high market concentration, with a few key global players holding significant market share. Leading entities such as Infineon Technologies AG, Honeywell International Inc., NXP Semiconductors, and Sick AG are at the forefront, driving innovation and setting industry standards. The market's innovation is primarily fueled by the increasing demand for automation, Industry 4.0 initiatives, and the growing adoption of smart technologies across various end-user verticals, particularly in the automotive and industrial sectors. Regulatory frameworks, such as those concerning industrial safety and environmental standards, play a crucial role in shaping product development and market entry strategies. While product substitutes exist, such as vision systems and ultrasonic sensors, proximity sensors offer distinct advantages in terms of cost-effectiveness, reliability, and ease of integration for specific applications. End-user trends highlight a strong push towards miniaturization, increased sensing capabilities, and enhanced connectivity in proximity sensor solutions. Mergers and acquisitions (M&A) activities, though not always publicly disclosed with precise values, are strategic moves by major players to expand their product portfolios, gain access to new technologies, and consolidate their market positions. For instance, an acquisition valued in the tens of millions could significantly impact the competitive landscape by integrating specialized sensor technologies or expanding geographic reach.

Europe Proximity Sensors Industry Industry Trends & Insights

The Europe Proximity Sensors Industry is experiencing robust growth, propelled by a confluence of technological advancements, evolving end-user demands, and supportive industrial policies. The Compound Annual Growth Rate (CAGR) is estimated to be around 8.5% to 10% during the forecast period of 2025-2033. This sustained expansion is underpinned by the pervasive trend towards Industry 4.0, where smart manufacturing, the Internet of Things (IoT), and artificial intelligence are transforming production processes. Proximity sensors are integral components in this revolution, enabling precise object detection, automation of material handling, quality control, and the monitoring of machine health. The automotive sector stands out as a significant growth driver, with the increasing complexity of Advanced Driver-Assistance Systems (ADAS) and the ongoing transition to electric vehicles (EVs) demanding sophisticated sensor solutions for applications like parking assistance, lane keeping, and battery management. Furthermore, the aerospace and defense industry is witnessing a growing adoption of proximity sensors for their critical safety and operational functions, including aircraft systems and defense equipment.

Technological disruptions are continuously reshaping the industry. Advancements in solid-state sensing technologies, miniaturization of components, and the integration of wireless connectivity are leading to more compact, energy-efficient, and intelligent proximity sensors. The development of IO-Link enabled sensors is also gaining traction, offering enhanced diagnostic capabilities and simplified integration into industrial networks. Consumer preferences are increasingly leaning towards sensors that offer higher accuracy, greater reliability in harsh environments, and seamless integration with smart home devices and wearable technology. This is driving innovation in consumer electronics and smart home applications.

The competitive dynamics within the Europe Proximity Sensors Industry are intensifying. While established players like Infineon Technologies AG, Honeywell International Inc., and Sick AG continue to innovate and expand their market presence, emerging players are also carving out niches by focusing on specialized technologies or specific end-user segments. Strategic partnerships and collaborations are becoming more prevalent as companies aim to leverage each other's expertise and market reach. The market penetration of advanced proximity sensor technologies is projected to increase significantly as cost barriers decrease and the benefits of automation become more apparent across a wider range of industries. The demand for robust and reliable sensing solutions in sectors like food and beverage for process automation and quality assurance further contributes to the industry's upward trajectory.

Dominant Markets & Segments in Europe Proximity Sensors Industry

The Europe Proximity Sensors Industry exhibits clear dominance in specific regions and segments, driven by economic policies, robust industrial infrastructure, and evolving technological adoption. Germany consistently emerges as a dominant market within Europe, owing to its strong manufacturing base, particularly in the automotive and industrial machinery sectors. Its commitment to Industry 4.0 principles and significant investments in automation technologies create a fertile ground for proximity sensor adoption.

Key Drivers of Dominance:

- Industrial Manufacturing Prowess: Germany's extensive manufacturing ecosystem, encompassing automotive, chemical, and mechanical engineering, demands a high volume of proximity sensors for automation, quality control, and safety.

- Technological Innovation Hub: The country hosts leading technology companies and research institutions, fostering rapid development and adoption of cutting-edge sensor technologies.

- Strict Safety Regulations: Stringent safety standards in industrial and automotive applications necessitate reliable and advanced proximity sensing solutions, driving demand for high-performance products.

- Strong Automotive Sector: As the home of several global automotive giants, Germany's automotive industry is a major consumer of proximity sensors for ADAS, EV charging infrastructure, and vehicle assembly automation.

Within the Technology segmentation, Inductive sensors historically hold a significant market share due to their robustness, reliability, and cost-effectiveness in detecting metallic objects, making them indispensable in industrial automation and harsh environments. However, Photoelectric sensors are witnessing substantial growth driven by their versatility in detecting a wider range of materials and their suitability for applications requiring precise object detection and counting, especially in packaging and logistics. Capacitive sensors are also gaining traction, particularly in applications where non-metallic object detection is crucial, such as in food and beverage processing and fluid level sensing. Magnetic sensors are indispensable in applications requiring non-contact detection and position sensing, finding significant use in the automotive sector for speed sensing and in industrial robotics.

In terms of End-User Verticals, the Industrial segment is by far the largest and most dominant. This encompasses a broad spectrum of applications within manufacturing plants, including assembly lines, material handling, robotics, and machine safety. The ongoing drive towards smart factories and automated production processes directly fuels the demand for proximity sensors. The Automotive segment follows closely, driven by the increasing integration of ADAS, the electrification of vehicles, and the automation of manufacturing processes within the automotive industry. The Aerospace and Defense sector, while smaller in volume, represents a high-value segment due to the stringent reliability and performance requirements. The Consumer Electronics sector is an emerging growth area, with proximity sensors finding applications in smart home devices, appliances, and wearable technology. The Food and Beverage industry is also a significant contributor, utilizing proximity sensors for process automation, hygiene monitoring, and packaging.

Europe Proximity Sensors Industry Product Developments

Recent product developments in the Europe Proximity Sensors Industry are characterized by enhanced intelligence, increased connectivity, and miniaturization. Companies are focusing on integrating advanced features like built-in diagnostics, predictive maintenance capabilities, and seamless integration with IoT platforms. The development of ** IO-Link enabled sensors** continues to be a key trend, simplifying setup, parameterization, and data exchange. Innovations in solid-state technology are leading to more robust and compact sensors that can operate in extreme temperatures and harsh industrial environments. Furthermore, the focus on energy efficiency is driving the development of low-power proximity sensors, crucial for battery-operated devices and sustainable industrial applications. These advancements translate to improved operational efficiency, reduced downtime, and enhanced safety across various end-user industries.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Europe Proximity Sensors Industry, segmented by Technology and End-User Verticals.

Technology Segmentation:

- Inductive Sensors: This segment, historically dominant, comprises sensors that detect metallic objects through electromagnetic induction. Growth is driven by established industrial automation needs.

- Capacitive Sensors: These sensors detect a wide range of objects (metallic and non-metallic) by changes in capacitance. Their market is expanding due to growing applications in food and beverage, and liquid level sensing.

- Photoelectric Sensors: Known for their versatility in detecting various materials and distances, these sensors are witnessing strong growth, particularly in packaging, logistics, and consumer electronics.

- Magnetic Sensors: These sensors detect magnetic fields and are crucial for position sensing, speed detection, and anti-tamper applications, especially in the automotive and industrial sectors.

End-User Verticals Segmentation:

- Aerospace and Defense: This high-value segment demands extreme reliability and precision for critical applications, with steady growth driven by advanced military systems and aircraft.

- Automotive: A major growth driver, this segment benefits from the increasing adoption of ADAS, EVs, and automated manufacturing, requiring a diverse range of proximity sensors.

- Industrial: The largest segment, encompassing manufacturing, automation, robotics, and machine safety, experiencing continuous expansion due to Industry 4.0 initiatives.

- Consumer Electronics: An emerging segment with significant growth potential, driven by smart home devices, wearables, and advanced appliances.

- Food and Beverage: This segment sees consistent demand for proximity sensors for process automation, quality control, and hygienic applications.

- Other End-user Verticals: This includes sectors like healthcare, logistics, and building automation, contributing to overall market growth.

Key Drivers of Europe Proximity Sensors Industry Growth

The Europe Proximity Sensors Industry is propelled by several key drivers. The relentless pursuit of automation and Industry 4.0 adoption across manufacturing sectors is a primary catalyst, demanding sophisticated sensing capabilities for efficient and intelligent operations. The automotive industry's evolution, particularly the surge in ADAS and EV development, necessitates advanced proximity sensors for safety and functionality. Technological advancements like miniaturization, increased accuracy, and enhanced connectivity are making sensors more versatile and cost-effective. Furthermore, stringent safety regulations in industrial and automotive environments mandate the use of reliable sensing solutions. Government initiatives promoting industrial modernization and digitalization also play a significant role in fostering market growth.

Challenges in the Europe Proximity Sensors Industry Sector

Despite robust growth, the Europe Proximity Sensors Industry faces several challenges. Intense price competition, especially from manufacturers in lower-cost regions, puts pressure on profit margins for established European players. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production timelines and costs. The rapid pace of technological change requires continuous investment in R&D, which can be a barrier for smaller companies. Additionally, the need for specialized expertise in designing and integrating advanced sensors can lead to talent shortages. Evolving cybersecurity threats also pose a challenge, as connected sensors become more prevalent, requiring robust security measures.

Emerging Opportunities in Europe Proximity Sensors Industry

Several emerging opportunities present significant growth potential for the Europe Proximity Sensors Industry. The increasing demand for smart manufacturing solutions in sectors beyond traditional heavy industry, such as pharmaceuticals and textiles, opens new avenues. The expansion of electric vehicle charging infrastructure creates a strong need for reliable proximity sensors. The growing adoption of smart home technologies and the Internet of Things (IoT) in consumer electronics offers substantial market penetration opportunities for miniaturized and connected sensors. Furthermore, the development of AI-powered sensing solutions capable of more complex object recognition and anomaly detection presents a future growth frontier. The focus on sustainability and energy efficiency is also driving demand for low-power, long-lasting proximity sensors.

Leading Players in the Europe Proximity Sensors Industry Market

- Infineon Technologies AG

- Honeywell International Inc.

- NXP Semiconductors

- Keyence Corporation

- STMicroelectronics NV

- Sick AG

- TE Connectivity Ltd

- Pepperl+Fuchs GmbH

- Datalogic SpA

- Panasonic Corporation

Key Developments in Europe Proximity Sensors Industry Industry

- 2023/11: Infineon Technologies AG launched a new series of highly integrated magnetic sensors for automotive applications, enhancing ADAS capabilities.

- 2023/10: Sick AG introduced advanced photoelectric sensors with integrated IO-Link communication, improving industrial automation efficiency.

- 2023/09: Honeywell International Inc. acquired a company specializing in embedded sensor technology, strengthening its IoT offerings.

- 2023/07: STMicroelectronics NV announced advancements in MEMS sensor technology, paving the way for smaller and more powerful proximity sensors.

- 2023/06: NXP Semiconductors partnered with a leading automotive OEM to develop next-generation sensor solutions for electric vehicles.

Strategic Outlook for Europe Proximity Sensors Industry Market

The strategic outlook for the Europe Proximity Sensors Industry is overwhelmingly positive, driven by the unstoppable march of digitalization and automation. Future growth will be catalyzed by the increasing integration of proximity sensors into complex IoT ecosystems, enabling smarter and more connected environments across all end-user verticals. Companies that focus on developing highly intelligent, energy-efficient, and secure sensor solutions will be well-positioned to capitalize on emerging opportunities. Strategic collaborations and partnerships will be crucial for navigating the evolving technological landscape and expanding market reach. The industry's ability to adapt to new demands for precision, reliability, and data-rich sensing will determine its continued success and expansion in the coming years.

Europe Proximity Sensors Industry Segmentation

-

1. Technology

- 1.1. Inductive

- 1.2. Capacitive

- 1.3. Photoelectric

- 1.4. Magnetic

-

2. End-User

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Consumer Electronics

- 2.5. Food and Beverage

- 2.6. Other End-user Verticals

Europe Proximity Sensors Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

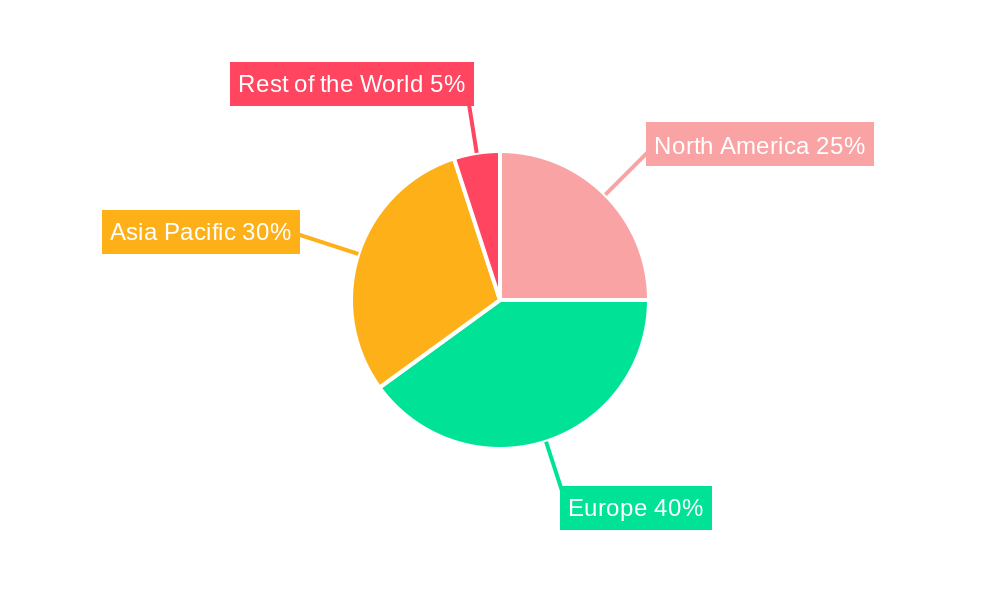

Europe Proximity Sensors Industry Regional Market Share

Geographic Coverage of Europe Proximity Sensors Industry

Europe Proximity Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Industrial Automation

- 3.3. Market Restrains

- 3.3.1. ; Limitations in Sensing Capabilities

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Automotive Sector is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Proximity Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Inductive

- 5.1.2. Capacitive

- 5.1.3. Photoelectric

- 5.1.4. Magnetic

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Consumer Electronics

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NXP Semiconductors

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Keyence Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sick AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TE Connectivity Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pepperl+Fuchs GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Datalogic SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Europe Proximity Sensors Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Proximity Sensors Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Proximity Sensors Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Proximity Sensors Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 3: Europe Proximity Sensors Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Proximity Sensors Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 5: Europe Proximity Sensors Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 6: Europe Proximity Sensors Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Proximity Sensors Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Proximity Sensors Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Proximity Sensors Industry?

Key companies in the market include Infineon Technologies AG, Honeywell International Inc, NXP Semiconductors, Keyence Corporation*List Not Exhaustive, STMicroelectronics NV, Sick AG, TE Connectivity Ltd, Pepperl+Fuchs GmbH, Datalogic SpA, Panasonic Corporation.

3. What are the main segments of the Europe Proximity Sensors Industry?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5319.5 million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Industrial Automation.

6. What are the notable trends driving market growth?

Increasing Investment in Automotive Sector is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; Limitations in Sensing Capabilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Proximity Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Proximity Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Proximity Sensors Industry?

To stay informed about further developments, trends, and reports in the Europe Proximity Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence