Key Insights

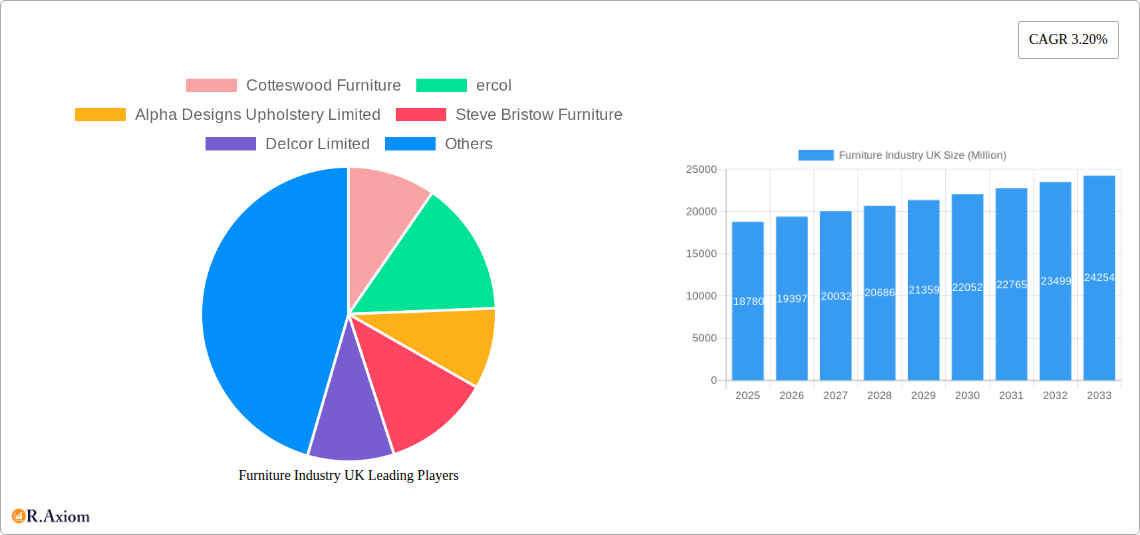

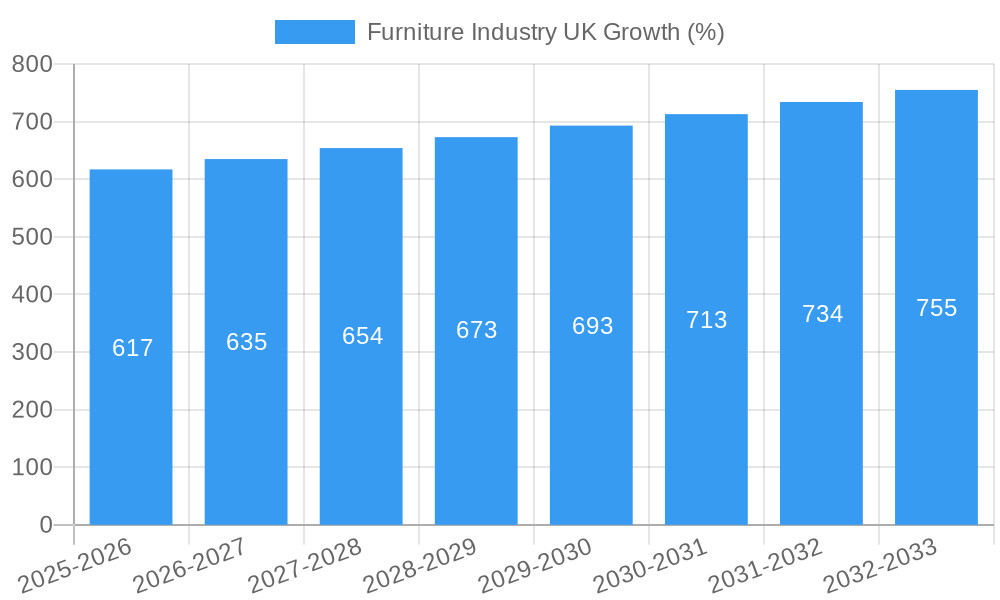

The UK furniture market, valued at £18.78 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.20% from 2025 to 2033. This growth is driven by several factors, including increasing disposable incomes, a rising demand for home improvement and renovation projects, and a shift towards more personalized and stylish home furnishings. The trend towards sustainable and ethically sourced furniture is also gaining momentum, influencing consumer choices and impacting the strategies of furniture manufacturers and retailers. However, challenges remain, primarily related to fluctuating material costs and global supply chain disruptions. These factors could exert pressure on profit margins and potentially moderate growth in certain segments. The market is segmented by product type (living room, dining room, bedroom, kitchen, and others) and distribution channels (home centers, flagship stores, specialty stores, online, and others). The online segment is experiencing rapid growth, fueled by the convenience and wider selection offered by e-commerce platforms. Key players such as IKEA, Wayfair, Dunelm, and DFS dominate the market, competing through a mix of price points, brand recognition, and diverse product offerings. Competition is expected to intensify further as smaller, specialized furniture companies increasingly leverage online channels to reach broader customer bases.

The strong performance of the online distribution channel is a notable feature, suggesting a continued shift towards e-commerce. This channel's growth necessitates investments in robust digital marketing strategies and streamlined logistics for furniture retailers. While the home improvement sector's overall growth remains positive, managing supply chain vulnerabilities and rising raw material costs will be crucial for companies seeking to maintain profitability. The market’s segmentation offers significant opportunities for specialized companies focusing on niche product categories or design aesthetics, allowing them to cater to specific consumer preferences and potentially command premium pricing. The increasing focus on sustainability presents both a challenge and an opportunity – companies embracing sustainable practices may attract environmentally conscious customers, while those failing to adapt risk losing market share.

Furniture Industry UK: Market Analysis & Forecast Report (2019-2033)

This comprehensive report provides an in-depth analysis of the UK furniture industry, encompassing market size, segmentation, competitive landscape, and future growth projections. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Key players analyzed include Cotteswood Furniture, ercol, Alpha Designs Upholstery Limited, Steve Bristow Furniture, Delcor Limited, DFS Furniture PLC, Steinhoff UK Retail Limited, Andrena Furniture Ltd, Dunelm Group PLC, Wayfair Inc, IKEA, Bed Bath & Beyond Inc (list not exhaustive). The report offers actionable insights for industry stakeholders, investors, and businesses operating within this dynamic market. The total market size is estimated at £XX Billion in 2025.

Furniture Industry UK Market Concentration & Innovation

The UK furniture market exhibits a moderately concentrated structure, with a few large players holding significant market share alongside numerous smaller, specialized businesses. DFS Furniture PLC and Dunelm Group PLC are among the dominant players, commanding a combined market share estimated at xx%. However, the presence of numerous smaller companies and the rise of online retailers like Wayfair Inc creates a competitive landscape. Innovation is driven by factors such as sustainable sourcing, technological advancements in manufacturing and design, and increasing consumer demand for customized and multifunctional furniture.

- Market Share: DFS Furniture PLC (xx%), Dunelm Group PLC (xx%), IKEA (xx%), Others (xx%).

- M&A Activity: Over the historical period (2019-2024), the total value of M&A deals in the UK furniture industry is estimated to be £xx Billion, reflecting consolidation trends within the sector. A significant portion of this activity involves acquisitions by larger companies to expand their product portfolios and market reach.

- Regulatory Framework: UK regulations concerning product safety, environmental standards, and labor practices significantly impact the industry.

- Product Substitutes: The rise of multi-functional furniture and alternative materials presents challenges to traditional furniture manufacturers.

- End-User Trends: Growing preference for sustainable and ethically sourced furniture is driving innovation. Consumer demand is shifting towards modular, customizable designs reflecting individual lifestyles.

Furniture Industry UK Industry Trends & Insights

The UK furniture market is experiencing steady growth driven by factors such as increasing disposable incomes, rising urbanization, and a growing focus on home improvement. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, indicating moderate expansion. However, this growth is impacted by economic fluctuations, changing consumer preferences, and technological disruptions. The market penetration of online furniture sales is increasing significantly, challenging traditional retail models. Competitive dynamics are characterized by both intense competition and collaborative ventures focusing on sustainable practices and product innovation.

Technological disruptions, including the increasing use of 3D printing and virtual reality for design and customization, are creating new opportunities. Consumer preferences are evolving towards sustainable and ethically produced furniture, leading to greater demand for recycled and reclaimed materials.

Dominant Markets & Segments in Furniture Industry UK

The largest segment within the UK furniture market is living room furniture, representing approximately xx% of the market in 2025. This dominance is attributed to the importance of living rooms as social and relaxation spaces. The online distribution channel is experiencing the highest growth, reflecting changing consumer behavior and the increasing adoption of e-commerce.

- By Product Type:

- Living Room Furniture: Key drivers include increasing disposable incomes and a focus on home improvement.

- Bedroom Furniture: Market size is estimated at £xx Billion in 2025.

- Dining Room Furniture: Market size is estimated at £xx Billion in 2025.

- Kitchen Furniture: Market size is estimated at £xx Billion in 2025.

- Other Types: Market size is estimated at £xx Billion in 2025.

- By Distribution Channel:

- Online: Key drivers include convenience, wider selection, and competitive pricing.

- Home Centers: Key drivers include a wide selection of products and a convenient location for consumers.

- Flagship Stores: Key drivers include brand experience and dedicated customer service.

- Specialty Stores: Key drivers include specialization in particular styles or materials.

- Other Distribution Channels: Market size is estimated at £xx Billion in 2025.

Furniture Industry UK Product Developments

Recent product innovations in the UK furniture industry focus on incorporating sustainable materials, smart home integration, and modular designs for flexibility. Manufacturers are emphasizing customization options and incorporating technological advancements to enhance product functionality and appeal. The focus on sustainable and ethically sourced products provides a key competitive advantage in a market increasingly sensitive to environmental concerns.

Report Scope & Segmentation Analysis

This report segments the UK furniture market by product type (living room, dining room, bedroom, kitchen, other) and distribution channel (home centers, flagship stores, specialty stores, online, other). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The report provides detailed forecasts for each segment for the period 2025-2033, considering factors such as economic conditions, consumer trends, and technological advancements.

Key Drivers of Furniture Industry UK Growth

The UK furniture industry's growth is driven by several factors, including rising disposable incomes, a growing focus on home improvement, and increasing urbanization. Government policies promoting sustainable construction and renovation also contribute to market expansion. Technological advancements in design and manufacturing processes, along with the rise of e-commerce, are also crucial drivers.

Challenges in the Furniture Industry UK Sector

The UK furniture sector faces challenges including supply chain disruptions, rising material costs, and intense competition. Brexit impacts on import/export have further complicated sourcing and logistics. Meeting stringent environmental regulations and adapting to evolving consumer preferences also pose significant hurdles. The estimated cost impact of these challenges on the industry in 2025 is £xx Billion.

Emerging Opportunities in Furniture Industry UK

Emerging opportunities lie in the growing demand for sustainable and ethically produced furniture, customized and modular designs, and smart home integration. The rise of the sharing economy and rental furniture models also present new market avenues. The focus on personalization and user experience is key to capitalize on these trends.

Leading Players in the Furniture Industry UK Market

- Cotteswood Furniture

- ercol

- Alpha Designs Upholstery Limited

- Steve Bristow Furniture

- Delcor Limited

- DFS Furniture PLC

- Steinhoff UK Retail Limited

- Andrena Furniture Ltd

- Dunelm Group PLC

- Wayfair Inc

- IKEA

- Bed Bath & Beyond Inc

Key Developments in Furniture Industry UK Industry

- November 2023: IKEA launched a new mattress removal and recycling scheme, promoting sustainability and addressing environmental concerns.

- September 2023: Dunelm launched its 'Home of Homes' ad campaign, highlighting seasonal homeware and influencing consumer demand.

Strategic Outlook for Furniture Industry UK Market

The UK furniture market exhibits promising growth potential driven by sustained consumer demand for high-quality, sustainable, and technologically advanced products. Focus on innovation, sustainable practices, and adapting to changing consumer preferences will be crucial for success in this dynamic market. The market is poised for continued expansion, fueled by strong domestic demand and ongoing technological advancements within the industry.

Furniture Industry UK Segmentation

-

1. Product Type

- 1.1. Living Room Furniture

- 1.2. Dining Room Furniture

- 1.3. Bedroom Furniture

- 1.4. Kitchen Furniture

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Flagship Stores

- 2.3. Specialty Stores

- 2.4. Online

- 2.5. Other Distribution Channels

Furniture Industry UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Furniture Industry UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market

- 3.3. Market Restrains

- 3.3.1. High Competitive with a Large Number of Domestic and International Players; Changing Work Habits

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Furniture and Furnishings in the United Kingdom is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Living Room Furniture

- 5.1.2. Dining Room Furniture

- 5.1.3. Bedroom Furniture

- 5.1.4. Kitchen Furniture

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Flagship Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Living Room Furniture

- 6.1.2. Dining Room Furniture

- 6.1.3. Bedroom Furniture

- 6.1.4. Kitchen Furniture

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Home Centers

- 6.2.2. Flagship Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Living Room Furniture

- 7.1.2. Dining Room Furniture

- 7.1.3. Bedroom Furniture

- 7.1.4. Kitchen Furniture

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Home Centers

- 7.2.2. Flagship Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Living Room Furniture

- 8.1.2. Dining Room Furniture

- 8.1.3. Bedroom Furniture

- 8.1.4. Kitchen Furniture

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Home Centers

- 8.2.2. Flagship Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Living Room Furniture

- 9.1.2. Dining Room Furniture

- 9.1.3. Bedroom Furniture

- 9.1.4. Kitchen Furniture

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Home Centers

- 9.2.2. Flagship Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Living Room Furniture

- 10.1.2. Dining Room Furniture

- 10.1.3. Bedroom Furniture

- 10.1.4. Kitchen Furniture

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Home Centers

- 10.2.2. Flagship Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

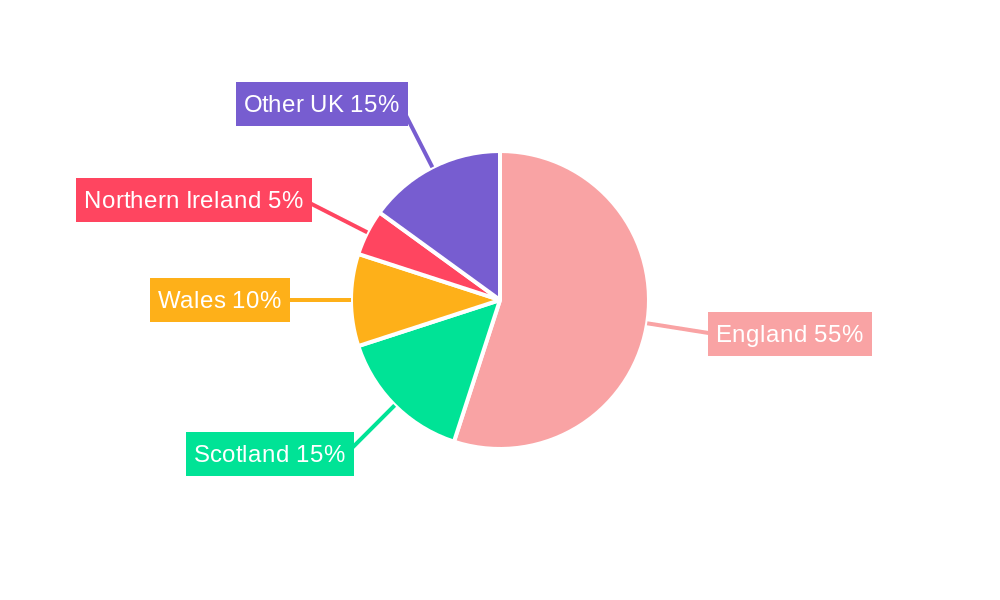

- 11. England Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 12. Wales Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 13. Scotland Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 14. Northern Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 15. Ireland Furniture Industry UK Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Cotteswood Furniture

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ercol

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Alpha Designs Upholstery Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Steve Bristow Furniture

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Delcor Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DFS Furniture PLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Steinhoff UK Retail Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Andrena Furniture Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dunelm Group PLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Wayfair Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 IKEA**List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Bed Bath & Beyond Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Cotteswood Furniture

List of Figures

- Figure 1: Global Furniture Industry UK Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Furniture Industry UK Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Furniture Industry UK Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Furniture Industry UK Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Furniture Industry UK Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Furniture Industry UK Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Furniture Industry UK Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Furniture Industry UK Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Furniture Industry UK Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Furniture Industry UK Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Furniture Industry UK Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Furniture Industry UK Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Furniture Industry UK Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Furniture Industry UK Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Furniture Industry UK Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Furniture Industry UK Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Furniture Industry UK Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Furniture Industry UK Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Furniture Industry UK Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Furniture Industry UK Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Furniture Industry UK Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Furniture Industry UK Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Furniture Industry UK Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Furniture Industry UK Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Furniture Industry UK Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Furniture Industry UK Revenue Million Forecast, by Product Type 2019 & 2032

- Table 45: Global Furniture Industry UK Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: Global Furniture Industry UK Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Furniture Industry UK Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Industry UK?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Furniture Industry UK?

Key companies in the market include Cotteswood Furniture, ercol, Alpha Designs Upholstery Limited, Steve Bristow Furniture, Delcor Limited, DFS Furniture PLC, Steinhoff UK Retail Limited, Andrena Furniture Ltd, Dunelm Group PLC, Wayfair Inc, IKEA**List Not Exhaustive, Bed Bath & Beyond Inc.

3. What are the main segments of the Furniture Industry UK?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market.

6. What are the notable trends driving market growth?

Increasing Expenditure on Furniture and Furnishings in the United Kingdom is Driving the Market.

7. Are there any restraints impacting market growth?

High Competitive with a Large Number of Domestic and International Players; Changing Work Habits.

8. Can you provide examples of recent developments in the market?

In November 2023, IKEA launched a new mattress removal and recycling scheme in partnership with The Furniture Recycling (TFR) Group. This initiative aims to offer a sustainable solution for recycling old mattresses that would otherwise end up as waste. The mattresses are recycled, and the materials they contain are reused.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Furniture Industry UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Furniture Industry UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Furniture Industry UK?

To stay informed about further developments, trends, and reports in the Furniture Industry UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence