Key Insights

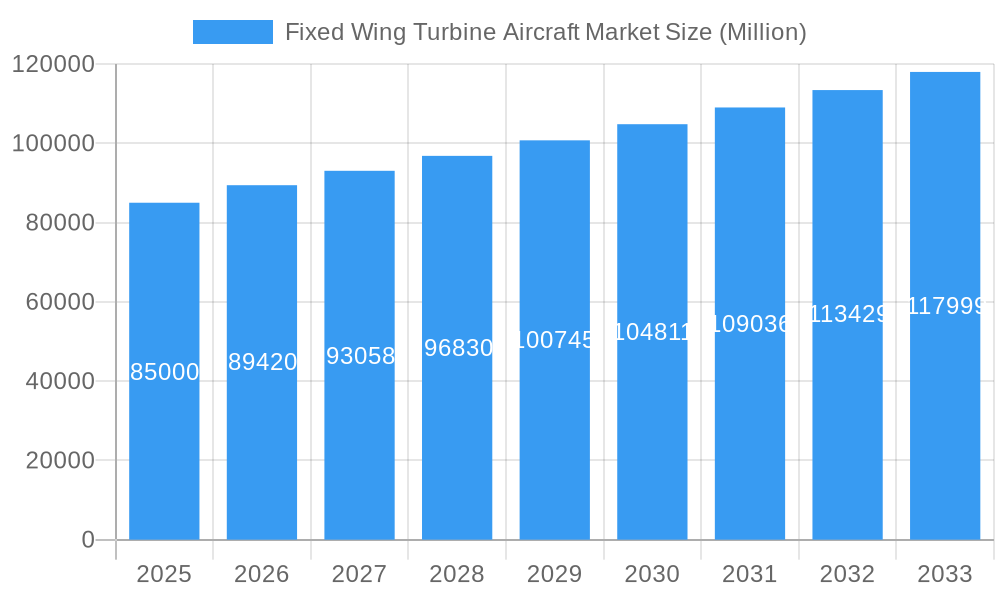

The global Fixed Wing Turbine Aircraft Market is poised for significant expansion, projected to reach a substantial market size by 2033. Driven by a robust Compound Annual Growth Rate (CAGR) of 5.20% from a base year of 2025, this growth is underpinned by several key factors. The increasing demand for faster and more efficient air travel, particularly in the commercial aviation sector, is a primary catalyst. Furthermore, the expanding role of business jets in corporate travel and the continuous modernization of military aviation fleets are contributing significantly to market momentum. Technological advancements, including the development of more fuel-efficient engines and advanced avionics, are also playing a crucial role in driving demand for new aircraft and upgrades. The market is also benefiting from a rising global middle class, leading to increased leisure travel and a subsequent surge in demand for commercial aircraft.

Fixed Wing Turbine Aircraft Market Market Size (In Billion)

However, the market is not without its challenges. Stringent environmental regulations and the increasing focus on sustainable aviation fuels may necessitate significant investments in research and development for greener technologies, potentially acting as a restraint. High initial procurement costs and the long replacement cycles for aircraft can also impact immediate growth. Despite these hurdles, the market is expected to witness strong performance across various segments. Commercial aircraft are anticipated to dominate due to sustained passenger traffic growth, while business jets will continue to be a vital segment for corporate mobility. Military aviation will also remain a stable contributor, driven by defense spending and modernization programs. Geographically, North America and Europe are expected to lead, followed by the rapidly growing Asia Pacific region, which presents immense future potential due to its expanding economies and increasing air travel penetration.

Fixed Wing Turbine Aircraft Market Company Market Share

Comprehensive Report: Fixed Wing Turbine Aircraft Market - Global Analysis and Forecast (2019-2033)

This in-depth market research report provides an exhaustive analysis of the global fixed wing turbine aircraft market, covering the historical period from 2019 to 2024, a base year of 2025, and an extensive forecast period extending to 2033. We delve into market dynamics, segmentation, key drivers, challenges, and emerging opportunities, offering actionable insights for industry stakeholders. The report focuses on critical segments including Business Jets, Military Aircraft, and Commercial Aircraft, and applications such as General Aviation, Scheduled Air Transport, and Military Aviation. Our analysis incorporates recent industry developments and strategic outlooks to provide a holistic view of the market's trajectory.

Fixed Wing Turbine Aircraft Market Market Concentration & Innovation

The fixed wing turbine aircraft market exhibits a moderate to high degree of concentration, driven by significant capital investment requirements and complex technological expertise. Major players like Textron Aviation, Airbus SE, and Boeing dominate market share, with their extensive portfolios and established global distribution networks. Innovation is a key differentiator, fueled by the pursuit of enhanced fuel efficiency, advanced avionics, sustainable aviation fuels (SAFs), and improved passenger comfort. Regulatory frameworks, including stringent safety standards and environmental mandates from bodies like the FAA and EASA, play a crucial role in shaping product development and market entry. The threat of product substitutes is relatively low in the high-end turbine aircraft segment, given the specialized nature of operations. End-user trends are shifting towards greater demand for longer range, increased cabin space in business jets, and more efficient, eco-friendly options in commercial aviation. Mergers and acquisition (M&A) activities, though not as frequent as in some other sectors, are strategic maneuvers to consolidate market position, acquire new technologies, or expand geographical reach. For instance, past M&A deals in the aerospace sector have often involved component suppliers or niche technology providers, valuing these transactions in the hundreds of millions of dollars.

Fixed Wing Turbine Aircraft Market Industry Trends & Insights

The global fixed wing turbine aircraft market is poised for robust growth, driven by several interconnected trends and compelling insights. The estimated market size for 2025 is projected to reach XXX Million, with a Compound Annual Growth Rate (CAGR) of approximately X.X% anticipated from 2025 to 2033. A significant driver of this growth is the escalating demand for business aviation, fueled by the increasing number of high-net-worth individuals and the need for efficient, flexible travel solutions for corporate executives. Technological advancements are at the forefront, with manufacturers investing heavily in research and development to create aircraft with improved fuel efficiency, reduced emissions, and enhanced operational capabilities. The integration of advanced avionics, fly-by-wire systems, and composite materials are becoming standard, contributing to lighter, faster, and more sustainable aircraft. Consumer preferences are evolving; while speed and range remain paramount, there is a growing emphasis on passenger experience, including cabin comfort, connectivity, and personalized services. The commercial aviation segment is witnessing a resurgence post-pandemic, with airlines focusing on fleet modernization to improve operational efficiency and meet environmental targets. This includes the development of next-generation narrow-body and wide-body aircraft that offer lower operating costs and reduced environmental impact. The military aviation sector continues to be a stable market, driven by national defense budgets and the need for advanced surveillance, transport, and combat aircraft. Competitive dynamics are characterized by intense innovation and strategic alliances among key players. Companies are focusing on differentiated product offerings, customized solutions, and after-sales services to maintain their market share. The exploration of hybrid-electric and all-electric propulsion systems, though in early stages, represents a significant future technological disruption that could redefine the market landscape. Furthermore, the increasing adoption of digital technologies, such as AI for predictive maintenance and advanced simulation for design and testing, is streamlining manufacturing processes and reducing development cycles. The market penetration of advanced aircraft technologies is expected to deepen as costs decrease and the benefits become more apparent to a wider range of operators.

Dominant Markets & Segments in Fixed Wing Turbine Aircraft Market

The fixed wing turbine aircraft market is characterized by distinct regional dominance and segment preferences, shaped by economic policies, infrastructure development, and geopolitical factors.

Aircraft Type Dominance:

- Business Jets: This segment holds significant sway, particularly in North America and Europe, driven by robust economies, a high concentration of corporate headquarters, and a strong culture of private air travel.

- Key Drivers: Favorable tax policies for corporate aircraft ownership, a mature MRO (Maintenance, Repair, and Overhaul) infrastructure, and the presence of leading business jet manufacturers like Textron Aviation, Bombardier Inc., and Dassault Falcon Jet Corp. The demand for ultra-long-range and high-performance jets continues to grow, supporting market expansion.

- Military Aircraft: Global defense spending remains a consistent catalyst for this segment. Major defense powers and their allies are key markets.

- Key Drivers: Geopolitical tensions, modernization programs for air forces, and the development of advanced capabilities such as stealth technology, electronic warfare, and unmanned aerial systems (UAS) integration. Countries like the United States, China, and Russia are major consumers and producers.

- Commercial Aircraft: This segment is heavily influenced by global economic growth, passenger traffic trends, and the operational efficiency demands of airlines.

- Key Drivers: The growing middle class in emerging economies, increasing air travel demand for both leisure and business, and the need for fuel-efficient, environmentally compliant aircraft. Asia-Pacific, particularly China and India, is a rapidly expanding market for commercial aircraft.

Application Dominance:

- Scheduled Air Transport: This is the largest application by volume, directly tied to global passenger and cargo demand.

- Key Drivers: Growing tourism, global trade, and the expansion of low-cost carriers, especially in developing regions. Infrastructure development, including the expansion of airports and air traffic control systems, is crucial for sustained growth. The demand for efficient narrow-body and wide-body aircraft is paramount here, with Airbus SE and The Boeing Company leading production.

- General Aviation: While smaller in terms of individual aircraft value, general aviation remains a vital application, encompassing private ownership, charter services, and flight training.

- Key Drivers: A strong culture of private aviation in North America, increasing demand for fractional ownership and jet card programs, and the growth of flight training schools. The growth in this segment is often linked to overall economic prosperity.

- Military Aviation: This application is intrinsically linked to national security and defense strategies.

- Key Drivers: Active military operations, regional security concerns, and the ongoing need for tactical and strategic air assets. Procurement cycles for military aircraft are typically long-term and subject to government budgeting.

Geographically, North America continues to be a dominant market due to its established aerospace industry, high disposable income for business aviation, and substantial defense spending. Europe follows closely, with a strong manufacturing base and significant demand for both business and commercial aircraft. The Asia-Pacific region is emerging as a critical growth engine, particularly for commercial aircraft, driven by expanding economies and increasing air travel penetration.

Fixed Wing Turbine Aircraft Market Product Developments

Product development in the fixed wing turbine aircraft market is intensely focused on enhancing performance, sustainability, and operational efficiency. Key trends include the introduction of aircraft with longer range capabilities, such as Bombardier's Global 8000, designed to cater to the growing demand for non-stop intercontinental travel. Manufacturers are also investing in sustainable aviation technologies, exploring SAF compatibility and developing more fuel-efficient engine designs. The integration of advanced avionics and cabin technologies, offering enhanced connectivity, passenger comfort, and pilot assistance systems, provides a competitive edge. These innovations aim to reduce operating costs for operators, improve the passenger experience, and meet increasingly stringent environmental regulations, thereby securing market relevance and attracting a diverse customer base across business, commercial, and military applications.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the fixed wing turbine aircraft market segmented by Aircraft Type and Application.

Aircraft Type:

- Business Jets: This segment is characterized by high-value transactions and a focus on performance, range, and cabin amenities. Growth is driven by corporate expansion and wealth creation.

- Military Aircraft: Driven by defense budgets and geopolitical factors, this segment includes fighters, bombers, transport, and surveillance aircraft.

- Commercial Aircraft: This segment encompasses narrow-body and wide-body passenger jets and cargo planes, with growth tied to global travel demand and fleet modernization efforts.

Application:

- General Aviation: Includes private ownership, charter services, and flight training, with steady growth linked to economic prosperity.

- Scheduled Air Transport: The largest segment, comprising commercial passenger and cargo flights, with significant expansion expected in emerging economies.

- Military Aviation: Encompasses all aircraft used for defense purposes, with procurement cycles dictated by government defense strategies.

Each segment is analyzed for market size, growth projections, and competitive dynamics, offering detailed insights into their respective trajectories.

Key Drivers of Fixed Wing Turbine Aircraft Market Growth

The growth of the fixed wing turbine aircraft market is propelled by a confluence of technological, economic, and regulatory factors.

- Technological Advancements: Continuous innovation in engine efficiency, aerodynamics, and lighter materials leads to improved performance and reduced operating costs. The development of advanced avionics and cabin technologies also enhances passenger experience and operational safety.

- Economic Growth and Globalization: A growing global economy, particularly in emerging markets, fuels demand for air travel, both commercial and business. Increased wealth creation leads to higher demand for business jets and fractional ownership programs.

- Increasing Air Passenger Traffic: The ongoing rise in global air passenger numbers, both for leisure and business, directly drives the demand for new commercial aircraft and fleet expansion by airlines.

- Defense Spending and Geopolitical Factors: Sustained or increased defense budgets by governments worldwide, coupled with geopolitical developments, necessitate the procurement and modernization of military aircraft fleets.

Challenges in the Fixed Wing Turbine Aircraft Market Sector

Despite robust growth prospects, the fixed wing turbine aircraft market faces several significant challenges.

- High Capital Investment and Long Development Cycles: The development and manufacturing of turbine aircraft require immense capital investment and lengthy research and development timelines, creating high barriers to entry for new players.

- Stringent Regulatory Compliance: Adhering to evolving safety, environmental, and noise regulations from bodies like the FAA and EASA adds complexity and cost to aircraft design and production.

- Supply Chain Volatility and Labor Shortages: Disruptions in the global aerospace supply chain, coupled with a shortage of skilled labor in manufacturing and MRO, can impact production schedules and increase costs.

- Economic Downturns and Geopolitical Instability: Global economic recessions, trade wars, or geopolitical conflicts can significantly dampen demand for discretionary purchases like business jets and impact airline profitability, thereby affecting new aircraft orders.

Emerging Opportunities in Fixed Wing Turbine Aircraft Market

The fixed wing turbine aircraft market is ripe with emerging opportunities driven by evolving technologies and shifting consumer preferences.

- Sustainable Aviation: The increasing focus on sustainability presents a significant opportunity for the development and adoption of sustainable aviation fuels (SAFs), hybrid-electric, and fully electric propulsion systems.

- Growth in Emerging Markets: Rapid economic development and a burgeoning middle class in regions like Asia-Pacific and the Middle East are creating substantial demand for both commercial and business aviation.

- Advanced Air Mobility (AAM): While often associated with smaller aircraft, the principles of AAM and the technologies developed for it could influence the design and operation of future fixed-wing turbine aircraft, particularly in short-haul or specialized applications.

- Digitalization and AI: The integration of artificial intelligence, machine learning, and advanced data analytics offers opportunities for optimized aircraft design, predictive maintenance, and enhanced flight operations, leading to greater efficiency and cost savings.

Leading Players in the Fixed Wing Turbine Aircraft Market Market

- Textron Aviation

- Airbus SE

- De Havilland Aircraft of Canada

- Pilatus Aircraft Ltd

- Embraer S A

- Bombardier Inc

- Dassault Falcon Jet Corp

- Gulfstream Aerospace Corporation

- The Boeing Company

Key Developments in Fixed Wing Turbine Aircraft Market Industry

- May 2022: Bombardier unveiled the newest member of its industry-leading business jet portfolio with the introduction of the Global 8000 aircraft, the world's fastest and longest-range purpose-built business jet.

- June 2022: Brazilian plane maker, Embraer SA, is exploring strategic partnerships globally, including in India, to build its first turboprop aircraft.

Strategic Outlook for Fixed Wing Turbine Aircraft Market Market

The strategic outlook for the fixed wing turbine aircraft market is one of sustained innovation and expansion. Key growth catalysts include the continued demand for efficient and high-performance business jets, the ongoing fleet modernization in commercial aviation driven by environmental concerns and passenger experience, and consistent defense spending in the military sector. The market is expected to benefit from advancements in sustainable aviation technologies, including the wider adoption of SAFs and the exploration of novel propulsion systems. Furthermore, the untapped potential in emerging economies presents significant opportunities for market penetration. Companies focusing on digitalization, advanced manufacturing techniques, and strategic partnerships will be well-positioned to capitalize on future market growth and navigate evolving industry dynamics, ensuring long-term competitiveness and value creation.

Fixed Wing Turbine Aircraft Market Segmentation

-

1. Aircraft Type

- 1.1. Business Jets

- 1.2. Military Aircraft

- 1.3. Commercial Aircraft

-

2. Application

- 2.1. General Aviation

- 2.2. Scheduled Air Transport

- 2.3. Military Aviation

Fixed Wing Turbine Aircraft Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Fixed Wing Turbine Aircraft Market Regional Market Share

Geographic Coverage of Fixed Wing Turbine Aircraft Market

Fixed Wing Turbine Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Business Jet Segment Will Drive the Market Due to Increase in High-net-worth Individuals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Business Jets

- 5.1.2. Military Aircraft

- 5.1.3. Commercial Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. General Aviation

- 5.2.2. Scheduled Air Transport

- 5.2.3. Military Aviation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Business Jets

- 6.1.2. Military Aircraft

- 6.1.3. Commercial Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. General Aviation

- 6.2.2. Scheduled Air Transport

- 6.2.3. Military Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Europe Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Business Jets

- 7.1.2. Military Aircraft

- 7.1.3. Commercial Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. General Aviation

- 7.2.2. Scheduled Air Transport

- 7.2.3. Military Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Asia Pacific Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Business Jets

- 8.1.2. Military Aircraft

- 8.1.3. Commercial Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. General Aviation

- 8.2.2. Scheduled Air Transport

- 8.2.3. Military Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Latin America Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Business Jets

- 9.1.2. Military Aircraft

- 9.1.3. Commercial Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. General Aviation

- 9.2.2. Scheduled Air Transport

- 9.2.3. Military Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Middle East and Africa Fixed Wing Turbine Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Business Jets

- 10.1.2. Military Aircraft

- 10.1.3. Commercial Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. General Aviation

- 10.2.2. Scheduled Air Transport

- 10.2.3. Military Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Aviation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 De Havilland Aircraft of Canad

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pilatus Aircraft Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embraer S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bombardier Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dassault Falcon Jet Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gulfstream Aerospace Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Boeing Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Textron Aviation

List of Figures

- Figure 1: Global Fixed Wing Turbine Aircraft Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 3: North America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fixed Wing Turbine Aircraft Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 9: Europe Fixed Wing Turbine Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 10: Europe Fixed Wing Turbine Aircraft Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Fixed Wing Turbine Aircraft Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Fixed Wing Turbine Aircraft Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Fixed Wing Turbine Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 15: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Fixed Wing Turbine Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 21: Latin America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 22: Latin America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Fixed Wing Turbine Aircraft Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Fixed Wing Turbine Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 27: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 28: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 5: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 10: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Russia Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 19: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: India Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: China Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 27: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Mexico Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Brazil Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Fixed Wing Turbine Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Fixed Wing Turbine Aircraft Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Wing Turbine Aircraft Market?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the Fixed Wing Turbine Aircraft Market?

Key companies in the market include Textron Aviation, Airbus SE, De Havilland Aircraft of Canad, Pilatus Aircraft Ltd, Embraer S A, Bombardier Inc, Dassault Falcon Jet Corp, Gulfstream Aerospace Corporation, The Boeing Company.

3. What are the main segments of the Fixed Wing Turbine Aircraft Market?

The market segments include Aircraft Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Business Jet Segment Will Drive the Market Due to Increase in High-net-worth Individuals.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: Bombardier unveiled the newest member of its industry-leading business jet portfolio with the introduction of the Global 8000 aircraft, the world's fastest and longest-range purpose-built business jet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Wing Turbine Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Wing Turbine Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Wing Turbine Aircraft Market?

To stay informed about further developments, trends, and reports in the Fixed Wing Turbine Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence