Key Insights

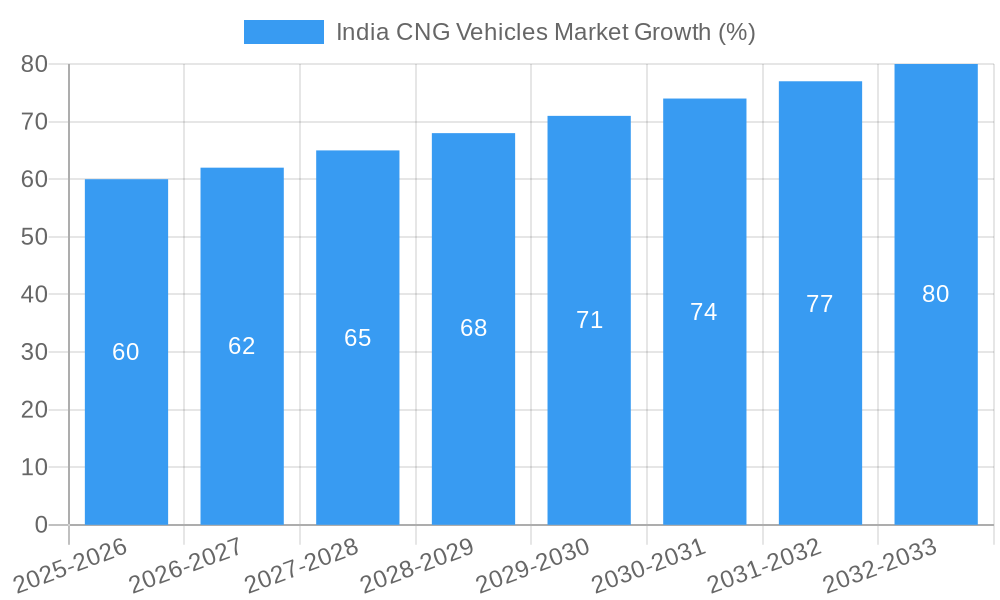

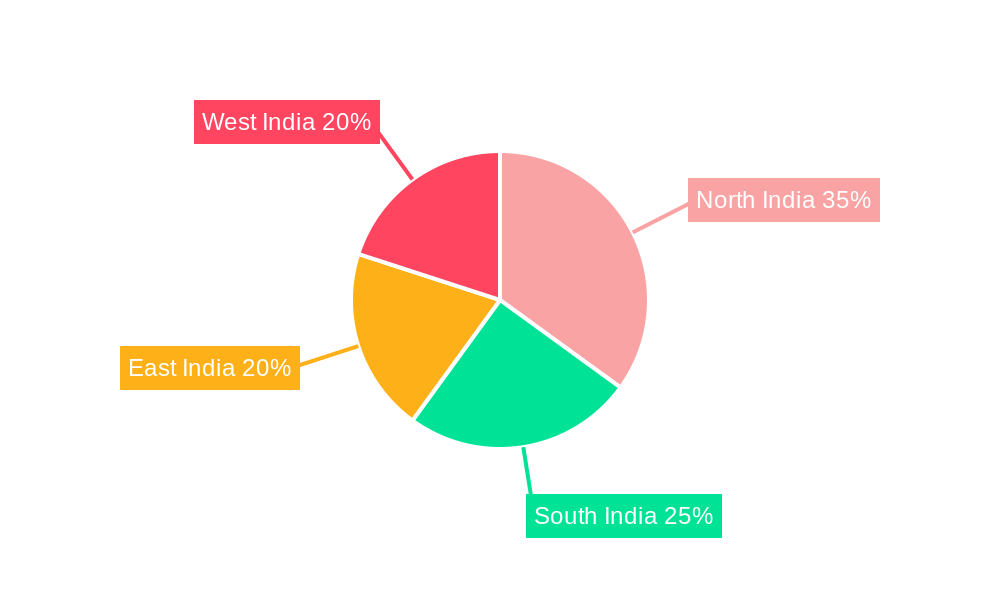

The India CNG Vehicles Market is experiencing robust growth, driven by increasing environmental concerns, government initiatives promoting cleaner fuels, and fluctuating petrol and diesel prices. The market, primarily encompassing medium-duty commercial trucks and other commercial vehicles, shows a Compound Annual Growth Rate (CAGR) exceeding 4% from 2019-2033, indicating a significant expansion. Key players like Ashok Leyland, Tata Motors, and Mahindra & Mahindra are leading this growth, constantly innovating and expanding their CNG vehicle offerings. The market segmentation by vehicle type shows strong demand for medium-duty commercial trucks due to their widespread use in intra-city logistics and goods transportation. Regional variations exist, with potential for higher growth in regions like North and West India driven by favorable government policies and infrastructure developments. However, challenges such as limited CNG refueling infrastructure in certain areas and the initial higher cost of CNG vehicles compared to diesel counterparts act as restraints on the market's full potential. Despite these restraints, the long-term outlook for the India CNG Vehicles Market remains positive, fueled by the continuous push towards sustainable transportation solutions and stricter emission norms.

The forecast period (2025-2033) promises further expansion, with substantial investments expected in infrastructure development, specifically CNG refueling stations. This will play a pivotal role in overcoming existing restraints and accelerating market penetration. Furthermore, technological advancements aimed at improving CNG vehicle efficiency and reducing operational costs will further stimulate market demand. The increasing focus on last-mile delivery and urban transportation will also create lucrative opportunities for CNG vehicles, as businesses strive to meet environmentally conscious consumer demands. Analyzing regional data (North, South, East, and West India) reveals varying growth trajectories, shaped by local policies, economic conditions, and existing CNG infrastructure. A comprehensive understanding of these regional dynamics is crucial for effective market penetration and strategic business planning.

India CNG Vehicles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India CNG Vehicles Market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). The report offers crucial insights into market dynamics, growth drivers, challenges, and emerging opportunities, specifically focusing on Commercial Vehicles and Medium-duty Commercial Trucks. It is an invaluable resource for industry stakeholders, investors, and strategic decision-makers seeking to navigate this rapidly evolving market. The report values are expressed in Millions.

India CNG Vehicles Market Concentration & Innovation

The Indian CNG vehicles market exhibits a moderately concentrated structure, with a few major players dominating the landscape. Market share analysis reveals that Tata Motors Limited, Maruti Suzuki India Limited, and Hyundai Motor India Limited hold significant portions, while other key players like Ashok Leyland Limited, SML Isuzu Limited, VE Commercial Vehicles Limited, Mahindra & Mahindra Limited, and JBM Auto Limited contribute substantially. However, the market also witnesses the presence of several smaller players, fostering competition. Innovation in the sector is driven by stricter emission norms, increasing fuel prices, and growing environmental concerns. This leads to continuous development of advanced CNG technologies, improved engine efficiency, and the introduction of new vehicle models with enhanced CNG compatibility. Recent regulatory frameworks supporting CNG infrastructure development further boost innovation. Product substitution primarily comes from electric vehicles (EVs), but CNG's affordability and established infrastructure currently maintain its competitive edge. End-user trends indicate a growing preference for fuel-efficient and cost-effective vehicles, favorably influencing CNG adoption. M&A activity has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million. The largest M&A deal involved xx in xx, while others have focused on smaller acquisitions and partnerships.

India CNG Vehicles Market Industry Trends & Insights

The India CNG Vehicles Market has witnessed significant growth in the past few years and is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033). This growth is fueled primarily by rising fuel costs, increasing environmental awareness, and supportive government policies promoting CNG adoption. The market penetration of CNG vehicles has steadily increased, reaching xx% in 2024, and is anticipated to surpass xx% by 2033. Technological disruptions, such as advancements in CNG engine technology and the development of dual-fuel vehicles, are driving efficiency and performance improvements. Consumer preferences are shifting towards more fuel-efficient and environmentally friendly vehicles, resulting in increased demand for CNG options. Competitive dynamics are shaped by the presence of both established automakers and new entrants, leading to intense competition in pricing, features, and technology. The market displays a fragmented nature, with a strong presence of both domestic and international players. The introduction of new models with enhanced CNG capabilities creates a dynamic and evolving market environment.

Dominant Markets & Segments in India CNG Vehicles Market

Within the India CNG Vehicles Market, the segment of Medium-duty Commercial Trucks is currently the most dominant within the Commercial Vehicle category. This dominance is primarily concentrated in urban and semi-urban regions.

- Key Drivers:

- Cost-effectiveness: CNG offers a significantly lower operating cost compared to diesel, making it attractive for commercial fleet operators.

- Government incentives: Various government schemes and subsidies are encouraging the adoption of CNG vehicles in the commercial sector.

- Expanding CNG infrastructure: The government's investment in expanding CNG refueling stations across major cities and highways facilitates wider adoption.

- Stringent emission norms: The increasing pressure to reduce vehicular emissions has propelled the shift towards cleaner fuel options like CNG.

- Improved vehicle technology: Advanced CNG engine technologies enhance fuel efficiency and performance, further boosting commercial viability.

The dominance is primarily driven by the favorable economics of CNG, coupled with increasingly stringent emission regulations and the burgeoning logistics and transportation sectors in India. This segment is projected to experience sustained high growth in the coming years.

India CNG Vehicles Market Product Developments

Recent product developments include the introduction of upgraded CNG variants for existing models by major players like Tata Motors and Maruti Suzuki, along with new CNG-powered vehicles. These developments showcase a focus on improved fuel efficiency, enhanced performance, and the incorporation of advanced technologies. This continuous innovation reflects the market's response to growing consumer preferences for greener and more cost-effective transportation solutions. The market is witnessing a shift towards dual-fuel vehicles, providing greater flexibility to consumers. The trend emphasizes optimizing market fit by catering to diverse consumer requirements while addressing the need for environmentally responsible transportation options.

Report Scope & Segmentation Analysis

This report segments the India CNG Vehicles Market by Vehicle Type (Commercial Vehicles and Passenger Vehicles), further categorized into sub-segments like Medium-duty Commercial Trucks, light commercial vehicles etc. The Commercial Vehicle segment is expected to grow at a CAGR of xx% during the forecast period driven by increased demand from the logistics and transportation sectors. Within Commercial Vehicles, Medium-duty Commercial Trucks are showing strong growth due to cost savings and environmental benefits. The Passenger Vehicle segment is also witnessing considerable growth, fueled by consumer preference for affordable and eco-friendly vehicles. Competitive dynamics vary across segments, with different manufacturers focusing on specific niches.

Key Drivers of India CNG Vehicles Market Growth

The growth of the India CNG Vehicles Market is primarily driven by several factors:

- Government initiatives: Subsidies and tax benefits encourage CNG vehicle adoption.

- Rising fuel costs: CNG's relatively lower price compared to gasoline and diesel makes it attractive.

- Environmental concerns: The rising awareness of environmental pollution is pushing consumers towards cleaner fuel options.

- Technological advancements: Improved CNG engine technology enhances vehicle performance and efficiency.

- Expanding CNG infrastructure: The increase in CNG filling stations across the country facilitates widespread adoption.

Challenges in the India CNG Vehicles Market Sector

Despite its potential, the India CNG Vehicles Market faces several challenges:

- Limited CNG infrastructure: While improving, the availability of CNG filling stations remains a constraint in certain regions.

- High initial vehicle cost: CNG vehicles often have a higher upfront cost compared to gasoline/diesel alternatives.

- Range anxiety: The limited driving range of some CNG vehicles compared to conventional vehicles remains a concern for some consumers.

- Competition from EVs: The increasing popularity of electric vehicles poses a significant challenge to CNG vehicle market share. The market share competition between CNG and EVs is expected to be xx% in 2033.

Emerging Opportunities in India CNG Vehicles Market

Emerging opportunities in the India CNG Vehicles Market include:

- Expansion into rural areas: Increased availability of CNG infrastructure in rural areas can tap into significant untapped potential.

- Development of dual-fuel vehicles: This provides flexibility and addresses range anxiety concerns.

- Focus on CNG-powered commercial vehicles: This segment offers high growth potential due to cost-effectiveness and emission benefits.

- Technological advancements: Continued innovation in CNG engine technology can further enhance efficiency and performance.

Leading Players in the India CNG Vehicles Market Market

- Ashok Leyland Limited

- SML Isuzu Limited

- Tata Motors Limited

- VE Commercial Vehicles Limited

- Mahindra & Mahindra Limited

- JBM Auto Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

Key Developments in India CNG Vehicles Market Industry

- July 2023: Maruti Suzuki India Limited launched the FRONX S-CNG, expanding its CNG vehicle offerings in the premium segment. This move broadened its market reach and catered to a growing customer base seeking fuel-efficient and premium vehicles.

- July 2023: Hyundai Motor India Limited launched the Exter compact SUV, offering a CNG variant with various transmission options. This introduction broadened the availability of CNG-powered compact SUVs, catering to the growing segment of urban commuters looking for fuel-efficient options.

- August 2023: Tata Motors upgraded its CNG variants for the Tiago and Tigor models and introduced the new Punch iCNG. This strategic product expansion significantly strengthened Tata Motors’ position in the CNG vehicle market, by offering a wider range of options at competitive price points across different vehicle segments.

Strategic Outlook for India CNG Vehicles Market Market

The India CNG Vehicles Market is poised for substantial growth in the coming years, driven by favorable government policies, rising fuel prices, and increasing environmental consciousness. The expanding CNG infrastructure, coupled with continuous technological advancements, will further propel market expansion. Strategic focus on developing advanced CNG technologies, expanding into new markets, and exploring opportunities in the commercial vehicle sector will be crucial for sustained success in this dynamic and rapidly evolving market. The strategic outlook is optimistic, anticipating substantial growth and market expansion across various segments in the coming years.

India CNG Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

-

1.1.1. Light Commercial Vehicles

- 1.1.1.1. Light Commercial Pick-up Trucks

- 1.1.1.2. Light Commercial Vans

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Medium-duty Commercial Trucks

-

1.1.1. Light Commercial Vehicles

-

1.1. Commercial Vehicles

India CNG Vehicles Market Segmentation By Geography

- 1. India

India CNG Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India CNG Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Light Commercial Vehicles

- 5.1.1.1.1. Light Commercial Pick-up Trucks

- 5.1.1.1.2. Light Commercial Vans

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Medium-duty Commercial Trucks

- 5.1.1.1. Light Commercial Vehicles

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India CNG Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India CNG Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India CNG Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India CNG Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Ashok Leyland Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SML Isuzu Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tata Motors Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 VE Commercial Vehicles Limite

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mahindra & Mahindra Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 JBM Auto Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Maruti Suzuki India Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor India Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Ashok Leyland Limited

List of Figures

- Figure 1: India CNG Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India CNG Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: India CNG Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India CNG Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India CNG Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India CNG Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India CNG Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India CNG Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India CNG Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India CNG Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India CNG Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: India CNG Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India CNG Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India CNG Vehicles Market?

Key companies in the market include Ashok Leyland Limited, SML Isuzu Limited, Tata Motors Limited, VE Commercial Vehicles Limite, Mahindra & Mahindra Limited, JBM Auto Limited, Maruti Suzuki India Limited, Hyundai Motor India Limited.

3. What are the main segments of the India CNG Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Tata Motors introduced upgraded CNG variants for its Tiago and Tigor models, along with the launch of the new Punch iCNG. The Tiago iCNG is priced between INR 654.9 thousand to INR 809.9 thousand, while the Tigor iCNG is priced between INR 779.9 thousand to INR 894.9 thousand. The Punch iCNG is priced from INR 709.9 thousand to INR 967.9 thousand.July 2023: Maruti Suzuki India Limited introduced FRONX S-CNG in their premium retail channel NEXA for a starting price of INR 841.5 thousand and going to INR 927.5 thousand.July 2023: Hyundai Motor India Limited (HMIL), launched the compact SUV Exter for a price of INR 599.9 thousand and going to INR 932 thousand. It comes equipped with a 1.2 l Kappa gasoline, a 4-cylinder engine (E20 fuel ready) with an option to choose from 3 powertrains that are manual transmission (MT), automated manual transmission (AMT) and gasoline with CNG engine with manual transmission MT.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India CNG Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India CNG Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India CNG Vehicles Market?

To stay informed about further developments, trends, and reports in the India CNG Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence