Key Insights

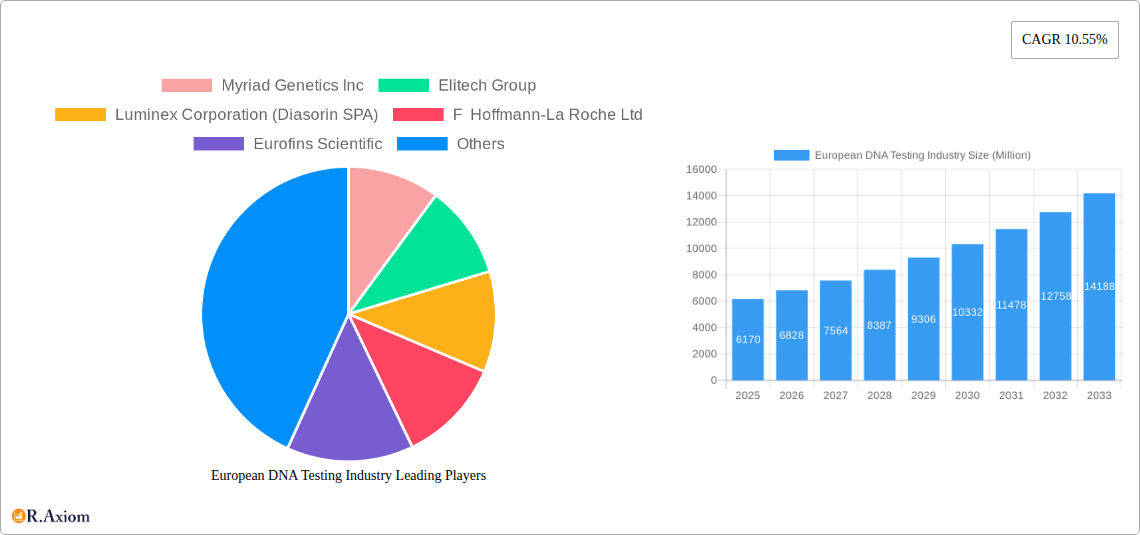

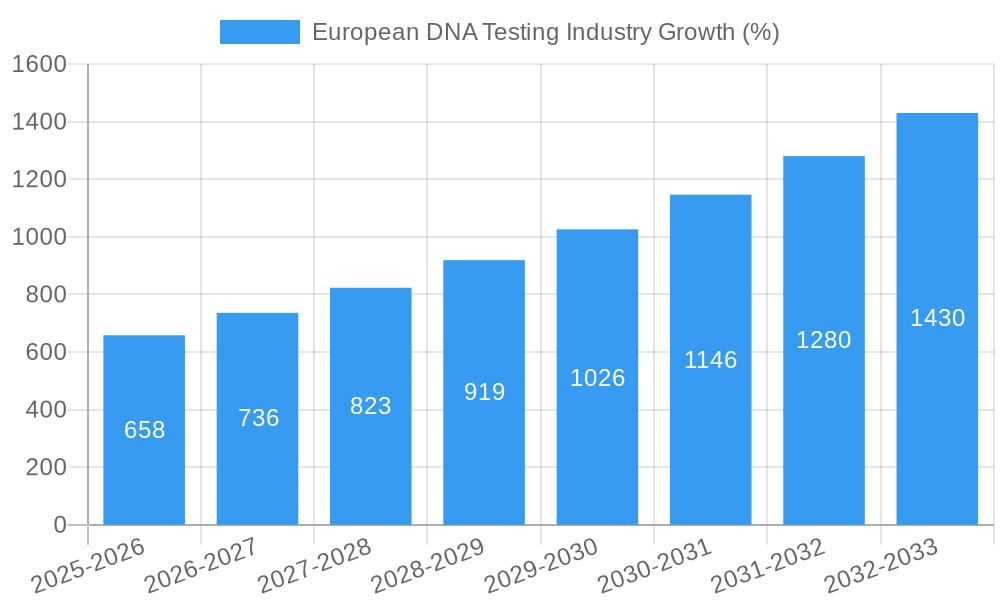

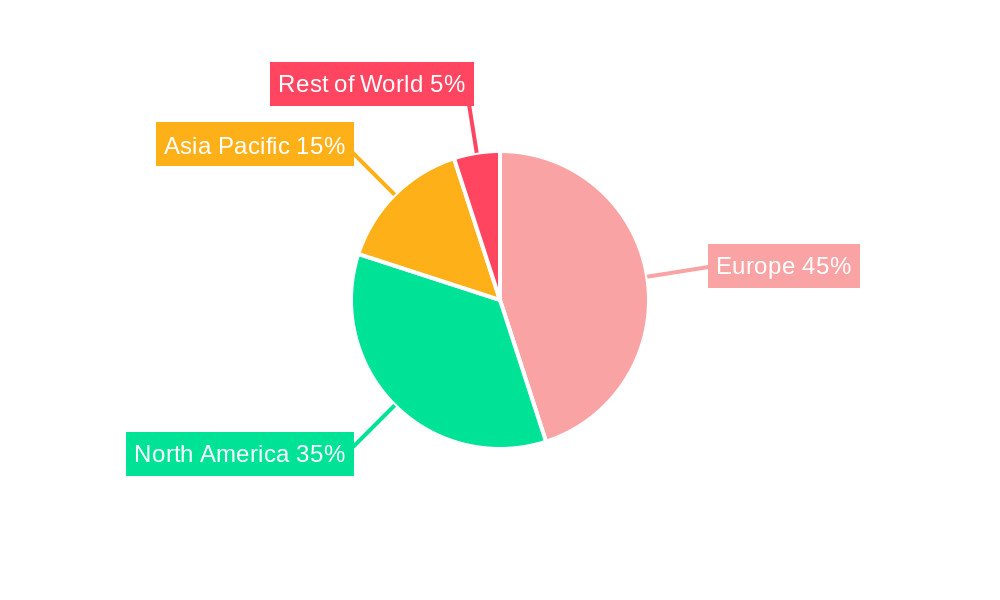

The European DNA testing market, valued at €6.17 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.55% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing awareness of genetic predispositions to diseases like Alzheimer's, cancer, and cystic fibrosis is fueling demand for predictive and presymptomatic testing. Advancements in molecular testing technologies, offering greater accuracy and efficiency at lower costs, are further accelerating market growth. Government initiatives promoting early disease detection and personalized medicine are also contributing to this positive trajectory. The market is segmented by testing type (carrier, diagnostic, newborn screening, predictive/presymptomatic, prenatal, and others), disease (Alzheimer's, cancer, cystic fibrosis, sickle cell anemia, Duchenne muscular dystrophy, thalassemia, Huntington's disease, and others), and technology (cytogenetic, biochemical, and molecular testing). Major players like Myriad Genetics, Roche, Eurofins Scientific, and Illumina are shaping the competitive landscape through innovation and strategic partnerships. The strong growth is particularly noticeable in countries like Germany, France, the UK, and Italy, reflecting a higher adoption rate of advanced diagnostic technologies and a greater emphasis on preventative healthcare within these regions.

Significant growth opportunities exist within the prenatal and newborn screening segments, driven by increasing maternal age and the desire for early intervention in genetic disorders. While regulatory hurdles and ethical concerns surrounding data privacy and genetic discrimination pose some restraints, the overall market outlook remains positive. The expanding application of DNA testing in pharmacogenomics, personalized medicine, and ancestry tracing is expected to further fuel market growth throughout the forecast period. Competition will likely intensify among established players and emerging biotech companies, leading to continuous innovation and potentially lower costs, ultimately benefiting patients and healthcare systems across Europe.

European DNA Testing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the European DNA testing industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this rapidly evolving market. The total market size is estimated at €XX Million in 2025, projected to reach €XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

European DNA Testing Industry Market Concentration & Innovation

The European DNA testing market exhibits a moderately concentrated landscape, with several large multinational corporations holding significant market share. Key players like Myriad Genetics Inc, Eurofins Scientific, F Hoffmann-La Roche Ltd, Illumina Inc, and Qiagen dominate the market, although the exact market share for each varies considerably by segment. Smaller specialized companies, such as Blueprint Genetics Oy and Centogene AG, also play a significant role in niche segments.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in next-generation sequencing (NGS), CRISPR technology, and bioinformatics are driving innovation, enabling faster, more accurate, and cost-effective testing.

- Regulatory Frameworks: Stringent regulatory requirements regarding data privacy (GDPR) and clinical validation significantly impact market dynamics. Variations in regulations across European countries pose challenges to market expansion.

- Product Substitutes: While no direct substitutes exist, alternative diagnostic methods like traditional karyotyping and biochemical tests compete in certain segments.

- End-User Trends: Increasing awareness of genetic diseases, personalized medicine, and direct-to-consumer (DTC) testing are fueling market growth.

- M&A Activities: The industry has witnessed significant M&A activity in recent years, driven by the need to expand product portfolios, gain access to new technologies, and secure market share. The total value of M&A deals in the European DNA testing market during the historical period (2019-2024) is estimated to be €XX Million.

European DNA Testing Industry Industry Trends & Insights

The European DNA testing market is experiencing robust growth driven by several factors. Rising prevalence of genetic disorders, increased adoption of preventative healthcare measures, and the expanding applications of genetic testing across diverse healthcare sectors are key growth catalysts. Technological advancements, such as the development of more sensitive and accurate testing methods, are significantly accelerating market penetration. Furthermore, the growing acceptance of DTC testing and the decreasing costs associated with DNA sequencing are further driving market expansion. The market is also witnessing a shift toward personalized medicine, with an increasing focus on developing targeted therapies based on an individual's genetic profile. The competitive landscape is characterized by intense competition among established players and emerging companies, fostering innovation and driving down costs. The market is projected to witness significant growth in areas such as prenatal testing, carrier screening, and newborn screening.

Dominant Markets & Segments in European DNA Testing Industry

The European DNA testing market is geographically diverse, with Germany, the UK, and France representing the largest national markets. The dominance of these countries is attributed to factors such as well-developed healthcare infrastructure, high healthcare expenditure, and increased awareness of genetic testing benefits. Within segment analysis:

- By Type: Prenatal and carrier testing currently dominate, driven by high demand and increased accessibility. Newborn screening programs are also expanding across several countries.

- By Disease: Cancer genetic testing is the most prevalent segment, followed by cystic fibrosis and other hereditary disorders. Market growth in Alzheimer’s disease testing is also expected to surge in upcoming years.

- By Technology: Molecular testing, particularly NGS, is the leading technology due to its high accuracy, speed, and versatility. However, cytogenetic and biochemical testing still retain significant market share for specific applications.

Key Drivers:

- Strong healthcare infrastructure: Well-established healthcare systems in several European countries facilitate wider access to genetic testing services.

- Governmental support and initiatives: Government funding and programs supporting genetic research and screening contribute significantly.

- Favorable economic conditions: Increased disposable income and healthcare spending drive demand.

- High disease prevalence: The considerable burden of genetic disorders across Europe fuels the demand.

European DNA Testing Industry Product Developments

Recent product innovations include the development of more accurate and affordable NGS platforms, improved bioinformatics tools for data analysis, and novel applications of CRISPR technology in gene editing. These advances offer faster turnaround times, increased diagnostic accuracy, and potential curative interventions. The market is witnessing a trend towards integrated solutions that combine genetic testing with diagnostic imaging and other diagnostic modalities. This trend emphasizes the movement toward personalized medicine, enhancing treatment efficacy and patient outcomes.

Report Scope & Segmentation Analysis

This report segments the European DNA testing market by testing type (Carrier Testing, Diagnostic Testing, Newborn Screening, Predictive and Presymptomatic Testing, Prenatal Testing, Other Types), disease (Alzheimer's Disease, Cancer, Cystic Fibrosis, Sickle Cell Anemia, Duchenne Muscular Dystrophy, Thalassemia, Huntington's Disease, Other Diseases), and technology (Cytogenetic Testing, Biochemical Testing, Molecular Testing). Each segment’s growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the prenatal testing segment is exhibiting strong growth due to increased awareness and accessibility. Similarly, cancer testing dominates by disease type, driven by high prevalence rates and advancements in early detection methods.

Key Drivers of European DNA Testing Industry Growth

Technological advancements in NGS and bioinformatics are major drivers, enhancing testing speed, accuracy, and affordability. Rising prevalence of genetic disorders coupled with increasing healthcare expenditure contributes significantly. Favorable regulatory frameworks and initiatives promoting personalized medicine also fuel growth.

Challenges in the European DNA Testing Industry Sector

Regulatory hurdles, varying across European countries, can impede market expansion. Data privacy concerns and ethical considerations related to genetic information are significant challenges. Supply chain constraints for reagents and equipment can impact market availability. The high cost of testing poses a barrier to widespread adoption for some segments.

Emerging Opportunities in European DNA Testing Industry

Direct-to-consumer (DTC) testing is rapidly growing, creating new avenues for market expansion. The development of innovative applications in areas like pharmacogenomics and oncology offers significant opportunities. Growth in liquid biopsies and non-invasive prenatal testing (NIPT) presents substantial potential.

Leading Players in the European DNA Testing Industry Market

- Myriad Genetics Inc

- Elitech Group

- Luminex Corporation (Diasorin SPA)

- F Hoffmann-La Roche Ltd

- Eurofins Scientific

- F Hoffmann-La Roche Ltd

- 23andMe Inc

- Abbott Laboratories

- Blueprint Genetics Oy

- Danaher Corporation

- Qiagen

- Illumina Inc

- Centogene AG

- Thermo Fisher Scientific

Key Developments in European DNA Testing Industry Industry

- October 2022: NHS England launched a national genetic testing service, expanding access and accelerating treatment for over 6,000 genetic diseases. This initiative significantly impacts market dynamics by increasing demand for testing services.

- August 2022: Myriad Genetics' partnership with German and French institutions broadened access to MyChoice CDx Plus Testing in key European markets, reinforcing the company's position and market penetration.

Strategic Outlook for European DNA Testing Industry Market

The European DNA testing market is poised for sustained growth, driven by technological innovation, increasing healthcare spending, and growing awareness of genetic diseases. The market will be shaped by continued M&A activity, the expansion of DTC testing, and the development of new applications in personalized medicine. Further regulatory clarity and addressed ethical considerations will play a vital role in shaping the future market potential.

European DNA Testing Industry Segmentation

-

1. Type

- 1.1. Carrier Testing

- 1.2. Diagnostic Testing

- 1.3. Newborn Screening

- 1.4. Predictive and Presymptomatic Testing

- 1.5. Prenatal Testing

- 1.6. Other Types

-

2. Disease

- 2.1. Alzheimer's Disease

- 2.2. Cancer

- 2.3. Cystic Fibrosis

- 2.4. Sickle Cell Anemia

- 2.5. Duchenne Muscular Dystrophy

- 2.6. Thalassemia

- 2.7. Huntington's Disease

- 2.8. Other Diseases

-

3. Technology

- 3.1. Cytogenetic Testing

- 3.2. Biochemical Testing

- 3.3. Molecular Testing

European DNA Testing Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

European DNA Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Emphasis on Early Disease Detection and Prevention; Increasing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology

- 3.3. Market Restrains

- 3.3.1. High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing

- 3.4. Market Trends

- 3.4.1. The Diagnostic Testing Segment is Expected to Hold a Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carrier Testing

- 5.1.2. Diagnostic Testing

- 5.1.3. Newborn Screening

- 5.1.4. Predictive and Presymptomatic Testing

- 5.1.5. Prenatal Testing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Disease

- 5.2.1. Alzheimer's Disease

- 5.2.2. Cancer

- 5.2.3. Cystic Fibrosis

- 5.2.4. Sickle Cell Anemia

- 5.2.5. Duchenne Muscular Dystrophy

- 5.2.6. Thalassemia

- 5.2.7. Huntington's Disease

- 5.2.8. Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Cytogenetic Testing

- 5.3.2. Biochemical Testing

- 5.3.3. Molecular Testing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carrier Testing

- 6.1.2. Diagnostic Testing

- 6.1.3. Newborn Screening

- 6.1.4. Predictive and Presymptomatic Testing

- 6.1.5. Prenatal Testing

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Disease

- 6.2.1. Alzheimer's Disease

- 6.2.2. Cancer

- 6.2.3. Cystic Fibrosis

- 6.2.4. Sickle Cell Anemia

- 6.2.5. Duchenne Muscular Dystrophy

- 6.2.6. Thalassemia

- 6.2.7. Huntington's Disease

- 6.2.8. Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Cytogenetic Testing

- 6.3.2. Biochemical Testing

- 6.3.3. Molecular Testing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carrier Testing

- 7.1.2. Diagnostic Testing

- 7.1.3. Newborn Screening

- 7.1.4. Predictive and Presymptomatic Testing

- 7.1.5. Prenatal Testing

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Disease

- 7.2.1. Alzheimer's Disease

- 7.2.2. Cancer

- 7.2.3. Cystic Fibrosis

- 7.2.4. Sickle Cell Anemia

- 7.2.5. Duchenne Muscular Dystrophy

- 7.2.6. Thalassemia

- 7.2.7. Huntington's Disease

- 7.2.8. Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Cytogenetic Testing

- 7.3.2. Biochemical Testing

- 7.3.3. Molecular Testing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carrier Testing

- 8.1.2. Diagnostic Testing

- 8.1.3. Newborn Screening

- 8.1.4. Predictive and Presymptomatic Testing

- 8.1.5. Prenatal Testing

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Disease

- 8.2.1. Alzheimer's Disease

- 8.2.2. Cancer

- 8.2.3. Cystic Fibrosis

- 8.2.4. Sickle Cell Anemia

- 8.2.5. Duchenne Muscular Dystrophy

- 8.2.6. Thalassemia

- 8.2.7. Huntington's Disease

- 8.2.8. Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Cytogenetic Testing

- 8.3.2. Biochemical Testing

- 8.3.3. Molecular Testing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carrier Testing

- 9.1.2. Diagnostic Testing

- 9.1.3. Newborn Screening

- 9.1.4. Predictive and Presymptomatic Testing

- 9.1.5. Prenatal Testing

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Disease

- 9.2.1. Alzheimer's Disease

- 9.2.2. Cancer

- 9.2.3. Cystic Fibrosis

- 9.2.4. Sickle Cell Anemia

- 9.2.5. Duchenne Muscular Dystrophy

- 9.2.6. Thalassemia

- 9.2.7. Huntington's Disease

- 9.2.8. Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Cytogenetic Testing

- 9.3.2. Biochemical Testing

- 9.3.3. Molecular Testing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Carrier Testing

- 10.1.2. Diagnostic Testing

- 10.1.3. Newborn Screening

- 10.1.4. Predictive and Presymptomatic Testing

- 10.1.5. Prenatal Testing

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Disease

- 10.2.1. Alzheimer's Disease

- 10.2.2. Cancer

- 10.2.3. Cystic Fibrosis

- 10.2.4. Sickle Cell Anemia

- 10.2.5. Duchenne Muscular Dystrophy

- 10.2.6. Thalassemia

- 10.2.7. Huntington's Disease

- 10.2.8. Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. Cytogenetic Testing

- 10.3.2. Biochemical Testing

- 10.3.3. Molecular Testing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Carrier Testing

- 11.1.2. Diagnostic Testing

- 11.1.3. Newborn Screening

- 11.1.4. Predictive and Presymptomatic Testing

- 11.1.5. Prenatal Testing

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Disease

- 11.2.1. Alzheimer's Disease

- 11.2.2. Cancer

- 11.2.3. Cystic Fibrosis

- 11.2.4. Sickle Cell Anemia

- 11.2.5. Duchenne Muscular Dystrophy

- 11.2.6. Thalassemia

- 11.2.7. Huntington's Disease

- 11.2.8. Other Diseases

- 11.3. Market Analysis, Insights and Forecast - by Technology

- 11.3.1. Cytogenetic Testing

- 11.3.2. Biochemical Testing

- 11.3.3. Molecular Testing

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 13. France European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Myriad Genetics Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Elitech Group

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Luminex Corporation (Diasorin SPA)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 F Hoffmann-La Roche Ltd

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Eurofins Scientific

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 23andMe Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Abbott Laboratories

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Blueprint Genetics Oy

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Danaher Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Qiagen

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Illumina Inc

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Centogene AG

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Thermo Fisher Scientific

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.1 Myriad Genetics Inc

List of Figures

- Figure 1: European DNA Testing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European DNA Testing Industry Share (%) by Company 2024

List of Tables

- Table 1: European DNA Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 4: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: European DNA Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 16: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 20: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 24: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 28: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 32: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 36: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 37: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European DNA Testing Industry?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the European DNA Testing Industry?

Key companies in the market include Myriad Genetics Inc, Elitech Group, Luminex Corporation (Diasorin SPA), F Hoffmann-La Roche Ltd, Eurofins Scientific, F Hoffmann-La Roche Ltd*List Not Exhaustive, 23andMe Inc, Abbott Laboratories, Blueprint Genetics Oy, Danaher Corporation, Qiagen, Illumina Inc, Centogene AG, Thermo Fisher Scientific.

3. What are the main segments of the European DNA Testing Industry?

The market segments include Type, Disease, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Emphasis on Early Disease Detection and Prevention; Increasing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology.

6. What are the notable trends driving market growth?

The Diagnostic Testing Segment is Expected to Hold a Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing.

8. Can you provide examples of recent developments in the market?

October 2022: NHS England launched a national genetic testing service to deliver rapid life-saving checks for children and babies. As a result of the launch, patients can undergo simple blood tests. Once they are processed, the service is likely to give medical teams from across the country results within days, meaning they can kick-start lifesaving treatment plans for more than 6,000 genetic diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European DNA Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European DNA Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European DNA Testing Industry?

To stay informed about further developments, trends, and reports in the European DNA Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence