Key Insights

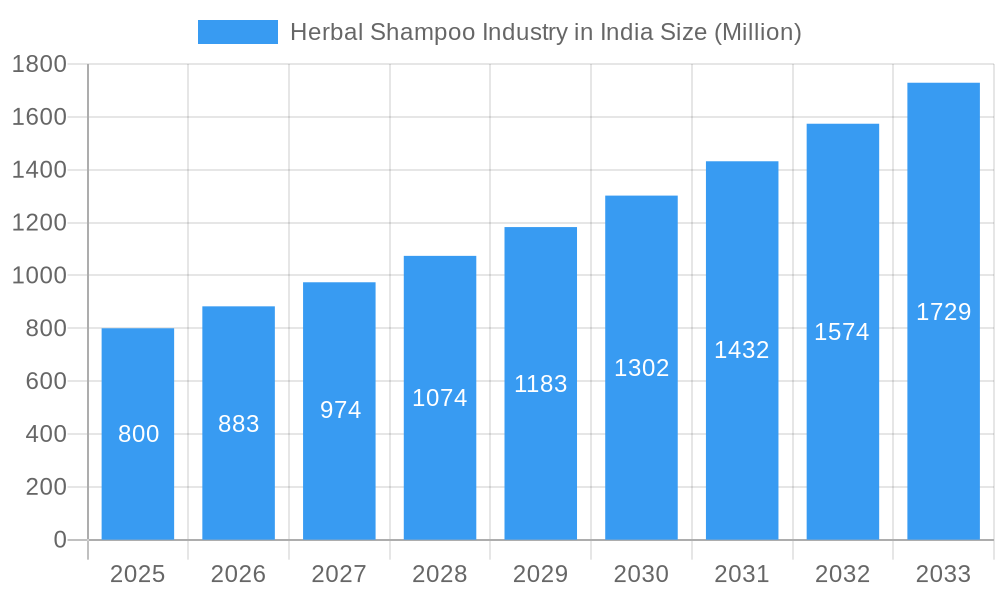

The Indian herbal shampoo market is poised for substantial growth, driven by escalating consumer demand for natural and organic personal care products, alongside a strong preference for Ayurvedic and herbal formulations. The market, valued at approximately 474.11 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This upward trajectory is underpinned by several key factors. Rising disposable incomes, particularly within India's expanding middle class, are enabling greater consumer expenditure on premium, natural personal care solutions. Concurrently, an increasing prevalence of hair-related concerns such as dandruff and hair fall, coupled with growing apprehension regarding the chemical content in conventional shampoos, is fueling demand for milder, herbal alternatives. The online distribution channel is experiencing significant expansion, mirroring India's robust e-commerce growth and enhancing product accessibility for a broader consumer base. Leading brands such as Dabur, Himalaya, and Patanjali are leveraging their established brand equity and extensive distribution networks to capitalize on this trend. Simultaneously, smaller, specialized brands are focusing on unique herbal formulations and targeted marketing to secure their market positions. The competitive environment is dynamic, with both established industry giants and emerging players vying for market leadership. Evolving regulatory frameworks promoting transparency in product labeling and ingredient sourcing are also anticipated to influence the market's future trajectory.

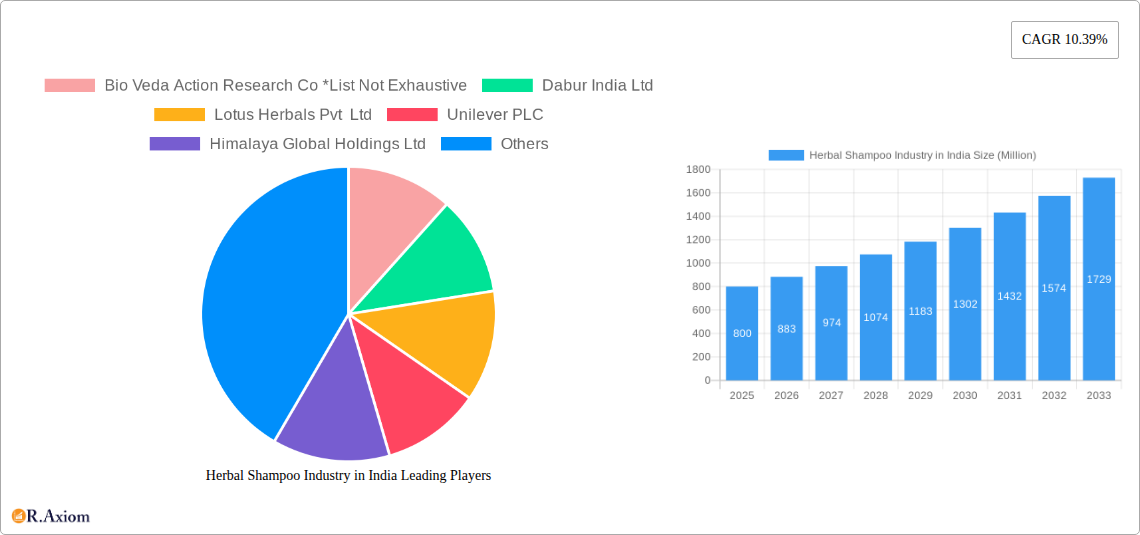

Herbal Shampoo Industry in India Market Size (In Million)

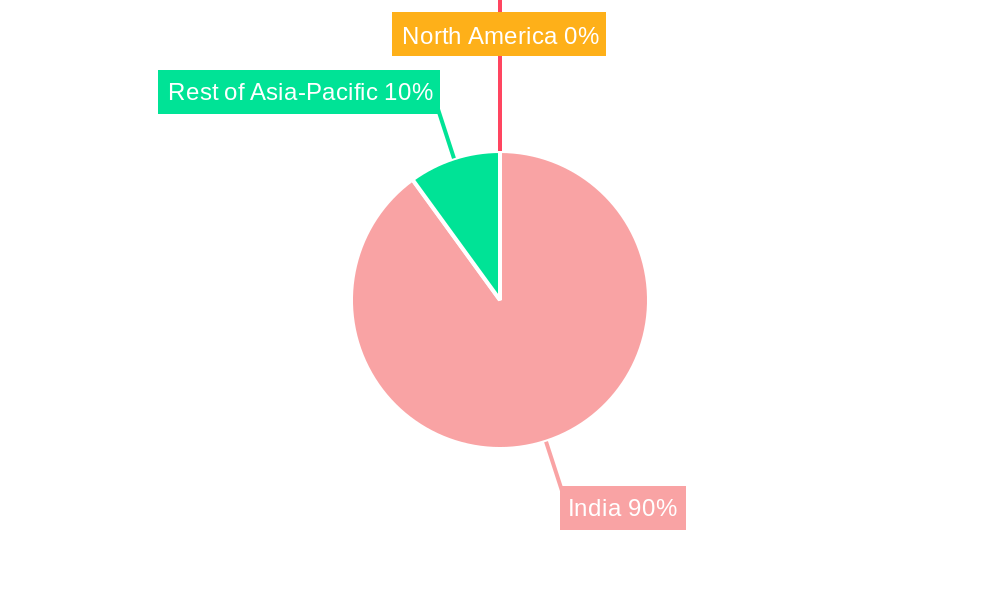

Market segmentation indicates that supermarkets/hypermarkets and online retail platforms currently command significant market shares, reflecting a blend of traditional and modern distribution strategies. However, convenience stores and specialty retailers are expected to witness growth throughout the forecast period, driven by strategic alliances and an expanding product presence. While India currently leads the market within the Asia-Pacific region, other markets in the region are demonstrating a growing interest in herbal shampoos, signaling potential future growth opportunities. Potential market restraints may include volatility in raw material pricing, challenges in maintaining consistent product quality, and the necessity for effective marketing strategies to address consumer perceptions concerning pricing and efficacy relative to conventional shampoo alternatives. The future outlook for the Indian herbal shampoo market remains highly optimistic, with considerable scope for continued expansion driven by prevailing trends and market dynamics.

Herbal Shampoo Industry in India Company Market Share

Herbal Shampoo Industry in India: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the herbal shampoo industry in India, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the dynamic Indian herbal shampoo market.

Herbal Shampoo Industry in India Market Concentration & Innovation

The Indian herbal shampoo market exhibits a moderately concentrated landscape, with a few dominant players alongside numerous smaller regional and niche brands. Market share data for 2024 suggests that the top five players account for approximately xx% of the total market, while the remaining xx% is distributed among numerous smaller players. Innovation in this sector is driven by consumer demand for natural and organic products, leading to the development of specialized shampoos catering to various hair types and concerns. The regulatory framework, while evolving, encourages the use of natural ingredients, although stricter regulations related to labeling and claims are anticipated. Product substitutes include conventional chemical-based shampoos, but the growing preference for natural and herbal options fuels market growth. M&A activities in the sector have been relatively moderate but are expected to increase as larger players seek to expand their market share and product portfolios. Recent mergers and acquisitions have involved deal values ranging from xx Million to xx Million INR. This trend is expected to continue, driven by the desire to acquire specialized brands and technologies.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Consumer preference for natural ingredients, specific hair concerns.

- Regulatory Framework: Encouraging natural ingredients, evolving labeling regulations.

- Product Substitutes: Conventional shampoos, but herbal options are gaining traction.

- M&A Activity: Moderate activity, with deal values ranging from xx Million to xx Million INR.

Herbal Shampoo Industry in India Industry Trends & Insights

The Indian herbal shampoo market is experiencing robust growth, driven primarily by increasing consumer awareness of the benefits of natural hair care products and rising disposable incomes. The market's compound annual growth rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by a growing middle class with a greater disposable income and a rising preference for natural and organic products. Technological advancements in extraction and formulation techniques are enhancing the quality and efficacy of herbal shampoos. Consumer preferences are shifting toward specialized products addressing specific hair concerns, such as dandruff, hair fall, and dry scalp. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants, resulting in innovative product launches and aggressive marketing strategies. Market penetration of herbal shampoos is gradually increasing, especially in urban areas, with significant potential for growth in rural markets.

Dominant Markets & Segments in Herbal Shampoo Industry in India

The Indian herbal shampoo market is witnessing strong growth across various regions, with urban areas exhibiting higher market penetration due to increased consumer awareness and purchasing power. However, rural markets are showing substantial growth potential driven by increasing accessibility and changing consumer preferences. Among distribution channels, online stores are rapidly gaining traction due to increasing internet penetration and e-commerce adoption. Supermarkets and hypermarkets remain a major channel, offering a wide range of products and convenient access for consumers.

- Key Drivers in Urban Markets: High disposable incomes, greater awareness of natural products.

- Key Drivers in Rural Markets: Increasing accessibility, changing consumer behavior.

- Online Stores: Rapid growth due to e-commerce adoption.

- Supermarkets/Hypermarkets: Strong presence, wide product range and accessibility.

- Convenience Stores: Localized access, suitable for impulse purchases.

- Specialty Stores: Targeting niche customer segments seeking high-quality products.

- Other Distribution Channels: Direct-to-consumer models, smaller retailers

Herbal Shampoo Industry in India Product Developments

Recent product innovations focus on specialized formulations targeting specific hair concerns, such as dandruff, hair fall, and hair growth. Companies are incorporating advanced extraction techniques to maximize the efficacy of herbal ingredients. These developments leverage technological advancements to improve product quality, efficacy, and consumer experience, aligning with market demand for effective and natural solutions. The competitive advantage lies in unique formulations, superior quality ingredients, and effective marketing strategies that resonate with target consumers.

Report Scope & Segmentation Analysis

This report segments the Indian herbal shampoo market based on distribution channels: Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Other Distribution Channels. Each segment's growth is projected based on market size, consumer preferences, and competitive dynamics. Growth projections vary across segments, with online stores exhibiting the highest growth potential, followed by supermarkets and hypermarkets. Competitive dynamics differ among segments, with increased competition in online stores and supermarkets, while specialty stores provide niche opportunities.

- Supermarkets/Hypermarkets: Moderate growth, driven by established presence and accessibility.

- Convenience Stores: Steady growth, fueled by impulse buying and localized convenience.

- Specialty Stores: High growth potential in niche segments seeking premium products.

- Online Stores: Rapid growth, propelled by e-commerce adoption and convenience.

- Other Distribution Channels: Growth varies based on specific channel characteristics.

Key Drivers of Herbal Shampoo Industry in India Growth

The growth of the Indian herbal shampoo industry is driven by several factors: increasing consumer awareness of the benefits of natural products, a rising middle class with greater disposable income, and government initiatives promoting herbal and organic products. Technological advancements in extraction and formulation techniques are enhancing product quality and efficacy. The evolving regulatory environment is supportive of natural ingredients.

Challenges in the Herbal Shampoo Industry in India Sector

The Indian herbal shampoo industry faces challenges including maintaining consistent product quality using natural ingredients, managing supply chain complexities, and intense competition from established players and new entrants. Regulatory hurdles, like evolving labeling standards and ingredient approvals, also pose challenges. Fluctuations in raw material prices can also impact profitability.

Emerging Opportunities in Herbal Shampoo Industry in India

Emerging opportunities include catering to growing demand for specialized products addressing specific hair types and concerns, expanding into untapped rural markets, and utilizing digital marketing and e-commerce platforms for enhanced reach. The development of sustainable and ethically sourced ingredients offers significant potential.

Leading Players in the Herbal Shampoo Industry in India Market

- Bio Veda Action Research Co

- Dabur India Ltd

- Lotus Herbals Pvt Ltd

- Unilever PLC

- Himalaya Global Holdings Ltd

- Fit & Glow Healthcare Pvt Ltd

- Cavinkare Pvt Ltd

- The Procter & Gamble Company

- Khadi Natural

- Patanjali Ayurved Limited

Key Developments in Herbal Shampoo Industry in India Industry

- June 2023: Himalaya Wellness Company launched Dandruff Control Aloe Vera Shampoo and Hair Fall Control Bhringaraja Shampoo in INR 2 sachet form, expanding market reach.

- May 2022: Medimix launched Total Care Shampoo, broadening its product portfolio.

- February 2022: Honasa Consumer acquired BBLUNT, strengthening its position in the premium hair care segment.

Strategic Outlook for Herbal Shampoo Industry in India Market

The Indian herbal shampoo market is poised for continued robust growth driven by consumer preference for natural products, rising disposable incomes, and technological advancements. Expanding into rural markets, focusing on specialized product formulations, and leveraging digital marketing strategies will be crucial for success. The market's future potential is significant, especially given the increasing health consciousness among Indian consumers.

Herbal Shampoo Industry in India Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Specialty Stores

- 1.4. Online Stores

- 1.5. Other Distribution Channels

Herbal Shampoo Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Herbal Shampoo Industry in India Regional Market Share

Geographic Coverage of Herbal Shampoo Industry in India

Herbal Shampoo Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Personal Care Products with Natural Ingredients; Innovations in Product Development by Manufacturers

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products And Regulatory Loopholes

- 3.4. Market Trends

- 3.4.1. Inclination Towards Personal Care Products with Natural Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Specialty Stores

- 5.1.4. Online Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Specialty Stores

- 6.1.4. Online Stores

- 6.1.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Specialty Stores

- 7.1.4. Online Stores

- 7.1.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Specialty Stores

- 8.1.4. Online Stores

- 8.1.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Specialty Stores

- 9.1.4. Online Stores

- 9.1.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Specialty Stores

- 10.1.4. Online Stores

- 10.1.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bio Veda Action Research Co *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dabur India Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lotus Herbals Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilever PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Himalaya Global Holdings Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fit & Glow Healthcare Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cavinkare Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Procter & Gamble Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Khadi Natural

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Patanjali Ayurved Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bio Veda Action Research Co *List Not Exhaustive

List of Figures

- Figure 1: Global Herbal Shampoo Industry in India Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 3: North America Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 5: North America Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: South America Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 9: South America Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: Middle East & Africa Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Middle East & Africa Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 19: Asia Pacific Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Herbal Shampoo Industry in India Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 34: China Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Herbal Shampoo Industry in India?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Herbal Shampoo Industry in India?

Key companies in the market include Bio Veda Action Research Co *List Not Exhaustive, Dabur India Ltd, Lotus Herbals Pvt Ltd, Unilever PLC, Himalaya Global Holdings Ltd, Fit & Glow Healthcare Pvt Ltd, Cavinkare Pvt Ltd, The Procter & Gamble Company, Khadi Natural, Patanjali Ayurved Limited.

3. What are the main segments of the Herbal Shampoo Industry in India?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 474.11 million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Personal Care Products with Natural Ingredients; Innovations in Product Development by Manufacturers.

6. What are the notable trends driving market growth?

Inclination Towards Personal Care Products with Natural Ingredients.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products And Regulatory Loopholes.

8. Can you provide examples of recent developments in the market?

June 2023: The Himalaya Wellness Company introduced two new shampoos, namely Dandruff Control Aloe Vera Shampoo and Hair Fall Control Bhringaraja Shampoo, in INR 2 sachet form. The company claims these shampoos are infused with natural ingredients carefully selected to provide effective hair care solutions. This new launch is a part of the brand's effort to reach a larger audience and increase its penetration in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Herbal Shampoo Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Herbal Shampoo Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Herbal Shampoo Industry in India?

To stay informed about further developments, trends, and reports in the Herbal Shampoo Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence