Key Insights

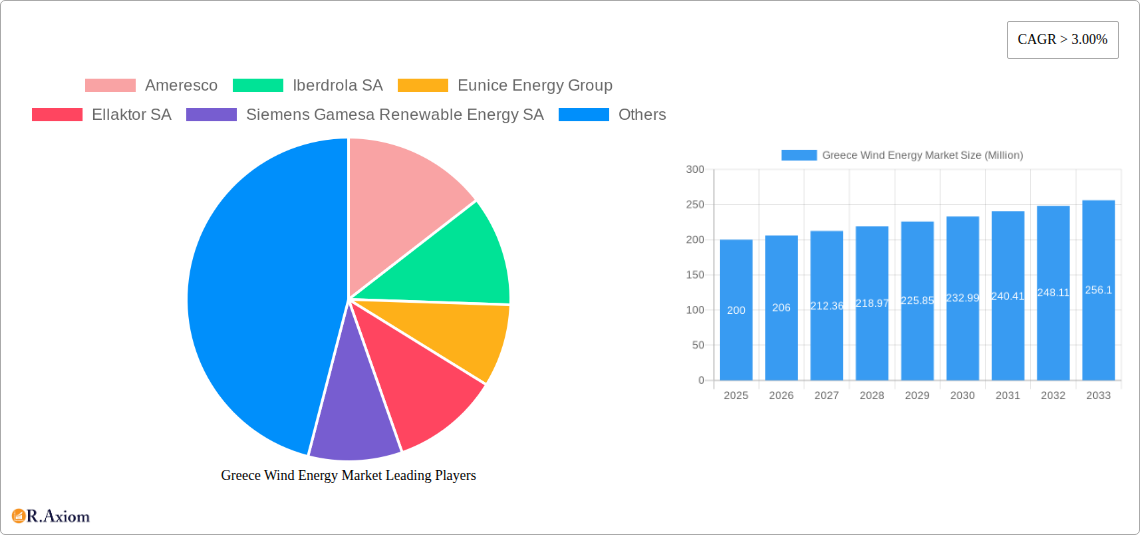

The Greece wind energy market presents a compelling investment opportunity, exhibiting robust growth potential over the forecast period (2025-2033). Driven by the country's ambitious renewable energy targets, supportive government policies aimed at reducing carbon emissions, and increasing energy independence, the market is poised for significant expansion. The onshore wind segment currently dominates, fueled by readily available land and established infrastructure. However, the offshore wind sector is anticipated to experience substantial growth, driven by technological advancements making deep-water installations more economically viable and the vast untapped potential of Greece's coastal waters. The utility-scale application segment is expected to remain the largest contributor to overall market value, driven by large-scale wind farm projects. Nevertheless, the distributed generation segment is expected to witness considerable growth, fueled by increased demand for decentralized power generation and the integration of renewable energy sources into local grids. Competition amongst established players like Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, and General Electric Company, alongside regional players like Terna Energy SA and Ellaktor SA, will intensify. The medium-scale and large-scale capacity segments will experience the most substantial growth, reflecting the industry trend towards larger, more efficient wind turbines. This growth trajectory is projected to continue, though potential restraints including permitting processes, grid infrastructure limitations, and environmental concerns will need careful consideration.

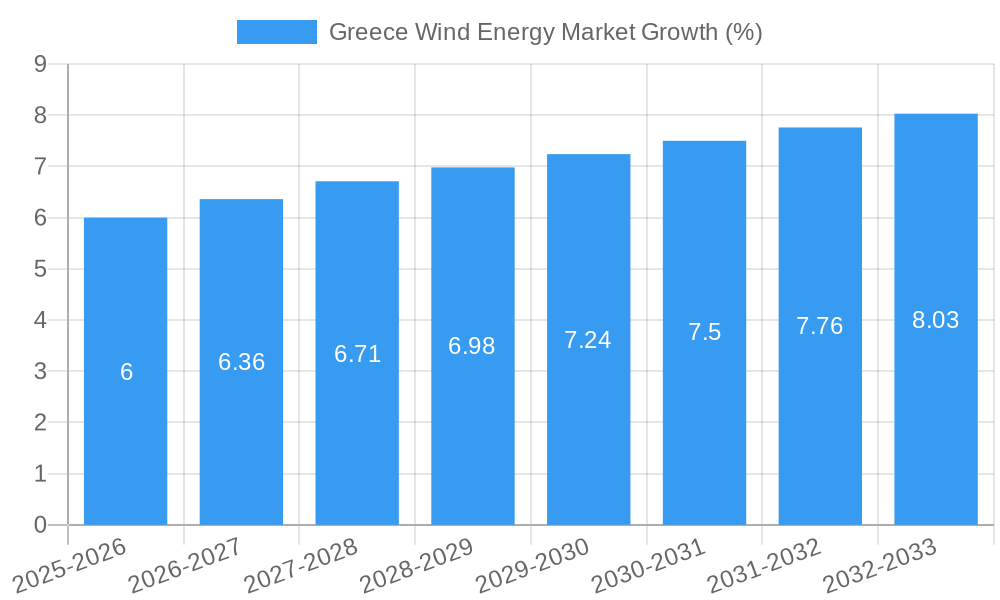

The projected Compound Annual Growth Rate (CAGR) of over 3.00% indicates a consistent upward trend in market value. Assuming a 2025 market size of €200 million (a reasonable estimate given the data's lack of a specific figure and the presence of major players), this translates to steady growth throughout the forecast period. While the exact market size for each segment and the precise market share of individual companies remain unspecified, the overall market trends suggest a promising outlook for investors and stakeholders in the Greek wind energy sector. This growth will be further influenced by the ongoing advancements in turbine technology, improving efficiency and reducing costs, as well as increasing public awareness and acceptance of renewable energy. Successful navigation of regulatory hurdles and the strategic development of grid infrastructure will be key to unlocking the full potential of the Greek wind energy market.

This detailed report provides a comprehensive analysis of the Greece wind energy market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for investors, industry stakeholders, and policymakers seeking to understand and navigate this dynamic sector.

Greece Wind Energy Market Concentration & Innovation

The Greek wind energy market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, specialized firms fosters innovation and competition. Market share data for 2024 indicates that the top five players collectively account for approximately xx% of the market, with a clear leader holding xx%. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values ranging from xx Million to xx Million. The regulatory framework, while supportive of renewable energy, still faces challenges in streamlining permitting processes. Product substitution is relatively limited, as wind energy primarily competes with other renewable sources and fossil fuels. End-user trends indicate a growing preference for large-scale wind farms due to economies of scale and grid integration ease.

- Key Market Concentration Metrics (2024):

- Top 5 players market share: xx%

- Largest player market share: xx%

- Average M&A deal value: xx Million

- Innovation Drivers: Government incentives, technological advancements (e.g., larger turbine sizes, improved efficiency), and pressure to reduce carbon emissions.

- Regulatory Framework: Supports renewable energy but needs simplification for faster project deployment.

- M&A Activity: Moderate activity with deals focused on consolidating market share and gaining access to new technologies.

Greece Wind Energy Market Industry Trends & Insights

The Greek wind energy market is poised for substantial growth, driven by a combination of factors including government support for renewable energy, favorable wind resources, and increasing energy security concerns. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2024 to xx% by 2033. Technological disruptions, such as advancements in turbine design and energy storage solutions, are expected to further accelerate market growth. Consumer preference for cleaner energy sources aligns perfectly with the sector's trajectory. Competitive dynamics are characterized by a mix of established players and emerging companies, leading to both consolidation and innovation within the market. The rising cost of fossil fuels and the growing awareness of climate change significantly bolster the demand for wind energy.

Dominant Markets & Segments in Greece Wind Energy Market

The onshore wind segment dominates the Greek wind energy market, accounting for xx% of the total installed capacity in 2024. This dominance is primarily attributed to the readily available land resources and relatively lower initial investment costs compared to offshore projects. The utility-scale application segment holds the largest market share, reflecting the focus on large-scale wind farm developments to meet the country's growing electricity demand. Large-scale projects are favored due to economies of scale and grid connectivity.

Key Drivers for Onshore Wind Dominance:

- Abundant onshore wind resources

- Lower initial investment costs compared to offshore

- Established grid infrastructure in many areas

Key Drivers for Utility-Scale Application Dominance:

- Economies of scale

- Easier grid integration

- Government support for large-scale projects

Regional variations: While the exact market share breakdown across regions within Greece is xx, the majority of installations are concentrated in areas with high wind speeds and suitable land availability.

Greece Wind Energy Market Product Developments

Recent product innovations focus on enhancing turbine efficiency, durability, and reducing the levelized cost of energy (LCOE). New turbine designs incorporate advanced materials and smart technologies for improved performance and reduced maintenance needs. The market is seeing a shift towards larger turbine capacities to maximize energy output per unit. This trend is driven by continuous technological advances in turbine design and material science. These developments improve the cost-effectiveness and overall efficiency of wind energy projects, making them more competitive with other energy sources.

Report Scope & Segmentation Analysis

This report segments the Greek wind energy market based on:

Type of Wind Turbine: Onshore and Offshore. Onshore wind holds a significantly larger market share, projected to reach xx Million by 2033, while the Offshore segment is still in its nascent stages with a projected xx Million by 2033. Competitive dynamics in the onshore segment are intense, with established players facing competition from new entrants. The offshore segment offers significant long-term potential but faces higher initial investment costs.

Application: Utility-scale and Distributed generation. Utility-scale projects are currently the dominant application, owing to their scale and ease of grid integration. However, Distributed generation is gaining traction, driven by advancements in small-scale turbine technology and government incentives.

Capacity: Small-scale, Medium-scale, and Large-scale. Large-scale projects currently dominate the market due to cost efficiency, but the other segments are expected to witness growth driven by technological advancements and changing policy environment.

Key Drivers of Greece Wind Energy Market Growth

The Greek wind energy market's growth is propelled by several factors. Government policies supporting renewable energy, including subsidies and tax incentives, are a key driver. The increasing need for energy security, coupled with the rising cost of fossil fuels, makes wind energy a more attractive alternative. The country's favorable wind resources and ongoing technological advancements further fuel market expansion. Lastly, the growing public awareness of climate change and the push for decarbonization strongly support the adoption of renewable energy.

Challenges in the Greece Wind Energy Market Sector

Despite the favorable outlook, the Greek wind energy market faces challenges. Permitting processes can be lengthy and complex, delaying project development. Grid infrastructure limitations in some regions pose a hurdle to integrating new wind farms. The intermittent nature of wind power requires the development of effective energy storage solutions. Furthermore, financing wind projects can sometimes prove challenging, especially for smaller developers.

Emerging Opportunities in Greece Wind Energy Market

The offshore wind sector presents a significant emerging opportunity. Technological advancements are reducing the costs associated with offshore wind farms. The development of hybrid projects, combining wind and solar energy, offers increased energy reliability and efficiency. Furthermore, the integration of smart grid technologies enhances the overall management and utilization of wind energy resources.

Leading Players in the Greece Wind Energy Market Market

- Ameresco

- Iberdrola SA

- Eunice Energy Group

- Ellaktor SA

- Siemens Gamesa Renewable Energy SA

- Terna Energy SA

- Vestas Wind Systems AS

- juwi AG

- General Electric Company

- Nordex SE

Key Developments in Greece Wind Energy Market Industry

- June 2021: Ameresco completed a 9.2-MW wind farm in Kefalonia, marking its first project in continental Europe.

- November 2021: The Greek Energy Department prepared a tender for a 600 MW wind and solar project (EUR 2.27 billion investment).

- November 2021: The European Commission approved a EUR 2.27 billion Greek scheme to support renewable energy production, including onshore wind.

Strategic Outlook for Greece Wind Energy Market Market

The Greek wind energy market is projected to experience significant growth over the next decade, driven by supportive government policies, favorable wind resources, and the global push towards decarbonization. Strategic investments in grid infrastructure, technological advancements, and innovative financing models will be crucial in unlocking the full potential of this sector. The market is expected to see continued consolidation among key players, as well as the emergence of new technologies and business models. The development of offshore wind projects represents a major growth opportunity.

Greece Wind Energy Market Segmentation

- 1. Onshore

- 2. Offshore

Greece Wind Energy Market Segmentation By Geography

- 1. Greece

Greece Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Costs

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ameresco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iberdrola SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eunice Energy Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ellaktor SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Terna Energy SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vestas Wind Systems AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 juwi AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nordex SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ameresco

List of Figures

- Figure 1: Greece Wind Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Greece Wind Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Greece Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Greece Wind Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Greece Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: Greece Wind Energy Market Volume Gigawatt Forecast, by Onshore 2019 & 2032

- Table 5: Greece Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: Greece Wind Energy Market Volume Gigawatt Forecast, by Offshore 2019 & 2032

- Table 7: Greece Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Greece Wind Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Greece Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Greece Wind Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Greece Wind Energy Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 12: Greece Wind Energy Market Volume Gigawatt Forecast, by Onshore 2019 & 2032

- Table 13: Greece Wind Energy Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 14: Greece Wind Energy Market Volume Gigawatt Forecast, by Offshore 2019 & 2032

- Table 15: Greece Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Greece Wind Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Wind Energy Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Greece Wind Energy Market?

Key companies in the market include Ameresco, Iberdrola SA, Eunice Energy Group, Ellaktor SA, Siemens Gamesa Renewable Energy SA, Terna Energy SA, Vestas Wind Systems AS, juwi AG, General Electric Company, Nordex SE.

3. What are the main segments of the Greece Wind Energy Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Costs.

8. Can you provide examples of recent developments in the market?

In June 2021, Ameresco completed EPC work on a 9.2-MW Greek island wind farm. The wind turbine project at Xerakia Dilinata in Kefalonia, Greece, has been completed and commenced operations. It is Ameresco's first wind project in continental Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Wind Energy Market?

To stay informed about further developments, trends, and reports in the Greece Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence