Key Insights

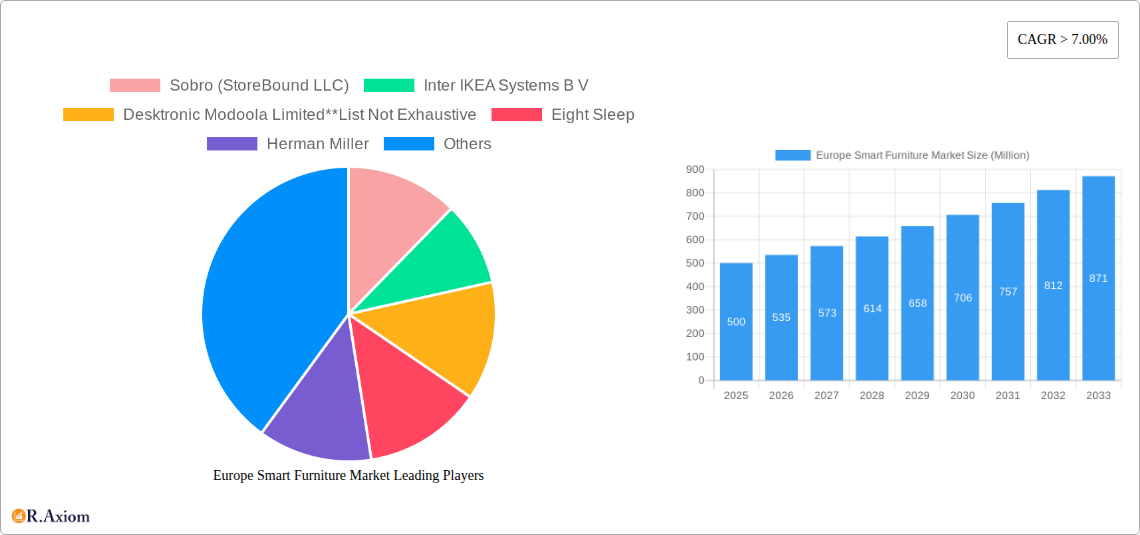

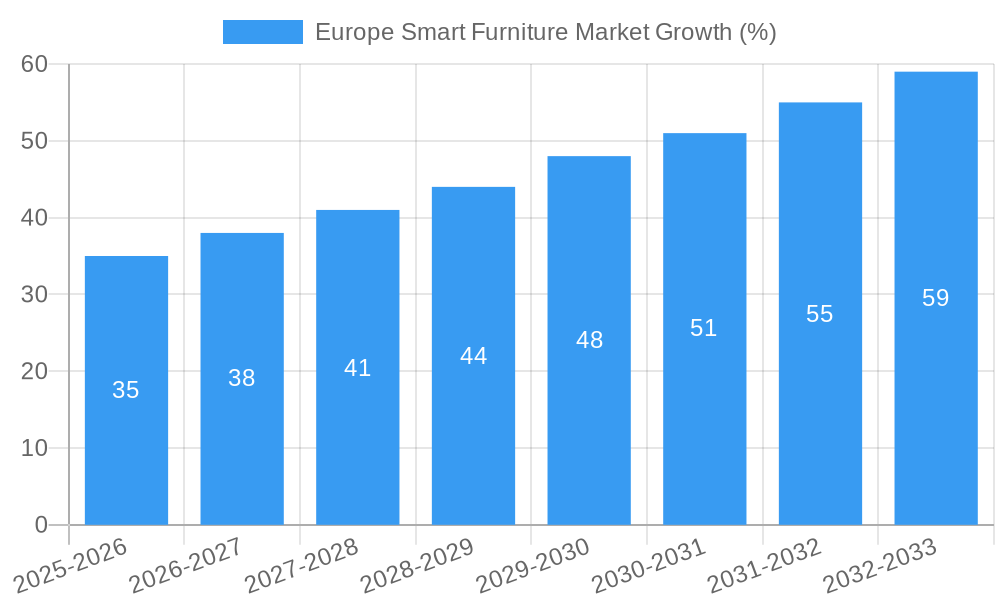

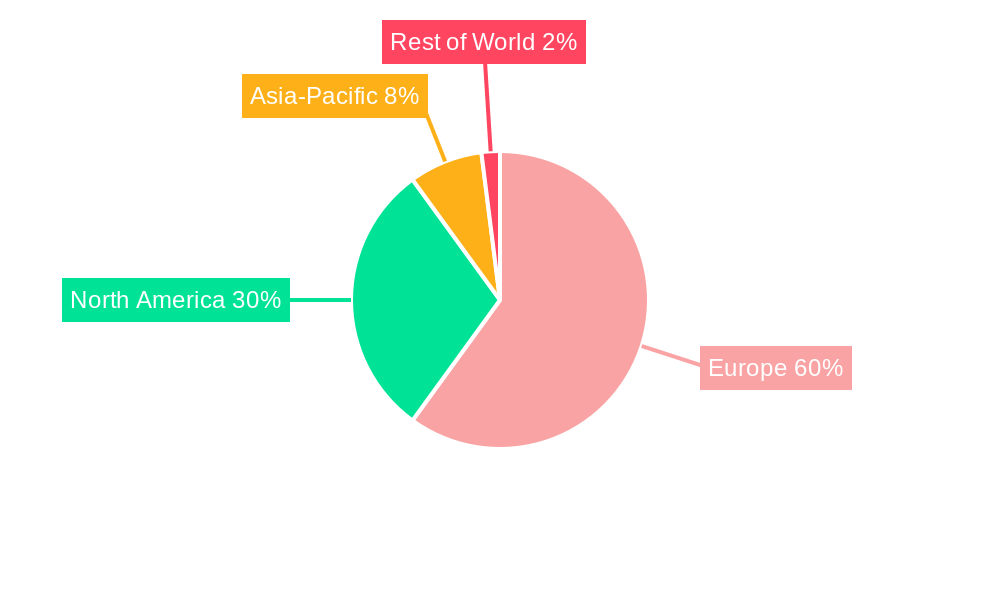

The European smart furniture market is experiencing robust growth, driven by increasing demand for technologically advanced and ergonomic home and office furnishings. The market, valued at approximately €[Estimate based on provided market size and currency conversion - e.g., €500 million] in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 7% through 2033. This expansion is fueled by several key factors. The rising adoption of smart home technology, coupled with a growing awareness of ergonomic benefits and increased disposable incomes, is significantly boosting consumer interest in smart desks, chairs, and tables. Furthermore, the increasing prevalence of remote work and the blurring lines between professional and personal spaces are driving demand for adaptable and functional smart furniture solutions. The market is segmented by product type (smart desks, tables, chairs, and others), end-user (residential and commercial), and distribution channel (home centers, specialty stores, and online retailers). Germany, France, the UK, and Italy represent significant market segments within Europe, reflecting their established economies and high technology adoption rates. While the initial investment cost of smart furniture may pose a restraint, ongoing technological advancements leading to cost reductions and enhanced functionality are expected to mitigate this barrier. Competition within the market is intense, with established furniture manufacturers and emerging tech companies vying for market share. Key players include Sobro, IKEA, Herman Miller, Steelcase, and others, continually innovating to offer increasingly sophisticated and user-friendly products.

The projected growth trajectory for the European smart furniture market is positive, reflecting sustained consumer interest and technological innovation. The integration of features such as adjustable height, built-in power outlets, and smart connectivity continues to enhance the appeal of smart furniture. The increasing prevalence of subscription models and rental options is also expected to broaden market accessibility. The market's ongoing evolution hinges on advancements in material science, user interface design, and the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies to enhance functionality and overall user experience. The market's future success will also depend on effective marketing strategies that highlight the value proposition of smart furniture, addressing consumer concerns regarding cost and data privacy. Competitive pressures will also drive innovation and potentially lead to more affordable and accessible options for consumers.

Europe Smart Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Smart Furniture Market, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, investors, and market entrants.

Europe Smart Furniture Market Market Concentration & Innovation

The Europe smart furniture market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is also characterized by a high degree of innovation, driven by advancements in technology and evolving consumer preferences. Market share data for 2024 indicates that Inter IKEA Systems B.V. holds approximately xx% market share, followed by Herman Miller with xx%, and Steelcase with xx%. The remaining market share is distributed among numerous smaller players, including Sobro (StoreBound LLC), Desktronic Modoola Limited, Eight Sleep, Hi-Interiors, Nitz Engineering Srl, Srl Fonesalesman Ltd, and Sleep Number Corporation. The average M&A deal value in the sector during the historical period (2019-2024) was approximately xx Million, reflecting a moderate level of consolidation. Regulatory frameworks, such as those related to product safety and environmental standards, play a significant role in shaping market dynamics. Substitute products, such as traditional furniture, continue to compete, while end-user trends, such as the increasing adoption of smart home technology and remote working, are driving market growth. Recent mergers and acquisitions, like the formation of Alpagroup from P3G Group and Alsapan in June 2021, demonstrate the industry's ongoing consolidation.

Europe Smart Furniture Market Industry Trends & Insights

The Europe smart furniture market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, technological advancements, such as the integration of IoT (Internet of Things) capabilities and AI (Artificial Intelligence), are enabling the development of increasingly sophisticated and user-friendly smart furniture products. Secondly, changing consumer preferences, particularly among younger demographics, are driving demand for smart furniture that enhances convenience, comfort, and functionality. This includes features such as adjustable height desks, integrated charging ports, and ambient lighting. The increasing popularity of remote work is further bolstering demand for smart furniture that optimizes productivity and ergonomics. However, the market faces challenges including high initial investment costs associated with smart furniture, which may limit market penetration, particularly in price-sensitive segments. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of new entrants offering innovative products and services. Market penetration of smart furniture in residential settings remains relatively low compared to commercial sectors, but is rapidly increasing.

Dominant Markets & Segments in Europe Smart Furniture Market

Germany and the United Kingdom currently represent the most significant national markets within the European Union for smart furniture, driven by robust economic growth and high levels of technological adoption. However, other countries, such as France, Italy, and Spain show promising growth potential.

- By Product: The smart desks segment dominates the market due to increasing adoption in both residential and commercial sectors, followed by smart chairs and smart tables. Other smart furniture items contribute a smaller but growing share.

- By End User: The commercial segment currently holds a larger market share compared to the residential segment, due to higher purchasing power and adoption in corporate settings. However, increasing consumer adoption is driving substantial growth in the residential market segment.

- By Distribution Channel: Online channels are experiencing the fastest growth, fueled by convenience and enhanced product visibility. However, traditional channels like home centers and specialty stores still play a significant role, particularly for larger purchases.

The key drivers behind the dominance of specific segments and countries include factors such as strong economic growth, government policies promoting technological advancement, and well-established distribution networks.

Europe Smart Furniture Market Product Developments

Recent product innovations focus on enhanced functionality, integration with smart home ecosystems, and improved ergonomics. Wireless workstations, as demonstrated by Bachmann's September 2021 announcement, represent a significant advancement. These offer increased flexibility and usability. Furthermore, the market is witnessing increased use of sustainable and eco-friendly materials in smart furniture production, responding to growing consumer demand for environmentally responsible products. The integration of health and wellness features, such as posture correction and sleep tracking capabilities, is further enhancing market appeal.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Europe smart furniture market across various segments:

- By Product: Smart Desks, Smart Tables, Smart Chairs, Others (xx Million market value in 2025, xx% CAGR, competitive landscape dominated by xx).

- By End User: Residential (xx Million market value in 2025, xx% CAGR, growth driven by xx), Commercial (xx Million market value in 2025, xx% CAGR, growth driven by xx)

- By Distribution Channel: Home Centers (xx Million market value in 2025, xx% CAGR, competitive landscape dominated by xx), Specialty Stores (xx Million market value in 2025, xx% CAGR, competitive landscape dominated by xx), Online (xx Million market value in 2025, xx% CAGR, competitive landscape dominated by xx), Other Distribution Channels (xx Million market value in 2025, xx% CAGR, competitive landscape dominated by xx).

Each segment's growth trajectory is analyzed, considering market size, competitive intensity, and key growth drivers.

Key Drivers of Europe Smart Furniture Market Growth

The growth of the Europe smart furniture market is propelled by several key factors:

- Technological advancements: The integration of IoT, AI, and other technologies is enhancing product functionality and user experience.

- Rising consumer demand: Increasing preference for smart home technologies and ergonomic furniture is driving market growth.

- Favorable economic conditions: Strong economic growth in several European countries is boosting consumer spending on discretionary items like smart furniture.

- Government initiatives: Policies promoting sustainable and technologically advanced manufacturing are supporting market growth.

Challenges in the Europe Smart Furniture Market Sector

Several challenges impede the market’s growth:

- High initial investment costs: The relatively high price point of smart furniture compared to traditional options can limit market penetration.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of components, impacting production and pricing.

- Intense competition: The market is characterized by intense competition among existing players, posing challenges for new entrants. The average profit margin for major players in 2024 was approximately xx%.

Emerging Opportunities in Europe Smart Furniture Market

Emerging opportunities include:

- Expansion into new markets: Untapped potential exists in less-developed European markets with increasing adoption of smart home technologies.

- Development of innovative product features: Creating products with unique selling propositions, such as integration with other smart home devices or improved sustainability features, will drive growth.

- Focus on niche segments: Targeting specialized consumer segments, like seniors or individuals with specific health needs, could yield significant returns.

Leading Players in the Europe Smart Furniture Market Market

- Sobro (StoreBound LLC)

- Inter IKEA Systems B.V.

- Desktronic Modoola Limited

- Eight Sleep

- Herman Miller

- Steelcase

- Hi-Interiors

- Nitz Engineering Srl

- Srl Fonesalesman Ltd

- Sleep Number Corporation

Key Developments in Europe Smart Furniture Market Industry

- September 2021: Bachmann announces its innovative wireless workstation, aiming to revolutionize the workplace.

- June 2021: P3G Group and Alsapan merge to form Alpagroup, creating a European furniture powerhouse.

Strategic Outlook for Europe Smart Furniture Market Market

The Europe smart furniture market exhibits strong potential for sustained growth, driven by continuous technological innovation, evolving consumer preferences, and favorable economic conditions. Strategic investments in research and development, coupled with expansion into new markets and development of innovative products, are expected to drive further market expansion. The focus on sustainability, ergonomics, and health & wellness integration will shape the competitive landscape and provide significant growth opportunities.

Europe Smart Furniture Market Segmentation

-

1. Product

- 1.1. Smart Desks

- 1.2. Smart Tables

- 1.3. Smart Chairs

- 1.4. Others

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Europe Smart Furniture Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Smart Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Home Automation Aiding the Smart Furniture Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Smart Desks

- 5.1.2. Smart Tables

- 5.1.3. Smart Chairs

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. UK

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Smart Desks

- 6.1.2. Smart Tables

- 6.1.3. Smart Chairs

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. UK Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Smart Desks

- 7.1.2. Smart Tables

- 7.1.3. Smart Chairs

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Smart Desks

- 8.1.2. Smart Tables

- 8.1.3. Smart Chairs

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Spain Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Smart Desks

- 9.1.2. Smart Tables

- 9.1.3. Smart Chairs

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Smart Desks

- 10.1.2. Smart Tables

- 10.1.3. Smart Chairs

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Smart Desks

- 11.1.2. Smart Tables

- 11.1.3. Smart Chairs

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Home Centers

- 11.3.2. Specialty Stores

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Germany Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Smart Furniture Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Sobro (StoreBound LLC)

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Inter IKEA Systems B V

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Desktronic Modoola Limited**List Not Exhaustive

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Eight Sleep

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Herman Miller

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Steel Case

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hi-Interiors

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Nitz Engineering Srl

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Srl Fonesalesman Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Sleep Number Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Sobro (StoreBound LLC)

List of Figures

- Figure 1: Europe Smart Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Europe Smart Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Smart Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 27: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Smart Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 35: Europe Smart Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Europe Smart Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Europe Smart Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Furniture Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Europe Smart Furniture Market?

Key companies in the market include Sobro (StoreBound LLC), Inter IKEA Systems B V, Desktronic Modoola Limited**List Not Exhaustive, Eight Sleep, Herman Miller, Steel Case, Hi-Interiors, Nitz Engineering Srl, Srl Fonesalesman Ltd, Sleep Number Corporation.

3. What are the main segments of the Europe Smart Furniture Market?

The market segments include Product , End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Home Automation Aiding the Smart Furniture Market Growth.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

On 15th September 2021, Bachmann announced their innovation in the form of wireless workstation, which can be flexibly positioned wherever it is needed. With this innovation, Bachmann aims to revolutionize the future of the world of work.The statement was made at the SICAM event in Pordenone, Italy, which was the annual gathering of the world's leading manufacturers of furniture accessories, semi-finished goods, and components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Furniture Market?

To stay informed about further developments, trends, and reports in the Europe Smart Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence