Key Insights

The global Gastrointestinal Devices Market is projected for substantial growth, estimated to reach USD 12.76 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 6.45% projected through 2033. This expansion is driven by the rising incidence of gastrointestinal conditions like GERD, IBD, and colorectal cancer, influenced by demographic shifts and evolving lifestyle factors. Innovations in minimally invasive endoscopic techniques and advanced devices, such as capsule endoscopes and endoscopic ultrasounds, are improving diagnostic precision and treatment effectiveness, bolstering market demand. Increased global healthcare spending, particularly in emerging markets, and a greater focus on early detection and preventative care are further contributing to this positive market trend. Capsule endoscopy and endoscopic ultrasound are anticipated to experience particularly robust growth due to their non-invasive nature and enhanced patient outcomes.

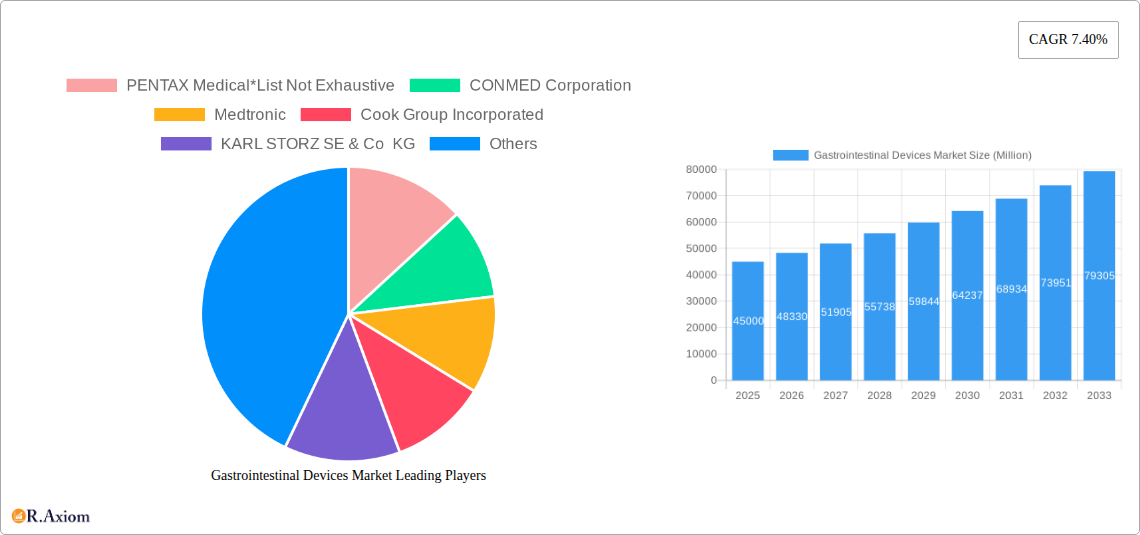

Gastrointestinal Devices Market Market Size (In Billion)

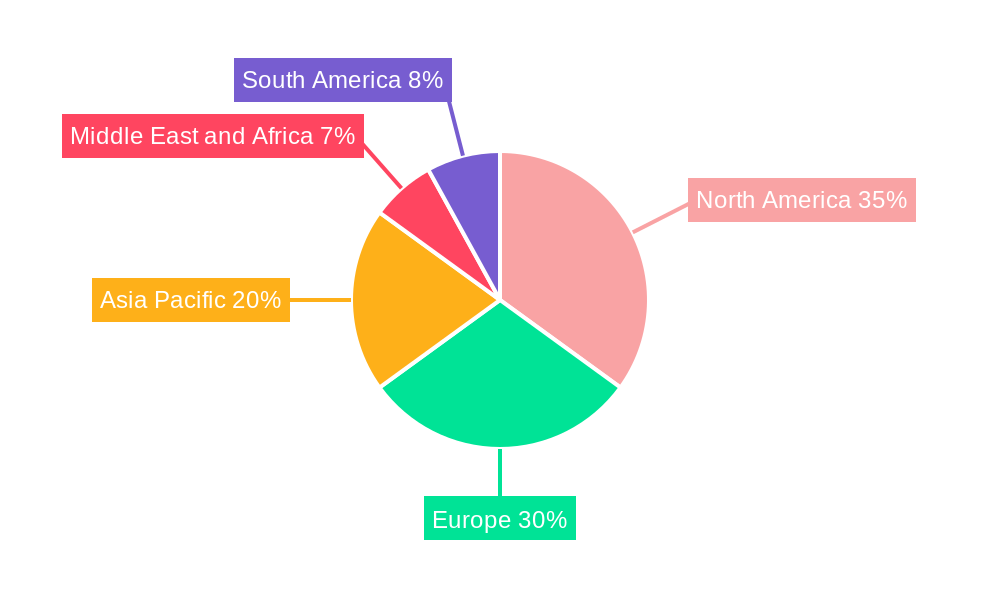

Market evolution is also shaped by the integration of cutting-edge technologies and sustained investment in research and development by key industry players. Manufacturers are committed to developing advanced, user-friendly gastrointestinal devices to address the changing requirements of clinicians and patients. However, factors such as the significant investment required for sophisticated endoscopic instrumentation and variable reimbursement policies in certain territories may present growth limitations. Nevertheless, heightened patient awareness of digestive health and the expanding healthcare infrastructure in developing regions offer considerable opportunities. While North America and Europe currently lead market share, the Asia Pacific region, characterized by its extensive population and rapidly advancing healthcare landscape, is emerging as a pivotal growth driver.

Gastrointestinal Devices Market Company Market Share

Gastrointestinal Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report delivers a definitive analysis of the global Gastrointestinal (GI) Devices Market, providing critical insights into market dynamics, segmentation, key players, and future trends. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders, including manufacturers, investors, healthcare providers, and regulatory bodies. We dissect the market's intricate landscape, offering actionable intelligence to navigate evolving challenges and capitalize on emerging opportunities. The forecast period of 2025–2033 is meticulously analyzed, building upon historical data from 2019–2024.

Gastrointestinal Devices Market Market Concentration & Innovation

The Gastrointestinal Devices Market exhibits a moderate to high level of concentration, with a few dominant players holding significant market share, estimated to be over 60% in the base year of 2025. Innovation is a key differentiator, driven by the increasing prevalence of gastrointestinal disorders, demand for minimally invasive procedures, and advancements in imaging and diagnostic technologies. The market is characterized by robust research and development investments aimed at enhancing device precision, patient comfort, and procedural efficiency. Regulatory frameworks, such as FDA approvals and CE marking, play a crucial role in product development and market access, influencing the pace of innovation and the introduction of novel GI devices. Product substitutes, while present in certain segments, are continually being outpaced by the development of more advanced and specialized GI devices. End-user trends point towards a growing preference for outpatient procedures and home-based monitoring, pushing for more portable and user-friendly GI diagnostic tools. Mergers and acquisitions (M&A) activities are strategically important for market expansion and technological integration, with deal values in recent years ranging from tens of millions to hundreds of millions of dollars. For instance, strategic acquisitions of smaller innovative companies by larger players are expected to further consolidate the market and accelerate the adoption of cutting-edge technologies.

Gastrointestinal Devices Market Industry Trends & Insights

The Gastrointestinal Devices Market is poised for significant expansion, driven by an escalating global burden of gastrointestinal diseases and a growing awareness of their early detection and management. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. Key growth drivers include an aging global population, which is inherently more susceptible to GI-related ailments, and the rising incidence of lifestyle-related disorders such as obesity and inflammatory bowel disease. Technological disruptions are reshaping the landscape, with the advent of artificial intelligence (AI) in image analysis for endoscopy, miniaturization of devices for enhanced patient comfort, and the development of advanced therapeutic GI instruments. Consumer preferences are increasingly aligning with minimally invasive techniques, leading to a surge in demand for endoscopic procedures over traditional surgical interventions. This shift not only improves patient outcomes but also reduces hospital stays and associated healthcare costs. Competitive dynamics are intensifying, with established players continuously innovating to maintain market leadership and new entrants focusing on niche segments and disruptive technologies. Market penetration for advanced GI devices, particularly in emerging economies, is still in its nascent stages, presenting substantial untapped potential. The integration of robotics in endoscopic procedures is another significant trend that promises to revolutionize surgical outcomes and physician control. Furthermore, the increasing focus on personalized medicine within gastroenterology is driving the development of GI devices that can facilitate targeted therapies and diagnostics.

Dominant Markets & Segments in Gastrointestinal Devices Market

North America currently dominates the global Gastrointestinal Devices Market, holding an estimated market share of over 35% in the base year of 2025. This leadership is attributed to several factors, including high healthcare expenditure, advanced healthcare infrastructure, a high prevalence of gastrointestinal diseases, and the early adoption of innovative medical technologies. Within North America, the United States leads significantly due to its robust reimbursement policies and a large patient pool seeking advanced GI diagnostic and therapeutic solutions.

Key Drivers of Regional Dominance:

- Economic Policies: Favorable government policies supporting healthcare innovation and research, coupled with strong private sector investment.

- Infrastructure: Well-established hospital networks, specialized GI clinics, and widespread access to advanced medical facilities.

- Technological Adoption: Rapid uptake of new GI technologies, including advanced endoscopy systems, capsule endoscopy, and endoscopic ultrasound.

- Disease Prevalence: High incidence rates of conditions like colorectal cancer, inflammatory bowel disease, and peptic ulcers, necessitating advanced diagnostic and treatment tools.

Dominant Segments:

- Product Type:

- Gi Videoscopes: This segment holds the largest market share due to their widespread use in diagnosis and screening for a broad spectrum of GI conditions. Their market share is estimated to be around 28% in 2025. Advancements in high-definition imaging and single-use scopes are driving growth.

- Endoscopic Ultrasound: This segment is experiencing rapid growth, with an estimated market share of 15% in 2025, driven by its superior diagnostic capabilities for deep-seated GI tumors and pancreatic disorders.

- Capsule Endoscopy: Projected to grow at a high CAGR, driven by patient preference for non-invasive diagnostics and its effectiveness in visualizing the small intestine.

- End-User:

- Hospitals: Represent the largest end-user segment, accounting for an estimated 70% of the market share in 2025, due to their comprehensive diagnostic and treatment facilities and higher patient volumes.

- Clinics: Emerging as a significant segment, particularly for routine diagnostic procedures and follow-up care, offering a more cost-effective and accessible alternative for certain GI interventions.

Gastrointestinal Devices Market Product Developments

Product innovations in the Gastrointestinal Devices Market are centered on enhancing diagnostic accuracy, therapeutic efficacy, and patient experience. Key trends include the development of AI-powered endoscopy systems for automated polyp detection and characterization, miniaturized and flexible instruments for improved navigation through complex anatomy, and advanced therapeutic devices for hemostasis, dilation, and stent placement. Competitive advantages are being achieved through superior imaging resolution, integrated functionalities for both diagnosis and treatment, and the development of single-use devices to mitigate infection risks. The market is witnessing a surge in smart GI devices that offer real-time data feedback to clinicians, enabling more precise interventions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Gastrointestinal Devices Market, segmented by Product Type and End-User. The Product Type segmentation includes GI Videoscopes, Biopsy Devices, Endoscops, Capsule Endoscopy, Endoscopic Ultrasound, and Other Product Types. The End-User segmentation covers Hospitals, Clinics, and Other End-Users. Each segment is analyzed for its market size, growth projections, and competitive dynamics, with specific attention to the impact of technological advancements and evolving healthcare needs. For instance, the GI Videoscopes segment is projected to maintain its leading position, while Endoscopic Ultrasound is expected to exhibit the highest growth rate.

- GI Videoscopes: Expected market size of approximately $5,500 million in 2025, with a projected CAGR of 6.0% during the forecast period.

- Biopsy Devices: Estimated market size of $1,200 million in 2025, with a CAGR of 5.5%.

- Endoscops: Market size projected at $800 million in 2025, with a CAGR of 5.0%.

- Capsule Endoscopy: Anticipated market size of $1,500 million in 2025, with a significant CAGR of 7.5%.

- Endoscopic Ultrasound: Expected market size of $3,000 million in 2025, with a robust CAGR of 7.0%.

- Other Product Types: Including endoscopes for specific applications, surgical instruments, and accessories, with a market size of $900 million in 2025 and a CAGR of 5.8%.

- Hospitals: Dominant end-user, holding an estimated market share of 70% in 2025.

- Clinics: Projected to grow at a CAGR of 6.8%, with a market share of approximately 25% in 2025.

- Other End-Users: Including diagnostic centers and research institutions, with a market share of around 5% in 2025.

Key Drivers of Gastrointestinal Devices Market Growth

The growth of the Gastrointestinal Devices Market is propelled by several key factors. Firstly, the increasing global prevalence of gastrointestinal disorders, including cancers, inflammatory bowel diseases, and functional gastrointestinal disorders, necessitates advanced diagnostic and therapeutic interventions. Secondly, a rapidly aging population is a significant demographic driver, as older individuals are more prone to developing these conditions. Thirdly, technological advancements in imaging, robotics, and miniaturization are leading to the development of more effective, less invasive, and patient-friendly GI devices. The growing preference for minimally invasive procedures over traditional surgery is also a major catalyst. Furthermore, supportive government initiatives and reimbursement policies aimed at improving gastrointestinal healthcare access and outcomes are contributing to market expansion. The rising awareness among patients and healthcare professionals about the benefits of early diagnosis and treatment further fuels demand for sophisticated GI devices.

Challenges in the Gastrointestinal Devices Market Sector

Despite robust growth, the Gastrointestinal Devices Market faces several challenges. High research and development costs associated with developing cutting-edge GI technologies can be a significant barrier, especially for smaller companies. The stringent regulatory approval processes in major markets, while ensuring safety and efficacy, can lead to prolonged time-to-market for new products. The cost of advanced GI devices can also be a restraint, particularly in price-sensitive markets or for healthcare systems with limited budgets. Reimbursement policies for novel procedures and devices can be complex and vary significantly across regions, impacting adoption rates. Additionally, the shortage of skilled endoscopists and gastrointestinal surgeons in certain developing regions can limit the widespread utilization of sophisticated GI devices. Intense competition among established players and the threat of disruptive technologies also pose ongoing challenges.

Emerging Opportunities in Gastrointestinal Devices Market

The Gastrointestinal Devices Market presents numerous emerging opportunities for growth and innovation. The untapped potential in emerging economies, particularly in Asia Pacific and Latin America, offers a significant avenue for expansion due to improving healthcare infrastructure and increasing disposable incomes. The development of AI-integrated GI devices for enhanced diagnostic accuracy and predictive analytics represents a major technological frontier. The growing demand for single-use and disposable GI devices to minimize infection risks and streamline workflows is another lucrative segment. Advances in therapeutic endoscopy, enabling a wider range of interventions to be performed endoscopically, are creating new market niches. Furthermore, the increasing focus on personalized medicine and the development of companion diagnostics for GI conditions are opening doors for specialized GI devices. Tele-endoscopy and remote patient monitoring solutions are also gaining traction, offering new business models and patient care pathways.

Leading Players in the Gastrointestinal Devices Market Market

- PENTAX Medical

- CONMED Corporation

- Medtronic

- Cook Group Incorporated

- KARL STORZ SE & Co KG

- Stryker

- Johnson & Johnson

- Boston Scientific Corporation

- B Braun SE

- Olympus Corporation

- Micro-tech

Key Developments in Gastrointestinal Devices Market Industry

- May 2023: Olympus Corporation received FDA clearance for its new EVIS X1 endoscopy system, along with two compatible gastrointestinal endoscopes, namely GIF-1100 gastrointestinal videoscope and CF-HQ1100DL/I colonovideoscope. The GIF-1100 gastrointestinal video scope is indicated for use within the upper digestive tract, including the esophagus, stomach, and duodenum. And the CF-HQ1100DL/I colonovideoscope is indicated for use within the lower digestive tract, including the anus, rectum, sigmoid colon, colon, and ileocecal valve. This development enhances diagnostic capabilities for both upper and lower GI conditions.

- April 2023: SonoScape received FDA 510(k) clearance for the HD-550 Endoscopy system, which is indicated for gastrointestinal diagnosis. This clearance expands the availability of advanced endoscopy systems for GI diagnostics, potentially improving patient care and diagnostic accuracy.

Strategic Outlook for Gastrointestinal Devices Market Market

The strategic outlook for the Gastrointestinal Devices Market is exceptionally promising, driven by continuous innovation and increasing healthcare demands. The market is set to witness accelerated growth fueled by the development of AI-powered diagnostic tools, miniaturized therapeutic devices, and advanced robotic endoscopy systems. Companies that focus on expanding their product portfolios to include comprehensive solutions for both diagnosis and treatment, while also prioritizing patient comfort and procedural efficiency, will likely gain a competitive edge. Strategic partnerships and collaborations will be crucial for market access, particularly in emerging economies. Furthermore, a strong emphasis on addressing unmet clinical needs, such as early detection of difficult-to-diagnose GI cancers and effective management of chronic inflammatory bowel diseases, will shape future market dynamics. The trend towards value-based healthcare will also encourage the development of GI devices that demonstrate superior clinical outcomes and cost-effectiveness, paving the way for sustained market expansion and innovation.

Gastrointestinal Devices Market Segmentation

-

1. Product Type

- 1.1. Gi Videoscopes

- 1.2. Biopsy Devices

- 1.3. Endoscop

- 1.4. Capsule Endoscopy

- 1.5. Endoscopic Ultrasound

- 1.6. Other Product Types

-

2. End-User

- 2.1. Hospitals

- 2.2. Clinics

- 2.3. Other End-Users

Gastrointestinal Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Gastrointestinal Devices Market Regional Market Share

Geographic Coverage of Gastrointestinal Devices Market

Gastrointestinal Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Gastrointestinal Diseases; Growing Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians & Complex Sterilization Procedures; Unfavourable Compensation Policies and Low Government Funding

- 3.4. Market Trends

- 3.4.1. Endoscopic Retrograde Cholangiopancreatography Devices (ERCP) is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Gi Videoscopes

- 5.1.2. Biopsy Devices

- 5.1.3. Endoscop

- 5.1.4. Capsule Endoscopy

- 5.1.5. Endoscopic Ultrasound

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Clinics

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Gi Videoscopes

- 6.1.2. Biopsy Devices

- 6.1.3. Endoscop

- 6.1.4. Capsule Endoscopy

- 6.1.5. Endoscopic Ultrasound

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals

- 6.2.2. Clinics

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Gi Videoscopes

- 7.1.2. Biopsy Devices

- 7.1.3. Endoscop

- 7.1.4. Capsule Endoscopy

- 7.1.5. Endoscopic Ultrasound

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals

- 7.2.2. Clinics

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Gi Videoscopes

- 8.1.2. Biopsy Devices

- 8.1.3. Endoscop

- 8.1.4. Capsule Endoscopy

- 8.1.5. Endoscopic Ultrasound

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals

- 8.2.2. Clinics

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Gi Videoscopes

- 9.1.2. Biopsy Devices

- 9.1.3. Endoscop

- 9.1.4. Capsule Endoscopy

- 9.1.5. Endoscopic Ultrasound

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals

- 9.2.2. Clinics

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Gastrointestinal Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Gi Videoscopes

- 10.1.2. Biopsy Devices

- 10.1.3. Endoscop

- 10.1.4. Capsule Endoscopy

- 10.1.5. Endoscopic Ultrasound

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals

- 10.2.2. Clinics

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PENTAX Medical*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CONMED Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cook Group Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KARL STORZ SE & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stryker

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B Braun SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Olympus Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Micro-tech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 PENTAX Medical*List Not Exhaustive

List of Figures

- Figure 1: Global Gastrointestinal Devices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gastrointestinal Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Gastrointestinal Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Gastrointestinal Devices Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Gastrointestinal Devices Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Gastrointestinal Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Gastrointestinal Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gastrointestinal Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Gastrointestinal Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Gastrointestinal Devices Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe Gastrointestinal Devices Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Gastrointestinal Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Gastrointestinal Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gastrointestinal Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Gastrointestinal Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Gastrointestinal Devices Market Revenue (billion), by End-User 2025 & 2033

- Figure 17: Asia Pacific Gastrointestinal Devices Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Gastrointestinal Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Gastrointestinal Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Gastrointestinal Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Gastrointestinal Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Gastrointestinal Devices Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: Middle East and Africa Gastrointestinal Devices Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East and Africa Gastrointestinal Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Gastrointestinal Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gastrointestinal Devices Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: South America Gastrointestinal Devices Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Gastrointestinal Devices Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: South America Gastrointestinal Devices Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Gastrointestinal Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Gastrointestinal Devices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Gastrointestinal Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Gastrointestinal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Gastrointestinal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 21: Global Gastrointestinal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 30: Global Gastrointestinal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Gastrointestinal Devices Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Gastrointestinal Devices Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Global Gastrointestinal Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Gastrointestinal Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gastrointestinal Devices Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the Gastrointestinal Devices Market?

Key companies in the market include PENTAX Medical*List Not Exhaustive, CONMED Corporation, Medtronic, Cook Group Incorporated, KARL STORZ SE & Co KG, Stryker, Johnson & Johnson, Boston Scientific Corporation, B Braun SE, Olympus Corporation, Micro-tech.

3. What are the main segments of the Gastrointestinal Devices Market?

The market segments include Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Gastrointestinal Diseases; Growing Geriatric Population.

6. What are the notable trends driving market growth?

Endoscopic Retrograde Cholangiopancreatography Devices (ERCP) is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians & Complex Sterilization Procedures; Unfavourable Compensation Policies and Low Government Funding.

8. Can you provide examples of recent developments in the market?

May 2023: Olympus Corporation received FDA clearance for its new EVIS X1 endoscopy system, along with two compatible gastrointestinal endoscopes, namely GIF-1100 gastrointestinal videoscope and CF-HQ1100DL/I colonovideoscope. The GIF-1100 gastrointestinal video scope is indicated for use within the upper digestive tract, including the esophagus, stomach, and duodenum. And the CF-HQ1100DL/I colonovideoscope is indicated for use within the lower digestive tract, including the anus, rectum, sigmoid colon, colon, and ileocecal valve.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gastrointestinal Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gastrointestinal Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gastrointestinal Devices Market?

To stay informed about further developments, trends, and reports in the Gastrointestinal Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence