Key Insights

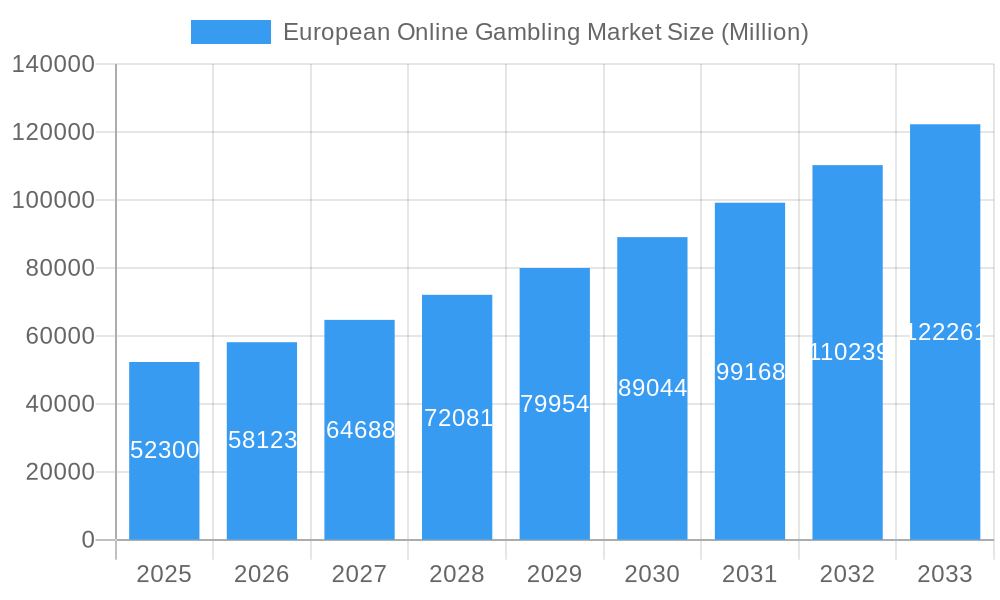

The European online gambling market is experiencing robust growth, projected to reach a market size of €52.30 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 11.01% from 2025 to 2033. This expansion is fueled by several key factors. Increased smartphone penetration and readily available high-speed internet access across Europe are driving accessibility. The rising popularity of diverse game types, including sports betting, casino games (slots, table games), lottery, and bingo, caters to a broad range of player preferences. Furthermore, innovative technological advancements, such as improved mobile gaming experiences and the integration of virtual reality (VR) and augmented reality (AR) technologies, are enhancing user engagement and driving market growth. The market is highly competitive, with established players like GVC Holdings, Flutter Entertainment, and Bet365 Group Ltd. vying for market share alongside newer entrants. Regulatory changes across various European countries are a significant influence, impacting both market opportunities and challenges. While some countries have embraced regulated online gambling, others maintain stricter regulations, creating a varied landscape across the region.

European Online Gambling Market Market Size (In Billion)

The regional distribution within Europe showcases significant variations. Major markets like the United Kingdom, Germany, and France are expected to contribute substantial revenue, driven by high player bases and established regulatory frameworks. However, growth potential also exists within smaller but rapidly developing markets such as the Netherlands and Sweden, where the regulatory environment is becoming more favorable to online gambling. Despite the overall positive outlook, challenges remain, including concerns about responsible gambling, the potential for increased regulatory scrutiny, and the ongoing threat of illegal and unregulated operators. Nevertheless, the ongoing expansion of online gaming coupled with targeted marketing and player engagement strategies points to continued positive growth for the European online gambling market throughout the forecast period.

European Online Gambling Market Company Market Share

This in-depth report provides a comprehensive analysis of the European online gambling market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on the dynamic landscape of this rapidly growing sector. The report leverages extensive market research, incorporating data from the historical period (2019-2024), the base year (2025), and forecasts for the period 2025-2033. The total market value in 2025 is estimated at xx Million.

European Online Gambling Market Market Concentration & Innovation

This section analyzes the competitive landscape of the European online gambling market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities.

The European online gambling market exhibits a moderately concentrated structure, with a few major players holding significant market share. For example, Flutter Entertainment and Entain PLC hold substantial positions, while other prominent players like Betsson AB and 888 Holdings PLC contribute significantly to the overall market size. Precise market share figures are difficult to obtain publicly but are estimated to vary across segments. The market is characterized by continuous innovation, driven by advancements in technology, evolving customer preferences, and increasing competition. M&A activity has been substantial, with deal values in the hundreds of Millions observed in recent years. Key drivers for M&A include achieving scale, expanding geographic reach, and accessing new technologies.

- Market Concentration: Moderately concentrated, with several large players dominating.

- Innovation Drivers: Technological advancements (e.g., mobile gaming, VR/AR), evolving customer preferences, and competitive pressure.

- Regulatory Frameworks: Vary significantly across European countries, impacting market access and operational costs.

- Product Substitutes: Limited direct substitutes, but competition exists from other forms of entertainment and leisure activities.

- End-User Trends: Increasing adoption of mobile gaming, preference for diverse game types, and demand for personalized experiences.

- M&A Activities: Significant activity, driven by consolidation, expansion, and technological acquisition. Examples include the xx Million deal between [insert example if available, otherwise state "unnamed companies"].

European Online Gambling Market Industry Trends & Insights

This section delves into the key trends and insights shaping the European online gambling market. The market is experiencing robust growth, driven by several factors, including increased internet and smartphone penetration, a shift towards mobile gaming, and the legalization of online gambling in several European countries. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, indicating significant market expansion. Market penetration is also expected to increase substantially as more consumers adopt online gambling. However, the market faces challenges, such as stringent regulations, increasing competition, and concerns regarding responsible gaming. Technological disruptions, such as the rise of blockchain technology and the integration of artificial intelligence, are also transforming the industry landscape.

Dominant Markets & Segments in European Online Gambling Market

This section identifies the leading regions, countries, and segments within the European online gambling market. The UK, Germany, and France are considered dominant markets, owing to their large populations, high internet penetration rates, and relatively liberal regulatory environments.

Key Drivers:

- Economic Policies: Favorable tax regimes and regulatory frameworks can significantly boost market growth.

- Infrastructure: Robust internet and mobile infrastructure is crucial for online gambling.

Dominance Analysis:

- Game Type: Sports betting and casino games are the largest segments, showing strong growth potential.

- Other Game Types: Lottery and bingo maintain a steady market share.

- End Use: Mobile gaming is rapidly surpassing desktop gaming as the dominant platform.

Specific country-level dominance and market size details are included in the full report for the UK, Germany, and France, alongside growth drivers and challenges specific to those markets.

European Online Gambling Market Product Developments

The European online gambling market is witnessing significant product innovation. Providers are constantly introducing new games, platforms, and features to attract and retain customers. Technological advancements like virtual reality (VR) and augmented reality (AR) are being integrated to enhance the gaming experience. Personalization and gamification are also key trends, allowing for tailored experiences and increased user engagement. The market is also seeing the rise of esports betting and the integration of blockchain technology for secure transactions and provably fair gaming. This continuous innovation ensures market fit and a competitive edge for providers.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the European online gambling market based on game type (sports betting, casino, lottery, bingo), end-use (desktop, mobile), and geography (specific European countries). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. For example, the mobile segment is experiencing the fastest growth, driven by increased smartphone penetration and convenience. The sports betting segment remains dominant, with consistent growth projected. The casino segment is witnessing continuous innovation, leading to a diversified gaming experience.

- Game Type: Detailed market size and growth projections for sports betting, casino games, lottery, and bingo are included.

- End Use: Analysis of market share and growth trends for desktop and mobile platforms.

Key Drivers of European Online Gambling Market Growth

The European online gambling market is fueled by several key drivers. These include: increasing internet and smartphone penetration across Europe, the legalization and regulation of online gambling in many jurisdictions, rising disposable incomes leading to increased spending on entertainment, and the continuous innovation and development of new and engaging games and platforms. Furthermore, the growing popularity of mobile gaming and the increasing adoption of esports betting are adding to the overall growth.

Challenges in the European Online Gambling Market Sector

The European online gambling market faces various challenges, including stringent regulations that vary across countries, creating complexities for operators. Maintaining responsible gaming practices and preventing underage gambling are critical concerns. The high level of competition among established and new players creates a challenging market. Supply chain disruption and increasing costs due to inflation also pose challenges to market growth.

Emerging Opportunities in European Online Gambling Market

Despite challenges, the European online gambling market presents significant opportunities. The expansion into new markets with emerging regulations presents potential for growth. The integration of new technologies like AI and blockchain will lead to enhanced gaming experiences and improved security. The increasing popularity of esports betting offers new avenues for market expansion. Furthermore, customized gaming experiences and targeted marketing will cater to specific consumer segments, boosting engagement and growth.

Leading Players in the European Online Gambling Market Market

- GVC Holdings

- LeoVegas AB

- The Stars Group Inc

- Betsson AB

- Flutter Entertainment

- 888 Holdings PLC

- The Kindred Group

- Bragg Gaming Group

- Entain PLC (William Hill PLC)

- Bet365 Group Ltd

Key Developments in European Online Gambling Market Industry

- March 2021: Playtech extended its partnership deal with Flutter Entertainment for five more years, strengthening their technological collaboration.

- July 2021: Betway launched a new France-facing website, expanding its market reach.

- February 2022: The Gaming Innovation Group Inc. (GiG) extended its partnership with Betsson Group, securing its platform services until 2025.

Strategic Outlook for European Online Gambling Market Market

The European online gambling market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and market expansion into new territories. Strategic partnerships, investments in innovative technologies, and a focus on responsible gaming practices will be key factors in determining success within the market. The market is expected to see further consolidation through M&A activities, with the larger players acquiring smaller companies to increase their market share and expand their product offerings. The continued development of mobile gaming and the integration of new technologies will create a robust and engaging market in the coming years.

European Online Gambling Market Segmentation

-

1. Game Type

-

1.1. Sports Betting

- 1.1.1. Football

- 1.1.2. Horse Racing

- 1.1.3. E-Sports

- 1.1.4. Other Game Types

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Baccarat

- 1.2.3. Blackjack

- 1.2.4. Poker

- 1.2.5. Slots

- 1.2.6. Other Casino Games

- 1.3. Lottery

- 1.4. Bingo

-

1.1. Sports Betting

-

2. End Use

- 2.1. Desktop

- 2.2. Mobile

European Online Gambling Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

European Online Gambling Market Regional Market Share

Geographic Coverage of European Online Gambling Market

European Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Improved Internet Connections and Streaming Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.1.1. Football

- 5.1.1.2. Horse Racing

- 5.1.1.3. E-Sports

- 5.1.1.4. Other Game Types

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Baccarat

- 5.1.2.3. Blackjack

- 5.1.2.4. Poker

- 5.1.2.5. Slots

- 5.1.2.6. Other Casino Games

- 5.1.3. Lottery

- 5.1.4. Bingo

- 5.1.1. Sports Betting

- 5.2. Market Analysis, Insights and Forecast - by End Use

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Spain European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.1.1. Football

- 6.1.1.2. Horse Racing

- 6.1.1.3. E-Sports

- 6.1.1.4. Other Game Types

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Baccarat

- 6.1.2.3. Blackjack

- 6.1.2.4. Poker

- 6.1.2.5. Slots

- 6.1.2.6. Other Casino Games

- 6.1.3. Lottery

- 6.1.4. Bingo

- 6.1.1. Sports Betting

- 6.2. Market Analysis, Insights and Forecast - by End Use

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. United Kingdom European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.1.1. Football

- 7.1.1.2. Horse Racing

- 7.1.1.3. E-Sports

- 7.1.1.4. Other Game Types

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Baccarat

- 7.1.2.3. Blackjack

- 7.1.2.4. Poker

- 7.1.2.5. Slots

- 7.1.2.6. Other Casino Games

- 7.1.3. Lottery

- 7.1.4. Bingo

- 7.1.1. Sports Betting

- 7.2. Market Analysis, Insights and Forecast - by End Use

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Germany European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.1.1. Football

- 8.1.1.2. Horse Racing

- 8.1.1.3. E-Sports

- 8.1.1.4. Other Game Types

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Baccarat

- 8.1.2.3. Blackjack

- 8.1.2.4. Poker

- 8.1.2.5. Slots

- 8.1.2.6. Other Casino Games

- 8.1.3. Lottery

- 8.1.4. Bingo

- 8.1.1. Sports Betting

- 8.2. Market Analysis, Insights and Forecast - by End Use

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. France European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.1.1. Football

- 9.1.1.2. Horse Racing

- 9.1.1.3. E-Sports

- 9.1.1.4. Other Game Types

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Baccarat

- 9.1.2.3. Blackjack

- 9.1.2.4. Poker

- 9.1.2.5. Slots

- 9.1.2.6. Other Casino Games

- 9.1.3. Lottery

- 9.1.4. Bingo

- 9.1.1. Sports Betting

- 9.2. Market Analysis, Insights and Forecast - by End Use

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Italy European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 10.1.1. Sports Betting

- 10.1.1.1. Football

- 10.1.1.2. Horse Racing

- 10.1.1.3. E-Sports

- 10.1.1.4. Other Game Types

- 10.1.2. Casino

- 10.1.2.1. Live Casino

- 10.1.2.2. Baccarat

- 10.1.2.3. Blackjack

- 10.1.2.4. Poker

- 10.1.2.5. Slots

- 10.1.2.6. Other Casino Games

- 10.1.3. Lottery

- 10.1.4. Bingo

- 10.1.1. Sports Betting

- 10.2. Market Analysis, Insights and Forecast - by End Use

- 10.2.1. Desktop

- 10.2.2. Mobile

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 11. Russia European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 11.1.1. Sports Betting

- 11.1.1.1. Football

- 11.1.1.2. Horse Racing

- 11.1.1.3. E-Sports

- 11.1.1.4. Other Game Types

- 11.1.2. Casino

- 11.1.2.1. Live Casino

- 11.1.2.2. Baccarat

- 11.1.2.3. Blackjack

- 11.1.2.4. Poker

- 11.1.2.5. Slots

- 11.1.2.6. Other Casino Games

- 11.1.3. Lottery

- 11.1.4. Bingo

- 11.1.1. Sports Betting

- 11.2. Market Analysis, Insights and Forecast - by End Use

- 11.2.1. Desktop

- 11.2.2. Mobile

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 12. Rest of Europe European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 12.1.1. Sports Betting

- 12.1.1.1. Football

- 12.1.1.2. Horse Racing

- 12.1.1.3. E-Sports

- 12.1.1.4. Other Game Types

- 12.1.2. Casino

- 12.1.2.1. Live Casino

- 12.1.2.2. Baccarat

- 12.1.2.3. Blackjack

- 12.1.2.4. Poker

- 12.1.2.5. Slots

- 12.1.2.6. Other Casino Games

- 12.1.3. Lottery

- 12.1.4. Bingo

- 12.1.1. Sports Betting

- 12.2. Market Analysis, Insights and Forecast - by End Use

- 12.2.1. Desktop

- 12.2.2. Mobile

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 GVC Holdings

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LeoVegas AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 The Stars Group Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Betsson AB

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flutter Entertainment

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 888 Holdings PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kindered Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bragg Gaming Group*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Entain PLC (William Hill PLC)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bet365 Group Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 GVC Holdings

List of Figures

- Figure 1: European Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 3: European Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 6: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 9: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 11: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 12: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 15: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 17: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 18: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 20: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 21: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 23: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 24: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Online Gambling Market?

The projected CAGR is approximately 11.01%.

2. Which companies are prominent players in the European Online Gambling Market?

Key companies in the market include GVC Holdings, LeoVegas AB, The Stars Group Inc, Betsson AB, Flutter Entertainment, 888 Holdings PLC, The Kindered Group, Bragg Gaming Group*List Not Exhaustive, Entain PLC (William Hill PLC), Bet365 Group Ltd.

3. What are the main segments of the European Online Gambling Market?

The market segments include Game Type, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Improved Internet Connections and Streaming Technology.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

February 2022: The Gaming Innovation Group Inc. (GiG) announced that it signed an extension of its agreement of partnership with Betsson Group to provide the Platform & Managed Services, which included customer services and full business operations of multiple territories. The contract extension was signed for the extension till 2025. The agreement included the brand's Guts, Thrills, Kaboo, and Rizk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Online Gambling Market?

To stay informed about further developments, trends, and reports in the European Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence