Key Insights

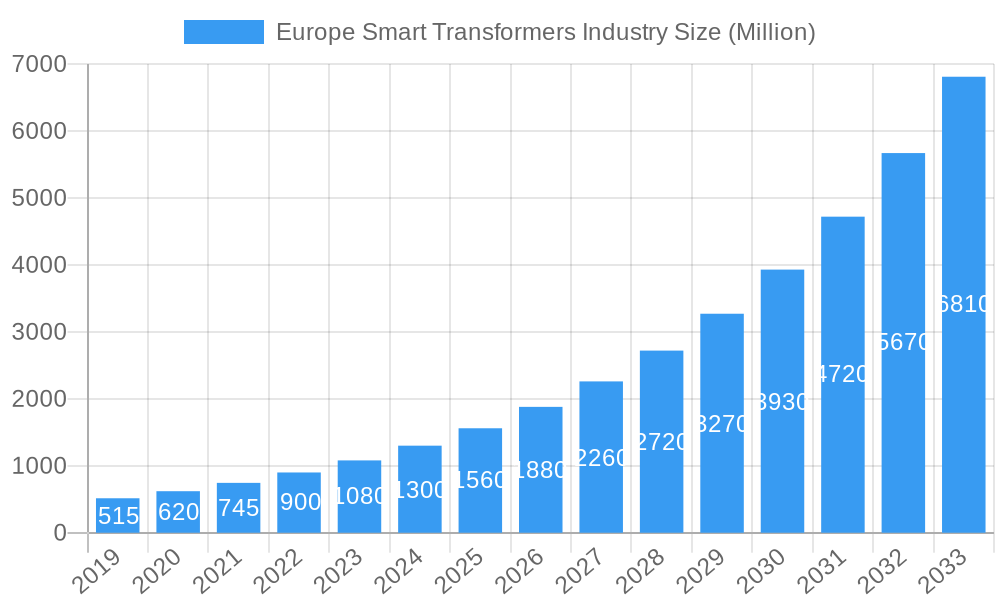

The European Smart Transformers market is poised for substantial expansion, projected to reach $1,560 million by 2025, driven by a remarkable 23.38% CAGR. This robust growth is underpinned by the escalating demand for enhanced grid reliability, efficiency, and the integration of renewable energy sources across the continent. Key growth drivers include the critical need for upgrading aging grid infrastructure, the increasing adoption of smart grid technologies, and the imperative to reduce energy losses. Furthermore, the surge in electric vehicle adoption and the subsequent strain on power distribution networks necessitate the deployment of advanced transformer solutions that can dynamically manage load fluctuations and improve overall grid resilience. Regulatory mandates promoting energy efficiency and digitalization also play a pivotal role in accelerating market adoption, as utilities invest in next-generation equipment to meet stringent environmental targets and evolving consumer demands for reliable power. The industry is witnessing a significant shift towards intelligent transformers capable of real-time monitoring, predictive maintenance, and automated control, which are instrumental in optimizing power flow and preventing outages.

Europe Smart Transformers Industry Market Size (In Million)

The market's segmentation reveals a strong emphasis on both Distribution Transformers and Power Transformers, catering to diverse grid needs. In terms of applications, Smart Grid initiatives represent a dominant segment, reflecting the continent's commitment to modernizing its electrical infrastructure. Traction locomotives also present a significant application, driven by the expansion of rail networks and the electrification of transportation. While the market is characterized by strong growth, potential restraints such as the high initial investment costs for smart transformer technology and the need for skilled personnel for implementation and maintenance require strategic consideration. Nevertheless, the overwhelming benefits of improved operational efficiency, reduced downtime, and enhanced grid stability are expected to outweigh these challenges, attracting substantial investment from both public and private sectors. Leading companies like Siemens AG, Hitachi Energy Ltd, and Schneider Electric SE are at the forefront of this innovation, continuously introducing advanced solutions and expanding their market presence across key European countries.

Europe Smart Transformers Industry Company Market Share

Europe Smart Transformers Industry Market Concentration & Innovation

The Europe smart transformers market is characterized by a moderate level of concentration, with a few key global players holding significant market shares alongside a growing number of specialized European manufacturers. This dynamic fosters continuous innovation, driven by the imperative to enhance grid efficiency, reliability, and the integration of renewable energy sources. Regulatory frameworks, particularly those promoting smart grid deployment and energy efficiency targets, are pivotal in shaping the market's trajectory. Product substitutes, such as conventional transformers with added monitoring devices, exist but are increasingly being outpaced by the integrated intelligence of true smart transformers. End-user trends are heavily influenced by utilities' focus on reducing operational costs, minimizing downtime, and enabling demand-side management. Mergers and acquisitions (M&A) are strategically employed by larger players to acquire niche technologies and expand their smart transformer portfolios. For instance, a significant M&A deal in the power transformer segment within Europe could be valued in the hundreds of millions of Euros, further consolidating market presence.

- Key Innovation Drivers:

- Integration of IoT and AI for predictive maintenance.

- Development of advanced sensor technologies for real-time data collection.

- Enhancement of cybersecurity features for grid protection.

- Focus on energy efficiency and loss reduction technologies.

- Regulatory Influence:

- EU directives on renewable energy integration and smart grid deployment.

- National policies supporting grid modernization and digitalization.

- M&A Activity:

- Acquisition of specialized technology firms to bolster smart transformer capabilities.

- Strategic partnerships to expand market reach and product offerings.

Europe Smart Transformers Industry Industry Trends & Insights

The Europe smart transformers industry is poised for robust growth, projected to reach approximately XX Million Euros by 2033. This expansion is underpinned by a compound annual growth rate (CAGR) of roughly XX% during the forecast period of 2025–2033. The primary growth drivers include the accelerating adoption of smart grid technologies across the continent, driven by a strong push towards decarbonization and the integration of distributed energy resources (DERs). Technological disruptions, such as the advent of advanced digital platforms and AI-powered analytics, are revolutionizing transformer performance and maintenance, moving from reactive to predictive strategies. Consumer preferences, primarily from utility companies and grid operators, are shifting towards solutions that offer enhanced operational efficiency, improved grid resilience, and better data-driven decision-making. The competitive dynamics are intensifying, with established global powerhouses vying for market share against agile European innovators.

The European smart grid initiative is a cornerstone of this market's ascendancy. Governments are actively investing in upgrading aging grid infrastructure to support the influx of renewable energy sources like solar and wind power, which are inherently intermittent. Smart transformers, with their ability to monitor and control power flow in real-time, are critical components in managing this complexity. They enable utilities to balance supply and demand more effectively, reduce transmission losses, and prevent outages. The increasing electrification of transportation, particularly the rise of electric vehicles (EVs), also presents a significant demand driver, requiring more sophisticated grid management capabilities to handle the increased load. Furthermore, the focus on energy security and the need for a more resilient energy supply in the face of geopolitical uncertainties are pushing utilities to adopt advanced technologies, including smart transformers. The development of digital twins for transformers, allowing for virtual simulations and performance analysis, is another key technological trend. This not only optimizes operational efficiency but also aids in planning future grid expansions and upgrades. The market penetration of smart transformers, while still growing, is expected to see a substantial increase as their economic and operational benefits become more widely recognized. The trend towards decentralized energy systems and microgrids further amplifies the need for intelligent and adaptable grid components like smart transformers. The regulatory landscape, with its emphasis on energy efficiency and emission reduction, directly supports the adoption of smart transformer technology, which contributes to a more stable and efficient power network.

Dominant Markets & Segments in Europe Smart Transformers Industry

The European smart transformers market exhibits dominance across several key segments, with the Smart Grid application and Distribution Transformers type leading the charge. This dominance is propelled by a confluence of strong economic policies, substantial infrastructure investments, and a concerted regulatory push towards digitalization and decarbonization within the European Union and its member states.

Leading Region/Country: While the entire European region is a significant market, countries like Germany, France, the United Kingdom, and the Nordic nations are at the forefront of smart transformer adoption. These countries have well-established grid modernization programs, substantial investments in renewable energy, and ambitious climate targets, creating a fertile ground for smart grid technologies.

Dominant Application: Smart Grid

- Key Drivers:

- Integration of Renewable Energy: The EU's commitment to renewable energy targets necessitates advanced grid management capabilities to handle the variability of solar and wind power. Smart transformers are crucial for balancing supply and demand in real-time and managing bi-directional power flow.

- Grid Modernization and Digitalization: Extensive investments in upgrading aging power grids with digital technologies to improve efficiency, reliability, and resilience.

- Demand-Side Management: Enabling utilities to monitor and influence energy consumption patterns, leading to reduced peak load and optimized energy usage.

- Electrification of Transportation: The rapid growth of electric vehicles requires enhanced grid capacity and intelligent management to prevent overloads.

- Cybersecurity Enhancements: Smart transformers with built-in security features are vital for protecting the grid from cyber threats.

- Detailed Dominance Analysis: The smart grid segment benefits from a dual driver of necessity and opportunity. Utilities are compelled to adopt smart transformers to meet regulatory mandates for grid stability and efficiency. Simultaneously, the economic benefits, such as reduced operational costs through predictive maintenance and optimized energy transmission, make it a highly attractive investment. The increasing complexity of the modern power grid, with its distributed energy resources and bidirectional power flows, demands the intelligence and adaptability that smart transformers provide.

- Key Drivers:

Dominant Type: Distribution Transformers

- Key Drivers:

- Ubiquitous Need: Distribution transformers are fundamental to the power delivery network, serving residential, commercial, and industrial end-users. Their widespread deployment makes them a prime candidate for technological upgrades.

- Aging Infrastructure: A significant portion of existing distribution transformers are aging and require replacement or modernization to meet current efficiency and reliability standards.

- Cost Savings: Smart distribution transformers offer substantial operational cost savings through reduced energy losses, extended lifespan, and minimized maintenance requirements due to their monitoring and diagnostic capabilities.

- Integration of DERs at the Local Level: As more renewable energy sources are integrated at the local distribution level, smart distribution transformers are essential for managing these new energy flows.

- Detailed Dominance Analysis: Distribution transformers are the workhorses of the power grid, situated closer to the end consumer. The sheer volume of these transformers across Europe makes them a significant market for smart technology. The ability of smart distribution transformers to provide granular data on local load conditions, voltage fluctuations, and potential faults allows for more proactive and efficient management of the network. This granular visibility is crucial for utilities seeking to optimize their operations, improve customer service, and meet increasingly stringent performance metrics.

- Key Drivers:

While Power Transformers also represent a significant segment, particularly in large-scale grid infrastructure and industrial applications, the sheer volume and the direct impact on grid stability and renewable integration give the smart grid application and distribution transformers type a leading edge in terms of current market momentum and future growth projections within the European smart transformers industry. Traction locomotive applications are growing with increased rail electrification, but represent a more specialized niche compared to the broader smart grid deployment.

Europe Smart Transformers Industry Product Developments

Recent product developments in the Europe smart transformers industry focus on enhanced digitalization, improved monitoring capabilities, and greater integration with advanced grid management systems. Innovations include transformers equipped with advanced sensor arrays for real-time data on temperature, load, and partial discharge, feeding into AI-powered analytics for predictive maintenance. Cybersecurity features are being integrated to protect against evolving threats. The development of modular designs allows for easier upgrades and customization. These advancements are crucial for meeting the evolving demands of smart grids, enabling greater operational efficiency, reducing downtime, and facilitating the seamless integration of renewable energy sources. The competitive advantage lies in offering solutions that provide unparalleled data insights and reliable performance in increasingly complex electrical networks.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe smart transformers industry, encompassing key market segments and projections. The segmentation is categorized by Type and Application, offering detailed insights into market sizes, growth rates, and competitive dynamics.

- Type: Distribution Transformers This segment focuses on smart distribution transformers used in lower voltage networks, serving residential, commercial, and light industrial customers. It includes analysis of market size, projected growth, and the competitive landscape of manufacturers offering intelligent solutions for these essential grid components.

- Type: Power Transformers This segment covers smart power transformers, typically used in high-voltage transmission networks and large industrial facilities. The analysis includes market size, growth forecasts, and the competitive strategies of players in this high-value segment, emphasizing their role in grid stability and bulk power transmission.

- Application: Smart Grid This segment explores the extensive adoption of smart transformers within smart grid infrastructure. It delves into market size, growth drivers such as renewable energy integration and grid modernization, and the competitive environment for transformers designed for advanced grid management and control.

- Application: Traction Locomotive This segment focuses on the niche market of smart transformers used in electric traction locomotives for railways. It includes market size, growth projections driven by rail electrification initiatives, and the specific technological requirements and competitive landscape for this application.

- Application: Other Applications This segment encompasses various other applications for smart transformers, including industrial automation, renewable energy plants (beyond grid integration), and specialized utility applications. It provides an overview of their market size, growth potential, and the competitive dynamics in these diverse areas.

Key Drivers of Europe Smart Transformers Industry Growth

The Europe smart transformers industry is propelled by several interconnected growth drivers. A primary catalyst is the accelerating pace of smart grid deployment across the continent, driven by ambitious EU and national policies focused on energy transition and decarbonization. This is intrinsically linked to the increasing integration of renewable energy sources, such as solar and wind, which necessitate more intelligent and responsive grid management systems. Furthermore, the ongoing modernization of aging grid infrastructure presents a significant opportunity for the adoption of advanced technologies like smart transformers. The growing electrification of transportation, particularly electric vehicles, is increasing grid load and demand for sophisticated monitoring and control. Finally, enhanced energy efficiency mandates and the desire for greater grid resilience and reliability are pushing utilities to invest in smart transformer technology.

Challenges in the Europe Smart Transformers Industry Sector

Despite the strong growth outlook, the Europe smart transformers industry faces several challenges. High upfront costs associated with implementing smart transformer technology can be a barrier for some utilities, especially smaller regional operators. Cybersecurity concerns remain paramount, as increased connectivity introduces vulnerabilities that require robust and evolving protection measures. Interoperability issues between different manufacturers' systems and legacy infrastructure can hinder seamless integration. Furthermore, a shortage of skilled personnel with expertise in digital grid technologies and data analytics poses a challenge for implementation and maintenance. Regulatory uncertainties and varying adoption rates across different EU member states can also create market fragmentation.

Emerging Opportunities in Europe Smart Transformers Industry

The Europe smart transformers industry is ripe with emerging opportunities. The growing trend of decentralized energy systems and microgrids offers a significant avenue for smart transformer deployment, enabling localized energy management and increased resilience. The continuous advancement of IoT and AI technologies presents opportunities for developing even more sophisticated predictive maintenance capabilities and advanced grid analytics, leading to optimized operations and cost savings. The increasing electrification of industries and heating systems will further drive demand for intelligent grid solutions. The development of standardized protocols and open platforms will facilitate wider adoption and interoperability. Finally, the drive towards a circular economy in the energy sector presents opportunities for smart transformers designed for longevity, recyclability, and efficient resource utilization.

Leading Players in the Europe Smart Transformers Industry Market

- Societa Elettromeccanica Arzignanese SpA

- Hitachi Energy Ltd

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- GBE SpA

- General Electric Company

- Westrafo SRL

Key Developments in Europe Smart Transformers Industry Industry

- March 2023: Ganz Transformers, the European technology provider for power grids, entered into a collaboration with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers with the help of MR’s ISM digital platform for intelligent solutions.

- February 2023: UK Power Networks, a distribution network operator in South East England, announced an innovative trial, dubbed Project Stratus, which will introduce “world-first” technology from Amp X in the form of smart transformers to two existing substations in East Sussex. This endeavor will offer unprecedented live data regarding electrical usage and demand, allowing the organization to develop greater network resilience and support its goal of achieving a low-carbon future.

Strategic Outlook for Europe Smart Transformers Industry Market

The strategic outlook for the Europe smart transformers industry is overwhelmingly positive, driven by the inexorable shift towards a sustainable and digitized energy landscape. The continuous need for grid modernization, coupled with the imperative to integrate large-scale renewable energy sources, positions smart transformers as critical infrastructure components. Future market potential will be further amplified by advancements in AI and IoT, leading to hyper-efficient and self-optimizing power grids. Emerging opportunities in microgrids, industrial electrification, and advanced data analytics will fuel sustained demand. Strategic collaborations, technological innovation, and a focus on cybersecurity will be key for players aiming to capitalize on this dynamic and rapidly evolving market.

Europe Smart Transformers Industry Segmentation

-

1. Type

- 1.1. Distribution Transformers

- 1.2. Power Transfomers

-

2. Application

- 2.1. Smart Grid

- 2.2. Traction Locomotive

- 2.3. Other Applications

Europe Smart Transformers Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Spain

- 4. France

- 5. Italy

- 6. Nordic Countries

- 7. Russia

- 8. Turkey

- 9. Rest of Europe

Europe Smart Transformers Industry Regional Market Share

Geographic Coverage of Europe Smart Transformers Industry

Europe Smart Transformers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Low Accessibility to Electricity in Underdeveloped Nations

- 3.4. Market Trends

- 3.4.1. Distribution Transformers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Distribution Transformers

- 5.1.2. Power Transfomers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Grid

- 5.2.2. Traction Locomotive

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Nordic Countries

- 5.3.7. Russia

- 5.3.8. Turkey

- 5.3.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Distribution Transformers

- 6.1.2. Power Transfomers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Grid

- 6.2.2. Traction Locomotive

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Distribution Transformers

- 7.1.2. Power Transfomers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Grid

- 7.2.2. Traction Locomotive

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Distribution Transformers

- 8.1.2. Power Transfomers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Grid

- 8.2.2. Traction Locomotive

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Distribution Transformers

- 9.1.2. Power Transfomers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Grid

- 9.2.2. Traction Locomotive

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Distribution Transformers

- 10.1.2. Power Transfomers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smart Grid

- 10.2.2. Traction Locomotive

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Nordic Countries Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Distribution Transformers

- 11.1.2. Power Transfomers

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Smart Grid

- 11.2.2. Traction Locomotive

- 11.2.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Russia Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Distribution Transformers

- 12.1.2. Power Transfomers

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Smart Grid

- 12.2.2. Traction Locomotive

- 12.2.3. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Turkey Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Distribution Transformers

- 13.1.2. Power Transfomers

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Smart Grid

- 13.2.2. Traction Locomotive

- 13.2.3. Other Applications

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Rest of Europe Europe Smart Transformers Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. Distribution Transformers

- 14.1.2. Power Transfomers

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Smart Grid

- 14.2.2. Traction Locomotive

- 14.2.3. Other Applications

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Societa Elettromeccanica Arzignanese SpA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Hitachi Energy Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Siemens AG

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Schneider Electric SE

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Eaton Corporation PLC

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 GBE SpA

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 General Electric Company

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Westrafo SRL

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.1 Societa Elettromeccanica Arzignanese SpA

List of Figures

- Figure 1: Europe Smart Transformers Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Smart Transformers Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Smart Transformers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Transformers Industry?

The projected CAGR is approximately 23.38%.

2. Which companies are prominent players in the Europe Smart Transformers Industry?

Key companies in the market include Societa Elettromeccanica Arzignanese SpA, Hitachi Energy Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, GBE SpA, General Electric Company, Westrafo SRL.

3. What are the main segments of the Europe Smart Transformers Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure.

6. What are the notable trends driving market growth?

Distribution Transformers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Low Accessibility to Electricity in Underdeveloped Nations.

8. Can you provide examples of recent developments in the market?

March 2023: Ganz Transformers, the European technology provider for power grids, entered into a collaboration with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers with the help of MR’s ISM digital platform for intelligent solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Transformers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Transformers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Transformers Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Transformers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence