Key Insights

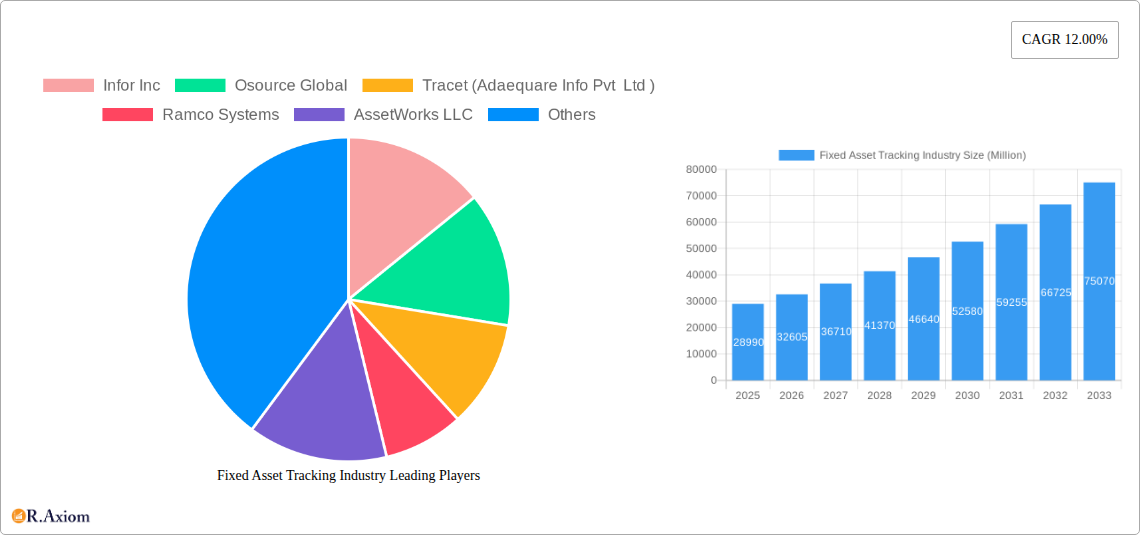

The global Fixed Asset Tracking market is poised for substantial expansion, estimated to reach $28.99 billion in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 12.63% throughout the forecast period of 2025-2033. This impressive growth is fueled by an increasing need across various industries for enhanced asset visibility, operational efficiency, and compliance adherence. The digital transformation initiatives and the growing adoption of IoT devices and cloud-based solutions are significantly contributing to the market's upward trajectory. Businesses are increasingly recognizing the value of precise asset tracking to minimize losses, optimize utilization, and streamline maintenance schedules, thereby improving their bottom line. The "Other" end-user industry segment, encompassing sectors like construction, retail, and government, is expected to exhibit significant adoption as they leverage technology to manage their diverse asset portfolios.

Fixed Asset Tracking Industry Market Size (In Billion)

The market is segmented into Software Solutions and Services, with both playing crucial roles in delivering comprehensive asset management capabilities. The deployment model is predominantly shifting towards On-Cloud solutions, offering scalability, accessibility, and cost-effectiveness. However, On-Premise deployments continue to hold relevance for organizations with stringent data security and regulatory requirements. Key market drivers include the rising cost of asset depreciation, the demand for improved inventory management, and the increasing regulatory pressures for asset accountability. While the market enjoys strong growth, potential restraints might include the initial implementation costs for smaller businesses and concerns regarding data security and privacy. Nevertheless, the pervasive need for efficient asset lifecycle management across sectors like Industrial Manufacturing, Transportation & Logistics, Healthcare & Life Sciences, and Energy & Utilities will continue to propel this dynamic market forward.

Fixed Asset Tracking Industry Company Market Share

Absolutely! Here's a detailed, SEO-optimized report description for the Fixed Asset Tracking Industry, incorporating high-traffic keywords and adhering to your specifications.

Fixed Asset Tracking Industry Market Concentration & Innovation

The Fixed Asset Tracking Industry is characterized by a moderate to high degree of market concentration, with key players like SAP SE, IBM Corporation, and Infor Inc. holding significant market shares, estimated to be in the tens of billions. Innovation is a primary driver, fueled by advancements in IoT, AI, and cloud computing, leading to enhanced accuracy and real-time visibility of assets. Regulatory frameworks, particularly concerning asset depreciation and compliance (e.g., Sarbanes-Oxley), are increasingly shaping market demands. While direct product substitutes are limited, the adoption of manual tracking methods or disparate spreadsheets presents an indirect competitive challenge. End-user industries are demanding more integrated and intelligent asset management solutions. Mergers and Acquisitions (M&A) are a notable trend, with deal values in the billions, as larger companies acquire innovative startups to expand their technological capabilities and market reach. For instance, acquisitions of specialized software providers by enterprise solution giants are common, consolidating market share and driving industry-wide adoption of advanced features.

Fixed Asset Tracking Industry Industry Trends & Insights

The global Fixed Asset Tracking Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This robust growth is propelled by a confluence of factors, including the escalating need for operational efficiency, stringent regulatory compliance, and the digital transformation initiatives across diverse sectors. The market penetration of advanced fixed asset tracking solutions is rapidly increasing, especially in developed economies, with a growing awareness of the financial and operational benefits. Technological disruptions are at the forefront, with the integration of Internet of Things (IoT) sensors, Radio-Frequency Identification (RFID) technology, barcode scanning, and Global Positioning System (GPS) devices revolutionizing how organizations monitor and manage their physical assets. Artificial intelligence (AI) and machine learning (ML) are further enhancing predictive maintenance capabilities, optimizing asset utilization, and reducing downtime, contributing billions in cost savings. Consumer preferences are leaning towards cloud-based solutions due to their scalability, accessibility, and reduced IT overhead, although on-premise solutions continue to cater to industries with strict data security requirements. Competitive dynamics are intensifying, with established players like Ramco Systems and AssetWorks LLC continuously innovating, while agile players such as Tracet (Adaequare Info Pvt Ltd ) and Asset Panda LLC are carving out niches with specialized offerings. The increasing volume of digital data generated by these systems is also leading to the development of sophisticated analytics platforms, providing deeper insights into asset performance and lifecycle management, further driving market value into the billions. The focus is shifting from mere tracking to intelligent asset lifecycle management, encompassing procurement, deployment, maintenance, and disposal, thereby creating a comprehensive ecosystem valued in the billions.

Dominant Markets & Segments in Fixed Asset Tracking Industry

The Industrial Manufacturing sector is a dominant market for fixed asset tracking solutions, with its extensive and high-value machinery, equipment, and inventory demanding precise management. The economic policies promoting industrial automation, coupled with the imperative to maintain production uptime, drive significant investment into these solutions, contributing billions to the market. Furthermore, the Transportation & Logistics industry showcases robust adoption, fueled by the need to track fleet vehicles, cargo, and valuable equipment across vast geographical areas. Government infrastructure investments and the increasing demand for efficient supply chain management are key economic drivers. In terms of segmentation, Software Solutions represent the largest and fastest-growing segment, with cloud-based platforms offering unparalleled flexibility and scalability, attracting billions in investment. The demand for Software-as-a-Service (SaaS) models is particularly high. From a deployment model perspective, On-Cloud solutions are witnessing accelerated adoption due to their cost-effectiveness, ease of deployment, and continuous updates, projected to capture billions in market value. Key drivers for this dominance include the inherent need for real-time data, enhanced security features, and the ability to integrate with other enterprise systems. The Healthcare & Life Sciences sector is also a significant contributor, driven by the need to track expensive medical equipment, manage compliance with stringent regulations, and ensure patient safety, with investments reaching billions. Similarly, the Energy & Utilities sector relies heavily on fixed asset tracking for managing critical infrastructure and adhering to safety and environmental regulations, further bolstering market demand in the billions. The "Other" end-user industries, encompassing sectors like government, education, and retail, are also progressively adopting these solutions, adding to the overall market's multi-billion dollar valuation.

Fixed Asset Tracking Industry Product Developments

Product development in the Fixed Asset Tracking Industry is heavily focused on enhancing real-time visibility and predictive capabilities. Innovations include the integration of AI-powered analytics for proactive maintenance alerts, reducing costly downtime, and the expanded use of IoT sensors for continuous monitoring of asset condition and location. Advanced RFID and GPS technologies are enabling more granular tracking of assets in complex environments. Competitive advantages are being gained by vendors offering comprehensive, cloud-native platforms that seamlessly integrate with existing ERP and supply chain management systems, providing a holistic view of an organization's asset portfolio. These developments are crucial for organizations seeking to optimize asset utilization and minimize risks, contributing to the multi-billion dollar market.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Fixed Asset Tracking Industry across several key segments. The End-user Industry segmentation includes Industrial Manufacturing, Transportation & Logistics, Healthcare & Life Sciences, Energy & Utilities, and Other Enterprises. Each segment is analyzed for its unique adoption drivers and growth projections, with significant market sizes expected in the billions. The Type segmentation categorizes the market into Software Solutions and Services, with software expected to lead in terms of market share and growth. The Deployment Model segmentation covers On-Cloud and On-Premise solutions, with a strong projected growth for on-cloud offerings, driven by their scalability and cost-effectiveness. Competitive dynamics within each segment are assessed, highlighting key players and their strategies.

Key Drivers of Fixed Asset Tracking Industry Growth

The growth of the Fixed Asset Tracking Industry is significantly driven by several key factors. Technologically, the proliferation of IoT devices, AI, and advanced analytics is enabling more intelligent and automated asset management. Economically, the increasing focus on operational efficiency, cost reduction, and maximizing return on assets (ROA) is compelling businesses to invest in robust tracking systems, saving billions in potential losses. Regulatory frameworks, such as those mandating asset depreciation tracking and environmental compliance, also act as powerful catalysts. Furthermore, the digital transformation initiatives across various industries are accelerating the adoption of integrated asset management solutions.

Challenges in the Fixed Asset Tracking Industry Sector

Despite robust growth, the Fixed Asset Tracking Industry faces several challenges. Implementing complex tracking systems can involve significant initial capital investment, posing a barrier for smaller enterprises. Regulatory hurdles, particularly in data privacy and security, require careful navigation and robust compliance measures. Supply chain disruptions can impact the availability of hardware components like sensors and RFID tags, potentially delaying project timelines and increasing costs. Intense competitive pressures among established and emerging players necessitate continuous innovation and competitive pricing strategies, which can squeeze profit margins. Quantifiable impacts include potential project delays costing millions and increased operational costs due to component price volatility.

Emerging Opportunities in Fixed Asset Tracking Industry

Emerging opportunities in the Fixed Asset Tracking Industry are abundant, driven by evolving technological landscapes and market demands. The increasing adoption of AI and ML for predictive maintenance and anomaly detection presents a significant avenue for growth, promising billions in savings for industries prone to equipment failure. The expansion of the Industrial Internet of Things (IIoT) ecosystem offers a platform for deeper integration and more sophisticated asset monitoring. New markets, particularly in developing economies, represent untapped potential for market penetration and revenue generation, with projected billions in future market expansion. Furthermore, the growing demand for sustainable asset management practices and circular economy initiatives creates opportunities for specialized tracking solutions focused on lifecycle management and resource optimization.

Leading Players in the Fixed Asset Tracking Industry Market

- Infor Inc.

- Osource Global

- Tracet (Adaequare Info Pvt Ltd )

- Ramco Systems

- AssetWorks LLC

- IBM Corporation

- RCS Technologie

- Xero Ltd

- Asset Panda LLC

- EZ Web Enterprises Inc

- FMIS Ltd

- Mynd Integrated Solutions

- InfoFort LLC

- SAP SE

Key Developments in Fixed Asset Tracking Industry Industry

- 2023 Q4: SAP SE launched enhanced AI-driven asset intelligence capabilities within its asset management suite, significantly boosting predictive maintenance features.

- 2023 Q3: Infor Inc. announced strategic partnerships to integrate its asset management solutions with leading IoT platforms, expanding real-time tracking options.

- 2023 Q2: Tracet (Adaequare Info Pvt Ltd ) introduced a new mobile-first asset tracking application for field service operations, targeting increased efficiency and ease of use.

- 2023 Q1: Ramco Systems expanded its cloud-based asset tracking services, offering more flexible subscription models to a wider range of industries.

- 2022 Q4: IBM Corporation acquired a specialized asset analytics firm, bolstering its portfolio with advanced machine learning capabilities for asset lifecycle management.

- 2022 Q3: AssetWorks LLC unveiled a new suite of cybersecurity features for its on-premise asset tracking solutions, addressing growing concerns for sensitive industries.

Strategic Outlook for Fixed Asset Tracking Industry Market

The strategic outlook for the Fixed Asset Tracking Industry is exceptionally promising, driven by ongoing digital transformation and the relentless pursuit of operational excellence. The increasing adoption of AI and IoT technologies will continue to be a significant growth catalyst, enabling more intelligent asset management and predictive capabilities. The shift towards cloud-based solutions will further democratize access to advanced tracking features, expanding market reach. Emerging economies present substantial untapped potential for expansion, promising billions in future market growth. Companies focusing on integrated, end-to-end asset lifecycle management solutions, coupled with robust data analytics and cybersecurity, will be well-positioned to capture a significant share of this burgeoning multi-billion dollar market.

Fixed Asset Tracking Industry Segmentation

-

1. End-user Industry

- 1.1. Industrial Manufacturing

- 1.2. Transportation & Logistics

- 1.3. Healthcare & Life Sciences

- 1.4. Energy & Utilities

- 1.5. Other En

-

2. Type

- 2.1. Software Solutions

- 2.2. Services

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

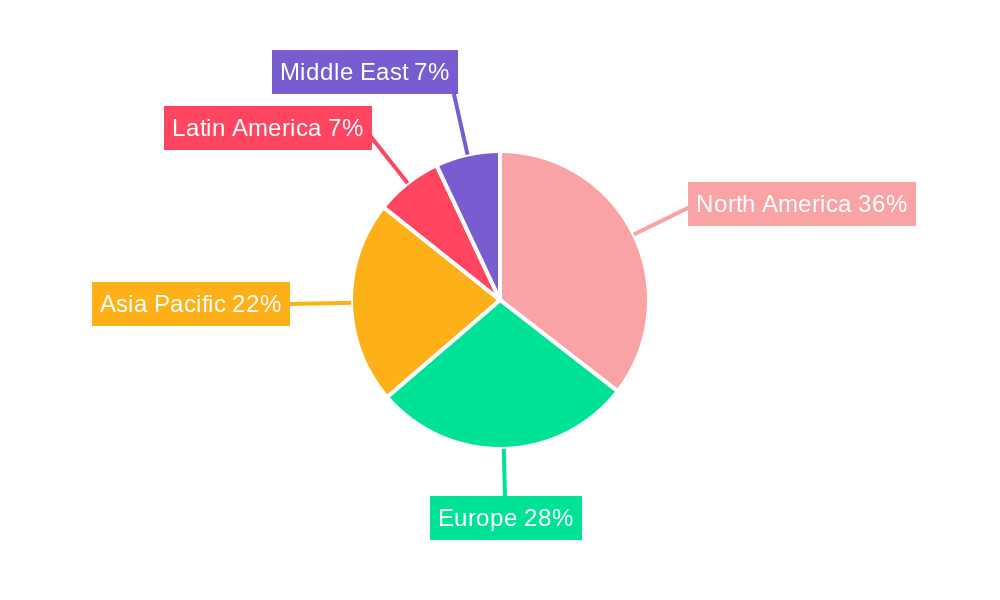

Fixed Asset Tracking Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fixed Asset Tracking Industry Regional Market Share

Geographic Coverage of Fixed Asset Tracking Industry

Fixed Asset Tracking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Focus on Optimizing Operational Cost; Increasing Adoption of IoT-based Assets

- 3.3. Market Restrains

- 3.3.1. ; High Upfront Cost Act as a Hindrance for SMEs

- 3.4. Market Trends

- 3.4.1. Industrial Manufacturing is Expected to Exhibit Maximum Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Industrial Manufacturing

- 5.1.2. Transportation & Logistics

- 5.1.3. Healthcare & Life Sciences

- 5.1.4. Energy & Utilities

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Software Solutions

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Industrial Manufacturing

- 6.1.2. Transportation & Logistics

- 6.1.3. Healthcare & Life Sciences

- 6.1.4. Energy & Utilities

- 6.1.5. Other En

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Software Solutions

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Industrial Manufacturing

- 7.1.2. Transportation & Logistics

- 7.1.3. Healthcare & Life Sciences

- 7.1.4. Energy & Utilities

- 7.1.5. Other En

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Software Solutions

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Industrial Manufacturing

- 8.1.2. Transportation & Logistics

- 8.1.3. Healthcare & Life Sciences

- 8.1.4. Energy & Utilities

- 8.1.5. Other En

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Software Solutions

- 8.2.2. Services

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Industrial Manufacturing

- 9.1.2. Transportation & Logistics

- 9.1.3. Healthcare & Life Sciences

- 9.1.4. Energy & Utilities

- 9.1.5. Other En

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Software Solutions

- 9.2.2. Services

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East Fixed Asset Tracking Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Industrial Manufacturing

- 10.1.2. Transportation & Logistics

- 10.1.3. Healthcare & Life Sciences

- 10.1.4. Energy & Utilities

- 10.1.5. Other En

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Software Solutions

- 10.2.2. Services

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infor Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Osource Global

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tracet (Adaequare Info Pvt Ltd )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramco Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AssetWorks LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IBM Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RCS Technologie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xero Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Asset Panda LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EZ Web Enterprises Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FMIS Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mynd Integrated Solutions

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 InfoFort LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SAP SE

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Infor Inc

List of Figures

- Figure 1: Global Fixed Asset Tracking Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fixed Asset Tracking Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: North America Fixed Asset Tracking Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Fixed Asset Tracking Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Fixed Asset Tracking Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Fixed Asset Tracking Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 7: North America Fixed Asset Tracking Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America Fixed Asset Tracking Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Fixed Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fixed Asset Tracking Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Fixed Asset Tracking Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Fixed Asset Tracking Industry Revenue (undefined), by Type 2025 & 2033

- Figure 13: Europe Fixed Asset Tracking Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Fixed Asset Tracking Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 15: Europe Fixed Asset Tracking Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: Europe Fixed Asset Tracking Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Fixed Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fixed Asset Tracking Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 19: Asia Pacific Fixed Asset Tracking Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Asia Pacific Fixed Asset Tracking Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Asia Pacific Fixed Asset Tracking Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Fixed Asset Tracking Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 23: Asia Pacific Fixed Asset Tracking Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 24: Asia Pacific Fixed Asset Tracking Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Fixed Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Fixed Asset Tracking Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 27: Latin America Fixed Asset Tracking Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Latin America Fixed Asset Tracking Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Latin America Fixed Asset Tracking Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Fixed Asset Tracking Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 31: Latin America Fixed Asset Tracking Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 32: Latin America Fixed Asset Tracking Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Fixed Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Fixed Asset Tracking Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 35: Middle East Fixed Asset Tracking Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East Fixed Asset Tracking Industry Revenue (undefined), by Type 2025 & 2033

- Figure 37: Middle East Fixed Asset Tracking Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East Fixed Asset Tracking Industry Revenue (undefined), by Deployment Model 2025 & 2033

- Figure 39: Middle East Fixed Asset Tracking Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 40: Middle East Fixed Asset Tracking Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Fixed Asset Tracking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 4: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 8: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 12: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 16: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 20: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Deployment Model 2020 & 2033

- Table 24: Global Fixed Asset Tracking Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Asset Tracking Industry?

The projected CAGR is approximately 12.63%.

2. Which companies are prominent players in the Fixed Asset Tracking Industry?

Key companies in the market include Infor Inc, Osource Global, Tracet (Adaequare Info Pvt Ltd ), Ramco Systems, AssetWorks LLC, IBM Corporation, RCS Technologie, Xero Ltd, Asset Panda LLC, EZ Web Enterprises Inc, FMIS Ltd, Mynd Integrated Solutions, InfoFort LLC, SAP SE.

3. What are the main segments of the Fixed Asset Tracking Industry?

The market segments include End-user Industry, Type, Deployment Model.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Optimizing Operational Cost; Increasing Adoption of IoT-based Assets.

6. What are the notable trends driving market growth?

Industrial Manufacturing is Expected to Exhibit Maximum Adoption.

7. Are there any restraints impacting market growth?

; High Upfront Cost Act as a Hindrance for SMEs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Asset Tracking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Asset Tracking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Asset Tracking Industry?

To stay informed about further developments, trends, and reports in the Fixed Asset Tracking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence