Key Insights

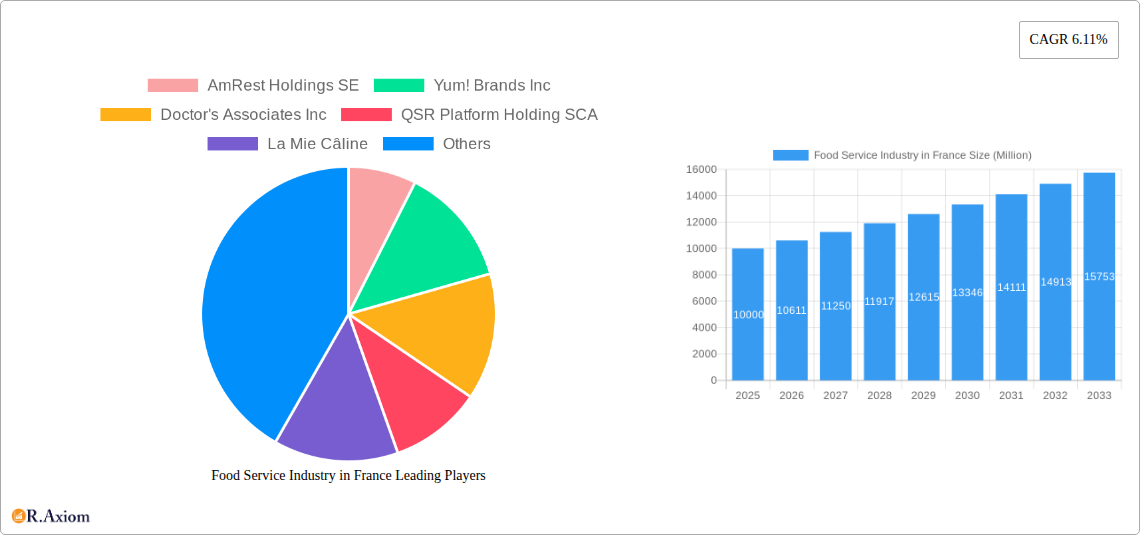

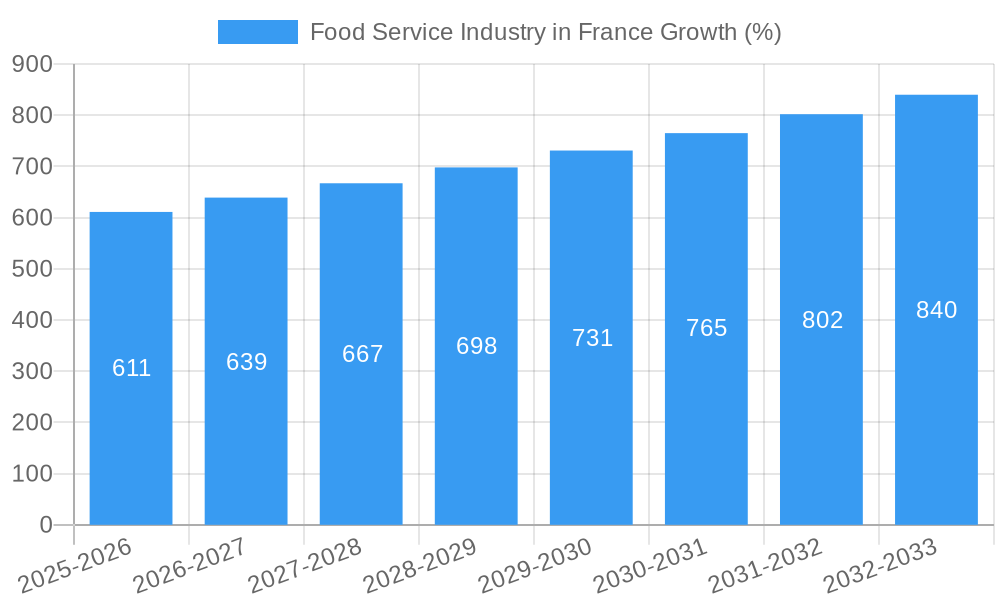

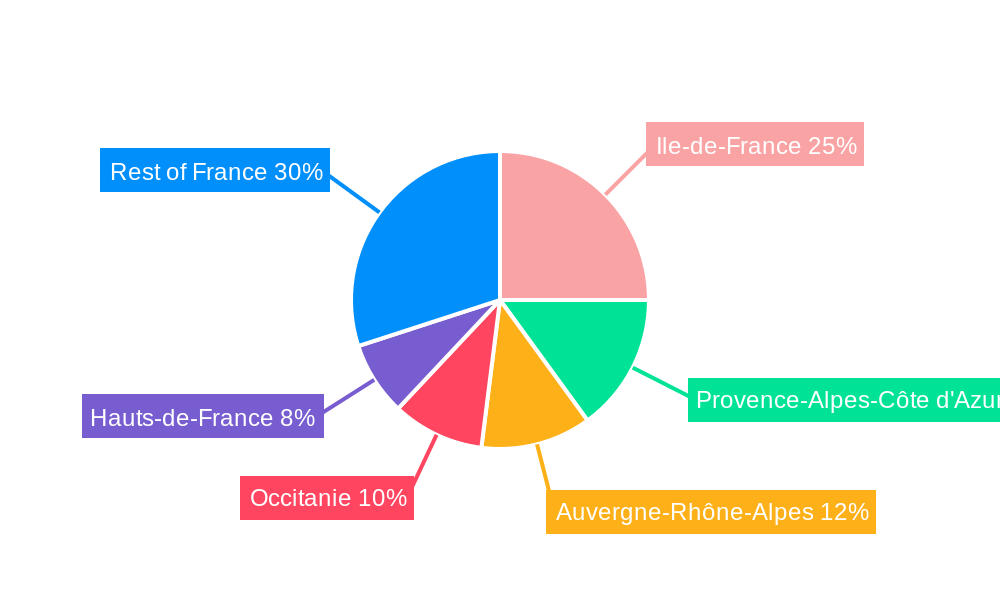

The French food service industry, a dynamic and significant sector within the broader European economy, is projected to experience robust growth over the next decade. Driven by factors such as increasing urbanization, rising disposable incomes, and a burgeoning tourism sector, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.11% from 2025 to 2033. This growth is fueled by evolving consumer preferences, with a notable shift towards diverse culinary experiences and convenient, on-the-go dining options. The rise of quick-service restaurants (QSRs) and cafes, particularly in urban centers and tourist hotspots, is a key contributor to this trend. Further segmentation reveals that chained outlets are currently dominating the market share, benefiting from established brand recognition and efficient operations. However, independent outlets are experiencing growth, catering to the increasing demand for unique and personalized dining experiences. Geographic segmentation shows strong performance across major metropolitan areas such as Paris, Lyon, and Marseille, with leisure and tourism locations experiencing particularly high demand.

The competitive landscape is characterized by both large multinational corporations like McDonald's and AmRest, and smaller, locally-owned businesses. The market's resilience is evident in its ability to adapt to shifting economic conditions and consumer demands. While challenges exist, such as fluctuating food costs and labor shortages, the overall outlook remains positive. Strategic partnerships, innovative menu offerings, and a focus on enhancing the customer experience are key strategies employed by successful players in this competitive market. Future growth is anticipated to be influenced by technological advancements, such as online ordering and delivery services, along with a growing emphasis on sustainability and ethical sourcing practices within the industry. The French food service industry is poised to continue its upward trajectory, presenting significant opportunities for both established players and new entrants.

Food Service Industry in France: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Food Service Industry in France, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory through the estimated year (2025) and the forecast period (2025-2033). This in-depth study is essential for businesses, investors, and stakeholders seeking to understand and navigate the dynamic French food service landscape.

Food Service Industry in France Market Concentration & Innovation

The French food service market exhibits a blend of large multinational corporations and smaller, independent operators. Market concentration is moderate, with a few dominant players holding significant market share, yet a large number of smaller businesses contributing significantly to the overall market size. The estimated market value in 2025 is €XX Million. Key players like McDonald's Corporation and AmRest Holdings SE hold a substantial share, while regional and independent chains maintain a strong presence, particularly in specific cuisines or locations.

Innovation in the French food service sector is driven by several factors:

- Consumer demand for diverse cuisines: A rising appetite for international flavors fuels innovation in menu offerings.

- Technological advancements: Digital ordering, online delivery platforms, and automated kitchen technologies are transforming operations.

- Sustainability concerns: Growing environmental consciousness is leading to innovations in sourcing, packaging, and waste reduction.

- Health and wellness trends: Demand for healthier options and personalized dietary choices fuels the development of new menu items.

Mergers and acquisitions (M&A) are common, with deal values varying significantly. For example, Lagardère Travel Retail's acquisition of Marché International AG in November 2022 demonstrates the ongoing consolidation within the sector. The total value of M&A activity in the past five years is estimated at €XX Million. Regulatory frameworks, while generally supportive of business growth, influence operational practices, such as food safety regulations and labor laws. Product substitutes, including home-cooked meals and meal delivery services, pose a competitive challenge, particularly in the casual dining segment.

Food Service Industry in France Industry Trends & Insights

The French food service market is experiencing robust growth, driven by several key trends:

The market is projected to achieve a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is fueled by rising disposable incomes, changing lifestyles, and a preference for dining out and convenient food options. Technological disruptions, such as the increased adoption of online ordering and delivery platforms, are reshaping consumer behavior and creating new opportunities for businesses.

Consumer preferences are shifting towards healthier, more sustainable, and ethically sourced food options. This is impacting menu offerings and operational practices across various segments. The competitive dynamics are intense, with established players facing challenges from new entrants and innovative business models. Market penetration of online food delivery services is growing rapidly, particularly in urban areas, which is transforming the competitive landscape. The increasing popularity of quick-service restaurants (QSRs) and casual dining establishments continues to drive market growth, impacting the overall market share of traditional restaurants.

Dominant Markets & Segments in Food Service Industry in France

The French food service market is diverse, with various segments exhibiting varying levels of dominance.

- Leading Foodservice Type: QSR cuisines dominate, driven by convenience and affordability, while cafes and bars maintain a substantial presence, particularly in urban areas.

- Dominant Outlet Type: Chained outlets, driven by brand recognition and economies of scale, hold a significant market share. However, independent outlets continue to thrive, particularly in specialized niches and local markets.

- Leading Location Type: Standalone restaurants and those within retail spaces represent the most significant portion of the market. Growth in travel and leisure segments is also significant.

Key Drivers:

- Strong Tourism Sector: France's robust tourism industry contributes significantly to the food service market, particularly in locations frequented by tourists.

- Government Support: Government policies aimed at promoting the hospitality and food industries provide support and stability to businesses.

- Developed Infrastructure: Well-developed transportation and logistics networks ensure the smooth flow of supplies and facilitate access to various locations.

Food Service Industry in France Product Developments

Recent product innovations focus on customization, healthier options, and convenient formats. Technologically driven advancements, including digital menu boards, automated ordering systems, and personalized recommendations, enhance customer experience. The market emphasizes products that align with contemporary consumer preferences for sustainability, ethical sourcing, and healthier ingredients. These innovations enhance the competitive advantage of companies that embrace them.

Report Scope & Segmentation Analysis

This report segments the French food service market across several key parameters:

Foodservice Type: Cafes & Bars, Other QSR Cuisines (with growth projections and market size estimations for each). Competitive dynamics vary significantly within these segments, with some characterized by intense competition and others by niche specializations.

Outlet Type: Chained Outlets (with projected growth and market size estimates) and Independent Outlets (with analysis of growth drivers and market share) – This segmentation provides insights into different operational models and business strategies.

Location Type: Leisure, Lodging, Retail, Standalone, and Travel (each segment assessed for growth potential, market size, and competitive dynamics). The report considers each location type's influence on the food service sector's operational needs and revenue streams.

Key Drivers of Food Service Industry in France Growth

Several factors fuel the growth of the French food service industry:

- Rising Disposable Incomes: Increased purchasing power enables consumers to spend more on dining out.

- Changing Lifestyles: Busy schedules and a preference for convenience drive demand for quick-service restaurants and delivery options.

- Tourism: France's popularity as a tourist destination boosts revenue for food service businesses.

- Technological Advancements: Digital ordering, delivery apps, and automated systems improve efficiency and customer experience.

Challenges in the Food Service Industry in France Sector

The industry faces several challenges:

- High Labor Costs: Staffing costs represent a significant expense for many businesses.

- Rising Food Prices: Fluctuations in food prices impact profitability and menu pricing.

- Intense Competition: The market is highly competitive, with established players and new entrants vying for market share.

- Regulatory Compliance: Adhering to food safety and labor regulations adds complexity to operations.

Emerging Opportunities in Food Service Industry in France

The market presents several opportunities:

- Growth of Online Food Delivery: The increasing popularity of food delivery platforms presents significant opportunities.

- Healthier and Sustainable Options: Consumer demand for healthier and more sustainable choices creates room for innovation.

- Expansion into Niche Markets: Catering to specialized dietary needs or ethnic cuisines opens new market segments.

- Technological Integration: Adopting automation and digital technologies can increase efficiency and profitability.

Leading Players in the Food Service Industry in France Market

- AmRest Holdings SE

- Yum! Brands Inc

- Doctor's Associates Inc

- QSR Platform Holding SCA

- La Mie Câline

- Groupe Bertrand

- Carrefour SA

- The Blachere Group

- Agapes Restauration

- Groupe Le Duff

- Areas SAU

- Lagardère Group

- Domino's Pizza Enterprises Ltd

- Groupe Delineo

- Starbucks Corporation

- Hana Group

- McDonald's Corporation

- Soleo

Key Developments in Food Service Industry in France Industry

- November 2022: Lagardère Travel Retail acquired 100% of Marché International AG, expanding its market presence.

- March 2023: McDonald's France introduced vegetable fries, demonstrating responsiveness to consumer preferences.

- April 2023: QSR Platform Holding SCA partnered with Foodtastic to bring Pita Pit to France and Western Europe, signifying expansion into new markets.

Strategic Outlook for Food Service Industry in France Market

The French food service market exhibits strong growth potential, driven by evolving consumer preferences, technological advancements, and tourism. Businesses that adapt to changing consumer demands, embrace technological innovations, and focus on sustainability and ethical practices are well-positioned to capitalize on future market opportunities. The focus on convenience, diverse cuisines, and personalized experiences will remain pivotal in shaping future growth and competition.

Food Service Industry in France Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service Industry in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service Industry in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1 High coffee consumption in the country

- 3.4.2 attracts a large number of international players driving the growth of cafes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. Germany Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 12. France Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 13. Italy Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Food Service Industry in France Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 AmRest Holdings SE

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Yum! Brands Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Doctor's Associates Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 QSR Platform Holding SCA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 La Mie Câline

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Groupe Bertrand

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Carrefour SA

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 The Blachere Group

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Agapes Restauration

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Groupe Le Duff

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Areas SAU

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Lagardère Group

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Domino's Pizza Enterprises Ltd

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Groupe Delineo

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Starbucks Corporation

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Hana Group

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 McDonald's Corporation

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.18 Soleo

- 18.2.18.1. Overview

- 18.2.18.2. Products

- 18.2.18.3. SWOT Analysis

- 18.2.18.4. Recent Developments

- 18.2.18.5. Financials (Based on Availability)

- 18.2.1 AmRest Holdings SE

List of Figures

- Figure 1: Global Food Service Industry in France Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Food Service Industry in France Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Food Service Industry in France Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Food Service Industry in France Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Food Service Industry in France Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Food Service Industry in France Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Food Service Industry in France Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Food Service Industry in France Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Food Service Industry in France Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service Industry in France Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service Industry in France Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 23: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 24: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 29: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 30: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 31: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 42: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 43: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 44: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Turkey Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Israel Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: GCC Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: North Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East & Africa Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Food Service Industry in France Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 52: Global Food Service Industry in France Revenue Million Forecast, by Outlet 2019 & 2032

- Table 53: Global Food Service Industry in France Revenue Million Forecast, by Location 2019 & 2032

- Table 54: Global Food Service Industry in France Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: India Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Japan Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: ASEAN Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Oceania Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Food Service Industry in France Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service Industry in France?

The projected CAGR is approximately 6.11%.

2. Which companies are prominent players in the Food Service Industry in France?

Key companies in the market include AmRest Holdings SE, Yum! Brands Inc, Doctor's Associates Inc, QSR Platform Holding SCA, La Mie Câline, Groupe Bertrand, Carrefour SA, The Blachere Group, Agapes Restauration, Groupe Le Duff, Areas SAU, Lagardère Group, Domino's Pizza Enterprises Ltd, Groupe Delineo, Starbucks Corporation, Hana Group, McDonald's Corporation, Soleo.

3. What are the main segments of the Food Service Industry in France?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

High coffee consumption in the country. attracts a large number of international players driving the growth of cafes..

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

April 2023: QSR Platform Holding SCA announced that it would be partnering with Foodtastic to bring the Pita Pit brand to France and Western Europe by opening 50 Pita Pits. In return, Foodtastic will expand O'Tacos in Canada by opening at least 50 locations in 2023.March 2023: McDonald's France replaced its potatoes with french fries and offered vegetable fries for a limited time. During this period, beets, carrots, and parsnips replaced the famous potato fries.November 2022: Lagardère Travel Retail signed an agreement to acquire 100% of the shares in Marché International AG, the holding company of the Marché Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service Industry in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service Industry in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service Industry in France?

To stay informed about further developments, trends, and reports in the Food Service Industry in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence