Key Insights

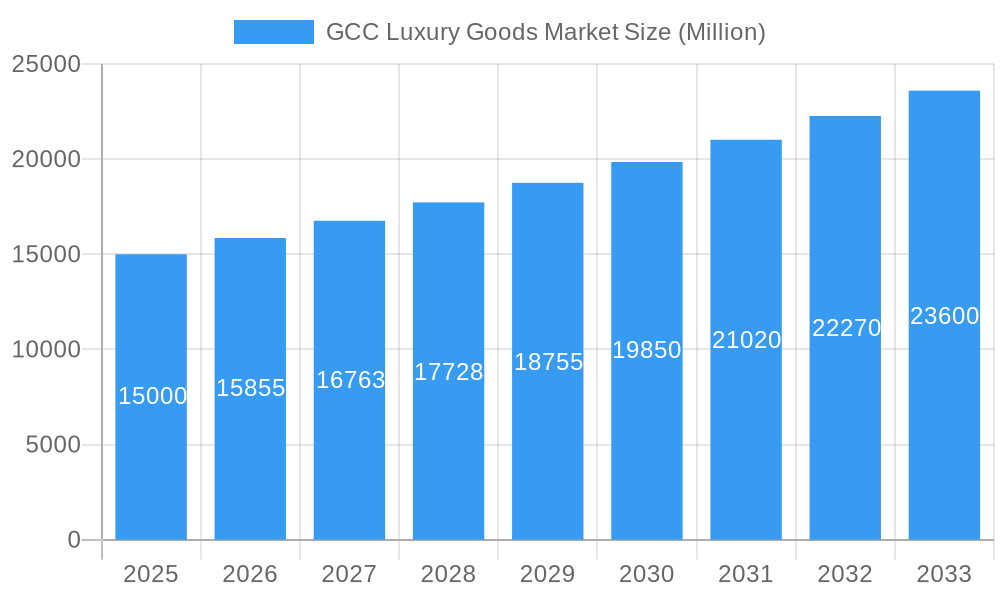

The GCC luxury goods market, encompassing clothing and apparel, footwear, bags, jewelry, watches, and other accessories, exhibits robust growth potential. Driven by a burgeoning affluent population with a high disposable income, a preference for high-end brands, and a thriving tourism sector, the market is projected to maintain a steady Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2033. Significant market segments include clothing and apparel, followed by jewelry and watches, which benefit from strong cultural affinity for luxury items. The distribution channel analysis reveals a balanced landscape, with single-branded stores maintaining a strong presence alongside the increasing popularity of online stores, reflecting evolving consumer preferences. Key players like Capri Holdings, Kering SA, and LVMH Moët Hennessy Louis Vuitton are strategically positioned to capitalize on this expansion, investing in both physical retail and e-commerce channels to reach a diverse consumer base. The male and female segments are both substantial contributors to the market's overall growth, though market research would be needed to determine which segment is currently more dominant and which segment is experiencing faster growth.

GCC Luxury Goods Market Market Size (In Billion)

While the market enjoys considerable momentum, potential restraints include economic volatility within the region and global economic fluctuations that could impact consumer spending on luxury items. However, the strong underlying economic fundamentals of the GCC countries, coupled with ongoing investments in infrastructure and tourism, are expected to mitigate these challenges. Future growth will likely be influenced by factors such as the introduction of new luxury brands, innovative marketing strategies focusing on the younger generation's preferences and the sustained appeal of high-quality craftsmanship and exclusivity. The continued development of e-commerce platforms specifically catering to luxury goods will also play a significant role in shaping the market's trajectory, enhancing accessibility and convenience for consumers.

GCC Luxury Goods Market Company Market Share

This in-depth report provides a comprehensive analysis of the GCC luxury goods market, covering market size, segmentation, growth drivers, challenges, and key players. With a detailed forecast from 2025 to 2033, this report is an essential resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities in this lucrative market. The study period covers 2019-2024 (Historical Period), with 2025 as the Base Year and Estimated Year, and forecasts extending to 2033 (Forecast Period). The market value is expressed in Millions throughout the report.

GCC Luxury Goods Market Market Concentration & Innovation

The GCC luxury goods market presents a dynamic landscape shaped by intense competition, rapid innovation, and evolving consumer preferences. Market concentration is high, with a few dominant players—LVMH, Kering, and Richemont, for example—holding a substantial share of the market in 2024 (precise figures pending data verification). This dominance stems from powerful brand recognition, well-established distribution networks, and substantial marketing investments. However, nimble, innovative brands are emerging, creating a more complex competitive environment than previously seen.

Innovation is a key battleground. Luxury brands are focusing on delivering hyper-personalized experiences, embracing sustainable and ethical sourcing practices, and leveraging technological advancements. The GCC's regulatory environment is increasingly stringent, demanding compliance with product labeling, environmental standards, and robust consumer protection laws. This regulatory pressure is driving innovation in areas such as supply chain traceability and ethical sourcing, pushing brands to be more transparent and accountable.

The market also faces challenges from product substitutes. High-street brands offer stylistic alternatives at lower price points, while the burgeoning pre-owned luxury goods market provides a more sustainable and affordable option for consumers. Consumer behavior is shifting towards experiences over material possessions. Luxury brands are adapting by offering curated experiences, exclusive events, and personalized services that extend beyond the mere acquisition of a product.

Mergers and acquisitions (M&A) activity has been significant, with numerous deals between 2019 and 2024 aimed at expanding market reach and brand portfolios (specific deal value and number pending data verification). This activity underscores the ongoing consolidation and strategic repositioning within the sector.

- Market Share (2024, projected): LVMH (xx%), Kering (xx%), Richemont (xx%), Others (xx%) (Data pending verification)

- M&A Deal Value (2019-2024): Approximately xx Million (Data pending verification)

- Key Innovation Drivers: Hyper-Personalization, Sustainability & Ethical Sourcing, Technological Integration (e.g., AI-powered personalization, virtual try-ons, blockchain for traceability)

GCC Luxury Goods Market Industry Trends & Insights

The GCC luxury goods market is experiencing robust growth driven by several factors. A rising affluent population, particularly in the UAE and Saudi Arabia, fuels demand for luxury goods. The region's focus on tourism and its increasingly globalized economy contribute to the growth. Technological disruption manifests in personalized e-commerce experiences, virtual try-ons, and data-driven marketing strategies. Consumer preferences are shifting towards sustainable and ethically produced luxury goods, and experiential luxury (e.g., bespoke services). Competitive dynamics are characterized by a fierce battle for market share among established luxury brands and the rise of niche luxury brands catering to specific consumer segments. The Compound Annual Growth Rate (CAGR) is projected at xx% from 2025 to 2033, with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in GCC Luxury Goods Market

The UAE consistently ranks as the dominant market within the GCC for luxury goods, driven by strong economic growth, a significant expatriate population, and a well-established luxury retail infrastructure. Saudi Arabia is another important market showing significant growth potential.

- Leading Region/Country: UAE

- Key Drivers for UAE Dominance: Strong economy, significant expatriate population, well-developed luxury retail infrastructure, tourism.

- Key Drivers for Saudi Arabia Growth: Rising disposable incomes, economic diversification initiatives (Vision 2030), expanding tourism sector.

Within the product segments, Watches and Jewellery consistently perform strongly, followed by Bags and Apparel. The Female segment demonstrates a significantly higher purchasing power compared to the Male segment. Single-branded stores remain the primary distribution channel, but online channels are experiencing rapid growth.

- Dominant Product Segments: Watches, Jewellery, Bags, Apparel

- Dominant Gender Segment: Female

- Dominant Distribution Channel: Single-branded stores, with online channels showing rapid growth.

GCC Luxury Goods Market Product Developments

Product innovation in the GCC luxury goods market focuses on integrating technology to enhance customer experience. Brands are adopting personalized services, virtual try-ons, and advanced supply chain management systems to increase efficiency. This focus on enhancing customer experience and leveraging technological trends aligns perfectly with the market's demand for high-quality, exclusive products and personalized experiences.

Report Scope & Segmentation Analysis

This report segments the GCC luxury goods market by type (Clothing and Apparel, Footwear, Bags, Jewellery, Watches, Other Accessories), gender (Male, Female), and distribution channel (Single branded stores, Multibranded stores, Online Stores, Other Distribution Channels). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, highlighting the unique characteristics and opportunities within each. The Clothing and Apparel segment is predicted to witness significant growth due to high fashion demand, while the Watches and Jewellery segment will be driven by the increasing preference for luxury timepieces and high-value jewellery among the affluent population. Online Stores are projected to experience the highest growth rate among distribution channels.

Key Drivers of GCC Luxury Goods Market Growth

Several factors drive growth in the GCC luxury goods market. These include a rapidly growing affluent population, increased tourism, government initiatives supporting the luxury sector, and significant investments in luxury retail infrastructure. Furthermore, the rising adoption of e-commerce and technology is transforming the consumer experience, supporting market expansion.

Challenges in the GCC Luxury Goods Market Sector

Challenges include maintaining brand authenticity in a market prone to counterfeiting, managing supply chain complexities, and navigating evolving consumer preferences. Fluctuations in oil prices and geopolitical instability could also impact consumer spending. The competitive landscape remains intense, requiring continuous investment in innovation and brand building.

Emerging Opportunities in GCC Luxury Goods Market

Significant opportunities exist in leveraging e-commerce for personalized experiences, catering to the growing demand for sustainable luxury, and expanding into untapped segments such as experiential luxury and bespoke services. Furthermore, exploring collaborations with local designers and artisans could open new avenues for growth.

Leading Players in the GCC Luxury Goods Market Market

- Capri Holdings

- Kering SA

- Burberry Group PLC

- Chanel Limited

- Prada S p A

- Alshaya Franchise Group

- Dolce & Gabbana Luxembourg S À R L

- AW Rostamani Group

- Rolex SA

- Etoile Group

- LVMH Moët Hennessy Louis Vuitton

Key Developments in GCC Luxury Goods Market Industry

- July 2021: Capri Holdings' Versace opened a new store at the Galleria Al Maryah Island in Abu Dhabi, enhancing luxury shopping options.

- April 2021: Alshaya launched the first Aerie store in the Middle East, expanding the premium clothing market.

- March 2022: Gucci launched in the UAE, featuring high jewelry pieces, expanding its presence in the region.

Strategic Outlook for GCC Luxury Goods Market Market

The GCC luxury goods market is poised for continued expansion driven by economic growth, a rising affluent population, and increased tourism. Strategic opportunities include focusing on personalization, sustainability, and technological integration to meet evolving consumer expectations. Brands focusing on ethical sourcing, unique experiences, and personalized services are likely to gain a competitive edge. The market's future potential is substantial, offering significant opportunities for growth and investment.

GCC Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Gender

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Single branded stores

- 3.2. Multi-branded stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. Kuwait

- 4.5. Oman

- 4.6. Bahrain

GCC Luxury Goods Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Kuwait

- 5. Oman

- 6. Bahrain

GCC Luxury Goods Market Regional Market Share

Geographic Coverage of GCC Luxury Goods Market

GCC Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Use of E-commerce Platform for Buying Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Single branded stores

- 5.3.2. Multi-branded stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Kuwait

- 5.4.5. Oman

- 5.4.6. Bahrain

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Qatar

- 5.5.4. Kuwait

- 5.5.5. Oman

- 5.5.6. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Gender

- 6.2.1. Male

- 6.2.2. Female

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Single branded stores

- 6.3.2. Multi-branded stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Qatar

- 6.4.4. Kuwait

- 6.4.5. Oman

- 6.4.6. Bahrain

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Gender

- 7.2.1. Male

- 7.2.2. Female

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Single branded stores

- 7.3.2. Multi-branded stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Qatar

- 7.4.4. Kuwait

- 7.4.5. Oman

- 7.4.6. Bahrain

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Gender

- 8.2.1. Male

- 8.2.2. Female

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Single branded stores

- 8.3.2. Multi-branded stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Qatar

- 8.4.4. Kuwait

- 8.4.5. Oman

- 8.4.6. Bahrain

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Kuwait GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Gender

- 9.2.1. Male

- 9.2.2. Female

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Single branded stores

- 9.3.2. Multi-branded stores

- 9.3.3. Online Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Qatar

- 9.4.4. Kuwait

- 9.4.5. Oman

- 9.4.6. Bahrain

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Oman GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Gender

- 10.2.1. Male

- 10.2.2. Female

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Single branded stores

- 10.3.2. Multi-branded stores

- 10.3.3. Online Stores

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Qatar

- 10.4.4. Kuwait

- 10.4.5. Oman

- 10.4.6. Bahrain

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Bahrain GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Clothing and Apparel

- 11.1.2. Footwear

- 11.1.3. Bags

- 11.1.4. Jewellery

- 11.1.5. Watches

- 11.1.6. Other Accessories

- 11.2. Market Analysis, Insights and Forecast - by Gender

- 11.2.1. Male

- 11.2.2. Female

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Single branded stores

- 11.3.2. Multi-branded stores

- 11.3.3. Online Stores

- 11.3.4. Other Distribution Channels

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Saudi Arabia

- 11.4.2. United Arab Emirates

- 11.4.3. Qatar

- 11.4.4. Kuwait

- 11.4.5. Oman

- 11.4.6. Bahrain

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Capri Holdings*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kering SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Burberry Group PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Chanel Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Prada S p A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alshaya Franchise Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dolce & Gabbana Luxembourg S À R L

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AW Rostamani Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Rolex SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Etoile Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 LVMH Moët Hennessy Louis Vuitton

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Capri Holdings*List Not Exhaustive

List of Figures

- Figure 1: Global GCC Luxury Goods Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 5: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 6: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 13: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 15: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 16: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 19: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 21: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Qatar GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Qatar GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Qatar GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 25: Qatar GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 26: Qatar GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 27: Qatar GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Qatar GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 29: Qatar GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Qatar GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Qatar GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Kuwait GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Kuwait GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Kuwait GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 35: Kuwait GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 36: Kuwait GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Kuwait GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Kuwait GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Kuwait GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Kuwait GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Kuwait GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Oman GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Oman GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Oman GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 45: Oman GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 46: Oman GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Oman GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Oman GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 49: Oman GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Oman GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Oman GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Bahrain GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 53: Bahrain GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Bahrain GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 55: Bahrain GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 56: Bahrain GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 57: Bahrain GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Bahrain GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 59: Bahrain GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Bahrain GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Bahrain GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 3: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Luxury Goods Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 8: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 13: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 18: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 23: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 28: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 33: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 35: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Luxury Goods Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the GCC Luxury Goods Market?

Key companies in the market include Capri Holdings*List Not Exhaustive, Kering SA, Burberry Group PLC, Chanel Limited, Prada S p A, Alshaya Franchise Group, Dolce & Gabbana Luxembourg S À R L, AW Rostamani Group, Rolex SA, Etoile Group, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the GCC Luxury Goods Market?

The market segments include Type, Gender, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Increasing Use of E-commerce Platform for Buying Luxury Goods.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2022: The Italian House of Gucci, a subsidiary of Kering Group, was newly launched in the United Arab Emirates. The brand's new launch featured its glittering high jewelry pieces encompassing necklaces, rings, and bracelets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Luxury Goods Market?

To stay informed about further developments, trends, and reports in the GCC Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence