Key Insights

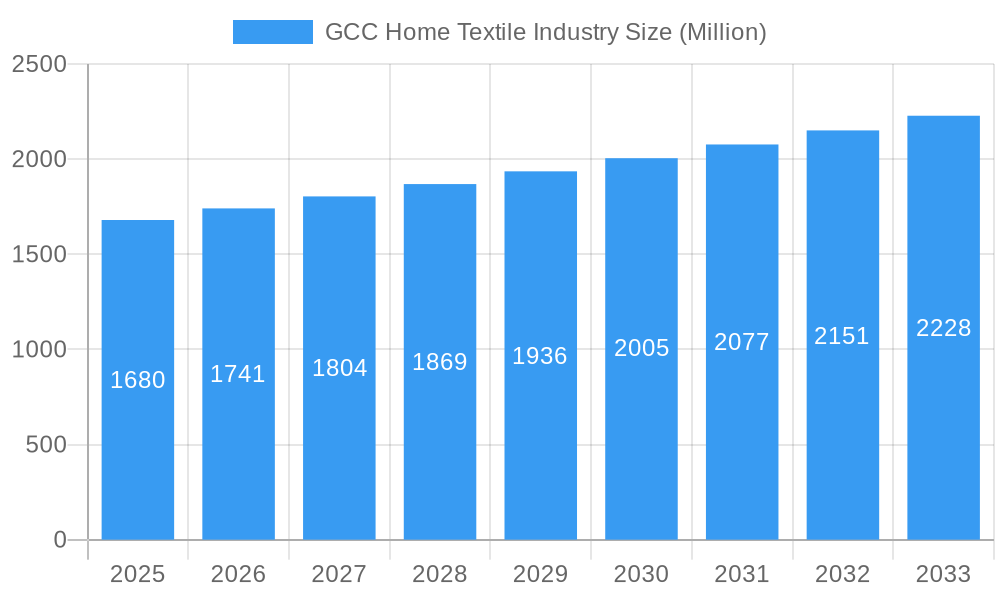

The GCC home textile industry is poised for significant growth, with a current market size of 1.68 Billion USD and a projected Compound Annual Growth Rate (CAGR) of 3.69% over the forecast period of 2025-2033. This expansion is driven by a confluence of factors, including rising disposable incomes among consumers in the region, an increasing trend towards home renovation and interior décor, and a growing demand for premium and aesthetically pleasing home furnishings. The market is also benefiting from a burgeoning tourism sector, which fuels demand for high-quality hospitality linens. Furthermore, a growing awareness of sustainable and eco-friendly textile options is influencing consumer choices and pushing manufacturers to adopt greener practices. E-commerce penetration is also a key enabler, providing greater accessibility to a wider range of products and brands for consumers across the GCC.

GCC Home Textile Industry Market Size (In Billion)

The Bed linen and Bath linen segments are anticipated to lead the market in terms of revenue contribution, owing to consistent consumer demand for these essential home goods. Specialty stores and online channels are emerging as dominant distribution avenues, reflecting a shift in consumer purchasing habits towards convenience and curated shopping experiences. Geographically, Saudi Arabia and the United Arab Emirates are expected to command the largest market shares, driven by their large consumer bases and robust economies. While the market presents a promising outlook, challenges such as fluctuating raw material prices and intense competition from both local and international players require strategic navigation by industry stakeholders. Nevertheless, the overall trajectory for the GCC home textile market remains strongly positive, indicating substantial opportunities for growth and innovation.

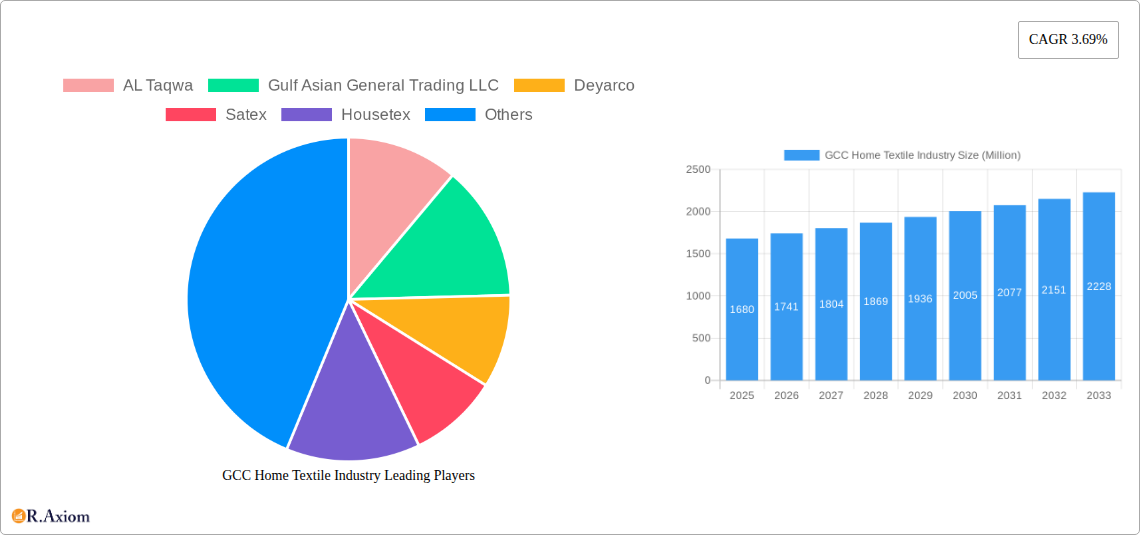

GCC Home Textile Industry Company Market Share

Here is an SEO-optimized, detailed report description for the GCC Home Textile Industry, incorporating high-traffic keywords and structured as requested:

GCC Home Textile Industry Market Concentration & Innovation

The GCC Home Textile Industry is characterized by a moderate level of market concentration, with a few dominant players holding significant market share, estimated to be around 60% by 2025. Innovation is a key driver, fueled by increasing consumer demand for premium and sustainable products. Regulatory frameworks are evolving to support industry growth, focusing on product safety and environmental standards. Product substitutes, such as decorative items and DIY solutions, present a minor challenge, but the core home textile market remains robust. End-user trends are heavily influenced by rising disposable incomes, urbanization, and a growing interest in interior design and home décor. Mergers and acquisitions (M&A) activity is on the rise, with estimated deal values reaching up to 50 Million for strategic consolidations aimed at expanding market reach and product portfolios.

- Market Share: Dominant players account for an estimated 60% of the market by 2025.

- Innovation Focus: Premium, sustainable, and technologically advanced home textiles.

- Regulatory Impact: Supportive frameworks for product safety and sustainability.

- M&A Deal Values: Up to 50 Million for strategic acquisitions.

GCC Home Textile Industry Industry Trends & Insights

The GCC Home Textile Industry is poised for significant growth, driven by a confluence of favorable economic, demographic, and lifestyle factors. The projected Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is an impressive 8.5%, reflecting strong market penetration and increasing consumer spending on home furnishings. This upward trajectory is underpinned by rapid urbanization across the region, leading to increased demand for new housing and, consequently, home textiles. A burgeoning young population and rising disposable incomes further contribute to the escalating consumer appetite for aesthetic and comfortable living spaces. Technological advancements are revolutionizing the industry, with a growing emphasis on smart textiles, eco-friendly materials, and innovative manufacturing processes. Online retail channels are witnessing exponential growth, offering consumers unparalleled convenience and access to a wider array of products, from affordable essentials to luxury designer collections. Furthermore, a growing awareness of sustainable living is spurring demand for organic cotton, recycled materials, and ethically produced home textiles, pushing brands to adopt more environmentally conscious practices. The competitive landscape is dynamic, with both established global brands and emerging local players vying for market share through product differentiation, strategic partnerships, and enhanced customer experiences. E-commerce platforms and omnichannel strategies are becoming critical for brands to effectively reach and engage a digitally savvy consumer base.

Dominant Markets & Segments in GCC Home Textile Industry

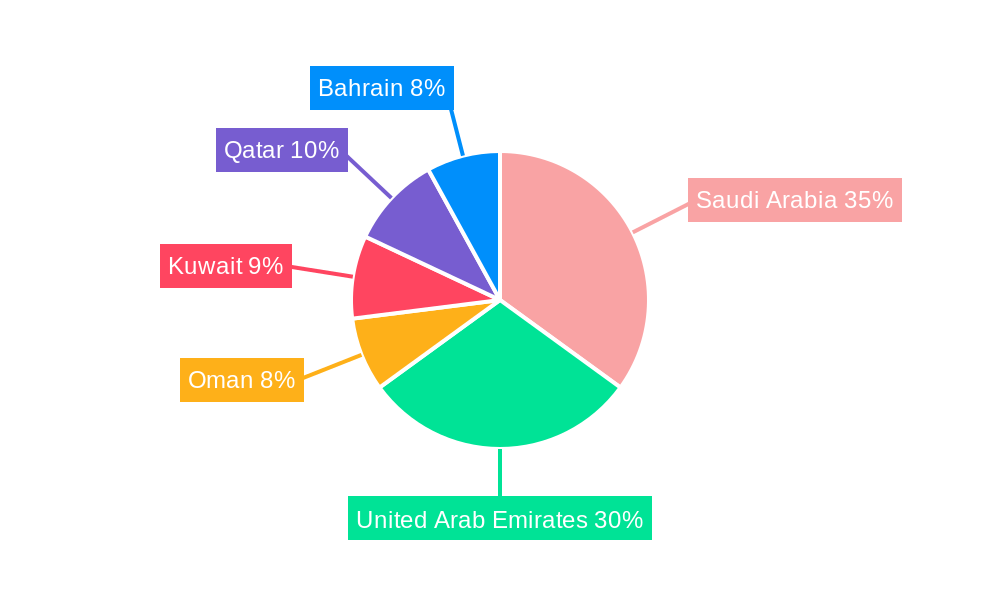

The GCC Home Textile Industry exhibits distinct dominance across various geographical regions and product segments. Saudi Arabia, with its large population and robust economy, is the leading market, accounting for an estimated 35% of the total GCC home textile market share by 2025. The United Arab Emirates follows closely, driven by its status as a global hub for tourism and expatriates, contributing approximately 25% to the market.

Geography Dominance:

- Saudi Arabia: Leading market share due to population size and economic strength. Key drivers include government initiatives promoting domestic manufacturing and infrastructure development, coupled with a growing middle class with increased spending power on home décor.

- United Arab Emirates: Significant market share driven by a high expatriate population and a strong tourism sector, leading to consistent demand for quality home furnishings. Factors like a thriving real estate market and a focus on luxury and premium products fuel its dominance.

Product Type Dominance:

- Bed Linen: This segment holds the largest market share, estimated at 30% by 2025. The demand is driven by the constant need for replacements and upgrades, as well as the growing trend of personalized bedroom aesthetics.

- Upholstery: Occupying a substantial share, upholstery products benefit from the booming construction and renovation sectors, with consumers investing in furniture upgrades and custom interior designs.

- Floor Covering: This segment is also a significant contributor, driven by both residential and commercial projects, with increasing interest in sustainable and design-led flooring solutions.

Distribution Channel Dominance:

- Supermarkets & Hypermarkets: These channels command a significant market presence, particularly for essential and mid-range home textile products, offering convenience and accessibility to a broad consumer base.

- Online: The online channel is experiencing the most rapid growth, with consumers increasingly opting for the convenience, wider selection, and competitive pricing offered by e-commerce platforms. This channel is projected to capture a substantial market share by 2025.

GCC Home Textile Industry Product Developments

Product developments in the GCC Home Textile Industry are increasingly focused on enhancing functionality, sustainability, and aesthetic appeal. Innovations include the integration of smart technologies for temperature regulation in bedding, antimicrobial properties in bath linens, and stain-resistant finishes for upholstery. There's a rising trend towards eco-friendly materials such as organic cotton, bamboo, and recycled fabrics, aligning with growing consumer demand for sustainable products. Competitive advantages are being carved out through unique designs, personalized options, and the use of premium quality materials that offer superior comfort and durability.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the GCC Home Textile Industry, segmented across key areas. The Product Type segmentation includes Bed Linen, Bath Linen, Kitchen Linen, Upholstery, and Floor Covering. The Distribution Channel is analyzed through Supermarkets & Hypermarkets, Specialty Stores, Online, and Other Distribution Channels. Geographically, the report covers Saudi Arabia, United Arab Emirates, Oman, Kuwait, Qatar, and Bahrain. Each segment is analyzed with projected growth rates and market sizes for the forecast period of 2025–2033, detailing competitive dynamics and key growth drivers.

Key Drivers of GCC Home Textile Industry Growth

Several factors are propelling the growth of the GCC Home Textile Industry. Rising disposable incomes and a growing young population are fueling consumer spending on home décor and furnishings. Urbanization and a booming construction sector create a consistent demand for new home textiles. The increasing popularity of online shopping provides convenient access to a wider product range and competitive pricing. Furthermore, a growing awareness of interior design trends and a desire for comfortable and aesthetically pleasing living spaces are significant motivators. Technological advancements in manufacturing and material science are also contributing to product innovation and market expansion.

Challenges in the GCC Home Textile Industry Sector

Despite the positive outlook, the GCC Home Textile Industry faces several challenges. Intense competition, both from local and international players, can put pressure on profit margins. Fluctuations in raw material prices, particularly cotton, can impact production costs and pricing strategies. Supply chain disruptions, as witnessed globally, can lead to delays and increased logistics expenses. Evolving consumer preferences require continuous adaptation and innovation, posing a challenge for manufacturers to stay ahead of trends. Additionally, stringent quality control and adherence to international standards can be demanding for smaller players.

Emerging Opportunities in GCC Home Textile Industry

Emerging opportunities in the GCC Home Textile Industry are abundant. The rising demand for sustainable and eco-friendly products presents a significant avenue for growth, with an increasing consumer willingness to invest in organic and recycled textiles. The e-commerce sector continues to expand, offering immense potential for brands to reach a wider customer base across the region through online platforms and direct-to-consumer models. The growing trend of home renovation and interior design services creates opportunities for premium and customized home textile solutions. Furthermore, exploring niche markets and developing specialized product lines, such as luxury bedding or performance-oriented upholstery, can unlock new revenue streams.

Leading Players in the GCC Home Textile Industry Market

- AL Taqwa

- Gulf Asian General Trading LLC

- Deyarco

- Satex

- Housetex

- Al Sorayai Group

- Dicitex

- Orient Textiles International LLC

- CLF Como Luxury Fabrics LLC

- B Tex International L L C

Key Developments in GCC Home Textile Industry Industry

- February 2023: Frugado.com launched, offering a wide variety of curated items from international brands. Frugado.com provides shoppers with the perfect mix of stylish sophistication and affordability. Customers can find everything they need - from organic cotton beach towels to classic home textile items like throws, blankets, bedsheets, chic dresses, to kids’ fashion - in one place, making it super easy to stay up-to-date with their style preferences.

- October 2023: LETSDRY is delighted to announce its exclusive and groundbreaking partnership with the Gulf Cooperation Council's (GCC) retail giant, LuLu Hypermark. As a renowned Bath-Liner brand, LETSRADY is delighted to collaborate with the pioneering LuLu Hypermarket, a force to be reckoned with in the corporate realm. This partnership marks a milestone in the domestic textile sector, offering remarkable prospects for growth and development.

Strategic Outlook for GCC Home Textile Industry Market

The GCC Home Textile Industry is set for robust growth in the coming years, driven by favorable demographic trends, increasing disposable incomes, and a rising appetite for home improvement and interior design. The strategic focus for industry players will be on embracing sustainability, leveraging digital channels for enhanced customer reach and engagement, and innovating with smart textiles and premium materials. Strategic partnerships and potential M&A activities will likely shape the market landscape, leading to consolidation and expanded market access. The industry's ability to adapt to evolving consumer preferences and embrace technological advancements will be crucial for sustained success.

GCC Home Textile Industry Segmentation

-

1. Product Type

- 1.1. Bed linen

- 1.2. Bath Linen

- 1.3. Kitchen Linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Oman

- 3.4. Kuwait

- 3.5. Qatar

- 3.6. Bahrain

GCC Home Textile Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Oman

- 4. Kuwait

- 5. Qatar

- 6. Bahrain

GCC Home Textile Industry Regional Market Share

Geographic Coverage of GCC Home Textile Industry

GCC Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Smart Kitchen is Driving the Market; Growing Urbanisation is Driving Need for Quick Meal Preparation

- 3.3. Market Restrains

- 3.3.1. Changing Needs and Taste of Customers; Limited Usage of the Product

- 3.4. Market Trends

- 3.4.1. Saudi Arabia is driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bed linen

- 5.1.2. Bath Linen

- 5.1.3. Kitchen Linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Oman

- 5.3.4. Kuwait

- 5.3.5. Qatar

- 5.3.6. Bahrain

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Oman

- 5.4.4. Kuwait

- 5.4.5. Qatar

- 5.4.6. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bed linen

- 6.1.2. Bath Linen

- 6.1.3. Kitchen Linen

- 6.1.4. Upholstery

- 6.1.5. Floor Covering

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets & Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Oman

- 6.3.4. Kuwait

- 6.3.5. Qatar

- 6.3.6. Bahrain

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bed linen

- 7.1.2. Bath Linen

- 7.1.3. Kitchen Linen

- 7.1.4. Upholstery

- 7.1.5. Floor Covering

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets & Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Oman

- 7.3.4. Kuwait

- 7.3.5. Qatar

- 7.3.6. Bahrain

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Oman GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bed linen

- 8.1.2. Bath Linen

- 8.1.3. Kitchen Linen

- 8.1.4. Upholstery

- 8.1.5. Floor Covering

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets & Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Oman

- 8.3.4. Kuwait

- 8.3.5. Qatar

- 8.3.6. Bahrain

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Kuwait GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bed linen

- 9.1.2. Bath Linen

- 9.1.3. Kitchen Linen

- 9.1.4. Upholstery

- 9.1.5. Floor Covering

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets & Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Oman

- 9.3.4. Kuwait

- 9.3.5. Qatar

- 9.3.6. Bahrain

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Qatar GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bed linen

- 10.1.2. Bath Linen

- 10.1.3. Kitchen Linen

- 10.1.4. Upholstery

- 10.1.5. Floor Covering

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets & Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Oman

- 10.3.4. Kuwait

- 10.3.5. Qatar

- 10.3.6. Bahrain

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Bahrain GCC Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Bed linen

- 11.1.2. Bath Linen

- 11.1.3. Kitchen Linen

- 11.1.4. Upholstery

- 11.1.5. Floor Covering

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets & Hypermarkets

- 11.2.2. Specialty Stores

- 11.2.3. Online

- 11.2.4. Other Distribution Channels

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. United Arab Emirates

- 11.3.3. Oman

- 11.3.4. Kuwait

- 11.3.5. Qatar

- 11.3.6. Bahrain

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 AL Taqwa

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Gulf Asian General Trading LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Deyarco

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Satex

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Housetex

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Al Sorayai Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dicitex

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Orient Textiles International LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CLF Como Luxury Fabrics LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 B Tex International L L C

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 AL Taqwa

List of Figures

- Figure 1: Global GCC Home Textile Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global GCC Home Textile Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: Saudi Arabia GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Saudi Arabia GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: Saudi Arabia GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: Saudi Arabia GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: Saudi Arabia GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: Saudi Arabia GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 12: Saudi Arabia GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 13: Saudi Arabia GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Saudi Arabia GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 15: Saudi Arabia GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Saudi Arabia GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Saudi Arabia GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: United Arab Emirates GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 20: United Arab Emirates GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: United Arab Emirates GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: United Arab Emirates GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: United Arab Emirates GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 24: United Arab Emirates GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 25: United Arab Emirates GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: United Arab Emirates GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 27: United Arab Emirates GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 28: United Arab Emirates GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 29: United Arab Emirates GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: United Arab Emirates GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 31: United Arab Emirates GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: United Arab Emirates GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: United Arab Emirates GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: United Arab Emirates GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Oman GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Oman GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Oman GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Oman GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Oman GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 40: Oman GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 41: Oman GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Oman GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 43: Oman GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 44: Oman GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 45: Oman GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Oman GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 47: Oman GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Oman GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Oman GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Oman GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Kuwait GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Kuwait GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Kuwait GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Kuwait GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Kuwait GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Kuwait GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: Kuwait GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Kuwait GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Kuwait GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 60: Kuwait GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 61: Kuwait GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Kuwait GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 63: Kuwait GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Kuwait GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Kuwait GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Kuwait GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Qatar GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Qatar GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Qatar GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Qatar GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Qatar GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 72: Qatar GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 73: Qatar GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Qatar GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Qatar GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 76: Qatar GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 77: Qatar GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Qatar GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 79: Qatar GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Qatar GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Qatar GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Qatar GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Bahrain GCC Home Textile Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 84: Bahrain GCC Home Textile Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: Bahrain GCC Home Textile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: Bahrain GCC Home Textile Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 87: Bahrain GCC Home Textile Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 88: Bahrain GCC Home Textile Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 89: Bahrain GCC Home Textile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 90: Bahrain GCC Home Textile Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 91: Bahrain GCC Home Textile Industry Revenue (Million), by Geography 2025 & 2033

- Figure 92: Bahrain GCC Home Textile Industry Volume (K Unit), by Geography 2025 & 2033

- Figure 93: Bahrain GCC Home Textile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Bahrain GCC Home Textile Industry Volume Share (%), by Geography 2025 & 2033

- Figure 95: Bahrain GCC Home Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Bahrain GCC Home Textile Industry Volume (K Unit), by Country 2025 & 2033

- Figure 97: Bahrain GCC Home Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Bahrain GCC Home Textile Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Global GCC Home Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global GCC Home Textile Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 19: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 35: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global GCC Home Textile Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global GCC Home Textile Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Global GCC Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global GCC Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 53: Global GCC Home Textile Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Global GCC Home Textile Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 55: Global GCC Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global GCC Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Home Textile Industry?

The projected CAGR is approximately 3.69%.

2. Which companies are prominent players in the GCC Home Textile Industry?

Key companies in the market include AL Taqwa, Gulf Asian General Trading LLC, Deyarco, Satex, Housetex, Al Sorayai Group, Dicitex, Orient Textiles International LLC, CLF Como Luxury Fabrics LLC, B Tex International L L C.

3. What are the main segments of the GCC Home Textile Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Smart Kitchen is Driving the Market; Growing Urbanisation is Driving Need for Quick Meal Preparation.

6. What are the notable trends driving market growth?

Saudi Arabia is driving the growth of the market.

7. Are there any restraints impacting market growth?

Changing Needs and Taste of Customers; Limited Usage of the Product.

8. Can you provide examples of recent developments in the market?

February 2023: Frugado.com launched, offering a wide variety of curated items from international brands. Frugado.com provides shoppers with the perfect mix of stylish sophistication and affordability. Customers can find everything they need - from organic cotton beach towels to classic home textile items like throws, blankets, bedsheets, chic dresses, to kids’ fashion - in one place, making it super easy to stay up-to-date with their style preferences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Home Textile Industry?

To stay informed about further developments, trends, and reports in the GCC Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence