Key Insights

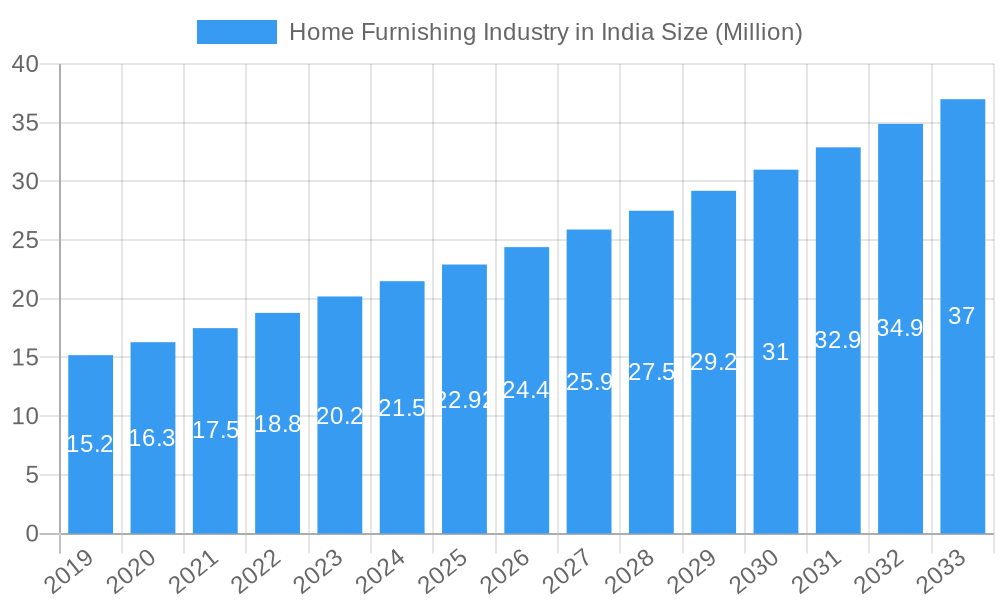

The Indian Home Furnishing Industry is poised for robust expansion, projected to reach a substantial market size of INR 22.92 billion by 2025, driven by a compelling CAGR of 10.64%. This significant growth is fueled by a confluence of factors including rising disposable incomes, increasing urbanization, and a burgeoning demand for aesthetically pleasing and functional living spaces. The "Make in India" initiative, coupled with a growing preference for organized retail and online purchasing channels, is further catalyzing market penetration. Consumers are increasingly investing in transforming their homes, with modular and semi-modular kitchen furniture, along with wardrobes, emerging as key growth segments. The increasing adoption of smart homes and a greater emphasis on interior design trends are also creating new avenues for innovation and market expansion. Key players are focusing on product diversification and enhancing customer experience to capture a larger market share.

Home Furnishing Industry in India Market Size (In Million)

The industry's growth trajectory is further supported by evolving consumer lifestyles and a strong desire for personalized home environments. While the market is dominated by organized players, the unorganized sector continues to hold a significant presence, offering competitive pricing and localized solutions. The distribution landscape is dynamic, with home centers and specialty stores playing a crucial role, while online platforms are rapidly gaining traction due to their convenience and wider product accessibility. However, challenges such as fluctuating raw material prices and the need for skilled labor in manufacturing and installation present potential restraints. Despite these, the sustained interest in home renovation, coupled with the increasing nuclearization of families and a rising middle class, paints a promising picture for the Indian home furnishing market, with a continued upward trend anticipated in the forecast period.

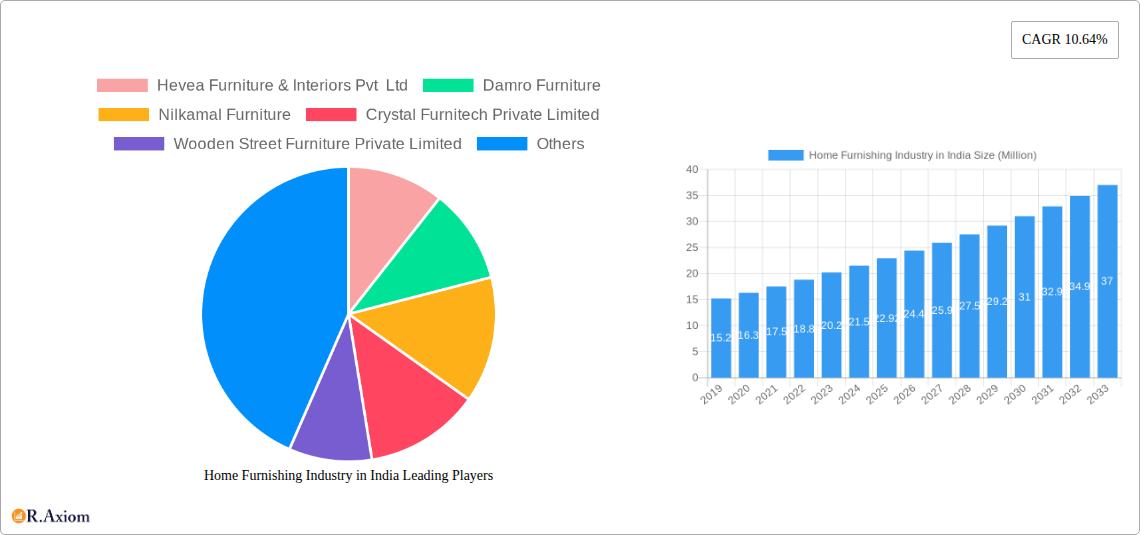

Home Furnishing Industry in India Company Market Share

India Home Furnishing Market: A Comprehensive Growth Report (2019-2033)

This in-depth report provides a detailed analysis of the Indian Home Furnishing Industry, covering market dynamics, key segments, growth drivers, challenges, and emerging opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the burgeoning Indian home décor and furniture market. Our analysis incorporates high-traffic keywords such as "Indian furniture market," "home decor India," "modular kitchen India," "bedroom furniture online," and "home furnishing trends" to ensure maximum search visibility and engagement. The report delves into a comprehensive segmentation of the market, examining product types like modular and semi-modular kitchens, bedroom furniture, bathroom furniture, and wardrobes, alongside market types (organized and unorganized) and distribution channels including home centers, specialty stores, and online platforms. The estimated market size for the Indian Home Furnishing Industry in 2025 is projected to be approximately 6 Million.

Home Furnishing Industry in India Market Concentration & Innovation

The Indian Home Furnishing Industry exhibits a moderate level of market concentration, with a mix of large organized players and a significant presence of the unorganized sector, accounting for an estimated 45% of the market share. Innovation is primarily driven by evolving consumer preferences for stylish, functional, and space-saving solutions, particularly in urban areas. The adoption of advanced manufacturing technologies, sustainable materials, and smart furniture designs are key innovation drivers. Regulatory frameworks, while evolving, primarily focus on product safety standards and environmental compliance. Product substitutes, ranging from DIY solutions to imported alternatives, present a constant competitive pressure. End-user trends are strongly influenced by urbanization, increasing disposable incomes, and a growing aspiration for aesthetically pleasing living spaces. Mergers & Acquisitions (M&A) activities are gradually increasing, with a projected deal value of over 500 Million expected over the forecast period as companies seek to consolidate their market position and expand their product portfolios.

Home Furnishing Industry in India Industry Trends & Insights

The Indian Home Furnishing Industry is experiencing robust growth, propelled by several key trends. The CAGR for the home furnishing market in India is estimated at 12.5% for the forecast period. A significant driver is the increasing urbanization and the resultant demand for compact and multi-functional furniture, especially modular and semi-modular solutions. The rise of the nuclear family structure and the growing preference for aspirational living spaces further fuel this demand. Technological disruptions are playing a pivotal role, with the widespread adoption of e-commerce platforms revolutionizing the distribution landscape and offering wider product accessibility. 3D visualization tools and augmented reality (AR) are enhancing the online shopping experience, allowing consumers to virtually place furniture in their homes before purchasing. Consumer preferences are shifting towards personalization, customization, and eco-friendly materials. There is a discernible move towards minimalist designs, earthy tones, and smart home integration. The competitive dynamics are intensifying, with established brands expanding their retail footprints and online presence, while D2C (Direct-to-Consumer) brands are gaining traction by offering unique value propositions and direct customer engagement. The market penetration of organized retail in the home furnishing sector is steadily increasing, projected to reach 60% by 2033. The growing demand for home renovation and interior décor services, often driven by a desire to upgrade living spaces or as part of real estate transactions, acts as another significant growth catalyst.

Dominant Markets & Segments in Home Furnishing Industry in India

The Indian Home Furnishing Industry is dominated by the Organized market segment, which is projected to hold a market share of approximately 55% by 2025, driven by increasing consumer trust, wider product availability, and standardized quality. Within Product Type, Modular and Semi-modular Kitchen Furniture commands the largest share, estimated at 20% of the total market, with L Shape Modular Kitchen and U Shape Modular Kitchen being particularly popular due to space optimization. Bedroom Furniture follows closely, accounting for approximately 18% of the market, with Beds being the highest revenue-generating category. The Online distribution channel is experiencing exponential growth, expected to capture 30% of the market share by 2025, facilitated by its convenience and wider selection.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting manufacturing and 'Make in India' are boosting domestic production and availability of organized furniture.

- Infrastructure Development: Rapid urbanization and the growth of the real estate sector are creating a constant demand for new homes and consequently, home furnishings.

- Disposable Income: Rising disposable incomes, especially among the middle and upper-middle classes, allow for greater expenditure on home improvement and décor.

- Changing Lifestyles: The shift towards smaller living spaces in urban areas drives demand for space-saving modular furniture.

- Digital Adoption: Increased internet penetration and smartphone usage facilitate online purchasing of home furnishings, making it accessible to a wider audience.

- Consumer Awareness: Greater exposure to global trends through media and online platforms has led to increased awareness and demand for aesthetically pleasing and functional furniture.

Wardrobes are also a significant segment, with Double-door Wardrobes and Three-door Wardrobes being the most sought-after. The demand for Bathroom Furniture, though nascent, is showing promising growth, driven by modern bathroom designs and increased spending on home utilities. The Unorganized sector, while shrinking in relative market share, still holds a substantial presence, particularly in tier-2 and tier-3 cities, owing to its affordability and local customization options. However, the organized sector's expansion through retail outlets and online presence is steadily capturing market share.

Home Furnishing Industry in India Product Developments

Product innovation in the Indian home furnishing sector is characterized by a strong focus on functionality, aesthetics, and sustainability. Manufacturers are increasingly integrating smart technologies into furniture, such as built-in charging ports and adjustable lighting. There's a growing emphasis on modular and customizable designs that cater to the diverse space constraints and personal preferences of Indian consumers. The application of eco-friendly materials, recycled components, and sustainable manufacturing processes is gaining momentum, appealing to environmentally conscious buyers. These developments provide a competitive advantage by meeting evolving consumer demands and differentiating brands in a crowded marketplace.

Report Scope & Segmentation Analysis

This report segments the Indian Home Furnishing Industry across several key dimensions. The Product Type segmentation includes Modular and Semi-modular Kitchen Furniture (L Shape Modular Kitchen, U Shape Modular Kitchen, Parallel Shape Modular Kitchen, Straight Shape Modular Kitchen, Other Modular Kitchen Furniture), Bedroom Furniture (Beds, Dresser/Dressing Tables, Bedside Tables, Other Bedroom Furniture), Bathroom Furniture (Bathroom Cabinets, Other Bathroom Furniture), and Wardrobes (Single-door Wardrobes, Double-door Wardrobes, Three-door Wardrobes, Four-door Wardrobes, Other Wardrobes like Almirahs). The Type of Market is divided into Organized and Unorganized sectors. The Distribution Channel analysis covers Home Centers, Specialty Stores, Online, and Other Distribution Channels. Growth projections for these segments indicate a strong upward trajectory, with the online channel and modular furniture segments expected to witness the highest growth rates. The competitive dynamics within each segment are analyzed, highlighting key players and their market strategies.

Key Drivers of Home Furnishing Industry in India Growth

The Indian Home Furnishing Industry's growth is propelled by a confluence of economic, social, and technological factors. A key economic driver is the sustained increase in disposable incomes and the growing aspirations of the burgeoning middle class. Socially, rapid urbanization and the resultant demand for compact, functional living spaces are critical. The government's focus on housing development and smart cities further fuels this trend. Technologically, the widespread adoption of e-commerce platforms has democratized access to a vast array of home furnishing products, while advancements in manufacturing, such as automated production and 3D printing, enable greater customization and efficiency.

Challenges in the Home Furnishing Industry in India Sector

Despite robust growth, the Indian Home Furnishing Industry faces several challenges. The presence of a significant unorganized sector creates intense price competition, making it difficult for organized players to compete solely on price. Supply chain inefficiencies, including logistics and raw material sourcing, can impact production costs and delivery timelines. Regulatory hurdles, such as varying state-level policies and compliance requirements, can add complexity for businesses operating nationwide. Furthermore, maintaining consistent product quality across diverse manufacturing bases and mitigating the impact of fluctuating raw material prices remain ongoing concerns for industry stakeholders.

Emerging Opportunities in Home Furnishing Industry in India

Emerging opportunities in the Indian Home Furnishing Industry lie in the growing demand for sustainable and eco-friendly products, appealing to a conscious consumer base. The rise of smart home technology presents a significant opportunity for integrated furniture solutions. Expansion into tier-2 and tier-3 cities, where the organized sector's penetration is still relatively low, offers untapped market potential. Furthermore, the increasing popularity of online customization platforms and the demand for personalized interior design services are creating new avenues for businesses to innovate and cater to niche markets. The growth of the rental housing market also presents opportunities for durable and adaptable furnishings.

Leading Players in the Home Furnishing Industry in India Market

- Hevea Furniture & Interiors Pvt Ltd

- Damro Furniture

- Nilkamal Furniture

- Crystal Furnitech Private Limited

- Wooden Street Furniture Private Limited

- Featherlite

- Spacewood Furnishers Pvt Ltd

- Zuari Furniture

- Durian Furniture

- Royaloak Incorporation

- Pepperfry

- Bluewud

- Godrej Interio

- Dynasty

- Wipro Seating Solutions

Key Developments in Home Furnishing Industry in India Industry

- October 2023: Godrej and Boyce, the flagship company of the Godrej Group, significantly enhanced the customer experience for Godrej Interio by opening 15 new stores in Delhi-NCR. This expansion increased the total store count to 35 in this crucial market, featuring various offerings, including modular kitchen solutions and various home furnishing options.

- February 2023: Featherlite recently opened a new exclusive experience center and retail outlet in Ahmedabad, showcasing various products, including ergonomic chairs and home furniture. With this launch, Featherlite now operates 66 stores across India.

Strategic Outlook for Home Furnishing Industry in India Market

The strategic outlook for the Indian Home Furnishing Industry remains exceptionally positive, driven by a strong combination of increasing consumer demand, evolving lifestyle preferences, and technological advancements. The market is poised for sustained growth, with opportunities to leverage online channels for wider reach and engage consumers through personalized experiences. Focus on sustainable and innovative product development, coupled with strategic retail expansion, will be crucial for market leadership. Collaborations and partnerships, along with a keen understanding of regional consumer nuances, will further solidify market positioning and unlock untapped potential in this dynamic sector.

Home Furnishing Industry in India Segmentation

-

1. Product Type

-

1.1. Modular and Semi-modular Kitchen Furniture

- 1.1.1. L Shape Modular Kitchen

- 1.1.2. U Shape Modular Kitchen

- 1.1.3. Parallel Shape Modular Kitchen

- 1.1.4. Straight Shape Modular Kitchen

- 1.1.5. Other Modular Kitchen Furniture

-

1.2. Bedroom Furniture

- 1.2.1. Beds

- 1.2.2. Dresser/Dressing Tables

- 1.2.3. Bedside Tables

- 1.2.4. Other Be

-

1.3. Bathroom Furniture

- 1.3.1. Bathroom Cabinets

- 1.3.2. Other Bathroom Furniture

-

1.4. Wardrobes

- 1.4.1. Single-door Wardrobes

- 1.4.2. Double-door Wardrobes

- 1.4.3. Three-door Wardrobes

- 1.4.4. Four-door Wardrobes

- 1.4.5. Other Wardrobes (Almirah, etc.)

- 1.5. Other Ho

-

1.1. Modular and Semi-modular Kitchen Furniture

-

2. Type of Market

- 2.1. Organized

- 2.2. Unorganized

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

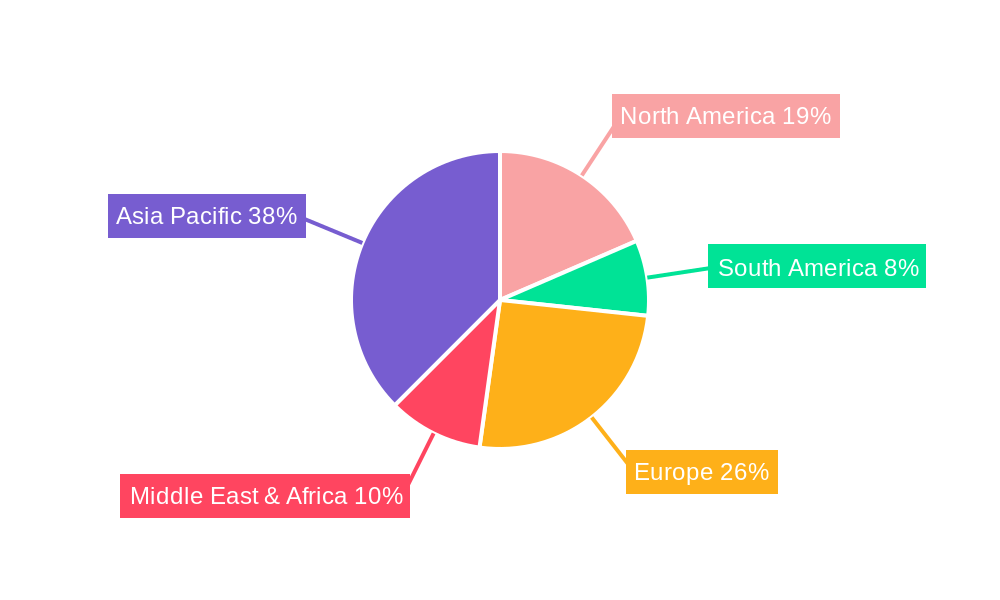

Home Furnishing Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Furnishing Industry in India Regional Market Share

Geographic Coverage of Home Furnishing Industry in India

Home Furnishing Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives; E-Commerce is Rapidly Expanding in the Indian Furniture Market

- 3.3. Market Restrains

- 3.3.1. Quality Control And Stadards; Logistical Constraints

- 3.4. Market Trends

- 3.4.1. Rising Demand for Modular and Semi-modular Kitchen Furniture Driving Growth in the Indian Home Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Modular and Semi-modular Kitchen Furniture

- 5.1.1.1. L Shape Modular Kitchen

- 5.1.1.2. U Shape Modular Kitchen

- 5.1.1.3. Parallel Shape Modular Kitchen

- 5.1.1.4. Straight Shape Modular Kitchen

- 5.1.1.5. Other Modular Kitchen Furniture

- 5.1.2. Bedroom Furniture

- 5.1.2.1. Beds

- 5.1.2.2. Dresser/Dressing Tables

- 5.1.2.3. Bedside Tables

- 5.1.2.4. Other Be

- 5.1.3. Bathroom Furniture

- 5.1.3.1. Bathroom Cabinets

- 5.1.3.2. Other Bathroom Furniture

- 5.1.4. Wardrobes

- 5.1.4.1. Single-door Wardrobes

- 5.1.4.2. Double-door Wardrobes

- 5.1.4.3. Three-door Wardrobes

- 5.1.4.4. Four-door Wardrobes

- 5.1.4.5. Other Wardrobes (Almirah, etc.)

- 5.1.5. Other Ho

- 5.1.1. Modular and Semi-modular Kitchen Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type of Market

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Modular and Semi-modular Kitchen Furniture

- 6.1.1.1. L Shape Modular Kitchen

- 6.1.1.2. U Shape Modular Kitchen

- 6.1.1.3. Parallel Shape Modular Kitchen

- 6.1.1.4. Straight Shape Modular Kitchen

- 6.1.1.5. Other Modular Kitchen Furniture

- 6.1.2. Bedroom Furniture

- 6.1.2.1. Beds

- 6.1.2.2. Dresser/Dressing Tables

- 6.1.2.3. Bedside Tables

- 6.1.2.4. Other Be

- 6.1.3. Bathroom Furniture

- 6.1.3.1. Bathroom Cabinets

- 6.1.3.2. Other Bathroom Furniture

- 6.1.4. Wardrobes

- 6.1.4.1. Single-door Wardrobes

- 6.1.4.2. Double-door Wardrobes

- 6.1.4.3. Three-door Wardrobes

- 6.1.4.4. Four-door Wardrobes

- 6.1.4.5. Other Wardrobes (Almirah, etc.)

- 6.1.5. Other Ho

- 6.1.1. Modular and Semi-modular Kitchen Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type of Market

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Modular and Semi-modular Kitchen Furniture

- 7.1.1.1. L Shape Modular Kitchen

- 7.1.1.2. U Shape Modular Kitchen

- 7.1.1.3. Parallel Shape Modular Kitchen

- 7.1.1.4. Straight Shape Modular Kitchen

- 7.1.1.5. Other Modular Kitchen Furniture

- 7.1.2. Bedroom Furniture

- 7.1.2.1. Beds

- 7.1.2.2. Dresser/Dressing Tables

- 7.1.2.3. Bedside Tables

- 7.1.2.4. Other Be

- 7.1.3. Bathroom Furniture

- 7.1.3.1. Bathroom Cabinets

- 7.1.3.2. Other Bathroom Furniture

- 7.1.4. Wardrobes

- 7.1.4.1. Single-door Wardrobes

- 7.1.4.2. Double-door Wardrobes

- 7.1.4.3. Three-door Wardrobes

- 7.1.4.4. Four-door Wardrobes

- 7.1.4.5. Other Wardrobes (Almirah, etc.)

- 7.1.5. Other Ho

- 7.1.1. Modular and Semi-modular Kitchen Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type of Market

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Modular and Semi-modular Kitchen Furniture

- 8.1.1.1. L Shape Modular Kitchen

- 8.1.1.2. U Shape Modular Kitchen

- 8.1.1.3. Parallel Shape Modular Kitchen

- 8.1.1.4. Straight Shape Modular Kitchen

- 8.1.1.5. Other Modular Kitchen Furniture

- 8.1.2. Bedroom Furniture

- 8.1.2.1. Beds

- 8.1.2.2. Dresser/Dressing Tables

- 8.1.2.3. Bedside Tables

- 8.1.2.4. Other Be

- 8.1.3. Bathroom Furniture

- 8.1.3.1. Bathroom Cabinets

- 8.1.3.2. Other Bathroom Furniture

- 8.1.4. Wardrobes

- 8.1.4.1. Single-door Wardrobes

- 8.1.4.2. Double-door Wardrobes

- 8.1.4.3. Three-door Wardrobes

- 8.1.4.4. Four-door Wardrobes

- 8.1.4.5. Other Wardrobes (Almirah, etc.)

- 8.1.5. Other Ho

- 8.1.1. Modular and Semi-modular Kitchen Furniture

- 8.2. Market Analysis, Insights and Forecast - by Type of Market

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Modular and Semi-modular Kitchen Furniture

- 9.1.1.1. L Shape Modular Kitchen

- 9.1.1.2. U Shape Modular Kitchen

- 9.1.1.3. Parallel Shape Modular Kitchen

- 9.1.1.4. Straight Shape Modular Kitchen

- 9.1.1.5. Other Modular Kitchen Furniture

- 9.1.2. Bedroom Furniture

- 9.1.2.1. Beds

- 9.1.2.2. Dresser/Dressing Tables

- 9.1.2.3. Bedside Tables

- 9.1.2.4. Other Be

- 9.1.3. Bathroom Furniture

- 9.1.3.1. Bathroom Cabinets

- 9.1.3.2. Other Bathroom Furniture

- 9.1.4. Wardrobes

- 9.1.4.1. Single-door Wardrobes

- 9.1.4.2. Double-door Wardrobes

- 9.1.4.3. Three-door Wardrobes

- 9.1.4.4. Four-door Wardrobes

- 9.1.4.5. Other Wardrobes (Almirah, etc.)

- 9.1.5. Other Ho

- 9.1.1. Modular and Semi-modular Kitchen Furniture

- 9.2. Market Analysis, Insights and Forecast - by Type of Market

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Home Furnishing Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Modular and Semi-modular Kitchen Furniture

- 10.1.1.1. L Shape Modular Kitchen

- 10.1.1.2. U Shape Modular Kitchen

- 10.1.1.3. Parallel Shape Modular Kitchen

- 10.1.1.4. Straight Shape Modular Kitchen

- 10.1.1.5. Other Modular Kitchen Furniture

- 10.1.2. Bedroom Furniture

- 10.1.2.1. Beds

- 10.1.2.2. Dresser/Dressing Tables

- 10.1.2.3. Bedside Tables

- 10.1.2.4. Other Be

- 10.1.3. Bathroom Furniture

- 10.1.3.1. Bathroom Cabinets

- 10.1.3.2. Other Bathroom Furniture

- 10.1.4. Wardrobes

- 10.1.4.1. Single-door Wardrobes

- 10.1.4.2. Double-door Wardrobes

- 10.1.4.3. Three-door Wardrobes

- 10.1.4.4. Four-door Wardrobes

- 10.1.4.5. Other Wardrobes (Almirah, etc.)

- 10.1.5. Other Ho

- 10.1.1. Modular and Semi-modular Kitchen Furniture

- 10.2. Market Analysis, Insights and Forecast - by Type of Market

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hevea Furniture & Interiors Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Damro Furniture

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nilkamal Furniture

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crystal Furnitech Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wooden Street Furniture Private Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Featherlite

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Spacewood Furnishers Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zuari Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Durian Furniture

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royaloak Incorporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pepperfry

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bluewud

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Godrej Interio

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dynasty

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wipro Seating Solutions

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Hevea Furniture & Interiors Pvt Ltd

List of Figures

- Figure 1: Global Home Furnishing Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Home Furnishing Industry in India Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Home Furnishing Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Home Furnishing Industry in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Home Furnishing Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Home Furnishing Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Home Furnishing Industry in India Revenue (Million), by Type of Market 2025 & 2033

- Figure 8: North America Home Furnishing Industry in India Volume (K Unit), by Type of Market 2025 & 2033

- Figure 9: North America Home Furnishing Industry in India Revenue Share (%), by Type of Market 2025 & 2033

- Figure 10: North America Home Furnishing Industry in India Volume Share (%), by Type of Market 2025 & 2033

- Figure 11: North America Home Furnishing Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America Home Furnishing Industry in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 13: North America Home Furnishing Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Home Furnishing Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Home Furnishing Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Home Furnishing Industry in India Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Home Furnishing Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Home Furnishing Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Home Furnishing Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 20: South America Home Furnishing Industry in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: South America Home Furnishing Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Home Furnishing Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 23: South America Home Furnishing Industry in India Revenue (Million), by Type of Market 2025 & 2033

- Figure 24: South America Home Furnishing Industry in India Volume (K Unit), by Type of Market 2025 & 2033

- Figure 25: South America Home Furnishing Industry in India Revenue Share (%), by Type of Market 2025 & 2033

- Figure 26: South America Home Furnishing Industry in India Volume Share (%), by Type of Market 2025 & 2033

- Figure 27: South America Home Furnishing Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America Home Furnishing Industry in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 29: South America Home Furnishing Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Home Furnishing Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Home Furnishing Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Home Furnishing Industry in India Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Home Furnishing Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Home Furnishing Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Home Furnishing Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Europe Home Furnishing Industry in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Europe Home Furnishing Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Europe Home Furnishing Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Europe Home Furnishing Industry in India Revenue (Million), by Type of Market 2025 & 2033

- Figure 40: Europe Home Furnishing Industry in India Volume (K Unit), by Type of Market 2025 & 2033

- Figure 41: Europe Home Furnishing Industry in India Revenue Share (%), by Type of Market 2025 & 2033

- Figure 42: Europe Home Furnishing Industry in India Volume Share (%), by Type of Market 2025 & 2033

- Figure 43: Europe Home Furnishing Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Europe Home Furnishing Industry in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Europe Home Furnishing Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe Home Furnishing Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe Home Furnishing Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Home Furnishing Industry in India Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Home Furnishing Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Home Furnishing Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Home Furnishing Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East & Africa Home Furnishing Industry in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Middle East & Africa Home Furnishing Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East & Africa Home Furnishing Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East & Africa Home Furnishing Industry in India Revenue (Million), by Type of Market 2025 & 2033

- Figure 56: Middle East & Africa Home Furnishing Industry in India Volume (K Unit), by Type of Market 2025 & 2033

- Figure 57: Middle East & Africa Home Furnishing Industry in India Revenue Share (%), by Type of Market 2025 & 2033

- Figure 58: Middle East & Africa Home Furnishing Industry in India Volume Share (%), by Type of Market 2025 & 2033

- Figure 59: Middle East & Africa Home Furnishing Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa Home Furnishing Industry in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa Home Furnishing Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa Home Furnishing Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Home Furnishing Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa Home Furnishing Industry in India Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Home Furnishing Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Home Furnishing Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Home Furnishing Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Asia Pacific Home Furnishing Industry in India Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Asia Pacific Home Furnishing Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Asia Pacific Home Furnishing Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Asia Pacific Home Furnishing Industry in India Revenue (Million), by Type of Market 2025 & 2033

- Figure 72: Asia Pacific Home Furnishing Industry in India Volume (K Unit), by Type of Market 2025 & 2033

- Figure 73: Asia Pacific Home Furnishing Industry in India Revenue Share (%), by Type of Market 2025 & 2033

- Figure 74: Asia Pacific Home Furnishing Industry in India Volume Share (%), by Type of Market 2025 & 2033

- Figure 75: Asia Pacific Home Furnishing Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific Home Furnishing Industry in India Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific Home Furnishing Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific Home Furnishing Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Home Furnishing Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific Home Furnishing Industry in India Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Home Furnishing Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Home Furnishing Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 4: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 5: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Home Furnishing Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Home Furnishing Industry in India Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 12: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 13: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Home Furnishing Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Home Furnishing Industry in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 26: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 27: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Home Furnishing Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Home Furnishing Industry in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 40: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 41: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Home Furnishing Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Home Furnishing Industry in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 64: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 66: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 67: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Home Furnishing Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Home Furnishing Industry in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Home Furnishing Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 84: Global Home Furnishing Industry in India Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 85: Global Home Furnishing Industry in India Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 86: Global Home Furnishing Industry in India Volume K Unit Forecast, by Type of Market 2020 & 2033

- Table 87: Global Home Furnishing Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global Home Furnishing Industry in India Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global Home Furnishing Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global Home Furnishing Industry in India Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Home Furnishing Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Home Furnishing Industry in India Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Furnishing Industry in India?

The projected CAGR is approximately 10.64%.

2. Which companies are prominent players in the Home Furnishing Industry in India?

Key companies in the market include Hevea Furniture & Interiors Pvt Ltd, Damro Furniture, Nilkamal Furniture, Crystal Furnitech Private Limited, Wooden Street Furniture Private Limited, Featherlite, Spacewood Furnishers Pvt Ltd, Zuari Furniture, Durian Furniture, Royaloak Incorporation, Pepperfry, Bluewud, Godrej Interio, Dynasty, Wipro Seating Solutions.

3. What are the main segments of the Home Furnishing Industry in India?

The market segments include Product Type, Type of Market, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives; E-Commerce is Rapidly Expanding in the Indian Furniture Market.

6. What are the notable trends driving market growth?

Rising Demand for Modular and Semi-modular Kitchen Furniture Driving Growth in the Indian Home Furniture Market.

7. Are there any restraints impacting market growth?

Quality Control And Stadards; Logistical Constraints.

8. Can you provide examples of recent developments in the market?

October 2023: Godrej and Boyce, the flagship company of the Godrej Group, significantly enhanced the customer experience for Godrej Interio by opening 15 new stores in Delhi-NCR. This expansion increased the total store count to 35 in this crucial market, featuring various offerings, including modular kitchen solutions and various home furnishing options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Furnishing Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Furnishing Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Furnishing Industry in India?

To stay informed about further developments, trends, and reports in the Home Furnishing Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence