Key Insights

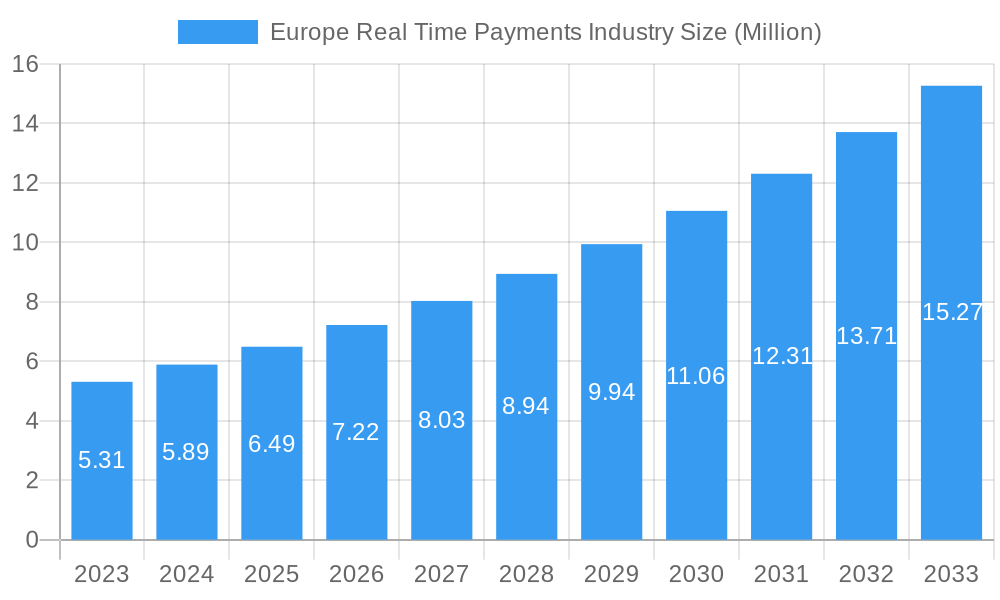

The European Real-Time Payments (RTP) market is poised for substantial expansion, projected to reach a market size of $6.49 billion by 2025, driven by a compelling CAGR of 11.54% over the forecast period of 2025-2033. This growth trajectory is underpinned by a confluence of factors, including the increasing demand for instant money transfers, the proliferation of digital payment solutions, and supportive regulatory initiatives across the region. The P2P (Person-to-Person) and P2B (Person-to-Business) payment segments are both expected to witness robust adoption, fueled by enhanced convenience, improved security features, and the growing preference for digital transactions among consumers and businesses alike. Leading players such as VISA Inc., Mastercard Inc., and Paypal Holdings Inc. are at the forefront, investing heavily in infrastructure and innovation to capitalize on this burgeoning market. The United Kingdom, Germany, and France are anticipated to be key markets within Europe, leveraging their advanced financial ecosystems and strong consumer adoption of digital technologies.

Europe Real Time Payments Industry Market Size (In Million)

The RTP landscape in Europe is characterized by a dynamic interplay of technological advancements and evolving consumer expectations. While the convenience and speed of real-time payments are significant drivers, the market also faces certain restraints. These include the potential for increased fraud and security concerns associated with instant transactions, the need for significant infrastructure upgrades by financial institutions, and the ongoing challenge of ensuring widespread interoperability across diverse payment systems. However, ongoing innovation in areas such as tokenization and multi-factor authentication, coupled with strategic partnerships between fintech companies and established financial players, are steadily mitigating these challenges. The growing focus on financial inclusion and the development of open banking frameworks are further expected to accelerate RTP adoption across the continent, promising a future where instant and seamless payments become the norm.

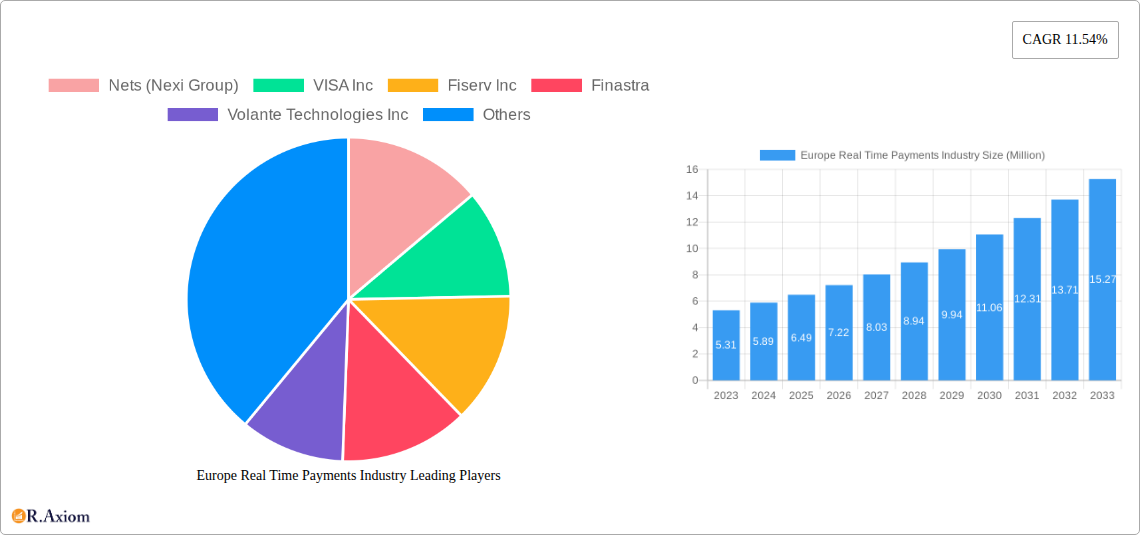

Europe Real Time Payments Industry Company Market Share

This comprehensive report delves into the dynamic Europe Real Time Payments Industry Market, providing an in-depth analysis of its growth, innovation, and future trajectory. Examining the period from 2019 to 2033, with a base year of 2025, this study offers critical insights for industry stakeholders, including Fintech companies, financial institutions, merchants, and payment processors. The report forecasts a robust CAGR of xx% for the Europe Real Time Payments Industry during the forecast period of 2025–2033.

Europe Real Time Payments Industry Market Concentration & Innovation

The Europe Real Time Payments Industry Market exhibits a moderate to high concentration, driven by the presence of a few dominant players alongside a growing number of specialized innovators. Key players like VISA Inc., Mastercard Inc., Fiserv Inc., Nets (Nexi Group), and ACI Worldwide Inc. hold significant market share, particularly in established payment infrastructures. Innovation is a critical differentiator, fueled by the demand for faster, more secure, and user-friendly payment solutions. The regulatory landscape, including initiatives like PSD2 and the ongoing modernization of national payment systems, acts as both an enabler and a modulator of market dynamics. Product substitutes, such as traditional card payments and mobile wallets, are increasingly being disrupted by the speed and efficiency of real-time payments. End-user trends highlight a strong preference for instant transactions among both consumers and businesses, pushing for broader adoption. Mergers and acquisitions (M&A) activity remains high, with significant deal values in the hundreds of millions to billions of Euros, as larger entities seek to consolidate their market position and acquire innovative technologies. For instance, the acquisition of Nets by Nexi Group exemplifies this trend.

- Market Concentration Drivers: Large network effects, established customer bases, and significant investment in infrastructure.

- Innovation Drivers: Demand for instant settlement, improved customer experience, fraud prevention, and integration with digital ecosystems.

- Regulatory Frameworks: PSD2, open banking initiatives, and national real-time payment scheme upgrades.

- Product Substitutes: Traditional card networks, e-wallets, and ACH transfers.

- End-User Trends: Growing demand for frictionless payments, peer-to-peer (P2P) transfers, and instant business-to-business (B2B) payments.

- M&A Activity: Consolidation for market share, acquisition of cutting-edge technology, and expansion into new geographies. Deal values often exceed several hundred million Euros.

Europe Real Time Payments Industry Industry Trends & Insights

The Europe Real Time Payments Industry is experiencing unprecedented growth, driven by a confluence of factors including technological advancements, evolving consumer expectations, and supportive regulatory environments. The inherent advantages of real-time payments – instant fund availability, reduced settlement risk, and enhanced cash flow management – are compelling businesses and individuals alike to adopt these solutions. Technological disruptions are at the forefront of this transformation, with the widespread adoption of APIs (Application Programming Interfaces) facilitating seamless integration of real-time payment capabilities into existing financial platforms and third-party applications. The proliferation of smartphones and the increasing reliance on digital channels for commerce further amplify the demand for immediate payment solutions. Consumer preferences are shifting dramatically towards instant gratification, making real-time payment options a key factor in purchasing decisions, whether for online shopping, P2P transfers, or bill payments. This shift is compelling merchants to offer real-time payment gateways to remain competitive and reduce cart abandonment rates.

The competitive dynamics within the Europe Real Time Payments Industry are intensifying, with traditional financial institutions, payment processors, and innovative Fintech startups vying for market dominance. Companies are investing heavily in enhancing their real-time payment infrastructure, focusing on scalability, security, and user experience. The development of new payment schemes and the modernization of existing ones, such as the UK's New Payments Architecture (NPA) program, are further stimulating innovation and competition. The market penetration of real-time payments is steadily increasing across various sectors, driven by the demonstrable benefits it offers in terms of efficiency and cost savings. For instance, the ability for businesses to receive payments instantly reduces the need for working capital loans and improves overall liquidity. The CAGR for the Europe Real Time Payments Industry is projected to be robust, indicating a sustained period of high growth. This growth is underpinned by the continuous innovation in payment technologies, the expansion of real-time payment networks, and the increasing adoption rates across all segments of the economy. The ongoing digital transformation of the financial sector, coupled with strong government initiatives to promote cashless societies, will continue to fuel the expansion of this critical industry.

Dominant Markets & Segments in Europe Real Time Payments Industry

Within the Europe Real Time Payments Industry, several markets and segments are demonstrating exceptional growth and dominance, propelled by a combination of economic policies, advanced infrastructure, and evolving consumer behavior. The P2B (Payment to Business) segment, in particular, is emerging as a significant driver of real-time payment adoption. This dominance is largely attributed to the tangible benefits real-time payments offer to businesses, including improved cash flow management, reduced operational costs associated with chasing payments, and enhanced customer experience through instant confirmation. Economic policies across Europe are increasingly favoring faster payment systems to stimulate economic activity and promote financial inclusion. Governments are actively encouraging the modernization of national payment infrastructures, leading to the development and widespread adoption of real-time payment rails.

The P2P (Peer-to-Peer) segment also remains a cornerstone of real-time payments in Europe. The convenience and speed of instant money transfers between individuals have made it a preferred method for everyday transactions, such as splitting bills, sending money to friends and family, or making small purchases. The widespread availability of user-friendly mobile payment applications has further cemented the P2P segment's position. Technological advancements, including the integration of real-time payment capabilities into popular messaging and social media platforms, are continuously expanding the reach and utility of P2P transfers. Infrastructure development plays a crucial role, with investments in robust and secure real-time payment networks underpinning the growth of both P2P and P2B segments. Countries that have prioritized the development of sophisticated real-time payment systems, such as Sweden with its Swish service, often see higher adoption rates.

Key Drivers of P2B Dominance:

- Improved Cash Flow: Businesses receive funds immediately, reducing reliance on credit and improving liquidity.

- Reduced Operational Costs: Automation and instant confirmation streamline payment processing, lowering administrative overhead.

- Enhanced Supplier Relationships: Timely payments foster stronger relationships with suppliers.

- E-commerce Growth: Real-time payment acceptance is becoming a standard for online merchants.

- SME Adoption: Small and medium-sized enterprises are increasingly recognizing the benefits of instant payment settlement.

Key Drivers of P2P Dominance:

- Convenience and Speed: Instant transfers for personal transactions.

- Mobile Accessibility: User-friendly apps on smartphones.

- Social Integration: Payments integrated into everyday communication platforms.

- Cost-Effectiveness: Often cheaper than traditional bank transfers for small amounts.

- Remittances: Facilitating quick and easy money transfers across borders within Europe.

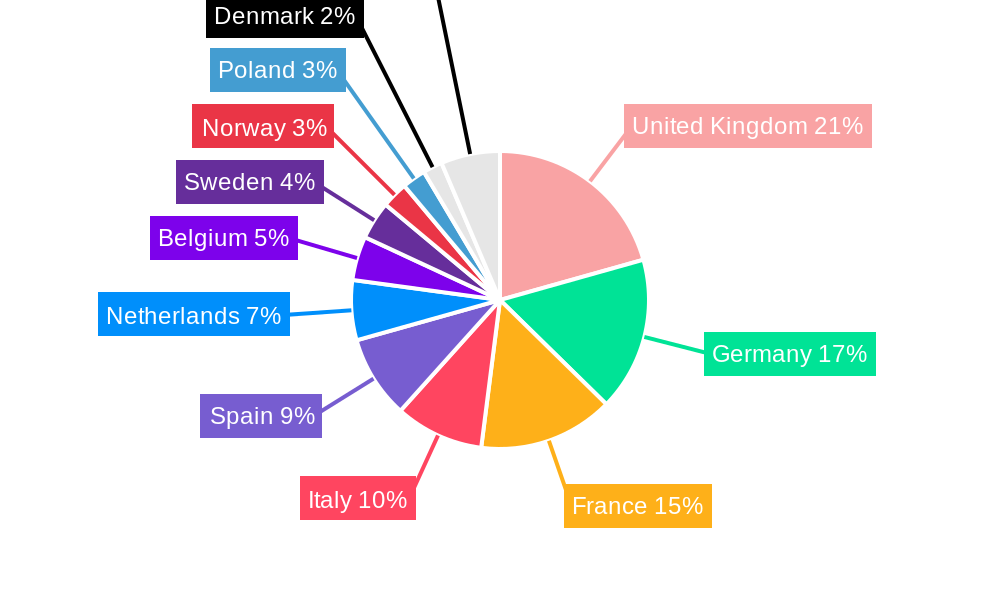

Dominant Countries: Germany, the UK, France, and Nordic countries are leading in real-time payment adoption due to strong economic policies and advanced digital infrastructure.

Europe Real Time Payments Industry Product Developments

The Europe Real Time Payments Industry is characterized by continuous product innovation aimed at enhancing speed, security, and user experience. Companies are actively developing and launching solutions that leverage advanced technologies like Artificial Intelligence (AI) and blockchain to improve transaction monitoring, fraud detection, and compliance. For instance, Finastra's recent launch of "Finastra Compliance as a Service" on Microsoft Azure, integrating real-time AML transaction screening and AI-powered monitoring, exemplifies this trend. ACI Worldwide's "ACI Instant Pay" further exemplifies this by enabling merchants to accept immediate online, mobile, and in-store payments through straightforward API integrations. These developments not only streamline payment processes but also provide greater flexibility and control for both consumers and businesses. The competitive advantage lies in offering seamless integration, robust security features, and a superior end-user experience that simplifies complex payment flows.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Europe Real Time Payments Industry, segmenting the market by Type of Payment into P2P (Peer-to-Peer) and P2B (Payment to Business).

P2P (Peer-to-Peer) Segment: This segment encompasses all direct fund transfers between individuals. It is projected to experience steady growth driven by the increasing adoption of mobile payment applications and the convenience of instant personal remittances. The competitive landscape is marked by mobile wallet providers and banking apps offering P2P functionality.

P2B (Payment to Business) Segment: This segment includes all real-time transactions from individuals to businesses and between businesses. It is anticipated to witness robust growth, fueled by e-commerce expansion, the need for improved business cash flow, and the integration of real-time payments into supply chain finance and merchant services. Leading players are focused on offering scalable and secure payment gateways for merchants.

Key Drivers of Europe Real Time Payments Industry Growth

The Europe Real Time Payments Industry is propelled by several interconnected drivers. Technological advancements, particularly in API integrations and cloud computing, enable faster and more seamless payment processing. The ongoing digitalization of economies and the increasing preference for cashless transactions by consumers and businesses create a fertile ground for real-time payments. Supportive regulatory frameworks, such as PSD2 in Europe, which encourages open banking and competition, further accelerate adoption. Furthermore, the significant operational and financial benefits real-time payments offer to businesses, including improved cash flow and reduced transaction costs, are powerful growth catalysts. The increasing demand for instant gratification in e-commerce and P2P transactions also plays a pivotal role.

Challenges in the Europe Real Time Payments Industry Sector

Despite its rapid growth, the Europe Real Time Payments Industry faces several challenges. Regulatory complexities and fragmentation across different European countries can hinder seamless cross-border real-time payments. Cybersecurity threats and the need for robust fraud prevention mechanisms are paramount, requiring continuous investment in advanced security technologies. Scalability of existing infrastructure to handle the surge in real-time transactions can also be a concern. Furthermore, interoperability issues between different real-time payment systems and the cost of implementing and maintaining new payment technologies can pose barriers, particularly for smaller financial institutions and businesses. Consumer education and trust-building are also crucial for widespread adoption, especially for less technologically savvy demographics.

Emerging Opportunities in Europe Real Time Payments Industry

Emerging opportunities in the Europe Real Time Payments Industry are vast and evolving. The expansion of real-time payments into cross-border transactions presents a significant avenue for growth, promising to reduce costs and delivery times for international remittances and business payments. The integration of real-time payments with other emerging technologies, such as IoT (Internet of Things) devices for automated payments and blockchain for enhanced transparency and security, offers innovative use cases. The growing demand for embedded finance, where payment capabilities are seamlessly integrated into non-financial applications and platforms, is another key opportunity. Furthermore, the development of instant payment solutions for specific industry verticals, such as healthcare, logistics, and government services, will unlock new markets and revenue streams. The continued push towards digital currencies and central bank digital currencies (CBDCs) could also revolutionize real-time payment infrastructure.

Leading Players in the Europe Real Time Payments Industry Market

- Nets (Nexi Group)

- VISA Inc.

- Fiserv Inc.

- Finastra

- Volante Technologies Inc.

- Mastercard Inc.

- ACI Worldwide Inc.

- Paypal Holdings Inc.

- FIS Global

- Apple Inc.

Key Developments in Europe Real Time Payments Industry Industry

- September 2023: Finastra launched its new payment solution, Finastra Compliance as a Service, on Microsoft Azure, integrating Fincom’s real-time AML transaction screening and ThetaRay's AI-powered transaction monitoring as a pre-integrated packaged solution with Finastra Payments To Go.

- June 2023: ACI announced the launch of ACI Instant Pay in Europe and the United Kingdom. This solution, via API integration with the ACI Payments Orchestration Platform, allows merchants to accept immediate online, mobile, and in-store payments. Concurrently, the United Kingdom initiated modernization of its Faster Payments program through the New Payments Architecture program.

Strategic Outlook for Europe Real Time Payments Industry Market

The strategic outlook for the Europe Real Time Payments Industry Market is exceptionally positive, driven by continuous innovation and increasing demand for instant financial transactions. The ongoing modernization of payment infrastructures across the continent, coupled with supportive regulatory initiatives, will continue to foster an environment conducive to growth. Key growth catalysts include the expanding adoption of real-time payments by small and medium-sized enterprises (SMEs) for improved cash flow and operational efficiency, and the increasing consumer preference for frictionless and immediate payment experiences in both online and offline environments. Strategic collaborations between payment providers, financial institutions, and technology firms will be crucial in developing sophisticated, secure, and interoperable real-time payment ecosystems. Emerging opportunities in cross-border real-time payments and the integration of AI for enhanced fraud detection and customer analytics will further shape the market's future, ensuring sustained expansion and a transformative impact on the European financial landscape.

Europe Real Time Payments Industry Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

Europe Real Time Payments Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Real Time Payments Industry Regional Market Share

Geographic Coverage of Europe Real Time Payments Industry

Europe Real Time Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration; Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments

- 3.3. Market Restrains

- 3.3.1. Operational Challenges Involving Cross-border Payments

- 3.4. Market Trends

- 3.4.1. Rising Penetration of Smartphone is Expected to Foster the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Real Time Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nets (Nexi Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 VISA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fiserv Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Finastra

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volante Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACI Worldwide Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paypal Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FIS Global

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nets (Nexi Group)

List of Figures

- Figure 1: Europe Real Time Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Real Time Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 2: Europe Real Time Payments Industry Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 3: Europe Real Time Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Real Time Payments Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Europe Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 6: Europe Real Time Payments Industry Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 7: Europe Real Time Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Real Time Payments Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: France Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Real Time Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Real Time Payments Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Real Time Payments Industry?

The projected CAGR is approximately 11.54%.

2. Which companies are prominent players in the Europe Real Time Payments Industry?

Key companies in the market include Nets (Nexi Group), VISA Inc, Fiserv Inc, Finastra, Volante Technologies Inc, Mastercard Inc, ACI Worldwide Inc, Paypal Holdings Inc, FIS Global, Apple Inc.

3. What are the main segments of the Europe Real Time Payments Industry?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration; Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments.

6. What are the notable trends driving market growth?

Rising Penetration of Smartphone is Expected to Foster the Market Growth.

7. Are there any restraints impacting market growth?

Operational Challenges Involving Cross-border Payments.

8. Can you provide examples of recent developments in the market?

September 2023 - Finastra, a global provider of financial software applications and marketplaces, has launched its new payment solution, Finastra Compliance as a Service, on Microsoft Azure. The service includes Fincom‘s real-time AML (anti-money laundering) transaction screening and ThetaRay‘s AI-powered transaction monitoring as a pre-integrated packaged solution with Finastra Payments To Go.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Real Time Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Real Time Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Real Time Payments Industry?

To stay informed about further developments, trends, and reports in the Europe Real Time Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence