Key Insights

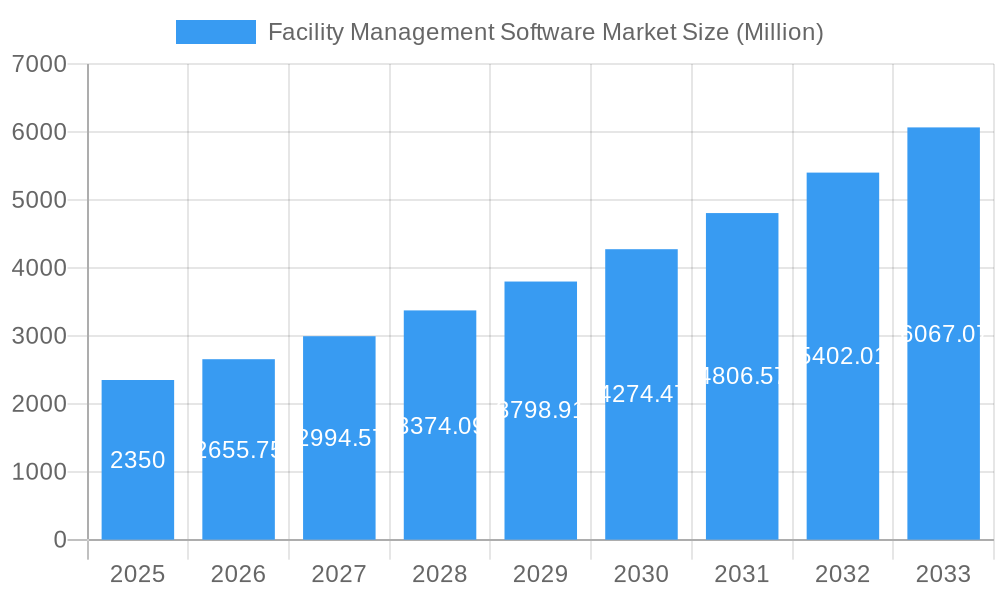

The Facility Management Software market is poised for significant expansion, projected to reach $2.35 billion in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 13.30%. This robust growth is fueled by increasing demand for streamlined operations, enhanced efficiency, and cost optimization across diverse industries. Key drivers include the rising complexity of managing large-scale facilities, the growing adoption of smart building technologies, and the imperative for better space utilization and predictive maintenance. The market is segmented into Computer-Aided Facility Management (CAFM), Integrated Workplace Management Systems (IWMS), and Computerized Maintenance Management Systems (CMMS), each catering to specific organizational needs. Furthermore, the widespread adoption across commercial, institutional, public infrastructure, and industrial sectors underscores the pervasive impact of facility management software in modern business environments.

Facility Management Software Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained momentum, driven by technological advancements and evolving workplace strategies. Emerging trends such as the integration of AI and IoT for real-time data analysis, the rise of mobile-first solutions for on-the-go management, and a greater focus on sustainability and energy efficiency in facility operations are expected to further propel market growth. While the market is experiencing robust expansion, potential restraints may include the initial implementation costs and the need for specialized training for effective software utilization. However, the long-term benefits of improved operational visibility, reduced downtime, and enhanced employee productivity are expected to outweigh these challenges, ensuring continued investment and innovation in the facility management software landscape. Key players like IBM Corporation, Oracle Corporation, and SAP SE are actively innovating, offering comprehensive solutions to meet the dynamic needs of this growing market.

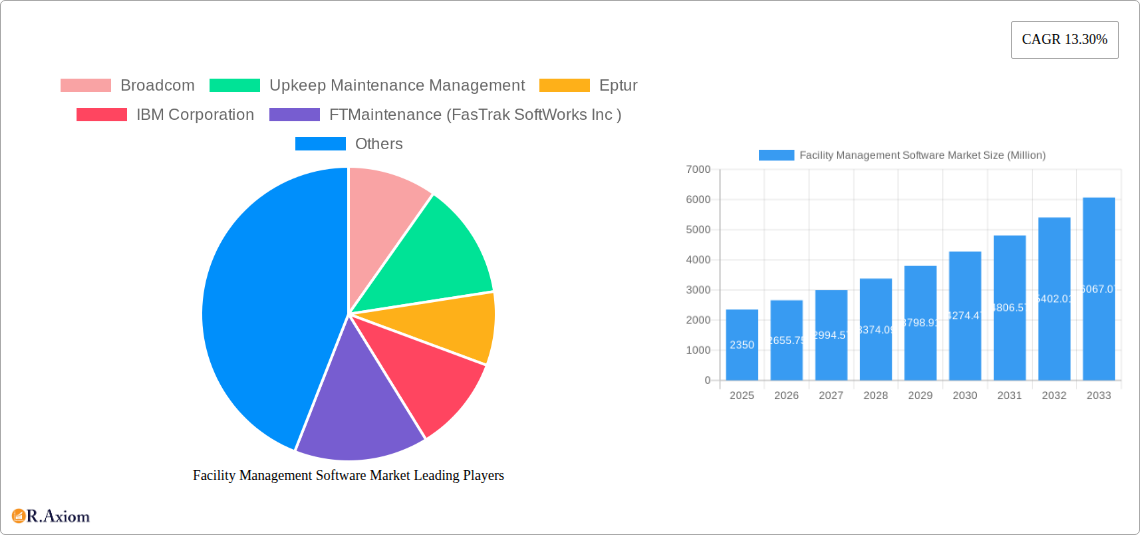

Facility Management Software Market Company Market Share

Facility Management Software Market Market Concentration & Innovation

The Facility Management Software market is characterized by a moderate level of concentration, with a mix of established global technology giants and specialized software providers vying for market share. Innovation is a primary driver, fueled by the increasing demand for intelligent, automated, and data-driven facility operations. Regulatory frameworks, while generally supportive of efficiency, can vary by region, impacting adoption rates for certain features. Product substitutes, such as manual tracking and disconnected software solutions, are gradually diminishing as the benefits of integrated facility management software become more apparent. End-user trends highlight a growing preference for cloud-based solutions offering scalability, remote accessibility, and advanced analytics. Mergers and Acquisitions (M&A) activities are significant, with deal values often in the tens to hundreds of millions, reflecting the strategic importance of acquiring technology and customer bases to expand offerings and market reach.

- Key Innovation Drivers:

- Advancements in Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and space optimization.

- Integration of IoT devices for real-time data collection and performance monitoring.

- Development of user-friendly, mobile-first interfaces for enhanced accessibility.

- Focus on sustainability and energy management features.

- M&A Impact:

- Consolidation of market share by larger players.

- Acquisition of innovative startups to enhance product portfolios.

- Expansion into new geographic markets and industry verticals.

Facility Management Software Market Industry Trends & Insights

The Facility Management Software market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period of 2025–2033. This upward trajectory is primarily attributed to the increasing need for operational efficiency, cost reduction, and enhanced occupant experience across diverse sectors. The growing adoption of smart building technologies, coupled with the surge in remote workforces, necessitates sophisticated facility management solutions to monitor and control building assets, optimize space utilization, and ensure a safe and productive environment. Technological disruptions, particularly the integration of AI and the Internet of Things (IoT), are transforming how facilities are managed, enabling predictive maintenance, energy optimization, and proactive issue resolution. Consumer preferences are shifting towards integrated platforms that offer a comprehensive suite of functionalities, from maintenance scheduling and work order management to space planning and asset tracking, all accessible through intuitive cloud-based interfaces. The competitive dynamics within the market are intense, with vendors continuously investing in R&D to offer advanced features and cater to the evolving demands of commercial, institutional, industrial, and public infrastructure end-users. Market penetration is steadily increasing as organizations recognize the tangible return on investment from implementing modern facility management software.

- Key Growth Drivers:

- Increasing emphasis on operational cost savings and resource optimization.

- Growing demand for smart building solutions and IoT integration.

- Heightened awareness of health, safety, and environmental compliance.

- The need for efficient space management in hybrid work environments.

- Market Penetration: Expected to rise significantly as SMEs adopt more affordable and scalable cloud solutions.

- Technological Advancements: AI-powered analytics and predictive maintenance are becoming standard features.

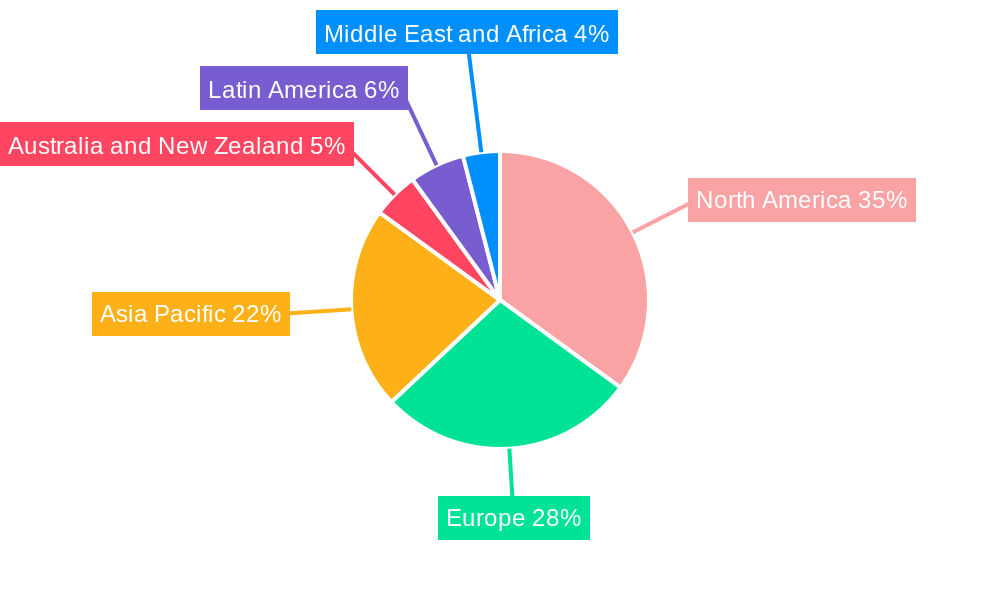

Dominant Markets & Segments in Facility Management Software Market

The global Facility Management Software market exhibits strong dominance in the Commercial end-user segment, driven by the sheer volume of office buildings, retail spaces, and hospitality venues that require efficient operational management. This segment is further bolstered by the widespread adoption of Integrated Workplace Management Systems (IWMS) due to their comprehensive approach to managing space, assets, maintenance, and strategic planning. North America, particularly the United States, remains a leading region, owing to its advanced technological infrastructure, early adoption of SaaS solutions, and a mature market for enterprise software.

Dominant Segment - Type:

- Integrated Workplace Management Systems (IWMS): This segment is expected to lead the market due to its holistic approach, integrating various facility management functions into a single platform. Key drivers include:

- Demand for streamlined operations and data centralization.

- Need for strategic asset and space planning.

- Integration with other business systems for enhanced efficiency.

- Computerized Maintenance Management Systems (CMMS): Continues to be a vital segment, particularly for industries with significant physical assets requiring proactive maintenance. Key drivers include:

- Focus on reducing downtime and maintenance costs.

- Regulatory compliance for asset upkeep.

- Increasing adoption in industrial and public infrastructure sectors.

- Computer Aided Facility Management (CAFM): While often overlapping with IWMS, CAFM solutions focus on the operational aspects of facility management, including space management and asset tracking. Key drivers include:

- Need for efficient space utilization and move management.

- Enhanced visualization of facility layouts and assets.

- Integration with building automation systems.

- Integrated Workplace Management Systems (IWMS): This segment is expected to lead the market due to its holistic approach, integrating various facility management functions into a single platform. Key drivers include:

Dominant Segment - End User:

- Commercial: This segment accounts for the largest market share, driven by the complex needs of managing office buildings, retail outlets, and hospitality services. Economic policies encouraging business growth and the need for efficient tenant management contribute to its dominance.

- Industrial: With a high concentration of physical assets and stringent safety regulations, the industrial sector is a significant adopter of CMMS and EAM solutions. Growth is fueled by infrastructure development and the need for asset reliability.

- Institutional: Healthcare facilities, educational institutions, and government buildings rely on robust facility management software for maintaining critical infrastructure, ensuring occupant safety, and managing large, complex sites.

Facility Management Software Market Product Developments

Recent product developments in the Facility Management Software market underscore a significant leap towards AI-driven operations and enhanced user experience. Auberon Technologies' release of Optima, its third-generation CAFM system, in March 2024, highlights the integration of advanced artificial intelligence to boost productivity and provide deeper insights, surpassing previous industry standards. Similarly, TMA Systems' October 2023 upgrade of its Eagle CMMS platform offers a transformational solution for businesses of all sizes, emphasizing robust asset maintenance and management with a focus on ease of use and rapid adoption. These advancements are crucial for gaining competitive advantage by offering more intelligent, automated, and user-centric solutions that address the evolving demands for efficiency and operational excellence in facility management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Facility Management Software market, segmented by Type and End User. The segmentation includes: Computer Aided Facility Management (CAFM), Integrated Workplace Management Systems (IWMS), and Computerized Maintenance Management Systems (CMMS) for Type; and Commercial, Institutional, Public Infrastructure, Industrial, and Other End Users for End User. Each segment is analyzed for its market size, growth projections, and competitive dynamics. The forecast period is from 2025 to 2033, with a base year of 2025, and a historical period from 2019 to 2024.

- CAFM Segment: Focuses on space management, asset tracking, and maintenance scheduling. Expected to witness steady growth driven by its utility in optimizing physical space utilization.

- IWMS Segment: Offers a comprehensive suite of functionalities, integrating space, asset, maintenance, and strategic planning. Projected for the highest growth due to its all-encompassing capabilities.

- CMMS Segment: Concentrates on maintenance operations, work order management, and asset upkeep. Its growth is tied to industries with significant physical infrastructure and critical maintenance needs.

- Commercial End User: Dominant segment, encompassing diverse commercial properties. High growth driven by the need for operational efficiency and tenant satisfaction.

- Institutional End User: Significant growth expected from healthcare and education sectors due to complex facility requirements and regulatory compliance.

- Public Infrastructure End User: Driven by the need for efficient management of utilities, transportation networks, and government facilities.

- Industrial End User: Strong adoption of CMMS and EAM solutions for asset-intensive operations and safety compliance.

Key Drivers of Facility Management Software Market Growth

The Facility Management Software market growth is primarily propelled by several key factors. Economically, the increasing emphasis on operational cost reduction and efficiency gains across all industries compels organizations to adopt sophisticated software solutions. Technologically, the rapid advancements in AI, IoT, and cloud computing are enabling more intelligent, automated, and predictive facility management capabilities. Regulatory frameworks mandating safety, sustainability, and compliance standards further drive the need for robust tracking and reporting features offered by these software platforms. The shift towards smart buildings and the growing adoption of hybrid work models also necessitate enhanced control and optimization of workspace environments.

- Technological Advancements: AI for predictive maintenance, IoT for real-time data, and cloud for scalability.

- Economic Pressures: Demand for cost savings, operational efficiency, and resource optimization.

- Regulatory Compliance: Mandates for safety, energy efficiency, and environmental standards.

- Smart Building Adoption: Integration with building automation systems for enhanced control.

Challenges in the Facility Management Software Market Sector

Despite the strong growth trajectory, the Facility Management Software market faces several challenges. The initial cost of implementation and integration with existing legacy systems can be a significant barrier, particularly for small and medium-sized enterprises. Data security and privacy concerns are paramount, especially with the increasing use of cloud-based solutions and the sensitive data they handle. A shortage of skilled professionals capable of effectively implementing and managing these advanced software systems also presents a hurdle. Furthermore, the fragmented nature of some facility management processes and the resistance to change within organizations can slow down adoption rates. Fierce competition among vendors can lead to price wars and pressure on profit margins.

- High Implementation Costs: Initial investment and integration complexities.

- Data Security & Privacy Concerns: Protecting sensitive facility and occupant data.

- Talent Gap: Shortage of skilled facility management software professionals.

- Organizational Resistance to Change: Inertia and reluctance to adopt new technologies.

Emerging Opportunities in Facility Management Software Market

Emerging opportunities in the Facility Management Software market are abundant, driven by innovation and evolving user needs. The growing global focus on sustainability and green building initiatives presents a significant avenue for software providers to offer enhanced energy management and environmental reporting features. The expansion of the Internet of Things (IoT) into the built environment opens up possibilities for real-time data analytics, predictive maintenance, and smart space utilization. The increasing adoption of remote and hybrid work models creates a demand for advanced software that can manage distributed workforces and optimize office space utilization effectively. Furthermore, the burgeoning markets in developing economies, coupled with government initiatives for smart city development, offer substantial growth potential for facility management software solutions.

- Sustainability & Green Building: Demand for energy management and ESG reporting.

- IoT Integration: Real-time data, predictive analytics, and smart building control.

- Hybrid Work Management: Tools for space optimization and workforce management.

- Emerging Markets: Growth potential in developing economies and smart city initiatives.

Leading Players in the Facility Management Software Market Market

- Broadcom

- Upkeep Maintenance Management

- Eptur

- IBM Corporation

- FTMaintenance (FasTrak SoftWorks Inc)

- Oracle Corporation

- Trimble Inc

- SAP SE

- Accruent LLC (Fortive Corporation)

- Planon Software Services Private Limited

Key Developments in Facility Management Software Market Industry

- March 2024: Auberon Technologies released Optima, its third-generation CAFM system, leveraging advanced AI for enhanced productivity and insights. This development signifies a move towards more intelligent and predictive facility management.

- October 2023: TMA Systems announced the readiness of its upgraded Eagle CMMS platform. This transformational CMMS solution emphasizes robustness, ease of use, and fast time-to-value for businesses of all sizes, highlighting a focus on user adoption and practical asset management.

Strategic Outlook for Facility Management Software Market Market

The strategic outlook for the Facility Management Software market is exceptionally positive, driven by the continuous demand for operational efficiency, cost optimization, and improved occupant experiences. The increasing integration of AI, IoT, and advanced analytics within these platforms will be a key differentiator, enabling predictive maintenance, smart space utilization, and proactive issue resolution. The growing emphasis on sustainability and ESG compliance will further drive the adoption of software solutions that can effectively monitor and manage energy consumption and environmental impact. As organizations worldwide continue to digitize their operations and adapt to evolving work models, the need for comprehensive, scalable, and user-friendly facility management software will only intensify, presenting a fertile ground for continued innovation and market expansion.

Facility Management Software Market Segmentation

-

1. Type

- 1.1. Computer Aided Facility Management (CAFM)

- 1.2. Integrated Workplace Management Systems (IWMS)

- 1.3. Computerized Maintenance Management Systems (CMMS)

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public Infrastructure

- 2.4. Industrial

- 2.5. Other End Users

Facility Management Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Facility Management Software Market Regional Market Share

Geographic Coverage of Facility Management Software Market

Facility Management Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand for CAFM Solutions; Rising Use of AI and IoT in Facility Management Software

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Integration with the Workflow

- 3.4. Market Trends

- 3.4.1. Commercial Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Computer Aided Facility Management (CAFM)

- 5.1.2. Integrated Workplace Management Systems (IWMS)

- 5.1.3. Computerized Maintenance Management Systems (CMMS)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Computer Aided Facility Management (CAFM)

- 6.1.2. Integrated Workplace Management Systems (IWMS)

- 6.1.3. Computerized Maintenance Management Systems (CMMS)

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Institutional

- 6.2.3. Public Infrastructure

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Computer Aided Facility Management (CAFM)

- 7.1.2. Integrated Workplace Management Systems (IWMS)

- 7.1.3. Computerized Maintenance Management Systems (CMMS)

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Institutional

- 7.2.3. Public Infrastructure

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Computer Aided Facility Management (CAFM)

- 8.1.2. Integrated Workplace Management Systems (IWMS)

- 8.1.3. Computerized Maintenance Management Systems (CMMS)

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Institutional

- 8.2.3. Public Infrastructure

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Computer Aided Facility Management (CAFM)

- 9.1.2. Integrated Workplace Management Systems (IWMS)

- 9.1.3. Computerized Maintenance Management Systems (CMMS)

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Institutional

- 9.2.3. Public Infrastructure

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Computer Aided Facility Management (CAFM)

- 10.1.2. Integrated Workplace Management Systems (IWMS)

- 10.1.3. Computerized Maintenance Management Systems (CMMS)

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Institutional

- 10.2.3. Public Infrastructure

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Facility Management Software Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Computer Aided Facility Management (CAFM)

- 11.1.2. Integrated Workplace Management Systems (IWMS)

- 11.1.3. Computerized Maintenance Management Systems (CMMS)

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Commercial

- 11.2.2. Institutional

- 11.2.3. Public Infrastructure

- 11.2.4. Industrial

- 11.2.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Broadcom

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Upkeep Maintenance Management

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Eptur

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 IBM Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 FTMaintenance (FasTrak SoftWorks Inc )

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oracle Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Trimble Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SAP SE

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Accruent LLC (Fortive Corporation)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Planon Software Services Private Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Broadcom

List of Figures

- Figure 1: Global Facility Management Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Australia and New Zealand Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Australia and New Zealand Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Facility Management Software Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Facility Management Software Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Facility Management Software Market Revenue (Million), by End User 2025 & 2033

- Figure 35: Middle East and Africa Facility Management Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 36: Middle East and Africa Facility Management Software Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Facility Management Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Facility Management Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Facility Management Software Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Facility Management Software Market Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Facility Management Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Facility Management Software Market?

The projected CAGR is approximately 13.30%.

2. Which companies are prominent players in the Facility Management Software Market?

Key companies in the market include Broadcom, Upkeep Maintenance Management, Eptur, IBM Corporation, FTMaintenance (FasTrak SoftWorks Inc ), Oracle Corporation, Trimble Inc, SAP SE, Accruent LLC (Fortive Corporation), Planon Software Services Private Limited.

3. What are the main segments of the Facility Management Software Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.35 Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand for CAFM Solutions; Rising Use of AI and IoT in Facility Management Software.

6. What are the notable trends driving market growth?

Commercial Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Proper Integration with the Workflow.

8. Can you provide examples of recent developments in the market?

March 2024 - Optima, the company’s third-generation computer-aided facility management (CAFM) system, was released by Auberon Technologies, a trailblazing provider of software-as-a-service (SaaS) solutions that enhance facility management. Advanced artificial intelligence (AI) technology will be leveraged by Optima to bring productivity and insight, surpassing the capabilities of its predecessor, AuberonSpace, a software that set industry standards more than 10 years ago.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Facility Management Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Facility Management Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Facility Management Software Market?

To stay informed about further developments, trends, and reports in the Facility Management Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence